Fill Out Your Mt Bank Beneficiary Form

The Mt Bank Beneficiary form plays a crucial role in estate planning for account holders of Whitebox Mutual Funds. This form allows individuals to designate or alter their primary and secondary beneficiaries for various types of Individual Retirement Accounts (IRAs), including Traditional, Roth, SEP, and Simple IRAs. One of its notable features is the flexibility it offers; account holders can change their beneficiary designations at any time. In addition, the form lays out essential sections that gather necessary investor information, such as the account owner's details, contact information, and specific beneficiary names and designations. It also includes provisions for contingent beneficiaries, ensuring that if a primary beneficiary does not survive the account holder, the designated contingent beneficiaries will inherit. Moreover, for those married, the form emphasizes the importance of spousal consent when naming non-spouse beneficiaries, reflecting the legal implications within community property and marital property states. Finally, the form provides sections for trust beneficiaries, along with a clear signature section to confirm the account holder's intent, ensuring that all previous beneficiary designations are revoked and that any change is effective upon submission. Understanding and correctly filling out this form is essential to ensure that your assets are allocated according to your wishes after your passing.

Mt Bank Beneficiary Example

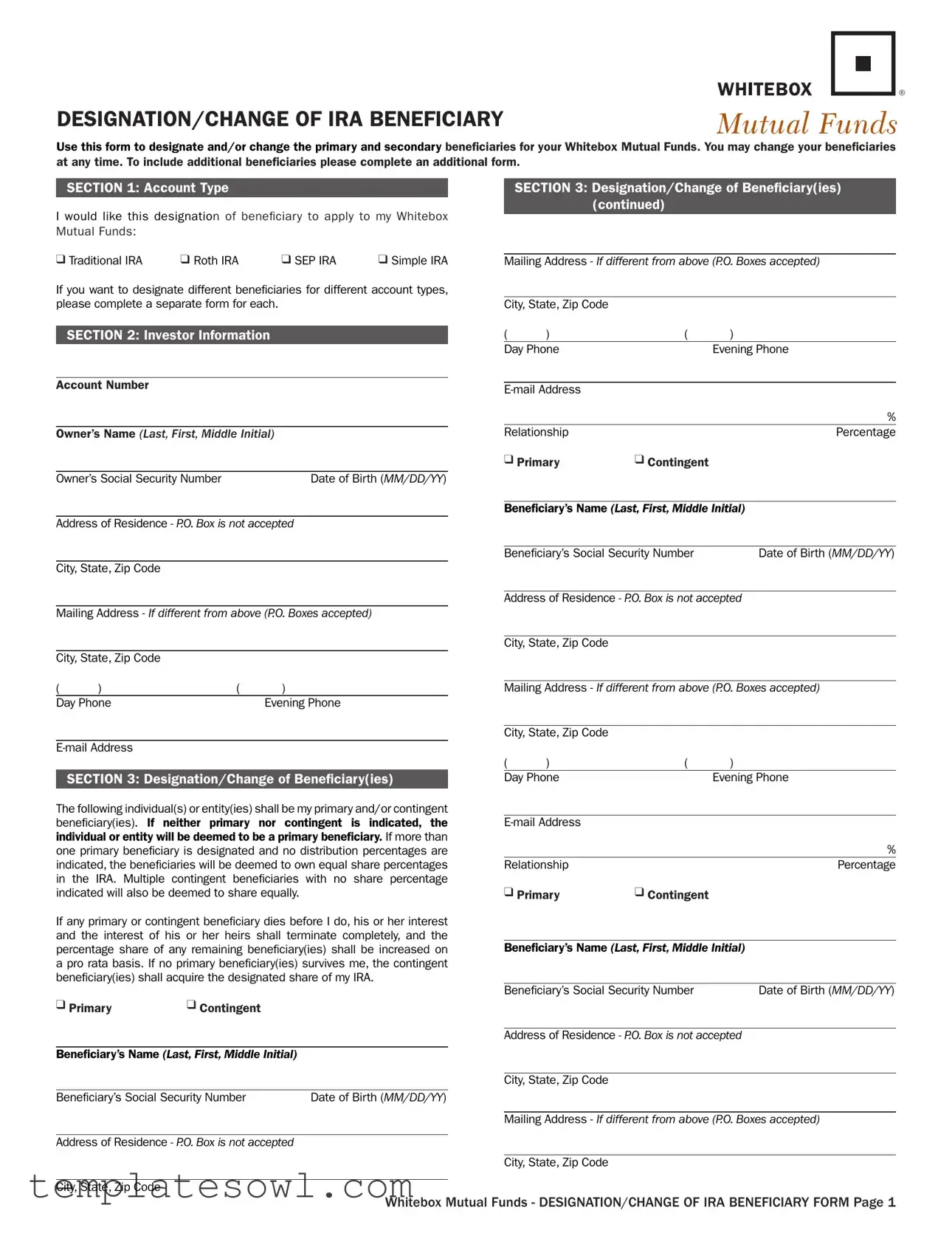

DESIGNATION/CHANGE OF IRA BENEFICIARY

Use this form to designate and/or change the primary and secondary beneiciaries for your Whitebox Mutual Funds. You may change your beneiciaries at any time. To include additional beneiciaries please complete an additional form.

SECTION 1: Account Type |

SECTION 3: Designation/Change of Beneiciary(ies) |

|

(continued) |

I would like this designation of beneiciary to apply to my Whitebox

Mutual Funds:

q Traditional IRA |

q Roth IRA |

q SEP IRA |

q Simple IRA |

If you want to designate different beneiciaries for different account types, please complete a separate form for each.

SECTION 2: Investor Information

Account Number

Owner’s Name (LAST, FIRST, MIDDLE INITIAL)

Owner’s Social Security Number |

Date of Birth (MM/DD/YY) |

Address of Residence - P.O. Box is not accepted

City, State, Zip Code

Mailing Address - If different from above (P.O. Boxes accepted)

City, State, Zip Code |

|

|

|

( |

) |

( |

) |

Day Phone |

|

Evening Phone |

|

SECTION 3: Designation/Change of Beneiciary(ies)

The following individual(s) or entity(ies) shall be my primary and/or contingent beneiciary(ies). If neither primary nor contingent is indicated, the individual or entity will be deemed to be a primary beneiciary. If more than one primary beneiciary is designated and no distribution percentages are indicated, the beneiciaries will be deemed to own equal share percentages in the IRA. Multiple contingent beneiciaries with no share percentage indicated will also be deemed to share equally.

If any primary or contingent beneiciary dies before I do, his or her interest and the interest of his or her heirs shall terminate completely, and the percentage share of any remaining beneiciary(ies) shall be increased on a pro rata basis. If no primary beneiciary(ies) survives me, the contingent beneiciary(ies) shall acquire the designated share of my IRA.

q Primary |

q Contingent |

|

|

|

|

Beneiciary’s Name (LAST, FIRST, MIDDLE INITIAL) |

|

|

|

|

|

Beneiciary’s Social Security Number |

Date of Birth (MM/DD/YY) |

|

|

|

|

Address of Residence - P.O. Box is not accepted |

|

|

|

|

|

City, State, Zip Code |

|

|

Mailing Address - If different from above (P.O. Boxes accepted)

City, State, Zip Code |

|

|

|

( |

) |

( |

) |

Day Phone |

|

Evening Phone |

|

|

|

|

|

|

|

||

|

|

|

% |

Relationship |

|

Percentage |

|

q Primary |

q Contingent |

|

|

|

|||

Beneiciary’s Name (LAST, FIRST, MIDDLE INITIAL) |

|||

|

|

||

Beneiciary’s Social Security Number |

Date of Birth (MM/DD/YY) |

||

Address of Residence - P.O. Box is not accepted

City, State, Zip Code

Mailing Address - If different from above (P.O. Boxes accepted)

City, State, Zip Code |

|

|

|

( |

) |

( |

) |

Day Phone |

|

Evening Phone |

|

|

|

|

|

|

|

||

|

|

|

% |

Relationship |

|

Percentage |

|

q Primary |

q Contingent |

|

|

|

|||

Beneiciary’s Name (LAST, FIRST, MIDDLE INITIAL) |

|||

|

|

||

Beneiciary’s Social Security Number |

Date of Birth (MM/DD/YY) |

||

Address of Residence - P.O. Box is not accepted

City, State, Zip Code

Mailing Address - If different from above (P.O. Boxes accepted)

City, State, Zip Code

Whitebox Mutual Funds - DESIGNATION/CHANGE OF IRA BENEFICIARY FORM Page 1

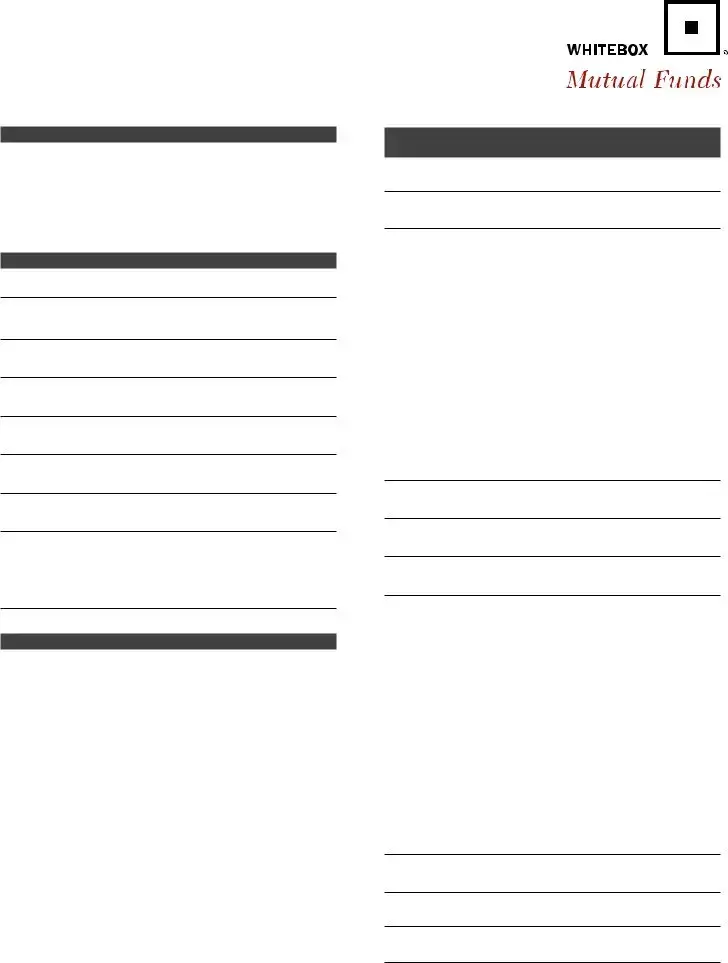

SECTION 3: Designation/Change of Beneiciary(ies)

(continued)

( |

) |

( |

) |

Day Phone |

|

Evening Phone |

|

|

|

|

|

|

|

||

|

|

|

% |

Relationship |

|

Percentage |

|

q Primary |

q Contingent |

|

|

|

|||

Beneiciary’s Name (LAST, FIRST, MIDDLE INITIAL) |

|||

|

|

||

Beneiciary’s Social Security Number |

Date of Birth (MM/DD/YY) |

||

Address of Residence - P.O. Box is not accepted

City, State, Zip Code

Mailing Address - If different from above (P.O. Boxes accepted)

City, State, Zip Code |

|

|

|

( |

) |

( |

) |

Day Phone |

|

Evening Phone |

|

|

|

|

|

|

|

||

|

|

|

% |

Relationship |

|

Percentage |

|

Spousal Consent:

This section should be reviewed if either the trust or the residence of the IRA holder is located in a community or marital property state and the IRA holder is married. Due to the important tax consequences of giving up one’s community property interest, individuals signing this section should consult with a competent tax or legal advisor.

CURRENT MARITAL STATUS

qI Am Not Married – I understand that if I become married in the future, I must complete a new IRA Designation/Change Of Beneiciary form.

qI Am Married – I understand that if I choose to designate a primary beneiciary other than my spouse, my spouse must sign below.

CONSENT OF SPOUSE

I am the spouse of the

I hereby give the IRA holder any interest I have in the Fund or property deposited in this IRA and consent to the beneiciary designation(s) indicated above. I assume full responsibility for any adverse consequences that may result. No tax or legal advice was given to me by the Custodian.

Signature of Spouse |

Date (MM/DD/YY) |

|

|

Signature of Witness |

Date (MM/DD/YY) |

SECTION 4: Trust Beneiciary(ies)

Complete this section if a trust is one of your primary beneiciaries. Consult your attorney regarding this designation.

Name of Trust

Street or P.O. Box

City, State, Zip Code

Percentage % |

Date of Trust |

Trust’s Tax Identiication Number |

SECTION 5: Signature

I hereby revoke all previous beneiciary designations for my Whitebox Mutual Funds. I understand that I may change my beneiciary at any time and that the change is effective when received in writing and accepted by Whitebox Mutual Funds.

Owner’s Signature |

Date (MM/DD/YY) |

Please mail completed form to: |

|

Mailing Address |

Overnight Address |

Whitebox Mutual Funds |

Whitebox Mutual Funds |

P.O. Box 13393 |

1290 Broadway, Suite 1100 |

Denver, CO 80201 |

Denver, CO 80203 |

If you have any questions, please contact an Investor Service Representative at

Whitebox Mutual Funds - DESIGNATION/CHANGE OF IRA BENEFICIARY FORM Page 2

092611

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | This form is used to designate or change primary and secondary beneficiaries for Whitebox Mutual Funds IRAs. |

| Account Types | You can use this form for various IRA types, including Traditional, Roth, SEP, and Simple IRAs. |

| Change Flexibility | Beneficiaries can be changed at any time using this form. Multiple forms are needed for different account types. |

| Equal Shares | If no percentages are specified among primary beneficiaries, they will share equally in the IRA assets. |

| Contingent Beneficiaries | If no primary beneficiaries survive, contingent beneficiaries will receive the designated share. |

| Spousal Consent | If married, the spouse must consent to any primary beneficiary designation that is not the spouse. |

| Trust Beneficiaries | A separate section is available to designate a trust as a primary beneficiary. Seeking legal advice is recommended. |

| Revocation of Previous Designations | Upon completing this form, all previous beneficiary designations for the specified IRAs are revoked. |

| Mailing Information | The completed form should be mailed to Whitebox Mutual Funds at the specified addresses for processing. |

Guidelines on Utilizing Mt Bank Beneficiary

Filling out the Mt Bank Beneficiary form is an essential step in managing your IRA designations. After completing the form, you will need to submit it according to the provided mailing options. Ensure that you have reviewed your information carefully, as the designations and percentages you choose will impact how your assets are distributed.

- Gather your necessary information, including your account type, personal details, and beneficiary information.

- In SECTION 1, select the type of IRA for which you want to designate beneficiaries.

- Move to SECTION 2. Fill in your account number, name, Social Security number, date of birth, residential address, mailing address (if different), phone numbers, and email address.

- Proceed to SECTION 3. Designate your primary and/or contingent beneficiaries. Provide their names, Social Security numbers, dates of birth, addresses, phone numbers, email addresses, percentage shares, and relationships to you.

- If applicable, review and complete the Spousal Consent section if you are married and designating someone other than your spouse as a primary beneficiary.

- Fill out SECTION 4 if a trust is designated as one of your beneficiaries. Provide the trust's name, address, percentage share, and tax identification number.

- In SECTION 5, sign and date the form, revoking all previous beneficiary designations.

- Mail the completed form to the address provided for both standard and overnight deliveries.

What You Should Know About This Form

What is the MT Bank Beneficiary form used for?

The MT Bank Beneficiary form allows individuals to designate or change the primary and secondary beneficiaries for their Whitebox Mutual Funds accounts. This form is essential for ensuring that your assets are distributed according to your wishes after your passing. You can update your beneficiaries at any time by completing this form.

Who can be listed as a beneficiary on the form?

Beneficiaries can include individuals or entities. You can name multiple primary and contingent beneficiaries. If you choose multiple primary beneficiaries and do not specify percentages for each, they will share the assets equally. The same rule applies for contingent beneficiaries.

Can I change my beneficiaries after submitting the form?

Yes, you may change your beneficiaries at any time by completing a new MT Bank Beneficiary form. The change will take effect once the new form is received and accepted by Whitebox Mutual Funds.

What should I do if I want to designate different beneficiaries for different account types?

If you wish to designate different beneficiaries for different account types (such as Traditional IRA, Roth IRA, etc.), it is necessary to complete a separate form for each account type. This ensures that each account is handled according to your specific wishes.

What information do I need to provide on the form?

You will need to provide several important details like your account number, personal information (name, Social Security Number, date of birth), and the details of your beneficiaries (name, Social Security Number, date of birth, relationship, and contact information). Ensuring this information is accurate will help avoid any disputes later on.

Do I need my spouse's consent if I designate someone else as a primary beneficiary?

If you are married and choose to designate a primary beneficiary other than your spouse, their consent is required. This is crucial in community or marital property states due to potential tax implications. Your spouse must acknowledge the designation by signing the form.

What happens if my beneficiary predeceases me?

If a primary beneficiary dies before you, their portion of the inherited assets will be reallocated among any remaining beneficiaries on a pro-rata basis. If no primary beneficiaries are alive at your passing, the contingent beneficiaries will receive your assets as designated on the form.

What is the process for submitting the form?

Once you have completed the MT Bank Beneficiary form, you should mail it to the designated address provided on the form or submit it via any available method that Whitebox Mutual Funds may have specified. It is recommended to retain a copy for your records.

Who should I contact if I have questions about the form?

If you have any questions regarding the MT Bank Beneficiary form or need assistance, you can reach out to an Investor Service Representative at 1-855-296-2866. You may also visit the Whitebox Mutual Funds website for more information and resources.

Common mistakes

Filling out the Mt Bank Beneficiary form accurately ensures a smooth transfer of assets. Many individuals make common mistakes that can cause delays or complications. One frequent error is neglecting to provide complete investor information. Each section, including the owner's name, Social Security number, and date of birth, must be filled out fully. Omitting any details can lead to the rejection of the form.

Another mistake involves incorrectly indicating the account type. The form allows for different types of IRAs, such as Traditional, Roth, SEP, and Simple. Failing to check the appropriate box may result in confusion regarding which account the beneficiary designation applies to. If multiple account types exist, a separate form must be completed for each type.

Individuals often overlook the designation of beneficiaries. It’s essential to clearly identify both primary and contingent beneficiaries. If no designation is noted, the beneficiaries will automatically be considered primary. Additionally, if there are multiple primary beneficiaries without indicated percentages, they will share equally. This can lead to disputes if intentions are not clearly stated.

Another issue is not specifying the percentage shares for each beneficiary if there are multiple designations. When percentages are not indicated, the form defaults to equal shares. This can lead to misunderstandings among beneficiaries about their respective shares of the IRA.

Additionally, people may forget to include a spouse's consent when designating a non-spouse primary beneficiary, especially in community property states. Not obtaining the necessary consent can invalidate the designation, resulting in unintended distribution of assets in the future.

Another common mistake is providing an incorrect Social Security number for the beneficiaries. Accurate numbers are crucial for identification purposes. An error here can hinder the processing of the beneficiary claims later on.

Finally, individuals often neglect to sign and date the form. The signature is necessary to validate the changes and revocations of previous beneficiary designations. Failing to provide these could delay the execution of the form entirely. Ensuring all sections are completed correctly will facilitate the intended transfer of benefits without future complications.

Documents used along the form

The Mt Bank Beneficiary form is essential for stipulating who will receive your assets after your passing. Alongside this form, several other documents may be required or beneficial to ensure that your intentions are clear and that your loved ones are protected. Below is a list of commonly associated forms and their purposes.

- Will: A legal document that outlines how you wish your assets to be distributed after your death. It can appoint guardians for minor children and specify funeral arrangements.

- Trust Agreement: This document establishes a trust, allowing a trustee to manage your assets on behalf of your beneficiaries. It can provide benefits such as privacy and avoiding probate.

- Power of Attorney (POA): A legal document that grants someone authority to make decisions on your behalf, especially concerning financial matters, if you become unable to do so yourself.

- Advanced Healthcare Directive: A document that specifies your healthcare preferences, including who can make medical decisions for you if you are incapacitated.

- Spousal Consent Form: If you’re married, this document may be required to confirm your spouse agrees with your beneficiary designations, especially for community property states.

- Change of Address Form: If you move, updating your address with financial institutions ensures that all documents, including the beneficiary form, are sent to the correct location.

- Beneficiary Designation Form: Separate from the Mt Bank form, this document applies specifically to life insurance policies or other financial accounts, ensuring that your selected beneficiaries receive funds directly.

Each of these documents serves a unique purpose in creating a comprehensive estate plan. It is advisable to consult with a legal or financial expert to ensure all documents align with your intentions and comply with state laws. This can provide peace of mind, knowing that your wishes are clearly articulated and legally binding.

Similar forms

- Living Will: Similar to the Mt Bank Beneficiary form, a living will allows individuals to express their wishes regarding medical treatment and end-of-life care. Both documents focus on designating preferences for future circumstances when one may not be able to make decisions.

- Power of Attorney: A Power of Attorney designates someone to act on your behalf in legal matters. Like the beneficiary form, it requires clear identification of parties involved and must be appropriately signed and dated to be valid.

- Last Will and Testament: A Last Will specifies how your assets will be distributed after death. Both documents are essential for managing beneficiary designations, ensuring that your wishes are honored when you can no longer express them.

- Trust Documents: Trust documents detail how assets are managed for beneficiaries. These documents, similar to the beneficiary form, require a clear outline of who benefits and under what conditions.

- Life Insurance Beneficiary Designation: This document specifies who will receive the benefits of a life insurance policy. Like the Mt Bank Beneficiary form, it is critical for ensuring that the intended recipients receive funds according to your wishes.

Dos and Don'ts

When completing the Mt Bank Beneficiary form, careful attention is required to ensure accuracy and compliance with the institution's guidelines. Below is a list of salient points to keep in mind.

- Do provide accurate personal information such as your full name, Social Security number, and date of birth.

- Do clearly indicate your IRA type, selecting from Traditional IRA, Roth IRA, SEP IRA, or Simple IRA.

- Do list all primary and contingent beneficiaries, including their full names and relationships to you.

- Do specify percentage shares for each beneficiary if designating more than one primary or contingent beneficiary.

- Do ensure beneficiaries' residential addresses are complete and do not use P.O. Boxes for the address of residence.

- Don't leave any sections incomplete, as this can delay processing.

- Don't use nicknames or abbreviations when writing beneficiary names; full legal names are required.

- Don't forget to consult a tax professional if needed, especially if you are married and do not designate your spouse as the primary beneficiary.

- Don't submit the form without your signature as well as the date, which confirms your understanding and agreement with the information provided.

- Don't assume that previous beneficiary designations are still valid. Clearly revoke any prior designations as instructed.

Misconceptions

The Mt Bank Beneficiary form may seem straightforward, but it is surrounded by several misconceptions. Here is a list of common misunderstandings and clarifications for each:

- Misconception 1: The beneficiary designation cannot be changed after it is made.

- Misconception 2: I only need to fill out one form for all my IRA accounts.

- Misconception 3: If I do not specify distribution percentages, beneficiaries will automatically receive equal shares.

- Misconception 4: Spousal consent is not necessary if my spouse is not listed as a primary beneficiary.

- Misconception 5: The form needs to be notarized to be valid.

- Misconception 6: I must have a trust to name a trust as a beneficiary.

- Misconception 7: My beneficiaries will automatically inherit my funds regardless of my wishes.

- Misconception 8: If I do not complete the spousal consent section, my spouse's rights will still be considered.

This is incorrect. You may change your beneficiaries at any time by submitting a new form.

This is a misunderstanding. If you want to designate different beneficiaries for different types of IRAs, separate forms must be completed for each type.

This can be misleading. While equal shares are the default if percentages are not stated, clarity in designations is always beneficial.

This is not entirely true. If you’re married and choose a beneficiary other than your spouse, obtaining their consent is required in community or marital property states.

This is false. The form is considered valid with just the owner's signature and does not require notarization unless otherwise specified by a legal advisor.

This is misleading. You can designate a trust as a beneficiary, but you should consult an attorney for proper designation and understanding of tax implications.

This misconception overlooks the importance of keeping the form updated. Designating beneficiaries properly ensures your wishes are honored in the event of your death.

This is incorrect. Not completing that section can lead to misunderstandings regarding property rights, which might negate your spouse’s interests.

Key takeaways

When filling out the MT Bank Beneficiary form, it’s essential to keep in mind a few key points to ensure that your beneficiaries are designated correctly and your intentions are clear.

- Multiple Beneficiaries Require Clarity: If you choose to designate more than one primary or contingent beneficiary, make sure to specify the percentage share each will receive. Without this, all designated beneficiaries will be treated as having equal shares, which may not reflect your wishes.

- Changes Are Allowed Anytime: You can change your beneficiary designations whenever needed. Just return a new form reflecting your current desires to ensure your beneficiaries are up to date.

- Spousal Consent is Important: If you are married and choose a primary beneficiary other than your spouse, your spouse will need to provide consent. This is a critical step, particularly in community property states, due to potential tax implications.

- Trusts as Beneficiaries: If you wish to name a trust as a beneficiary, make sure to complete the relevant section of the form accurately and consult your attorney. Setting up a trust can have specific legal nuances that are important to address.

By understanding these takeaways, you can ensure that the beneficiary form is completed accurately and reflects your intentions. For any questions or clarifications, consider reaching out to a financial or legal advisor.

Browse Other Templates

Chiropractor Bill Sample - A two-view elbow X-ray for joint diagnosis.

What Documents Do I Need to Apply for Medicare - The application includes fields for listing all household income sources.

Non Profit Mailing Permit - Applications for the nonprofit rates can enhance operational costs for eligible organizations.