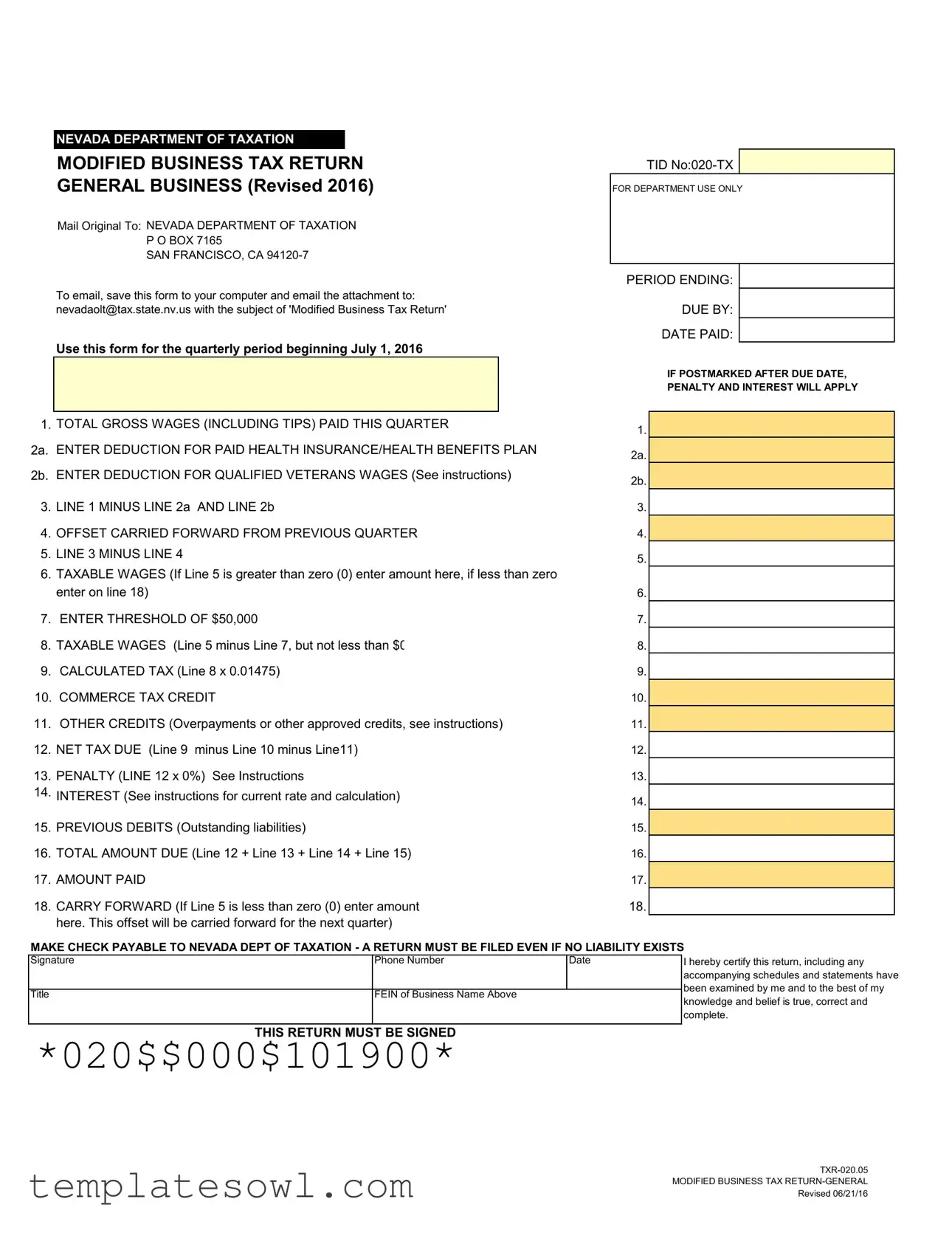

Fill Out Your Modified Business Tax Form

The Modified Business Tax (MBT) form is essential for employers in Nevada, as it facilitates the reporting and payment of state taxes on employee wages. Key elements included in the form are total gross wages paid during the quarter, as well as deductions for health insurance and qualified veterans' wages. Employers calculate net taxable wages by subtracting these deductions from gross wages. An important feature is the threshold of $50,000, which determines the taxable amount. Calculating the tax due involves multiplying the adjusted taxable wages by the specified tax rate. Additionally, the form allows for credits stemming from the Commerce Tax and potential overpayments from previous periods. Interest and penalties may apply for late submissions, making timely filing imperative. Even if no tax liability exists, businesses must file this return, ensuring compliance with state tax regulations. Understanding the intricacies of this form can help employers avoid potential issues and accurately fulfill their tax obligations.

Modified Business Tax Example

|

NEVADA DEPARTMENT OF TAXATION |

|

|

|

|

|

|

|

|

|

|

|

MODIFIED BUSINESS TAX RETURN |

|

TID |

|

|

||||||

|

GENERAL BUSINESS (Revised 2016) |

|

FOR DEPARTMENT USE ONLY |

|

|||||||

|

Mail Original To: NEVADA DEPARTMENT OF TAXATION |

|

|

|

|

|

|

||||

|

P O BOX 7165 |

|

|

|

|

|

|

|

|

|

|

|

SAN FRANCISCO, CA |

|

|

|

|

|

|

|

|

|

|

|

To email, save this form to your computer and email the attachment to: |

|

PERIOD ENDING: |

|

|

||||||

|

|

|

|

DUE BY: |

|

|

|||||

|

nevadaolt@tax.state.nv.us with the subject of 'Modified Business Tax Return' |

|

|

|

|

|

|||||

|

Use this form for the quarterly period beginning July 1, 2016 |

|

|

DATE PAID: |

|

|

|||||

|

|

|

IF POSTMARKED AFTER DUE DATE, |

||||||||

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

PENALTY AND INTEREST WILL APPLY |

|||

|

|

|

|

|

|

|

|

|

|

||

1. |

TOTAL GROSS WAGES (INCLUDING TIPS) PAID THIS QUARTER |

|

1. |

|

|

|

|

||||

2a. |

ENTER DEDUCTION FOR PAID HEALTH INSURANCE/HEALTH BENEFITS PLAN |

|

2a. |

|

|

|

|

||||

2b. |

ENTER DEDUCTION FOR QUALIFIED VETERANS WAGES (See instructions) |

|

2b. |

|

|

|

|

||||

3. |

LINE 1 MINUS LINE 2a AND LINE 2b |

|

|

|

|

|

3. |

|

|

|

|

4. |

OFFSET CARRIED FORWARD FROM PREVIOUS QUARTER |

|

4. |

|

|

|

|

||||

5. |

LINE 3 MINUS LINE 4 |

|

|

|

|

|

5. |

|

|

|

|

6. |

TAXABLE WAGES (If Line 5 is greater than zero (0) enter amount here, if less than zero |

|

|

|

|

|

|||||

|

|

|

|

|

|

||||||

|

enter on line 18) |

|

|

|

|

|

6. |

|

|

|

|

7. |

ENTER THRESHOLD OF $50,000 |

|

|

|

|

|

7. |

|

|

|

|

8. |

TAXABLE WAGES (Line 5 minus Line 7, but not less than $0 |

|

8. |

|

|

|

|

||||

9. |

CALCULATED TAX (Line 8 x 0.01475) |

|

|

|

|

|

9. |

|

|

|

|

10. COMMERCE TAX CREDIT |

|

|

|

|

|

10. |

|

|

|

|

|

11. |

OTHER CREDITS (Overpayments or other approved credits, see instructions) |

|

11. |

|

|

|

|

||||

12. |

NET TAX DUE (Line 9 minus Line 10 minus Line11) |

|

12. |

|

|

|

|

||||

13. |

PENALTY (LINE 12 x 0%) See Instructions |

0 |

|

|

|

|

13. |

|

|

|

|

14. |

INTEREST (See instructions for current rate and calculation) |

|

14. |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

15. |

PREVIOUS DEBITS (Outstanding liabilities) |

|

|

|

|

|

15. |

|

|

|

|

16. |

TOTAL AMOUNT DUE (Line 12 + Line 13 + Line 14 + Line 15) |

|

16. |

|

|

|

|

||||

17. |

AMOUNT PAID |

|

|

|

|

|

17. |

|

|

|

|

18. |

CARRY FORWARD (If Line 5 is less than zero (0) enter amount |

|

18. |

|

|

|

|

||||

|

here. This offset will be carried forward for the next quarter) |

|

|

|

|

|

|

||||

MAKE CHECK PAYABLE TO NEVADA DEPT OF TAXATION - A RETURN MUST BE FILED EVEN IF NO LIABILITY EXISTS |

|||||||||||

Signature |

|

|

Phone Number |

Date |

|

|

I hereby certify this return, including any |

||||

|

|

|

|

|

|

|

|

|

accompanying schedules and statements have |

||

|

|

|

|

|

|

|

|

|

been examined by me and to the best of my |

||

Title |

|

|

|

FEIN of Business Name Above |

|

|

|

||||

|

|

|

|

|

|

knowledge and belief is true, correct and |

|||||

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

complete. |

||

|

THIS RETURN MUST |

BE SIGNED |

|

|

|

|

|

|

|||

*020$$000$101900* |

|

|

101900 |

|

|||||||

|

|

|

|

|

|

|

|||||

MODIFIED BUSINESS TAX

INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - GENERAL BUSINESSES ONLY

(Financial Institutions need to use the form developed specifically for them,

IF YOU COMPLETE THIS FORM ONLINE THE CALCULATIONS WILL BE MADE FOR YOU

Line 1. Total Gross Wages - Enter the total amount of all gross wages and reported tips paid this calendar quarter Line 2a. Employer paid health care costs, paid this calendar quarter, as described in NRS 363B.115.

Line 2b. Enter deduction for qualified Veterans wages. Attach employee verification of Unemployment Benefits and signed affidavit that employee meets the requirements pursuant to AB71 of the 78th (2015) legislative session.

Line 3. Net taxable wages. Add Line 2a and Line 2b. Subtract this sum from Line 1.

Line 4. Offsets carried forward are created when allowable health care costs exceed gross wages in the previous quarter. If applicable, enter the previous quarter's offset here. This is not a credit against any tax due. This reduces the wage base upon which the tax is calculated.

Line 5. Line 3 minus Line 4.

Line 6. Net taxable wages is the amount that will be used in the calculation of the tax. If line 5 is greater than zero, this is the taxable wages. If line 5 is less than zero, then no tax is due. (This amount will be entered on line 18 as the offset carried forward for the next quarter. The offset carried forward is only limited to the health care deduction. This excludes the deduction for veteran wages.)

Line 7. Enter the threshold of $50,000.00. SB483 set the threshold to $50,000.00 for quarterly wages. Tax is calculated on wages over this threshold. Line 8. Taxable wages. The threshold in Line 7 is subtracted from Line 5 to calculate taxable wages; do not enter an amount if less than 0.

Line 9. Calculated Tax. Multiply Line 8 x .01475, the rate established by SB483.

Line 10. Commerce Tax Credit – Enter 50% of the Commerce Tax paid in the prior tax year up to the amount of MBT tax owed. Do not enter an amount less than zero. If the credit amount is higher than the MBT tax owed it may be carried forward up to the fourth quarter immediately following the end of the Commerce Tax year for which Commerce Tax is paid.

Line 11. Other Credits - Enter amount of overpayment of Modified Business Tax (MBT) made in prior reporting periods for which you have received a Department of Taxation credit notice. Credit notices received from the Department are not cumulative. Do not take the credit if you have applied for a refund. NOTE: Only credits established by the Department may be used. The 78th (2015) legislative session enacted several Bills that created credits towards the MBT that may be taken on this tax return if qualified. These credits except for the college savings plan contributions require prior approval by the Department and a credit notice. Please attach credit notice and/or College Savings Plan Contributions Form to this return.

Line 12. Net Tax Due - Line 9 minus Line 10. This amount is due and payable by the due date; the last day of the month following the applicable quarter. If payment of the tax is late, penalty and interest (as calculated below) are applicable.

Line 13. Penalty - If this return will not be submitted/postmarked and the taxes paid on or before the due date as shown on the face of this return, the amount of penalty due is based on the number of days late payment is made per NAC 360.395. Determine the number of days the payments is late and multiply the net tax owed by the appropriate rate based on the table below. The result is the amount of penalty that should be entered. For example, if the taxes were due January 31, but not paid until February 15. The number of days late is 15 so the penalty is 4%. The maximum penalty amount is 10%.

|

Number of days late |

Penalty Percentage |

Multiply By |

|

|||

|

|

|

|

|

2% |

0.02 |

|

4% |

0.04 |

||

|

16 - 20 |

6% |

0.06 |

21- 30 |

8% |

0.08 |

|

|

31 + |

10% |

0.1 |

Line 14. Interest: To calculate interest for each month late, multiply Line 11 x 0.75% (or .0075).

Line 15. Previous Debits - Enter only those liabilities that have been established for prior quarters by the Department and for which you have received a liability notice.

Line 16. Total Amount Due

Line 18. Carry Forward - If line 5 is less than zero enter figure here. This amount will be carried forward to the next quarter (offset)

GENERAL INFORMATION:

GENERAL BUSINESSES MUST USE FORM

Who Must File: Every employer who is subject to the Nevada Unemployment Compensation Law (NRS 612) except for

Businesses that have ceased doing business (gone out of business) in Nevada must notify the Employment Security Division and the Department of Taxation in writing, the date the business ceased doing business. The Department will send written notice when a credit request has been processed and the credit is available for use/refund.

Please do not use/apply a credit prior to receiving Departmental notification that it is available.

** For up to date information on tax issues, be sure to check our website

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | The Modified Business Tax (MBT) form is used by employers in Nevada to report wages and calculate taxes owed based on those wages for a specific quarterly period. |

| Filing Requirement | Every employer subject to the Nevada Unemployment Compensation Law, excluding certain non-profit organizations, must file this form. This obligation includes entities that have stopped operations in Nevada. |

| Governance | This form is governed by NRS 612 (Nevada Revised Statutes) and SB483, which establishes tax calculations and wage thresholds. |

| Due Dates | Completed forms are due by the last day of the month following the end of the applicable quarter, and failure to submit on time may result in penalties and interest. |

Guidelines on Utilizing Modified Business Tax

Completing the Modified Business Tax form is crucial for every business required to file in Nevada. It is essential to gather necessary information beforehand to fill out the form accurately. Below is a simple guide to help you through each step of the process. Follow these instructions carefully to ensure a smooth submission.

- Enter the Taxpayer Identification Number (TID No.) at the top of the form.

- Fill in the period ending date for the quarterly report.

- Indicate the due date for the submission of the form.

- List the total gross wages paid for the quarter, including tips, on Line 1.

- For Line 2a, enter the deduction for paid health insurance or health benefits.

- On Line 2b, input the deduction for qualified veterans' wages, ensuring you have the required documentation.

- Calculate Line 3 by subtracting the sum of Lines 2a and 2b from Line 1.

- If you have an offset from the previous quarter, enter that amount on Line 4.

- Calculate Line 5 by subtracting Line 4 from Line 3.

- Line 6 will show taxable wages—if Line 5 is greater than zero, enter that amount; otherwise, note it on Line 18.

- Input the threshold amount of $50,000 on Line 7.

- Calculate Line 8 by subtracting the threshold on Line 7 from the taxable wages on Line 5.

- Calculate Line 9 using the formula: Line 8 multiplied by 0.01475.

- For Line 10, enter the commerce tax credit if applicable.

- On Line 11, add any other credits you may have from overpayments or previous approvals.

- Line 12 will be the net tax due, calculated by subtracting Lines 10 and 11 from Line 9.

- If applicable, calculate any penalty on Line 13 based on late submission.

- Calculate interest for late payments to enter on Line 14.

- Input any previous debits from the Department on Line 15.

- Sum up Lines 12 through 15 to find the total amount due, and write it on Line 16.

- Enter the amount you are paying with this return on Line 17.

- If Line 5 was less than zero, add that figure to Line 18 as the carry-forward offset for the next quarter.

- Don’t forget to sign the form, include your contact number, and date it. Make sure to include your business name and FEIN.

Once you've completed the form, make a copy for your records before mailing it to the Nevada Department of Taxation or emailing it as an attachment. Ensure the subject line states 'Modified Business Tax Return.' Double-check for accuracy to avoid delays or penalties.

What You Should Know About This Form

What is the Modified Business Tax and who is required to file it?

The Modified Business Tax (MBT) is a tax levied on employers in Nevada based on their gross wages paid to employees, including tips. This tax is applicable to general businesses, and every employer subject to the Nevada Unemployment Compensation Law is required to file the MBT form. Exceptions include non-profit organizations, Indian tribes, and political subdivisions. Employers must file the return even if they do not owe any tax for the quarter.

How is the tax calculated on the Modified Business Tax form?

The calculation starts with the total gross wages paid during the quarter, which is recorded on Line 1 of the form. Employers may deduct certain amounts, including health care costs and qualified veterans' wages (Lines 2a and 2b), from the total gross wages to find the net taxable wages (Line 3). Further adjustments are made by accounting for any carry-forward offsets from the previous quarter (Line 4). The final taxable wages are then determined, and the tax amount is calculated by applying the tax rate of 0.01475 to the taxable wages that exceed $50,000.

What happens if the Modified Business Tax payment is late?

If the tax payment is submitted after the due date, penalties and interest will accrue. The penalty is calculated based on how many days late the payment is. For example, if the payment is 1 to 10 days late, a 2% penalty applies. After 30 days, the maximum penalty reaches 10%. Interest is calculated separately at a rate of 0.75% per month on any outstanding tax balance. Timely filing and payment are essential to avoid these additional charges.

Can businesses claim credits against their Modified Business Tax liability?

Yes, businesses may apply for credits to offset their Modified Business Tax liability. The Commerce Tax Credit allows employers to use a portion of the Commerce Tax paid in the preceding year, while other credits may include adjustments for overpayments made in prior periods. It is crucial for businesses to attach any necessary documentation, such as credit notices from the Department of Taxation, when submitting the tax return. These credits can help reduce the overall tax burden for eligible employers.

Common mistakes

Completing the Modified Business Tax form accurately is essential to avoid penalties and ensure compliance. However, many individuals make common mistakes during this process. Understanding these pitfalls can help streamline your filing and minimize the chance of errors.

One frequent mistake is failing to report total gross wages accurately on Line 1. It's crucial to include all gross wages and reported tips paid during the quarter. Underreporting can lead to incorrect taxable amounts, which may cause issues with the Department of Taxation.

Another common error is not taking into account eligible deductions for health insurance and veterans' wages. Lines 2a and 2b require specific deductions that can significantly reduce your taxable wages. Omitting these deductions can result in an inflated tax liability.

Some individuals do not understand how to calculate the offset carried forward on Line 4 correctly. This element is essential for maintaining accurate accounts from one quarter to the next. Mismanagement here can complicate future filings and lead to unexpected taxes due.

In addition, many people mistakenly enter negative amounts where they shouldn't. Specifically, if the outcome of Line 5 is less than zero, this amount belongs on Line 18 as an offset carried forward, not in calculations for taxable wages. Mishandling this can create a confusing situation in future quarters.

Another critical error is misunderstanding the threshold of $50,000 on Line 7. Tax is computed on wages exceeding this threshold. Failing to accurately factor this number into your calculations can lead to significant discrepancies in what you owe.

Calculating tax owed can be tricky and people often substitute the wrong numbers. For Line 9, the calculated tax should be derived from Line 8 times 0.01475. If incorrect figures are inserted here, the total tax liability reported will be inaccurate.

Line 10 can also cause confusion regarding Commerce Tax Credits. If these credits are misapplied or incorrectly calculated, it will either lead to overpayment or a higher tax due. It’s essential to verify eligibility and accurately report these amounts.

People frequently overlook the penalty and interest on Line 13 and Line 14. Properly understanding and calculating these penalties and interests is crucial for total compliance. If these figures are not reported correctly, it leads to larger bills down the road.

Lastly, individuals sometimes forget to sign the return. Without a signature, the return is considered incomplete, which can delay processing or lead to rejection. A signature is not merely a formality; it's a declaration of the validity of the information provided.

By being aware of these common mistakes when filling out the Modified Business Tax form, individuals can avoid unnecessary complications and ensure compliance with Nevada tax laws. Take a moment to double-check your numbers and documentation before submission.

Documents used along the form

When filing the Modified Business Tax return, it’s important to consider additional forms and documents that may be necessary to complete the process. Below is a list of key documents often used in conjunction with the Modified Business Tax form.

- Employer's Quarterly Wage Report (NUCS 4072): This report details the wages paid to employees during a specific quarter. While it does not need to accompany the Modified Business Tax return, it should be available for review by the Department of Taxation if requested.

- Commerce Tax Return: Companies that exceed a certain gross revenue threshold must file this tax return. The amount paid as Commerce Tax may be credited against the Modified Business Tax due, allowing for potential savings.

- Health Insurance Deduction Documentation: Employers claiming deductions for health care costs must maintain records that validate these expenses. This documentation is critical for ensuring the deductions are approved during the tax assessment process.

- Credit Notices: These documents issued by the Department of Taxation inform businesses about available credits from previous years. It's essential to attach these notices when filing if credits are to be claimed against the Modified Business Tax.

- Wage Verification for Qualified Veterans: To claim deductions for qualified veterans' wages, businesses are required to attach appropriate verification. This may include a signed affidavit from the veteran confirming their status.

- Penalty and Interest Calculation Worksheets: If taxes are paid late or penalties are incurred, a worksheet detailing the calculations for any penalties or interest due may be necessary. This helps ensure accuracy in reporting the total amount owed.

Understanding these forms and documents will streamline the filing process for businesses. By preparing and gathering all necessary paperwork ahead of time, employers can minimize errors and potential delays when submitting their Modified Business Tax return.

Similar forms

- 1040 Individual Income Tax Return: The Modified Business Tax form and the 1040 share a focus on informing the tax authority about an entity's income and deductions over a specific period. Both require detailed reporting on income, deductions, and credits to arrive at the tax due.

- 1120 Corporate Income Tax Return: Like the Modified Business Tax form, the 1120 is used by businesses but is specifically for corporations. Both forms require calculations of gross income, taxable income, and applicable deductions to determine tax obligations.

- Form 941 (Employer’s Quarterly Federal Tax Return): The Modified Business Tax form and Form 941 are both filed quarterly. Each form helps report wages paid and tax liabilities, including deductions such as health insurance and other benefits, highlighting the similarities in reporting employment taxes.

- W-2 Wage and Tax Statement: Both documents relate to employee compensation and tax withholdings. The Modified Business Tax form takes into account total gross wages, which is reported on W-2 forms, ensuring consistency in how wages are documented for tax purposes.

- 990 Return of Organization Exempt from Income Tax: While the focus differs significantly, both forms require disclosure of financial information to the tax authority. The 990 provides transparency about nonprofit finances, similar to how the Modified Business Tax form outlines business finances.

- Schedule C (Profit or Loss from Business): This schedule is for sole proprietors to report income and expenses. The concept of calculating net income or loss after deductions aligns with practices on the Modified Business Tax form, even if the tax types differ.

- Form 1065 (U.S. Return of Partnership Income): Partnerships and businesses alike must report income, deductions, and tax liabilities. The Modified Business Tax form’s treatment of gross wages mirrors the income reporting on a 1065, thus catering to various business structures.

- Form 8862 (Information to Claim Certain Refundable Credits): This document addresses the complexities of credit claims and deductions. Similarly, both the Modified Business Tax form and Form 8862 require careful accounting of credits that can reduce the tax owed.

Dos and Don'ts

Here are five things to do when filling out the Modified Business Tax form:

- Gather all necessary documents, including payroll records and health insurance costs.

- Review the instructions closely to ensure accurate completion of each line.

- Calculate your total gross wages carefully to avoid mistakes.

- Fax or email the completed form by the due date to avoid penalties.

- Keep copies of the form and supporting documents for your records.

Here are five common mistakes to avoid:

- Don’t skip lines; ensure every section is completed as required.

- Do not forget to sign the form before submission.

- Don’t submit a return without verifying the amounts entered.

- Avoid submitting credits without prior approval from the Department.

- Do not ignore the payment due date to prevent penalties and interest.

Misconceptions

There are several misconceptions about the Modified Business Tax (MBT) form that can lead to confusion for business owners. Below are six common misunderstandings along with their clarifications.

-

The MBT only applies to large businesses.

This is not true; any business that meets the requirements of the Nevada Unemployment Compensation Law must file the MBT, regardless of size, except for certain exempt entities.

-

Non-profit organizations need to file the MBT.

Actually, 501(c) nonprofit organizations are exempt from filing the Modified Business Tax in Nevada.

-

Only businesses in Nevada need to file.

This is a misconception. If businesses are subject to Nevada Unemployment laws, they must file, even if they operate from another state.

-

Filing the MBT is optional if no taxes are due.

It is important to note that a return must be filed even if there is no tax liability for the quarter.

-

Tax credits can be used freely without notification.

This is incorrect. Only credits approved by the Department of Taxation may be claimed, and businesses must attach the appropriate credit notice to the return.

-

The due date is flexible and can be adjusted.

On the contrary, the due date is fixed. The return must be postmarked by the last day of the month following the quarter, or penalties may apply.

Understanding these key points can help avoid errors when filing the Modified Business Tax form.

Key takeaways

Filling out and using the Modified Business Tax form can seem complex, but understanding a few key points can make the process easier. Here are some important takeaways to keep in mind:

- Filing Requirement: Employers subject to the Nevada Unemployment Compensation Law must file this form, even if their tax liability is zero. Not filing can lead to issues down the line.

- Calculate Correctly: Ensure you accurately calculate taxable wages by subtracting deductions for health insurance and qualified veterans’ wages from total gross wages. Mistakes in calculation can affect your tax obligation.

- Deadlines Matter: The tax return is due by the last day of the month following the end of the quarter. Late submissions will incur penalties and interest, so timely filing is crucial.

- Utilize Available Credits: If applicable, make sure to apply any credits you're eligible for to reduce your overall tax liability. Include documentation when needed, as these can significantly affect the amount you owe.

Browse Other Templates

What Does Haccp Stand for - Conduct verification through records review to maintain food safety standards.

Sante Prior Auth Form - You may need to provide lab values or treatment failures as evidence.