Fill Out Your Missouri 5177 Form

The Missouri 5177 form, also known as the Title Assignment Correction Form, serves a crucial purpose for those involved in the transfer of motor vehicle ownership. This document is particularly important when the original title or certificate of ownership contains incomplete information that must be rectified to ensure a lawful transfer. Designed by the Missouri Department of Revenue, the form asks for essential details about the vehicle, including the year, make, and Vehicle Identification Number (VIN). The form requires the names and addresses of the purchasers, along with the odometer reading at the time of sale, which is critical for accurate record-keeping. All parties involved in the transaction—buyers and sellers—must provide their signatures, affirming the accuracy of the information submitted. A section dedicated to an acknowledgment statement mandates that individuals declare their commitment to the accuracy and completeness of the information provided, thereby reducing the risk of fraud. Completing this form accurately is vital; it not only complies with state laws under Chapter 301 of the Revised Statutes of Missouri but also protects the interests of all parties in the transaction. By ensuring that the necessary modifications are documented accordingly, the Missouri 5177 form upholds the integrity of vehicle ownership records within the state.

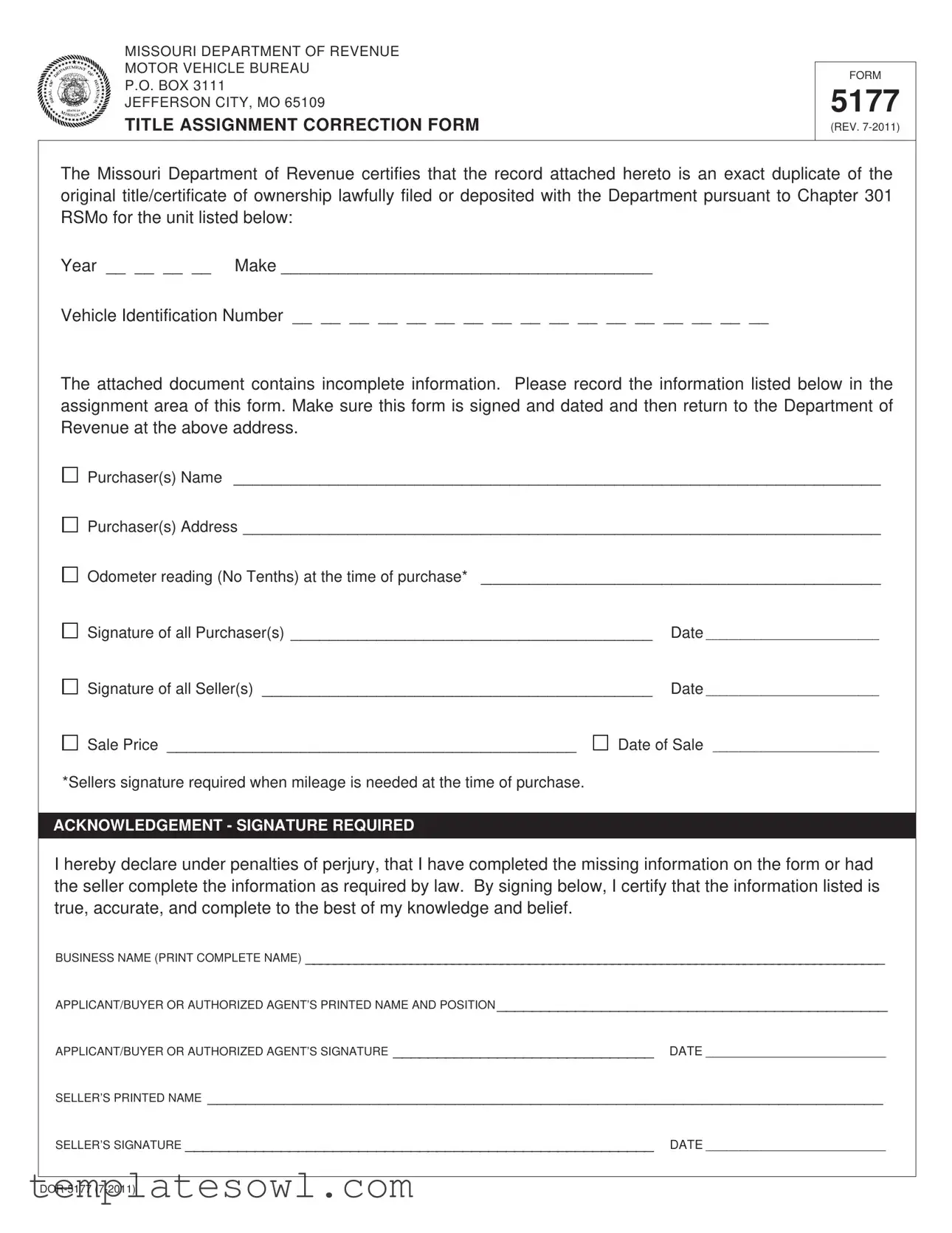

Missouri 5177 Example

MISSOURI DEPARTMENT OF REVENUE MOTOR VEHICLE BUREAU

P.O. BOX 3111

JEFFERSON CITY, MO 65109

TITLE ASSIGNMENT CORRECTION FORM

FORM

5177

(REV.

The Missouri Department of Revenue certifies that the record attached hereto is an exact duplicate of the original title/certificate of ownership lawfully filed or deposited with the Department pursuant to Chapter 301 RSMo for the unit listed below:

Year __ __ __ __ Make _______________________________________

Vehicle Identification Number __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __

The attached document contains incomplete information. Please record the information listed below in the assignment area of this form. Make sure this form is signed and dated and then return to the Department of Revenue at the above address.

Purchaser(s) Name ____________________________________________________________________

Purchaser(s) Address ___________________________________________________________________

Odometer reading (No Tenths) at the time of purchase* __________________________________________

Signature of all Purchaser(s) ______________________________________ |

Date _________________________ |

Signature of all Seller(s) _________________________________________ |

Date _________________________ |

Sale Price ___________________________________________

*Sellers signature required when mileage is needed at the time of purchase.

Date of Sale ________________________

ACKNOWLEDGEMENT - SIGNATURE REQUIRED

I hereby declare under penalties of perjury, that I have completed the missing information on the form or had the seller complete the information as required by law. By signing below, I certify that the information listed is true, accurate, and complete to the best of my knowledge and belief.

BUSINESS NAME (PRINT COMPLETE NAME) ___________________________________________________________________________________

APPLICANT/BUYER OR AUTHORIZED AGENT’S PRINTED NAME AND POSITION _____________________________________________

APPLICANT/BUYER OR AUTHORIZED AGENT’S SIGNATURE ______________________________ |

DATE __________________________ |

SELLER’S PRINTED NAME _______________________________________________________________________ |

|

SELLER’S SIGNATURE ______________________________________________________ |

DATE __________________________ |

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The Missouri 5177 form is used for correcting information on a title assignment. |

| Governing Law | This form is governed by Chapter 301 of the Revised Statutes of Missouri (RSMo). |

| Revision Date | The most recent revision of the form occurred in July 2011. |

| Department | The form must be submitted to the Missouri Department of Revenue, Motor Vehicle Bureau. |

| Signature Requirement | Signatures of all purchasers and sellers are required on the form. |

| Odometer Disclosure | Odometer reading at the time of purchase must be provided, without tenths. |

| Punishments for Misstatement | Submitting false information can result in penalties of perjury. |

Guidelines on Utilizing Missouri 5177

Filling out the Missouri 5177 form involves providing specific details about the vehicle and the transaction. Ensure all required fields are completed accurately. Once finished, the form must be signed and returned to the Department of Revenue.

- Obtain the Missouri 5177 form from the Department of Revenue's website or an authorized location.

- Fill in the following vehicle details:

- Year of the vehicle.

- Make of the vehicle.

- Vehicle Identification Number (VIN).

- Locate the assignment area of the form and enter the purchaser's name and address.

- Record the odometer reading at the time of purchase, ensuring no tenths are included.

- All purchasers must sign and date the form.

- All sellers must also sign and date the form, particularly if the mileage is required.

- Input the sale price of the vehicle.

- Fill in the date of sale.

- In the acknowledgment section, print the business name, if applicable, and your name and position as the applicant or authorized agent.

- Sign and date the acknowledgment section, confirming the information is true and accurate.

- Ensure all signatures are present before submitting the form.

- Send the completed form to the Missouri Department of Revenue at the provided address.

What You Should Know About This Form

What is the Missouri 5177 form used for?

The Missouri 5177 form, also known as the Title Assignment Correction Form, is used to correct incomplete information on a vehicle title or certificate of ownership. This form helps ensure that all necessary details, like the purchaser's name and odometer reading, are accurately recorded. Completing this form is essential for a smooth transfer of vehicle ownership.

Who needs to complete the Missouri 5177 form?

This form must be completed by both sellers and purchasers when there is missing or incorrect information on the vehicle title. It’s particularly relevant for any transactions where the title has not been properly filled out. Both parties must provide their signatures to affirm the accuracy of the information provided.

How do I fill out the Missouri 5177 form?

To fill out the Missouri 5177 form, start by ensuring you have the original title and the vehicle's details, including the year, make, and Vehicle Identification Number (VIN). Then, provide the missing details in the assignment area of the form, such as the purchaser's name, address, odometer reading, sale price, and signatures of both parties. Make sure to date the form correctly. After completing the form, return it to the Missouri Department of Revenue at the specified address.

Where do I send the completed Missouri 5177 form?

Once the Missouri 5177 form is completed and signed, it should be sent to the Missouri Department of Revenue at the address listed on the form: Motor Vehicle Bureau, P.O. Box 3111, Jefferson City, MO 65109. It’s important to ensure that all sections are accurately filled out to avoid delays in processing your corrections.

What happens if I do not complete the Missouri 5177 form?

If you do not complete the Missouri 5177 form when required, it could lead to complications in the vehicle transfer process. The Department of Revenue may not process your title application until all necessary corrections are made. This can result in delays, and in some cases, it may prevent you from legally owning or selling the vehicle until the title is corrected.

Common mistakes

Filling out the Missouri 5177 form correctly is crucial for ensuring that vehicle title assignments proceed smoothly. However, many people inadvertently make mistakes that can delay the process. One common error is leaving the Purchaser(s) Name blank. Complete and accurate names must be provided, including middle initials or suffixes if applicable. Without this information, the Department of Revenue may return the form for correction, causing frustration and delays.

Another frequent mistake involves the Odometer reading. This section must include a full reading without tenths. Some individuals mistakenly write a reading with tenths or omit the reading altogether. This can lead to complications, especially since sellers’ signatures are required when mileage is needed at the time of purchase. Ensuring this detail is accurate is essential.

It's also not uncommon for people to forget to include the Sale Price. Leaving this field blank may seem minor, but it is a requirement that must be fulfilled. If the sale price is not specified, the Department may question the validity of the form, leading to further inquiries and potential issues in processing.

Signing and dating the form is another critical step that some overlook. All Purchaser(s) and Seller(s) must provide their signatures along with the corresponding dates. If even one signature is missing, the form cannot be processed. This oversight is not only easy to make but also an easy fix, as a simple reminder can often prevent it.

Additionally, not completing the Acknowledgement section can create problems. This part requires a declaration confirming that all information on the form is accurate and true. Failing to complete or sign this part might result in legal complications down the road. Consequently, take the time to read and sign this section properly.

Finally, individuals sometimes neglect to review the entire form before submission. Double-checking for completeness and accuracy can make a significant difference. A quick review can help catch any of these common mistakes, ensuring a smoother and quicker processing time with the Department of Revenue.

Documents used along the form

The Missouri 5177 form, also known as the Title Assignment Correction Form, is commonly used to correct incomplete information on a vehicle title. In conjunction with this form, several other documents may be required to ensure proper processing. Below is a list of these documents, along with brief descriptions of their purposes.

- Missouri Application for Title and License (Form 108) - This form is used to apply for a new title and license plates for a vehicle. It collects basic information such as the buyer's details and vehicle specifications.

- Sales Tax Receipt - A receipt that confirms the payment of sales tax on the purchase of the vehicle. This document is necessary for title transfer to prove tax obligations have been fulfilled.

- Vehicle Identification Number (VIN) Verification - This document verifies the VIN of the vehicle, ensuring it matches what is recorded with the Department of Revenue. It can be required for certain transactions, especially for out-of-state vehicles.

- Notarized Bill of Sale - A legal document that outlines the details of the vehicle sale. It serves as proof of the transaction and includes information about the buyer and seller, the vehicle, and the sales price.

- Power of Attorney - This document allows one person to act on behalf of another in vehicle transactions. It may be needed if the buyer or seller cannot be present for the signing of the title or related documents.

Ensuring access to these documents can facilitate the smooth transfer of vehicle ownership and address any discrepancies in title information. Properly preparing each document can help streamline the process with the Missouri Department of Revenue.

Similar forms

The Missouri 5177 form, which is used for title assignment corrections, shares similarities with several other important documents in the vehicle ownership and registration process. Understanding these similarities can help clarify the purpose and usage of each document.

- Form 101: Application for Missouri Title and License - This document initiates the process for obtaining a new title and license plates. Like the 5177, it requires specific vehicle and owner information. Both forms ensure that records are accurate and reflect the true ownership of a vehicle.

- Form 5049: Vehicle Bill of Sale - The Vehicle Bill of Sale serves as proof of purchase between the buyer and the seller. In a similar manner to the 5177, it includes details such as the sale price and vehicle identification number. Both documents are crucial in confirming ownership and transfer of a vehicle.

- Form 300: Application for Duplicate Title - This form is used to request a duplicate title when the original is lost or damaged. Like the 5177, it reinforces the importance of having accurate title records. Both forms require personal information and details about the vehicle.

- Form 5120: Notice of Sale - The Notice of Sale is used to inform the Department of Revenue of a sale. This document, similar to the 5177, captures essential transaction details, confirming the sale and helping to update ownership records. Proper documentation is vital to prevent future disputes.

- Form 580: Statement of Facts - This statement may be used to provide additional information or clarify issues related to a vehicle title. Whereas the 5177 corrects incomplete information, the Statement of Facts supports transparency and can serve as a supplementary document to aid in accurate vehicle records.

Dos and Don'ts

When filling out the Missouri 5177 form, there are important steps to keep in mind. The following guidelines will help ensure that your submission is complete and accurate.

- Do carefully read all instructions provided with the form.

- Do provide complete and accurate names and addresses for all parties involved.

- Do clearly write the vehicle identification number (VIN) without omitting any digits.

- Do sign and date the form in the required sections.

- Don’t leave any required fields blank; ensure all necessary information is filled in.

- Don’t forget to include the odometer reading in the designated space, if applicable.

- Don’t submit the form without ensuring that all signatures are present.

Following these guidelines can help prevent delays in processing your form and assist you in completing the transaction smoothly.

Misconceptions

The Missouri 5177 form, also known as the Title Assignment Correction Form, is often misunderstood. Here are seven common misconceptions:

- The Missouri 5177 form is only for correcting titles. While it is primarily used for correcting title information, it can also be used to update ownership records and report incomplete information.

- Any person can fill out the form. Only authorized sellers and purchasers should fill out the form, ensuring accuracy and compliance with the law.

- The signature of the seller is optional. The seller's signature is required when the odometer reading is included. This is important for tracking mileage accurately.

- The form should only be sent if there is an issue. It can also be submitted proactively to update or correct ownership details even if there is not an apparent issue with the title.

- The form can be filed electronically. Currently, this form must be printed, signed, and mailed to the Missouri Department of Revenue. Electronic submission is not an option.

- Only the Department of Revenue can make changes to the form. Buyers and sellers are responsible for supplying accurate information on the form before submission.

- The date of sale is irrelevant. The date of sale is a critical piece of information that helps establish the timeline for ownership transfer and legal standing.

Understanding these misconceptions helps ensure that the Missouri 5177 form is completed accurately and submitted properly.

Key takeaways

When filling out and using the Missouri 5177 form, keep the following key takeaways in mind:

- This form is specifically for correcting title assignment information.

- It is issued by the Missouri Department of Revenue, Motor Vehicle Bureau.

- Ensure the form is signed and dated by all parties involved.

- Provide complete and accurate information about the vehicle, including the VIN and year.

- The odometer reading must be entered without tenths; a seller's signature is required if this information is needed.

- All purchasers’ and sellers’ names and addresses must be clearly written on the form.

- Include the sale price of the vehicle in the designated area.

- By signing the form, you are declaring under penalties of perjury that your information is accurate.

- It is essential to return the completed form to the Department of Revenue at the address provided.

- Keep a copy of the submitted form for your records.

Browse Other Templates

Free Health Insurance Massachusetts - Additional forms for children under age 16 are included as well.

Vtr-141 - Applications for trailers built to specifications by others require additional certification.