Fill Out Your Mv 4St Form

The MV-4ST form, known as the "Vehicle Sales and Use Tax Return/Application for Registration," serves a crucial role in the process of transferring vehicle ownership in Pennsylvania. This document is particularly designed for authorized agents of the Pennsylvania Department of Transportation (PennDOT) and is essential for obtaining a Pennsylvania Certificate of Title for vehicles already titled within the state. The form comprises several sections that require specific information about the vehicle, the seller, and any purchasers involved in the transaction. Notably, applicants must provide various details, including the vehicle’s make, model year, and VIN. The form facilitates the proper transfer of ownership and includes instructions for listing the correct purchase price while calculating any applicable sales tax. It further stipulates the retention of copies for different parties: the white copy must be submitted to PennDOT, the yellow copy retained by the dealer or agent, and the pink copy kept by the individual or business to whom the title will be issued. Understanding the procedure for completing the MV-4ST form can help ensure a smoother transition during the vehicle purchase and registration process.

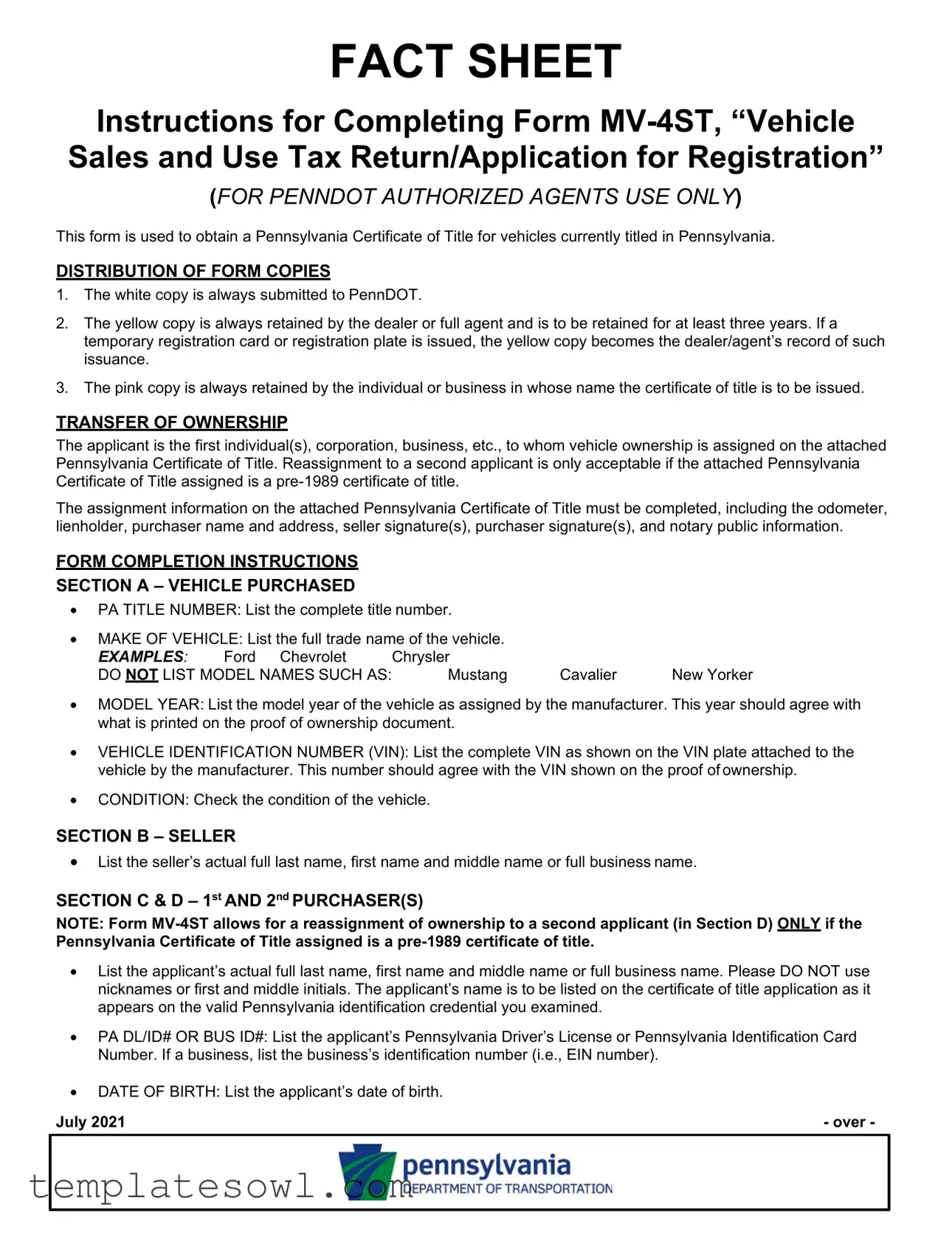

Mv 4St Example

FACT SHEET

Instructions for Completing Form

(FOR PENNDOT AUTHORIZED AGENTS USE ONLY)

This form is used to obtain a Pennsylvania Certificate of Title for vehicles currently titled in Pennsylvania.

DISTRIBUTION OF FORM COPIES

1.The white copy is always submitted to PennDOT.

2.The yellow copy is always retained by the dealer or full agent and is to be retained for at least three years. If a temporary registration card or registration plate is issued, the yellow copy becomes the dealer/agent’s record of such issuance.

3.The pink copy is always retained by the individual or business in whose name the certificate of title is to be issued.

TRANSFER OF OWNERSHIP

The applicant is the first individual(s), corporation, business, etc., to whom vehicle ownership is assigned on the attached Pennsylvania Certificate of Title. Reassignment to a second applicant is only acceptable if the attached Pennsylvania Certificate of Title assigned is a

The assignment information on the attached Pennsylvania Certificate of Title must be completed, including the odometer, lienholder, purchaser name and address, seller signature(s), purchaser signature(s), and notary public information.

FORM COMPLETION INSTRUCTIONS

SECTION A – VEHICLE PURCHASED

•PA TITLE NUMBER: List the complete title number.

•MAKE OF VEHICLE: List the full trade name of the vehicle.

EXAMPLES: |

Ford Chevrolet |

Chrysler |

|

|

DO NOT LIST MODEL NAMES SUCH AS: |

Mustang |

Cavalier |

New Yorker |

|

•MODEL YEAR: List the model year of the vehicle as assigned by the manufacturer. This year should agree with what is printed on the proof of ownership document.

•VEHICLE IDENTIFICATION NUMBER (VIN): List the complete VIN as shown on the VIN plate attached to the vehicle by the manufacturer. This number should agree with the VIN shown on the proof of ownership.

•CONDITION: Check the condition of the vehicle.

SECTION B – SELLER

•List the seller’s actual full last name, first name and middle name or full business name.

SECTION C & D – 1st AND 2nd PURCHASER(S)

NOTE: Form

•List the applicant’s actual full last name, first name and middle name or full business name. Please DO NOT use nicknames or first and middle initials. The applicant’s name is to be listed on the certificate of title application as it appears on the valid Pennsylvania identification credential you examined.

•PA DL/ID# OR BUS ID#: List the applicant’s Pennsylvania Driver’s License or Pennsylvania Identification Card Number. If a business, list the business’s identification number (i.e., EIN number).

•DATE OF BIRTH: List the applicant’s date of birth.

July 2021 |

- over - |

|

|

•

actual last name, first name and middle name. NOTE: If there is a

•STREET: List applicant’s full street address and P.O. Box number, Rural Delivery Route number or apartment

number, if such numbers apply. (NOTE: P.O. Box numbers may be used in addition to the actual address, but cannot be used as the only address.) The applicant’s address listed on the valid Pennsylvania identification credential must agree with the address information that is being recorded on the title application and vehicle record.

The exceptions to this address requirement are U.S. Armed Forces personnel or their dependents; an employee of federal or state government or their immediate families whose workplace is located outside of Pennsylvania; or companies that have no Pennsylvania office and use the vehicle to regularly carry on business within the commonwealth or a Park Model Trailer permanently located in Pennsylvania. If the applicant is entitled to this exception, they must complete and attach Form

•CITY: List the full city name. Please DO NOT abbreviate.

•STATE: List the official state abbreviation designated by the U.S. Postal Service. If Pennsylvania, list PA.

•ZIP: List the full, correct zip code. Please take time to verify the zip code.

•DATE ACQUIRED/PURCHASED: List the date the APPLICANT received or purchased and was assigned

ownership of the vehicle. This date should be listed numerically. EXAMPLE: mm/dd/yyyy.

•COUNTY CODE: Indicate the actual county of residence by listing the appropriate county code from the table below:

COUNTY CODES: |

|

|

|

|

|

|

|

|

|

|

|

01 |

- ADAMS |

13 |

- CARBON |

24 |

- ELK |

35 |

- LACKAWANNA |

46 |

- MONTGOMERY |

57 |

- SULLIVAN |

02 |

- ALLEGHENY |

14 |

- CENTRE |

25 |

- ERIE |

36 |

- LANCASTER |

47 |

- MONTOUR |

58 |

- SUSQUEHANNA |

03 |

- ARMSTRONG |

15 |

- CHESTER |

26 |

- FAYETTE |

37 |

- LAWRENCE |

48 |

- NORTHAMPTON |

59 |

- TIOGA |

04 |

- BEAVER |

16 |

- CLARION |

27 |

- FOREST |

38 |

- LEBANON |

49 |

- NORTHUMBERLAND |

60 |

- UNION |

05 |

- BEDFORD |

17 |

- CLEARFIELD |

28 |

- FRANKLIN |

39 |

- LEHIGH |

50 |

- PERRY |

61 |

- VENANGO |

06 |

- BERKS |

18 |

- CLINTON |

29 |

- FULTON |

40 |

- LUZERNE |

51 |

- PHILADELPHIA |

62 |

- WARREN |

07 |

- BLAIR |

19 |

- COLUMBIA |

30 |

- GREENE |

41 |

- LYCOMING |

52 |

- PIKE |

63 |

- WASHINGTON |

08 |

- BRADFORD |

20 |

- CRAWFORD |

31 |

- HUNTINGDON |

42 |

- MCKEAN |

53 |

- POTTER |

64 |

- WAYNE |

09 |

- BUCKS |

21 |

- CUMBERLAND |

32 |

- INDIANA |

43 |

- MERCER |

54 |

- SCHUYLKILL |

65 |

- WESTMORELAND |

10 |

- BUTLER |

22 |

- DAUPHIN |

33 |

- JEFFERSON |

44 |

- MIFFLIN |

55 |

- SNYDER |

66 |

- WYOMING |

11 |

- CAMBRIA |

23 |

- DELAWARE |

34 |

- JUNIATA |

45 |

- MONROE |

56 |

- SOMERSET |

67 |

- YORK |

12 |

- CAMERON |

|

|

|

|

|

|

|

|

|

|

SECTION E - VEHICLE TRADED

Complete this section only if the applicant traded a vehicle for the vehicle they are acquiring, and they are applying for PA Certificate of Title.

List the make of vehicle, Vehicle Identification Number (VIN), model year and body type of the traded vehicle following the guidelines for completion of Section A.

CONDITION: Check the block which best describes the condition of the traded vehicle. NOTE: The condition of the vehicle should, within reason, correspond to the purchase assigned in Section I.

SECTION F - APPLICATION FOR REGISTRATION

•REGISTRATION PLATE INFORMATION:

-If original registration plate issuance, check block indicating either; (1) registration plate is to be issued by PennDOT, (2) exchange registration plate is to be issued by PennDOT, or (3) temporary registration plate is being issued by a full agent. NOTE: If registration plate is to be issued by PennDOT, valid proof of insurance must be attached.

-Temporary Registration Plate Number - Place the sticker for the corresponding registration plate that was issued with the temporary registration plate on the line provided for the temporary registration plate number. A temporary registration plate is valid for 90 days. NOTE: Before placing the sticker on Form

Instructions for Completing Form

•TRANSFER OF A PREVIOUSLY ISSUED REGISTRATION PLATE: Check this block if the applicant istransferring a registration plate from another vehicle.

•TRANSFER AND RENEWAL OF REGISTRATION PLATE: Check this block if the applicant is transferring a registration plate from another vehicle. The applicant may be eligible to renew their motor vehicle registration for either a

•TRANSFER AND REPLACEMENT OF REGISTRATION PLATE: Check this block if the applicant is transferringa registration plate from another vehicle and replacement of the registration plate is needed. Be sure to collect and submit replacement fee, if appropriate.

•REGISTRATION PLATE NUMBER: List registration plate number being transferred.

•EXPIRES: List month and year of expiration of registration plate as shown on the applicant’s registration card for the registration plate being transferred.

•REASON FOR REPLACEMENT: Check appropriate block for reason for replacement of registration plate. NOTE: If "NEVER RECEIVED" block is checked, applicant must submit a completed Form

•TRANSFERRED FROM TITLE NUMBER: List title number of the vehicle from which registration plate is being transferred.

•VIN: List Vehicle Identification Number of vehicle from which registration plate is being transferred.

•SIGNATURE OF PERSON FROM WHOM REGISTRATION PLATE IS BEING TRANSFERRED (if other than applicant): If the registration plate was not taken from a vehicle registered in the applicant’s name, the signature of the person to whom the registration plate was previously registered is required.

•RELATIONSHIP TO APPLICANT: Relationship of person from whom the registration plate is being transferred must be listed. Under Section 1314(a) of the Pennsylvania Vehicle Code, a registration plate may be transferred between spouses or between parent(s) including

•Trailers, Trucks or Truck Tractors:

-GVWR (Gross Vehicle Weight Rating): List the Gross Vehicle Weight Rating.

-UNLADEN WEIGHT: List the weight of the vehicle fully equipped for service, excluding the weight of any load.

-REQUESTED REGISTERED GROSS WEIGHT (INCLUDING LOAD): List the registered gross weight.

•If the vehicle is a truck or truck tractor which will be operated in combination:

-REQUESTED REGISTERED GROSS COMBINATION WEIGHT: List the registered gross combination weight.

•INSURANCE INFORMATION: List the name of the applicant’s insurance company, policy number, policy effective and policy expiration dates covering this vehicle. If a policy number has not been issued, attach a copy of the insurance binder.

•ISSUING AGENT INFORMATION:

-Month, day and year of issuance of the temporary registration plate or the transfer of temporary registration must be listed. No alteration of the date will be accepted. This date certifies the date the authorized agent verified the applicant had valid proof of financial responsibility.

-Issuing Agent: Print name exactly as registered with the Bureau of Motor Vehicles.

-Agent Number: List card agent identification number, full agent identification number or Dealer/Business Partner Identification Number.

-Issuing Agent Signature: Signature of issuing agent is required.

-Telephone: List area code and business telephone number of issuing agent.

Instructions for Completing Form

NOTE: The issuing agent information must be completed even if no registration was issued. The date would be blank if no registration plate was issued or no transfer of registration was completed.

SECTION G - CERTIFICATION

•CERTIFICATION:

-When the applicant signs this section, after completion of the entire form, it certifies that all statements on this form are true and correct.

-The applicant refers to the person(s) whose name(s) appear in Section C and/or Section D.

-PURCHASER – FIRST ASSIGNMENT: Signature of first purchaser must appear on the first line in the space provided. When the vehicle is in the name of a company/corporation, the signature of an authorized representative is required. The title of the authorized signer for a business must appear on the second line. If applying for joint ownership, the

-PURCHASER – SECOND ASSIGNMENT: If a second purchaser is shown in Section D, signature of the second purchaser must appear in the space provided.

SECTION H - TAX/FEES

For a complete listing of motor vehicle fees, refer to Form

NOTE: The first column is for the fees owed by the purchaser listed in Section C. The second column is for the fees owed by the purchaser listed in Section D, if applicable.

•PURCHASE PRICE: List the correct purchase price. Purchase price includes any lien or other obligation assumed by the purchaser. Enter total purchase price in Section I, including installation charges on contract sales of mobile homes. If purchase price is less than 80% of the vehicle’s average fair market value, or the vehicle is over 15 years old and the purchase price is less than $500, Form

•LESS

•TAXABLE AMOUNT: Determine the taxable amount by subtracting the

•Sales Tax:

Multiply taxable amount by 6% (.06).

Multiply taxable amount by 7% (.07), for residents of Allegheny County (additional 1 % sales tax). Multiply taxable amount by 8% (.08), for residents of the City of Philadelphia (additional 2 % sales tax).

1.SALES TAX DUE: Sales tax due is the amount shown in sales tax block unless a tax credit is listed. If sales tax credit is listed, determine sales tax due by subtracting tax credit from 6% sales tax (Allegheny County residents pay 7% sales tax and City of Philadelphia residents pay 8%) and list proper amount.

1a. If claiming a tax exemption, indicate the proper exemption reason code from the reverse side of the white copy of Form

1b. List exemption authorization number (issued by Revenue Department, ICC or PUC) in block 1B, if applicable.

2.TITLE FEE: List $58 fee.

3.LIEN FEE: List $28 fee, if recording a lien against this vehicle. NOTE: An additional $28 fee is required for each subsequent lien recorded.

4.REGISTRATION OR PROCESSING FEE: If the applicant is applying for a registration plate from PennDOT ora temporary registration plate has been issued, list appropriate registration fee or list the processing fee amount in this block. The applicant may be eligible to register their motor vehicle for either a

(a)If claiming retired status, Form

Instructions for Completing Form

(b)If requesting a street rod registration plate, a $57 fee is required when transferring and replacing a previously issued registration plate. NOTE: If a street rod registration plate is being requested on a newly purchased vehicle, the $57 fee must accompany the vehicle’s appropriate registration fee.

(c)For organizations covered under Section 1901(c) of the Pennsylvania Vehicle Code, include a $10 processing fee. NOTE: If an applicant is eligible for a processing fee in lieu of registration, they cannot obtain a

FEE EXEMPT CODE: If the applicant is a

(d)If requesting a farm truck certificate of exemption (Type A, Type B, Type C or Type D), use Form

5.COUNTY FEE: The applicant’s county of residence may implement an annual fee of $5 for each

6.DUPLICATE REGISTRATION CARD FEE AND NUMBER OF CARDS: A $2 fee for each duplicate registration card is due at the time of registration, replacement of registration plate or transfer of registration plate. List appropriate fee and number of cards desired.

7.TRANSFER FEE: If the applicant is transferring a registration plate, list the transfer fee.

8.INCREASE FEE: If the applicant is transferring a registration plate from a vehicle to another vehicle in a higher class and the registration fee is greater, list the increase in fee due.

9.REPLACEMENT FEES:

a.Registration Plate: The fee for a replacement registration plate is $11. In conjunction with replacement of your registration plate, you will receive one registration card. If additional registration cards are desired, there is a $2 fee for each additional registration card. (See #6 above.)

b.Weight Class Sticker: There is no fee for a replacement weight class sticker. Along with the replacement of your weight class sticker, you will receive one registration card. If additional registration cards are desired, there is a fee for each additional registration card. (See #6 above.)

10.TOTAL PAID 1st Purchaser: Add blocks 1 thru 9 and list total amount due for column in box10.

11.TOTAL PAID 2nd Purchaser: Add blocks 1 thru 9 and list total amount due for column in box 11.

12.GRAND TOTAL: Add blocks 10 & 11. List the total amount in Block 12. Send one check or money order payable to the Commonwealth of Pennsylvania.

SECTION I – ADDITIONAL TITLE INFORMATION

•JOINT OWNERSHIP: When applying for a certificate of title with a

"TENANTS IN COMMON."

-JOINT TENANTSWITH RIGHT OF SURVIVORSHIP refers to a vehicle titled to more than one person, where on the death of one owner, the vehicle goes to the surviving owner(s). This automatically applies for a spouse.

-TENANTS IN COMMON refers to a vehicle titled to more than one person, where on the death of one owner of the vehicle, the deceased owner’s interest in the vehicle will go to his or her heirs or estate.

•LEASE VEHICLE: Check block and complete Form

APPLICATIONS FOR CERTIFICATE OF TITLE FOR MOBILE HOME OR MANUFACTURED HOME

When transferring ownership of a mobile home or manufactured home, additional documentation must be included.

If a mobile home or manufactured home that has been anchored to the ground to facilitate connection with electricity, water and sewerage and that has been previously titled in Pennsylvania and used as a residence in Pennsylvania

Instructions for Completing Form

immediately preceding its sale or transfer, is offered for sale or transfer, the transferor shall obtain a tax status certification from the Tax Claim Bureau of the county in which the home is situated, showing the county, municipal and school district real estate taxes due on the home as shown by the Tax Bureau records as of the date of the certification. This includes any delinquent taxes turned over to a third party for collection. This tax certification shall be provided to the transferee and PennDOT in conjunction with the transfer of ownership.

NOTE: If a new mobile home or manufactured home is being titled using the Manufacturer’s Certificate of Origin (MCO) as the proof of ownership, neither the tax status certification nor Form

The tax status certification must include the following information:

•The parcel number assigned to the home.

•The amount of current or delinquent taxes owed from the parcel number.

•The date upon which a tax for the parcel number will accrue and the taxing period that the tax will cover.

•The address and telephone numbers of the tax collection authority and tax claim bureau or equivalent office.

If taxes are due for the home, the transferor shall pay the delinquent real estate taxes in full or cause the taxes to be paid in full and an updated tax status certification must be obtained and provided to the transferee and PennDOT before the transfer is completed.

If the mobile home or manufactured home is NOT anchored to the ground to facilitate connections with electricity, water and sewerage OR was not used as a residence in Pennsylvania or isn’t titled in Pennsylvania, Form

MAILING REQUIREMENTS

Please use the unique post office box number printed in the upper right corner of Form

Please Note: Authorized agents are under contract with PennDOT and may charge a market driven service (delivery) fee. These are in addition to any PennDOT statutory fees for temporary, or in some cases, permanent motor vehicle registration plates and cards or other related products and services offered by the agent. The agent’s service (delivery) fees are market driven and vary by agent. To compare service (delivery) fees, you are encouraged to contact the authorized agents in your area for the applicable service (delivery) fees charged.

Instructions for Completing Form

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The MV-4ST form is used to apply for a Certificate of Title for vehicles currently registered in Pennsylvania. |

| Distribution of Copies | There are three copies of the MV-4ST: the white copy is submitted to PennDOT, the yellow copy is kept by the dealer, and the pink copy is retained by the purchaser. |

| Transfer of Ownership | Ownership can only be reassigned if the original Certificate of Title is pre-1989. The title must include complete assignment details. |

| Section Requirements | Applicants must provide extensive details including the vehicle make, title number, VIN, and personal information in various sections of the form. |

| Tax Requirements | Sales tax on the vehicle purchase price is calculated at 6%, with additional rates for specific counties, such as 7% in Allegheny County and 8% in Philadelphia. |

| Governing Law | The MV-4ST form is governed by the Pennsylvania Vehicle Code, under Title 75 of the Pennsylvania Consolidated Statutes. |

Guidelines on Utilizing Mv 4St

Filling out the MV-4ST form is a crucial step in acquiring a vehicle title in Pennsylvania. Ensuring that all required information is accurately reported is essential for a smooth processing experience. Below are the necessary steps to successfully complete this form.

- Obtain the Form: Access the MV-4ST form through the PennDOT website or from an authorized agent.

- Section A - Vehicle Purchased:

- Fill in the PA Title Number.

- Enter the Make of the Vehicle (e.g., Ford, Chevrolet).

- State the Model Year as per the manufacturer's designation.

- List the Vehicle Identification Number (VIN) as it appears on the VIN plate.

- Indicate the condition of the vehicle by checking the corresponding box.

- Section B - Seller: Write the seller's full name or business name.

- Section C & D - Purchaser(s):

- Fill in the first applicant’s full name as it appears on their ID.

- Provide the Pennsylvania Driver’s License or Business ID number.

- List the applicant’s date of birth.

- If applicable, enter the co-purchaser’s name and information.

- Complete the address section with full details as per the ID.

- Fill out the city, state abbreviation, and zip code correctly.

- Indicate the acquisition date of the vehicle in mm/dd/yyyy format.

- Select and fill in the appropriate county code.

- Section E - Vehicle Traded: If applicable, fill this section with details of the traded vehicle.

- Section F - Application for Registration:

- Choose the relevant registration plate information options.

- If applicable, enter the temporary registration plate number.

- Provide details on the transferred registration plate, if relevant.

- Fill in necessary insurance details regarding the applicant.

- Section G - Certification: Sign to certify that all information is true and correct, ensuring signatures are from the right individuals.

- Section H - Tax/Fees:

- List the purchase price, taxable amount, and calculate the sales tax.

- Provide any fees applicable for title, lien, registration, etc.

- Sum the total amounts due in the designated boxes.

- Section I - Additional Title Information: Indicate if there is joint ownership or if the vehicle is leased and fill out accordingly.

Once the form is accurately completed, it is vital to review all entries for correctness. Submitting the form will initiate the processing of your request for a vehicle title in Pennsylvania.

What You Should Know About This Form

What is the purpose of the MV-4ST form?

The MV-4ST form, also known as the “Vehicle Sales and Use Tax Return/Application for Registration,” is primarily used to obtain a Pennsylvania Certificate of Title for vehicles that are already titled in Pennsylvania. It serves to facilitate the transfer of ownership and ensure that all necessary taxes and fees related to the transaction are properly accounted for.

Who needs to complete the MV-4ST form?

Any individual, corporation, or business that is acquiring ownership of a vehicle titled in Pennsylvania will need to complete this form. This applies whether you are purchasing a vehicle from a dealer or from a private seller. Additionally, dealers and full agents must also fill out this form when registering a vehicle on behalf of a customer.

What information is required in Section A of the MV-4ST form?

In Section A, you must provide detailed information about the vehicle you're purchasing. This includes the PA title number, the full manufacturer’s name (not model names), the model year, the complete Vehicle Identification Number (VIN), and the vehicle's condition. Accuracy is crucial because this information will be used to verify vehicle ownership and assess registration fees.

How do I handle the transfer of ownership if the vehicle has a lien?

If there is a lien on the vehicle, you must ensure that the lienholder's information is completely filled out on the form. This includes the lienholder's name and address, as well as any relevant approval for the transfer. The signature of the lienholder may also be required on the Pennsylvania Certificate of Title to complete the transfer process. Always check the lienholder’s policy regarding such transfers.

What happens if I am transferring a registration plate?

If you are transferring a registration plate from another vehicle, you need to indicate this in Section F. You must provide details such as the previous registration plate number, the expiration date, and the title number of the vehicle from which the registration plate is being transferred. Additionally, the signature of the person from whom the registration plate is being transferred is required if that vehicle was not registered in your name.

Are there any fees associated with the MV-4ST form?

Yes, there are several fees that might apply when completing the MV-4ST form. These include a title fee, potential lien fees, and registration fees, which vary depending on whether you are requesting a one-year or two-year registration. For vehicles in certain areas, additional local taxes may apply as well. The total fees due should be calculated and listed accurately on the form.

What should I do if I make a mistake on the MV-4ST form?

If you notice a mistake after completing the MV-4ST form, it is recommended to start a new form instead of making corrections directly on the original. This will help avoid confusion and ensure that all information is recorded clearly and accurately. Carefully review the completed form before submitting it to PennDOT.

Common mistakes

Filling out the Mv 4St form correctly is essential for obtaining a Pennsylvania vehicle title. However, many individuals make common mistakes that can lead to delays or complications in processing. Understanding these pitfalls can help ensure a smoother application process.

One frequent error is neglecting to enter the full Vehicle Identification Number (VIN). The VIN is critical because it uniquely identifies the vehicle and must match the one on the proof of ownership. Omitting digits or using an incorrect VIN can result in rejection of the application. Always double-check the VIN against the vehicle's documentation.

Another mistake involves misidentifying the vehicle's make or model year. Applicants sometimes list the model name instead of the full trade name. For example, writing "Mustang" instead of "Ford" is an error. Furthermore, the model year should align with what is printed on the proof of ownership. Inaccuracies here can create difficulties during the titling process.

In Section C and D, individuals often fail to provide complete names for the purchasers. Using nicknames or initials instead of the full legal name can lead to issues since the name must match the valid Pennsylvania identification document. Everyone involved should have their names printed clearly to avoid miscommunication later on.

Correctly listing the address is also critical. Many applicants erroneously include only a P.O. Box without the actual street address. According to the guidelines, a P.O. Box can complement but not replace the residential address. This detail is vital for verification against documentation provided by the state.

Applicants frequently make mistakes when reporting the taxable amount. It's important to ensure that the purchase price correctly reflects any trade-in values. Any errors in calculations or omissions may lead to inaccuracies in the tax owed. Double-check all mathematical entries to avoid underreporting or overreporting taxes.

Finally, applicants sometimes overlook the signatures required in Section G. Each purchaser must sign to certify the accuracy of the information provided. Failing to include a signature can cause significant delays, as the application may be returned for correction. Signatures must be clear and unambiguous, ensuring that all parties acknowledge their agreement to the stated facts.

By being mindful of these common mistakes when completing the Mv 4St form, applicants can help facilitate a more efficient processing experience. Paying close attention to details such as VIN accuracy, complete names, and proper taxation will result in fewer complications and a quicker path to title acquisition.

Documents used along the form

When completing the Form MV-4ST for vehicle transactions in Pennsylvania, several other forms and documents commonly accompany this form. Each document serves a unique purpose that complements the overall process of vehicle registration, title transfer, and tax application.

- Form MV-8: This form is for individuals who wish to certify their residency in Pennsylvania when their address does not match the identification presented. It is especially useful for U.S. Armed Forces personnel or government employees working outside of Pennsylvania.

- Form MV-3: If a vehicle's purchase price is significantly below its fair market value, this form must be completed. It acts as a verification tool to ensure the price listed aligns with the vehicle's actual worth.

- Form MV-70S: This document provides a complete schedule of fees related to motor vehicle transactions in Pennsylvania. It includes fees for registration, title transfers, and other related costs.

- Form MV-1L: Required when applying for a title transfer for a leased vehicle, this form ensures that all lease details are recorded appropriately, preventing any issues during registration.

- Form MV-371: This form is used by retired individuals claiming a reduced processing fee for vehicle registration. It's essential for those eligible for this discount to ensure they receive the appropriate fee reduction.

- Form MV-77A: This document is used to apply for a certificate of exemption for farm vehicles. It must accompany Form MV-4ST if the vehicle being registered qualifies for the exemption.

Understanding these additional forms can streamline the registration process and help applicants avoid delays. Being prepared with all the necessary documentation ensures a smoother transaction and compliance with Pennsylvania vehicle regulations.

Similar forms

The MV-4ST form is similar to several other documents used in the vehicle registration and title application process. Here are seven such documents and descriptions of their similarities:

- Form MV-1: This form is an application for a Pennsylvania Certificate of Title and is used to register a vehicle for the first time. Like the MV-4ST, it requires detailed information about the vehicle and the purchaser.

- Form MV-60: Known as the "Application for Restoration of Operating Privileges," this form is also used in vehicle transactions. It necessitates the disclosure of similar personal information and vehicle details, although it pertains to license restoration.

- Form MV-44: This is a document for replacing a registration plate or card. It shares similarities with MV-4ST in that it requires the reason for the replacement as well as applicant information.

- Form MV-70S: This form provides a schedule of fees related to vehicle transactions. It aligns with MV-4ST because both documents involve the calculation of fees for transactions, specifically for vehicle purchases and registrations.

- Form MV-3: This is used for verifying the fair market value of a vehicle, which might be necessary if the vehicle purchase price is suspiciously low. Similar to MV-4ST, it requires specific vehicle details and values.

- Form MV-8: Also known as "Self Certification for Proof of Residency," this form is utilized when applicants claim exceptions regarding their residence. Like MV-4ST, it necessitates personal and residency information from the applicant.

- Form MV-1L: This application is for leasing vehicles. Similar to MV-4ST, it requests comprehensive details about the vehicle and the lessee, and must be filed to properly complete a transaction involving a leased vehicle.

Dos and Don'ts

Do:

- Carefully read all instructions before starting to fill out the form.

- Provide complete and accurate information for each section.

- Use full names and proper identification numbers as required.

- Double-check the Vehicle Identification Number (VIN) against the proof of ownership.

- Attach any necessary documents, such as proof of insurance or supporting certificates.

- Sign the application in the designated areas as required.

- Keep a copy of the completed form for your records.

- Submit the white copy to PennDOT as instructed.

Don't:

- Do not use abbreviations for city names or the state.

- Avoid using nicknames or initials for names.

- Do not omit any required signatures or dates.

- Refrain from providing incomplete or inaccurate information.

- Do not submit the yellow copy; retain it instead.

- Never assume the information is correct without verification.

- Do not forget to indicate the correct county code.

- Do not delay in submitting the application to ensure timely processing.

Misconceptions

1. The MV-4ST Form Can Be Completed by Anyone - Many believe that anyone can complete the MV-4ST form. In reality, it should be completed by individuals with an understanding of the vehicle registration process, such as authorized dealers or agents familiar with the requirements.

2. Only One Copy Needs to be Submitted - Some think that submitting a single copy is enough. However, there are three specific copies of the MV-4ST form: one for PennDOT, one for the dealer, and one for the applicant. Each serving an important purpose in the registration process.

3. The Vehicle Identification Number (VIN) is Optional - There is a common misconception that including the VIN is optional. In fact, the complete VIN is a crucial part of the application process and must match the proof of ownership document.

4. Tax and Fees Are Fixed - A lot of people assume that tax and fees remain constant no matter the location. In truth, sales tax rates vary depending on the county or city, with additional fees in places like Allegheny County and Philadelphia.

5. Title Transfer is Automatic Upon Submission - Some believe that submitting the MV-4ST automatically transfers the vehicle title. This is not true; the title transfer will only be recognized once PennDOT processes the application and issues the new certificate of title.

6. All Information Has to Be Perfect the First Time - Many applicants worry that any kind of mistake will lead to rejection. While accuracy is important, PennDOT allows corrections in specific circumstances as long as the necessary steps are followed to amend the form properly.

Key takeaways

The MV-4ST form is required for obtaining a Pennsylvania Certificate of Title for vehicles currently titled in Pennsylvania.

Submit the white copy of the MV-4ST form to PennDOT and retain the yellow and pink copies for your records.

Record the vehicle's complete title number and VIN accurately to match the proof of ownership document.

Section A requires information about the vehicle, including its make, model year, and condition.

When listing owners in Sections C and D, provide full legal names as they appear on identification documents.

Always check and confirm the applicant’s address matches the identification details before submission.

If trading in a vehicle, provide details about the trade-in vehicle according to the guidelines in Section E.

Attach valid proof of insurance if you request a new registration plate from PennDOT.

For tax calculations, the purchase price should include any lien or obligation assumed, and sales tax varies by location.

The form must be signed by all purchasers to certify the information is true, ensuring compliance with the requirements.

Payment via check or money order for fees owed should be made to the Commonwealth of Pennsylvania, ensuring the total is accurate.

Browse Other Templates

Newbury College Transcripts - Personal information must be accurately entered for proper identification.

R229 - On the form, applicants provide personal details such as name, gender, date of birth, and contact information.