Fill Out Your Mv70S Form

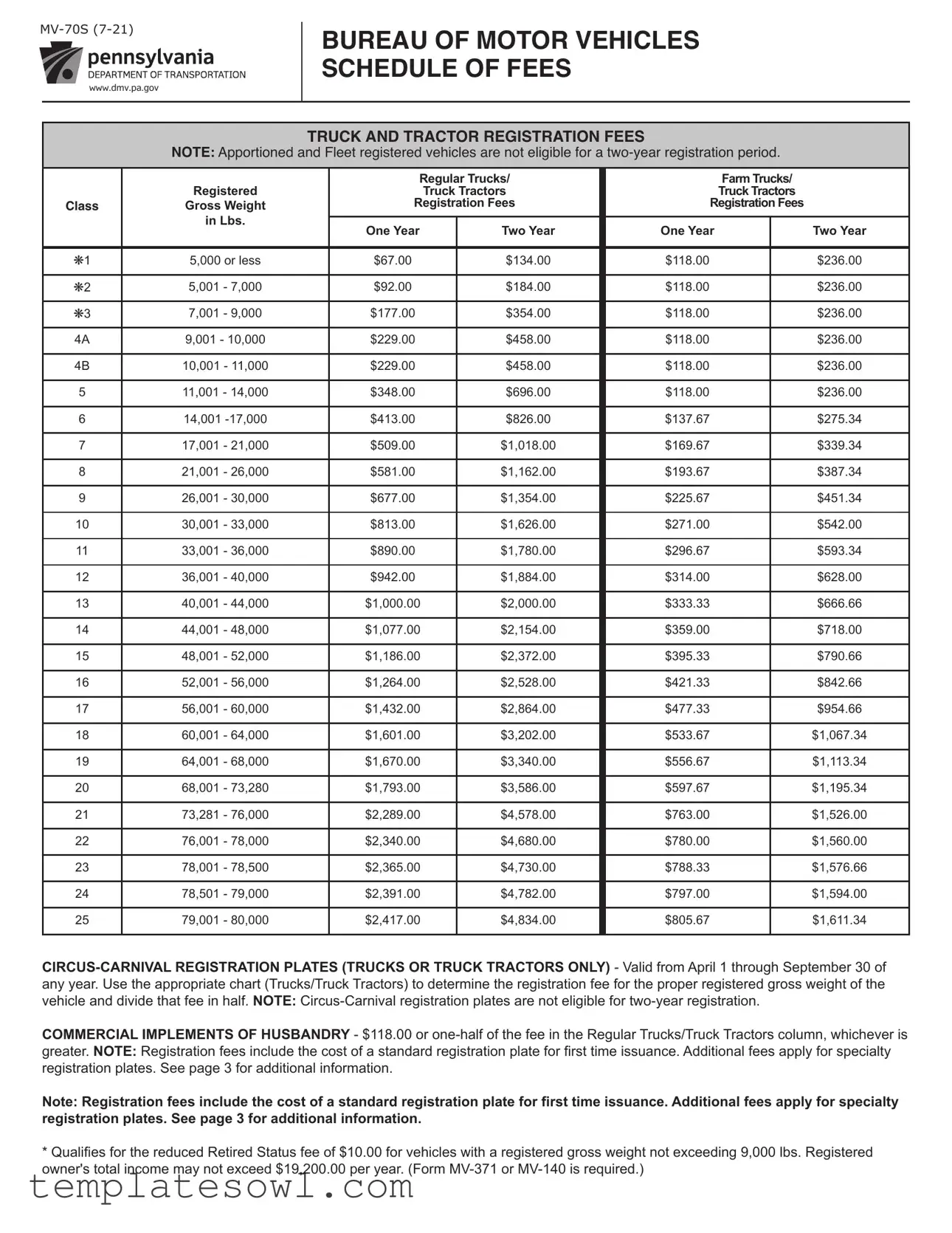

The MV70S form is a critical document for vehicle owners, particularly for those registering trucks and tractors in Pennsylvania. It delineates the fee structure associated with different vehicle classifications based on their gross weight. For instance, registration fees vary significantly depending on whether the vehicle is a regular truck, farm truck, or a truck tractor, with specific rates set for each weight category. Additionally, the form outlines fees associated with trailers, buses, motor homes, and other specialty vehicles. Unique provisions exist for circus-carnival registrations, emphasizing the form's breadth. Notably, for commercial implements of husbandry, a separate fee structure applies. Furthermore, the MV70S details registration options, such as one-year and two-year periods, and highlights special fees for personalized and military registration plates, as well. This comprehensive fee schedule ensures that vehicle owners understand their obligations and options when it comes to vehicle registration.

Mv70S Example

www.dmv.pa.gov

BUREAU OF MOTOR VEHICLES SCHEDULE OF FEES

TRUCK AND TRACTOR REGISTRATION FEES

NOTE: Apportioned and Fleet registered vehicles are not eligible for a

|

Registered |

Regular Trucks/ |

|

Farm Trucks/ |

|

||||

|

|

Truck Tractors |

|

Truck Tractors |

|

||||

Class |

Gross Weight |

Registration Fees |

|

Registration Fees |

|

||||

|

in Lbs. |

|

|

|

|

|

|

|

|

|

One Year |

|

Two Year |

|

One Year |

|

Two Year |

||

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

k1 |

5,000 or less |

$67.00 |

|

$134.00 |

|

$118.00 |

|

$236.00 |

|

|

|

|

|

|

|

|

|

|

|

k2 |

5,001 |

- 7,000 |

$92.00 |

|

$184.00 |

|

$118.00 |

|

$236.00 |

|

|

|

|

|

|

|

|

|

|

k3 |

7,001 |

- 9,000 |

$177.00 |

|

$354.00 |

|

$118.00 |

|

$236.00 |

|

|

|

|

|

|

|

|

|

|

4A |

9,001 - 10,000 |

$229.00 |

|

$458.00 |

|

$118.00 |

|

$236.00 |

|

|

|

|

|

|

|

|

|

|

|

4B |

10,001 - 11,000 |

$229.00 |

|

$458.00 |

|

$118.00 |

|

$236.00 |

|

|

|

|

|

|

|

|

|

|

|

5 |

11,001 - 14,000 |

$348.00 |

|

$696.00 |

|

$118.00 |

|

$236.00 |

|

|

|

|

|

|

|

|

|

|

|

6 |

14,001 |

$413.00 |

|

$826.00 |

|

$137.67 |

|

$275.34 |

|

|

|

|

|

|

|

|

|

|

|

7 |

17,001 |

- 21,000 |

$509.00 |

|

$1,018.00 |

|

$169.67 |

|

$339.34 |

|

|

|

|

|

|

|

|

|

|

8 |

21,001 |

- 26,000 |

$581.00 |

|

$1,162.00 |

|

$193.67 |

|

$387.34 |

|

|

|

|

|

|

|

|

|

|

9 |

26,001 |

- 30,000 |

$677.00 |

|

$1,354.00 |

|

$225.67 |

|

$451.34 |

|

|

|

|

|

|

|

|

|

|

10 |

30,001 |

- 33,000 |

$813.00 |

|

$1,626.00 |

|

$271.00 |

|

$542.00 |

|

|

|

|

|

|

|

|

|

|

11 |

33,001 |

- 36,000 |

$890.00 |

|

$1,780.00 |

|

$296.67 |

|

$593.34 |

|

|

|

|

|

|

|

|

|

|

12 |

36,001 |

- 40,000 |

$942.00 |

|

$1,884.00 |

|

$314.00 |

|

$628.00 |

|

|

|

|

|

|

|

|

|

|

13 |

40,001 |

- 44,000 |

$1,000.00 |

|

$2,000.00 |

|

$333.33 |

|

$666.66 |

|

|

|

|

|

|

|

|

|

|

14 |

44,001 |

- 48,000 |

$1,077.00 |

|

$2,154.00 |

|

$359.00 |

|

$718.00 |

|

|

|

|

|

|

|

|

|

|

15 |

48,001 |

- 52,000 |

$1,186.00 |

|

$2,372.00 |

|

$395.33 |

|

$790.66 |

|

|

|

|

|

|

|

|

|

|

16 |

52,001 |

- 56,000 |

$1,264.00 |

|

$2,528.00 |

|

$421.33 |

|

$842.66 |

|

|

|

|

|

|

|

|

|

|

17 |

56,001 |

- 60,000 |

$1,432.00 |

|

$2,864.00 |

|

$477.33 |

|

$954.66 |

|

|

|

|

|

|

|

|

|

|

18 |

60,001 |

- 64,000 |

$1,601.00 |

|

$3,202.00 |

|

$533.67 |

|

$1,067.34 |

|

|

|

|

|

|

|

|

|

|

19 |

64,001 |

- 68,000 |

$1,670.00 |

|

$3,340.00 |

|

$556.67 |

|

$1,113.34 |

|

|

|

|

|

|

|

|

|

|

20 |

68,001 |

- 73,280 |

$1,793.00 |

|

$3,586.00 |

|

$597.67 |

|

$1,195.34 |

|

|

|

|

|

|

|

|

|

|

21 |

73,281 |

- 76,000 |

$2,289.00 |

|

$4,578.00 |

|

$763.00 |

|

$1,526.00 |

|

|

|

|

|

|

|

|

|

|

22 |

76,001 |

- 78,000 |

$2,340.00 |

|

$4,680.00 |

|

$780.00 |

|

$1,560.00 |

|

|

|

|

|

|

|

|

|

|

23 |

78,001 |

- 78,500 |

$2,365.00 |

|

$4,730.00 |

|

$788.33 |

|

$1,576.66 |

|

|

|

|

|

|

|

|

|

|

24 |

78,501 |

- 79,000 |

$2,391.00 |

|

$4,782.00 |

|

$797.00 |

|

$1,594.00 |

|

|

|

|

|

|

|

|

|

|

25 |

79,001 |

- 80,000 |

$2,417.00 |

|

$4,834.00 |

|

$805.67 |

|

$1,611.34 |

|

|

|

|

|

|

|

|

|

|

COMMERCIAL IMPLEMENTS OF HUSBANDRY - $118.00 or

Note: Registration fees include the cost of a standard registration plate for first time issuance. Additional fees apply for specialty registration plates. See page 3 for additional information.

*Qualifies for the reduced Retired Status fee of $10.00 for vehicles with a registered gross weight not exceeding 9,000 lbs. Registered owner's total income may not exceed $19,200.00 per year. (Form

TRAILER AND

Trailers 10,000 lbs. or less may be registered

for periods of one year or five years.

Registered Gross |

|

Registration Fee |

|

||

Weight in Lbs. |

One Year |

|

5 Yr Opt. |

|

Optional |

|

|

|

|

|

Permanent |

3,000 or less |

$6.00 |

|

$30.00 |

|

N/A |

|

|

|

|

|

|

3,001 to 10,000 |

$12.00 |

|

$60.00 |

|

N/A |

|

|

|

|

|

|

10,001 or more |

$38.00 |

|

N/A |

|

$184.00 |

RECREATIONAL TRAILER & RECREATIONAL CARGO TRAILER

Trailers 13,000 lbs or less may be registered

for periods of one year or five years.

Registered Gross |

|

Registration Fee |

|

||

|

|

|

|

|

|

Weight in Lbs. |

|

5 Yr Opt. |

|

Optional |

|

|

|

|

|

|

Permanent |

8,000 or less |

$12.00 |

|

$60.00 |

|

N/A |

|

|

|

|

|

|

8,001 - 13,000 |

$36.00 |

|

$180.00 |

|

N/A |

|

|

|

|

|

|

13,001 or more |

$94.00 |

|

N/A |

|

$442.00 |

|

|

|

|

|

|

BUS AND LIMOUSINE REGISTRATION FEES

Buses and limousines that participate in the International Registration Plan (IRP) are not eligible for a

|

REGISTRATION FEE |

|

|

REGISTRATION FEE |

|

|

|

|

|

|

|

Seating Capacity |

One Year |

Two Year |

Seating Capacity |

One Year |

Two Year |

|

|

|

|

|

|

6 |

$84.00 |

$168.00 |

30 |

$434.00 |

$868.00 |

|

|

|

|

|

|

7 |

$98.00 |

$196.00 |

31 |

$452.00 |

$904.00 |

|

|

|

|

|

|

8 |

$112.00 |

$224.00 |

32 |

$470.00 |

$940.00 |

|

|

|

|

|

|

9 |

$126.00 |

$252.00 |

33 |

$488.00 |

$976.00 |

|

|

|

|

|

|

10 |

$140.00 |

$280.00 |

34 |

$506.00 |

$1,012.00 |

|

|

|

|

|

|

11 |

$154.00 |

$308.00 |

35 |

$524.00 |

$1,048.00 |

|

|

|

|

|

|

12 |

$168.00 |

$336.00 |

36 |

$542.00 |

$1,084.00 |

|

|

|

|

|

|

13 |

$182.00 |

$364.00 |

37 |

$560.00 |

$1,120.00 |

|

|

|

|

|

|

14 |

$196.00 |

$392.00 |

38 |

$578.00 |

$1,156.00 |

|

|

|

|

|

|

15 |

$210.00 |

$420.00 |

39 |

$596.00 |

$1,192.00 |

|

|

|

|

|

|

16 |

$224.00 |

$448.00 |

40 |

$614.00 |

$1,228.00 |

|

|

|

|

|

|

17 |

$238.00 |

$476.00 |

41 |

$632.00 |

$1,264.00 |

|

|

|

|

|

|

18 |

$252.00 |

$504.00 |

42 |

$650.00 |

$1,300.00 |

|

|

|

|

|

|

19 |

$266.00 |

$532.00 |

43 |

$668.00 |

$1,336.00 |

|

|

|

|

|

|

20 |

$280.00 |

$560.00 |

44 |

$686.00 |

$1,372.00 |

|

|

|

|

|

|

21 |

$294.00 |

$588.00 |

45 |

$704.00 |

$1,408.00 |

|

|

|

|

|

|

22 |

$308.00 |

$616.00 |

46 |

$722.00 |

$1,444.00 |

|

|

|

|

|

|

23 |

$322.00 |

$644.00 |

47 |

$740.00 |

$1,480.00 |

|

|

|

|

|

|

24 |

$336.00 |

$672.00 |

48 |

$758.00 |

$1,516.00 |

|

|

|

|

|

|

25 |

$350.00 |

$700.00 |

49 |

$776.00 |

$1,552.00 |

|

|

|

|

|

|

26 |

$364.00 |

$728.00 |

50 |

$794.00 |

$1,588.00 |

|

|

|

|

|

|

27 |

$380.00 |

$760.00 |

51 |

$812.00 |

$1,624.00 |

|

|

|

|

|

|

28 |

$398.00 |

$796.00 |

52 or more |

$834.00 |

$1,668.00 |

|

|

|

|

|

|

29 |

$416.00 |

$832.00 |

|

|

|

|

|

|

|

|

|

MOTOR HOME REGISTRATION FEES

Registered |

Registration Fee |

|

Gross Weight in Lbs. |

One Year |

Two Year |

|

|

|

8,000 or less |

$73.00 |

$146.00 |

|

|

|

8,001 to 11,000 |

$101.00 |

$202.00 |

|

|

|

11,001 or more |

$130.00 |

$260.00 |

|

|

|

NOTE: Registration fees include the cost of a standard registration plate for first time issuance. Additional fees apply for specialty registration plates. See page 3 for additional information.

kQualifies for the reduced Retired Status fee of $10 for vehicles with a registered gross weight not exceeding 9,000 lbs. Registered owner's total income may not exceed $19,200 per year. (Form

OTHER REGISTRATION FEES

CLASS |

Registration Fee |

||

|

|

||

One Year |

Two Year |

||

|

|||

k Passenger |

$39.00 |

$78.00 |

|

|

|

|

|

Motorcycle |

$21.00 |

$42.00 |

|

|

|

|

|

$9.00 |

$18.00 |

||

|

|

|

|

Motorized Pedalcycle |

$9.00 |

$18.00 |

|

|

|

|

|

Ambulances and Hearses |

$86.00 |

$172.00 |

|

|

|

|

|

Taxi (8 Passenger or less excluding driver) |

$86.00 |

$172.00 |

|

|

|

|

|

School Bus/School Vehicle |

$37.00 |

$74.00 |

|

|

|

|

|

Implements of Husbandry |

$29.00 |

$58.00 |

|

|

|

|

|

Special Mobile Equipment |

$58.00 |

$116.00 |

|

|

|

|

|

DEALER REGISTRATION PLATE FEES |

|

Registration Fee |

|

Fee to personalize Dealer registration plates is an additional $112. |

One Year |

|

Two Year |

|

|

||

Moped Dealer |

$16.00 |

|

$32.00 |

|

|

|

|

$16.00 |

|

$32.00 |

|

|

|

|

|

Motorcycle Dealer |

$29.00 |

|

$58.00 |

|

|

|

|

Manufacturer |

$58.00 |

|

$116.00 |

|

|

|

|

Trailer Dealer |

$58.00 |

|

$116.00 |

|

|

|

|

New/Used Vehicle Dealer |

$58.00 |

|

$116.00 |

|

|

|

|

Financier or |

$58.00 |

|

$116.00 |

|

|

|

|

Repair or Towing |

$58.00 |

|

$116.00 |

|

|

|

|

Transporter |

$58.00 |

|

$116.00 |

|

|

|

|

Vehicle Salvage Dealer |

$58.00 |

|

$116.00 |

|

|

|

|

Watercraft Trailer Dealer |

$58.00 |

|

$116.00 |

|

|

|

|

Special Mobile Equipment Dealer |

$58.00 |

|

$116.00 |

|

|

|

|

Utility Trailer Dealer |

$58.00 |

|

$116.00 |

|

|

|

|

•Farm Equipment Dealer - $376.00 or

•Multipurpose Dealer - See fee listed in the Regular Trucks/Truck Tractor columns.

SPECIALTY REGISTRATION PLATE FEES |

Fee |

Fee with |

|

Personalization |

|||

|

|

||

Amateur Radio Operator |

$11.00 |

N/A |

|

|

|

|

|

Antique, Classic and Collectible (Fee is in addition to $58.00 certificate of title fee.) |

$84.00 |

$196.00 |

|

|

|

|

|

Disabled Veteran |

$11.00 |

$67.00 |

|

|

|

|

|

Emergency Vehicle |

$11.00 |

$123.00 |

|

|

|

|

|

Gold Star Family |

$23.00 |

$135.00 |

|

|

|

|

|

Hearing Impaired |

$11.00 |

$123.00 |

|

|

|

|

|

Historic Military Vehicle (Fee is in addition to $58.00 certificate of title fee and $84.00 Antique/Classic |

$81.00 |

$193.00 |

|

registration fee.) |

|||

|

|

||

|

|

|

|

In God We Trust |

$23.00 |

$135.00 |

|

|

|

|

|

Legislative (The replacement fee for these special plates is $85.00.) |

$85.00 |

N/A |

|

|

|

|

|

Judicial (The replacement fee for these special registration plates is $28.00.) |

$28.00 |

N/A |

|

|

|

|

|

PA Steel Worker (The replacement fee for these special plates is $23.00.) |

$23.00 |

$135.00 |

|

|

|

|

|

Personalized (The replacement fee for these special plates is $85.00.) |

N/A |

$85.00 |

|

|

|

|

|

Persons with Disability |

$11.00 |

$67.00 |

|

|

|

|

|

Press Photographer |

$11.00 |

$123.00 |

|

|

|

|

|

Severely Disabled Veteran |

$11.00 |

$67.00 |

|

|

|

|

|

Special Organization (The participating organizations may charge an initial and renewal fee. |

$28.00 |

$140.00 |

|

Please contact the organization representative for payment information.) |

|||

|

|

||

|

|

|

|

Street Rod |

$57.00 |

$169.00 |

|

|

|

|

|

Teen Driver |

$11.00 |

$123.00 |

|

|

|

|

|

USA Semiquincentennial |

$52.00 |

$164.00 |

|

|

|

|

|

Vertical Motorcycle (The replacement fee for these special plates is $23.00.) |

$23.00 |

$135.00 |

|

|

|

|

|

Vintage (Fee is in addition to $58.00 certificate of title fee and $84.00 Antique/Classic registration fee.) |

$84.00 |

N/A |

|

|

|

|

NOTE: Registration fees include the cost of a standard registration plate for first time issuance. Additional fees apply for specialty registration plates.

SPECIAL FUND REGISTRATION PLATE FEES |

FEE |

FEE WITH |

|

PERSONALIZATION |

|||

|

|

||

Preserve Our Heritage - The |

$57.00 |

N/A |

|

registration fee ($23.00 goes to the established fund). |

|||

|

|

||

Zoological Council - The |

$57.00 |

$169.00 |

|

registration fee ($23.00 goes to the established fund). |

|||

|

|

||

PA Monuments - The |

$57.00 |

$169.00 |

|

registration fee ($23.00 goes to the established fund). |

|||

|

|

||

Wild Resource Conservation - The |

$38.00 |

$150.00 |

|

registration fee ($15.00 goes to the established fund). |

|||

|

|

||

Honoring Our Veterans - The |

$38.00 |

$150.00 |

|

registration fee ($15.00 goes to the established fund). |

|||

|

|

||

Honoring Our Veterans Motorcycle - The |

$38.00 |

$150.00 |

|

to the registration fee ($15.00 goes to the established fund). |

|||

|

|

||

Honoring Our Women Veterans - The |

$37.00 |

$149.00 |

|

to the registration fee ($15.00 goes to the established fund). |

|||

|

|

||

Distracted Driving Awareness (All proceeds from the purchase of this registration plate |

|

|

|

will be used exclusively to advance public education and outreach on the dangers posed |

$40.00 |

$152.00 |

|

by distracted driving.) |

|

|

|

Share the Road (All proceeds from the purchase of this registration plate will help fund |

$40.00 |

$152.00 |

|

the Department's Bicycle & Pedestrian safety efforts.) |

|||

|

|

||

|

|

|

|

MILITARY REGISTRATION PLATE FEES |

FEES |

FEE WITH |

|

PERSONALIZATION |

|||

Air Force Cross |

$10.00 |

$122.00 |

|

Airborne Unit |

$23.00 |

$135.00 |

|

Bronze Star |

$23.00 |

$135.00 |

|

Bronze Star for Valor |

$10.00 |

$122.00 |

|

Combat Action Badge |

$23.00 |

$135.00 |

|

Combat Action Medal |

$23.00 |

$135.00 |

|

Combat Action Ribbon |

$23.00 |

$135.00 |

|

Combat Infrantryman Badge |

$23.00 |

$135.00 |

|

Combat Medical Badge |

$23.00 |

$135.00 |

|

Distinguished Flying Cross |

$10.00 |

$122.00 |

|

Distinguished Service Cross |

$10.00 |

$122.00 |

|

Expeditionary Forces |

$23.00 |

$135.00 |

|

$11.00 |

$123.00 |

||

Korean Defense Service |

$23.00 |

$135.00 |

|

Korean War Veteran |

$23.00 |

$135.00 |

|

Legion of Merit |

$22.00 |

$134.00 |

|

Medal of Honor |

$11.00 |

N/A |

|

Navy Cross |

$10.00 |

$122.00 |

|

Operation Enduring Freedom |

$23.00 |

$135.00 |

|

Operation Iraqi Freedom |

$23.00 |

$135.00 |

|

Pearl Harbor Survivor |

$23.00 |

$135.00 |

|

Persian Gulf War Veteran |

$23.00 |

$135.00 |

|

Presidential Service Badge |

$22.00 |

$134.00 |

|

Purple Heart |

$11.00 |

$123.00 |

|

Purple Heart Motorcycle |

$11.00 |

$123.00 |

|

Silver Star |

$10.00 |

$122.00 |

|

Soldier’s Medal |

$22.00 |

$134.00 |

|

US Air Force |

$23.00 |

$135.00 |

|

US Air Force Veteran |

$23.00 |

$135.00 |

|

US Army |

$23.00 |

$135.00 |

|

US Army Veteran |

$23.00 |

$135.00 |

|

US Coast Guard |

$23.00 |

$135.00 |

|

US Coast Guard Veteran |

$23.00 |

$135.00 |

|

US Marine Corps |

$23.00 |

$135.00 |

|

US Marine Corps Veteran |

$23.00 |

$135.00 |

|

US Merchant Marine |

$23.00 |

$135.00 |

|

US Navy |

$23.00 |

$135.00 |

|

US Navy Veteran |

$23.00 |

$135.00 |

|

Veteran |

$23.00 |

$135.00 |

|

Veterans of an Allied Foreign Country |

$22.00 |

$134.00 |

|

Veteran Motorcycle |

$23.00 |

$135.00 |

|

Vietnam War Veteran |

$23.00 |

$135.00 |

|

World War II Veteran |

$23.00 |

$135.00 |

|

|

ADDITIONAL FEE INFORMATION |

|

|

Transfer of Registration Plate |

$9.00 |

|

|

|

|

|

|

Replacement of Standard Issued Registration Plate |

$11.00 |

|

|

|

|

|

|

Duplicate Credential (issued through the mail and not received within 90 days) |

No Fee |

|

|

|

|

|

|

Duplicate Registration Card (at time of initial registration, transfer, renewal or replacement of registration plate) |

$2.00 |

|

|

Duplicate Registration Card (if done online) |

No Fee |

|

|

|

|

|

|

Duplicate Registration Card (governmental and |

Exempt |

|

|

|

|

|

|

Duplicate Registration Card (at any time other than identified above) |

$6.00 |

|

Farm Truck |

|

||

Type A - |

A vehicle with a gross vehicle weight or combination weight or weight rating of 10,000 lbs. or less. - requires no |

$27.00 |

|

|

|

inspection(daylight operation only) |

$27.00 |

Type B - |

A vehicle with a gross vehicle weight or combination weight or weight rating of 10,001 lbs. and not exceeding 17,000 lbs. |

||

|

|

- requires no inspection (daylight operation only) |

$56.00 |

Type C - |

A vehicle with a gross vehicle weight or combination weight or weight rating of 17,001 lbs. or greater |

||

|

|

- requires no inspection(daylight operation only) |

$112.00 |

Type D - |

A vehicle with a gross vehicle weight or combination weight or weight rating of 17,001 lbs. or greater. - requires an annual |

||

|

|

inspection (no time restriction for operation) |

|

|

|

|

|

|

Certificate of Title |

$58.00 |

|

|

|

|

|

|

Duplicate Certificate of Title (lost, destroyed, etc.) |

$58.00 |

|

|

|

|

|

|

Recording a Lien (Fee is per lien recorded in addition to title fee) |

$28.00 |

|

|

|

|

|

|

Dealer’s Notification |

$5.00 |

|

|

Copies of Records |

$12.00 |

|

|

|

|

|

|

Certified Copies of Records (Fee is in addition to the $12.00 record fee) |

$26.00 |

|

|

|

|

|

|

Annual Inspection Sticker |

$9.00 |

|

|

$7.00 |

||

|

|

|

|

|

Emission Inspection Sticker |

No Fee |

|

|

|

|

|

|

Civil Penalty in Lieu of Suspension |

$500.00 |

|

|

|

|

|

|

Processing Fee in Lieu of Registration |

$10.00 |

|

|

|

|

|

|

Motor Vehicle Registration Restoration |

$98.00 |

|

|

|

|

|

|

Out of Service Order Restoration |

$79.00 |

|

|

|

|

|

|

$10.00 |

||

|

Secure Power of Attorney Documents |

$26.00 |

|

|

|

|

|

|

Uncollectible Check (Return Check) Transaction Fee (Fee is in addition to the $20.00 Uncollectible Check Penalty.) |

$40.00 |

|

|

|

|

|

|

Motor Vehicle Recovery Fund |

$60.00 |

|

Messenger Service Fees |

$22.00 |

||

- |

Location Transfer |

||

- |

Additional Place of Business |

$107.00 |

|

- |

Annual Registration Fees |

$215.00 |

|

|

|

|

|

|

Temporary Registration Plates (Cost to Dealer or Agent) |

$17.00 |

|

|

|

|

|

|

Fee for Local Use – Annual fee for |

|

|

|

each year the registration is valid. NOTE: For a list of participating counties, refer to the “Fee for Local Use – Participating Counties" |

$5.00 |

|

|

Fact Sheet. |

|

|

|

|

|

|

|

Salvor Reclaim Fee |

$56.00 |

|

|

|

|

|

|

Fee for Authorization to Issue Apportioned Credentials |

$75.00 |

|

|

|

|

|

|

Change of Address |

No Fee |

|

|

|

|

|

|

Person with Disability Placard |

No Fee |

|

|

|

|

|

|

Severely Disabled Veteran Motorcycle Decal |

No Fee |

|

|

|

|

|

Visit us at www.dmv.pa.gov or call us at

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Title | The MV-70S form is officially called the "Schedule of Fees for Truck and Tractor Registration Fees" and is issued by the Bureau of Motor Vehicles in Pennsylvania. |

| Registration Periods | Vehicles registered under Apportioned and Fleet categories are not eligible for a two-year registration period. All others may choose between one-year or two-year options. |

| Fee Categories | Registration fees vary based on vehicle class and gross weight. Specific fees have been established for Regular Trucks, Farm Trucks, and Truck Tractors. |

| Special Rates | Circus-Carnival registration plates are valid from April 1 to September 30 each year and are not eligible for two-year registration. Fees are half the standard rate for the vehicle's weight. |

| Retired Status | A reduced fee of $10.00 is available for vehicles with a registered gross weight not exceeding 9,000 lbs, provided the owner's annual income does not exceed $19,200. |

| Additional Fees | Registration fees cover the cost of a standard registration plate for first-time issuance, though extra charges apply for specialty plates. |

Guidelines on Utilizing Mv70S

Completing the MV-70S form is an important step when registering your vehicle. Whether you're renewing a registration or applying for a new one, following the correct process will ensure a smooth experience. Below are the steps to guide you through filling out this form effectively.

- Obtain the MV-70S form: Visit the Pennsylvania Department of Motor Vehicles (DMV) website or request a physical copy from your local DMV office.

- Read the instructions: Familiarize yourself with the guidelines provided on the form to understand the specific requirements related to your vehicle type.

- Enter your personal information: Fill in the required fields with your name, address, and contact information. Ensure each detail is accurate to avoid processing delays.

- Specify your vehicle details: Provide information about your vehicle, including its make, model, year, and Vehicle Identification Number (VIN).

- Indicate the registration type: Choose whether you are registering a truck, trailer, bus, or another type of vehicle. Refer to the relevant section on the form.

- Select the appropriate fee: Use the fee schedule included in the form to identify the registration fee based on your vehicle's classification and gross weight.

- Review and sign: Carefully review your entries for accuracy. Your signature certifies that all information provided is true and correct.

- Submit the form: Return the completed form either in person or by mail, along with the applicable payment for the registration fees.

Following these steps will help ensure your MV-70S form is filled out correctly and submitted without delay. Always keep a copy of your completed form and any correspondence for your records.

What You Should Know About This Form

What is the MV70S form?

The MV70S form is a schedule of fees for registering trucks and tractors in Pennsylvania. It provides information on the costs associated with various classes of vehicles based on their weight and type, including one-year and two-year registration fees.

Who needs to use the MV70S form?

This form is primarily for individuals and businesses looking to register trucks, truck tractors, and trailers in Pennsylvania. It is relevant for commercial operators, as well as those registering personal vehicles that fall under the specified classes.

What are the different registration fee categories listed in the MV70S?

The MV70S outlines fees based on vehicle classes. Categories include registered regular trucks, farm trucks, truck tractors, trailers, motor homes, buses, limousines, and more. Each category has specific fee structures, which vary according to the vehicle's weight and type.

Are there reduced fees available for certain vehicles?

Yes, some vehicles qualify for reduced fees. For example, vehicles with a gross weight not exceeding 9,000 pounds may qualify for a reduced Retired Status fee of $10. However, the registered owner's total income must not exceed $19,200 annually, and specific forms (MV-371 or MV-140) are required.

Can I register a vehicle for a period longer than one or two years?

No, most vehicles listed in the MV70S form are only eligible for one-year or two-year registration periods. Exceptions include certain trailers, which may have options for five-year registrations or permanent registration in some cases.

What fees are associated with trailer registrations?

Trailer registration fees vary by weight. For example, trailers 3,000 pounds or less have a one-year fee of $6, while those over 10,001 pounds carry a fee of $38. Some trailers may also qualify for five-year or permanent registration options.

Are there any additional fees I should be aware of when registering?

Yes, additional fees apply in various circumstances, such as for transferring or replacing registration plates and duplicate registration cards. It's essential to review the detailed fee structure to understand any potential additional costs.

What types of specialty registration plates are mentioned in the MV70S form?

The MV70S highlights various specialty registration plates, including amateur radio operator, antique, disabled veteran plates, and more. Each specialty plate comes with its own fee, which may include personalization options.

Where can I find more information if I have questions about the MV70S form?

For more information, you can visit the Pennsylvania Department of Motor Vehicles website at www.dmv.pa.gov or call their office directly at 717-412-5300. TTY assistance is available by dialing 711.

Common mistakes

When completing the MV-70S form, many individuals make simple mistakes that can lead to delays or complications in the registration process. One common error is failing to select the correct weight class for the vehicle. This form requires specific weight categories to determine the appropriate registration fees. Providing the wrong weight can result in incorrect fee calculations, leading to potential rejection of the application.

Another frequent mistake is not checking the registration period options. The MV-70S allows for one-year or two-year registration fees, but this may not apply to certain vehicles, such as apportioned or fleet registered vehicles. Not carefully reading through the guidelines can lead to selecting the wrong period and incurring additional fees later on.

Many people also forget to include all necessary documentation. Complete applications require supporting documents like proof of insurance and identification. Missing these documents can cause significant delays in processing the registration.

Another mistake arises when individuals fail to sign the form. A signature is essential for validating the application. Without it, the DMV cannot process the request, which can lead to extended wait times for registration.

Some applicants overlook the need for accurate payment information. Individuals should ensure they fill out the payment section correctly, including credit card numbers or check details. Errors in this section can result in payment failures and registration delays.

Lastly, many individuals do not print or save a copy of their completed form for their records. Keeping a copy can be helpful for tracking the application status and providing proof of submission if issues arise. By being aware of these common mistakes, applicants can enhance their chances of a smooth registration process.

Documents used along the form

The MV-70S form plays a critical role in the registration of trucks and truck tractors in Pennsylvania. However, it is often accompanied by several other forms and documents that facilitate the registration process and ensure compliance with state requirements. Understanding these documents can help vehicle owners navigate the registration landscape more effectively.

- Form MV-371: This form is necessary for vehicles with a registered gross weight not exceeding 9,000 lbs. It allows owners with an income of $19,200 or less to qualify for a reduced Retired Status fee.

- Form MV-140: Similar to MV-371, this form also targets owners of lighter vehicles seeking a reduced registration fee based on income. It supports the same reduced fee structure.

- Certificate of Title: Required for the initial registration of a vehicle, this document serves as proof of ownership. It must be presented when registering a truck or tractor.

- Application for Duplicate Title: Should a title be lost or destroyed, this form can be filed to obtain a replacement title. This step is crucial for compliance and for securing any loans tied to the vehicle.

- Liens Recording Form: If there is a lien on the vehicle, this document records the lender's interest, protecting their investment. This form is essential for ensuring that all financial obligations are transparent.

- Annual Inspection Form: This document confirms that a vehicle has passed the necessary safety and emissions inspections required by Pennsylvania law before registration or renewal.

Utilizing the appropriate forms and understanding their purposes can significantly streamline the registration process for truck owners in Pennsylvania. By ensuring that all documentation is in order, vehicle owners can avoid unnecessary delays and potential complications, allowing for smoother vehicle operations on the road.

Similar forms

- MV-70: Similar to the MV-70S, this form outlines registration fees for different classes of vehicles but does not differentiate between one-year and two-year fees.

- MV-362: This form covers fees for various special registration plates, providing details on the additional costs associated with personalization and specific categories.

- MV-371: This document addresses reduced registration fees for retired status, specifically designed for eligible vehicle owners with defined income limits.

- MV-140: Like the MV-371, this form also pertains to reduced fees but targets a broader audience, encompassing various vehicle types with specific income conditions.

- MV-11: This form is used for vehicle title applications and includes related fees, similar to how MV-70S lists fees pertaining to registration processes for trucks and tractors.

- MV-12: This document contains the costs associated with transferring vehicle titles, paralleling MV-70S in its focus on financial transactions related to vehicle ownership.

- MV-53: This form details the fees for duplicate registration cards, to be used in conjunction with the original registrations outlined in MV-70S.

- MV-44: Similar in nature, this form outlines licensing fees and requirements for motorcycle registrations, providing comparative vehicle classifications.

- MV-313: This document discusses commercial vehicle registrations, focusing on fees that vary based on weight categories, much like the MV-70S format.

- MV-83: This form applies to abandoned vehicle notifications and includes information on related fees, showcasing another aspect of vehicle registration administration.

Dos and Don'ts

When filling out the MV70S form, there are several important do's and don'ts to consider. Adhering to these guidelines can ensure a smoother registration process. Here’s a helpful list:

- DO ensure that all information is accurately filled out to avoid delays.

- DO review the registration fees based on the gross weight of your vehicle.

- DO include any necessary supplemental forms required for your vehicle classification.

- DO verify your eligibility for reduced fees if applicable, such as the Retired Status fee.

- DO provide a valid proof of identity when submitting your application.

- DON'T use a pencil; all information should be filled out in permanent ink or typed.

- DON'T leave any sections blank; if a section does not apply, mark it as "N/A."

- DON'T forget to sign the application, as an unsigned form will be rejected.

- DON'T ignore submission deadlines; late applications may incur additional fees.

- DON'T overlook the need for additional fees if applying for specialty plates.

Misconceptions

Misunderstandings about the MV70S registration form can lead to confusion and errors. Here are seven common misconceptions:

- All vehicles are eligible for a two-year registration period. This is not accurate. Vehicles that are apportioned or fleet registered cannot take advantage of the two-year registration.

- Registration fees are the same for all weight classes. In fact, registration fees vary significantly based on the vehicle's gross weight. The weight class dictates how much one must pay.

- Farm trucks are treated the same as regular trucks. While farm trucks may have similar registration processes, certain exemptions and reduced fees apply to them under specific conditions.

- There is a flat fee for all trailer registrations. This is misleading. Trailer registration fees change based on weight and the chosen registration period, with different costs for one year versus five years.

- Specialty plates incur no additional fees. In reality, applying for specialty registration plates often incurs additional costs, making them pricier than standard plates.

- All vehicles qualify for reduced fees based on veteran status. Not every vehicle is eligible. Only those that meet specific criteria, such as weight and income restrictions, can qualify for discounted rates.

- The MV70S form provides complete and final guidance on registration. Not quite. While the MV70S offers valuable information, individuals may need to refer to additional resources or forms for comprehensive details on registration, especially concerning various vehicle types.

Understanding these misconceptions can facilitate a smoother registration process and ensure compliance with regulations. Always consult the appropriate resources for the most accurate and detailed information.

Key takeaways

Understanding the MV70S Form is vital for anyone involved in registering trucks, trailers, or related vehicles in Pennsylvania. Here are some key takeaways to help you navigate the form effectively:

- Know the registration fees: The MV70S outlines specific fees based on the gross weight of your vehicle. Understanding these fees will help you budget appropriately.

- Determine eligibility for two-year registration: Certain vehicle types, like apportioned and fleet registered vehicles, may not qualify for a two-year registration period. Always check the requirements before proceeding.

- Special categories: Registration fees vary for commercial implements of husbandry, recreational trailers, and vehicles with military designations. Be sure to evaluate your vehicle’s classification to avoid unexpected costs.

- Keep track of important forms: For reduced fees, like the Retired Status fee for eligible vehicles, ensure you have the necessary forms (MV-371 or MV-140) ready to submit.

Browse Other Templates

Form 5329 - Submitting an improper request may result in delays or complications in processing the distribution.

If I Go Back to School Will My Student Loans Pause - Keep a copy of the completed form for your records.