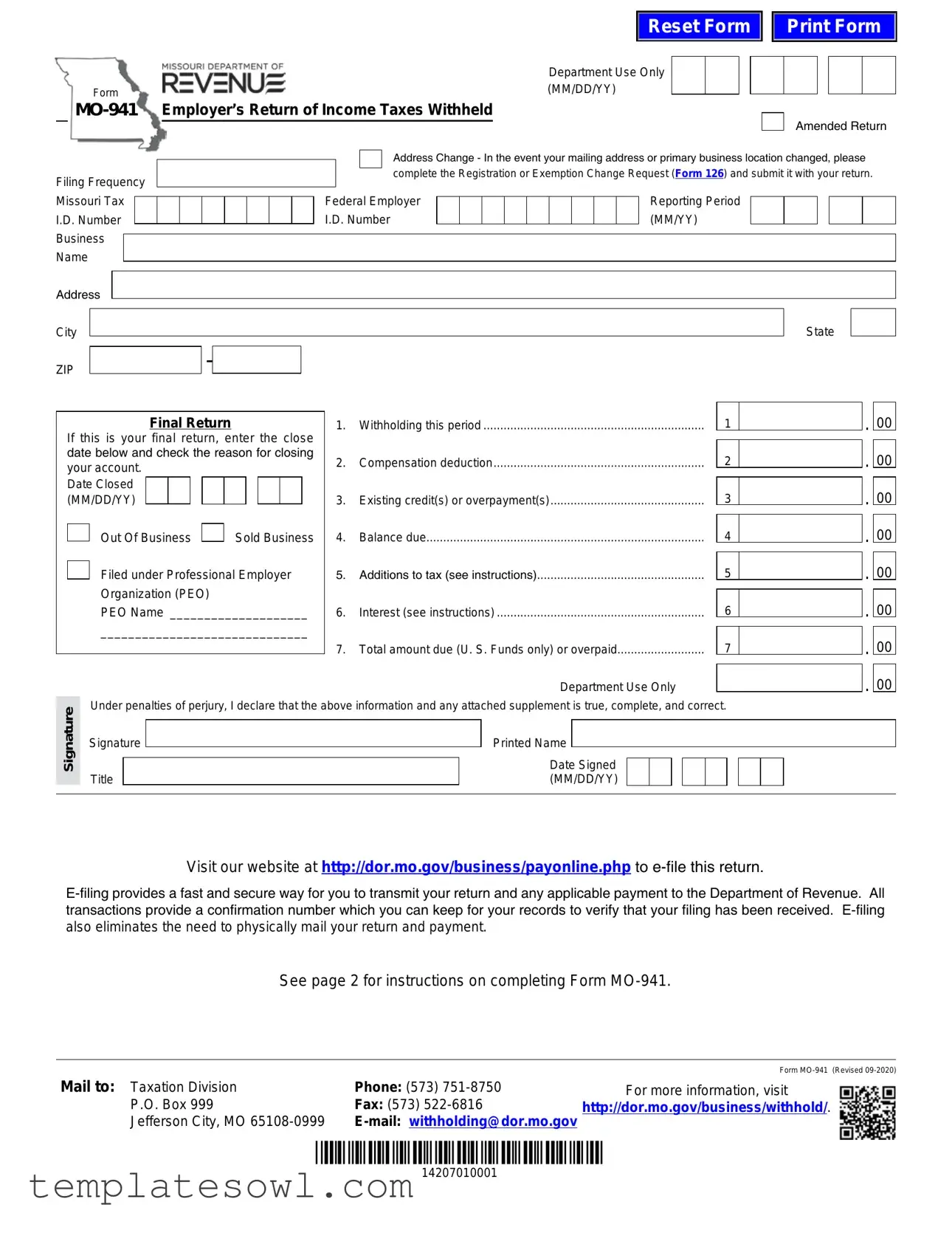

Fill Out Your Mo 941 Form

The MO-941 form serves as the Employer's Return of Income Taxes Withheld in Missouri, providing an essential tool for businesses to report their withholding tax liabilities. This form requires the submission of various details, including the Missouri Tax I.D. Number and the Federal Employer I.D. Number, ensuring that the state can accurately track tax payments associated with specific businesses. Notably, it accommodates scenarios such as an amended return or an address change, making it adaptable to the shifting needs of a business. Employers must indicate their withholding amounts for the reporting period and must also account for any existing credits or overpayments. If applicable, the form ensures that businesses can apply any previously held credits towards their current liabilities. Additionally, it delineates the penalties and interest that may accrue from late filings, emphasizing the importance of timely submissions. Completing the form requires diligence, as employers must verify the accuracy of financial details, including total amounts due and overpaid. Finally, as businesses navigate their tax responsibilities, the MO-941 form not only operates as a reporting mechanism but also provides guidance on actions they can take in the event of amending previous returns or claiming refunds for overpaid taxes.

Mo 941 Example

Reset Form

Print Form

Form

Filing Frequency

Missouri Tax

I.D. Number

Business

Name

Address

Department Use Only (MM/DD/YY)

Employer’s Return of Income Taxes Withheld

Amended Return

Address Change - In the event your mailing address or primary business location changed, please complete the Registration or Exemption Change Request (Form 126) and submit it with your return.

Federal Employer |

|

|

|

|

|

|

|

|

|

Reporting Period |

|

|

|

|

|

|

|

|

|

||

I.D. Number |

|

|

|

|

|

|

|

|

|

(MM/YY) |

City

State

ZIP-

Final Return

If this is your final return, enter the close date below and check the reason for closing your account.

Date Closed (MM/DD/YY)

Out Of Business

Sold Business

Sold Business

Filed under Professional Employer Organization (PEO)

PEO Name_ ____________________

______________________________

1.Withholding this period...................................................................

2.Compensation deduction...............................................................

3.Existing credit(s) or overpayment(s)..............................................

4.Balance due...................................................................................

5.Additions to tax (see instructions)..................................................

6.Interest (see instructions)...............................................................

7.Total amount due (U. S. Funds only) or overpaid..........................

Department Use Only

1

2

3

4

5

6

7

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

|

Signature |

|

Under penalties of perjury, I declare that the above information and any attached supplement is true, complete, and correct. |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date |

Signed |

||||||||||

|

|

|

Signature |

|

|

Printed Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(MM/DD/YY) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Title |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Visit our website at http://dor.mo.gov/business/payonline.php to

See page 2 for instructions on completing Form

|

|

Form |

Mail to: Taxation Division |

Phone: (573) |

For more information, visit |

P.O. Box 999 |

Fax: (573) |

http://dor.mo.gov/business/withhold/. |

Jefferson City, MO |

|

*14207010001*

14207010001

Instructions

Amended Return Box should be selected if you have previously filed a return and need to increase or decrease tax liability.

Note: A separate

If the increased return and payment are being submitted after the period(s) due date, penalties and interest will apply to the additional amount of tax liability reported. Visit http://dor.mo.gov/business/withhold to view the due dates in the Employer’s Withholding Tax Guide.

To show a decrease in liability: attach proper documentation for verification of changes made. Provide a copy of the

Note: If documentation is not provided for an amended return, no changes will be made.

Note: if an overpayment has been authorized, the overpayment is subject to be used as an offset toward any debt. To receive a refund of the overpayment attach the Employer’s Refund Request (Form 4854). If no form is attached, overpayment(s) generated will remain as credit(s) on the account. For additional information and to locate the refund request form visit the Online Credit Inquiry System at http://www.dor.mo.gov/business/creditinquiry/.

Address Change Check Box — This box should be selected if you need to update or correct the address of your business. Please complete the Registration or Exemption Change Request (Form 126) and submit it with your return.

Filing Frequency — This is the frequency in which you are required to file your returns.

Missouri Tax I.D. Number — An eight digit number issued by the Missouri Department of Revenue to identify your business. If you have not registered for an identification number you can do so by visiting https://dor.mo.gov/registerbusiness/index.php or by completing the Missouri Tax Registration Application (Form 2643). If you have misplaced this identification number and are an authorized person for the account, you may call (573)

Federal Employer I.D. Number — This is a nine digit identification number issued by the Internal Revenue Service to identify your business.

Reporting Period — This is the tax period you are required to file based on your filing frequency. For due dates you may access Form 2414W at http://dor.mo.gov/forms/.

Business Name, Address, City, State, and ZIP — Enter the name, address, city, state and ZIP code of your business.

Line 1

Withholding This Period — Enter the total amount of state withholding tax withheld for the reporting period. If there was no withholding during the reporting period enter zero.

Line 2

Compensation Deduction — Enter the amount retained for timely payment(s). For a breakdown of compensation deduction, see the Employer’s Withholding Tax Guide (Form 4282) at http://dor.mo.gov/business/withhold/.

Line 3

Existing Credits or Overpayments — If your withholding account has an existing credit, enter the amount to apply towards the report period. To determine the amount of credit on an account view the Online Credit Inquiry System at http://dor.mo.gov/business/creditinquiry/.

Line 4

Balance Due — Subtract Line 2 and Line 3, if applicable, from Line 1. Enter the difference on Line 4.

Line 5

Additions to Tax - Enter the total amount of additions on Line 5.

A.For failure to pay withholding tax by the due date – subtract Line 3, if applicable, from Line 1 and multiply the result by 5%; or

B.For failure to file your return by the due date – subtract Line 3, if applicable, from Line 1 and multiply the result by 5% for each month late, not to exceed 25%.

Line 6

Interest — Enter on Line 6. Divide the annual interest rate by 365 (366 for leap years) to obtain the daily interest rate. Then subtract Line 3 from Line 1 and multiply the result by the daily interest rate for each day late.

* The annual interest rate is subject to change each year. Access the annual interest rate at http://dor.mo.gov/intrates.php.

Line 7

Total Amount Due or Overpaid — Add Lines 4, 5 and 6. An overpayment should reflect a negative figure.

*14000000001*

14000000001

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose of Form MO-941 | This form is used by employers in Missouri to report and pay state income taxes that have been withheld from their employees' wages. |

| Filing Frequency | Employers must file this return according to their designated withholding tax filing frequency, which can be monthly, quarterly, or annually. |

| Missouri Tax I.D. Number | Each business is assigned an eight-digit tax identification number by the Missouri Department of Revenue, which must be included on the form. |

| Use of Amended Return | If you need to adjust a previously filed return, check the "Amended Return" box and submit proper documentation to support the changes. |

| Final Return | If this is your final return, indicate the closure date and reason such as "Out of Business" or "Sold Business." This provides necessary closure to the tax account. |

| Governing Law | Form MO-941 is governed by Missouri state tax laws, specifically under the Missouri Revised Statutes Chapter 143, which regulates income tax withholdings. |

Guidelines on Utilizing Mo 941

Completing the MO-941 form can seem daunting, but following these clear steps can make the process efficient and straightforward. Once you've gathered your information, you’ll be able to complete the form accurately and submit it for review. Here’s a step-by-step guide to help you through filling out the MO-941 form.

- Gather your business information, including the business name, address, city, state, and ZIP code.

- Locate your Missouri Tax I.D. Number, which is an eight-digit number unique to your business.

- Find your Federal Employer I.D. Number, a nine-digit number issued by the IRS.

- Specify the reporting period for which you are filing based on your filing frequency.

- Indicate if this is an amended return or if you need to change your address.

- If applicable, fill in the date closed in the event this is your final return and check the reason for closing your account.

- Complete Line 1 by entering the total amount of state withholding tax withheld during the reporting period.

- For Line 2, enter any compensation deductions retained for timely payments.

- Line 3 requires you to enter any existing credits or overpayments you wish to apply towards this reporting period.

- Determine your balance due for Line 4 by subtracting Line 2 and any applicable amounts in Line 3 from Line 1.

- For Line 5, add any penalties. The calculation may depend on whether you failed to pay or file on time.

- Calculate interest for Line 6 by determining the daily rate, then multiplying by the number of days late.

- Finally, sum Lines 4, 5, and 6 for Line 7 to find your total amount due or overpaid.

- Sign and date the form, ensuring your printed name and title are included beneath your signature.

- Submit the form by mailing it to the appropriate division or consider e-filing for quicker processing.

By following these steps, you will ensure that your MO-941 form is completed accurately, enabling you to fulfill your tax obligations with confidence. Always keep a copy for your records and consider reaching out to the Missouri Department of Revenue if you have questions along the way.

What You Should Know About This Form

What is the MO-941 form used for?

The MO-941 form, also known as the Employer's Return of Income Taxes Withheld, is used by employers in Missouri to report the income taxes withheld from employee wages. This form helps the Missouri Department of Revenue track withholding tax obligations and ensure compliance with state tax laws. Employers must file this form periodically, depending on their designated filing frequency, to report the amount of taxes withheld during that specific reporting period.

How often do I need to file the MO-941 form?

The filing frequency for the MO-941 form varies depending on the size of your business and the amount of withholding tax you collect. Most employers will file quarterly, while some may be required to file monthly or annually. It's crucial to verify your specific filing requirements with the Missouri Department of Revenue. Failure to file on time can result in penalties and interest on any balance due.

What should I do if I need to amend my MO-941 form?

If you discover an error in a previously filed MO-941 form, you must submit an amended return. To do this, select the amended return box on the form and complete it with the corrected information. If the amendment results in an increased tax liability, be aware that penalties and interest may apply if it’s filed after the due date. Be sure to provide proper documentation to support your amendment to ensure it is processed accurately.

How do I change my business address on the MO-941 form?

If your business address has changed, you need to update it on the MO-941 form by checking the address change box. Additionally, you must complete a Registration or Exemption Change Request (Form 126) and submit it along with your return. This ensures that the Missouri Department of Revenue has your current business information for all future correspondence.

What information do I need to include on the MO-941 form?

When filling out the MO-941 form, you need to provide essential details such as your Missouri Tax I.D. Number, Federal Employer I.D. Number, business name, and address. You will also need to report the total amount of state withholding tax for the period, any compensation deductions, existing credits or overpayments, and the total balance due or overpaid. Providing accurate information helps to avoid any issues with your filing.

Where should I mail my completed MO-941 form?

Your completed MO-941 form should be mailed to the Taxation Division of the Missouri Department of Revenue at P.O. Box 999, Jefferson City, MO 65108-0999. If you prefer, you can also file online through the department's e-filing system, which offers a quicker and more secure way to submit your return. Be sure to keep confirmation numbers for your records when you file online.

Common mistakes

Filling out the Missouri MO-941 form can be straightforward, yet many people make common mistakes that can lead to problems down the road. One frequent error is not entering the correct Missouri Tax I.D. Number. This eight-digit number is critical for identifying your business with the Department of Revenue. Without it, your form may be rejected or processed incorrectly. Always double-check this number before submitting your return.

Another mistake is failing to accurately report the withholding amount for the period. Line 1 of the form asks for the total amount of state withholding tax that was collected. If you enter zero without realizing there was withholding, you could face substantial penalties. It's important to review your payroll records thoroughly.

People also often neglect to account for existing credits or overpayments on Line 3. Missing out on applying these figures can result in an inaccurate balance due. If you have credits from prior periods, ensure you include them in your calculations to avoid overpaying or facing penalties.

Frequently, individuals forget to check the appropriate boxes for amended returns or address changes. Selecting the correct box is essential for the Department of Revenue to understand your submission accurately. If you need to amend your return, the process requires a different approach, so do not overlook this detail.

Lastly, many filers do not provide the necessary documentation when claiming changes in liability. If you're amending your return, attach the proper verification, such as a W-2C or payroll ledger. Without this documentation, your amendments might not be accepted. Keeping thorough records helps ensure that any changes can be adequately validated.

Documents used along the form

The MO-941 form is essential for Missouri employers to report state income taxes withheld from employee wages. It is often accompanied by various forms and documents to ensure compliance with tax regulations. Below are some commonly used forms and documents related to the MO-941 filing process.

- Form 126 - This form is used for the Registration or Exemption Change Request. Employers must submit it if they are updating their business address or primary location.

- Form 4854 - Known as the Employer’s Refund Request, this document is used to request a refund for overpayments made on withholding taxes.

- Form 2643 - The Missouri Tax Registration Application must be completed to obtain a Missouri Tax I.D. Number, which is necessary for filing the MO-941 form.

- Form 2414W - This form provides critical due dates based on the employer's filing frequency, helping to avoid late filings and associated penalties.

- Form 4282 - The Employer’s Withholding Tax Guide, which outlines details regarding compensation deductions and instructions for reporting on the MO-941.

- 1099-R - This form is required to report distributions from pensions, annuities, and retirement plans. If there are changes, corrections must be made with a revised 1099-R attached with the MO-941.

Employers should carefully consider these forms in conjunction with the MO-941 to maintain compliance with Missouri tax regulations. Utilizing the right documents can streamline the reporting process and mitigate potential issues with the Department of Revenue.

Similar forms

The MO-941 form, which is used for filing employer income taxes withheld in Missouri, has similarities with several other tax-related documents. Here’s a list of nine forms that share features with the MO-941:

- Form W-2: This form reports wages paid to employees and the taxes withheld from those wages. Like the MO-941, it summarizes tax information for a specific period and is essential for employee tax filing.

- Form 941: This federal form is used by employers to report income taxes withheld from employee paychecks, Social Security, and Medicare taxes. Both forms serve similar purposes at different governmental levels.

- Form 940: This form is used to report Federal Unemployment Tax Act (FUTA) taxes. While it addresses unemployment taxes, both forms require an annual summary of tax obligations related to employees.

- Form 4854: The Employer’s Refund Request form is necessary to claim a refund for overpayments. Similar to MO-941, it deals with adjustments in tax amounts due to errors or changes in liability.

- Form 2652: This is the Missouri Business Registration Application form. It seeks similar identifying information, such as business name and Missouri Tax I.D. number, required for proper tax reporting.

- Form 126: The Registration or Exemption Change Request is used to update information like the business address. This is crucial for ensuring that tax filings, including the MO-941, are directed to the correct location.

- Form 2414W: This form outlines the due dates for the Missouri Employer’s Withholding Tax. Understanding these dates is crucial when filing the MO-941 and helps maintain compliance with tax obligations.

- Form 4282: The Employer’s Withholding Tax Guide assists employers with the breakdown of withholding calculations. It is a resource that complements the information reported on MO-941, ensuring accuracy.

- Form 1099-R: This form is issued for reporting distributions from pensions, annuities, retirement, etc. Adjustments to withholding on this form may require similar procedures to those found on the MO-941 for filing accurate tax amounts.

Dos and Don'ts

When filling out the MO-941 form, there are several important dos and don’ts to keep in mind. Below are nine key practices to guide you through the process.

- Do double-check all entered information. Verify your business name, address, and tax identification numbers to avoid delays.

- Don’t leave any required fields blank. All necessary sections must be filled in to ensure your submission is complete.

- Do review the filing frequency. Ensure you are submitting for the correct period based on your filing requirements.

- Don’t ignore the instructions for amended returns. If your return needs to be adjusted, ensure you reference the correct guidelines.

- Do keep documentation for any reported changes. If you’re amending your return, include relevant documents such as W-2C or payroll ledgers.

- Don’t forget to calculate interest and penalties. If your submission is late, be aware of additional amounts due that you may need to report.

- Do utilize e-filing if possible. This method is fast, secure, and provides confirmation of your submission.

- Don’t use forms that are outdated. Always ensure you are using the latest version of the MO-941 form.

- Do consult the Department of Revenue’s website for resources. They provide guidance and support for proper completion of your return.

Following these guidelines will help ensure that your MO-941 form is filled out accurately and that you comply with tax obligations.

Misconceptions

Understanding the MO-941 form is crucial for businesses in Missouri that withhold income taxes from employees. However, several misconceptions can lead to confusion and incorrect filings. Below are four common misconceptions, accompanied by clear explanations.

- Misconception 1: The MO-941 form is only for large businesses.

- Misconception 2: You only have to file the MO-941 form once a year.

- Misconception 3: Amending the MO-941 form is complicated.

- Misconception 4: You don’t need to keep records for the MO-941 form.

In reality, the MO-941 form is applicable to any business that withholds state income tax from employee wages, regardless of size. Whether you run a small business or a large corporation, fulfilling your tax obligations is essential.

This is incorrect. The frequency of filing the MO-941 depends on your business's reporting period. Many businesses are required to file quarterly, so staying informed about your specific requirements is important.

While it may seem daunting, amending the MO-941 form is straightforward. If you need to adjust your tax liability, simply select the amended return box, attach the necessary documentation, and submit it on time to avoid penalties and interest.

This is a potential pitfall. It is essential to maintain accurate and complete records regarding withholding taxes, as these documents support your filings and are necessary if discrepancies arise or if an audit occurs.

Key takeaways

Understanding the MO-941 form is crucial for businesses operating in Missouri. Here are key takeaways to keep in mind when filling out and using this form:

- Filing Frequency: Know your required filing frequency, which determines how often you need to submit this form.

- Identification Numbers: Be sure to include both your Missouri Tax I.D. Number and your Federal Employer I.D. Number, as these are essential for identifying your business.

- Filing Method: E-filing is available and recommended. It offers speed, security, and provides a confirmation number for your records.

- Amended Return: If you need to adjust a previously filed return, remember to select the amended return box and provide necessary documentation.

- Final Returns: If this is your final return, indicate the closing date and reason for closing your account.

- Corrections: To correct withholding errors, you must attach the appropriate documentation, such as a corrected W-2 or payroll ledger.

- Existing Credits: If applicable, enter any existing credits or overpayments on Line 3 to lower your overall balance due.

- Interest and Penalties: Be aware that late submissions may incur interest and penalties, calculated based on the balance due.

Browse Other Templates

What Is a 5988-e Army - This form is an integral tool for aircraft maintenance personnel.

How to Ask Her Parents Permission to Date - Applicants should look beyond the humor and consider the implications of their answers.