Fill Out Your Modern Woodmen 948 Form

The Modern Woodmen 948 form serves a crucial purpose in estate planning and beneficiary designation for policyholders of the Modern Woodmen of America. This form allows individuals to revoke previous beneficiary designations and set new ones, ensuring that their preferences are clearly documented. It captures essential information like the insured’s full name, social security number, and certificate number, guiding users through making specific choices regarding the distribution of benefits upon the insured’s passing. Each section of the form is meticulously crafted to gather detailed data for principal and contingent beneficiaries, including their names, relationships to the insured, and contact information. Beneficiaries may be individuals, living trusts, or even the estate of the insured. The document also allows for the selection of the method of settlement, whether it be a one-time sum or a deposit at interest, offering flexibility based on the needs of the beneficiaries. Each request for change must be acknowledged in writing by the National Secretary to ensure its validity. Additionally, if a change of name is required, the form accommodates this process too, prompting the insured to provide the new legal name and reason for the change, along with necessary legal documentation if applicable. Navigating this form correctly ensures policyholders align their financial intentions with their estate planning goals, reinforcing the importance of accurate and up-to-date beneficiary designations.

Modern Woodmen 948 Example

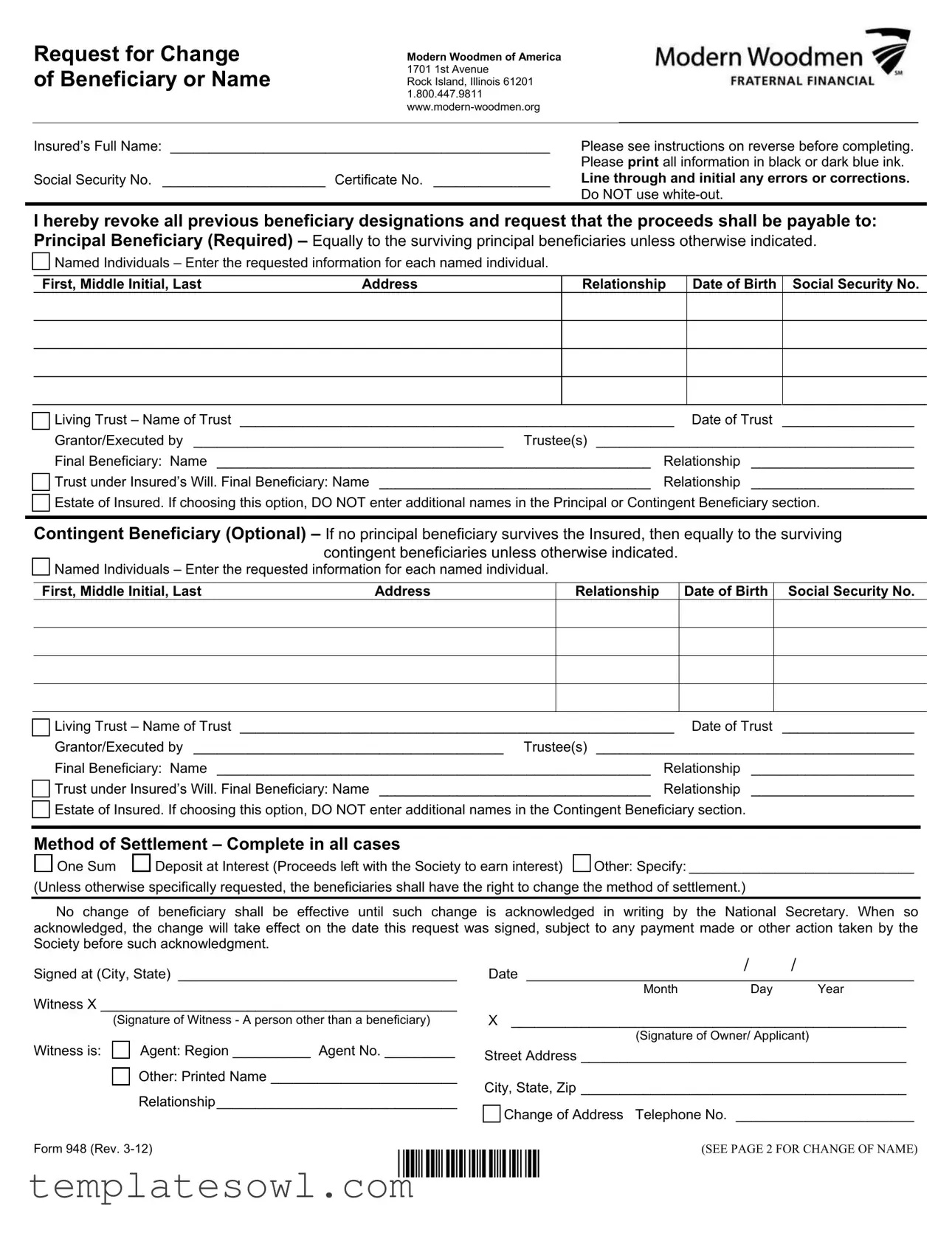

Request for Change of Beneficiary or Name

Modern Woodmen of America

1701 1st Avenue

Rock Island, Illinois 61201 1.800.447.9811

Insured’s Full Name: _________________________________________________

Social Security No. _____________________ Certificate No. _______________

Please see instructions on reverse before completing. Please print all information in black or dark blue ink.

Line through and initial any errors or corrections. Do NOT use

I hereby revoke all previous beneficiary designations and request that the proceeds shall be payable to: Principal Beneficiary (Required) – Equally to the surviving principal beneficiaries unless otherwise indicated.

Named Individuals – Enter the requested information for each named individual.

First, Middle Initial, Last |

Address |

Relationship |

Date of Birth |

Social Security No. |

|

|

|

Living Trust – Name of Trust ________________________________________________________ Date of Trust _________________

Grantor/Executed by ________________________________________ Trustee(s) _________________________________________

Final Beneficiary: Name ________________________________________________________ |

Relationship |

_____________________ |

Trust under Insured’s Will. Final Beneficiary: Name ___________________________________ |

Relationship |

_____________________ |

Estate of Insured. If choosing this option, DO NOT enter additional names in the Principal or Contingent Beneficiary section.

Contingent Beneficiary (Optional) – If no principal beneficiary survives the Insured, then equally to the surviving contingent beneficiaries unless otherwise indicated.

Named Individuals – Enter the requested information for each named individual.

First, Middle Initial, Last |

Address |

Relationship

Date of Birth Social Security No.

Living Trust – Name of Trust ________________________________________________________ Date of Trust _________________

Grantor/Executed by ________________________________________ Trustee(s) _________________________________________

Final Beneficiary: Name ________________________________________________________ |

Relationship |

_____________________ |

Trust under Insured’s Will. Final Beneficiary: Name ___________________________________ |

Relationship |

_____________________ |

Estate of Insured. If choosing this option, DO NOT enter additional names in the Contingent Beneficiary section.

Method of Settlement – Complete in all cases

One Sum

Deposit at Interest (Proceeds left with the Society to earn interest)

Other: Specify: _____________________________

(Unless otherwise specifically requested, the beneficiaries shall have the right to change the method of settlement.)

No change of beneficiary shall be effective until such change is acknowledged in writing by the National Secretary. When so acknowledged, the change will take effect on the date this request was signed, subject to any payment made or other action taken by the Society before such acknowledgment.

Signed at (City, State) ____________________________________

Witness X ______________________________________________

|

(Signature of Witness - A person other than a beneficiary) |

Witness is: |

Agent: Region __________ Agent No. _________ |

|

Other: Printed Name ________________________ |

|

Relationship_______________________________ |

/ |

|

/ |

Date __________________________________________________ |

||

Month |

Day |

Year |

X___________________________________________________

(Signature of Owner/ Applicant)

Street Address __________________________________________

City, State, Zip __________________________________________

Change of Address Telephone No. _______________________

Form 948 (Rev. |

*00869* |

(SEE PAGE 2 FOR CHANGE OF NAME) |

|

|

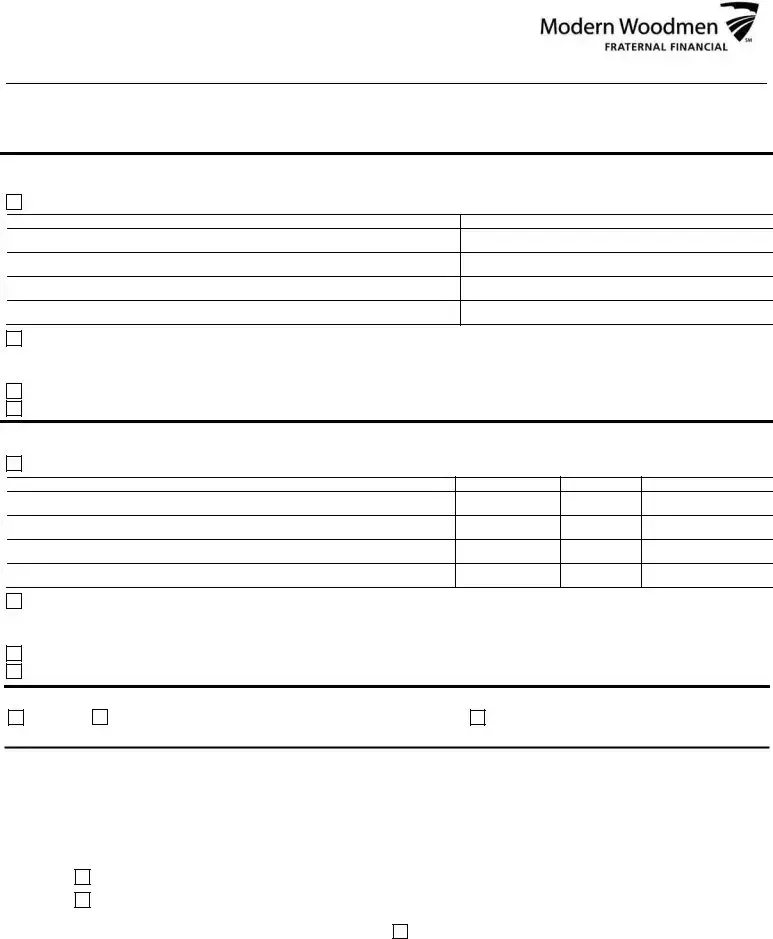

Request for Name Change

Insured’s Full Name (Print)

Certificate Number

The name of the

Insured

Owner has been changed to: (Print) _____________________________________________________

New complete legal name (First, Middle, Last, Suffix)

The reason for the change is:

Marriage |

Adoption |

|

Divorce |

Other (Specify): _________________________________________________ |

|||

|

|||||||

|

|

|

|

If selecting Other, please provide copy of legal documentation. |

|

||

X_____________________________________________________ |

Date ______________________________________ |

||||||

|

Signature of Insured or Owner |

Month |

Day |

Year |

|||

X_____________________________________________________

Signature of Witness

Witness is

Agent: Region _____ Agent No. _______

Agent: Region _____ Agent No. _______

Other: Printed Name ___________________________________

Instructions for Change of Beneficiary Request – Page 1

The beneficiary designation will remain unchanged until the properly completed form is received and acknowledged in writing at our

Home Office. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If a change of beneficiary is desired on more than one |

|

Trust (Inter Vivos Living Trust): |

The trust must be in effect |

||||||||||||

certificate, a separate form should be completed for each |

|

at the time the beneficiary designation is completed. It is |

|||||||||||||

certificate. |

|

|

|

|

|

necessary to furnish the name of the trust, the date the trust |

|||||||||

Designate beneficiary(ies) by selecting the check box next to |

|

was executed, who executed it, and the name of the trustee(s). |

|||||||||||||

the appropriate category(ies) and then complete requested |

|

A final beneficiary must be named to receive the proceeds if |

|||||||||||||

information. |

|

|

|

|

|

the trust is not properly qualified or fails to make claim within |

|||||||||

This change of beneficiary form, once acknowledged, will |

|

120 days from the date of death. |

|

|

|

|

|||||||||

automatically revoke all prior beneficiary designations. |

Trust under Insured’s Will (Testamentary Trust): |

The |

|||||||||||||

Therefore, even if a principal or contingent beneficiary is to |

|

proceeds paid according to the Insured’s Last Will and |

|||||||||||||

remain, such beneficiary must be renamed on this form. |

|

Testament. |

|

|

|

|

|

|

|

|

|||||

The owner/applicant completing this form cannot specify how |

|

A final beneficiary must be named to receive the proceeds if |

|||||||||||||

a beneficiary is to use the proceeds. |

|

|

|

the trust is not properly qualified or fails to make claim within |

|||||||||||

The proceeds for minor beneficiaries are held by the Society |

|

120 days from the date of death. |

|

|

|

|

|||||||||

until they attain legal age, unless a |

Method of Settlement. All or part of the proceeds may be left |

||||||||||||||

the minor’s estate properly requests payment prior to that time. |

|

with Modern Woodmen under a settlement option. |

If Deposit |

||||||||||||

Beneficiaries for a minor Insured must always have an |

|

at Interest or any Other Optional Method of Settlement is |

|||||||||||||

insurable interest in the life of the child. Insurable interest is |

|

selected and a principal beneficiary (payee) is eligible to |

|||||||||||||

when an individual is responsible either in whole or in part for |

|

receive payment but dies before any of the proceeds have |

|||||||||||||

the care and welfare of the child. A parent or a grandparent is |

|

been paid, then, unless otherwise provided, the proceeds will |

|||||||||||||

automatically assumed to have an insurable interest in the |

|

be paid to any then surviving principal beneficiaries; if none, to |

|||||||||||||

child’s life. |

|

|

|

|

|

any then surviving contingent beneficiaries; if none, in one sum |

|||||||||

Named Individuals: |

When naming individual beneficiaries, |

|

to the estate of the payee. |

If One Sum is selected and a |

|||||||||||

print the full |

names |

of the desired principal and contingent |

|

beneficiary is eligible to receive payment but dies before any of |

|||||||||||

|

the proceeds have been paid, then, unless otherwise specified, |

||||||||||||||

beneficiaries, |

their |

addresses, their |

relationships to the |

|

|||||||||||

|

the proceeds |

will |

be |

paid |

in one sum |

to the beneficiary’s |

|||||||||

Insured, dates of birth and Social Security numbers. Proceeds |

|

||||||||||||||

|

estate. |

Deposit |

at Interest |

may |

not be |

selected |

for |

a tax |

|||||||

will be paid |

equally |

to the surviving |

principal |

beneficiaries |

|

||||||||||

|

qualified certificate, such as an IRA. |

|

|

|

|||||||||||

unless otherwise indicated. The proceeds will be paid to the |

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||

person(s) named in the contingent beneficiary section only if |

Signature Required. |

The person having legal control of the |

|||||||||||||

no principal beneficiary survives the |

Insured. |

If additional |

|

certificate should sign the beneficiary change request using his |

|||||||||||

space is needed, attach a signed and dated sheet. Note: This |

|

or her full name. All signatures must be original. |

|

|

|||||||||||

space may also be used to name corporations, businesses, or |

Date. |

The application should be dated with the month, day |

|||||||||||||

charitable organizations. Include address, city, state and |

|

and year it is signed. |

|

|

|

|

|

|

|||||||

taxpayer ID if applicable. |

|

|

Witness. The signature should be witnessed by an adult other |

||||||||||||

|

|

|

|

|

|

than one named as a beneficiary. |

|

|

|

|

|||||

|

|

|

|

|

|

Questions: |

Please contact |

your |

Modern |

Woodmen |

|||||

Representative or our Home Office at

Form 948B (Rev. |

(SEE PAGE 1 FOR CHANGE OF BENEFICIARY) |

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Title | Request for Change of Beneficiary or Name |

| Organization | Modern Woodmen of America, located at 1701 1st Avenue, Rock Island, Illinois 61201 |

| Contact Information | Call 1-800-447-9811 or visit www.modern-woodmen.org for assistance. |

| Insured's Information | Must provide full name, social security number, and certificate number. |

| Beneficiary Designation | Revocation of all previous beneficiary designations occurs when a new request is submitted. |

| Principal Beneficiary | Equally shared among surviving principal beneficiaries unless specified otherwise. |

| Contingent Beneficiary | This optional section activates only if no principal beneficiaries survive. |

| Method of Settlement | Options include One Sum or Deposit at Interest, among others. |

| Signature Requirement | Owner/applicant's signature is necessary for the form to be processed. |

| State-Specific Law | For states where applicable, changes governed by certain state laws, such as the Uniform Probate Code. |

Guidelines on Utilizing Modern Woodmen 948

Completing the Modern Woodmen 948 form is an important process that allows you to designate beneficiaries for your insurance policy or make changes to your existing designations. It is essential to follow the steps carefully to ensure that your requests are processed without issues.

- Obtain the Form: Acquire the Modern Woodmen 948 form, either from the Modern Woodmen website or by contacting their office directly.

- Personal Information: Fill in your full name, Social Security number, and certificate number at the top of the form.

- Revoking Previous Beneficiaries: Indicate that you revoke all previous beneficiary designations by checking the appropriate box.

- Principal Beneficiary Information: Provide the information for the principal beneficiary, including their full name, relationship to you, address, date of birth, and Social Security number. If applicable, fill in details for a living trust.

- Contingent Beneficiary Information: Fill in the information for any contingent beneficiaries who will receive the proceeds if the principal beneficiary does not survive you.

- Method of Settlement: Choose a method for how the insurance proceeds will be paid out: one sum, deposit at interest, or specify an alternative.

- Signature and Date: Sign and date the form at the bottom. Make sure your signature is original.

- Witness Signature: Have a witness who is not a beneficiary sign the form. The witness must provide their name and indicate their relationship to you.

- Submit the Form: Send the completed form to Modern Woodmen’s Home Office at the address provided on the form.

After you submit the form, Modern Woodmen will review your request. Once acknowledged in writing by the National Secretary, the changes will take effect from the date you signed the request. It is advisable to keep a copy of your completed form for your records.

What You Should Know About This Form

What is the purpose of the Modern Woodmen 948 form?

The Modern Woodmen 948 form is designed to allow policyholders to officially change their beneficiary designations or their name on an insurance certificate. This process is crucial for ensuring that the desired individuals or entities receive the insurance proceeds after the policyholder's passing. Policyholders can designate principal and contingent beneficiaries and specify the method of settlement for the insurance proceeds. It is important to complete the form accurately, as it will revoke all previous beneficiary designations upon acknowledgment.

Who should sign the Modern Woodmen 948 form?

The form must be signed by the policy owner or applicant, and a witness is also required. The witness cannot be a beneficiary named in the form. This ensures impartiality and safeguards the interests of all parties involved. The signature of the insurance owner confirms their intent to modify the beneficiary designations or name as outlined in the form.

What happens after the form is submitted?

Once the Modern Woodmen 948 form is filled out and submitted, it must be acknowledged in writing by the National Secretary of Modern Woodmen. Only after this acknowledgment will the changes take effect. Until then, the previous beneficiary designations remain in force. It’s important to keep a copy of the submitted form for your records. If there are any outstanding payments or actions taken by the society before the acknowledgment occurs, those will still stand.

What should I do if I made a mistake on the form?

If a mistake is made while completing the Modern Woodmen 948 form, do not use white-out. Instead, simply line through the error and initial it. This method maintains the integrity of the form by allowing the corrections to be easily identified. Ensuring that all information is clearly printed in black or dark blue ink is critical for readability and processing.

Common mistakes

Completing the Modern Woodmen 948 form is a crucial step in ensuring that your beneficiary designations are clear and legally valid. However, several mistakes can undermine this process. Understanding these common pitfalls can help ensure that your wishes are fully honored.

One frequent error is neglecting to read the instructions on the reverse side of the form. This can lead to incomplete or incorrect submissions. It’s critical to follow these guidelines closely. Missing even a small detail can delay or complicate the acknowledgment of your request.

Another common mistake is failing to print the information in black or dark blue ink. Using a different color or style of writing can result in an illegible form, making it difficult for the processing team to read your entries. Clarity is essential; make sure everything is easy to distinguish.

People often mistakenly use white-out to correct errors on the form. This is a violation of form rules. Official adjustments should be made by striking through the error and initialing next to it. This method preserves the integrity of the original submission.

Not providing complete information for each named beneficiary can cause significant problems. Each individual listed should include their full name, address, relationship to the insured, date of birth, and Social Security number. Incomplete submissions might not be processed correctly, leaving beneficiaries without their rightful claims.

Some applicants overlook the need for a witness signature, which is required on the form. This signature must come from someone who is not named as a beneficiary. Collecting this signature is vital to validate your request.

Another common oversight involves the method of settlement. If the method is left unspecified, this may lead to delays in disbursing benefits. Clearly indicate how you wish the settlement to be made to avoid any confusion in the future.

For those using a trust, failing to provide the necessary details can be detrimental. The name of the trust, date of establishment, and the trustee's details must be clearly stated. If this information is missing or incorrect, it may invalidate the beneficiary designation.

Lastly, many do not date their application accurately. It is important to include the month, day, and year that you sign the form. An undated application can cause problems in processing and will lead to further delays.

Avoiding these nine mistakes when filling out the Modern Woodmen 948 form is essential. Time is of the essence. Ensure your intentions are honored by reviewing your application thoroughly before submission.

Documents used along the form

The Modern Woodmen 948 form serves as a vital tool for individuals wishing to change their beneficiary designations or update their personal information. Along with it, there are several other forms that may be necessary to fully process such changes. Below is a list of some commonly used documents, each with a brief description, to provide clarity on their purpose and use.

- Change of Address Form: This document allows the insured or owner of the policy to update their contact information. It is crucial for ensuring that all correspondence, including important policy documents, is sent to the correct address.

- Beneficiary Designation Form: Similar to the Modern Woodmen 948 form, this document is specifically designed to designate beneficiaries for life insurance policies. It may be used in cases where more detailed information about multiple beneficiaries or different types of designations is required.

- Trust Documentation: When a living trust or testamentary trust is named as a beneficiary, supporting documentation regarding the trust will often be needed. This includes the name of the trust, trust date, and trustee information, ensuring that the trust is valid and properly recognized.

- Name Change Documentation: If a name change is part of the request, legal documentation confirming the change—such as a marriage certificate, divorce decree, or court order—is necessary to validate the new name being requested on the policy.

Understanding the associated forms and documents enhances the beneficiary change process and helps policyholders ensure their wishes are accurately reflected. By being aware of what is needed, individuals can avoid potential delays or complications in their requests.

Similar forms

Change of Beneficiary Form: Like the Modern Woodmen 948 form, this document allows individuals to update or change their designated beneficiaries for various types of insurance policies or financial accounts, ensuring that proceeds are directed to the desired recipients upon the insured's death.

Life Insurance Beneficiary Designation Form: This document serves a similar function by allowing policyholders to designate beneficiaries for life insurance policies, specifying how proceeds will be distributed, thus streamlining the claims process for loved ones.

Trust Beneficiary Designation: Similar to the Modern Woodmen 948 form, this document establishes who will benefit from a trust, clarifying the roles of the trustee and final beneficiaries, as well as addressing issues of legal ownership and claims.

Health Insurance Beneficiary Update Form: This form allows individuals to update beneficiary information for health-related benefits. It mirrors the beneficiary change process in ensuring that healthcare coverage extends to the right parties.

Retirement Account Beneficiary Designation: This document allows individuals to specify beneficiaries for retirement accounts like IRAs or 401(k)s. It is similar in that it dictates who will receive assets after the account owner's passing.

Will and Testament: While usually part of a broader estate plan, a will includes a section for beneficiaries, outlining who will inherit various assets. Like the 948 form, it serves to ensure that an individual's preferences for asset distribution are respected after their death.

Power of Attorney Beneficiary Designation: This document grants authority to another individual to make decisions regarding financial matters. Although different in purpose, it provides mechanisms for beneficiary designation when the principle cannot act.

Joint Account Ownership Agreement: This agreement allows multiple individuals to jointly own an account and specify what happens to the account’s funds if one owner passes away, similar to how the 948 form addresses beneficiary rights.

Life Insurance Assignment Form: This document enables policyholders to assign their life insurance benefits to a third party, akin to beneficiary designations, facilitating financial assistance for debts or other obligations.

Dos and Don'ts

Here is a list of things to do and not to do when filling out the Modern Woodmen 948 form:

- Print all information clearly in black or dark blue ink.

- Ensure all required fields are completed.

- Carefully read the instructions on the reverse side before proceeding.

- Line through and initial any errors or corrections you may make.

- Include the full names, addresses, relationships, dates of birth, and Social Security numbers of all beneficiaries.

- Complete the method of settlement section according to your preference.

- Sign and date the form in the required sections.

- Have another adult witness your signature who is not named as a beneficiary.

- Attach additional signed sheets if more space is needed for beneficiaries.

- Do NOT use white-out or corrections fluids on the form.

- Do NOT leave any required fields blank.

- Do NOT forget to specify the method of settlement.

- Do NOT list additional names in the wrong sections of the form.

- Do NOT submit the form without a witness signature.

- Do NOT neglect to provide legal documentation if changing the beneficiary for a reason such as marriage or divorce.

- Do NOT assume prior beneficiary designations are retained after submitting the new form.

- Do NOT use a form that is not properly completed; each certificate requires a separate form.

- Do NOT provide false information, which could cause delays or issues with the processing of your request.

Misconceptions

When dealing with the Modern Woodmen 948 form, several misconceptions frequently arise. Understanding these misunderstandings can help ensure that individuals make informed decisions regarding beneficiary designations and name changes. Here are eight common misconceptions:

- The form is only for changing beneficiaries. In reality, the Modern Woodmen 948 form serves dual purposes: it allows users to change beneficiaries and can also be utilized for changing the name of the insured individual.

- All previous beneficiary designations are automatically retained. It's essential to note that signing this form effectively revokes all previous beneficiary designations. Therefore, any new beneficiaries must be clearly designated to avoid confusion.

- Beneficiary changes are immediate. Contrary to popular belief, no changes take effect until the National Secretary acknowledges the request in writing. This means that delays can occur, depending on processing time.

- The signer of the form must be the insured individual. In fact, any legal owner of the certificate can complete and sign the form. This flexibility allows someone other than the insured to initiate changes.

- Only individuals can be named as beneficiaries. This is misleading; the form allows for naming trusts or even estates as beneficiaries. Users must specify the necessary details if choosing this option.

- Witnessing is optional. It's important to emphasize that the signature of a witness is mandatory. This witness must be an adult who is not a named beneficiary.

- Minor beneficiaries cannot receive proceeds. While it's true that proceeds for minors are typically held until they reach legal age, they can still be beneficiaries on the form. A guardian can request payment prior to the child reaching adulthood in certain situations.

- The form cannot be used for multiple beneficiaries. This is incorrect; the form allows for the designation of multiple beneficiaries, ensuring each can be clearly identified along with relevant supporting information.

By demystifying these misconceptions, individuals can more effectively navigate the process of altering beneficiary information or submitting name changes while ensuring their intentions are clearly communicated and legally compliant.

Key takeaways

Understanding the Modern Woodmen 948 form is crucial for any insured party. Here are nine key takeaways to guide you through its completion:

- Complete All Required Fields: Fill in your full name, Social Security number, and certificate number accurately. Ensure this information is printed clearly in black or dark blue ink.

- Revocation of Prior Beneficiaries: Completing this form automatically revokes all previous beneficiary designations. You must list primary and contingent beneficiaries afresh.

- Principal Beneficiary Details: Provide details for the principal beneficiary, including full name, address, relationship, date of birth, and Social Security number.

- Living Trust Details: If applicable, include the name of the trust, the date it was executed, the grantor, and the trustee(s) for clarity on who handles the proceeds.

- Selection of Settlement Method: Choose a method of settlement that suits your needs. Options include "One Sum" or "Deposit at Interest." Specify if you have another preference.

- Signature and Date Requirements: Ensure the form is signed by you (the owner/applicant) and witnessed by an adult who is not a beneficiary. The form must also include the date.

- Beneficiaries for Minors: If naming minors as beneficiaries, bear in mind that the proceeds will be held until they reach legal age unless a guardian requests an earlier payment.

- Contact for Questions: If you have any doubts or need further assistance, reach out to your Modern Woodmen representative or call their Home Office at 1-800-447-9811.

- Documentation for Name Changes: If changing the insured's name, provide the new legal name and relevant documentation to support the request, such as marriage or divorce certificates.

Carefully following these takeaways will streamline the process of filling out and using the Modern Woodmen 948 form.

Browse Other Templates

Kyc Update Federal Bank - Multiple identifiers aid in a holistic view of each customer’s financial profile.

HVAC Alteration Compliance Certificate,Residential HVAC Update Form,Energy Efficiency HVAC Change Report,HVAC Installation and Modification Form,California HVAC Regulatory Compliance Form,HERS Verification HVAC Adjustment Request,HVAC System Improvem - The thermostat for all HVAC alterations must be a setback type for energy management and efficiency.