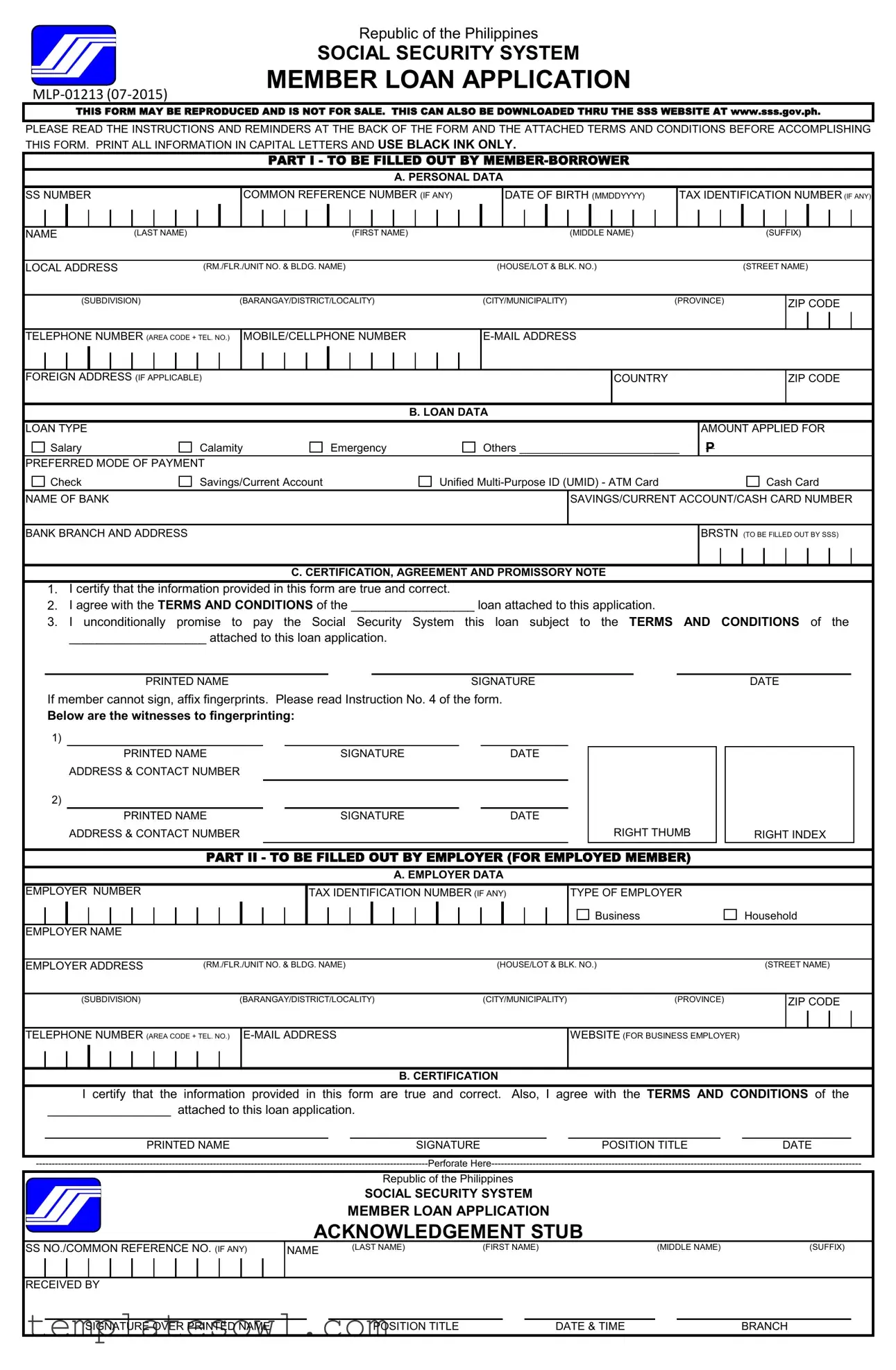

Fill Out Your Mlp 01213 Form

The MLP-01213 form is an essential document for members of the Social Security System (SSS) in the Philippines applying for a loan. It facilitates various types of loans, including salary, calamity, and emergency loans. Applicants must complete the personal data section by providing their name, date of birth, contact information, and Social Security number. The form also requires details about the loan, such as the amount being applied for and the preferred payment method. To ensure correct processing, applicants must carefully read provided instructions and clearly print all required information using black ink. For employed individuals, specific employer data must be filled out, certifying the information given is true and correct. The form serves not just as an application but also includes a section for a promissory note, indicating the borrower's agreement to repay the loan according to the stated terms and conditions. Additionally, options for submitting the form are outlined, such as presenting valid identification and, if necessary, securing signatures from witnesses in cases of fingerprinting. This systematic approach aims to streamline the application process while protecting both the member-borrower and the SSS.

Mlp 01213 Example

Republic of the Philippines

SOCIAL SECURITY SYSTEM

MEMBER LOAN APPLICATION

THIS FORM MAY BE REPRODUCED AND IS NOT FOR SALE. THIS CAN ALSO BE DOWNLOADED THRU THE SSS WEBSITE AT www.sss.gov.ph.

PLEASE READ THE INSTRUCTIONS AND REMINDERS AT THE BACK OF THE FORM AND THE ATTACHED TERMS AND CONDITIONS BEFORE ACCOMPLISHING THIS FORM. PRINT ALL INFORMATION IN CAPITAL LETTERS AND USE BLACK INK ONLY.

SS NUMBER

PART I - TO BE FILLED OUT BY

A. PERSONAL DATA

COMMON REFERENCE NUMBER (IF ANY) |

DATE OF BIRTH (MMDDYYYY) |

TAX IDENTIFICATION NUMBER (IF ANY) |

|

|

|

NAME |

(LAST NAME) |

(FIRST NAME) |

(MIDDLE NAME) |

(SUFFIX) |

|

|

|

|

|

LOCAL ADDRESS |

(RM./FLR./UNIT NO. & BLDG. NAME) |

|

(HOUSE/LOT & BLK. NO.) |

(STREET NAME) |

(SUBDIVISION) |

(BARANGAY/DISTRICT/LOCALITY) |

(CITY/MUNICIPALITY) |

(PROVINCE) |

ZIP CODE

TELEPHONE NUMBER (AREA CODE + TEL. NO.)

MOBILE/CELLPHONE NUMBER

FOREIGN ADDRESS (IF APPLICABLE)

COUNTRY

ZIP CODE

B. LOAN DATA

LOAN TYPE

Salary

Calamity

Emergency

Others __________________________

AMOUNT APPLIED FOR

P

PREFERRED MODE OF PAYMENT |

|

|

|

|

Check |

Savings/Current Account |

Unified |

Cash Card |

|

NAME OF BANK |

|

|

SAVINGS/CURRENT ACCOUNT/CASH CARD NUMBER |

|

|

|

|

|

|

BANK BRANCH AND ADDRESS

BRSTN (TO BE FILLED OUT BY SSS)

C. CERTIFICATION, AGREEMENT AND PROMISSORY NOTE

1.I certify that the information provided in this form are true and correct.

2.I agree with the TERMS AND CONDITIONS of the __________________ loan attached to this application.

3.I unconditionally promise to pay the Social Security System this loan subject to the TERMS AND CONDITIONS of the

____________________ attached to this loan application.

PRINTED NAME |

SIGNATURE |

If member cannot sign, affix fingerprints. Please read Instruction No. 4 of the form.

Below are the witnesses to fingerprinting:

1) |

|

|

|

|

|

|

|

PRINTED NAME |

|

SIGNATURE |

|

DATE |

|

|

ADDRESS & CONTACT NUMBER |

|

|

|

|

|

2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PRINTED NAME |

|

SIGNATURE |

|

DATE |

|

|

ADDRESS & CONTACT NUMBER |

|

|

|

|

|

|

|

|

|

|

|

|

RIGHT THUMB

RIGHT INDEX

PART II - TO BE FILLED OUT BY EMPLOYER (FOR EMPLOYED MEMBER)

A. EMPLOYER DATA

EMPLOYER NUMBER |

|

|

|

|

|

|

|

TAX IDENTIFICATION NUMBER (IF ANY) |

TYPE OF EMPLOYER |

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business |

Household |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EMPLOYER NAME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|||||||||||||||||||||

EMPLOYER ADDRESS |

|

|

(RM./FLR./UNIT NO. & BLDG. NAME) |

(HOUSE/LOT & BLK. NO.) |

(STREET NAME) |

|||||||||||||||||||||

(SUBDIVISION) |

(BARANGAY/DISTRICT/LOCALITY) |

(CITY/MUNICIPALITY) |

(PROVINCE) |

ZIP CODE

TELEPHONE NUMBER (AREA CODE + TEL. NO.)

WEBSITE (FOR BUSINESS EMPLOYER)

B. CERTIFICATION

I certify that the information provided in this form are true and correct. Also, I agree with the TERMS AND CONDITIONS of the

__________________ attached to this loan application.

PRINTED NAME |

SIGNATURE |

POSITION TITLE |

DATE |

|

|

|

|

Perforate Here |

|||

|

|

Republic of the Philippines |

|

|

|

|

|

SOCIAL SECURITY SYSTEM |

|

|

|

|

|

MEMBER LOAN APPLICATION |

|

|

|

|

ACKNOWLEDGEMENT STUB |

|

|

||

SS NO./COMMON REFERENCE NO. (IF ANY) |

NAME |

(LAST NAME) |

(FIRST NAME) |

(MIDDLE NAME) |

(SUFFIX) |

|

|

|

|

||

RECEIVED BY |

|

|

|

|

|

SIGNATURE OVER PRINTED NAME |

|

POSITION TITLE |

DATE & TIME |

|

BRANCH |

PART III - TO BE FILLED OUT BY SSS

RECEIVED AND ENCODED BY

SIGNATURE OVER PRINTED NAME |

DATE & TIME |

BRANCH |

REVIEWED BY

SIGNATURE OVER PRINTED NAME |

DATE & TIME |

INSTRUCTIONS

1.Fill out this form in one (1) copy.

Note: If the "Preferred Mode of Payment is Savings/Current Account or Cash Card or UMID - ATM Card, the following fields shall be filled out if the member opts to avail of the "Salary Loan Release Thru the Bank Program" (upon implementation of the Program.):

-Name of Bank,

-Savings/Current Account/Cash Card Number

-Bank Branch and Address

2.Always indicate "N/A" or "Not Applicable", if the required data is not applicable.

3.Present valid identification cards/documents. Refer to attached "List of Filer's Valid Identification (ID) Cards/Documents".

4.If member cannot sign, witnesses to fingerprinting shall be as follows: Filed by

▪SSS receiving personnel who shall affix his/her signature on the portion provided in Part

Filed by authorized representative/employer/company representative/employer's representative/household employer's representative

▪Two (2) witnesses. One (1) witness is the authorized representative/employer/company representative/employer's representative/household employer's representative himself and the other one (1) could be any person. Both should affix their signatures and indicate their addresses and contact numbers on the portions provided in Part

5.The signatory in Part

REMINDER

Verification of status may be made thru the SSS Website at www.sss.gov.ph or contact our Call Center at

WARNING

ANY PERSON WHO MAKES ANY FALSE STATEMENT IN THIS APPLICATION OR SUBMITS ANY FALSIFIED DOCUMENT IN CONNECTION WITH THE APPLICATION FOR LOAN WITH THE SSS SHALL BE LIABLE CRIMINALLY UNDER SECTION 28 OF R.A. 8282 OR UNDER PERTINENT PROVISION OF THE REVISED PENAL CODE OF THE PHILIPPINES.

TERMS AND CONDITIONS FOR SALARY LOAN

(SSC Res. No.:

A.ELIGIBILITY REQUIREMENTS

1.All employed and currently contributing

1.1For a

1.2For a

2.The

3.The

4.The

5.The

B.LOAN AMOUNT

1. A

2.A

3.The net amount of the loan shall be the difference between the approved loan amount and all outstanding balance of

C.REPAYMENT TERM AND SCHEDULE OF PAYMENT

1.The loan shall be payable within two (2) years in 24 equal monthly installments.

2.The monthly amortization shall start on the 2nd month following the date of the granting of the loan, which is due on or before the payment deadline, as follows:

For Employers (ERs) |

For |

|||

|

|

|

|

|

If 10th digit of the |

Payment Deadline |

If 10th (last) digit of the |

Payment Deadline |

|

(following the |

(following the |

|||

ER number ends in: |

SS number ends in: |

|||

applicable month) |

applicable month or quarter) |

|||

|

|

|||

|

|

|

|

|

1 or 2 |

10th day of the month |

1 or 2 |

10th day of the month |

|

3 or 4 |

15th day of the month |

3 or 4 |

15th day of the month |

|

5 or 6 |

20th day of the month |

5 or 6 |

20th day of the month |

|

7 or 8 |

25th day of the month |

7 or 8 |

25th day of the month |

|

9 or 0 |

Last day of the month |

9 or 0 |

Last day of the month |

|

For OFW members, the payment deadline is on or before the 10th day of the month following the applicable month or quarter.

3.Payment shall be made at any SSS branch with automated tellering system,

D.INTEREST AND PENALTY

1.The loan shall be charged an interest rate of 10% per annum until fully paid, based on diminishing principal balance, and shall be amortized over a period of 24 months. If the loan is not fully paid at the end of the term, interest shall continue to be charged on the outstanding principal balance until fully paid. .

2.Interest of 10% shall continue to be charged on the outstanding principal balance until fully paid.

3.Any excess in the amortization payment shall be applied to the outstanding principal balance.

4.Loan amortization not remitted on due date shall bear a penalty of 1% per month.

E.SERVICE FEE

A service fee of 1% of the loan amount shall be charged and deducted from the proceeds of the loan.

F.LOAN RENEWAL

1.Renewal shall be allowed after payment of at least 50% of the original principal amount and at least 50% of the term has lapsed.

2.Proceeds of renewal loan may be any amount greater than or equal to zero, provided that the outstanding balance on the previous loan has been deducted.

G.RESPONSIBILITIES OF THE EMPLOYER

1.The employer shall be responsible for the collection and remittance to the SSS of the amortization due on the

2.The employer shall deduct the total balance of the loan from any benefit/s due to the employee and shall remit the same in full to SSS, in case the

3.The employer shall report to the SSS the effective date of separation from the company and the unpaid loan balance of the employee, through the collection list, if the benefit(s) due the employee is insufficient to fully repay his loan.

4.The employer shall require a new employee to secure from the SSS an updated statement of his account, deduct from his salary the amortization due and remit the payment to SSS.

H.RESPONSIBILITY OF

A

I.DEDUCTION OF UNPAID LOAN FROM BENEFITS (Sickness/Maternity/Partial Disability/Total Disability/Retirement/ Funeral/Death)

In case of default, the arrearages/unpaid loan shall be deducted from the benefits claimed by the member, whichever comes first, as follows:

1.For

2.In case of

J.OTHER CONDITIONS

1.Any overpayment on a previous loan shall be applied to the subsequent loan, if any. Otherwise, the overpayment shall be refunded upon request of the

2.The

R.A.3765, OTHERWISE KNOWN AS "TRUTH IN LENDING ACT"

A DISCLOSURE STATEMENT ON LOAN TRANSACTION SHALL BE ISSUED BY SSS TO THE MEMBER- BORROWER UPON RECEIPT OF HIS LOAN APPLICATION.

Page 1 of 1

LIST OF FILER'S VALID IDENTIFICATION (ID) CARDS/DOCUMENTS

Member Loan Application Form

A.Primary ID Cards/Document

1.Social Security (SS) card

2.Unified

3.Driver's License

4.Passport

5.Professional Regulation Commission (PRC) card

6.Seaman's Book (Seafarer's Identification & Record Book)

B.Secondary ID Cards/Documents

1.Alien Certificate of Registration

2.Certificate of Licensure/Qualification Documents from Maritime Industry Authority

3.Certificate of Muslim Filipino Tribal Affiliation issued by National Commission on Muslim Filipinos

4.Company ID card

5.Credit card

6.Firearm License card issued by Philippine National Police (PNP)

7.Fishworker's License issued by Bureau of Fisheries and Aquatic Resources (BFAR)

8.Government Service Insurance System (GSIS) card/Member's Record/Certificate of Membership

9.Health or Medical card

10.Home Development Mutual Fund

11.ID card issued by Local Government Units (LGUs) (e.g., Barangay/Municipality/City)

12.ID card issued by professional association recognized by PRC

13.Marriage Contract/Marriage Certificate

14.Overseas Worker Welfare Administration (OWWA) card

15.Philippine Health Insurance Corporation (PHIC) ID card

16.Police Clearance

17.Postal ID card

18.School ID card

19.Seafarer's Registration Certificate issued by Philippine Overseas Employment Administration

20.Senior Citizen card

21.Student Permit issued by Land Transportation Office (LTO)

22.Taxpayer's Identification Number (TIN) card

23.Voter's Identification card or Voter's Affidavit/Certificate of Registration

1.Filed by

Present the original copy of any one (1) of the primary ID cards/document in Item A or two (2) secondary ID cards/documents in Item B at least one (1) with signature and photo.

2.Filed by Authorized Representative of

2.1Original copy of any one (1) of the Authorized Representative's primary ID cards/document in Item A or original copies of two (2) secondary ID cards/documents in Item B at least one (1) with signature and photo; and

2.2Original copy of any one (1) of the

3.Filed by Employer Present the following:

3.1Original copy of any one (1) of the Employer's primary ID cards/document in Item A or original copies of two (2) secondary ID cards/documents in Item B at least one (1) signature and photo; and

3.2Original copy of any one (1) of the

4.Filed by Company Representative

Present the Authorized Company Representative Card (ACR Card) or

If without ACR Card (not available at the time of filing), present the following:

4.1Original copy of any one (1) of the Company Representative's primary ID cards/documents in Item A or original copies of two (2) secondary ID cards/documents in Item B at least one (1) with signature and photo; and

4.2Original copy of any one (1) of the

5.Filed by Employer's Representative Present the following:

5.1Original copy of any one (1) of the Employer Representative's primary ID cards/document in Item A or original copies of two (2) secondary ID cards/documents in Item B at least one (1) signature and photo; and

5.2Original copy of any one (1) of the

6.Filed by Household Employer's Representative Present the following:

6.1Original copy of any one (1) of the Household Employer Representative's primary ID cards/document in Item A or original copies of two (2) secondary ID cards/documents in Item B at least one (1) signature and photo; and

6.2Original copy of any one (1) of the

one (1) with signature and photo; and

Note: For security agencies and employers with branches but with centralized filing of loan applications, photocopy of the above cited documents duly certified by the member and authenticated by the authorized company signatory may be accepted.

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Title | MLP-01213 is titled "Social Security System Member Loan Application." It is utilized for applying for loans from the Social Security System in the Philippines. |

| Governing Law | This form is governed by Republic Act No. 8282, which outlines the legal framework for loan applications within the Social Security System. |

| Submission Guidelines | The form must be filled out using capital letters and black ink only. Applicants should also provide valid identification as specified in the form. |

| Loan Conditions | Borrowers must meet specific eligibility conditions, including having a minimum number of monthly contributions and a valid employer, to qualify for a loan. |

Guidelines on Utilizing Mlp 01213

Filling out the MLP 01213 form is an essential part of the loan application process, helping to ensure all necessary information is completed accurately. Once you've gathered the required details, follow these steps to fill out the form correctly.

- Personal Data: Start by entering your Social Security Number and Common Reference Number, if applicable.

- Provide your Date of Birth in the format MMDDYYYY.

- Add your Tax Identification Number, if you have one.

- Enter your full name, including Last Name, First Name, Middle Name, and Suffix.

- Fill in your Local Address with the required details, such as Unit Number, Street Name, Barangay, City/Municipality, and Province.

- Include your ZIP code, Telephone Number, and Mobile Number.

- Add your Email Address. If you have a foreign address, provide the necessary details including the country and ZIP code.

- Loan Data: Select the Loan Type from the options provided (e.g., Salary, Calamity, Emergency, Others).

- Indicate the Amount Applied For, using both figures and words.

- Choose your Preferred Mode of Payment and fill in the related bank information where applicable.

- Certification, Agreement, and Promissory Note: Carefully read and confirm that the information listed is accurate. Provide your Printed Name and Signature. If you cannot sign, ensure witnesses sign as well.

- Employer Data: If employed, your employer will provide their information, including Employer Number, Tax Identification Number, and address details. They will also sign to certify the information.

- Once the form is completed, make sure to keep a copy for your records before submitting it.

After you submit the form, it will go through the processing stage with the SSS. You might want to keep an eye on your application's status by checking the SSS website or contacting their call center if you have inquiries. This way, you'll stay updated on any next steps or additional information that might be required.

What You Should Know About This Form

What is the MLP-01213 form?

The MLP-01213 form is the Member Loan Application Form used by members of the Social Security System (SSS) in the Philippines to apply for various types of loans. This form must be filled out accurately, as it collects personal data, loan data, and certifications necessary for the approval process. It can be reproduced and downloaded from the SSS website.

Who can apply using this form?

Eligible applicants include all employed individuals and currently contributing self-employed or voluntary members of the SSS. Certain conditions apply; for instance, a borrower must have made a specified number of monthly contributions and be under the age of sixty-five at the time of application.

What types of loans are available through the MLP-01213 form?

The form allows for various loan types, including salary loans, calamity loans, emergency loans, and other specific types as determined by the SSS. Applicants must specify the loan type they are applying for in the form.

What are the repayment terms for loans obtained through this form?

Loans are to be repaid within two years through 24 equal monthly installments. The repayment begins two months after the loan is granted, and specific payment deadlines are determined based on the member's SS number. Employers are typically responsible for deducting loan payments from salaries.

What identification is required when submitting the MLP-01213 form?

The member must provide valid identification. This can include primary ID cards such as a Social Security (SS) card, Unified Multi-Purpose ID (UMID) card, or a driver's license. Secondary identification can also be accepted. Specific requirements will depend on whether the application is filed by the member directly, an authorized representative, or an employer.

How is the loan amount determined?

The loan amount depends on the member's latest posted Monthly Salary Credits (MSCs). For a one-month salary loan, the amount is based on the average of the latest 12 MSCs or the amount applied for, whichever is lower. For two-month loans, the calculation involves twice the average MSC or the amount requested, again choosing the lower figure.

What happens if a loan payment is missed?

If a loan payment is missed, a penalty of 1% per month will be applied to the outstanding balance. Interest continues to accrue on unpaid amounts. Employers are tasked with collecting and remitting the loan repayments, which may lead to deductions from benefits in cases of default or negligence in repayment.

How can an applicant verify their application status?

The applicant can verify their application status through the SSS website or by contacting the SSS Call Center. It is advisable to keep the receipt given upon submission of the loan application for reference in any inquiries.

Common mistakes

Filling out the MLP-01213 form can be a daunting task, and many people make common mistakes that can delay their loan application. One frequent error is failing to use capital letters and black ink as specified. The instructions are clear: all information should be printed in uppercase letters. Using lower case or colored ink can lead to rejection or significant delays in processing.

Another mistake is neglecting to provide a complete and accurate local address. A missing detail, such as the zip code or house number, can result in confusion and possible delays. Ensure that your address is precise so the Social Security System (SSS) can contact you without issue.

Many applicants forget to indicate "N/A" or "Not Applicable" for sections that do not apply to them. Leaving fields blank instead of providing this indication can send the form back for corrections. It's essential to follow all instructions closely to avoid unnecessary administrative hurdles.

Providing an incorrect tax identification number (TIN) is another common error. It is necessary for verification purposes. Double-check that this number is accurate and matches your official documents before submission.

Another oversight involves the loan data section. Applicants often miss listing the correct type of loan or fail to state the amount applied for clearly. This information is mandatory, and inaccuracies can affect the assessment of your application.

Signature mismatches or missing signatures altogether create significant issues. SSS must have your wet signature on the document to process the application. Furthermore, if a member cannot sign, the instructions for fingerprinting must be followed correctly, including the requirement for witnesses.

Many individuals forget to present the required identification documents when submitting their application. Underestimating the importance of providing valid ID can lead to immediate rejection. It's recommended to prepare these documents ahead of time to avoid delays.

Lastly, people often overlook the terms and conditions attached to the loan. Understanding these is crucial. Agreeing to terms without fully reading them can lead to unintended consequences later on. Always take the time to understand your obligations before signing the form.

Documents used along the form

The MLP-01213 form is essential for members of the Social Security System (SSS) in the Philippines when applying for loans. However, there are several other forms and documents that may accompany this application. Understanding these documents can simplify the process and ensure that everything needed is submitted correctly.

- SSS ID Card: This serves as proof of membership and is often required for identification when submitting loan applications.

- Employer's Certification: This document verifies the member's employment status and is usually completed by a supervisor or HR representative.

- Loan Terms and Conditions: This outlines the specific terms related to the loan being applied for, including interest rates and repayment schedules.

- Promissory Note: A signed agreement that indicates the member's promise to repay the loan. This may be included in the loan application documentation.

- Bank Account Information: Required for members opting for bank disbursement, to facilitate loan deposit through their savings or current account.

- ID Documents: Valid identification is often necessary, such as a driver's license or passport, to support the application.

- Signature Card: This is typically used by employers to authorize the signers of documents, including loan application forms.

- Loan Release Receipt: Issued by SSS upon approval and release of the loan, confirming receipt of the loan amount.

- Updated Contribution Report: This document reflects the member’s recent contributions to ensure eligibility for the loan based on posted contributions.

- Intent to Renew Form: If the member wishes to renew an existing loan, this form is necessary to express that intention officially.

Gathering these accompanying forms and documents will help streamline the loan application process. It’s vital to ensure all information is accurate and complete to avoid delays. Should uncertainties arise, don’t hesitate to reach out for assistance. Support is available to guide you through each step of the process.

Similar forms

The MLP 01213 form, used for member loan applications within the Social Security System (SSS) of the Philippines, shares similarities with several other documents commonly used in financial and member benefit transactions. The following list outlines these documents and highlights the key similarities:

- Loan Application Form (Fannie Mae or Freddie Mac) - Like the MLP 01213, this form captures personal data, loan amount requests, and borrower certifications, reflecting a standard structure for loan applications.

- Bank Loan Application - Similar to the MLP 01213, this document requires personal information and loan details, including the purpose of the loan and repayment terms, ensuring clarity and compliance from the borrower.

- Mortgage Application - This document parallels the MLP 01213 by collecting borrower information, property details, and financial information, emphasizing the importance of accurate data for loan approval.

- Credit Card Application - Like the MLP 01213, it requires personal identification and an agreement to the terms and conditions, underlining the borrower's financial responsibility and understanding.

- Membership Enrollment Form - Similar in structure, this form gathers personal details and requires agreement to terms, much like the certification section of the MLP 01213.

- Insurance Application Form - This document resembles the MLP 01213 as both require personal data and a signature for agreement, along with information relevant to the specific type of insurance or loan.

- Grant Application - Both forms necessitate a detailed account of the applicant's information and intended use of funds, presenting a clear representation of the purpose for financial assistance.

- Job Application Form - This shares similarities in requiring personal identification, contact information, and possibly references, helping to verify the identity of the applicant.

- Financial Aid Application (FAFSA) - Like the MLP 01213, this application evaluates eligibility and requires detailed financial information to process funding requests.

These documents, while designed for different contexts, reveal a consistent approach to gathering essential borrower information, ensuring compliance, and securing agreements between the parties involved. Each serves a distinct purpose within its framework but shares fundamental elements found in the MLP 01213 form.

Dos and Don'ts

When filling out the MLP 01213 form, consider the following guidelines:

- Do print all information in capital letters and use only black ink.

- Do provide accurate data for every required field.

- Do indicate "N/A" if certain information is not applicable.

- Do present valid identification cards as specified in the instructions.

- Do keep a copy of the completed form for your records.

- Don't leave any fields blank unless you have marked them as not applicable.

- Don't sign the form without ensuring all information is correct.

- Don't forget to include your preferred mode of payment.

- Don't submit the form without the necessary identification documents.

- Don't use any color ink other than black for the form.

Misconceptions

Misconception 1: The MLP-01213 form is only for government employees.

This form is intended for all employed individuals who are members of the Social Security System (SSS), including those in the private sector and self-employed individuals who meet certain criteria.

Misconception 2: You cannot change the information once the form is submitted.

If you realize there's an error after submission, you can contact the SSS to correct the information. It's essential to act quickly to avoid complications with your loan application.

Misconception 3: The loan amount is automatically granted based on the application.

Loan amounts are subject to approval based on factors such as the member’s contributions and outstanding balances. The final approved amount may differ from what is requested.

Misconception 4: There is no need to provide identification when submitting the form.

Valid identification is required. The member must present either primary or secondary ID cards/documents at the time of application to verify identity and eligibility.

Misconception 5: All applications are processed immediately.

Processing times may vary, and it can take several days for the SSS to review and approve loan applications, depending on the completeness of the documents submitted.

Misconception 6: Once approved, the loan does not need to be repaid until it is convenient.

All loans must be repaid according to the agreed schedule. Failure to adhere to the repayment terms can result in penalties, and any unpaid balances may be deducted from future benefits.

Key takeaways

- Complete Accurate Information: When filling out the MLP 01213 form, it is essential to provide accurate and complete information. Use capital letters and black ink throughout the form.

- Loan Eligibility: Ensure eligibility by confirming that you have the required number of monthly contributions, and that your employer is up to date with contributions and loan remittances.

- Payment Preferences: Choose your preferred mode of payment for the loan, whether it be a check, savings account, or cash card. Ensure to fill in all relevant bank details if applicable.

- Signatures and Witnesses: The form requires signatures from the member-borrower. If you cannot sign, fingerprints must be affixed and witnessed by two individuals as specified.

- Submission and Verification: After completing the form, submit it at a designated SSS branch. You can verify your application status through the SSS website or by contacting their call center.

Browse Other Templates

Routing Number Charles Schwab - Documents such as a death certificate may be necessary if submitting due to a beneficiary’s death.

Payroll Nanny - Be aware that any late payments can lead to additional fees.