Fill Out Your Mvu 29 Form

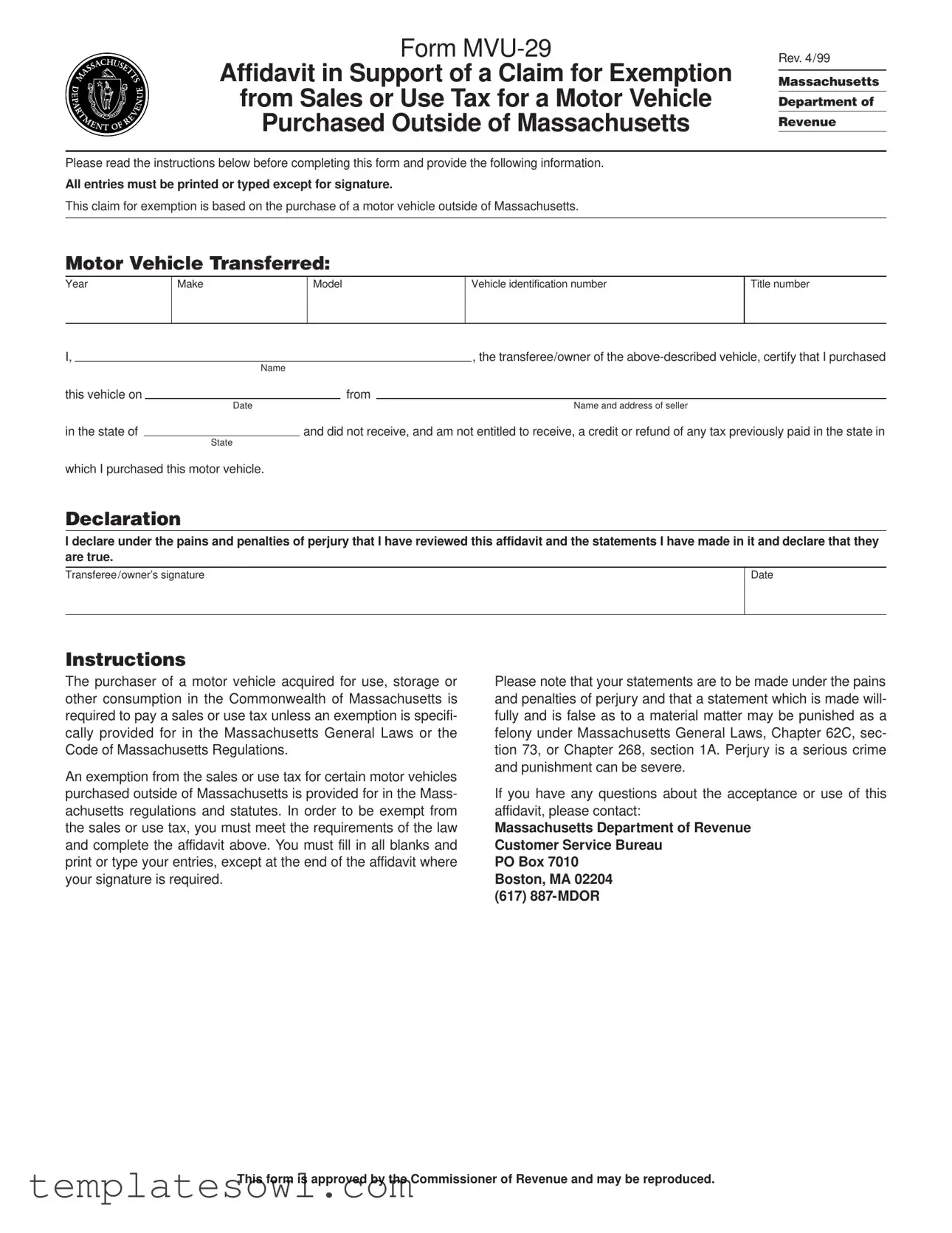

Understanding the intricacies of state tax regulations can be daunting, particularly when it comes to specific forms such as the MVU-29. This form, officially titled the Affidavit in Support of a Claim for Exemption from Sales or Use Tax for a Motor Vehicle Purchased Outside of Massachusetts, serves a crucial function for individuals who have acquired a vehicle outside of the Commonwealth. The MVU-29 is necessary if the purchaser seeks to exempt their vehicle from sales or use tax within Massachusetts, provided that this exception is aligned with applicable state regulations. To utilize this form correctly, you must provide detailed information about the motor vehicle, including its year, make, model, identification number, and title number, alongside the details of the seller and the date of purchase. There is also a declaration section that underscores the importance of honesty; it requires the applicant to affirm that the information supplied is true, acknowledging the potential legal repercussions of perjury. Before completing the MVU-29, it is essential to review the accompanying instructions thoroughly to ensure compliance with the Massachusetts sales tax laws, which mandate that any vehicle purchased for use, storage, or consumption in the state is subject to such taxes unless a valid exemption applies. Therefore, understanding both the form and the legal framework behind it can empower buyers to navigate their responsibilities and rights effectively.

Mvu 29 Example

Form

Affidavit in Support of a Claim for Exemption

from Sales or Use Tax for a Motor Vehicle

Purchased Outside of Massachusetts

Rev. 4/99

Massachusetts

Department of

Revenue

Please read the instructions below before completing this form and provide the following information.

All entries must be printed or typed except for signature.

This claim for exemption is based on the purchase of a motor vehicle outside of Massachusetts.

Motor Vehicle Transferred:

Year

Make

Model

Vehicle identification number

Title number

I, |

|

|

|

|

|

, the transferee/owner of the |

|

|

|

|

Name |

||||

this vehicle on |

|

|

|

from |

|

|

|

|

|

Date |

|

|

|

|

Name and address of seller |

in the state of |

|

|

and did not receive, and am not entitled to receive, a credit or refund of any tax previously paid in the state in |

||||

|

|

State |

|

|

|

|

|

which I purchased this motor vehicle.

Declaration

I declare under the pains and penalties of perjury that I have reviewed this affidavit and the statements I have made in it and declare that they

are true.

Transferee /owner’s signature

Date

Instructions

The purchaser of a motor vehicle acquired for use, storage or other consumption in the Commonwealth of Massachusetts is required to pay a sales or use tax unless an exemption is specifi- cally provided for in the Massachusetts General Laws or the Code of Massachusetts Regulations.

An exemption from the sales or use tax for certain motor vehicles purchased outside of Massachusetts is provided for in the Mass- achusetts regulations and statutes. In order to be exempt from the sales or use tax, you must meet the requirements of the law and complete the affidavit above. You must fill in all blanks and print or type your entries, except at the end of the affidavit where your signature is required.

Please note that your statements are to be made under the pains and penalties of perjury and that a statement which is made will- fully and is false as to a material matter may be punished as a felony under Massachusetts General Laws, Chapter 62C, sec- tion 73, or Chapter 268, section 1A. Perjury is a serious crime and punishment can be severe.

If you have any questions about the acceptance or use of this affidavit, please contact:

Massachusetts Department of Revenue

Customer Service Bureau

PO Box 7010

Boston, MA 02204

(617)

This form is approved by the Commissioner of Revenue and may be reproduced.

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The MVU-29 form serves as an affidavit for claiming an exemption from sales or use tax for a motor vehicle purchased outside of Massachusetts. |

| Governing Laws | This form aligns with Massachusetts General Laws and the Code of Massachusetts Regulations that govern sales and use tax exemptions. |

| Completion Requirements | All required fields on the form must be completed with printed or typed entries, except for the signature, which must be hand-written. |

| Legal Implications | Falsifying any information on the MVU-29 form can lead to severe consequences, including charges of perjury under Massachusetts law. |

Guidelines on Utilizing Mvu 29

Filling out the MVU-29 form is a straightforward process, requiring specific information about the motor vehicle and the transaction. Completing this form accurately is essential for claiming an exemption from sales or use tax on a vehicle purchased outside of Massachusetts.

- Begin by clearly writing the year of the motor vehicle you are claiming exemption for.

- Next, indicate the make of the vehicle.

- Then, write down the model of the vehicle.

- Find and enter the vehicle identification number (VIN). This can usually be found on the dashboard near the windshield or on the driver's side door frame.

- Provide the title number of the vehicle.

- In the space provided, write your name as the transferee or owner of the vehicle.

- Next, enter the date on which you purchased the vehicle.

- Fill in the name and address of the seller from whom you purchased the vehicle.

- Specify the state where the vehicle was purchased.

- Confirm that you did not receive, and are not entitled to receive, a credit or refund of any tax previously paid in the state of purchase.

- Sign the declaration, affirming the truthfulness of your statements. Be sure to include the date of your signature.

What You Should Know About This Form

What is the MVU-29 form?

The MVU-29 form is an affidavit used by individuals to claim an exemption from sales or use tax on a motor vehicle purchased outside of Massachusetts. This form must be completed to confirm that the buyer did not receive or is entitled to any tax credits or refunds from the state of purchase.

Who should complete the MVU-29 form?

The form should be completed by the transferee or owner of a motor vehicle who has purchased it outside of Massachusetts. It applies specifically to those who intend to use, store, or consume the vehicle within Massachusetts.

What information is required on the MVU-29 form?

You will need to provide detailed information about the motor vehicle. This includes the year, make, model, vehicle identification number (VIN), and title number. You will also need to supply your name, the date of the vehicle purchase, the name and address of the seller, and the state in which you made the purchase.

What happens if I do not complete the MVU-29 form?

If you do not complete this form, you will likely be required to pay sales or use tax on the motor vehicle when you register it in Massachusetts. The exemption is only granted if the form is properly filled out and submitted, following all guidelines set by the Massachusetts Department of Revenue.

Is there a penalty for providing false information on the MVU-29 form?

Yes, providing false information on this form can result in severe penalties. The statements you make are under the pains and penalties of perjury. If you knowingly provide false information, you may be charged with a felony under Massachusetts law.

Who can I contact if I have questions about the MVU-29 form?

If you have any questions or need assistance with the MVU-29 form, you can contact the Massachusetts Department of Revenue. They provide a Customer Service Bureau that can address your concerns. You can reach them at (617) 887-MDOR or send correspondence to their office at PO Box 7010, Boston, MA 02204.

Common mistakes

When completing the MVU-29 form, individuals often make critical mistakes that can lead to delays or denials of their tax exemption claim. Understanding these common errors can enhance the likelihood of a successful submission.

One frequent mistake is failing to provide complete information. Each section of the form, including the details of the motor vehicle, such as year, make, model, and vehicle identification number, must be thoroughly filled out. Omissions can invalidate the affidavit and prolong processing times.

Another error involves improperly inputting the name and address of the seller. It is essential to ensure that the details are accurate and legible. Incomplete or illegible information can hinder the verification process, resulting in unnecessary complications.

Some individuals also neglect to specify the state where the vehicle was purchased. This omission can raise questions about the validity of the claim, as the form clearly requests the state of purchase. Providing this information is crucial for establishing the basis of the exemption.

Additionally, many people overlook the importance of the signatures. The transferee or owner must sign the form, and this step should not be skipped. A missing signature will likely result in the form being returned or rejected altogether.

A prevalent misconception is that the purchase date can be estimated. In reality, an exact date is required on the form. Providing an approximate date can create confusion and may be considered invalid, undermining the entire affidavit.

Furthermore, some claimants fail to read and understand the instructions provided in the document. Ignoring these guidelines can lead to misinformation and errors in data entry. Individuals should take the time to thoroughly review the instructions prior to completing the form.

Another common mistake is not asserting the entitlement to the exemption clearly. A well-articulated declaration stating the basis for the exemption helps clarify the claim's legitimacy. Ambiguities can lead to higher scrutiny from the authorities.

Lastly, many applicants disregard the legal implications of their statements. The affidavit must be signed under penalties of perjury, indicating that false information could result in severe consequences. Claimants should take this requirement seriously and ensure their assertions are both truthful and substantiated.

By recognizing and avoiding these common mistakes, individuals can improve their chances of successfully obtaining an exemption from sales or use tax for their motor vehicle purchases made outside of Massachusetts.

Documents used along the form

The MVU-29 form is an important document for individuals who want to claim an exemption from sales or use tax when purchasing a motor vehicle outside of Massachusetts. To complete this process smoothly, several other forms and documents may be necessary. Here’s a list of other commonly used forms and documents that may accompany the MVU-29:

- Form ST-2: Sales Tax Exemption Certificate - This form is used to claim sales tax exemption for specific purchases. It usually covers exemptions for certain organizations or entities and requires the seller to accept the certificate to avoid charging sales tax.

- Form ST-5: Sales Tax Resale Certificate - When a buyer purchases items for resale, this form allows the buyer to inform the seller that no sales tax will be paid. This is often used by businesses purchasing inventory.

- Vehicle Title Application - This application is necessary for registering the vehicle in Massachusetts. It requires details like the vehicle's make, model, and identification number, and must be submitted to the Registry of Motor Vehicles.

- Proof of Payment - Documentation that confirms the payment for the vehicle, such as a bill of sale or a receipt from the seller, is crucial. It serves as evidence that the purchase occurred and supports the claim for exemption.

- Form MV-1: Application for a Massachusetts Title - This is needed when registering a vehicle in Massachusetts. It requires the vehicle's information and the owner's details to establish ownership officially.

- Sales Contract - This document outlines the terms and conditions of the sale between the buyer and seller. It's important to retain a copy as it details the agreed-upon price and conditions for the vehicle purchase.

- Form 1099-S: Proceeds From Real Estate Transactions - If the vehicle was involved in a trade or part of another transaction, this form may document the value exchanged. While it primarily pertains to real estate, it can be relevant in complex transactions.

- Proof of Residency - To claim an exemption, you may need to show that you are a Massachusetts resident, often through documents like utility bills or bank statements that include your name and address.

Gathering these documents can help ensure your exemption claim is processed quickly and correctly. Always ensure all information is accurate and complete before submission. If you have specific questions regarding the forms or the process, consider reaching out to the Massachusetts Department of Revenue for assistance.

Similar forms

-

Form MVU-28: This form is also used for claiming exemptions from sales or use tax. It serves a similar purpose but may be used for different types of purchases, such as trailers or boats purchased outside Massachusetts. Both forms require information about the vehicle and a declaration under penalty of perjury.

-

Form ST-2: This form allows individuals to apply for a sales tax exemption certificate. Like the MVU-29, it requires details about the buyer, seller, and the items being purchased. Both forms ensure that tax exemptions are claimed legally and correctly.

-

Form ST-5: The ST-5 is a resale certificate used when purchasing goods for resale. While the MVU-29 focuses on motor vehicles, both documents share the need for accurate declaration and explanation of the exemption in question.

-

Form MVU-1: This form deals with the registration of motor vehicles. The MVU-1 requires similar personal identification and vehicle information as the MVU-29. Both documents are essential for compliance with Massachusetts law regarding vehicle ownership and tax obligations.

-

Form KP-130: The KP-130 is a Massachusetts form for claiming exemptions for certain public or non-profit purchases. This document, like the MVU-29, necessitates providing details about the transaction and the buyer, confirming that the exemption applies to the purchase.

-

Form CA-6: This form allows for claiming a sales tax refund. Similar to the MVU-29, it requires detailed documentation about the transaction. Both forms emphasize the importance of truthful declarations under penalty of perjury.

Dos and Don'ts

When completing the MVU-29 form, it’s important to approach the task with care. Here are a few guiding principles to consider:

- Do: Ensure that all entries are printed or typed clearly, as legibility is crucial.

- Do: Fill in all required blanks completely, providing accurate information about the motor vehicle and the purchase.

- Do: Sign and date the affidavit at the end to validate your claim.

- Do: Review your statements to confirm their accuracy before submitting the form.

- Don't: Leave any blanks empty; incomplete forms may result in delays or denial of your exemption.

- Don't: Provide false statements on the affidavit; doing so could lead to serious legal consequences.

- Don't: Submit the form without double-checking for errors or missing information.

- Don't: Overlook the instructions provided; they are essential for correctly completing the form.

Misconceptions

Misconceptions surrounding the MVU-29 form can lead to confusion and potential issues for individuals seeking tax exemptions on vehicles purchased outside of Massachusetts. Understanding the facts is essential. Here are six common misconceptions:

- It is an automatic exemption. Many believe that completing the MVU-29 form automatically grants a tax exemption. In reality, the exemption is contingent upon meeting specific legal requirements. The form must be filled out correctly and submitted in accordance with Massachusetts laws.

- Only certain vehicles qualify for exemption. While there are restrictions, the MVU-29 can apply to a variety of motor vehicles, not just luxury or out-of-state purchases. Every vehicle meeting the requisite conditions may be eligible for tax exemption.

- The form does not require accuracy. Some think that minor inaccuracies in the form are permissible. However, statements made on this form come with serious implications. Being intentional in your disclosures is crucial, as inaccuracies can lead to penalties.

- Filling out the form is optional. Many purchasers believe that submitting the MVU-29 form is a secondary option. Conversely, if you do not submit the form when required, you will likely owe sales or use tax on your vehicle purchase.

- Information can be submitted verbally. There may be a misconception that verbal communication of details is sufficient. However, all entries must be printed or typed on the form itself. Incomplete or verbal submissions are not acceptable.

- Filling the form out incorrectly carries little consequence. Some presume that minor errors or omissions will be overlooked. However, completing the MVU-29 inaccurately can result in legal repercussions, including potential charges of perjury for willful inaccuracies.

Addressing these misconceptions ensures that individuals are well-informed and can approach the MVU-29 process with the necessary diligence and accuracy.

Key takeaways

Form MVU-29 serves as an important document for individuals purchasing motor vehicles outside of Massachusetts. Here are key takeaways regarding its completion and use:

- Complete all sections of the form accurately, ensuring each entry is printed or typed except for the signature.

- Make sure to state the necessary details about the vehicle, including its year, make, model, and vehicle identification number.

- Understand that this form is a declaration under the pains and penalties of perjury; any false statements can have serious legal consequences.

- Contact the Massachusetts Department of Revenue with any questions regarding the form or the exemption process to ensure a smooth experience.

Browse Other Templates

Louisiana Practitioner Registration Form,Louisiana Medical Provider Credentialing Form,Louisiana Healthcare Provider Application,Credentialing Submission Form for Louisiana,Louisiana Medical License Application,Louisiana Credentialing Document,Health - Emergency protocols are necessary for ensuring patient safety and care continuity.

Credit Repair Agreement Template - Adjustments to the client’s responsibilities may be necessary as the process unfolds.