Fill Out Your Montana New Hire Form

The Montana New Hire Reporting Form plays a crucial role in ensuring compliance with state and federal laws pertaining to employment and child support enforcement. When employers hire new employees, they are required to fill out this form, which gathers essential information necessary for both reporting and record-keeping. This includes important details about the employer, such as the Federal ID Number, business name, and contact information, ensuring that authorities can appropriately identify and track employer activities. The employee section captures vital identification details, including the social security number and hire date, along with personal contact information. Optional information regarding health insurance availability can also be included. Additionally, the form provides specific instructions for reporting and offers contact numbers for inquiries, emphasizing its user-friendly nature. Properly completing this form not only helps facilitate a smoother administrative process for employers but also supports broader community interests, including the swift collection of child support payments. Understanding the importance and requirements of the Montana New Hire Reporting Form is essential for both employers and employees to ensure compliance and promote efficiency in the labor market.

Montana New Hire Example

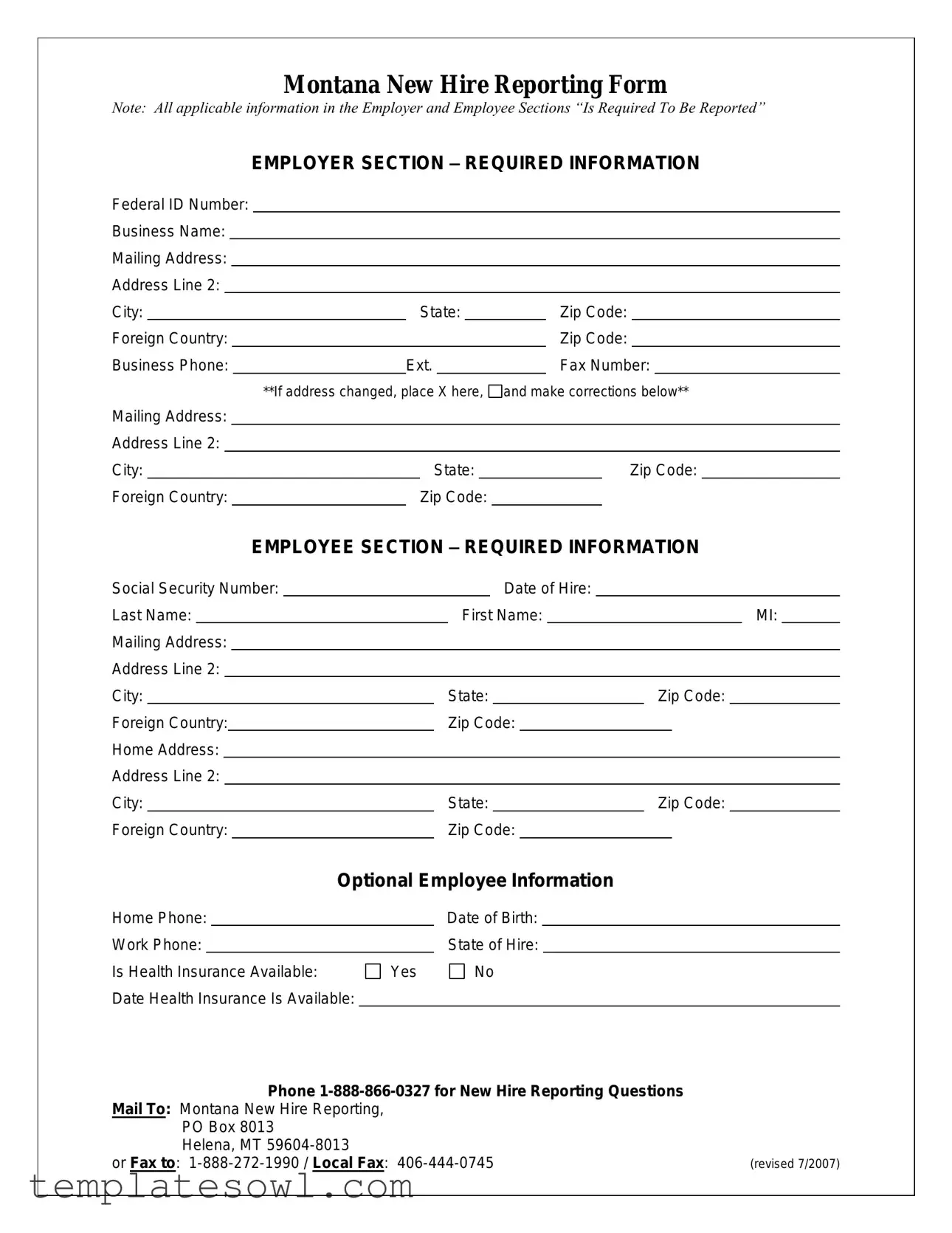

Montana New Hire Reporting Form

Note: All applicable information in the Employer and Employee Sections “Is Required To Be Reported”

EMPLOYER SECTION – REQUIRED INFORMATION

Federal ID Number:

Business Name:

Mailing Address:

Address Line 2:

City: |

|

|

|

|

|

State: |

|

|

Zip Code: |

|

||||||

Foreign Country: |

|

|

|

|

|

|

|

|

|

Zip Code: |

|

|||||

Business Phone: |

|

|

|

Ext. |

|

|

Fax Number: |

|

||||||||

|

|

|

|

**If address changed, place X here, |

and make corrections below** |

|||||||||||

Mailing Address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Address Line 2: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City: |

|

|

|

|

|

State: |

|

|

|

Zip Code: |

|

|||||

Foreign Country: |

|

|

|

|

Zip Code: |

|

|

|

|

|

|

|||||

EMPLOYEE SECTION – REQUIRED INFORMATION

Social Security Number: |

|

|

|

|

Date of Hire: |

|

|

|

|

|

|

||||||||

Last Name: |

|

|

|

First Name: |

|

|

|

|

|

MI: |

|

||||||||

Mailing Address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Address Line 2: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

City: |

|

|

|

State: |

|

|

Zip Code: |

|

|||||||||||

Foreign Country: |

|

|

Zip Code: |

|

|

|

|

|

|

||||||||||

Home Address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Address Line 2: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

City: |

|

|

|

State: |

|

|

Zip Code: |

|

|||||||||||

Foreign Country: |

|

|

|

Zip Code: |

|

|

|

|

|

|

|

||||||||

Optional Employee Information

Home Phone: |

|

|

Date of Birth: |

|

|

Work Phone: |

|

|

State of Hire: |

|

|

Is Health Insurance Available: |

Yes |

No |

|||

Date Health Insurance Is Available: |

|

|

|

||

Phone |

|

Mail To: Montana New Hire Reporting, |

|

PO Box 8013 |

|

Helena, MT |

|

or Fax to: |

(revised 7/2007) |

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose of the Form | The Montana New Hire Reporting Form is used to report newly hired employees to the state for child support enforcement purposes. |

| Governing Laws | This form is governed by federal law under the Personal Responsibility and Work Opportunity Reconciliation Act and Montana state law. |

| Required Employer Information | Employers must provide essential details including their Federal ID Number, business name, and mailing address. |

| Required Employee Information | Employers are required to report the Social Security Number, date of hire, and full name of each new employee. |

| Optional Employee Information | In addition to required fields, employers can report optional information such as the employee's home phone and date of birth. |

| Submission Methods | The completed form can be mailed to the Montana New Hire Reporting office or faxed directly for submission. |

| Contact Information | For inquiries regarding new hire reporting, individuals can call the toll-free number 1-888-866-0327. |

| Last Revision Date | The form was last revised in July 2007, and any changes must be noted if the employer's address has changed. |

Guidelines on Utilizing Montana New Hire

After completing the Montana New Hire Reporting Form, it's crucial to submit it promptly to ensure compliance with state regulations. The information gathered is essential for various administrative processes related to employment. Below are the steps to fill out the form accurately.

- Start with the Employer Section. Fill in the Federal ID Number. This is a unique identifier for your business.

- Enter the Business Name, which should match the official registered name of your company.

- Provide the Mailing Address. Include any additional address information in Address Line 2 if needed.

- Specify the City, State, and Zip Code for both the mailing address and any relevant foreign country details.

- Include the Business Phone number and the Fax Number. Ensure you provide an extension if applicable.

- If your business address has changed, mark the box and correct the information in the designated space below.

- Now, proceed to the Employee Section. Input the Social Security Number of the employee.

- Document the Date of Hire for the employee you are reporting.

- Fill in the Last Name, First Name, and Middle Initial (MI) of the employee.

- Provide the employee's Mailing Address, including any additional information under Address Line 2.

- Specify the City, State, and Zip Code for the mailing address.

- If applicable, include the employee's Home Address with necessary details.

- For the Home Phone and Work Phone, if available, provide the relevant numbers.

- Record the Date of Birth of the employee.

- Indicate the State of Hire.

- Specify if Health Insurance is available. Circle Yes or No as appropriate.

- If health insurance is available, fill in the Date Health Insurance Is Available.

- Once completed, submit the form by mailing it to Montana New Hire Reporting, PO Box 8013 Helena, MT 59604-8013 or faxing it to 1-888-272-1990. The local fax number is 406-444-0745.

What You Should Know About This Form

What is the Montana New Hire Reporting Form?

The Montana New Hire Reporting Form is a document that employers must complete when they hire new employees. This form collects critical information about both the employer and the employee. It is used to report the new hire to the state for various purposes, including child support enforcement and other state programs that require up-to-date employment information.

Who is required to file this form?

All employers in Montana are required to report new hires. This includes businesses of all sizes, non-profits, and governmental organizations. If you have employees in Montana, it’s important to ensure that you are fulfilling your reporting obligations.

What information is required in the Employer Section?

The Employer Section must include detailed information such as the Federal ID Number, business name, mailing address, city, state, zip code, foreign country (if applicable), business phone, and fax number. It’s important to fill out all applicable fields to avoid any delays in processing the form.

What details are needed from the employee?

The Employee Section requires specific information, including the employee’s Social Security Number, date of hire, last name, first name, middle initial, mailing address, and home address. Optional information, such as home and work phone numbers, date of birth, and details about health insurance availability, can also be provided, but they are not mandatory.

What happens if my address changes?

If your address changes, you will need to indicate this on the form. There is a designated section where you can place an “X” to highlight the change and provide the correct address details. Keeping your address updated is essential to ensure you receive important correspondence from the state.

Where do I send the completed form?

You can mail the completed Montana New Hire Reporting Form to Montana New Hire Reporting, PO Box 8013, Helena, MT 59604-8013. Alternatively, the form can be faxed to 1-888-272-1990 or the local fax number at 406-444-0745. Choose the method that is most convenient for you.

What should I do if I have questions about the form?

If you have any questions about completing the Montana New Hire Reporting Form, you can reach out to the dedicated helpline at 1-888-866-0327. They can provide guidance and support to ensure that you fill out the form correctly and understand your reporting responsibilities.

Common mistakes

Filling out the Montana New Hire form can seem like a straightforward task. However, many people make mistakes that can cause delays in processing. One common error is in the Employer Section.

Sometimes, individuals forget to provide the Federal ID Number. This number is vital for identifying the business. Without it, the state cannot link the new hire to the correct employer. Another issue occurs when the business name is misspelled. Double-checking the spelling ensures that all documents match and nothing gets lost in translation.

Providing accurate contact information is also essential. Mistakes in the business phone number or fax number can lead to complications. If the state needs to reach out for more information, an incorrect phone number can slow down the process. Additionally, if an address has changed, failing to mark that correctly can create further confusion. It is important to check that box and provide the new details.

Moving on to the Employee Section, many people overlook the importance of the Social Security Number. This number is crucial for tax and identification purposes. If someone provides an incorrect number, it can lead to serious issues later on. Similarly, not including the Date of Hire can result in processing delays, as this date is essential for various reports and records.

Another frequent mistake is omitting information regarding the home address. Many people assume it’s optional, but it is required for accurate record-keeping. Furthermore, errors in a new hire's last name, first name, or middle initial can also complicate matters. Each piece of information needs to be precise.

Lastly, people often skip the optional information section. While these details, such as Home Phone or Date of Birth, may seem trivial, they can serve useful purposes in the future. Providing complete information, whenever possible, allows for smoother communication between all parties involved.

In conclusion, taking the time to accurately fill out the Montana New Hire form can save both employees and employers from potential headaches. By avoiding common mistakes, everyone can ensure a smoother onboarding process.

Documents used along the form

The Montana New Hire form is a crucial document that employers must complete when bringing on new employees. It serves to report necessary information to the state regarding hiring, as mandated by federal and state law. However, it is often used alongside other important documents that provide further detail about employment and ensure compliance with various regulations.

- I-9 Employment Eligibility Verification: This form verifies the identity and employment authorization of individuals hired for employment in the United States. Employers must ensure that new hires complete this form to comply with immigration laws.

- W-4 Employee’s Withholding Certificate: Employees complete this form to indicate their tax withholding allowances. It instructs employers on how much federal income tax to withhold from employees' paychecks.

- State Tax Withholding Form: Similar to the W-4, this form is specific to the state tax requirements. Employees provide details on their state withholding preferences to ensure accurate deductions.

- Direct Deposit Authorization Form: If employees wish to have their paychecks deposited directly into their bank accounts, they must complete this form. It ensures that employers have the correct bank information to facilitate the transfers.

- Health Insurance Enrollment Form: This document allows new employees to enroll in health insurance plans offered by the employer. It details the options available and must be completed by the employee within a certain time frame.

- Employee Handbook Acknowledgment: New hires often sign an acknowledgment form to confirm they have received and understood the employee handbook, which outlines company policies, procedures, and expectations.

- Emergency Contact Form: This form collects information about whom to contact in case of an emergency involving the employee. It is vital for ensuring employee safety in the workplace.

- Non-Disclosure Agreement (NDA): In industries where proprietary information is crucial, employers may require new employees to sign an NDA to protect sensitive company information from being disclosed.

- Job Offer Letter: This formal letter outlines the job position, salary, start date, and other terms of employment. It serves as documentation of the employment agreement between the employer and the new hire.

Altogether, these forms and documents play a vital role in the hiring process. They help to ensure that both employers and employees comply with legal requirements and set clear expectations for the employment relationship.

Similar forms

- W-4 Form: This form is used for tax withholding allowances. Both documents require personal information of the employee, including Social Security Number and address details.

- I-9 Form: The I-9 is used to verify an employee’s eligibility to work in the U.S. Both forms need the employee’s personal and contact information along with Social Security details.

- State New Hire Reporting Forms: Similar to Montana's form, state-specific new hire forms are designed to report new employees. They gather personal information, including names and addresses.

- Employee Onboarding Forms: These collect essential information for a new hire's integration into the company. They often include sections similar to the Montana form, like personal details and emergency contacts.

- Health Insurance Enrollment Forms: These documents collect personal and insurance-related information. Like the Montana New Hire form, they often ask about health insurance availability and require Social Security Numbers.

- Direct Deposit Authorization Forms: These forms are used to set up an employee’s payment method. They require personal banking details and employee address information, paralleling the Montana New Hire form's required sections.

- Performance Review Forms: While focused on employee evaluation, these also gather personal and employment information, reflecting the same emphasis on employee details as the new hire form.

- Employee Identification Forms: These are used to create employee IDs and require similar personal information. They share the need for full names and contact details.

- Tax Exemption Certificates: These are submitted by employees claiming exemptions from tax withholding. They also require personal details akin to those requested in the Montana form.

- Background Check Authorization Forms: These forms are used to initiate background checks for new employees. They, too, require personal information and consent, mirroring aspects of the Montana New Hire form.

Dos and Don'ts

When filling out the Montana New Hire form, attention to detail is crucial. Properly completing this form can ensure compliance with state regulations and help your new employee get the necessary benefits. Here are five things you should and shouldn't do during the process:

- Do double-check the Employer Section for accuracy, especially the Federal ID Number and Business Name.

- Do fill in all required fields in the Employee Section, including the Social Security Number and Date of Hire.

- Do ensure that the mailing address for the business is complete and up to date.

- Do review optional employee information, even if it is not required; it might be helpful for future communication.

- Do send the completed form to the correct address or fax number listed at the end of the document.

- Don't forget to mark any changes with an X if the business address has recently changed.

- Don't leave any required fields blank, as incomplete forms may be returned or delayed.

- Don't use abbreviations for addresses; spell everything out to avoid confusion.

- Don't assume that optional information is not important; it can facilitate better service.

- Don't ignore the submission deadlines, as timely reporting is essential for compliance.

Misconceptions

Misconceptions about the Montana New Hire Reporting Form can lead to confusion and errors in submission. Below are some common misunderstandings:

- 1. It is optional to fill out the Employer section. Many believe they can skip this section, but all information in both the Employer and Employee sections is required.

- 2. The form must be submitted immediately after hiring. Although prompt reporting is recommended, the Montana law requires employers to report new hires within 20 days.

- 3. You don’t need to report rehired employees. This is incorrect. Rehired employees should also be reported using the same form.

- 4. Providing the Social Security Number is optional. On the contrary, the Social Security Number is a mandatory part of the Employee section.

- 5. The mailing address and home address can be the same. While it's possible, both addresses are required to be provided, even if they are identical.

- 6. The health insurance section is mandatory. The form includes optional employee information. Employers are not required to report on health insurance availability.

- 7. Only full-time employees need to be reported. This is a misconception. Both full-time and part-time employees must be reported.

- 8. The form can’t be submitted online. This is not true. While it can be mailed or faxed, some states offer electronic submission options as well.

Key takeaways

Understanding the Montana New Hire form is crucial for both employers and employees. Below are key points to keep in mind when filling out and submitting this form:

- Required Sections: Both the employer and employee sections of the form contain mandatory information that must be filled out completely.

- Employer Information: The employer must provide their Federal ID Number, business name, and complete contact details.

- Employee Identification: Employees are required to include their Social Security Number along with personal details like name, address, and date of hire.

- Accuracy is Key: Ensure all information is correct. Errors in the address or identification numbers can delay processing.

- Optional Information: While some employee information, such as home phone and date of birth, is optional, providing it can facilitate easier communication.

- Health Insurance Availability: If health insurance is available, this section must clearly indicate the date it became available.

- Submission Methods: The completed form can either be mailed to the specified address or faxed to the designated numbers.

- Keep Records: Always retain a copy of the submitted form for your records. This could be useful for future reference and reporting inquiries.

These tips will aid in accurately completing the Montana New Hire form, ensuring compliance and smooth processing for all parties involved.

Browse Other Templates

Coworx Staffing Login - Understand that incomplete forms may cause delays in payment.

How to Buy a Stamp - Orders are handled with care to ensure quality and efficiency.