Fill Out Your Mortgage Statement Form

Understanding a mortgage statement is crucial for homeowners managing their mortgage payments. This important document is sent periodically by your mortgage servicer and contains multiple sections designed to give you a clear picture of your mortgage account. At a glance, you’ll find vital details including the servicer’s name and contact information, the payment due date, and the total amount you owe for that period. Key figures are displayed prominently, such as the outstanding principal balance, interest rate, and whether a prepayment penalty applies. The statement also breaks down the amount due into categories like principal, interest, and escrow for taxes and insurance, making it easier to comprehend where your money is going. Additionally, it includes transaction activities that outline charges and payments made, while past payment history offers insight into your payment patterns. Important messages about partial payments and delinquency notices serve as reminders of your obligations, as well as provide guidance if you find yourself facing financial difficulties. Overall, the mortgage statement is a comprehensive tool that keeps you informed, encourages timely payments, and helps avoid potential penalties. Familiarity with this document can empower you to manage your mortgage more effectively.

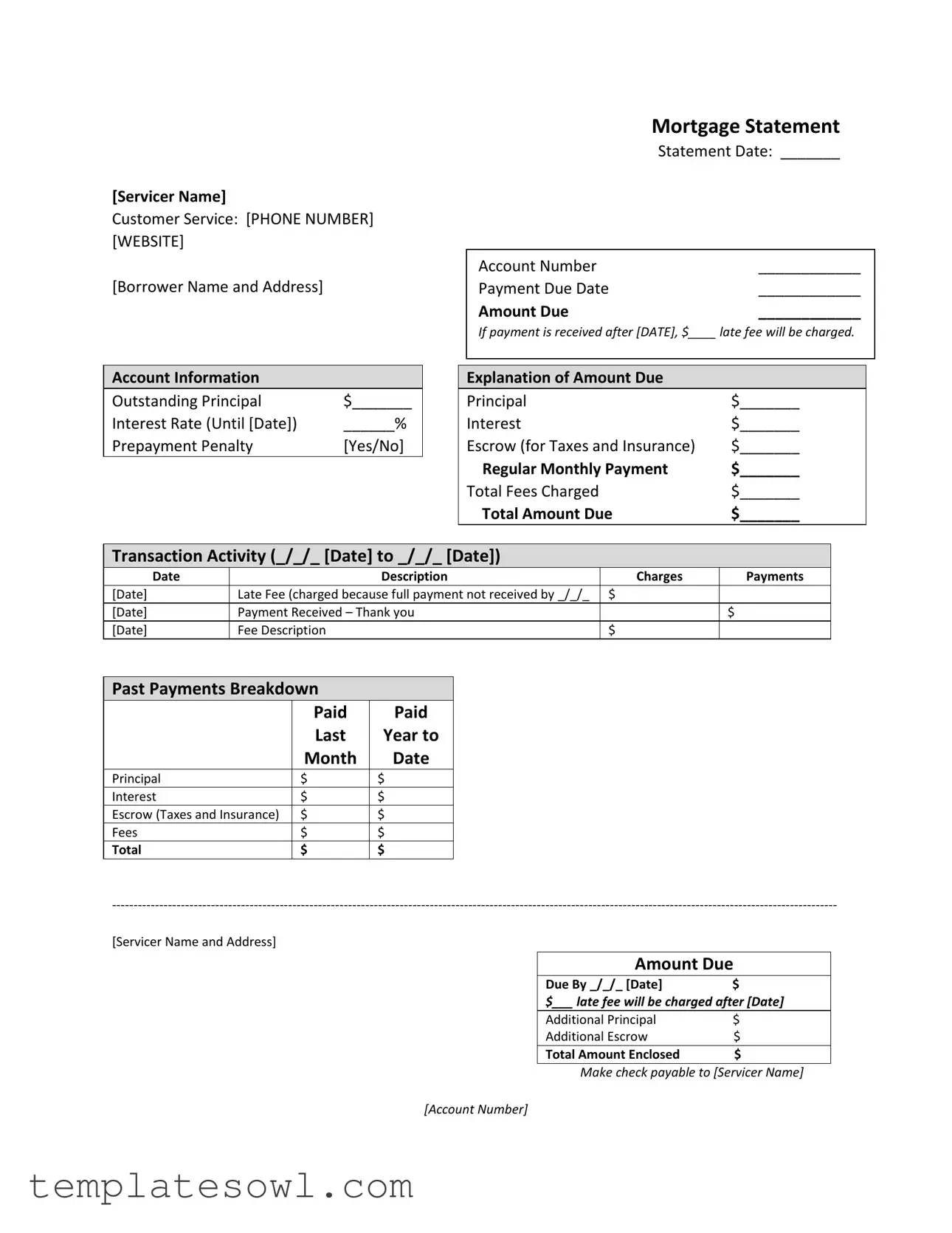

Mortgage Statement Example

[Servicer Name]

Customer Service: [PHONE NUMBER] [WEBSITE]

[Borrower Name and Address]

Mortgage Statement

Statement Date: _______

Account Number |

____________ |

Payment Due Date |

____________ |

Amount Due |

____________ |

If payment is received after [DATE], $____ late fee will be charged.

Account Information

Outstanding Principal |

$_______ |

Interest Rate (Until [Date]) |

______% |

Prepayment Penalty |

[Yes/No] |

Explanation of Amount Due

Principal |

$_______ |

Interest |

$_______ |

Escrow (for Taxes and Insurance) |

$_______ |

Regular Monthly Payment |

$_______ |

Total Fees Charged |

$_______ |

Total Amount Due |

$_______ |

Transaction Activity (_/_/_ [Date] to _/_/_ [Date])

Date |

Description |

Charges |

Payments |

[Date] |

Late Fee (charged because full payment not received by _/_/_ |

$ |

|

[Date] |

Payment Received – Thank you |

|

$ |

[Date] |

Fee Description |

$ |

|

Past Payments Breakdown

|

Paid |

Paid |

|

Last |

Year to |

|

Month |

Date |

Principal |

$ |

$ |

Interest |

$ |

$ |

Escrow (Taxes and Insurance) |

$ |

$ |

Fees |

$ |

$ |

Total |

$ |

$ |

[Servicer Name and Address]

Amount Due

Due By _/_/_ [Date]$

$___ late fee will be charged after [Date]

Additional Principal |

$ |

Additional Escrow |

$ |

Total Amount Enclosed |

$ |

Make check payable to [Servicer Name]

[Account Number]

[Additional tables to be translated]

Important Messages

*Partial Payments: Any partial payments that you make are not applied to your mortgage, but instead are held in a separate suspense account. If you pay the balance of a partial payment, the funds will then be applied to your mortgage.

**Delinquency Notice**

You are late on your mortgage payments. Failure to bring your loan current may result in fees and foreclosure – the loss of your home. As of [Date], you are __ days delinquent on your mortgage loan.

Recent Account History

·Payment due [Date]: Fully paid on time

·Payment due [Date]: Fully paid on [Date]

·Payment due [Date]: Unpaid balance of $________

·Current payment due [Date]: $_______

·Total: $_______ due. You must pay this amount to bring your loan current.

If you are Experiencing Financial Difficulty: See back for information about mortgage counseling or assistance.

Form Characteristics

| Fact Name | Description |

|---|---|

| Servicer Information | The mortgage statement includes the servicer's name, customer service phone number, and website for borrower inquiries. |

| Payment Due Date | The statement specifies the due date for the payment and the amount required. |

| Late Fee Policy | A late fee is assessed if payment is not received by the stipulated payment due date. |

| Outstanding Principal | The amount of outstanding principal is clearly stated, providing insight into the current mortgage balance. |

| Interest Rate Details | The statement indicates the current interest rate and the validity period until a specified date. |

| Escrow Information | Details regarding escrow for taxes and insurance are included, outlining the monthly allocation towards these expenses. |

| Transaction Activity | Recent transaction activity is recorded, showing all charges and payments made during a specific time frame. |

| Delinquency Notice | The statement warns borrowers of potential consequences for late payments, including foreclosure risks. |

| Financial Assistance | Information about mortgage counseling or assistance is provided for borrowers facing financial difficulty. |

Guidelines on Utilizing Mortgage Statement

Completing the Mortgage Statement form is a key step in managing your mortgage effectively. Ensure that you fill in all required fields accurately to avoid any delays or issues with your payments.

- Begin by entering the Servicer Name in the designated space at the top.

- Provide the Customer Service Phone Number and Website for the mortgage servicer.

- Fill in your Borrower Name and Address accurately.

- Record the Statement Date.

- Write your Account Number in the appropriate area.

- Indicate the Payment Due Date.

- Enter the Amount Due as stated in the form.

- Note the date after which a late fee will be charged and write the late fee amount.

- In the Account Information section, fill in the Outstanding Principal.

- Record the Interest Rate and the date it applies until.

- Indicate if there is a Prepayment Penalty with 'Yes' or 'No'.

- Fill in the explanation of the Amount Due covering Principal, Interest, Escrow, Regular Monthly Payment, Total Fees Charged, and Total Amount Due.

- For Transaction Activity, enter relevant dates, descriptions, charges, payments, and late fees.

- In the Past Payments Breakdown, fill in the amounts paid for Principal, Interest, Escrow, and Fees for the last year up to the current month.

- List the Amount Due, along with the due date and late fee information in the final sections.

- Finally, check for any Important Messages and ensure you understand any implications regarding partial payments and delinquency.

Once you have filled out these details, review the form to catch any errors. It is essential to ensure accuracy before submitting the form, as this helps avoid complications with your mortgage management.

What You Should Know About This Form

What information is included in a Mortgage Statement?

A Mortgage Statement provides essential details about your mortgage account. It includes your servicer's name, customer service contact information, your name, and your address. Key details such as the statement date, account number, payment due date, and the amount due are presented prominently. You'll also find information on outstanding principal, interest rate, prepayment penalties, and a breakdown of components contributing to your total payment for the month.

What happens if I make my payment after the due date?

If your payment is received after the due date, a late fee may be charged. The amount and the date when this fee applies will be indicated on your statement. It's vital to understand these details to avoid unexpected costs and maintain your account in good standing.

What does the transaction activity section show?

The transaction activity section lists all relevant transactions that occur within a specific period. It will detail the dates and descriptions of both charges and payments. If a late fee was incurred, it will also be noted here, along with any payments that have been received. This section helps you track your payment history effectively.

Can I make partial payments on my mortgage?

Yes, you can make partial payments, but it’s important to note that these amounts won't be applied directly to your mortgage balance. Instead, they will be held in a suspense account. Once you pay the remaining balance of the partial payment, only then will those funds apply to your mortgage balance. Understanding this can help you better manage your payments.

What should I do if I am struggling to make my mortgage payments?

If you are experiencing financial difficulty, your mortgage statement may provide resources for mortgage counseling or assistance. There are typically options available to help you address missed payments and avoid foreclosure. It’s wise to reach out promptly to explore your options.

What is meant by 'delinquency notice' in my Mortgage Statement?

A delinquency notice indicates that you have not made mortgage payments on time, and it will specify how many days you are delinquent. This section is crucial; failure to act on this notice may lead to additional fees or even foreclosure. If your account is flagged, addressing the situation swiftly can help you maintain your homeownership.

How can I contact my mortgage servicer for support?

Your Mortgage Statement will include the name and contact information of your mortgage servicer, which typically consists of a customer service phone number and a website. Use these resources for any questions or concerns you may have about your account. Don’t hesitate to reach out; they are there to assist you!

Common mistakes

When filling out the Mortgage Statement form, people often make several mistakes that can lead to confusion and complications down the road. One common error is failing to provide the correct account number. This number is essential for proper identification of the mortgage account. A simple typo can delay processing and lead to miscommunication.

Another frequent mistake involves ignoring the payment due date. It is crucial to pay attention to this date and ensure that it is clearly marked on the form. Missing payment deadlines not only incurs late fees but can also affect one’s credit standing.

Many individuals also overlook the escrow information, specifically the section regarding taxes and insurance. This oversight can lead to unexpected costs later, as failing to account for these periodic expenses may result in insufficient funds for payment.

Additionally, when documenting the amounts for principal, interest, and fees, it’s easy to mix up the figures. Errors in these calculations can produce a misleading picture of financial obligations. Double-checking these amounts ensures accuracy and can prevent disputes with the servicer.

Another mistake relates to the partial payments section. Some borrowers may assume that partial payments will automatically be applied toward their mortgage balance. Instead, they should understand that such payments are typically held in a suspense account until the full payment is received. Failing to recognize this could lead to further payment complications.

People often neglect to review the delinquency notice carefully. If the statement indicates that the account is delinquent, it can be alarming. Understanding the implications of this notice is crucial, as it outlines the risks involved if payments are not brought up to date.

Moreover, borrowers sometimes fail to adequately address the section regarding fees charged. Understanding any applicable fees is vital to maintaining financial control. Reviewing this section helps prevent unwelcome surprises when payments are processed.

Ignoring the recent account history summary can also be detrimental. This summary provides critical insights into payment patterns and current obligations. Anyone filling out the form should pay close attention here to ensure that their record is accurate and to identify any discrepancies immediately.

Finally, many forget to include relevant contact information for customer service. Should issues arise, knowing how to reach the servicer is important. Having this information handy can facilitate quick resolutions to any problems related to the mortgage statement.

Documents used along the form

The Mortgage Statement form is a crucial document for homeowners. It provides a detailed account of the mortgage balance, payment history, and any applicable fees. Alongside the Mortgage Statement, several other documents may be relevant in understanding one’s mortgage situation. The following list outlines these additional forms and their purposes.

- Loan Agreement: This document outlines the terms and conditions of the mortgage. It specifies the loan amount, interest rate, repayment schedule, and the rights and responsibilities of both the borrower and lender.

- Truth in Lending Disclosure Statement: This form provides key details about the cost of the mortgage, including the annual percentage rate (APR), finance charges, and the total payments over the life of the loan. It helps borrowers understand the true cost of borrowing.

- Payment History Statement: This document offers a record of all payments made towards the mortgage. It shows dates, amounts, and whether payments were made on time, allowing borrowers to track their payment behavior.

- Escrow Analysis Statement: If a portion of the mortgage payment goes towards escrow for taxes and insurance, this statement details the escrow account's balance. It provides an analysis of past and projected expenses and may suggest required adjustments to monthly payments.

- Delinquency Notice: Issued when payments are late, this notice communicates the borrower’s current status regarding unpaid amounts. It alerts the borrower to the risk of fees and foreclosure if payments are not made promptly.

- Mortgage Counseling Information: This resource provides information about available counseling services for borrowers facing financial challenges. It may include contacts for local support groups or government programs aimed at assisting struggling homeowners.

Understanding these documents can equip borrowers with the knowledge necessary to manage their mortgage effectively. Keeping organized records ensures that homeowners are prepared for any inquiries about their mortgage status.

Similar forms

The Mortgage Statement form provides vital information regarding your mortgage status. It has similarities with several other important documents that homeowners may encounter. Here are five such documents:

- Loan Estimate: This form is provided at the beginning of the mortgage process. It breaks down the estimated costs and terms of your loan, similar to how a Mortgage Statement details your current mortgage payments and any outstanding balances.

- Annual Percentage Rate (APR) Disclosure: Like the Mortgage Statement, this document shows your interest rate and the costs over the loan term. Both documents help you understand the financial obligations associated with your mortgage.

- Billing Statement: A general billing statement gives a summary of amounts owed and payment due dates, much like a Mortgage Statement that provides detailed information on what is owed and when.

- Escrow Analysis Statement: This document is similar in that it provides information about any escrow accounts you have for taxes and insurance. The Mortgage Statement outlines the escrow amount due each month.

- Default Notice: This critical notice informs you of late payments and possible foreclosure, echoing the delinquency warnings found in the Mortgage Statement if payments are overdue.

Dos and Don'ts

When filling out the Mortgage Statement form, attention to detail is crucial. Here are ten important dos and don’ts to keep in mind.

- Do double-check the servicer’s contact information for accuracy.

- Do confirm all amounts are clearly written and easy to read.

- Do include your account number on all correspondence.

- Do ensure the payment due date is correct before sending your payment.

- Do pay attention to the explanation of amounts due for clarity.

- Don’t leave blank spaces in the form; every field should be filled out.

- Don’t ignore the potential late fees mentioned; they could add up.

- Don’t forget to check the prepayment penalty section if it applies to you.

- Don’t use pencil; always fill out the form in ink to avoid changes.

- Don’t overlook the importance of keeping a copy of the completed form for your records.

Misconceptions

Understanding mortgage statements is crucial for homeowners. However, several misconceptions often confuse borrowers. Here are five common misunderstandings about mortgage statements:

- 1. The amount due is always the same each month. Many borrowers believe that their mortgage payment stays constant. In reality, it can change due to variations in escrow amounts for taxes and insurance or if adjustable interest rates are in play.

- 2. Partial payments count towards my mortgage balance. Some homeowners think that making a partial payment improves their mortgage standing. However, these payments are held in a separate suspense account and do not apply directly to the mortgage until the full payment is made.

- 3. Late fees are automatic. Many people assume that they will automatically incur a late fee if they miss a payment. While this can be true, fees typically depend on the specific terms outlined in the mortgage agreement, including the grace period for late payments.

- 4. I will not face consequences for missed payments for a few months. Some believe that missing a few payments will not have serious repercussions. However, delayed payments can lead to fees and even foreclosure if the loan becomes significantly delinquent.

- 5. My servicer must contact me if I'm behind. Many think that servicers are required to notify them of missed payments. While servicers will often attempt to reach out, it’s the borrower's responsibility to keep track of payment dates and manage their accounts actively.

Being aware of these misconceptions can empower homeowners to better manage their mortgage and avoid unnecessary fees or complications.

Key takeaways

When filling out and utilizing the Mortgage Statement form, it is important to understand several key aspects to ensure your mortgage management is effective.

- Accurate Information: Always double-check that all fields are completed correctly, including the account number, payment due date, and the amount due. Inaccuracies can lead to confusion and potential late fees.

- Understanding Charges: Review the transaction activity section carefully. It details the charges, payments, and any late fees incurred, giving a clear overview of your financial standing regarding the mortgage.

- Partial Payments Policy: Be aware that any partial payments made do not apply directly to your mortgage. They are held in a separate suspense account until the balance of the payment is settled.

- Consequences of Delinquency: If you fall behind on payments, the statement clearly outlines potential consequences, including additional fees and the risk of foreclosure. Prompt communication with your lender can help in managing these situations effectively.

Staying informed and proactive will help in maintaining a positive relationship with your mortgage servicer and ensure the health of your financial situation.

Browse Other Templates

California Sales Tax Authorization,Merchant Sales License Application,California Tax Seller Registration,Business Permit Application for Sellers,Taxpayer Seller Request Form,Seller's License Application,California Seller's Tax Registration,Seller Per - If in doubt, you may contact the Board for assistance at any stage of your application process.

Travel Card 101 - The information provided is also subject to scrutiny by relevant government agencies.