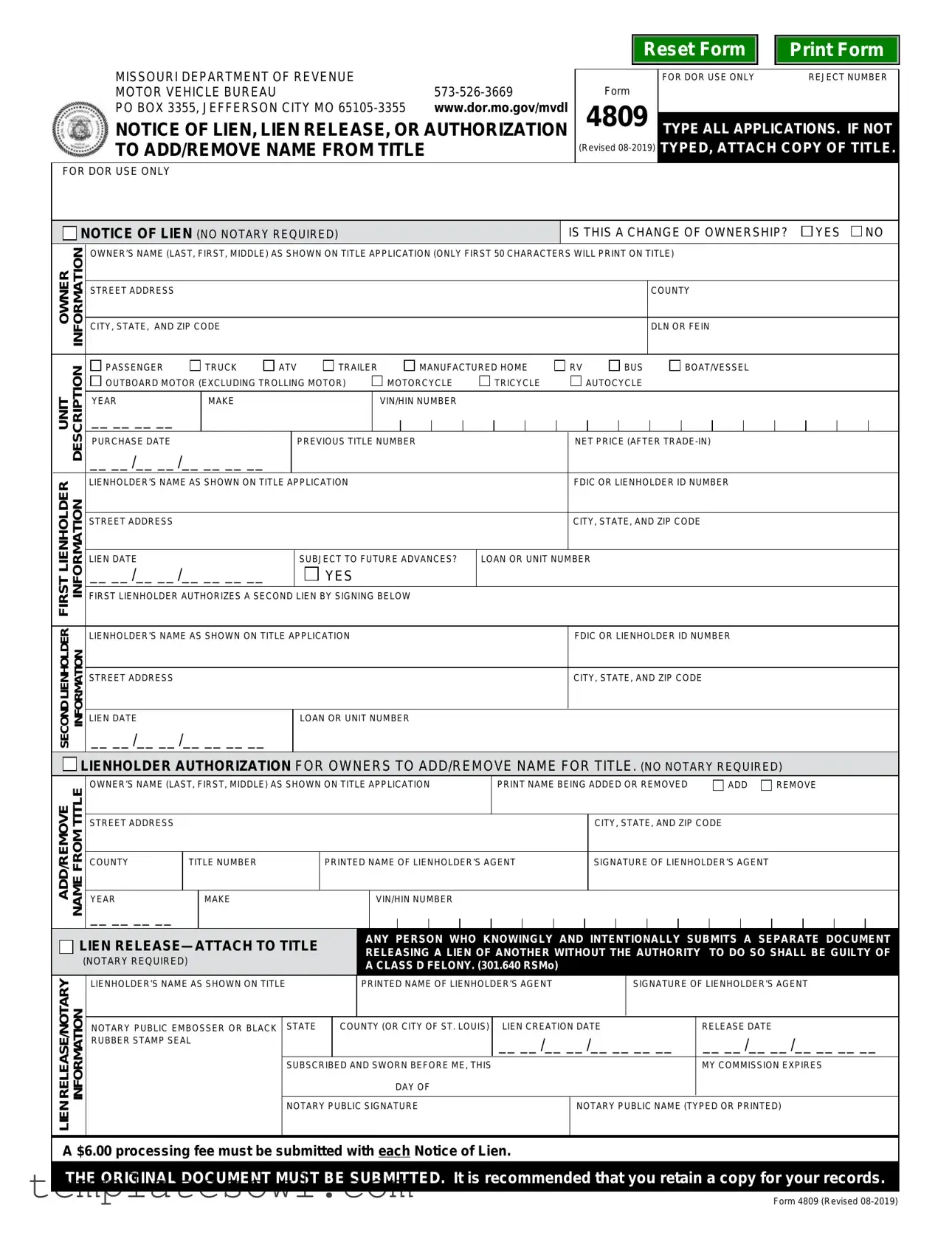

Fill Out Your Missouri Lien Form

The Missouri Lien Form, officially designated as Form 4809, plays a crucial role in documenting liens associated with vehicles and other assets. It serves as a Notice of Lien, a Lien Release, or an authorization to add or remove names from a title, depending on the circumstance. When filling out this form, the person must provide detailed owner information, including the owner’s name and address, as well as a unit description specifying the vehicle type, such as ATV, trailer, or motorboat. The section designated for lienholders requires specific details about those holding a financial interest in the asset, including their names and addresses. There are provisions for additional lienholders, allowing for a secondary lien if authorized by the primary lienholder. For all submissions, a processing fee of $6.00 is required, and it is essential that the completed form is submitted to the Missouri Department of Revenue within 30 days of the loan date to ensure the lienholder's protection against potential bankruptcies by the debtor. Failure to comply may jeopardize the rights of the lienholder. The form also outlines the process for lien release, which requires notarization, ensuring that all parties act within the boundaries of the law. Overall, understanding the Missouri Lien Form is key for anyone involved in motor vehicle transactions or financing in the state.

Missouri Lien Example

Reset Form

Print Form

MISSOURI DEPARTMENT OF REVENUE |

|

MOTOR VEHICLE BUREAU |

|

PO BOX 3355, JEFFERSON CITY MO |

www.dor.mo.gov/mvdl |

NOTICE OF LIEN, LIEN RELEASE, OR AUTHORIZATION TO ADD/REMOVE NAME FROM TITLE

|

FOR DOR USE ONLY |

REJECT NUMBER |

Form |

|

|

4809 |

|

|

TYPE ALL APPLICATIONS. IF NOT |

||

(Revised |

TYPED, ATTACH COPY OF TITLE. |

|

|

|

|

FOR DOR USE ONLY

|

|

|

NOTICE OF LIEN (NO NOTARY REQUIRED) |

|

|

|

|

|

|

|

|

|

|

IS THIS A CHANGE OF OWNERSHIP? |

YES NO |

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

OWNER INFORMATION |

|

OWNER’S NAME (LAST, FIRST, MIDDLE) AS SHOWN ON TITLE APPLICATION (ONLY FIRST 50 CHARACTERS WILL PRINT ON TITLE) |

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

STREET ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COUNTY |

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

CITY, STATE, AND ZIP CODE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DLN OR FEIN |

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

UNIT DESCRIPTION |

|

PASSENGER |

|

TRUCK |

ATV |

|

TRAILER |

|

MANUFACTURED HOME |

RV |

|

BUS |

|

BOAT/VESSEL |

|

|

|

||||||||||||||||||||||

|

|

OUTBOARD MOTOR (EXCLUDING TROLLING MOTOR) |

|

|

MOTORCYCLE |

|

TRICYCLE |

|

AUTOCYCLE |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

YEAR |

|

MAKE |

|

|

|

|

|

|

|

|

VIN/HIN NUMBER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

__ __ __ __ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

PURCHASE DATE |

|

|

|

|

|

PREVIOUS TITLE NUMBER |

|

|

|

|

|

NET PRICE (AFTER |

|

|

|

||||||||||||||||||||

|

|

|

|

|

__ __ /__ __ /__ __ __ __ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

LIENHOLDERFIRST INFORMATION |

|

LIENHOLDER’S NAME AS SHOWN ON TITLE APPLICATION |

|

|

|

|

|

|

|

|

|

|

FDIC OR LIENHOLDER ID NUMBER |

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

STREET ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CITY, STATE, AND ZIP CODE |

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIEN DATE |

|

|

|

|

|

SUBJECT TO FUTURE ADVANCES? |

|

LOAN OR UNIT NUMBER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

__ __ /__ __ /__ __ __ __ |

|

|

|

|

YES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

FIRST LIENHOLDER AUTHORIZES A SECOND LIEN BY SIGNING BELOW |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

LIENHOLDERSECOND INFORMATION |

|

__ __ /__ __ /__ __ __ __ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FDIC OR LIENHOLDER ID NUMBER |

|

|

|

|||||||||||||||||

|

|

|

|

|

LIENHOLDER’S NAME AS SHOWN ON TITLE APPLICATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

STREET ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CITY, STATE, AND ZIP CODE |

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIEN DATE |

|

|

|

|

|

LOAN OR UNIT NUMBER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

LIENHOLDER AUTHORIZATION FOR OWNERS TO ADD/REMOVE NAME FOR TITLE. (NO NOTARY REQUIRED) |

|

|

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

|

ADD/REMOVE TITLEFROMNAME |

|

OWNER’S NAME (LAST, FIRST, MIDDLE) AS SHOWN ON TITLE APPLICATION |

|

|

PRINT NAME BEING ADDED OR REMOVED |

|

ADD REMOVE |

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

STREET ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CITY, STATE, AND ZIP CODE |

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

COUNTY |

|

TITLE NUMBER |

|

|

|

|

PRINTED NAME OF LIENHOLDER’S AGENT |

|

|

|

SIGNATURE OF LIENHOLDER’S AGENT |

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YEAR |

|

MAKE |

|

|

|

|

|

|

|

VIN/HIN NUMBER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

__ __ __ __ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

LIEN |

ANY PERSON WHO KNOWINGLY AND INTENTIONALLY SUBMITS A SEPARATE DOCUMENT |

||||||||||||||||||||||||||||||||||||

|

|

|

||||||||||||||||||||||||||||||||||||||

|

|

|

RELEASING A LIEN OF ANOTHER WITHOUT THE AUTHORITY |

|

TO DO SO SHALL BE GUILTY OF |

|||||||||||||||||||||||||||||||||||

|

|

|

|

(NOTARY REQUIRED) |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

A CLASS D FELONY. (301.640 RSMo) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

RELEASE/NOTARY INFORMATION |

|

LIENHOLDER’S NAME AS SHOWN ON TITLE |

|

|

|

|

PRINTED NAME OF LIENHOLDER’S AGENT |

|

|

|

|

|

SIGNATURE OF LIENHOLDER’S AGENT |

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

NOTARY PUBLIC EMBOSSER OR BLACK |

|

STATE |

|

COUNTY (OR CITY OF ST. LOUIS) |

LIEN CREATION DATE |

|

|

|

RELEASE DATE |

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

RUBBER STAMP SEAL |

|

|

|

|

|

|

|

|

|

|

|

|

|

__ __ /__ __ /__ __ __ __ |

|

__ __ /__ __ /__ __ __ __ |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

SUBSCRIBED AND SWORN BEFORE ME, THIS |

|

|

|

|

|

|

|

|

|

MY COMMISSION EXPIRES |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DAY OF |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

LIEN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

NOTARY PUBLIC SIGNATURE |

|

|

|

|

|

NOTARY PUBLIC NAME (TYPED OR PRINTED) |

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A $6.00 processing fee must be submitted with each Notice of Lien.

THE ORIGINAL DOCUMENT MUST BE SUBMITTED. It is recommended that you retain a copy for your records.

Form 4809 (Revised

NOTICE OF LIEN

PLEASE PERFECT YOUR LIEN IMMEDIATELY!

IMPORTANT: Liens must be filed and/or received with the Department within 30 days of the loan date (perfected) for the lienholder to be protected from the debtor filing for bankruptcy relief.

A $6.00 processing fee must be submitted with each Notice of Lien.

OWNER INFORMATION AND UNIT DESCRIPTION — Complete all applicable blocks.

FIRST LIEN — Complete the FIRST LIENHOLDER INFORMATION section, if applicable.

SECOND LIEN — Complete the FIRST and SECOND LIENHOLDER INFORMATION sections, if applicable.

First Lienholder Authorization — This block must be signed by the first lienholder when adding a second lien.

Checks may be accepted as payment. Make checks payable to: Missouri Department of Revenue. The check must be

1.Driver license or

2.Date of birth; and

3.Daytime phone number.

Other restrictions may apply. NOTE: The Missouri Department of Revenue may electronically resubmit checks returned for insufficient or uncollected funds.

The lienholder will receive a receipt as proof the lien has been perfected.

Submit the completed Notice of Lien (Form 4809) to your local license office or by mail to the following address:

MOTOR VEHICLE BUREAU

301 WEST HIGH STREET

PO BOX 3355

JEFFERSON CITY MO

LIEN RELEASE

OWNER INFORMATION AND UNIT DESCRIPTION SECTIONS — Complete all applicable blocks.

FIRST AND SECOND LIENHOLDER SECTIONS — Leave blank.

LIEN RELEASE SECTION — Enter the lienholder’s name as shown on title, the date of release, printed name of the lienholder’s agent, and signature of lienholder’s agent.

NOTARIZATION — The notary information is required to be completed to release the lien.

NOTE: License Office notary service - $2.00

FRAUDULENT LIEN RELEASE — ANY PERSON WHO KNOWINGLY AND INTENTIONALLY SUBMITS A SEPARATE DOCUMENT RELEASING A LIEN OF ANOTHER WITHOUT THE AUTHORITY TO DO SO SHALL BE GUILTY OF A CLASS D FELONY. (301.640, RSMo)

Form 4809

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The Missouri Lien Form (Form 4809) is used to establish, release, or modify a lien on a motor vehicle or related property. |

| Governing Law | This form operates under Missouri Revised Statutes, specifically Section 301.640. |

| Filing Deadline | Liens must be filed within 30 days of the loan date to ensure protection against the debtor's bankruptcy filings. |

| Processing Fee | A processing fee of $6.00 is required for each Notice of Lien submission. |

Guidelines on Utilizing Missouri Lien

Completing the Missouri Lien Form accurately is essential for ensuring that your lien is properly recorded. This process includes providing necessary details about the owner, the lienholder, and the vehicle involved. Following these steps will help streamline the filing process.

- Obtain the Missouri Lien Form (Form 4809) from the Missouri Department of Revenue or their website.

- Type all information on the form. If not using a computer, attach a copy of the title.

- Indicate whether this is a change of ownership by selecting "Yes" or "No."

- Fill in the owner’s information, including their name (last, first, middle), street address, county, city, state, and ZIP code.

- Enter the Driver License Number (DLN) or Federal Employer Identification Number (FEIN) for the owner.

- Select the type of unit (e.g., passenger car, truck, trailer, etc.) and fill in the description fields including the year, make, and VIN/HIN number.

- Provide the purchase date and previous title number. Include the net price after any trade-in.

- Complete the first lienholder's information, including their name, FDIC or lienholder ID number, street address, city, state, ZIP code, lien date, and loan or unit number.

- If applicable, complete the second lienholder's information in the same manner as the first lienholder.

- Indicate whether this loan is subject to future advances and whether the first lienholder authorizes a second lien by signing in the provided area.

- If you are adding or removing a name from the title, fill in the owner’s name as shown on the title application. Specify whether to add or remove a name and provide the relevant details, including the title number.

- Have the lienholder’s agent print and sign their name where indicated.

- Pay the processing fee of $6.00 either by check, made payable to the Missouri Department of Revenue, or as instructed on the form.

- Submit the completed Notice of Lien by mailing it to the address provided: Motor Vehicle Bureau, 301 West High Street, PO Box 3355, Jefferson City, MO 65105-3355 or deliver it to your local license office.

Double-check all sections for completeness and accuracy before submission. Retain a copy of the filled-out form for your records, as this may be necessary for future reference.

What You Should Know About This Form

What is the Missouri Lien form used for?

The Missouri Lien form, specifically Form 4809, is used to officially declare a lien against a motor vehicle. This can be necessary when someone secures a loan using a vehicle as collateral. The form allows lienholders to protect their interest in the vehicle, ensuring that they have a legal claim to it until the debt is paid off. It can also be utilized to release a lien once the debt is cleared, or to add or remove an owner's name from the title. This form is essential for anyone involved in vehicle loans or ownership transfers in Missouri.

How do I complete the Missouri Lien form?

Completing the Missouri Lien form involves several steps. Start by filling in the owner's information as it appears on the vehicle title. This includes the owner's name, address, and other identifying details. Next, provide information about the vehicle, such as the year, make, and VIN/HIN number. For lienholders, you'll need to roster the first and, if applicable, second lienholder's details. Their names and addresses, along with the lien date, should be accurately recorded. It's important to ensure all information is clearly typed and correct, as errors can cause delays. Don't forget that a processing fee of $6 must accompany the form, and the original document needs to be submitted, preferably with a copy kept for your records.

What happens if I do not file the lien within the required timeframe?

If the lien is not filed within 30 days of the loan date, the lienholder may lose protections against the borrower in the event of bankruptcy. This is crucial because a timely filing ensures the lienholder's claim takes precedence. Failing to perfect the lien can jeopardize the lienholder's ability to repossess the vehicle if necessary. To avoid this risk, it's best to complete and submit the Missouri Lien form as soon as the loan is secured.

How can I check the status of my lien after filing?

Common mistakes

When filling out the Missouri Lien form, it is easy to overlook certain details. One common mistake is not typing the application. The instructions clearly state that all applications should be typed. If they aren't, you must attach a copy of the title. Skipping this step can cause delays or even rejections.

Another frequent error involves the owner’s information section. Some individuals fail to enter the full name of the owner as it appears on the title. Remember, only the first 50 characters will print on the title. Leaving out middle names or using nicknames can lead to discrepancies that may complicate the lien process.

Many people also forget to provide complete lienholder information. The form requires both first and second lienholder sections to be filled out accurately. Each lienholder’s name, address, and ID number must be captured correctly. Failure to do this can result in denial or confusion in lien status.

It’s essential not to skip the lien date. Some individuals mistakenly leave this field blank or miscalculate the date. This date marks when the lien becomes effective. An incorrect lien date may create problems, especially in situations where the lienholder seeks protection in legal matters.

Payment details are often overlooked. A $6.00 processing fee must accompany the form, and this fee should be paid by a check that meets specific criteria. A check that doesn’t have the correct information printed can be rejected. Providing your driver license number and other required details is crucial in ensuring smooth processing.

Lastly, the notary requirement is sometimes neglected. A lien release needs a notary’s completion. If the notary information isn’t filled out correctly, the release may not be valid. This mistake can lead to complications and further actions down the line, making it a critical step that should not be overlooked.

Documents used along the form

When processing a Missouri Lien form, it's essential to be aware of other important documents that may accompany or relate to the lien. These forms help ensure that all aspects of the lien process are completed correctly and in compliance with state regulations.

- Notice of Lien (Form 4809): This is the primary form for filing a lien on a motor vehicle in Missouri. It secures the lender's interest in the vehicle until the debt is paid.

- Title Application: This form initiates the vehicle title issuance process. It is necessary for registering a vehicle and serves as a record of ownership, linking the owner to the vehicle.

- Lien Release Form: After the debt is settled, this document formally releases the lien on the vehicle. It should be submitted to the Department of Revenue to update the title information.

- Power of Attorney: If someone other than the vehicle owner is handling the lien process, a power of attorney form grants them the legal authority to act on the owner's behalf.

- Change of Ownership Form: This form is used when transferring ownership of a vehicle. It is necessary to ensure that any liens are appropriately reflected on the new title.

Understanding these documents can prevent complications during the lien filing and release processes. Timely completion is crucial for protecting rights and interests. Ensure all documents are filled out accurately and submitted in accordance with Missouri regulations.

Similar forms

The Missouri Lien form shares similarities with several other documents related to property liens and ownership transfers. Here are four documents that resemble the Missouri Lien form and explanations of how they are similar:

- UCC-1 Financing Statement: This document serves to perfect a security interest in personal property. Like the Missouri Lien form, it needs to be filed with the appropriate state authority to protect the lienholder's rights. Both documents require specific information about the debtor and the property involved.

- Mechanic's Lien: Used by contractors and suppliers, a mechanic's lien allows them to claim a legal right to a property due to unpaid services. Similar to the Missouri Lien form, it ensures that the lien is officially recorded, providing the lienholder with a security interest in the property until payment is made.

- Title Application for Vehicles: When applying for a vehicle title, the application often requests information about any existing liens. This is like the Missouri Lien form since both documents require detailed information about the vehicle and the lienholder, ensuring transparent ownership records.

- Liens Waiver Form: This document is often used in construction and property transactions to confirm that a lien has been satisfied. Similar to the lien release section of the Missouri Lien form, it serves to notify parties involved that the obligation has been fulfilled and the lien is no longer in effect.

Dos and Don'ts

Filling out the Missouri Lien form accurately is essential to ensure compliance and protect your interests as a lienholder. Below is a list of important do's and don'ts to consider when completing the form.

- Do type all information in the application to ensure legibility.

- Do submit the original document along with the $6 processing fee.

- Do complete all applicable sections, including the owner and lienholder information.

- Do obtain the first lienholder authorization if adding a second lien.

- Don't leave any sections blank if they apply to your situation.

- Don't forget to notarize the lien release, as it's a required step.

- Don't submit a separate document releasing a lien without proper authority.

- Don't neglect to retain a copy of the completed form for your records.

By following these guidelines, you can navigate the process of filling out the Missouri Lien form with confidence, ensuring that all necessary information is included and accurately presented.

Misconceptions

Understanding the Missouri Lien form can be challenging due to various misconceptions. Here are four common misunderstandings regarding this form:

- No Notary Required: Many believe that all lien actions require notarization. However, for certain sections of the Missouri Lien form, such as the Notice of Lien, notarization is not necessary.

- Filing is Optional: Some think that submitting the lien is optional. In fact, the Department of Revenue requires liens to be filed within 30 days of the loan date to protect the lienholder's rights in case the debtor files for bankruptcy.

- Only One Lien Can Be Filed: A common myth is that only one lien can be recorded for a vehicle. In actuality, both first and second liens can be reported on the same vehicle, with proper authorization from the first lienholder.

- Just a Fee Submission: It is mistakenly assumed that submitting the processing fee is enough for lien perfection. However, it is essential to complete the entire form accurately and submit it to the Department of Revenue to ensure proper processing.

Key takeaways

When filling out the Missouri Lien form (Form 4809), several key points must be considered to ensure accuracy and compliance:

- Timely Filing: Liens must be filed with the Department of Revenue within 30 days of the loan date. This timeframe helps protect the lienholder in case of the debtor's bankruptcy.

- Complete Information: Fill out all necessary sections, including owner information and unit description. If applicable, ensure both the first and second lienholder sections are completed correctly.

- Processing Fee: A $6.00 fee is required with each Notice of Lien submission. Be prepared to submit payment, and ensure the check includes your driver’s license number, date of birth, and contact information.

- Notarization Requirement: If you are releasing a lien, notary information must be completed. This is crucial for the validity of the release. Additionally, avoid submitting any fraudulent lien release documents, as this is a serious offense.

By following these steps, you can ensure the lien is processed smoothly and legally. It is prudent to keep a copy of the completed form for your records after submission.

Browse Other Templates

Canadian Nuclear Safety Commission - Contact information for the current policy owner can be updated on this form.

Gun License California 2024 - Social security information is confidential but may be used for identity verification.