Fill Out Your Mutual Of Omaha Accidental Death Claim Pdf Form

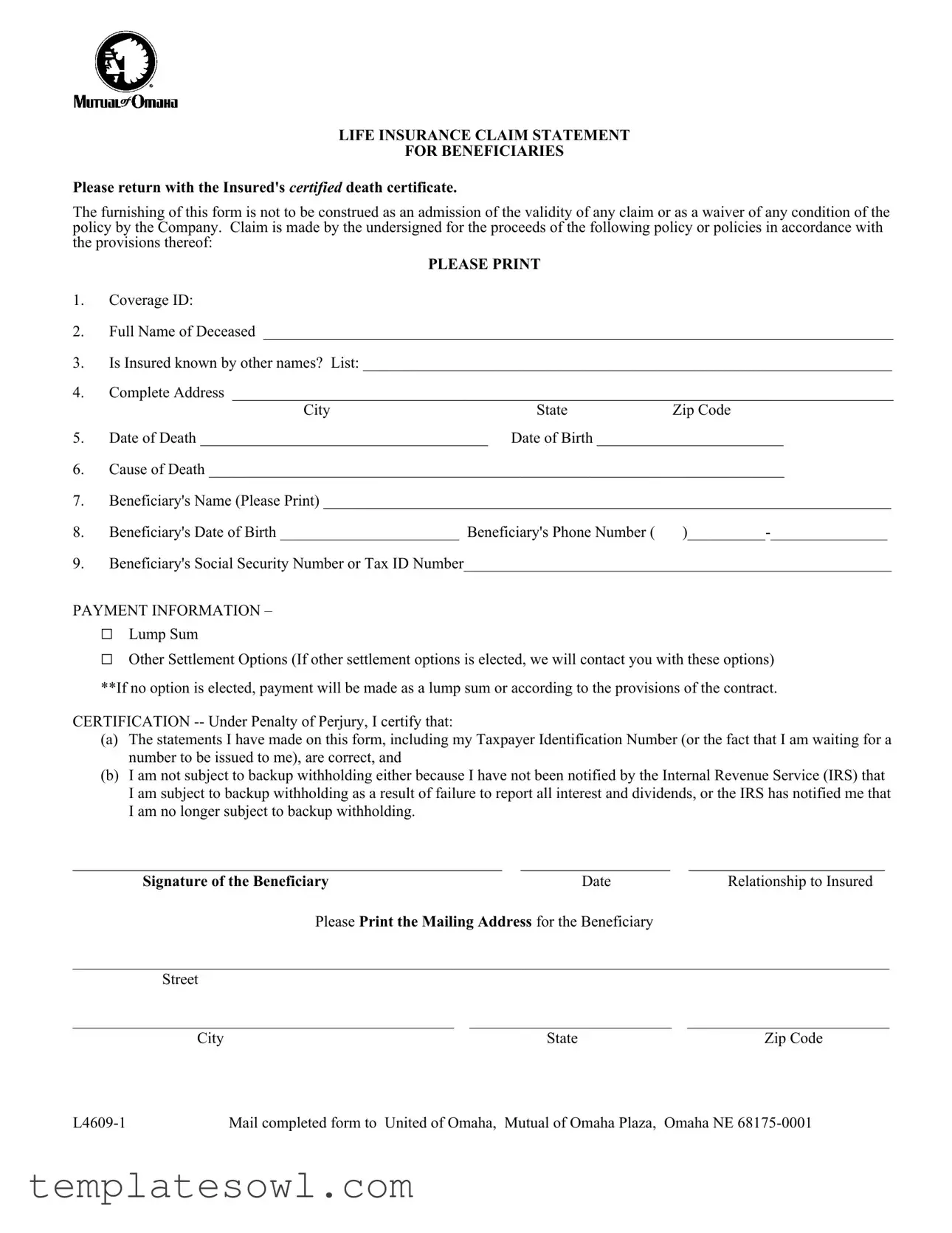

The Mutual of Omaha Accidental Death Claim form is a crucial document for beneficiaries seeking to claim life insurance proceeds after the insured's accidental death. This form requires several key pieces of information, starting with the coverage ID and the full name of the deceased. It also asks for the insured’s alternate names, complete address, date of death, and cause of death. Additionally, the form requires details about the beneficiary, including name, date of birth, phone number, and Social Security or Tax ID number. Beneficiaries must choose a payment option, with the default being a lump sum unless otherwise specified. The form emphasizes the necessity of submitting a certified death certificate along with the claim and includes a certification section that obligates the beneficiary to verify the accuracy of the information provided. Importantly, the form contains a series of fraud statements tailored to various states, highlighting the serious ramifications associated with submitting false information. Completing this form accurately is essential for obtaining the insurance benefits due to the beneficiary, as any discrepancies could delay the claim process or result in denial of the claim.

Mutual Of Omaha Accidental Death Claim Pdf Example

LIFE INSURANCE CLAIM STATEMENT

FOR BENEFICIARIES

Please return with the Insured's CERTIFIED death certificate.

The furnishing of this form is not to be construed as an admission of the validity of any claim or as a waiver of any condition of the policy by the Company. Claim is made by the undersigned for the proceeds of the following policy or policies in accordance with the provisions thereof:

PLEASE PRINT

1.Coverage ID:

2.Full Name of Deceased _________________________________________________________________________________

3.Is Insured known by other names? List: ____________________________________________________________________

4.Complete Address _____________________________________________________________________________________

|

City |

State |

Zip Code |

5. |

Date of Death _____________________________________ |

Date of Birth ________________________ |

|

6.Cause of Death __________________________________________________________________________

7.Beneficiary's Name (Please Print) _________________________________________________________________________

8. |

Beneficiary's Date of Birth _______________________ Beneficiary's Phone Number ( |

9.Beneficiary's Social Security Number or Tax ID Number_______________________________________________________

PAYMENT INFORMATION –

□

□

Lump Sum

Other Settlement Options (If other settlement options is elected, we will contact you with these options)

**If no option is elected, payment will be made as a lump sum or according to the provisions of the contract.

CERTIFICATION

(a)The statements I have made on this form, including my Taxpayer Identification Number (or the fact that I am waiting for a number to be issued to me), are correct, and

(b)I am not subject to backup withholding either because I have not been notified by the Internal Revenue Service (IRS) that I am subject to backup withholding as a result of failure to report all interest and dividends, or the IRS has notified me that I am no longer subject to backup withholding.

______________________________________________ |

________________ |

_____________________ |

Signature of the Beneficiary |

Date |

Relationship to Insured |

Please Print the Mailing Address for the Beneficiary

_________________________________________________________________________________________________________

Street |

|

|

_________________________________________________ |

__________________________ |

__________________________ |

City |

State |

Zip Code |

Mail completed form to United of Omaha, Mutual of Omaha Plaza, Omaha NE |

FRAUD STATEMENTS

The following fraud language is attached to, and made part of this claim form. Please read and do not remove these pages from this claim form.

**Alabama: Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or who knowingly presents false information in an application for insurance is guilty of a crime and may be subject to restitution fines or confinement in prison, or any combination thereof.

**Alaska: A person who knowingly and with intent to injure, defraud or deceive an insurance company files a claim containing false, incomplete, or misleading information may be prosecuted under state law.

**Arizona: For your protection Arizona law requires the following statement to appear on this form.

Any person who knowingly presents a false or fraudulent claim for payment of a loss is subject to criminal and civil penalties.

**Arkansas: Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or knowingly presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.

**California: For your protection California law requires the following to appear on this form. Any person who knowingly presents a false or fraudulent claim for the payment of a loss is guilty of a crime and may be subject to fines and confinement in state prison.

**Colorado: It is unlawful to knowingly provide false, incomplete, or misleading facts or information to an insurance company for the purpose of defrauding or attempting to defraud the company. Penalties may include imprisonment, fines, denial of insurance and civil damages. Any insurance company or agent of an insurance company who knowingly provides false, incomplete, or misleading facts or information to a policyholder or claimant for the purpose of defrauding or attempting to defraud the policyholder or claimant with regard to a settlement or award payable from insurance proceeds shall be reported to the Colorado Division of Insurance within the Department of Regulatory Agencies.

**Delaware: Any person who knowingly and with intent to injure, defraud or deceive any insurer, files a statement of claim containing any false, incomplete or misleading information is guilty of a felony.

**District of Columbia: WARNING: It is a crime to provide false or misleading information to an insurer or any other person. Penalties include imprisonment and/or fines. In addition, an insurer may deny insurance benefits if false information materially related to a claim was provided by the applicant.

**Florida: Any person who knowingly and with intent to injure, defraud, or deceive any insurer files a statement of claim or an application containing any false, incomplete, or misleading information is guilty of a felony of the third degree.

**Idaho: Any person who knowingly, and with intent to defraud or deceive any insurance company, files a statement containing any false, incomplete, or misleading information is guilty of a felony.

**Indiana: A person who knowingly and with intent to defraud an insurer files a statement of claim containing any false, incomplete, or misleading information commits a felony.

**Kentucky: Any person who knowingly and with intent to defraud any insurance company or other person files a statement of claim containing any materially false information or conceals, for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act, which is a crime.

**Louisiana: Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or knowingly presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.

**Maine: It is a crime to knowingly provide false, incomplete or misleading information to an insurance company for the purpose of defrauding the company. Penalties include imprisonment, fines or a denial of insurance benefits.

**Maryland: Any person who knowingly or willfully presents a false or fraudulent claim for payment of a loss or benefit or who knowingly or willfully presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison..

FS12222_0812

**Minnesota: A person who files a claim with intent to defraud or helps commit a fraud against an insurer is guilty of a crime.

**New Hampshire: Any person who, with a purpose to injure, defraud or deceive any insurance company, files a statement of claim containing any false, incomplete or misleading information is subject to prosecution and punishment for insurance fraud, as provided in RSA 638:20.

**New Jersey: Any person who knowingly files a statement of claim containing any false or misleading information is subject to criminal and civil penalties.

**New Mexico: ANY PERSON WHO KNOWINGLY PRESENTS A FALSE OR FRAUDULENT CLAIM FOR PAYMENT OF A LOSS OR BENEFIT OR KNOWINGLY PRESENTS FALSE INFORMATION IN AN APPLICATION FOR INSURANCE IS GUILTY OF A CRIME AND MAY BE SUBJECT TO CIVIL FINES AND CRIMINAL PENALTIES.

**New York: Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance or statement of claim containing any materially false information or conceals for the purpose of misleading, information concerning any fact material thereto, commits a fraudulent insurance act, which is a crime and shall also be subject to a civil penalty not to exceed five thousand dollars and the stated value of the claim for each such violation.

**Ohio: Any person who, with intent to defraud or knowing that he is facilitating a fraud against an insurer, submits an application or files a claim containing a false or deceptive statement is guilty of insurance fraud.

**Oklahoma: WARNING: Any person who knowingly, and with intent to injure, defraud or deceive any insurer, makes any claim for the proceeds of an insurance policy containing any false, incomplete or misleading information is guilty of a felony.

**Pennsylvania: Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance or statement of claim containing any materially false information or conceals for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act, which is a crime and subjects such person to criminal and civil penalties.

**Puerto Rico: Any person who knowingly and with the intention of defrauding presents false information in an insurance application, or presents, helps, or causes the presentation of a fraudulent claim for the payment of a loss or any other benefit, or presents more than one claim for the same damage or loss, shall incur a felony and, upon conviction, shall be sanctioned for each violation by a fine of not less than five thousand dollars ($5,000) and not more than ten thousand dollars ($10,000), or a fixed term of imprisonment for three (3) years, or both penalties. Should aggravating circumstances be present, the fixed penalty thus established may be increased to a maximum of five (5) years; if extenuating circumstances are present, it may be reduced to a minimum of two (2) years.

**Rhode Island: Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or knowingly presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.

**Tennessee: It is a crime to knowingly provide false, incomplete or misleading information to an insurance company for the purpose of defrauding the company. Penalties include imprisonment, fines and denial of insurance benefits.

**Texas: Any person who knowingly presents a false or fraudulent claim for the payment of a loss is guilty of a crime and may be subject to fines and confinement in state prison.

**Virginia: It is a crime to knowingly provide false, incomplete or misleading information to an insurance company for the purpose of defrauding the company. Penalties include imprisonment, fines and denial of insurance benefits.

**Washington: It is a crime to knowingly provide false, incomplete, or misleading information to an insurance company for the purpose of defrauding the company. Penalties include imprisonment, fines and denial of insurance benefits.

**West Virginia: Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or knowingly presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.

**If you live in a state other than mentioned above, the following statement applies to you: Any person who knowingly, and with intent to injure, defraud or deceive any insurer or insurance company, files a statement of claim containing any materially false, incomplete, or misleading information or conceals any fact material thereto, may be guilty of a fraudulent act, may be prosecuted under state law and may be subject to civil and criminal penalties. In addition, any insurer or insurance company may deny benefits if false information materially related to a claim is provided by the claimant.

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Form Purpose | This PDF form is intended for beneficiaries of a Mutual of Omaha life insurance policy to claim benefits following the insured's death. |

| Documentation Required | A certified death certificate must accompany the claim form for it to be processed. |

| State-specific Fraud Notices | The form includes specific warnings for states like California and New York, highlighting the consequences of providing false information. |

| Mailing Address | Completed forms should be mailed to United of Omaha, Mutual of Omaha Plaza, Omaha NE 68175-0001. |

Guidelines on Utilizing Mutual Of Omaha Accidental Death Claim Pdf

Completing the Mutual of Omaha Accidental Death Claim form requires accurate information about the deceased and the beneficiary. It is essential to provide all necessary details clearly to ensure a smooth processing of the claim.

- Obtain the Form: Download or print the Mutual of Omaha Accidental Death Claim PDF form.

- Collect Required Documents: Have the deceased’s certified death certificate ready, as it must accompany the form when submitted.

- Fill in Coverage ID: Locate the policy’s coverage ID and write it at the top of the form.

- Enter the Deceased’s Full Name: Provide the full name of the deceased in the designated space.

- Other Names: If applicable, specify any other names the insured was known by in the provided section.

- Complete Address: Clearly write the full address of the deceased, including city, state, and zip code.

- Dates: Fill in the date of death and the date of birth of the deceased.

- Cause of Death: Provide details regarding the cause of death in the respective section.

- Beneficiary Information: Print the beneficiary’s name, date of birth, and phone number.

- Social Security/TIN: Enter the beneficiary's Social Security Number or Tax ID Number.

- Payment Information: Indicate whether you choose a lump sum or other settlement options.

- Certification: Read through the certification statement, then sign and date the form to confirm correctness.

- Mailing Address: Provide the beneficiary's mailing address to ensure correct delivery of the claim payment.

- Submit the Form: Mail the completed claim form along with the certified death certificate to the address listed in the form.

What You Should Know About This Form

What is the purpose of the Mutual Of Omaha Accidental Death Claim PDF form?

The Mutual Of Omaha Accidental Death Claim form is designed for beneficiaries to request the proceeds from a life insurance policy following the insured individual's death. It serves as a formal statement that provides necessary information about the deceased and the beneficiary, facilitating the claims process. This form must accompany a certified death certificate to validate the claim.

What information do I need to provide on the claim form?

As a claimant, you will need to provide several key pieces of information. You must enter the Coverage ID, the full name and address of the deceased, the date of death, and the cause of death. Additionally, you will need to include your name as the beneficiary, your relationship to the insured, and your social security or tax ID number. Detailed and accurate information is crucial for a smooth processing of the claim.

What happens if I do not choose a payment option?

If you do not select a payment option when submitting your claim, the proceeds will default to being issued as a lump sum payment. According to the provisions of the policy, this is the standard approach if no other settlement options are elected. It’s important to review any additional options you may prefer to discuss with the claims department.

What should I do if the claim form is incomplete?

Submitting an incomplete claim form may delay the processing of your claim. Make sure to double-check all required fields and sign the form appropriately. If you realize that any information is missing after submission, you should contact Mutual Of Omaha without delay to rectify the issue and provide the necessary information for completion.

What is the fraud statement included in the claim form?

The fraud statement warns claimants against providing false or misleading information when submitting their claim. Each state has specific penalties for committing fraud in insurance claims, ranging from fines to imprisonment. The inclusion of this statement highlights the importance of honesty and accuracy in the claims process. Ensuring that the information you provide is truthful will help you avoid potential legal consequences.

Where do I send the completed claim form?

Once you have completed the Mutual Of Omaha Accidental Death Claim form, you should mail it to United of Omaha at the following address: Mutual of Omaha Plaza, Omaha, NE 68175-0001. Make sure to use the correct mailing address to ensure that your claim is processed without any unnecessary delays.

What if I have questions about filling out the form?

If you have any questions about how to fill out the claim form or about the claims process in general, don’t hesitate to reach out to Mutual Of Omaha’s customer service. They can provide assistance and clarify any uncertainties you may have, ensuring that your claim is submitted properly and efficiently.

Common mistakes

Filling out the Mutual Of Omaha Accidental Death Claim form can be overwhelming, especially during a time of loss. Many people inadvertently make mistakes that could delay their claims or even result in denial. Recognizing common pitfalls can help ensure the process goes smoothly.

One frequent error is a lack of clarity in the deceased's full name. Some individuals may assume middle names or initials are unnecessary, but every detail matters. Omitting or misspelling any part of the name can lead to confusion and complications down the line.

Another common mistake involves providing an incorrect or incomplete date of death and date of birth. These dates must be precise. Ensure you're using the official death certificate as a reference. A simple typo here can raise questions about the validity of the claim.

Many claimants neglect to mention if the deceased was known by any other names. This is an essential section that shouldn't be overlooked. Failure to provide this information might result in a rejected claim, especially if the insurance provider finds out later that the deceased was known by another name.

Additionally, leaving out the beneficiary's social security number or tax ID number can create unnecessary delays. This information is crucial for processing the claim. If you're unsure, it's better to ask for help rather than leave it blank.

Some people also forget to sign the form. A missing signature is an easy fix, yet it can halt the entire claims process. Don't let a simple oversight cause additional stress during this tough time.

Not providing a certified death certificate with the claim form is another significant error. This document is typically required to move forward. Ensure you include it to avoid unnecessary delays.

Misunderstanding the section regarding settlement options can also be an issue. Some may forget to select a preference or assume that a lump sum is the default. Clarifying your choice is essential, as it can affect how and when you receive benefits.

Sometimes, beneficiaries may not think to provide their complete mailing address. Ensure that the entire address, including city and state, is legible and accurate. This ensures the insurance company can reach you when necessary.

Lastly, people often misunderstand the anti-fraud statement. It’s crucial to read this carefully and understand the implications of providing false information. Honesty is not just the best policy; it’s necessary for a smooth claims process.

By avoiding these common mistakes, you can help ensure that your claim is processed without unnecessary hitches. Taking the time to double-check your entries can save you from future headaches and delays.

Documents used along the form

When preparing your claim for accidental death benefits with Mutual of Omaha, there are several important forms and documents you may also need. Each of these supports your claim and ensures a smoother process in obtaining the benefits to which you may be entitled. Below is a list of commonly used documents.

- Certified Death Certificate: This official document verifies the date, cause, and other essential details surrounding the deceased's death. It must be submitted along with your claim form to validate the claim.

- Claimant Identification Documentation: A government-issued ID is needed to establish the identity of the beneficiary. This may include a driver's license, passport, or any other official identification.

- Insurance Policy Documents: Along with the claim form, you may need to submit a copy of the deceased’s insurance policy, which outlines the coverage details and beneficiary designations.

- Medical Records or Reports: In cases where the cause of death requires further clarification, medical records may be needed. This documentation helps clarify the circumstances and confirms the details provided on the claim form.

Each of these documents plays a crucial role in the claims process. Ensuring you have all necessary paperwork can help expedite your claim and reduce any potential delays. If you have questions about the requirements, consult with your insurance provider for guidance.

Similar forms

- Life Insurance Claim Form: Like the Mutual of Omaha Accidental Death Claim form, a life insurance claim form requires details about the deceased, including name, date of birth, and relationship to the beneficiary. Both forms serve as a formal request for insurance benefits following the insured's death.

- Funeral Benefit Claim Form: This document similarly seeks information about the deceased and the beneficiary while collecting necessary documentation, like a death certificate. Just as with the Accidental Death Claim, the completion of this form is essential to process claims for funeral-related expenses.

- Health Insurance Claim Form: Although focused on medical claims, this form operates under the same principles—requiring personal information and proper documentation to validate a claim. Both forms rely heavily on accurate information to ensure timely payment of benefits.

- Disability Insurance Claim Form: This claim form also asks for detailed personal and medical information regarding the insured party. Both forms serve to initiate claims processes and ensure that the insurance company has sufficient evidence to review and approve claims related to loss of life or inability to work.

Dos and Don'ts

Please consider the following important guidelines when filling out the Mutual Of Omaha Accidental Death Claim form. Adhering to these do's and don'ts will help ensure a smoother claims process.

- Do gather all necessary documents. Ensure you have the certified death certificate and any other required paperwork ready before you start filling out the form.

- Do fill out the form completely. Leaving any sections blank can lead to delays in processing your claim.

- Do provide accurate information. Double-check all personal details, including names, dates, and numbers, to avoid mistakes.

- Do follow the instructions. Each question on the form has specific guidelines, so make sure to read them carefully.

- Do sign and date the form. Ensure that your signature is present where required, along with today's date.

- Don't use corrections fluid or tape. If you make a mistake, cross it out neatly and write the correct information. This keeps the form looking professional.

- Don't submit the form without checking it. Review all your answers before mailing the form to catch any possible errors.

- Don't forget to include contact information. Make sure to provide a phone number so that the claims department can reach you if they have questions.

- Don't overlook important disclosures. Be aware of any fraud statements included in the form and ensure compliance with all legal requirements.

Following these recommendations will significantly enhance your experience during the claims process. Take your time and address each component carefully for the best results.

Misconceptions

Understanding the Mutual Of Omaha Accidental Death Claim form can help beneficiaries navigate the claims process more effectively. Here are six common misconceptions about this form:

- All claims are automatically approved. Many believe that filling out the claim form guarantees payment. However, submitting the form does not guarantee approval. Each claim is reviewed to ensure it meets policy requirements.

- A simple form is sufficient for complex claims. Some individuals think that a basic claim form is all that's needed, even for complicated situations. Detailed documentation, like a certified death certificate, may be required to support the claim.

- Only accidental deaths qualify for claims. It is a misconception that claims are limited to accidental deaths. Depending on the policy, claims may also be applicable for other types of deaths if they fall within policy provisions.

- Submission deadlines are forgiving. Many assume there is ample time to submit the form. Deadlines often exist, and missing them can lead to claim denial, so prompt action is crucial.

- The claims process is the same in every state. Different states have varying laws regarding insurance claims. Misunderstanding these differences can affect the outcome of a claim, making research essential.

- Only the beneficiary can submit the claim form. Some think only the beneficiary has the right to submit the claim. However, an authorized representative can also submit the form on behalf of the beneficiary, if necessary.

Clarity about these misconceptions will empower beneficiaries during the claims process and facilitate a smoother experience with Mutual of Omaha.

Key takeaways

Filing a claim for an accidental death benefit can seem daunting, but understanding the process is crucial. Here are key takeaways to keep in mind when completing and using the Mutual of Omaha Accidental Death Claim form:

- Submit with a Certified Death Certificate: Ensure that you return the completed claim form alongside the insured's certified death certificate, as this is mandatory for processing the claim.

- Provide Accurate Details: Accuracy is essential. Incorrect information can delay the claim or even lead to denial.

- Know Your Policy Numbers: Have the Coverage ID and policy details ready. This information helps the insurer locate the relevant policies quickly.

- Beneficiary Information is Key: Include the complete name, date of birth, and Social Security number or Tax ID of the beneficiary to avoid complications.

- Make Payment Option Choices: Decide if you prefer a lump sum payment or other settlement options. If selecting other options, the insurer will contact you to discuss available choices.

- Signature Requirement: The claim must be signed by the beneficiary under penalty of perjury, affirming the truthfulness of the information provided.

- Understand Fraud Consequences: Be aware that filing false information can lead to criminal charges and penalties, including potential denial of benefits.

By following this guidance, you can streamline the process of claiming accidental death benefits and ensure the claim is handled efficiently.

Browse Other Templates

Car Title Sent to Wrong Address - The statement must be filled out completely to comply with federal and state laws.

Krispy Kreme Jobs - Krispy Kreme's commitment to a drug-free workplace is essential for all employees.