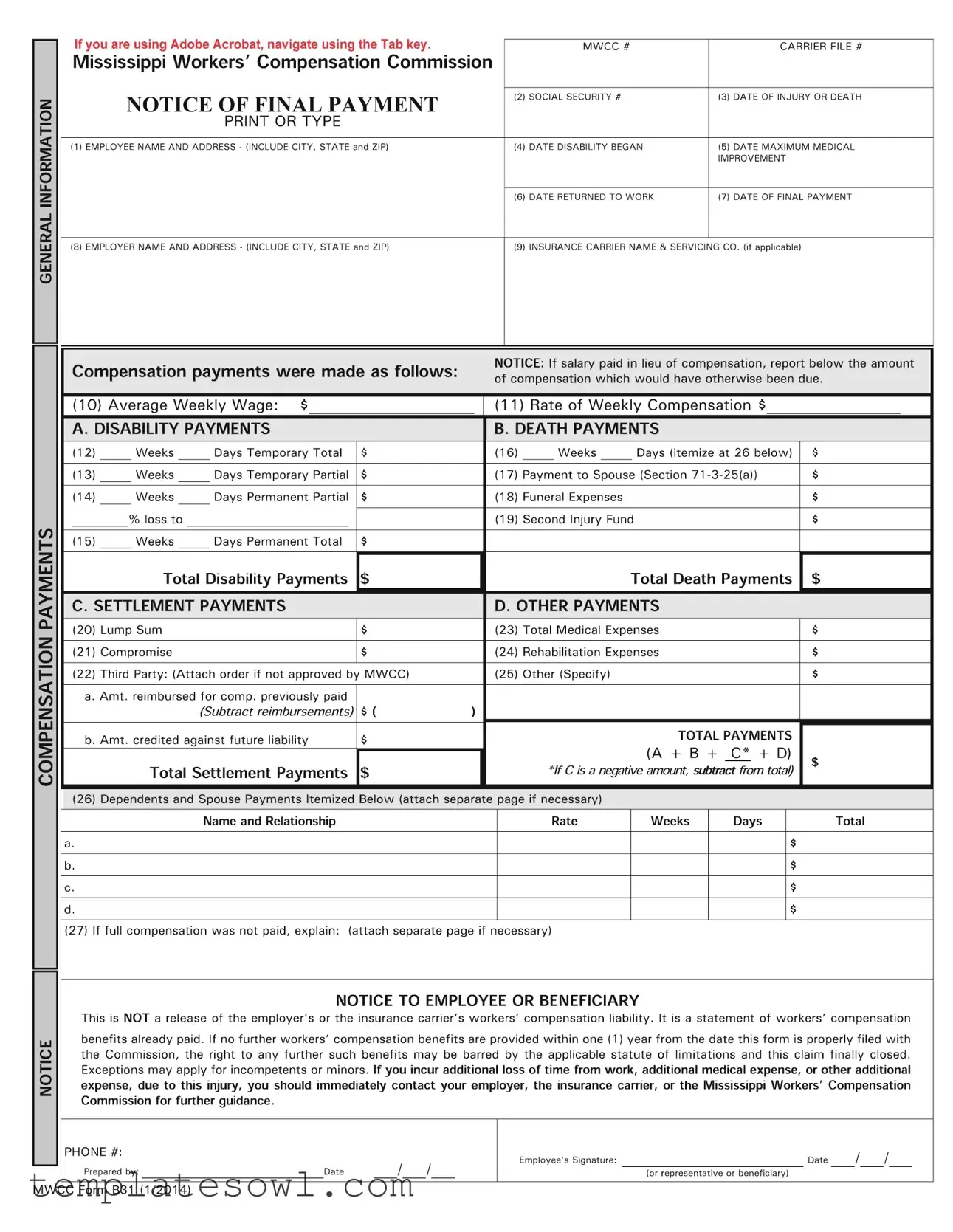

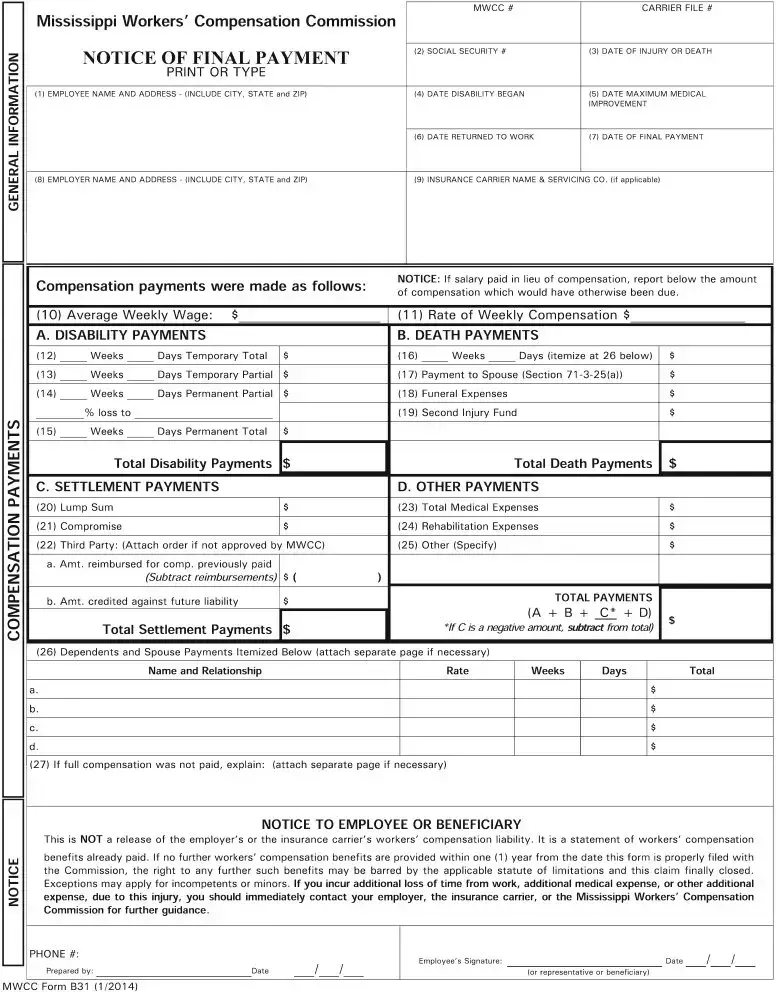

Fill Out Your Mwcc B31 Form

The MWCC B31 form serves as a crucial document in the Mississippi workers' compensation process, particularly when addressing final payment notifications. Designed to capture essential details, this form collects information about the employee, such as their name, address, Social Security number, and specific dates related to their injury and recovery. Additionally, it outlines the payment details, including different types of compensation such as temporary total disability, permanent partial disability, and death payments. Each section is meticulously structured, allowing for itemized accountings of weekly wages, medical expenses, and various payment types to ensure clarity in communication. Important notices are included to inform employees or beneficiaries that this document does not release the employer or insurance carrier from future liabilities. Instead, it indicates payments already made and emphasizes the necessity of timely communication with relevant parties should further costs arise. Overall, the B31 form plays an integral role in documenting the flow of workers' compensation benefits and upholding the rights of injured workers in Mississippi.

Mwcc B31 Example

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | The MWCC B31 form is used to notify the Mississippi Workers' Compensation Commission of final compensation payments made to an employee due to a workplace injury or death. |

| Governing Law | This form is governed by the Mississippi Workers' Compensation Law, specifically under Sections 71-3-1 to 71-3-99 of the Mississippi Code. |

| Required Information | Key details such as employee name, injury date, and payment amounts must be clearly filled out to ensure proper processing. |

| Submission Deadline | This form should be filed within one year of the final payment date to ensure compliance with the statute of limitations. |

| Impact of Non-Compliance | If the form is not filed properly, the right to further compensation could be lost, highlighting the importance of timely submission. |

| Employee Notifications | The form includes a notice stating it does not release the employer or insurance carrier from liability for future compensation claims. |

| Medical Expenses | In addition to disability payments, the form also accounts for total medical expenses related to the injury. |

| Rehabilitation Payments | Rehabilitation expenses can be itemized in the form, ensuring all costs associated with recovery are accounted for. |

| Dependents' Payments | The form allows for itemization of payments made to dependents or a spouse if applicable, ensuring transparency in financial assistance. |

| Signature Requirement | The form must be signed and dated by the employee or their representative, affirming the validity of the information provided. |

Guidelines on Utilizing Mwcc B31

Filling out the MWCC B31 form is an important task that requires attention to detail. The information you provide on the form is essential for documenting compensation payments related to a worker's injury. Once the form is completed, it will need to be submitted to the Mississippi Workers' Compensation Commission for processing.

- Gather necessary information: Collect all relevant details such as your name, address, and social security number. Have your employer's information and the insurance carrier's name on hand.

- Start with employee details: In the first section of the form, print or type your name and address clearly, including your city, state, and ZIP code, alongside the MWCC number and carrier file number.

- Provide identification details: Fill in your social security number, the date of injury or death, the start date of your disability, the date you returned to work, and the date of maximum medical improvement.

- Input employer information: Enter the name and address of your employer, including the city, state, and ZIP code.

- Complete insurance carrier details: If applicable, include the name of the insurance carrier and servicing company.

- List compensation payments: Begin detailing the compensation payments made, including average weekly wage, temporary total payments, temporary partial payments, and permanent partial payments.

- Document disability payments: Provide specifics on temporary and permanent disabilities, including dollar amounts and percentage loss if applicable.

- Include settlement payments: Itemize any lump sum payments and compromises, as well as amounts reimbursed for past compensation or amounts credited against future liabilities.

- Detail any death payments: Record all payments related to death benefits, including payments to the spouse and funeral expenses.

- Account for other payments: Include total medical expenses, rehabilitation expenses, and any other specified expenses.

- Calculate total payments: Sum up all compensation categories (A, B, C, D) to arrive at the total payments. If there are negative amounts, ensure they are subtracted from the total.

- Itemize dependent payments: If applicable, list any payments made to dependents or spouses and their details, such as name, relationship, rate, and duration.

- Provide additional explanations: If full compensation was not paid, include an explanation of the circumstances on a separate page if necessary.

- Authorize with signature: Sign and date the form as the employee or beneficiary. Include the signature and date of the person who prepared the form.

Once all sections are completed accurately, double-check for any errors. Proper submission of this form is crucial, as it can impact future benefits. If needed, consult with your employer, the insurance carrier, or the Mississippi Workers' Compensation Commission for further assistance.

What You Should Know About This Form

What is the Mwcc B31 form used for?

The Mwcc B31 form is a notice of final payment for workers' compensation benefits in Mississippi. It provides details of compensation payments made to an employee who has suffered an injury or death due to work-related activities. This form helps document the amounts paid for disability, death, and other related expenses associated with the injury.

Who needs to fill out the Mwcc B31 form?

This form must be completed by the employer or insurance carrier when final payments are made to an employee or their beneficiaries. It is essential for those involved in workers' compensation claims to ensure that all necessary information, including payment details and dates, is accurately reported on the form.

What information is required on the Mwcc B31 form?

The Mwcc B31 form requires specific information, including the employee's name and address, social security number, and details about the work-related injury. Key dates such as the date of injury, date disability began, and date of final payment must also be included. Payment information, including amounts for temporary and permanent disabilities, along with any medical or funeral expenses, needs to be detailed as well.

What happens if the Mwcc B31 form is not filed properly?

If the Mwcc B31 form is not filed accurately or within the designated timeframe, it may affect the employee's ability to receive further compensation benefits. Failure to file can potentially bar the employee from seeking additional benefits due to the statute of limitations. This is why timely and accurate submission of the form is crucial.

Can I ask for additional payments after submitting the Mwcc B31 form?

Is the Mwcc B31 form a release of liability?

No, the Mwcc B31 form is not a release of liability for the employer or insurance carrier. Instead, it acts as a statement of benefits that have already been paid. Liabilities may still exist, and this form does not prevent further claims if they arise within the stipulated timeframe.

Common mistakes

When filling out the MWCC B31 form, individuals often encounter several common mistakes that can lead to complications or delays. It's important to pay attention to every detail to ensure the process is as smooth as possible.

One frequent error is neglecting to provide the correct employee name and address. This information should include the city, state, and ZIP code. Omitting any part of this can lead to significant administrative issues. Additionally, both the employee and the employer must be easily identifiable on the form.

Another mistake is failing to include the Social Security number. This is a critical piece of information necessary for proper identification and processing. Ensuring this number is accurate is essential for maintaining the integrity of the claim.

Incorrect dates are also a common problem. Specifically, people often misreport the date of injury or death and the date disability began. These dates need to be precise, as they determine eligibility for benefits and affect the timeline of the case. Double-checking these entries can prevent delays.

Additionally, sometimes individuals forget to indicate the average weekly wage. This figure helps to calculate the benefits owed to the employee. Errors here can lead to incorrect amounts being reported and, ultimately, to wrong calculations of compensation payments.

It’s crucial to pay attention to how payments are itemized on the form. Often, people will incorrectly enter medical expenses, rehabilitation expenses, or other payments. Each category should be filled out accurately to provide a clear understanding of all costs incurred related to the incident in question.

Another common error involves the completion of the section pertaining to dependents and spouse payments. This part may require additional documentation. If individuals do not include the necessary details here, it can result in delays or denial of claims for dependents.

Moreover, failing to sign and date the form is another significant oversight. The employee’s signature is essential to validate the document. Without it, the form may not be processed, which can lead to further complications.

Finally, when individuals do not adequately explain why full compensation was not provided in the designated section, it raises red flags. Providing clear and concise explanations helps prevent misunderstandings and ensures all parties are on the same page regarding the case.

By being mindful of these common mistakes, individuals can navigate the MWCC B31 form process more effectively, ensuring a quicker resolution to their claims.

Documents used along the form

The MWCC B31 form is essential for documenting compensation payments related to worker's compensation claims in Mississippi. There are several other forms and documents that are commonly used alongside the B31 form, each serving a specific purpose in the process of managing workers’ compensation claims. Below is a list of some of these documents:

- MWCC Form 1: This form, known as the "Notice of Claim," is used to officially notify the Mississippi Workers' Compensation Commission about an employee's work-related injury or illness. It includes details about the incident, the employee, and initial claim information.

- MWCC Form 4: Often referred to as the "Employer's First Report of Injury or Illness," this document requires employers to report workplace injuries to the Commission within a specific timeframe. It outlines the severity and circumstances of the injury.

- MWCC Form 3: The "Notice of Controversy" is submitted when there is a dispute regarding the claim. This document notifies the Commission of the disagreement, allowing for further investigation and resolution processes.

- MWCC Form 5: This is the "Notification of Change in Condition" form. It is important for claimants who experience a change in their medical condition related to the prior injury. This allows them to seek adjustments to their benefits based on new medical findings.

- MWCC Form 6: Known as the "Application for Hearing," this form is used by either party when a dispute arises that cannot be resolved informally. It formally requests a hearing before the Commission to address the issues in question.

These documents work together to support the claims process and ensure that proper record-keeping and communication take place among all parties involved. Proper use of these forms can help streamline the resolution of claims and any associated disputes.

Similar forms

- Form I-9: This document verifies the identity and employment authorization of individuals hired for employment in the United States. Like the Mwcc B31, it requires detailed information about the individual and the employer, and emphasizes accuracy in reporting.

- W-2 Form: Employed by employers to report wages, tips, and other compensation paid to employees. Similar to the Mwcc B31, it summarizes payment information, ensuring that all relevant financial details are accurately captured for tax reporting.

- Workers' Compensation Claim Form: Initiated by employees to claim benefits for work-related injuries. It shares similarities with the Mwcc B31 form, as both documents require detailed information about the employee, injury, and compensation amounts.

- SSDI Application (Social Security Disability Insurance): This form requests disability benefits for individuals unable to work due to medical conditions. Both the SSDI application and Mwcc B31 address disability payment information and require comprehensive data supporting the claim.

- VA Form 21-526EZ: Used by veterans to apply for disability compensation. It necessitates a detailed account of medical conditions and injuries, akin to the Mwcc B31’s focus on injury details and compensation awards.

- 401(k) Withdrawal Form: This document is utilized when employees want to withdraw funds from their retirement savings. It bears resemblance to the Mwcc B31 in that both require personal and financial information and serve as formal requests for specific benefits.

- Health Insurance Claim Form: Submitted to healthcare providers or insurance companies for reimbursement of medical expenses. Similar to the Mwcc B31, it includes sections for itemizing payments and services received.

- Form 1099-MISC: Reports various types of income other than wages, salaries, or tips. Both forms require detailed information about payment amounts and related parties, ensuring accurate reporting and accountability.

- State Unemployment Claim Form: Similar in structure and purpose, this form allows individuals to apply for unemployment benefits. It similarly focuses on personal information and reasons for eligibility, just like the Mwcc B31 addresses compensation claims.

- Insurance Policy Claim Form: Used to claim benefits from an insurance policy, such as health or auto. Like the Mwcc B31, it requires specific details about the incident or injury and compensation amounts.

Dos and Don'ts

When filling out the Mwcc B31 form, it's important to be mindful of certain practices. Here are seven things you should and shouldn't do:

- Do print or type clearly to ensure legibility.

- Don't leave any required fields blank; complete each section thoroughly.

- Do double-check your Social Security number for accuracy.

- Don't use abbreviations; write out names and addresses fully.

- Do indicate the dates correctly, as this information is crucial.

- Don't submit the form without reviewing it for typos or missing information.

- Do keep a copy of the completed form for your records.

Misconceptions

The MWCC B31 form, related to Mississippi workers' compensation, is essential for both employees and employers. However, several misconceptions can lead to confusion. Here are seven common misconceptions clarified:

- Misconception 1: The MWCC B31 form is a final release of liability.

- Misconception 2: Filing the MWCC B31 form closes my claim permanently.

- Misconception 3: The information on the B31 is optional.

- Misconception 4: I need to file this form only if I am fully compensated.

- Misconception 5: The B31 form is only necessary for employees who are injured on the job.

- Misconception 6: I can delay submitting the B31 form until I have all paperwork sorted.

- Misconception 7: This form has no significance once it's submitted.

In reality, this form does not release your employer or their insurance from further responsibilities. It only reflects benefits that have been paid up to that point.

Filing this form does not permanently close your ability to claim further benefits. However, if you do not file any additional claims within one year, you may lose the right to future benefits.

All the requested information must be completed accurately. Omitting information can result in processing delays or complications.

The form should be submitted regardless of whether you feel fully compensated. It provides crucial documentation of all payments made to date.

While primarily for workplace injuries, this form can also be relevant for beneficiaries in cases of fatal accidents, including payments related to death benefits.

Timeliness is important. It is best to submit the form as soon as possible, even if you are awaiting additional documents or confirmations.

The MWCC B31 form is a critical piece of documentation. Retaining a copy for your records is essential should any disputes or further claims arise.

Key takeaways

Understanding the Mwcc B31 form is essential for both employees and employers involved in workers' compensation claims. Here are five key takeaways to keep in mind when filling out and using this form:

- Complete All Sections: Make sure to fill in every required section, including personal information and payment details. Incomplete forms can cause delays in processing.

- Report Compensation Payments: Clearly outline all compensation payments made, including temporary and permanent disability payments. This helps provide a comprehensive view of the financial transactions involved.

- Understand the Notice: The form includes a notice indicating that it does not release the employer's liability. This is crucial if further claims arise in the future.

- Be Aware of Limitations: Note that if no further benefits are claimed within one year, the right to additional benefits may be lost. Keeping track of this timeline is important.

- Seek Guidance When Needed: If new expenses or missed time arise due to the injury, it's important to contact your employer or the Mississippi Workers' Compensation Commission promptly for assistance.

Browse Other Templates

Lien Release Statement - This form assists in updating the state’s vehicle title records.

Irsc Rn Program - Following the submission of the IRSC 68 form, enrollment in college classes becomes possible.