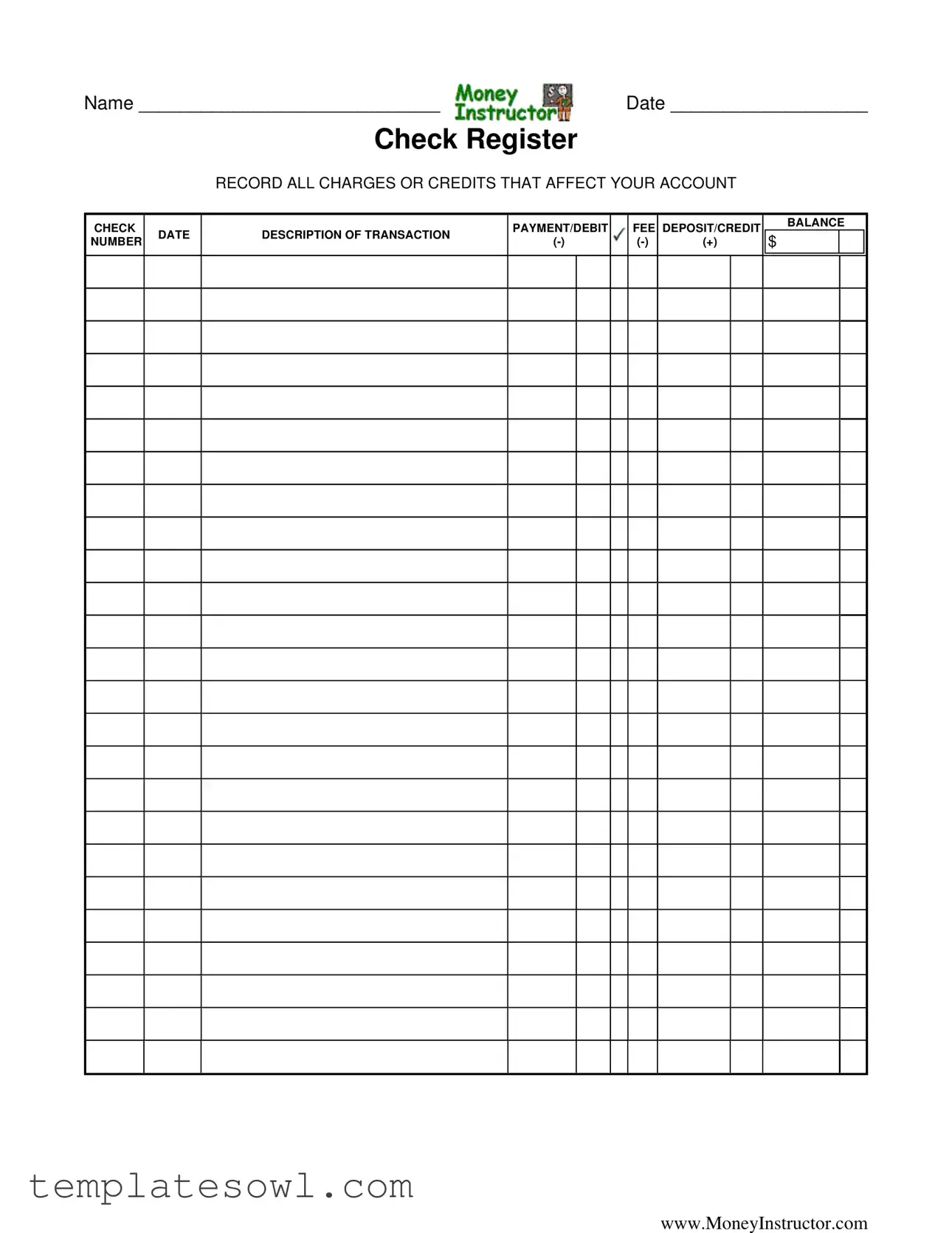

Fill Out Your Money Instructor Check Register Form

The Money Instructor Check Register form serves as an essential financial tool for individuals looking to manage their checking accounts effectively. By clearly documenting each transaction, users can maintain an accurate and up-to-date record of their financial activities. The form is designed to capture key details, including the date of the transaction, a description of the transaction, and the corresponding amounts for payments, debits, and deposits. Individuals are prompted to fill in their name and date at the top, creating a personalized financial record. Transactions are categorized into charges or credits, with specific columns for check payments and deposits, allowing users to visually track their account balance over time. Consequently, this structured approach aids users in gaining insights into their spending habits and maintaining financial stability. Overall, the form is an invaluable resource for anyone looking to take charge of their finances and ensure their checking account remains accurately balanced.

Money Instructor Check Register Example

NAME _____________________________ |

DATE ___________________ |

Check Register

RECORD ALL CHARGES OR CREDITS THAT AFFECT YOUR ACCOUNT

CHECK |

|

|

PAYMENT/DEBIT |

|

FEE DEPOSIT/CREDIT |

BALANCE |

||||

DATE |

DESCRIPTION OF TRANSACTION |

|

$ |

|

||||||

NUMBER |

|

(+) |

|

|

||||||

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

www.MoneyInstructor.com

Form Characteristics

| Fact Name | Detail |

|---|---|

| Purpose | The Money Instructor Check Register is used to track all transactions affecting a bank account. |

| Record Types | It is designed to record both payments/debits and deposits/credits. |

| Balance Calculation | Users can calculate their account balance after each transaction. |

| Documentation | Each entry requires a date and description for clarity and record-keeping. |

| Format | The form has designated spaces for monetary values, both positive and negative. |

| Website Reference | The form can be found online at www.MoneyInstructor.com for easy access and utilization. |

| Usage | It is suitable for personal finance management and budgeting purposes. |

| Legal Considerations | While it helps in personal tracking, users must comply with their state’s banking laws and regulations. |

Guidelines on Utilizing Money Instructor Check Register

Once you have the Money Instructor Check Register form in hand, it’s important to fill it out carefully. This form helps you keep track of your finances by recording transactions that affect your account balance. You'll input details about each charge, credit, and your current balance. Follow these steps to complete the form accurately.

- Name: Write your full name on the line next to "NAME." Make sure it’s legible.

- Date: Enter today’s date next to "DATE." Be sure to use the correct format, like MM/DD/YYYY.

- Date of Transaction: For each transaction, fill in the date you made that purchase or deposit in the “DATE” column.

- Description: In the "DESCRIPTION" column, briefly describe what each charge or credit is for. For example, if it's a grocery store purchase, write "Groceries."

- Check Number (if applicable): If you have a check payment, include the check number in the “CHECK NUMBER” column. If you used a debit card or made a direct withdrawal, leave this blank.

- Payment/Debit Fee: In the “PAYMENT/DEBIT FEE” column, record any amounts that decrease your account balance with a negative sign (-).

- Deposit/Credit: For any funds added to your account, write the amount in the “DEPOSIT/CREDIT” column using a positive sign (+).

- Balance: Calculate your new balance after each transaction and write it in the “BALANCE” column. Start with your previous balance and adjust according to your entries.

By following these clear and straightforward steps, you will maintain an organized view of your financial activity. This record will empower you to track your money and helps prevent overdrafts or unintentional overspending. Make it a habit to update the register each time you make a transaction.

What You Should Know About This Form

What is the Money Instructor Check Register form used for?

The Money Instructor Check Register form is designed to help individuals track their bank account transactions. Users can log all charges or credits that affect their account, allowing for better management of finances. This tool helps maintain an accurate balance and keeps a record of spending and deposits.

How do I fill out the Check Register form?

To fill out the Check Register form, begin by entering your name and the date at the top. For each transaction, record the date it occurred, a brief description of the transaction, and the amount. If it’s a charge or debit, indicate this by writing the amount in the appropriate column with a minus sign. For deposits or credits, write the amount with a plus sign. Finally, calculate and update your account balance after each entry.

Why is it important to keep track of my account balance?

Tracking your account balance is essential for avoiding overdrafts and managing your spending. By regularly updating your check register, you gain a clearer picture of your finances. This vigilance can prevent fees that come from insufficient funds and help in planning your budget effectively.

Can I use the Check Register for types of accounts other than checking accounts?

Yes, the Check Register form can be used for any account where you need to track transactions—such as a savings account. While it is particularly designed for checking accounts, the principles of logging charges and credits are applicable to varying financial accounts, ensuring you manage your money effectively.

Where can I find the Money Instructor Check Register form?

The form is available on the official Money Instructor website at www.MoneyInstructor.com. You can download it for free and print it for your use. This accessibility allows anyone to take charge of their financial tracking without any cost.

Is there support available if I have questions about using the Check Register form?

Yes, support is available through the Money Instructor website. You can find additional resources, tutorials, and customer support options designed to assist users with any questions or issues they may have regarding the Check Register form or personal finance management in general.

Common mistakes

When using the Money Instructor Check Register form, many people overlook essential details. One common mistake is forgetting to write down the date of each transaction. Keeping track of when a transaction occurs is crucial for understanding your spending habits and staying organized.

Another frequent issue is the misrecording of amounts. Some individuals might accidentally enter a deposit as a withdrawal or vice versa. Such discrepancies can lead to confusion and an inaccurate account balance. Always double-check the amounts to ensure they are recorded correctly.

Failing to provide a clear description of transactions also creates problems. Someone might note “gas” instead of giving a full account of the purchase, like “gas for trip to Austin.” A complete description helps people remember the purpose of their spending when looking back.

Additionally, leaving the balance column blank is a common pitfall. Tracking your running balance after each transaction provides a clearer picture of your financial state. This habit can prevent overdrafts and help manage expenses effectively.

People often neglect to record all transactions immediately. Waiting to log expenses can lead to forgotten entries and inaccurate balances. It’s best to fill out the register right after a transaction occurs to maintain accuracy.

Finally, many users fail to review their check register regularly. This oversight may result in missing discrepancies or errors that could affect future transactions. Regular reviews help catch mistakes early and promote better financial management overall.

Documents used along the form

The Money Instructor Check Register form is an essential tool for individuals seeking to maintain an accurate record of financial transactions. However, several other forms and documents can complement this check register to provide a comprehensive view of one's financial standing. Below is a list of these documents, each serving a distinct purpose in financial management.

- Bank Statement: A monthly summary provided by financial institutions detailing all transactions in an account, including deposits, withdrawals, and fees. This document helps verify the accuracy of the check register.

- Deposit Slip: A form used to deposit cash or checks into a bank account. It typically includes fields for the date, account number, and amount to be deposited, ensuring accurate entries in the check register.

- Withdrawal Slip: Often used when cash is taken out of an account, this form specifies the amount and can assist in tracking debit transactions accurately.

- Receipt: A document that serves as proof of a transaction, whether it is a purchase or payment. Keeping receipts allows individuals to track expenses and match them back to their check register.

- Budget Worksheet: A planning tool that helps individuals allocate their income across various expenses and savings goals. This form aids in aligning spending habits with financial objectives.

- Transaction Log: This document serves as a detailed record of individual transactions, often including categories for better tracking and analysis of expenses over time.

- Electronic Funds Transfer (EFT) Authorization Form: A document that allows customers to authorize automatic transfers of funds from one bank account to another. This helps to monitor scheduled payments and deposits accurately.

- Credit Card Statement: A monthly summary from a credit card issuer that outlines purchases made, payments received, fees charged, and the remaining balance, which aids in comprehensive financial tracking.

Incorporating these additional forms and documents into financial management can enhance accuracy and provide deeper insights into an individual's monetary habits. Utilizing these resources alongside the Money Instructor Check Register form can lead to more informed financial decision-making and improved personal finance skills.

Similar forms

- Personal Checkbook Ledger: This document tracks all incoming and outgoing transactions, including deposits and fees, helping users manage their finances effectively.

- Bank Account Statement: Monthly statements from banks summarize all transactions, including deposits and withdrawals, similar to a check register but presented over a longer timespan.

- Expense Tracker: An expense tracker lists all spending and income, serving as a budgeting tool, just like a check register maintains a record of all transactions.

- Transaction Log: Individuals use this to keep a detailed account of financial transactions, mirroring how a check register records checks paid and deposits made.

- Petty Cash Log: This log tracks small cash transactions, similar to a check register in documenting financial movements, though typically on a smaller scale.

- Budget Worksheet: A budget worksheet outlines expected income and expenses, while the check register tracks actual transactions, providing a complete financial picture.

- Invoice Tracking Sheet: Used to monitor payments received and amounts due, this document serves a similar purpose by keeping financial records straight, as does a check register.

- Credit Card Statement: Like a check register, a credit card statement provides a summary of charges and payments made throughout the billing cycle.

- Loan Amortization Schedule: This document details the repayment schedule for a loan and tracks payments over time, akin to how a check register monitors account balance changes.

- Financial Planner: This comprehensive tool allows users to outline their income and expenses, similar to a check register but often encompassing a broader view of financial health.

Dos and Don'ts

When filling out the Money Instructor Check Register form, it’s important to follow certain guidelines to maintain accuracy and clarity. Here are some things to do and avoid:

- Do write clearly and legibly to ensure all information is easily readable.

- Do fill in the date of each transaction promptly to keep your records up to date.

- Do categorize each transaction accurately, noting whether it is a payment or a deposit.

- Do double-check your calculations after each entry to avoid errors in your balance.

- Do use a consistent format for your entries, making it easier to track changes over time.

- Don’t leave spaces or blanks in your register, as this can lead to confusion about your transactions.

- Don’t ignore smaller transactions; they can add up and significantly impact your balance.

By adhering to these dos and don’ts, one can effectively manage their account and make informed financial decisions.

Misconceptions

Misconceptions about the Money Instructor Check Register form can lead to confusion and mismanagement of one's finances. Let's clarify some common misunderstandings.

-

It only tracks checks written.

Many people believe that the Check Register form is solely for recording checks. In reality, it is designed to track all transactions affecting your account, including deposits and withdrawals, debit fees, and other charges.

-

It requires extensive financial knowledge.

A common misconception is that users need to be financial experts to effectively use the Check Register form. However, this tool is user-friendly and intended for anyone wishing to manage their finances more efficiently.

-

It is only for those with checking accounts.

Some individuals think that the form is limited to checking account users. On the contrary, anyone managing money can benefit from the organized structure of recording transactions, whether in checking, savings, or even business accounts.

-

It eliminates the need for online banking.

Another myth is that using a Check Register form negates the need for online banking. While online banking provides digital convenience, the Check Register serves as a complementary tool that helps individuals track their spending and balances manually, promoting better financial awareness.

Key takeaways

Filling out and utilizing the Money Instructor Check Register form can improve your financial awareness and help you manage your account effectively. Here are some key takeaways:

- Accurate Record Keeping: Always record all charges or credits that affect your account promptly to maintain an accurate balance.

- Detailed Descriptions: Write clear descriptions of each transaction in the designated area. This helps in tracking spending habits over time.

- Consistent Updates: Regularly update your check register each time you make a transaction, whether it is a deposit or a withdrawal.

- Balance Monitoring: Calculate your balance after each entry. This ensures you are aware of your current financial status and can avoid overdrawing your account.

- Transaction Types: Include all types of transactions, such as check payments, debit fees, and deposits, to have a comprehensive view of your finances.

- Reflecting on Spending: Periodically review your completed check register. Analyzing past transactions can help you identify trends and make informed budgeting decisions.

Browse Other Templates

Cbu Transcript Request - All information provided will be kept confidential.

Dmv Salvage Title - The person responsible for the vehicle should sign and date the CHP 279.

Scad Transcript - Consider how your request might need to change based on your semester attendance.