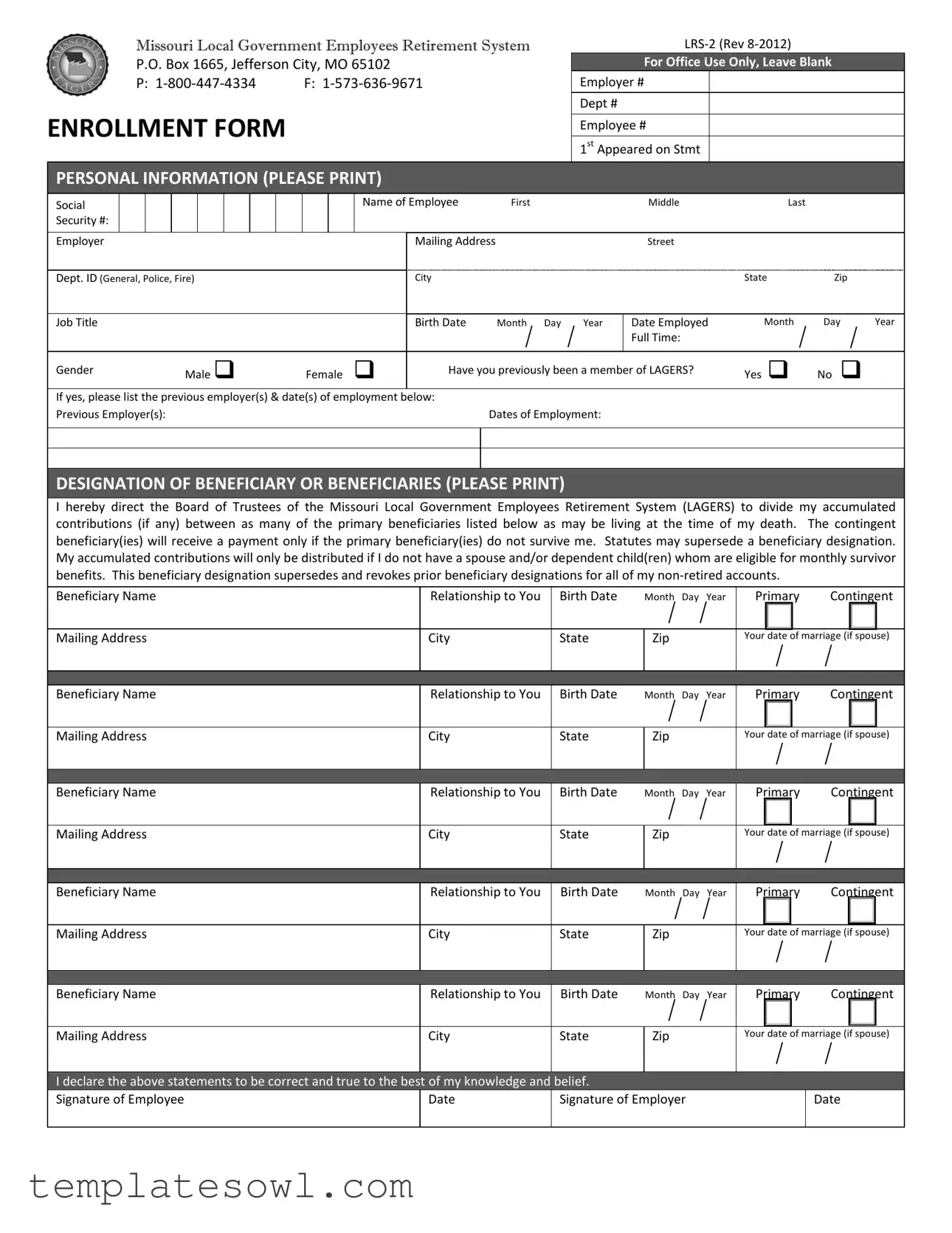

Fill Out Your Missouri Lrs 2 Form

Navigating the world of retirement benefits can often feel overwhelming, especially for local government employees in Missouri. The Missouri LRS 2 form, also known as the Enrollment Form for the Local Government Employees Retirement System (LAGERS), plays a crucial role in establishing your participation in this important retirement program. This form collects essential information, including your personal details such as name, Social Security number, and employment history, which helps facilitate your enrollment in the system. Additionally, the LRS 2 form allows you to designate beneficiaries who would receive your accumulated contributions in the event of your passing before retirement. Understanding the impact of your selections is vital; it clarifies who may benefit from your contributions and under what circumstances. Specifically, if you die while still an active member, your spouse or dependent children might be eligible for monthly survivor benefits, depending on state laws and your designation choices. Should there be no eligible survivors, your accumulated contributions can be refunded to your designated beneficiaries. Keeping this form updated is essential, as it ensures your preferences reflect any changes in your personal circumstances. With such significant implications, it is important to approach the Missouri LRS 2 form thoughtfully, ensuring that you secure the future you envision for yourself and your loved ones.

Missouri Lrs 2 Example

Missouri Local Government Employees Retirement System P.O. Box 1665, Jefferson City, MO 65102

P: |

F: |

ENROLLMENT FORM

For Office Use Only, Leave Blank

Employer #

Dept #

Employee #

1st Appeared on Stmt

PERSONAL INFORMATION (PLEASE PRINT)

Social Security #:

Name of Employee |

First |

Middle |

Last |

Employer |

Mailing Address |

Street |

|

|

City |

State |

Zip |

Dept. ID (General, Police, Fire) |

Job Title |

|

|

|

Birth Date |

Month |

Day |

Year |

Date Employed |

Month |

Day |

Year |

|

|

|

|

|

|

|

|

Full Time: |

|

|

|

Gender |

Male |

Female |

|

Have you previously been a member of LAGERS? |

Yes |

No |

|

||||

If yes, please list the previous employer(s) & date(s) of employment below:

Previous Employer(s): |

Dates of Employment: |

DESIGNATION OF BENEFICIARY OR BENEFICIARIES (PLEASE PRINT)

I hereby direct the Board of Trustees of the Missouri Local Government Employees Retirement System (LAGERS) to divide my accumulated contributions (if any) between as many of the primary beneficiaries listed below as may be living at the time of my death. The contingent beneficiary(ies) will receive a payment only if the primary beneficiary(ies) do not survive me. Statutes may supersede a beneficiary designation. My accumulated contributions will only be distributed if I do not have a spouse and/or dependent child(ren) whom are eligible for monthly survivor benefits. This beneficiary designation supersedes and revokes prior beneficiary designations for all of my

Beneficiary Name

Mailing Address

Beneficiary Name

Mailing Address

Beneficiary Name

Mailing Address

Beneficiary Name

Mailing Address

Relationship to You |

|

Birth Date |

Month |

Day |

Year |

|

Primary |

Contingent |

|

|

|

|

|

|

|

|

|

|

|

City |

|

State |

|

Zip |

|

|

|

Your date of marriage (if spouse) |

|

Relationship to You |

|

Birth Date |

|

|

|

|

|

Primary |

Contingent |

|

Month |

Day |

Year |

|

|||||

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

City |

|

State |

|

Zip |

|

|

|

Your date of marriage (if spouse) |

|

Relationship to You |

|

Birth Date |

|

|

|

|

|

Primary |

Contingent |

|

Month |

Day |

Year |

|

|||||

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

City |

|

State |

|

Zip |

|

|

|

Your date of marriage (if spouse) |

|

Relationship to You |

|

Birth Date |

|

Month |

Day |

Year |

|

Primary |

Contingent |

|

|

|

|||||||

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

City |

|

State |

|

Zip |

|

|

|

Your date of marriage (if spouse) |

|

|

|

|

|

|

|

|

|

|

|

Beneficiary Name

Mailing Address

Relationship to You |

Birth Date |

Month Day Year |

Primary |

Contingent |

|

|

|

|

|

City |

State |

Zip |

Your date of marriage (if spouse) |

|

|

|

|

|

|

I declare the above statements to be correct and true to the best of my knowledge and belief.

Signature of Employee |

Date |

Signature of Employer |

Date |

|

|

|

|

DESIGNATING BENEFICIARIES PRIOR TO RETIREMENT

What Benefits are Payable if I Die?

If an active LAGERS member were to pass away before retirement, LAGERS will look first to pay a monthly survivor benefit to any eligible spouse or dependent children. If no monthly survivor benefit is payable, LAGERS will pay a refund of any accumulated member contributions to the designated beneficiary of record.

Who is Eligible for a Monthly Survivor Benefit?

Regardless of any beneficiary designation you make with the LAGERS office, Missouri state law decides who the eligible recipient will be on a LAGERS monthly survivor benefit. A spouse of at least two years* will be considered the first eligible recipient. If there is no eligible spouse, the recipient will automatically be any dependent child, see definition below. If there is no eligible spouse or dependent children, there is no monthly survivor benefit payable.

What if No Monthly Survivor Benefit is Payable?

If no monthly survivor benefit is payable, LAGERS will refund any employee contributions, plus interest, to your beneficiary of record.

Who May I List as a Beneficiary for a Refund of My Contributions?

You may designate an individual, legal entity (such as a charity), trust, or your estate as a beneficiary. You may designate more than one primary and/or contingent beneficiary to share equally in your accumulated contributions.

Why Should I List a Contingent Beneficiary?

A contingent beneficiary will only be eligible to receive your accumulated contributions should all your primary beneficiaries predecease your contingent beneficiaries. Without a contingent beneficiary, your estate would determine how your contributions are disbursed should your primary beneficiary predecease you.

My Employer is Currently Non‐Contributory, Do I Still Need to Designate Beneficiaries?

It is always a best practice to keep current beneficiaries on file with the LAGERS office. LAGERS employers have the option to change their ‘Contributory Status’ once every two years. This means that even if you are not contributing toward your LAGERS retirement today, there is always the possibility that you may in the future. Likewise, if you at any time worked for a LAGERS employer who was contributory, or you made contributions in the past with your current employer (and you have not taken a refund of those contributions), they will still be accumulating interest in your LAGERS account and would be payable to your beneficiaries should no monthly survivor benefit be payable at the time of your death.

Where Can I View my Current Designations and Account Balances?

You can view your current beneficiary designations by logging on to the myLAGERS member page. There, you may view your account information as well as make updates to your beneficiary designations. You may also refer to your most recent annual statement or contact the LAGERS office to obtain this information.

What Does My Eligible Beneficiary Need to Do in the Event of My Death?

In the event of your death, it is solely the beneficiary’s responsibility to notify the LAGERS system and submit the required

Application for Survivor’s Benefit Form or Request for Refund of Employee’s Contributions by Beneficiary Form to the LAGERS office.

These forms may be obtained at www.molagers.org or by contacting our office.

*The two year requirement for a spousal survivor benefit will be waived if the cause of the death is determined to be accidental or duty related.

Missouri Revised Statutes define a child as a ‘dependent’ “until the child's death or marriage or attainment of age eighteen, whichever occurs first; provided, the age eighteen maximum shall be extended as long as the child continues uninterruptedly being a full‐time student at an accredited secondary school or college or university… [AND] the age eighteen maximum shall be extended for any child who has been found totally incapacitated by a court of competent jurisdiction for as long as such incapacity exists.”

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The LRS 2 form serves as the official enrollment document for employees joining the Missouri Local Government Employees Retirement System (LAGERS). |

| Personal Information Required | Employees must provide essential personal details including their Social Security number, job title, birth date, and employment history. |

| Beneficiary Designation | Members can designate multiple primary and contingent beneficiaries for their accumulated contributions, revoking any prior designations. |

| Survivor Benefits Eligibility | According to Missouri law, a spouse married for at least two years can qualify as the first recipient of monthly survivor benefits if the member passes away. |

| Refund of Contributions | If no monthly survivor benefits are payable, LAGERS will refund any accumulated member contributions to the designated beneficiary of record. |

| Current Employer Status | Even if an employer is non-contributory, it remains important to continually update beneficiary designations with LAGERS to ensure accurate records. |

Guidelines on Utilizing Missouri Lrs 2

The Missouri LRS 2 form is essential for employees enrolling in the Missouri Local Government Employees Retirement System. Completing the form accurately ensures the correct processing of personal and beneficiary information. Below are the steps to fill it out.

- Begin with the section labeled PERSONAL INFORMATION. Print your details clearly.

- Enter your Social Security Number and full name (First, Middle, Last).

- Provide your Employer Mailing Address including street, city, state, and zip code.

- Fill in your Dept. ID which corresponds to your job (General, Police, Fire) and your Job Title.

- Indicate your Birth Date and Date Employed.

- Check the box to indicate if you are Full Time.

- Specify your Gender by checking either Male or Female.

- Answer whether you have previously been a member of LAGERS by selecting Yes or No.

- If you answered Yes, list your previous employer(s) and periods of employment.

- Move to the section DESIGNATION OF BENEFICIARY OR BENEFICIARIES. Clearly print the names and addresses of your chosen beneficiaries.

- For each beneficiary, indicate their Relationship to You and Birth Date.

- Designate whether they are Primary or Contingent.

- If applicable, provide your date of marriage for your spouse.

- Once you have completed the form, review all entries for accuracy.

- Sign and date the form where indicated as the Employee.

- Your employer must also sign and date the form in the designated area.

After submitting the form, keep a copy for your records. The information provided will be used to establish your benefits within the retirement system. It's important to stay informed about any changes to your beneficiary designations as your personal circumstances evolve.

What You Should Know About This Form

What is the Missouri LRS 2 form?

The Missouri LRS 2 form is the enrollment form for the Local Government Employees Retirement System (LAGERS). It collects personal information, employment details, and designates beneficiaries for the member's accumulated contributions in the event of their death before retirement.

Why do I need to complete the LRS 2 form?

Completing the LRS 2 form ensures that your retirement contributions are managed properly and that your beneficiaries are clearly designated. This helps prevent delays or complications in the event of your passing.

What happens if I don't designate a beneficiary?

If you do not designate a beneficiary, the LAGERS system will follow state laws regarding the distribution of your contributions. This may result in your estate being responsible for distributing your assets, which can lead to delays and additional complications.

Can I change my beneficiary after submitting the form?

Yes, you can change your beneficiary designation at any time. It is important to keep your designations up to date, especially after major life events such as marriage, divorce, or the birth of children.

Who is eligible for a monthly survivor benefit?

A spouse married for at least two years or dependent children may be eligible for a monthly survivor benefit. If no eligible spouse or children exist, there will be no monthly benefit, but your designated beneficiary may receive a refund of your contributions instead.

What if my employer is currently non-contributory?

Even if your employer is non-contributory, you should still designate beneficiaries. Contributions may occur in the future, or you may have prior contributions that still earn interest. Keeping beneficiary designations current ensures that your preferences are known.

What does my beneficiary need to do if I die?

Your beneficiary is responsible for notifying LAGERS and submitting the necessary forms to claim benefits. This includes the Application for Survivor’s Benefit Form or the Request for Refund of Employee’s Contributions by Beneficiary Form. These forms are available through the LAGERS website or office.

Can I list a legal entity as a beneficiary?

Yes, you may designate individuals, legal entities (like charities), trusts, or your estate as beneficiaries for your contributions. You can also name multiple primary and contingent beneficiaries.

What if I previously worked for a different LAGERS employer?

Your previous employer's contributory status may still affect your benefits if you have not taken a refund of your contributions. It's crucial to verify your account and beneficiary designations, regardless of your current employment status.

How can I view my current designations and account balance?

You can log in to the myLAGERS member page to access your account information. You can also check your recent annual statement or contact the LAGERS office for assistance with your beneficiary designations and account balance.

Common mistakes

Filling out the Missouri LRS 2 form correctly is crucial for prospective members of the Local Government Employees Retirement System. However, many make common mistakes that can delay their enrollment or complicate future benefits. One frequent error is not providing a complete Social Security number. It’s important to ensure that every digit is accurate. A missing or incorrect number may lead to significant delays in processing your application.

Another common mistake is failing to designate a primary beneficiary. Without this information, your contributions may not be distributed according to your wishes. Ensure that all sections of the beneficiary designation are filled out correctly. Incomplete beneficiary information can create confusion and ultimately impact who receives your accrued benefits.

Not providing a valid mailing address is another mistake that can hinder the process. The form requires the complete mailing address of both the employee and beneficiaries. Missing this information can prevent important correspondence from reaching you, which may lead to complications down the line.

Some individuals forget to check their employment status, specifically whether they are full-time. This detail is critical as it determines eligibility and benefits. Be sure to confirm your employment status on the form to avoid issues with future claims or benefits.

Omitting previous employment information with LAGERS is also a common oversight. If you have previously been a member and do not list past employers, it could complicate your current application. Detailing all relevant past employment helps ensure a smoother transition into the program.

Incorrect or incomplete beneficiary names and addresses are further issues that arise. Names should be accurate and reflect the legal name of the beneficiary. Any discrepancies can cause delays in benefit disbursement. Always double-check this information for accuracy.

Another frequent issue is misunderstanding the distinction between primary and contingent beneficiaries. Some applicants mix these terms up, which can lead to incorrect designations. Make sure to read the instructions carefully to understand who gets paid first under your beneficiary designation.

Lastly, failing to sign and date the form is a simple but impactful error that can render the application void. A signature is a confirmation of the information provided, and without it, processing cannot proceed. Be sure to thoroughly review the form before submission to guarantee that every required section is complete.

By being mindful of these common mistakes, applicants can avoid unnecessary delays and ensure their enrollment process is smooth and efficient.

Documents used along the form

The Missouri LRS 2 form serves as an important enrollment document for local government employees within the Missouri Local Government Employees Retirement System (LAGERS). Along with the LRS 2 form, various other documents can assist in ensuring a comprehensive understanding of retirement benefits and procedures. Below are a few key forms that often accompany the LRS 2 form in the enrollment process.

- Application for Survivor’s Benefits: This form is necessary for beneficiaries to request survivor benefits after the member's passing. It outlines the required information that proves eligibility and facilitates the distribution of benefits to the designated recipients.

- Request for Refund of Employee’s Contributions by Beneficiary: If members of the LAGERS system pass away without eligible survivors, this form allows beneficiaries to request a refund of any accumulated employee contributions. It ensures that individuals receive what is rightfully theirs in the absence of a monthly benefit.

- Beneficiary Designation Update Form: This document allows employees to update their chosen beneficiaries after changes in life circumstances, such as marriage or divorce. Maintaining current designations is crucial for ensuring that benefits are distributed according to the member's wishes.

- Direct Deposit Authorization Form: Beneficiaries can complete this form to facilitate direct deposit of benefits into their bank accounts. It simplifies the payment process and enhances timely access to funds.

Each of these forms plays a significant role in the administration of retirement benefits within the LAGERS system. By understanding and utilizing these documents, members can better prepare themselves and their loved ones for the future. Active communication and timely updates to these forms are essential for ensuring that intentions regarding benefits are honored and fulfilled.

Similar forms

The Missouri LRS-2 form serves a specific function related to employee retirement benefits, and it is similar to several other important documents. Here’s a quick comparison to help understand those similarities:

- IRS W-4 Form: Both the LRS-2 and the W-4 involve important personal information, such as social security numbers and identification details, to manage financial benefits accurately.

- Beneficiary Designation Forms: Like the LRS-2, these forms allow individuals to specify who should receive benefits or assets upon their death, ensuring that the right persons are connected to financial contributions.

- Health Insurance Enrollment Forms: Both documents require personal data and have sections for beneficiary information, focusing on care in case of unforeseen events related to health or work.

- Life Insurance Applications: Just like the LRS-2, life insurance applications often demand information about beneficiaries, clarifying who will benefit from the policy after the policyholder's demise.

- Pension Enrollment Forms: Both forms outline a member’s information and include sections for designating beneficiaries, ensuring that benefits are distributed appropriately after death.

- Power of Attorney Documents: These documents also serve to specify who makes decisions if someone becomes unable to do so, similar to how the LRS-2 designates beneficiaries for retirement contributions.

- Estate Planning Documents: Like the LRS-2, estate documents list beneficiaries and direct how financial assets are distributed, addressing the needs and rights after someone passes away.

Dos and Don'ts

Filling out the Missouri LRS-2 form is an important step in ensuring your retirement benefits are appropriately managed. Here’s a list of things you should and shouldn’t do when completing this form.

- Do print all information clearly. Ensure that your handwriting is legible.

- Do provide accurate Social Security and personal information to avoid processing delays.

- Do list all previous employers if you have been a member of LAGERS before.

- Do designate both primary and contingent beneficiaries to ensure your contributions go to intended recipients.

- Do keep a copy of the completed form for your records.

- Don't leave any required fields blank. Ensure every section is completed as thoroughly as possible.

- Don't neglect to inform your beneficiaries about their designation; they should know how to claim the benefits if necessary.

By following these guidelines, the process of filling out the LRS-2 form can be much smoother and more effective. Taking the time to carefully complete this form will help safeguard your future benefits and ensure that your intentions regarding your beneficiaries are clearly communicated.

Misconceptions

The Missouri LRS 2 form is crucial for local government employees participating in the Local Government Employees Retirement System (LAGERS). However, several misconceptions about this form can lead to confusion. Here are nine common misconceptions:

- The LRS 2 form is only for retirees. Many believe this form is solely for those already retired. In fact, the LRS 2 form is for employees to enroll in the retirement system and designate beneficiaries, regardless of their retirement status.

- You cannot change your beneficiaries after submitting the LRS 2 form. Some think that once beneficiaries are designated, they cannot be modified. This is incorrect; you can update your beneficiary designations at any time by contacting LAGERS or through your myLAGERS account.

- Your beneficiaries will automatically receive funds upon your death. This misconception assumes that beneficiaries will automatically access your contributions. However, it’s important for them to notify LAGERS and submit the necessary forms for the release of any funds.

- The LRS 2 form is not necessary if my employer does not contribute. Some employees believe that if their employer is non-contributory, they have no need for this form. However, it’s wise to file the form regardless, as contributions may start in the future, and maintaining accurate beneficiary records is essential.

- You must have a spouse to designate a beneficiary. This thought leads to important individuals being left out. While spousal beneficiaries are prioritized for survivor benefits, any individual, entity, or your estate can be designated as a beneficiary.

- Just filling out the LRS 2 form means you’re fully covered. Some feel that completing the form guarantees full benefits. However, understanding state laws regarding survivor benefits and knowing who is eligible is crucial.

- The two-year spousal requirement cannot be waived under any circumstances. Many think this rule is absolute. While it generally applies, exceptions exist for accidental deaths or duty-related incidents where the two-year requirement can be waived.

- All contributions are refunded to the beneficiary upon death. This is misleading. If there is an eligible spouse or dependent child, those individuals may receive a monthly survivor benefit before any contributions are refunded.

- Updating your beneficiary does not need to be a priority. Some believe they can wait indefinitely to update their designations. In reality, life changes such as marriage, divorce, or the birth of a child necessitate timely updates to reflect current family dynamics.

Understanding these misconceptions is vital for making informed decisions concerning retirement planning and beneficiary designations. Taking the time to clarify any doubts can help ensure that your contributions are managed and disbursed according to your wishes.

Key takeaways

Understanding the Missouri LRS 2 form is essential for employees involved in the Local Government Employees Retirement System (LAGERS). Here are some key takeaways:

- Accurate Information is Crucial: Make sure to fill in all personal details completely and accurately. Your Social Security number, birth date, and employment details are required for proper processing.

- Beneficiary Designation Matters: Designating beneficiaries ensures that your accumulated contributions are distributed according to your wishes. Don't forget to include both primary and contingent beneficiaries.

- Understanding Survivor Benefits: If you pass away before retirement, benefits will first be directed to an eligible spouse or dependent children. Knowing who qualifies for these benefits can provide peace of mind.

- Regular Updates Are Important: Even if your employer is currently non-contributory, keep your beneficiary designations up-to-date, as these can impact future payouts significantly.

- Responsibility of Beneficiaries: In the event of a member's death, it falls on the beneficiaries to inform the LAGERS office and complete necessary forms to claim benefits. Being proactive about this process ensures a smoother transition for all involved.

By keeping these points in mind, employees can navigate the LRS 2 form and the associated benefits with greater ease.

Browse Other Templates

Acs Voucher Application - This form helps streamline the process of accessing child care services by clarifying income levels.

Decedent's Estate Hearing Notification,Notice of Estate Administration Hearing,Probate Status Report Notice,Hearing Reminder for Decedent's Estate,Notice of Trust Proceedings,Hearing Announcement for Estate Matters,Decedent Trust Notification Form,Es - Requests for accommodations are noted, ensuring accessibility at the hearing.

How to Site a Quote - Using appropriate citation styles is crucial for maintaining scholarly standards.