Fill Out Your Mw 507 Form

The Maryland MW507 form plays a crucial role in determining the correct amount of state income tax withholding from your paycheck. Designed to ensure that your employer knows how much tax to withhold, this form allows you to claim personal exemptions based on your individual circumstances. Each year or whenever your personal or financial situation changes, it is wise to review and possibly update this form. When filling it out, you begin by stating the number of personal exemptions you will claim on your tax return. If you need to claim more exemptions or if your income exceeds certain thresholds, additional worksheets are available to help refine this information. The form also offers options for those who may qualify for exemption from withholding entirely, such as students whose income stays below the minimum filing requirement, or those from certain neighboring states employed in Maryland. Additionally, you can indicate if you are a resident of states like the District of Columbia, Virginia, or West Virginia and wish to claim an exemption. Specific choices also cater to military spouses who might qualify under special laws. Employers have responsibilities too; they must retain this form and submit it under certain circumstances, thereby ensuring compliance with state regulations. Understanding how to correctly complete the MW507 can help you maximize your take-home pay while adhering to Maryland's tax laws.

Mw 507 Example

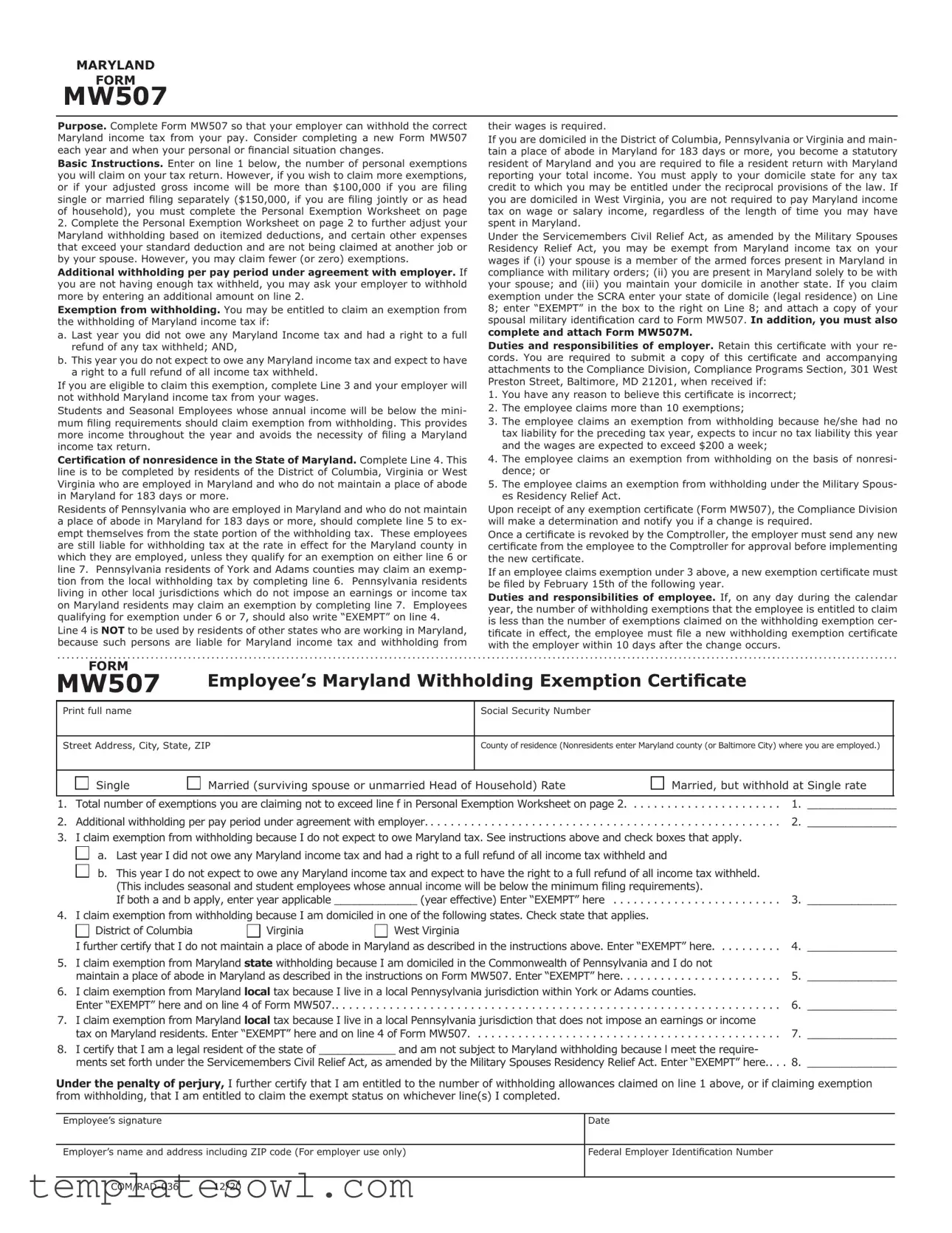

MARYLAND

FORM

MW507

Purpose. Complete Form MW507 so that your employer can withhold the correct Maryland income tax from your pay. Consider completing a new Form MW507 each year and when your personal or financial situation changes.

Basic Instructions. Enter on line 1 below, the number of personal exemptions you will claim on your tax return. However, if you wish to claim more exemptions, or if your adjusted gross income will be more than $100,000 if you are filing single or married filing separately ($150,000, if you are filing jointly or as head of household), you must complete the Personal Exemption Worksheet on page

2.Complete the Personal Exemption Worksheet on page 2 to further adjust your Maryland withholding based on itemized deductions, and certain other expenses that exceed your standard deduction and are not being claimed at another job or by your spouse. However, you may claim fewer (or zero) exemptions.

Additional withholding per pay period under agreement with employer. If you are not having enough tax withheld, you may ask your employer to withhold more by entering an additional amount on line 2.

Exemption from withholding. You may be entitled to claim an exemption from the withholding of Maryland income tax if:

a. Last year you did not owe any Maryland Income tax and had a right to a full refund of any tax withheld; AND,

b. This year you do not expect to owe any Maryland income tax and expect to have a right to a full refund of all income tax withheld.

If you are eligible to claim this exemption, complete Line 3 and your employer will not withhold Maryland income tax from your wages.

Students and Seasonal Employees whose annual income will be below the mini- mum filing requirements should claim exemption from withholding. This provides more income throughout the year and avoids the necessity of filing a Maryland income tax return.

Certification of nonresidence in the State of Maryland. Complete Line 4. This line is to be completed by residents of the District of Columbia, Virginia or West Virginia who are employed in Maryland and who do not maintain a place of abode in Maryland for 183 days or more.

Residents of Pennsylvania who are employed in Maryland and who do not maintain a place of abode in Maryland for 183 days or more, should complete line 5 to ex- empt themselves from the state portion of the withholding tax. These employees are still liable for withholding tax at the rate in effect for the Maryland county in which they are employed, unless they qualify for an exemption on either line 6 or line 7. Pennsylvania residents of York and Adams counties may claim an exemp- tion from the local withholding tax by completing line 6. Pennsylvania residents living in other local jurisdictions which do not impose an earnings or income tax on Maryland residents may claim an exemption by completing line 7. Employees qualifying for exemption under 6 or 7, should also write “EXEMPT” on line 4.

Line 4 is NOT to be used by residents of other states who are working in Maryland, because such persons are liable for Maryland income tax and withholding from

their wages is required.

If you are domiciled in the District of Columbia, Pennsylvania or Virginia and main- tain a place of abode in Maryland for 183 days or more, you become a statutory resident of Maryland and you are required to file a resident return with Maryland reporting your total income. You must apply to your domicile state for any tax credit to which you may be entitled under the reciprocal provisions of the law. If you are domiciled in West Virginia, you are not required to pay Maryland income tax on wage or salary income, regardless of the length of time you may have spent in Maryland.

Under the Servicemembers Civil Relief Act, as amended by the Military Spouses Residency Relief Act, you may be exempt from Maryland income tax on your wages if (i) your spouse is a member of the armed forces present in Maryland in compliance with military orders; (ii) you are present in Maryland solely to be with your spouse; and (iii) you maintain your domicile in another state. If you claim exemption under the SCRA enter your state of domicile (legal residence) on Line 8; enter “EXEMPT” in the box to the right on Line 8; and attach a copy of your spousal military identification card to Form MW507. In addition, you must also complete and attach Form MW507M.

Duties and responsibilities of employer. Retain this certificate with your re- cords. You are required to submit a copy of this certificate and accompanying attachments to the Compliance Division, Compliance Programs Section, 301 West Preston Street, Baltimore, MD 21201, when received if:

1.You have any reason to believe this certificate is incorrect;

2.The employee claims more than 10 exemptions;

3.The employee claims an exemption from withholding because he/she had no tax liability for the preceding tax year, expects to incur no tax liability this year and the wages are expected to exceed $200 a week;

4.The employee claims an exemption from withholding on the basis of nonresi- dence; or

5.The employee claims an exemption from withholding under the Military Spous- es Residency Relief Act.

Upon receipt of any exemption certificate (Form MW507), the Compliance Division will make a determination and notify you if a change is required.

Once a certificate is revoked by the Comptroller, the employer must send any new certificate from the employee to the Comptroller for approval before implementing the new certificate.

If an employee claims exemption under 3 above, a new exemption certificate must be filed by February 15th of the following year.

Duties and responsibilities of employee. If, on any day during the calendar year, the number of withholding exemptions that the employee is entitled to claim is less than the number of exemptions claimed on the withholding exemption cer- tificate in effect, the employee must file a new withholding exemption certificate with the employer within 10 days after the change occurs.

FORM |

|

MW507 |

Employee’s Maryland Withholding Exemption Certificate |

Print full name

Social Security Number

Street Address, City, State, ZIP

County of residence (Nonresidents enter Maryland county (or Baltimore City) where you are employed.)

Single

Married (surviving spouse or unmarried Head of Household) Rate

Married, but withhold at Single rate

1. Total number of exemptions you are claiming not to exceed line f in Personal Exemption Worksheet on page 2 |

1._ ______________ |

2.Additional withholding per pay period under agreement with employer.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2._ ______________

3.I claim exemption from withholding because I do not expect to owe Maryland tax. See instructions above and check boxes that apply.

|

a. Last year I did not owe any Maryland income tax and had a right to a full refund of all income tax withheld and |

|

||

|

b. This year I do not expect to owe any Maryland income tax and expect to have the right to a full refund of all income tax withheld. |

|

||

|

(This includes seasonal and student employees whose annual income will be below the minimum filing requirements). |

|

||

|

If both a and b apply, enter year applicable _____________ (year effective) Enter “EXEMPT” here |

3._ ______________ |

||

4. |

I claim exemption from withholding because I am domiciled in one of the following states. Check state that applies. |

|

||

|

District of Columbia |

Virginia |

West Virginia |

|

|

I further certify that I do not maintain a place of abode in Maryland as described in the instructions above. Enter “EXEMPT” here |

4._ ______________ |

||

5. |

I claim exemption from Maryland state withholding because I am domiciled in the Commonwealth of Pennsylvania and I do not |

5._ ______________ |

||

|

maintain a place of abode in Maryland as described in the instructions on Form MW507. Enter “EXEMPT” here |

|||

6. |

I claim exemption from Maryland local tax because I live in a local Pennysylvania jurisdiction within York or Adams counties. |

|

||

|

Enter “EXEMPT” here and on line 4 of Form MW507 |

. . . . . . . . . 對 |

6._ ______________ |

|

7. |

I claim exemption from Maryland local tax because I live in a local Pennsylvania jurisdiction that does not impose an earnings or income |

|

||

|

tax on Maryland residents. Enter “EXEMPT” here and on line 4 of Form MW507 |

7._ ______________ |

||

8. |

I certify that I am a legal resident of the state of ____________ and am not subject to Maryland withholding because l meet the require- |

|

||

|

ments set forth under the Servicemembers Civil Relief Act, as amended by the Military Spouses Residency Relief Act. Enter “EXEMPT” here.. |

8._ ______________ |

||

Under the penalty of perjury, I further certify that I am entitled to the number of withholding allowances claimed on line 1 above, or if claiming exemption from withholding, that I am entitled to claim the exempt status on whichever line(s) I completed.

Employee’s signature

Date

Employer’s name and address including ZIP code (For employer use only)

Federal Employer Identification Number

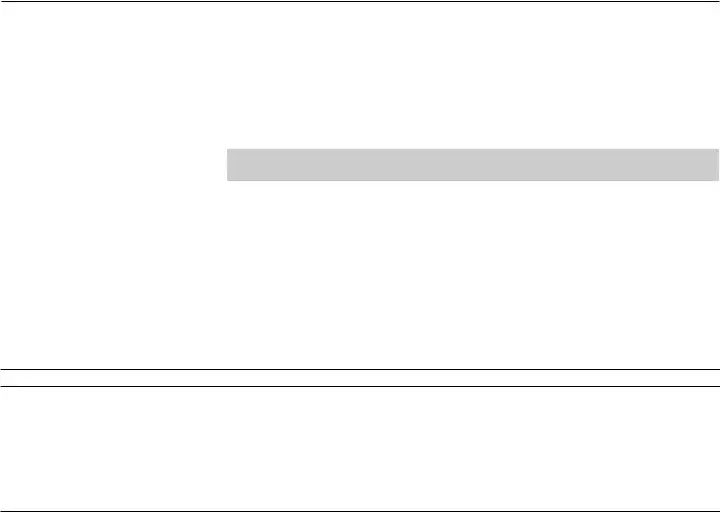

MARYLAND |

page 2 |

FORM |

|

MW507 |

|

|

Personal Exemptions Worksheet |

|

|

Line 1

a. Multiply the number of your personal exemptions by the value of each exemption from the table below. (Generally the value of your exemption will be $3,200; however, if your federal adjusted gross income is expected to be over $100,000, the value of your exemption may be reduced. Do not claim any personal exemptions you currently claim at another job, or any exemptions being claimed by your spouse. To qualify as your dependent, you must be entitled to an exemption for the dependent on your federal income tax return for the corresponding tax year. NOTE: Dependent taxpayers may not claim themselves as

an exemption.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . a. ______________

b.Multiply the number of additional exemptions you are claiming for dependents age 65 or over by the value of

each exemption from the table below. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . b. ______________

c.Enter the estimated amount of your itemized deductions (excluding state and local income taxes) that exceed the amount of your standard deduction, alimony payments, allowable childcare expenses, qualified retirement contributions, business losses and employee business expenses for the year. Do not claim any additional amounts you currently claim at another job or any amounts being claimed by your spouse. NOTE: Standard deduction allowance is 15% of Maryland adjusted gross income with a minimum of $1,550

and a maximum of $2,300... . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . c. ______________

d.Enter $1,000 for additional exemptions for taxpayer and/or spouse age 65 or over and/or blind.. . . . . . . . . d. ______________

e. Add total of lines a through d.. . |

. . . . . . . . . . . . . . . . 對 . . . . . . . . . . e. ______________ |

f.Divide the amount on line e by $3,200. Drop any fraction. Do not round up. This is the maximum

number of exemptions you may claim for withholding tax purposes. . . . . . . . . . . . . . . . . . . . . . . . . . . . . f. ______________

If your federal AGI is |

If you will file your tax return |

||

|

|

||

|

|

Single or Married Filing Separately |

Joint, Head of Household |

|

|

Your Exemption is |

or Qualifying Widow(er) |

|

|

|

Your Exemption is |

$100,000 or less |

$3,200 |

$3,200 |

|

Over |

But not over |

|

|

$100,000 |

$125,000 |

$1,600 |

$3,200 |

$125,000 |

$150,000 |

$800 |

$3,200 |

$150,000 |

$175,000 |

$0 |

$1,600 |

$175,000 |

$200,000 |

$0 |

$800 |

In excess of $200,000 |

$0 |

$0 |

|

FEDERAL PRIVACY ACT INFORMATION

Social Security numbers must be included. The mandatory disclosure of your Social Security number is authorized by the provisions set forth in the

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | Form MW507 helps employers withhold the correct Maryland income tax from an employee's pay. |

| Annual Update | Employees should consider completing a new Form MW507 each year and whenever their personal or financial situation changes. |

| Personal Exemptions | Employees must enter the number of personal exemptions on line 1, limited to allowances determined on the Personal Exemption Worksheet. |

| Eligibility for Exemption | To claim an exemption from withholding, an employee must not expect to owe Maryland income tax based on last year’s tax status. |

| Residency Certification | Nonresidents from D.C., Virginia, or West Virginia must complete Line 4 to certify they don't maintain a Maryland abode for 183 days or more. |

| Tax Credits | Domiciled residents in D.C., Virginia, or Pennsylvania must apply for any tax credits under reciprocal provisions when working in Maryland. |

| Military Exemption | Under the Servicemembers Civil Relief Act, military spouses may qualify for exemption based on their spouse's military status. |

| Employer Responsibilities | Employers must submit copies of Form MW507 to the Compliance Division under certain conditions, like incorrect information or more than 10 exemptions claimed. |

| Form Revision | Employees must file a new MW507 within 10 days if their withholding exemptions change during the year. |

Guidelines on Utilizing Mw 507

Filling out the MW507 form correctly ensures your employer withholds the right amount of Maryland income tax from your paycheck. It’s essential to keep this form updated whenever your personal or financial situation changes in order to avoid over- or under-withholding taxes.

- Print your full name at the top of the form.

- Provide your Social Security Number.

- Enter your current address, including street, city, state, and ZIP code.

- Indicate the county of your residence. If you are a nonresident, enter the Maryland county or Baltimore City where employed.

- Select your filing status: Check either “Single,” “Married,” or “Head of Household.” If married, you can also choose to "withhold at Single rate."

- On line 1, write the total number of exemptions you are claiming. Ensure this does not exceed the maximum allowed on the Personal Exemption Worksheet.

- On line 2, if you want additional withholding, enter the amount here.

- For line 3, check the boxes confirming that you expect to owe no Maryland income tax and have had a full refund in the past year.

- If applicable, complete line 4 to certify you are a nonresident of Maryland, and enter “EXEMPT.”

- Complete line 5 if you are a Pennsylvania resident and meet the specific criteria for exemption, then enter “EXEMPT.”

- If applicable, complete lines 6 or 7 if you’re claiming local tax exemptions based on your residence in Pennsylvania.

- Line 8 must be filled out if you are claiming exemption due to the Servicemembers Civil Relief Act; specify your state of domicile and enter “EXEMPT.”

- Sign and date the bottom of the form to certify that your information is correct.

- Provide your employer’s name and address, along with their Federal Employer Identification Number, for their records.

After submitting the MW507 form to your employer, they will adjust your withholding accordingly. It is a good practice to keep a copy of the completed form for your records. If any changes occur that affect your tax situation, don’t hesitate to fill out and submit a new MW507 to ensure your withholdings reflect your current circumstances.

What You Should Know About This Form

What is the purpose of the MW507 form?

The MW507 form is designed for employees in Maryland to provide their employer with the necessary information to ensure the correct amount of state income tax is withheld from their paychecks. Employers rely on this information to manage withholding in accordance with the employee's tax situation.

Who should complete a new MW507 form?

Employees should consider completing a new MW507 form annually and whenever there are changes in personal or financial circumstances. Situations that might prompt a new form include a change in marital status, a new job, or changes in number of dependents.

How do I determine the number of personal exemptions to claim on the MW507?

To determine the number of personal exemptions, enter the total you plan to claim on your income tax return on line 1 of the MW507. However, if your adjusted gross income is expected to exceed certain thresholds, you may need to fill out the Personal Exemption Worksheet located on page 2 of the form.

What if I expect to owe no Maryland income tax?

If you did not owe Maryland income tax last year and do not expect to owe it this year, you may qualify for an exemption from withholding. To claim this exemption, complete line 3 of the MW507 and ensure you meet the criteria provided in the instructions.

Can students and seasonal employees claim an exemption?

Yes, students and seasonal employees whose annual income will be below the minimum filing requirements can claim exemption from withholding. This allows them to receive more income throughout the year and avoids the need to file a Maryland income tax return.

How do I claim an exemption if I am a nonresident?

Nonresidents who work in Maryland must provide specific information on lines 4 or 5 of the MW507 to claim exemption from withholding. This includes those living in the District of Columbia, Virginia, West Virginia, or Pennsylvania, who do not maintain a place of abode in Maryland for 183 days or more.

What should I do if the number of exemptions I can claim changes during the year?

If the number of withholding exemptions decreases at any point during the calendar year, you must file a new MW507 with your employer within 10 days of the change occurring. This ensures your withholding aligns with your current tax situation.

What is required if I am claiming an exemption under the Servicemembers Civil Relief Act?

For individuals eligible under the Servicemembers Civil Relief Act, complete line 8 on the MW507, entering your state of domicile and marking "EXEMPT." Additionally, attach a copy of your spousal military identification card and complete Form MW507M.

What are the employer's responsibilities upon receiving the MW507 certificate?

Upon receiving the MW507 certificate, employers must retain it with their records. They must submit a copy to the Compliance Division in certain circumstances, such as if they believe the certificate is incorrect or if the employee claims more than 10 exemptions.

What happens if my MW507 certificate is revoked?

If the Comptroller revokes an exemption certificate, the employer is required to obtain approval for any new certificate from the employee before implementing withholding based on the new certificate. This ensures compliance with tax withholding regulations.

Common mistakes

The MW 507 form is essential for ensuring the correct Maryland income tax withholding from your pay. However, many people make common mistakes when filling it out, which could lead to incorrect withholding amounts. Understanding these mistakes can help you navigate the form more effectively.

One frequent error is claiming too many personal exemptions. Line 1 of the MW 507 asks for the number of personal exemptions you are entitled to claim. If you incorrectly enter more exemptions than you are eligible for, this could result in insufficient tax being withheld from your paychecks. Alternatively, if you claim fewer exemptions than you are entitled to, you might end up having too much tax withheld, affecting your take-home pay.

Another mistake involves misunderstanding the eligibility for exemption from withholding. Line 3 allows individuals who do not expect to owe any Maryland income tax to claim an exemption. Many taxpayers incorrectly assume they can claim this exemption based on last year’s tax situation without sufficiently considering their current or anticipated income. It’s essential to evaluate your financial situation for the current year carefully before making this claim.

Additionally, not completing the Personal Exemption Worksheet accurately can lead to issues. This worksheet helps you determine the correct number of exemptions to enter on Line 1. Failing to account for income exceeding the adjusted gross income limits or not following the guidelines for dependents can greatly impact your withholding and tax obligations. If you are uncertain about how to complete the worksheet, seeking guidance or assistance can prevent misunderstandings.

Lastly, some individuals disregard the requirement to complete a new MW 507 form when their personal or financial situations change. If you get a new job, move, or experience a significant change in family status, such as marriage or the birth of a child, it's vital to update your withholding form. Failing to do so can result in a mismatch between your actual tax obligations and the amount withheld from your wages.

By being aware of these common mistakes, you can fill out the MW 507 form with greater confidence and accuracy. Take the time to review your entries carefully, and remember that it’s always a good idea to consult with a tax professional if you have questions or are unsure about your withholding status.

Documents used along the form

The Maryland Form MW507 is an essential document for ensuring that employers withhold the correct amount of state income tax from employees' wages. Along with this form, several other documents may also be necessary to provide additional information or clarifications regarding tax withholding. Below is a brief overview of each relevant form.

- MW507M: This form is used by spouses of active military members who wish to claim exemption from Maryland state taxes under the Servicemembers Civil Relief Act (SCRA). It requires proof of residency in another state and military identification.

- W-4 Form: The federal Employee's Withholding Certificate allows employees to indicate their tax filing status, exemptions, and additional withholding amounts for federal income tax purposes. It is often submitted alongside the MW507.

- Personal Exemption Worksheet: This worksheet, often included with the MW507, helps individuals compute the number of exemptions they are entitled to claim for Maryland tax withholding purposes.

- Federal Income Tax Return (Form 1040): This annual tax return details an individual's income, deductions, and credits for federal taxes and may support claims made on the MW507.

- Claim for Exemption from Withholding: Employees may need to provide additional documentation if claiming exemption from withholding tax, particularly if their financial situation has changed significantly.

- Tax Credit Application: Maryland residents may apply for tax credits that affect withholding amounts, especially when filing for reciprocal tax agreements with their home states.

- State Residency Affidavit: This document may be requested from nonresidents working in Maryland to confirm their home state residency, which can affect tax liability.

- Wage and Tax Statement (W-2): Employers provide this annual report to employees, summarizing wages earned and taxes withheld, which helps reconcile withholding amounts claimed on the MW507.

Understanding these forms and documents can help employees navigate their tax obligations smoothly. Ensuring accurate and timely submission of these documents is vital for avoiding potential tax issues and for maintaining financial well-being.

Similar forms

- W-4 Form (Employee's Withholding Certificate) - Similar to Form MW507, the W-4 allows employees to claim withholding allowances for federal income tax. Both forms help employers determine how much tax to withhold from employees' paychecks based on personal circumstances.

- W-2 Form (Wage and Tax Statement) - While the W-2 is an annual report of wages and tax withheld, it is closely related to MW507 in that the accuracy of withholding reported on the W-2 depends on the information provided in MW507 at the start of employment or when changes are necessary.

- Form 1040 (U.S. Individual Income Tax Return) - The information regarding exemptions and income reported on MW507 can directly affect the details on Form 1040. Each document plays a role in calculating tax obligations for the tax year.

- Form 1099 (Miscellaneous Income) - Although this form is used for reporting income from sources other than employment, like freelance work, it can impact tax withholding preferences similar to the MW507 when it comes to managing total tax liability.

- State Income Tax Return - Just as the MW507 influences withholding, the data on the tax return can ensure that all tax obligations have been met. It shows how much was withheld versus the actual tax due at the end of the year.

- Form MW508 (Maryland Employer's Annual Withholding Reconciliation Return) - Employers use this form to report total income tax withheld from all employees, paralleling the MW507’s purpose of calculating the correct withholding amount.

- Schedule A (Itemized Deductions) - Just like completing the Personal Exemption Worksheet on MW507, this form helps taxpayers assess their itemized deductions which may affect their overall tax situation.

- Form I-9 (Employment Eligibility Verification) - This form verifies that employees are eligible to work in the U.S. While its primary function is different, it is often completed alongside MW507 as part of the hiring process.

- IRS Pub 505 (Tax Withholding and Estimated Tax) - This publication provides guidance on how to estimate liabilities based on withholding and other tax factors, similar to how MW507 guides Maryland employees.

- Form 8857 (Request for Innocent Spouse Relief) - In cases where tax liabilities are shared, similar to withholding claims, this form addresses issues surrounding tax responsibility with respect to income tax situations influenced by MW507.

Dos and Don'ts

Things to Do:

- Enter the correct number of personal exemptions you are claiming on line 1.

- Complete the Personal Exemption Worksheet on page 2 if you need to adjust your withholding.

- Consider filling out a new Form MW507 each year and when your personal or financial situation changes.

- If necessary, request additional withholding by entering an amount on line 2.

- If eligible, claim exemption from withholding by completing line 3 correctly.

Things Not to Do:

- Do not claim personal exemptions you also claim on another job.

- Avoid claiming any exemptions if your federal adjusted gross income exceeds set limits.

- Do not forget to enter “EXEMPT” if claiming exemption under specific criteria.

- Steer clear of leaving any necessary fields blank, as this may delay processing.

- Do not use line 4 if you are a resident of a state other than D.C, Virginia, or West Virginia.

Misconceptions

- Misconception 1: Completing Form MW507 is only necessary for new employees.

- Misconception 2: You can't claim exemptions if you expect to earn over $100,000.

- Misconception 3: Students and seasonal workers are automatically exempt from Maryland income tax.

- Misconception 4: You can claim exemption from withholding if you are a resident of a neighboring state.

This is not true. It's advisable to complete a new Form MW507 each year or whenever personal or financial situations change. This helps ensure the correct amount of Maryland income tax is withheld from your pay.

This is a misunderstanding. While there are limits on exemptions based on your income, you can still claim exemptions. If your adjusted gross income exceeds $100,000 while filing single or married filing separately, you'll need to complete the Personal Exemption Worksheet to adjust your withholding accurately.

Not necessarily. Students and seasonal employees may claim exemption from withholding only if their annual income falls below certain minimum filing requirements. It is important to check eligibility before assuming exemption.

This depends on your specific situation. Residents of D.C., Virginia, and West Virginia may claim exemption if they meet certain criteria, such as not maintaining a place of abode in Maryland. However, residents of other states working in Maryland are typically subject to Maryland income tax.

Key takeaways

- Form MW507 is essential for ensuring your employer withholds the correct amount of Maryland income tax from your pay.

- It's advisable to complete a new MW507 form each year and whenever your personal or financial situation changes.

- The number of personal exemptions you claim directly influences your withholding, so make sure to calculate accurately on line 1.

- If your income exceeds certain thresholds, the Personal Exemption Worksheet on page 2 should be completed for more precise withholding adjustments.

- If you find your tax withholding is insufficient, you can request additional withholding by entering a specific amount on line 2.

- Eligible individuals may claim exemption from withholding if they expect a full refund of any tax withheld, completing line 3 in such cases.

- Understanding residency qualifications is crucial. Nonresidents working in Maryland must follow specific lines on the form to avoid improper withholding.

Browse Other Templates

Yardi Breeze Training Manual Pdf - Process Checks details the steps involved in issuing vendor payments via checks.

Wisconsin Tax Simplified Form,WI 2017 Income Adjustment Form,Wisconsin Amended Tax Return,WI-Z Income Tax Return,Wisconsin Tax Reporting Form,WI Joint Filing Form,Wisconsin Easy Tax Return,WI-Z Simple Tax Submission,Wisconsin 2017 Tax Revision Form,W - Follow the specific instructions provided for filling out each line accurately.

Mortgage Payment Deferral - Ensure to check the boxes that apply to your current financial situation.