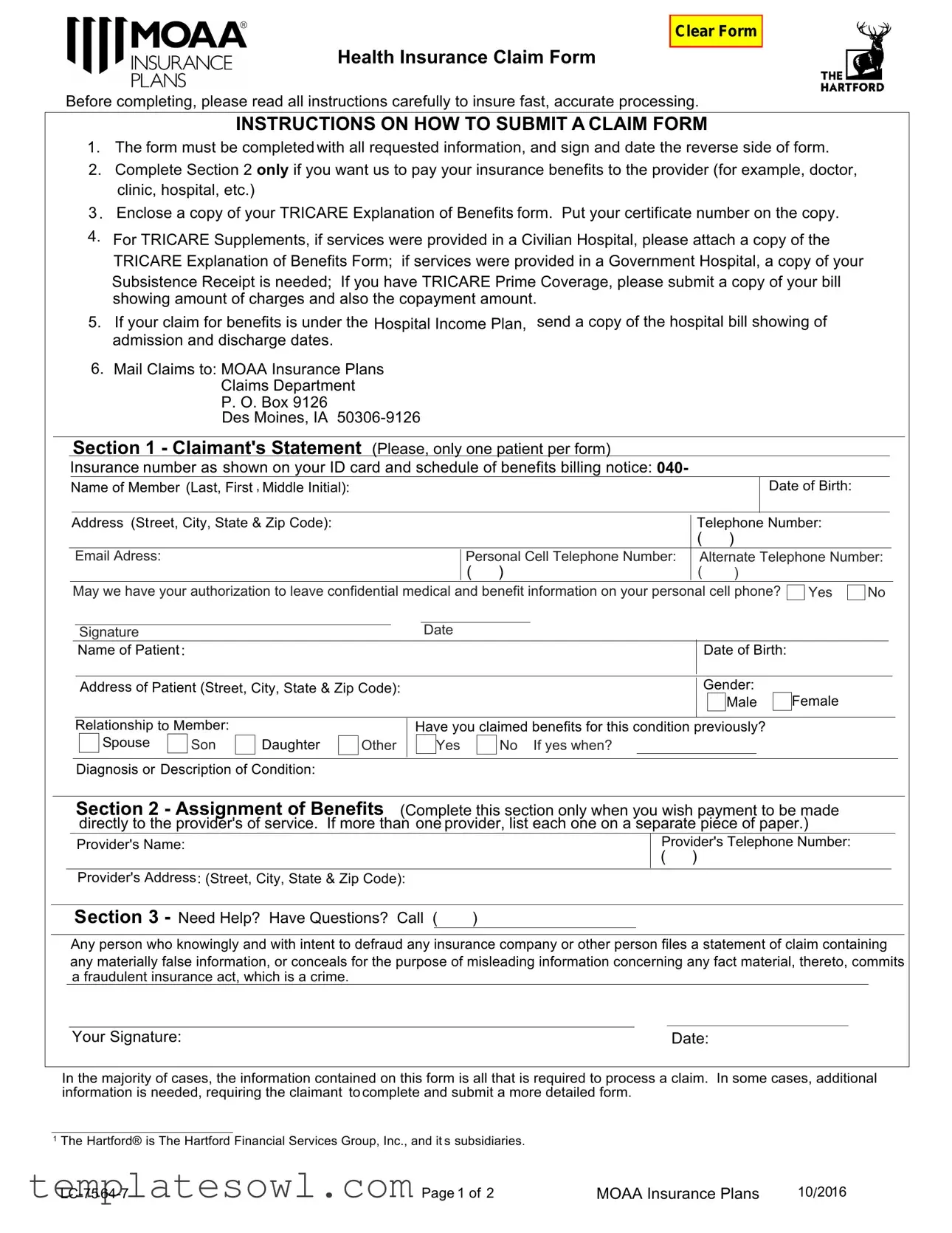

Fill Out Your Moaa Claim Form

The MOAA Claim Form is an essential tool for members seeking to streamline their health insurance claims process. Designed to assist in the efficient processing of claims related to medical expenses, the form requires detailed information about both the member and the patient. The first section collects basic details, including names, contact information, and a description of the medical condition, ensuring that all facts are recorded clearly. If direct payment to a healthcare provider is preferred, the second section allows the member to authorize this action, which can expedite settlement of the claim. Additionally, the submission of a TRICARE Explanation of Benefits or hospital bills may be necessary to support the claim, depending on the care received. To ensure that all required documents are submitted, the form includes specific guidance regarding the necessary attachments based on the patient's treatment location, whether a civilian or government hospital. Claims should be mailed to the specified address, and care must be taken to review state-specific warnings concerning fraudulent claims, underscoring the importance of accuracy and honesty in all responses provided. By following the outlined instructions and completing the form meticulously, members can facilitate a smoother claims experience.

Moaa Claim Example

Health Insurance Claim Form

Clear Form

Before completing, please read all instructions carefully to insure fast, accurate processing.

INSTRUCTIONS ON HOW TO SUBMIT A CLAIM FORM

1.The form must be completed with all requested information, and sign and date the reverse side of form.

2.Complete Section 2 only if you want us to pay your insurance benefits to the provider (for example, doctor, clinic, hospital, etc.)

3 . Enclose a copy of your TRICARE Explanation of Benefits form. Put your certificate number on the copy.

4.For TRICARE Supplements, if services were provided in a Civilian Hospital, please attach a copy of the TRICARE Explanation of Benefits Form; if services were provided in a Government Hospital, a copy of your Subsistence Receipt is needed; If you have TRICARE Prime Coverage, please submit a copy of your bill showing amount of charges and also the copayment amount.

5.If your claim for benefits is under the Hospital Income Plan, send a copy of the hospital bill showing of admission and discharge dates.

6.Mail Claims to: MOAA Insurance Plans

Claims Department

P. O. Box 9126

Des Moines, IA

Section 1 - Claimant's Statement (Please, only one patient per form)

Insurance number as shown on your ID card and schedule of benefits billing notice: 040-

|

Name of Member (Last, First , Middle Initial): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of Birth: |

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Address (Street, City, State & Zip Code): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Telephone Number: |

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

Email Adress: |

|

|

|

|

|

|

|

|

|

|

|

Personal Cell Telephone Number: |

|

Alternate Telephone Number: |

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

May we have your authorization to leave confidential medical and benefit information on your personal cell phone? |

Yes |

No |

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

Signature |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

Name of Patient : |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of Birth: |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

Address of Patient (Street, City, State & Zip Code): |

|

|

|

|

|

|

|

|

|

|

|

|

Gender: |

Female |

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Male |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

Relationship to Member: |

|

|

|

|

|

Have you claimed benefits for this condition previously? |

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

Spouse |

|

Son |

|

Daughter |

|

Other |

|

|

|

Yes |

|

No If yes when? |

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diagnosis or Description of Condition:

Section 2 - Assignment of Benefits (Complete this section only when you wish payment to be made directly to the provider's of service. If more than one provider, list each one on a separate piece of paper.)

|

|

Provider's Name: |

|

|

Provider's Telephone Number: |

|

||

|

|

|

|

|

|

( ) |

|

|

|

|

Provider's Address: (Street, City, State & Zip Code): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Section 3 - Need Help? Have Questions? Call ( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Any person who knowingly and with intent to defraud any insurance company or other person files a statement of claim containing any materially false information, or conceals for the purpose of misleading information concerning any fact material, thereto, commits a fraudulent insurance act, which is a crime.

Your Signature: |

|

Date: |

In the majority of cases, the information contained on this form is all that is required to process a claim. In some cases, additional information is needed, requiring the claimant to complete and submit a more detailed form.

1The Hartford® is The Hartford Financial Services Group, Inc., and it s subsidiaries.

Page 1 of 2 |

MOAA Insurance Plans |

10/2016 |

Signature - Please read the statement that applies to your state of residence and sign the bottom of the page.

With the exception of any source(s) of income reported above in this form, I certify by my signature that I have not received and am not eligible to receive any source of income, except for my disability benefits from this plan. Further, I understand that should I receive income of any kind or perform work of any kind during any period The Hartford has approved my disability claim, I must report all details to The Hartford, immediately. If I receive disability income benefits greater than those which should have been paid, I understand that I will be required to provide a lump sum repayment to the Plan. The Hartford has the option to reduce or eliminate future disability payments in order to recover any overpayment balance that is not reimbursed.

For residents of all states EXCEPT Arizona, California, Colorado, Florida, Kentucky, Maine, Maryland, New Jersey, New York, Oregon, Pennsylvania, Puerto Rico, Tennessee, Virginia and Washington: Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or knowingly presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.

For Residents of Arizona: For your protection Arizona law requires the following statement to appear on this form. Any person who knowingly presents a false or fraudulent claim for payment of a loss is subject to criminal and civil penalties.

For Residents of California: For your protection, California law requires the following to appear on this form: Any person who knowingly presents false or fraudulent claim for the payment of a loss is guilty of a crime and may be subject to fines and confinement in state prison.

For residents of Colorado: It is unlawful to knowingly provide false, incomplete, or misleading facts or information to an insurance company for the purpose of defrauding or attempting to defraud the company. Penalties may include imprisonment, fines, denial of insurance, and civil damages. Any insurance company or agent of an insurance company who knowingly provides false, incomplete, or misleading facts or information to a policyholder or claimant for the purpose of defrauding or attempting to defraud the policyholder or claimant with regard to a settlement award payable from insurance proceeds shall be reported to the Colorado Division of Insurance within the Department of Regulatory Agencies.

For residents of Florida: Any person who knowingly and with intent to injure, defraud, or deceive any insurer files a statement of claim or an application containing any false, incomplete, or misleading information is guilty of a felony of the third degree.

For residents of Kentucky: Any person who knowingly and with intent to defraud any insurance company or other person files a statement of claim or an application for insurance containing any materially false information or conceals, for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act, which is a crime.

For residents of Maine, Tennessee, and Washington: It is a crime to knowingly provide false, incomplete or misleading information to an insurance company for the purpose of defrauding the company. Penalties may include imprisonment, fines and denial of insurance benefits.

For Residents of Maryland: Any person who knowingly or willfully presents a false or fraudulent claim for payment of a loss or benefit and who knowingly or willfully presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.

For residents of New Jersey: Any person who knowingly files a statement of claim containing any false or misleading information is subject to criminal and civil penalties. Any person who includes any false or misleading information on an application for insurance policy is subject to criminal and civil penalties.

For residents of New York: Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance or statement of claim containing any materially false information, or conceals for the purpose of misleading, information concerning any fact material thereto, commits a fraudulent insurance act, which is a crime, and shall also be subject to a civil penalty not to exceed five thousand dollars and the stated value of the claim for each such violation.

For residents of Oregon: Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance or statement of claim containing any materially false information or conceals for the purpose of misleading, information concerning any fact material thereto that the insurer relied upon is subject to a denial and/or reduction in insurance benefits and may be subject to any civil penalties available.

For residents of Pennsylvania: Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance or statement of claim containing any materially false information or conceals for the purpose of misleading, information concerning any fact material hereto commits a fraudulent insurance act, which is a crime and subjects

such person to criminal and civil penalties.

For residents of Puerto Rico: Any person who knowingly and with the intention of defrauding presents false information in an insurance application, or presents, helps, or causes the presentation of a fraudulent claim for the payment of a loss or any other benefit, or presents more than one claim for the same damage or loss, shall incur a felony and, upon conviction, shall be sanctioned for each violation by a fine of not less than five thousand dollars ($5,000) and not more than ten thousand dollars ($10,000), or a fixed term of imprisonment for three (3) years, or both penalties. Should aggravating circumstances be present, the penalty thus established may be increased to a maximum of five (5) years, if extenuating circumstances are present, it may be reduced to a minimum of two (2) years.

For residents of Virginia: Any person who, with the intent to defraud or knowing that he is facilitating a fraud against an insurer, submits an application or files a claim containing a false or deceptive statement may have violated the state law.

The statements contained in this form are true and complete to the best of my knowledge and belief.

|

Signature |

|

|

|

Date |

|

|

|

|

|

|||

Page 2 of 2 |

MOAA Insurance Plans |

10/2016 |

||||

Form Characteristics

| Fact Name | Description |

|---|---|

| Completeness Requirement | The claim form must be fully completed with all requested information, including signature and date on the reverse side. |

| Direct Payment Option | Section 2 should be completed only if you want insurance benefits paid directly to a healthcare provider. |

| EOB Submission | A copy of the TRICARE Explanation of Benefits form is required, including the certificate number for processing claims. |

| State-Specific Fraud Disclosure | Residents of Arizona, California, Colorado, Florida, Kentucky, Maine, Maryland, New Jersey, New York, Oregon, Pennsylvania, Puerto Rico, Tennessee, Virginia, and Washington are subject to specific state laws regarding fraud and false claims. |

Guidelines on Utilizing Moaa Claim

Filling out the MOAA Claim form requires careful attention to detail to ensure all necessary information is provided. Properly completing the form helps facilitate timely processing of claims. Below are step-by-step instructions to guide you through the process.

- Begin by completing all requested information on the front side of the form. Ensure you sign and date the reverse side.

- Fill out Section 2 only if you prefer payment to be made directly to the service provider.

- Attach a copy of your TRICARE Explanation of Benefits form, making sure to include your certificate number on the copy.

- If services occurred in a Civilian Hospital, include the TRICARE Explanation of Benefits Form. For services in a Government Hospital, provide a copy of your Subsistence Receipt.

- If you have TRICARE Prime Coverage, also submit a copy of the bill that shows the total charges and the copayment amount.

- If your claim falls under the Hospital Income Plan, include a copy of the hospital bill detailing admission and discharge dates.

- Send the completed claim form and all attachments to the address provided: MOAA Insurance Plans Claims Department, P.O. Box 9126, Des Moines, IA 50306-9126.

After submission, be prepared for possible follow-up requests for additional information, although most claims process with the data provided on this form.

What You Should Know About This Form

What is the Moaa Claim form and why is it important?

The Moaa Claim form is a document used to request benefits from your insurance plan, specifically under the MOAA Insurance Plans. Completing this form accurately is crucial for ensuring that your claim is processed quickly and without issues. Properly filled out, it allows the insurance provider to assess your claim and determine the benefits you are entitled to receive.

What information do I need to provide on the Moaa Claim form?

When filling out the Moaa Claim form, several important details must be included. Start by providing your insurance number as seen on your ID card, along with the name and date of birth of the member. Address information, telephone numbers, and emails are also necessary. Additionally, specify the relationship of the patient to the member and provide diagnosis details. If you're requesting direct payment to a provider, you must complete Section 2 with their information. Make sure to sign and date the form for validation.

How do I submit the Moaa Claim form?

After completing the Moaa Claim form, submission is straightforward. First, gather any required supporting documents, such as the TRICARE Explanation of Benefits form or hospital bills, depending on your circumstances. Then, mail the completed form along with any necessary attachments to the MOAA Insurance Plans Claims Department at the specified address: P. O. Box 9126, Des Moines, IA 50306-9126. It's advisable to keep copies of everything for your records before mailing out the claim.

What happens if I submit the form incorrectly?

If the Moaa Claim form is submitted with incomplete or incorrect information, it could delay the processing of your claim. The insurance provider may require you to complete a new form or provide additional information, which can prolong the timeframe before you receive any benefits. To avoid this, carefully review the instructions provided and ensure all sections of the form are filled out completely and accurately.

Common mistakes

Filling out the MOAA Claim form can seem straightforward, yet many individuals make avoidable mistakes that can delay their claims. One common error is not checking the claim form for completeness. Many claimants overlook sections that require necessary information or fail to sign and date the reverse side of the form. Ensuring every mandatory field is filled out can prevent unnecessary delays and confusion during the processing of your claim.

Another frequent pitfall involves providing inaccurate or incomplete supporting documentation. For example, the instructions clearly state that a copy of the TRICARE Explanation of Benefits form must be enclosed. Some individuals fail to include this crucial document or forget to add their certificate number, risking rejection of their claim. Providing accurate and necessary documentation is essential for speeding up the claims process and ensuring all relevant information is considered.

Moreover, claimants often misinterpret the sections regarding payment assignments. Filling out Section 2 requires a clear intent to have benefits sent directly to a healthcare provider. It is important to understand when to complete this section. Failing to indicate this appropriately can lead to confusion or even non-payment. Be precise and clear in your intentions to avoid problems down the line.

Lastly, not following submission guidelines can hinder even the most thoroughly completed form. Individuals sometimes neglect to mail their claims to the correct address or fail to track their submissions, which can result in important communications being overlooked. It's advisable to keep a copy of the entire claim packet and any correspondence sent. This way, if issues arise, you have a clear record to refer to while resolving them.

Documents used along the form

The MOAA Claim Form is essential for initiating a claim for health insurance benefits. To support the claim process, several other forms and documents may be required. Below is a list of these supplementary documents frequently used in conjunction with the MOAA Claim Form.

- TRICARE Explanation of Benefits (EOB) Form: This document outlines the services provided and the amount covered by TRICARE. It must be included as it verifies benefits received and any amounts owed by the patient.

- Hospital Bill: A detailed statement from the hospital showing the dates of admission and discharge, as well as itemized charges for services rendered, is necessary for claims under the Hospital Income Plan.

- Subsistence Receipt: For services rendered in a Government Hospital, the Subsistence Receipt is required. It documents the necessary expenses incurred during the stay.

- Provider's Bill: A copy of the bill from the healthcare provider detailing the charges and any copayment amounts is needed, especially for claims related to TRICARE Prime Coverage.

- Authorization for Direct Payment: If the claimant desires to assign benefits directly to the provider, this form or statement must be completed, indicating consent for payment to be made to the service provider.

It is crucial to gather all these documents to ensure a smooth and efficient claims process. Each document serves a specific purpose and helps in validating the claim being made.

Similar forms

- Health Insurance Claim Form: Similar to the Moaa Claim form, this document requires detailed patient information, diagnosis, and assignment of benefits. It also emphasizes the need for supporting documentation to facilitate processing.

- Medicare Claim Form (CMS-1500): Like the Moaa Claim form, this form includes sections for patient demographics and necessary codes for diagnosis and treatment. Both forms serve to process claims through insurance providers efficiently.

- Auto Accident Claim Form: This document, similar to the Moaa Claim form, requires information about the incident, medical treatment, and related expenses. It ensures that the insurance company has all necessary details to assess the claim's validity.

- Worker’s Compensation Claim Form: This form requests details about the injury, medical treatments, and employer information. Much like the Moaa Claim form, it stipulates that accompanying documentation is essential for processing claims.

- Disability Benefits Claim Form: This form also asks for personal information and health details, akin to the Moaa Claim form. Similarly, it includes an assignment of benefits section, directing payments to healthcare providers.

- Life Insurance Claim Form: This document gathers information on the insured, the claimant, and the cause of death, much like the Moaa Claim form collects details pertinent to initiating claims. Both forms emphasize accuracy to avoid delays.

- Supplemental Health Insurance Claim Form: Very similar in structure, it requires patient identifiers, diagnosis, and treatment details. Both forms also mandate the attachment of other insurance explanations or bills.

- Travel Insurance Claim Form: This form, like the Moaa Claim form, requires information on the type of coverage, incidents that led to the claim, and supporting documents. Both require a clear statement from the claimant.

- Hospital Admission Form: Though primarily a registration document, it functions similarly in that it collects detailed patient information and may also require insurance information, paralleling the initial sections of the Moaa Claim form.

Each of these documents shares a goal: to gather comprehensive information that facilitates the claims process for medical or related expenses. Attention to detail is paramount across all forms to ensure prompt processing and payment.

Dos and Don'ts

When filling out the MOAA Claim form, it's important to be thorough and accurate. Here are some essential dos and don'ts that can help streamline the process:

- Do read all instructions carefully before you begin filling out the form.

- Do ensure all requested information is complete to avoid delays.

- Do include your TRICARE Explanation of Benefits form with your submission.

- Do provide copies of relevant documents like hospital bills if you're claiming under specific plans.

- Do sign and date the reverse side of the claim form.

- Don't forget to verify that the insurance number is correct as shown on your ID card.

- Don't leave any sections blank unless they are not applicable to your situation.

- Don't assume that all claims will be processed with just the basic information; additional details may be required.

- Don't submit the form without double-checking for any errors or missing information.

- Don't ignore the importance of keeping a copy of the submitted claim for your records.

By keeping these pointers in mind, you can help ensure that your claim is processed smoothly and efficiently.

Misconceptions

Misconceptions about the MOAA Claim Form

- The form can be partially completed. Many believe they can leave some sections blank, but this is incorrect. All requested information must be provided for prompt processing.

- Section 2 is mandatory. Some individuals think that Section 2 is required for every claim. It only needs to be filled out if payment is to be made directly to the service provider.

- TRICARE Explanation of Benefits is optional. It's a common misunderstanding that the TRICARE Explanation of Benefits is not necessary. However, a copy is essential to support the claim.

- Submissions do not require documentation for civilian services. For civilian hospital services, attaching the TRICARE Explanation of Benefits is a must. This ensures the claim is processed correctly.

- Claims for Hospital Income Plans do not need specific bills. It's incorrect to think you can submit any bill. A bill showing admission and discharge dates is required.

- You can send claims to any address. Many assume they can mail the claims wherever. However, it must be sent to the designated MOAA Insurance Plans Claims Department address.

- Information on the form does not need to be current. Some claimants think that outdated information is acceptable. It's crucial to provide accurate and current personal and insurance details.

- Signing the form is not essential. There might be a belief that the signature can be skipped, but signing and dating the form is mandatory for it to be valid.

- Submitting the claim guarantees payout. It's a misconception that submitting the claim form leads to automatic payment of benefits. The claim still undergoes a review process.

- There is no risk for inaccuracies. Some might think that there are no consequences for mistakes. Filing a false claim can lead to serious penalties including criminal charges.

Key takeaways

Understanding the MOAA Claim Form is crucial for a smooth claims process. Here are some key takeaways:

- Complete All Sections: Ensure that every required part of the form is filled out accurately. This includes your personal details and information about the medical condition.

- Provider Payment: If you want payments to go directly to your healthcare provider, make sure to complete Section 2. This step is important for the provider’s communication with the insurance company.

- Include Necessary Documentation: Always attach a copy of your TRICARE Explanation of Benefits form. This document supports your claim and helps expedite the process.

- Submit Timely: Mail your completed claim form to the specified address. Prompt submission can lead to faster processing and receipt of your benefits.

- Prevent Fraud: Be aware of the fraud warnings included on the form. Providing false information can result in serious penalties.

Browse Other Templates

Usps Forms - The certificate can affirm that your mail was properly collected by USPS.

Plantation Permit - The deadline for starting construction is emphasized to prevent expiration of the permit.