Fill Out Your Mortgage Prequalification Worksheet Form

The Mortgage Prequalification Worksheet form is a valuable tool for prospective homebuyers, especially those interested in a Rhode Island Housing FirstHomes Mortgage. This straightforward worksheet facilitates the prequalification process by allowing applicants to provide essential information about their financial standing and employment history, which helps lenders assess their eligibility. Key aspects of the form include personal details such as names, dates of birth, and Social Security numbers for both the applicant and co-applicant. Additionally, it collects vital information about income, including gross monthly salaries and the type of employment, whether full or part-time. It also prompts applicants to list assets, household size, and existing credit obligations, offering a comprehensive view of their financial health. For first-time homebuyers, the form asks a simple yes or no question regarding their status, which can lead to valuable insights. Required documents must be included, like recent pay stubs and tax returns, ensuring that the prequalification is based on accurate and up-to-date data. With this form, Rhode Island Housing aims to notify applicants promptly about their prequalification status, guiding them through the mortgage process with ease.

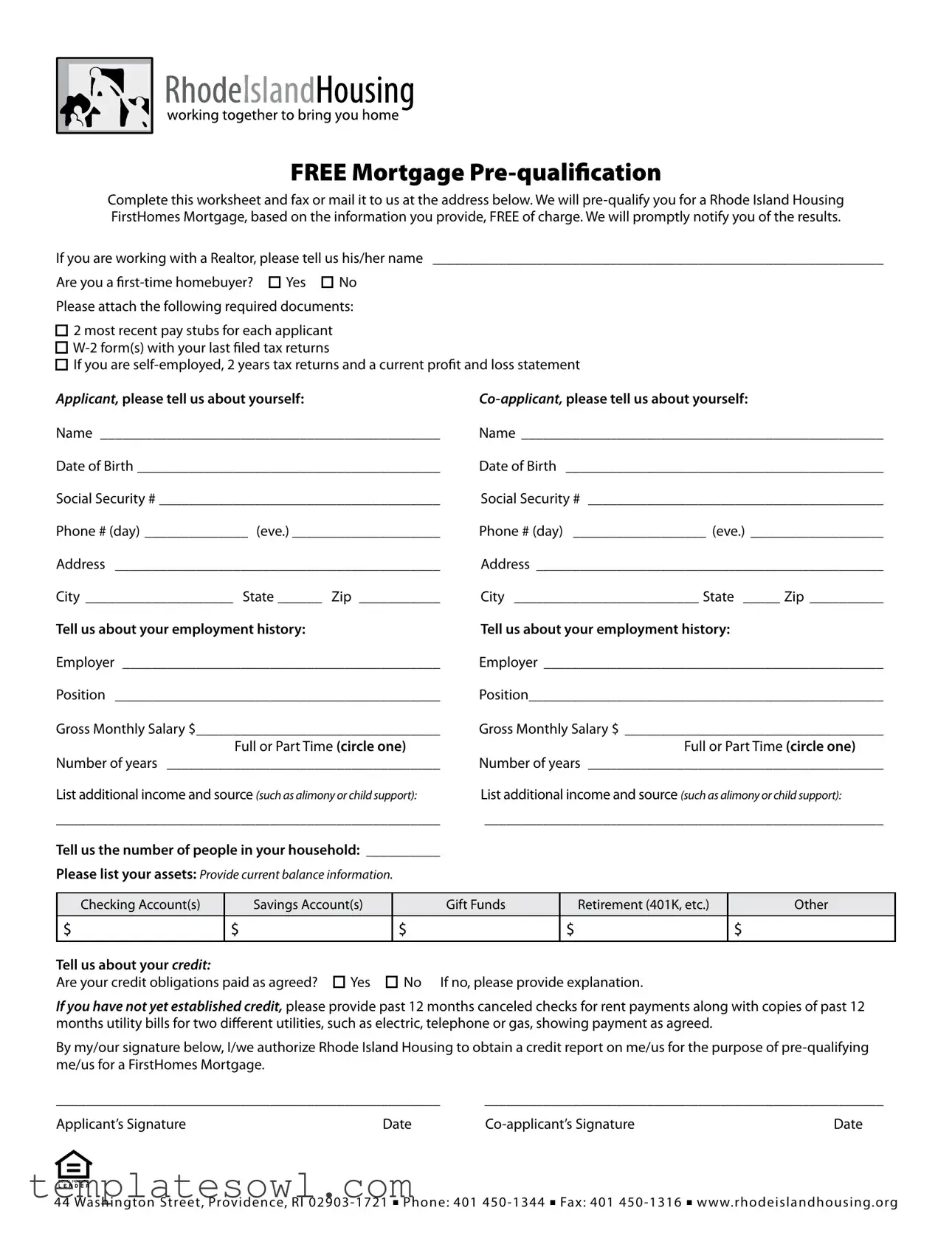

Mortgage Prequalification Worksheet Example

FREE Mortgage

Complete this worksheet and fax or mail it to us at the address below. We will

If you are working with a Realtor, please tell us his/her name _____________________________________________________________

Are you a |

Yes |

No |

Please attach the following required documents:

2 most recent pay stubs for each applicant

2 most recent pay stubs for each applicant

If you are

If you are

Applicant, please tell us about yourself: |

|

Name ______________________________________________ |

Name _________________________________________________ |

Date of Birth _________________________________________ |

Date of Birth ___________________________________________ |

Social Security # ______________________________________ |

Social Security # ________________________________________ |

Phone # (day) ______________ (eve.) ____________________ |

Phone # (day) __________________ (eve.) __________________ |

Address ____________________________________________ |

Address _______________________________________________ |

City ____________________ State ______ Zip ___________ |

City _________________________ State _____ Zip __________ |

Tell us about your employment history: |

Tell us about your employment history: |

Employer ___________________________________________ |

Employer ______________________________________________ |

Position ____________________________________________ |

Position________________________________________________ |

Gross Monthly Salary $_________________________________ |

Gross Monthly Salary $ ___________________________________ |

||||||

|

Full or Part Time (circle one) |

|

Full or Part Time (circle one) |

||||

Number of years _____________________________________ |

Number of years ________________________________________ |

||||||

List additional income and source (such as alimony or child support): |

List additional income and source (such as alimony or child support): |

||||||

____________________________________________________ |

______________________________________________________ |

||||||

Tell us the number of people in your household: __________ |

|

|

|

||||

Please list your assets: Provide current balance information. |

|

|

|

|

|||

|

|

|

|

|

|

|

|

Checking Account(s) |

Savings Account(s) |

|

|

Gift Funds |

Retirement (401K, etc.) |

Other |

|

|

|

|

|

|

|

|

|

$ |

$ |

|

|

$ |

|

$ |

$ |

Tell us about your credit: |

|

|

|

|

|

|

|

Are your credit obligations paid as agreed? |

Yes |

No |

If no, please provide explanation. |

|

|||

If you have not yet established credit, please provide past 12 months canceled checks for rent payments along with copies of past 12 months utility bills for two diferent utilities, such as electric, telephone or gas, showing payment as agreed.

By my/our signature below, I/we authorize Rhode Island Housing to obtain a credit report on me/us for the purpose of

____________________________________________________ |

______________________________________________________ |

||

Applicant’s Signature |

Date |

Date |

|

4 4 Wa s h i n g t o n S t r e e t , Pr o v i d e n c e, R I 0 2 9 0 3 - 1 7 2 1 n P h o n e : 4 0 1 4 5 0 - 1 3 4 4 n Fa x : 4 0 1 4 5 0 - 1 3 1 6 n w w w. r h o d e i s l a n d h o u s i n g . o r g

Form Characteristics

| Fact | Description |

|---|---|

| Purpose | The Mortgage Prequalification Worksheet is used for prequalifying applicants for a Rhode Island Housing FirstHomes Mortgage at no cost. |

| Required Documents | Applicants must attach their two most recent pay stubs, W-2 forms with tax returns, and additional documentation if self-employed. |

| Household Information | Applicants need to provide information about their household size and any additional income sources, such as alimony or child support. |

| Credit Authorization | By signing the form, applicants authorize Rhode Island Housing to obtain their credit report for the purpose of pre-qualification. |

| State Regulation | This form is governed by the laws of Rhode Island applicable to mortgage lending and housing financing. |

Guidelines on Utilizing Mortgage Prequalification Worksheet

Filling out the Mortgage Prequalification Worksheet is a crucial step in assessing your eligibility for a mortgage. After completing the form, you will send it to the respective institution for evaluation. They will review your information and notify you of the results, allowing you to take the next steps towards homeownership.

- At the top of the worksheet, fill in your name and, if applicable, your co-applicant's name.

- Enter your and your co-applicant's date of birth and Social Security numbers.

- Provide your daytime and evening phone numbers for both applicants.

- Fill in your current address and the address of your co-applicant.

- Indicate if you are a first-time homebuyer by checking "Yes" or "No."

- List your and your co-applicant's employment information, including employer, position, gross monthly salary, and whether you are full or part-time.

- Include the number of years you and your co-applicant have worked at your respective jobs.

- Detail any additional income sources, such as alimony or child support.

- State the total number of people in your household.

- List your assets, including the current balances for checking accounts, savings accounts, gift funds, retirement accounts, and any other assets.

- Answer whether your credit obligations are paid as agreed. If not, provide an explanation.

- If you have not established credit, attach canceled checks for rent payments and utility bills showing payment history.

- Sign and date the form to authorize the institution to obtain your credit report.

Once you have filled out the worksheet completely, gather the required documents—such as pay stubs, W-2 forms, or tax returns—needed to support your application. Send everything via fax or mail to the provided address for processing.

What You Should Know About This Form

What is the purpose of the Mortgage Prequalification Worksheet?

The Mortgage Prequalification Worksheet is designed to help potential homebuyers assess their eligibility for a Rhode Island Housing FirstHomes Mortgage. By completing this form, individuals can provide essential personal and financial information, allowing the institution to evaluate their suitability for prequalification without any costs involved. Applicants will receive a prompt notification regarding the results, helping them understand their next steps in the home-buying process.

What information do I need to provide on the worksheet?

The worksheet requires several key pieces of information. You'll need to provide details about yourself and any co-applicant, including names, dates of birth, and social security numbers. Employment history and gross monthly salary for both applicants are crucial for evaluating financial stability. Additionally, listing any extra income or assets, such as bank accounts or retirement funds, will give a clearer picture of your financial situation. Finally, you’ll need to address credit obligations and provide documentation about your credit history if necessary.

Are there any documents I need to attach with the worksheet?

Yes, applicants must attach several required documents to streamline the prequalification process. Two most recent pay stubs for each applicant, W-2 forms for the last filed tax returns, and if applicable, two years of tax returns along with a current profit and loss statement for self-employed individuals. These documents provide a foundation for understanding your financial background, which is crucial for assessing your eligibility for the mortgage.

How will I be notified of my prequalification results?

You will be informed of your prequalification results promptly after the mortgage provider reviews your worksheet and attached documents. Communication can occur via phone, mail, or email, depending on the contact information you provide on the form. It’s essential to ensure that the contact details are clear and current to facilitate smooth communication.

What if I am a first-time homebuyer?

If you are a first-time homebuyer, you should indicate this on the worksheet. Being a first-time buyer may affect the mortgage options and programs available to you. Rhode Island Housing often has specific initiatives and assistance for first-time homebuyers, so it's critical to share this information. Doing so could provide additional resources to support your homeownership journey!

Common mistakes

Filling out the Mortgage Prequalification Worksheet can be a critical step in your journey to homeownership. However, many individuals make mistakes that could hinder their ability to secure a mortgage. Understanding these common errors can help ensure a smoother process.

One frequent mistake is incomplete personal information. Applicants often leave out crucial details such as their date of birth or Social Security number. This missing information can delay the prequalification process. Make sure to double-check that all sections requesting personal data are fully completed to avoid unnecessary holdups.

Another area where people err involves employment and income reporting. Many applicants do not provide accurate or up-to-date information about their employment status or monthly salary. For instance, failing to indicate whether a job is full-time or part-time can lead to confusion about financial stability. Providing precise information about your position and income is essential for a thorough evaluation.

Additionally, applicants often misunderstand the requirement for income verification. Some may provide incomplete supporting documents or forget to attach necessary pay stubs or tax returns. It is crucial to include all the requested documentation to facilitate a quick and effective prequalification process. Double-check that you have attached the required materials when you submit your form.

Lastly, many people underestimate the importance of their credit history. A common mistake is neglecting to address any issues related to unpaid credit obligations. If you answer "no" to the question about whether your credit obligations are paid as agreed, provide a thorough explanation. Transparency regarding your credit situation can help lenders understand your financial background better and can enhance your chances of qualifying for a mortgage.

By being mindful of these pitfalls, you can streamline your experience with the Mortgage Prequalification Worksheet. Careful attention to detail will not only improve your chances of getting prequalified but also set a solid foundation for your mortgage journey.

Documents used along the form

When preparing to apply for a mortgage, various forms and documents can help streamline the process. Each form serves a distinct function, ensuring that lenders have the necessary information to assess applicants' qualifications. Below is a list of documents commonly used alongside the Mortgage Prequalification Worksheet.

- Loan Application Form: This form collects detailed personal and financial information from the applicant. It includes sections for employment history, income, assets, and liabilities.

- Credit Authorization Form: This document authorizes the lender to obtain the applicant's credit report. It helps lenders evaluate creditworthiness.

- Debt-to-Income Ratio Calculation Form: This form outlines monthly income and debt obligations, enabling calculations of the debt-to-income ratio. Lenders use this ratio to gauge financial stability.

- Asset Verification Form: This form is used to document and verify the applicant's assets, such as bank accounts and investment portfolios, which can play a role in mortgage approval.

- Employment Verification Form: This document may be required by lenders to confirm employment status and income for the applicant and co-applicant.

- Self-Employment Documentation: For self-employed individuals, this includes two years of tax returns and profit and loss statements to validate income stability.

- Gift Letter: If the applicant is receiving gift funds for the down payment, this letter must confirm that the funds are a gift, not a loan, and outline the donor’s relationship to the borrower.

- Tax Returns: Lenders usually require copies of the most recent tax returns to assess total income and verify employment history.

- Utility Bills: Recent utility bills may be requested to establish residency and demonstrate payment history, especially for applicants with no credit.

Gathering these documents early can facilitate a smoother mortgage application process. Ensuring that all information is organized and accurate will benefit both the applicant and the lender.

Similar forms

The Mortgage Prequalification Worksheet serves as a crucial step for potential homebuyers seeking to assess their financial readiness for a mortgage. Similar documents share the common goal of gathering essential financial information to facilitate various loan processes. Below are five documents that are comparable to the Mortgage Prequalification Worksheet:

- Loan Application Form: This form collects detailed information about the applicant's financial situation, including income, assets, and liabilities, similar to the Prequalification Worksheet but is typically used after the initial prequalification stage.

- Credit Report Authorization Form: This document is often required to grant permission for lenders to access the applicant's credit history. Both documents play a role in assessing creditworthiness, although the authorization form is more focused on credit evaluation.

- Income Verification Document: This may include recent pay stubs or tax returns. Like the Prequalification Worksheet, it helps confirm the borrower's income, but it usually serves as supporting documentation during the application process rather than an assessment tool.

- Debt-to-Income Ratio Worksheet: This tool calculates the ratio of monthly debt payments to monthly gross income. It complements the Prequalification Worksheet by providing a clearer picture of the applicant's financial obligations in relation to their earnings.

- Asset Verification Form: This form collects information about a borrower’s assets, such as bank accounts, investments, and retirement funds. Both this form and the Prequalification Worksheet aim to affirm the applicant’s financial stability and capability for mortgage payments.

Dos and Don'ts

When filling out the Mortgage Prequalification Worksheet form, certain best practices can help ensure smooth processing of your application. Here are six things you should and shouldn't do:

- Do provide accurate information. Inaccurate or misleading information can lead to delays or denial of your prequalification.

- Do attach required documents. Include your most recent pay stubs, W-2 forms, and any relevant tax returns for self-employed individuals.

- Do clarify your employment status. Indicate whether your position is full-time or part-time and provide the number of years you've been employed.

- Don't omit household information. Be sure to list the total number of people living in your household.

- Don't forget about credit obligations. Include details on how you manage your credit and any explanations for late payments if necessary.

- Don't leave signatures missing. Both applicants must sign the form to authorize a credit report check.

Following these guidelines will help you complete the form effectively and improve your chances of receiving timely prequalification.

Misconceptions

Understanding the process of mortgage prequalification can be daunting for many potential homebuyers. Here are some common misconceptions about the Mortgage Prequalification Worksheet form that may help clarify its purpose and function.

- It guarantees a loan approval. Completing the Mortgage Prequalification Worksheet does not guarantee that a loan will be approved. Prequalification simply provides an estimate of what a lender might consider based on the information provided.

- It requires a credit check. While providing information about credit is necessary, the prequalification process does not always involve a hard credit inquiry at the initial stage. Many lenders perform a soft pull or no credit check to start.

- It is too complicated to fill out. The form is designed to be user-friendly. It captures essential information without overwhelming the applicant, making it accessible for everyone.

- Only first-time homebuyers need to fill it out. This form is beneficial for any prospective homebuyer, whether it's their first home or they are seasoned buyers looking to finance a new purchase.

- It's only necessary if you have perfect credit. Many people mistakenly believe that only those with excellent credit can benefit from prequalification. In reality, individuals with varying credit scores can still gain insights from the process.

- Documentation is not needed. While the form itself may be simple, providing the required documents, such as pay stubs and tax returns, is essential for accurate assessment and faster results.

- Prequalification guarantees the interest rate. The interest rate quote provided at prequalification is only an estimate based on the initial information. The final rate can change depending on market conditions and the full loan application review.

- It is a waste of time. On the contrary, completing this worksheet provides valuable information about your financial standing and purchasing power. It acts as a first step in the mortgage process and can help you make informed decisions.

By dispelling these misconceptions, potential homebuyers can approach the mortgage prequalification process with a clearer understanding and greater confidence.

Key takeaways

Filling out the Mortgage Prequalification Worksheet can be a straightforward process, and it’s a crucial first step in your home-buying journey. Here are some key takeaways to help you navigate this form effectively:

- Understand the purpose: This worksheet allows you to provide essential financial information so that you can get pre-qualified for a Rhode Island Housing FirstHomes Mortgage without any cost.

- Gather required documents: Make sure to collect and attach necessary documents such as your most recent pay stubs, W-2 forms, and, if applicable, tax returns if you're self-employed. These documents are vital for an accurate assessment.

- Provide accurate information: Carefully input your personal details, employment history, and income sources. Misrepresentations can lead to delays or issues in the pre-qualification process.

- Disclose your credit status: Answer questions about your credit obligations truthfully. If you have not established credit yet, be prepared to provide alternative documentation, like canceled checks and utility bills, to demonstrate your payment history.

- Submit the worksheet promptly: After filling out the form, fax or mail it to the designated address quickly. The sooner you submit, the sooner you will receive your pre-qualification results.

By keeping these takeaways in mind, you can approach the Mortgage Prequalification Worksheet with confidence and clarity, setting yourself up for a successful home purchase journey.

Browse Other Templates

Bankruptcy Reaffirmation Agreement - The form emphasizes the risks associated with reaffirming debts.

Apply for Champva - This form allows veterans’ dependents to access health care benefits through CHAMPVA.