Fill Out Your Mvr 613 Form

The MVR-613 form, officially known as the Highway Use Tax Exemption Certification, serves an important function for buyers in North Carolina looking to secure an exemption from highway use tax. This form is outlined by both federal law and state statutes to facilitate the transfer of vehicles under specific circumstances without incurring this tax. Various qualifying scenarios exist, including transfers between co-owners, gifts between family members, and transactions involving local educational institutions. The form also accommodates exemptions related to vehicles for handicapped individuals, volunteer fire departments, and government entities. In addition, it permits partial exemptions under certain conditions. Key sections of the form require the buyer's details, vehicle specifications, and a declaration of the reason for the exemption. Additionally, the signature of a notary public is required to validate the form, ensuring that all statements are true under penalty of law. Understanding how to properly complete the MVR-613 is crucial for anyone seeking to take advantage of these tax exemptions in North Carolina.

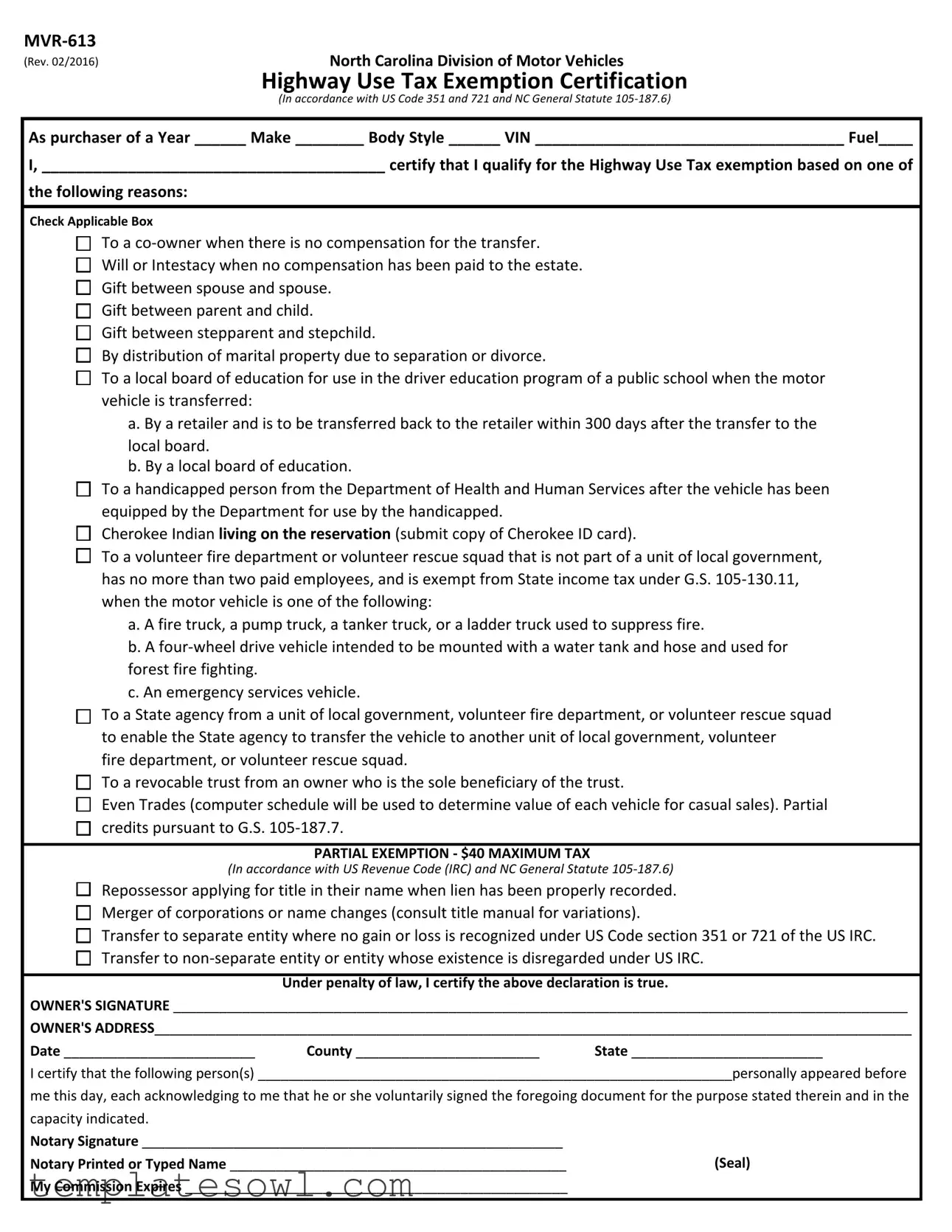

Mvr 613 Example

(Rev. 02/2016) |

North Carolina Division of Motor Vehicles |

|

Highway Use Tax Exemption Certification |

|

(In accordance with US Code 351 and 721 and NC General Statute |

As purchaser of a Year ______ Make ________ Body Style ______ VIN ____________________________________ Fuel____

I, ________________________________________ certify that I qualify for the Highway Use Tax exemption based on one of

the following reasons:

Check Applicable Box

To a

Will or Intestacy when no compensation has been paid to the estate. Gift between spouse and spouse.

Gift between parent and child.

Gift between stepparent and stepchild.

By distribution of marital property due to separation or divorce.

To a local board of education for use in the driver education program of a public school when the motor vehicle is transferred:

a. By a retailer and is to be transferred back to the retailer within 300 days after the transfer to the local board.

b. By a local board of education.

To a handicapped person from the Department of Health and Human Services after the vehicle has been equipped by the Department for use by the handicapped.

Cherokee Indian living on the reservation (submit copy of Cherokee ID card).

To a volunteer fire department or volunteer rescue squad that is not part of a unit of local government, has no more than two paid employees, and is exempt from State income tax under G.S.

a. A fire truck, a pump truck, a tanker truck, or a ladder truck used to suppress fire.

b. A

c. An emergency services vehicle.

To a State agency from a unit of local government, volunteer fire department, or volunteer rescue squad to enable the State agency to transfer the vehicle to another unit of local government, volunteer

fire department, or volunteer rescue squad.

To a revocable trust from an owner who is the sole beneficiary of the trust.

Even Trades (computer schedule will be used to determine value of each vehicle for casual sales). Partial credits pursuant to G.S.

PARTIAL EXEMPTION - $40 MAXIMUM TAX

(In accordance with US Revenue Code (IRC) and NC General Statute

Repossessor applying for title in their name when lien has been properly recorded. Merger of corporations or name changes (consult title manual for variations).

Transfer to separate entity where no gain or loss is recognized under US Code section 351 or 721 of the US IRC. Transfer to

Under penalty of law, I certify the above declaration is true.

OWNER'S SIGNATURE ________________________________________________________________________________________________

OWNER'S ADDRESS___________________________________________________________________________________________________

Date _________________________ County ________________________ State _________________________

I certify that the following person(s) ______________________________________________________________personally appeared before

me this day, each acknowledging to me that he or she voluntarily signed the foregoing document for the purpose stated therein and in the capacity indicated.

Notary Signature _______________________________________________________ |

|

Notary Printed or Typed Name ____________________________________________ |

(Seal) |

My Commission Expires __________________________________________________ |

|

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The MVR-613 form certifies eligibility for a Highway Use Tax exemption in North Carolina, allowing certain qualified transfers of motor vehicles without incurring this tax. |

| Governing Laws | This form operates under US Code sections 351 and 721 along with North Carolina General Statute 105-187.6. |

| Eligible Transfers | Eligible transfers include gifts between family members, transfers due to divorce, and vehicle transfers for public education programs, among others. |

| Signatures Required | The form must be signed by the vehicle owner and requires notarization to ensure the validity of the declarations made on the form. |

Guidelines on Utilizing Mvr 613

Filling out the MVR-613 form is an important step for individuals seeking to certify their eligibility for a highway use tax exemption in North Carolina. The next step involves carefully completing each section of the form to ensure accuracy and compliance with the required legal standards.

- Begin by entering the year of the vehicle in the space provided, labeled “Year ______.”

- Next, write the make of the vehicle in the “Make ________” section.

- Indicate the body style of the vehicle by filling in the “Body Style ______” section.

- Provide the Vehicle Identification Number (VIN) of the vehicle in the space labeled “VIN ____________________________________.”

- Specify the type of fuel used by the vehicle in the “Fuel____” section.

- Write your full name in the space provided for the certifier, indicated as “I, ________________________________________.”

- Select the reason for the tax exemption by checking the appropriate box next to the relevant statement.

- Sign the form in the area designated for the owner’s signature, labeled “OWNER'S SIGNATURE ________________________________________________________________________________________________.”

- Fill out your address in the “OWNER'S ADDRESS___________________________________________________________________________________________________” section.

- Indicate the date on which you are signing the form in the provided space, marked “Date _________________________.”

- Enter the county and state information where the vehicle is registered in the “County ________________________ State _________________________” fields.

- If a notary is required, have them sign and print or type their name in the designated area for “Notary Signature” and “Notary Printed or Typed Name.”

- Ensure the notary includes their seal and commission expiration date in the appropriate spaces.

What You Should Know About This Form

What is the purpose of the MVR-613 form?

The MVR-613 form is used to certify eligibility for a Highway Use Tax exemption in North Carolina. Buyers of certain vehicles can claim this exemption when purchasing from specific categories of sellers, based on reasons like gifts or transfers without compensation. It helps those eligible avoid paying taxes during the vehicle registration process.

Who can use the MVR-613 form?

The form can be utilized by various individuals and entities, including co-owners transferring vehicles without compensation, parents gifting vehicles to children, and organizations such as volunteer fire departments. Handicapped individuals receiving specially equipped vehicles and local boards of education also qualify. Each eligibility category must be correctly checked on the form.

What information is required to complete the MVR-613 form?

Your vehicle’s details are essential for this form. You need to provide the year, make, body style, VIN, and fuel type of the vehicle. Additionally, your name and address are required, along with the reason for the exemption. Make sure you check the correct box that corresponds to your situation, as this determines your eligibility.

Is there a maximum tax exemption allowed under the MVR-613 form?

Yes, there are specific limits. For partial exemptions, the maximum tax allowed is $40 in accordance with North Carolina General Statute 105-187.6. This limit applies to situations such as repossessions and certain corporate transactions. It's important to review the criteria carefully to understand your potential tax obligations.

Do I need a notary to sign the MVR-613 form?

A notary signature is required on the MVR-613 form to validate your certification. After you sign the form, a notary public will acknowledge your signature, confirming that you signed it voluntarily. Make sure to include the notary’s printed name, signature, and commission expiration date in the designated sections for it to be completed correctly.

Common mistakes

Filling out the MVR-613 form can be straightforward, but many individuals make common mistakes that can delay processing. One frequent error is neglecting to provide accurate information regarding the vehicle's details. Missing entries, such as the year, make, body style, or Vehicle Identification Number (VIN), can render the form invalid.

Another common mistake involves selecting the wrong exemption reason. The form includes specific reasons for tax exemption, and checking an incorrect box can lead to complications. It is essential to review the options carefully and ensure that the selected exemption applies to the vehicle transfer.

Some people forget to sign the form or fail to provide a complete owner's address. A signature is a critical element of the certification, and an unsigned form will not be accepted. Additionally, an incomplete address can further delay processing, as the DMV needs to verify the owner's identity and residence.

Improperly designating the date is another oversight. The form requires a specific date, and missing or incorrect information can cause delays. Ensure to include the correct date when filling it out.

Another mistake can occur with notary requirements. Individuals may overlook the need for a notary to witness the signature. It is important to understand that a notarized signature is often required for the form to be valid. Failure to meet this requirement can halt processing.

Some individuals incorrectly assume that the exemption applies to all vehicle transfers. To avoid this mistake, it is crucial to understand the limitations and ensure that the conditions for the exemption are met.

Errors in the notary portion itself can also impede the process. Notaries must provide their name and expiration date of their commission. Missing this information can lead to complications.

Inaccurate information regarding the vehicle purchase price can also be an issue. While a gift or transfer may not involve monetary exchange, the correct valuation is still necessary for record-keeping within the DMV.

Lastly, individuals may fail to read the instructions carefully, which can lead to misunderstanding the requirements or process. It is advisable to refer back to the instructions while completing the form to avoid potential pitfalls.

Documents used along the form

The MVR-613 form is an important document for vehicle owners seeking exemption from highway use tax in North Carolina. However, there are several other forms and documents that are often used in conjunction with the MVR-613. Here’s a brief overview of these additional documents.

- Title Application (MVR-1): This form is used to apply for a new title for a vehicle. It captures necessary details about the vehicle and its ownership, ensuring the title reflects the correct information.

- Bill of Sale: A bill of sale provides proof of a transaction between a buyer and seller. This document includes the sale price and details of the vehicle, serving as a record of ownership transfer.

- Odometer Disclosure Statement: This statement is required by law and must be provided when transferring vehicle ownership. It verifies the vehicle's mileage at the time of sale.

- Power of Attorney: This document allows another individual to act on behalf of the vehicle owner. It may be needed for signing various forms and documents related to the vehicle transfer.

- Form 250 (Application for Exemption): Used by individuals or organizations applying for specific exemptions related to taxes or fees when transferring ownership of a vehicle.

- Liens and Title Search Documentation: If a vehicle has an existing lien, documentation proving the lien's fulfillment is necessary when transferring the title to a new owner.

- Affidavit of Heirship: In cases where a vehicle is inherited, this form serves as a sworn statement detailing the legal heirs entitled to receive the vehicle.

- Vehicle Registration Application: This application is required to register a vehicle with the state. It involves providing details about the vehicle owner, the vehicle itself, and may be needed alongside the MVR-613.

- Notarization Form: Many forms, including the MVR-613, require notarization. This form confirms that the signatures on the document were witnessed by a notary public.

- Tax Exemption Certificates: Certain tax exemption certificates may need to be submitted based on the vehicle's intended use, especially for vehicles going to non-profit organizations or state entities.

These documents can help ensure a smooth title transfer process and maintain compliance with state regulations. It's crucial to gather all necessary forms and information to avoid any delays during the transaction.

Similar forms

- Form 8283: Like the MVR-613, IRS Form 8283 certifies non-cash charitable contributions. Both documents help avoid unnecessary taxes in specific situations, requiring detailed information about the transfer and the parties involved.

- Form 1099-MISC: This form reports various incomes and is similar in that it deals with the transfer of assets or property. Each serves to document transactions for tax exemption or reporting purposes.

- Transfer of Title Form: This form is used to officially transfer ownership of a vehicle. Both the Transfer of Title and the MVR-613 require the seller to declare the reasons for the transfer, especially for tax purposes.

- Form 8821: This form allows a representative to receive tax information. Like the MVR-613, it requires clear identification of parties involved, ensuring authorized representation in tax exemptions or liabilities.

- Form 2553: This is used to elect S Corporation status. Similar to the MVR-613, it facilitates the transfer of tax benefits and responsibilities from one entity to another, allowing exemptions under specific conditions.

- Gift Tax Return (Form 709): When transferring property as a gift, this form details the transaction. The MVR-613 outlines tax exemptions related to gifts, emphasizing the purpose of the transfer.

- Form 990: Nonprofit organizations use this to report their financial activities, including asset transfers. Like the MVR-613, it requires justification for tax-exempt status based on asset disposition.

- Form 1065: This form is used for partnership income tax reporting. Both forms involve the transfer of ownership interests and the requirement to document specific reasons behind these transfers.

- Bill of Sale: This document acts as proof of the sale of goods, including vehicles. Similar to the MVR-613, it validates the transaction and may concern tax-exempt transfers in specific scenarios.

Dos and Don'ts

When filling out the MVR-613 form, attention to detail is crucial. The following are important things you should and shouldn’t do to ensure your application is processed smoothly.

- Do ensure all personal information is accurate and complete. Missing details can delay processing.

- Do check the applicable box for the reason you qualify for the Highway Use Tax exemption. This clarity speeds up the approval process.

- Do verify the Vehicle Identification Number (VIN) is correct. A single incorrect digit could lead to issues.

- Do maintain a copy of the completed form for your records. It’s always wise to have documentation.

- Don't forget to sign the form. An unsigned form will be considered invalid.

- Don't submit without a notary signature, if required. This step is essential to validate your declaration.

By following these guidelines, completing the MVR-613 form will be a much more straightforward process.

Misconceptions

Understanding the MVR 613 form is important for anyone who needs to claim a Highway Use Tax exemption in North Carolina. However, several misconceptions exist surrounding this document. Below is a list of common misconceptions and clarifications regarding the MVR 613 form.

- The MVR 613 form is only for businesses. This form is applicable to individuals as well. Anyone who qualifies for the Highway Use Tax exemption can use it, including private citizens.

- You can use the form for any vehicle. The MVR 613 form is only valid for specific situations listed on the document, such as gifts between family members or transfers to educational boards.

- Filling out the form guarantees tax exemption. Completing the MVR 613 form does not automatically mean you will receive an exemption. Qualification must be based on specific reasons outlined in the form.

- The signature of a notary is optional. A notarized signature is required for the MVR 613 form to ensure the authenticity of the signer’s declaration and that it meets legal requirements.

- All gifts are exempt from tax. While the MVR 613 form allows for some exemptions on gifts, not all gifts qualify. It must fall under specific categories like gifts between family members.

- It's a one-time form. The MVR 613 form may need to be submitted multiple times if you have different vehicles or if you make additional transfers that qualify for the exemption.

- You cannot transfer vehicles to a trust. The form allows for transfers to revocable trusts, as long as the owner is the sole beneficiary.

- Changes in corporate structure do not require this form. Changes like mergers or name changes do require the use of this form, provided certain conditions are met.

- Filing the MVR 613 form eliminates other required documentation. Other documents may still be necessary depending on the specifics of the vehicle transfer situation.

By addressing these misconceptions, individuals can better navigate the process of applying for a Highway Use Tax exemption using the MVR 613 form.

Key takeaways

Here are some key takeaways about filling out and using the MVR-613 form:

- Ensure that you accurately fill in the vehicle details such as Year, Make, Body Style, and VIN. This information is essential for processing your tax exemption claim.

- Clearly indicate the reason for your Highway Use Tax exemption by checking the appropriate box. There are several valid reasons, including gifts between family members and transfers to educational institutions.

- Understand that partial exemptions may apply under certain conditions, such as repossessions or transfers that do not result in gain or loss.

- Do not forget to sign the form and provide your address. A notary public must also acknowledge your signature for the form to be valid.

Browse Other Templates

Standard Form 410 T - The contract mandates the provision of smoke and carbon monoxide alarms, emphasizing tenant safety.

Atm Card Activation - Enter your existing credit card number for reference.