Fill Out Your Nafta Certificate Of Origin Canada Form

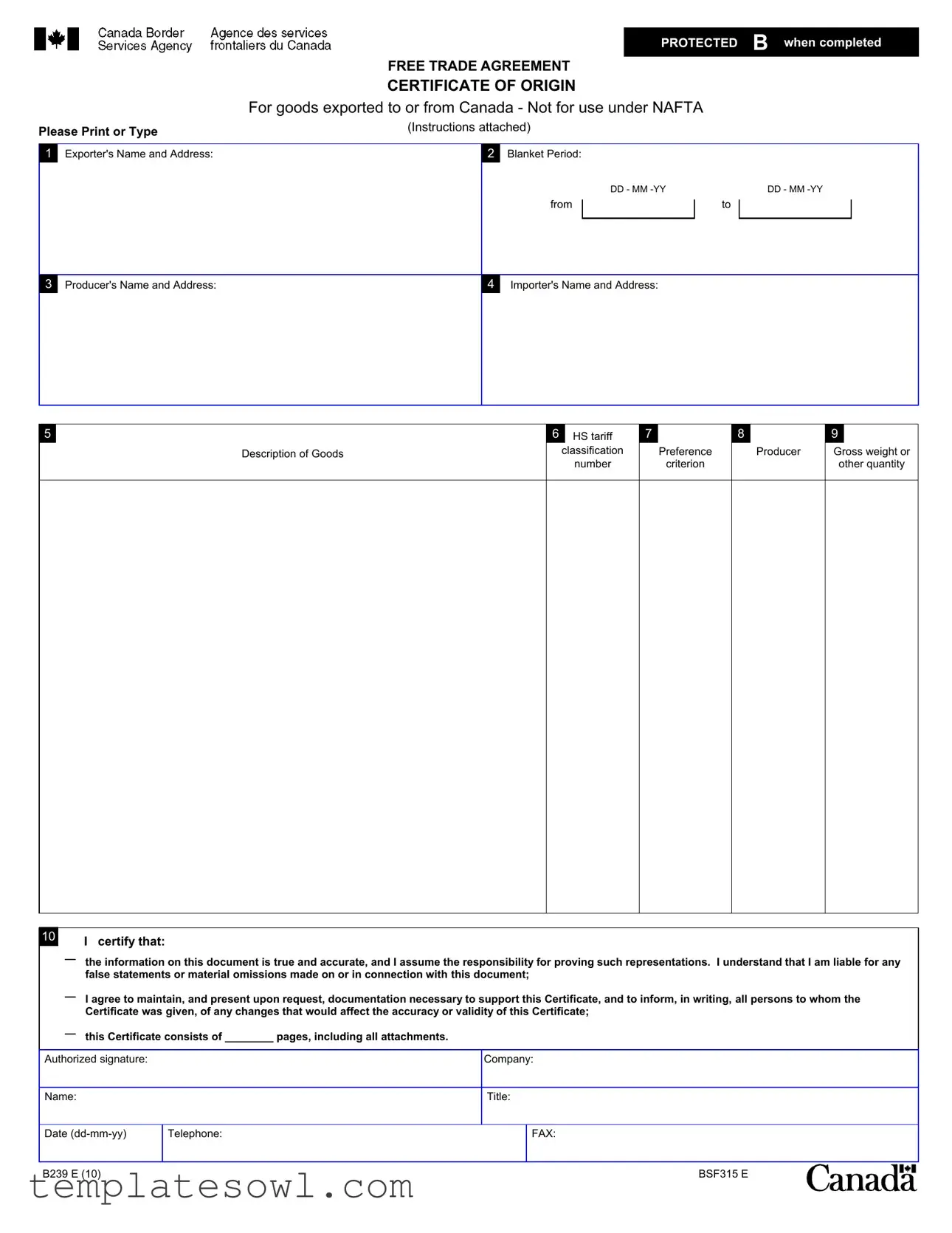

The NAFTA Certificate of Origin for Canada plays a crucial role in international trade, particularly for goods exported to or imported from Canada. This document seeks to facilitate preferential tariff treatment under trade agreements, ensuring that qualifying goods receive reduced duties or are exempt from certain tariffs. It requires the exporter to provide essential information, including their name, address, and details about the goods being traded. Key sections of the form address the producer's and importer's information, as well as a thorough description of the goods, linked to their Harmonized System (HS) classification numbers. Notably, the certificate includes space for a verification of compliance with specific preference criteria, indicating how the goods qualify for preferential treatment. Exporters must certify the accuracy of the information presented, acknowledging their responsibility for any inaccuracies or omissions. Maintaining documentation to support the claims made within the certificate is an added requirement, indicating a commitment to transparency in the trading process.

Nafta Certificate Of Origin Canada Example

PROTECTED B when completed

FREE TRADE AGREEMENT

CERTIFICATE OF ORIGIN

For goods exported to or from Canada - Not for use under NAFTA

Please Print or Type |

(Instructions attached) |

|

|

|

||||

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

1 |

Exporter's Name and Address: |

|

2 |

Blanket Period: |

|

|

|

|

|

|

|

|

|

DD - MM |

|

DD - MM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

from |

|

to |

|

|

|

|

|

|

|

|

|

|

|

3Producer's Name and Address:

4Importer's Name and Address:

5

Description of Goods

6HS tariff

classification

number

7

Preference

criterion

8

Producer

9

Gross weight or

other quantity

10I certify that:

—the information on this document is true and accurate, and I assume the responsibility for proving such representations. I understand that I am liable for any false statements or material omissions made on or in connection with this document;

—I agree to maintain, and present upon request, documentation necessary to support this Certificate, and to inform, in writing, all persons to whom the Certificate was given, of any changes that would affect the accuracy or validity of this Certificate;

—this Certificate consists of ________ pages, including all attachments.

Authorized signature:

Company:

Name:

Title:

Date

Telephone:

FAX:

B239 E (10) |

BSF315 E |

FREE TRADE AGREEMENT

CERTIFICATE OF ORIGIN INSTRUCTIONS FOR GOODS EXPORTED TO OR FROM CANADA -

NOT FOR USE UNDER NAFTA

For purposes of obtaining preferential tariff treatment, this document must be completed legibly and in full by the exporter and be in the possession of the importer at the time the declaration is made. Please print or type.

Field 1: State the full legal name and address of the exporter.

Field 2: Complete this field if the certificate covers multiple shipments of identical goods, as described in Field 5, that are imported for a specified period of up to one year (blanket period). "From" is the date upon which the certificate becomes applicable to the good covered by the blanket certificate (it may be prior to the date of signing this certificate). "To" is the date upon which the blanket period expires. The importation of a good for which preferential tariff treatment is claimed based on this certificate must occur between these dates.

Field 3: State the full legal name and address of the producer. If more than one producer's good is included on the certificate, attach a list of the additional producers, including the legal name and address cross referenced to the good described in field 5. If you wish this information to be confidential, it is acceptable to state "Available to customs upon request." If the producer and the exporter are the same, complete field with "Same." If the producer is unknown, it is acceptable to state "Unknown."

Field 4: State the full legal name and address of the importer. If the importer is not known, state "Unknown"; if multiple importers, state "Various."

Field 5: Provide a full description of each good. The description should be sufficient to relate it to the invoice description and to the Harmonized System (HS) description of the good. If the certificate covers a single shipment of a good, i.e., it is not a blanket certificate, include the invoice number as shown on the commercial invoice. If not known, indicate another unique reference number, such as the shipping order number.

Field 6: For each good described in Field 5, identify the HS tariff classification to six digits. If the good is subject to a specific rule of origin that requires eight digits, identify to eight digits, using the HS tariff classification of the Party into whose territory the good is imported.

Field 7: For each good described in Field 5, state which criterion (A through E) is applicable. The rules of origin are set out in the regulations enacted and published by the Parties.

Note: In order to be entitled to preferential tariff treatment, each good must meet at least one of the criteria below.

Preference criteria

AThe good is "wholly obtained or produced entirely" in the

Note: The purchase of a good in the

BThe good is produced entirely in the

CThe good satisfies, as a result of production occurring entirely within the

DThe good is produced entirely in the

Goods are produced in the

Eundergo the required change in tariff classification. This criterion is applicable only where the good incorporated one or more

Note: This criterion does not apply to Chapters 61 through 63 of the HS

Field 8: For each good described in Field 5, state "Yes" if you are the producer of the good. If you are not the producer of the good, state "No" followed by (1) or (2), depending on whether this certificate was based upon: (1) your knowledge of whether the good qualifies as an originating good or (2) your reliance on the producer's written representation that the good qualifies as an originating good.

Field 9: Where the certificate is not a blanket certificate indicate the gross weight or number of pieces in the shipment.

Field 10: This field must be completed, signed, and dated by the exporter. The date must be the date the certificate was completed and signed.

Form Characteristics

| Fact Name | Detail |

|---|---|

| Document Purpose | The Free Trade Agreement Certificate of Origin is used for goods exported to or from Canada, specifically under trade agreements, not NAFTA. |

| Exporter Information | Field 1 requires the full legal name and address of the exporter to ensure accountability and traceability. |

| Blanket Period | Field 2 allows for a blanket period covering multiple shipments of identical goods for up to one year. |

| Producer Details | In Field 3, the full legal name and address of the producer must be provided. Additional producers can be listed if applicable. |

| Importer Information | Field 4 is dedicated to the importer’s full legal name and address. If unknown, "Unknown" may be stated. |

| Goods Description | Field 5 must provide a clear description of each good to relate it to the invoice and Harmonized System classification. |

| HS Tariff Classification | Field 6 requires identification of the HS tariff classification, crucial for determining duty rates and eligibility for tariff treatment. |

| Preference Criterion | Field 7 requires indicating which preference criterion (A through E) applies for each good, critical for establishing eligibility for preferential treatment. |

| Producer Status | In Field 8, the exporter certifies whether they are the producer of the goods, which impacts the validity of the certificate. |

| Certification Requirement | In Field 10, the exporter must sign and date the certificate, acknowledging the truthfulness of the information provided. |

Guidelines on Utilizing Nafta Certificate Of Origin Canada

After gathering the necessary information, the next step is to accurately fill out the NAFTA Certificate of Origin for Canada. This ensures that the document meets the requirements for preferential tariff treatment. Proper completion helps in avoiding delays during transportation and potential penalties.

- Exporter's Name and Address: Enter the full legal name and complete address of the exporter.

- Blanket Period: If applicable, provide the start and end dates for multiple shipments of identical goods in a format of DD-MM-YY.

- Producer's Name and Address: Fill in the full legal name and address of the producer. Attach a list for multiple producers, if necessary.

- Importer's Name and Address: Input the full legal name and address of the importer. Use "Unknown" if not known, or "Various" if there are multiple importers.

- Description of Goods: Offer a full description of each good that relates it to the invoice and HS description. Include the invoice number, if applicable.

- HS Tariff Classification Number: Identify the six-digit tariff classification for each good. Use eight digits if required by specific rules.

- Preference Criterion: State which of the specific criteria (A through E) applies to each good described.

- Producer: Indicate "Yes" if you are the producer, or "No" followed by (1) or (2) to explain your knowledge or reliance on the producer's representation.

- Gross Weight or Other Quantity: Provide the gross weight or the number of pieces for non-blanket certificates.

- Certification: Sign and date the certificate, ensuring the date reflects when it was completed and signed. Include your title, company, and contact information such as telephone and fax numbers.

What You Should Know About This Form

What is the purpose of the NAFTA Certificate of Origin Canada form?

The NAFTA Certificate of Origin Canada form serves as a declaration that specific goods qualify for preferential tariff treatment under trade agreements. This document must be completed accurately by the exporter and presented to the importer at the time of declaration. It ensures that goods meet the origin criteria, allowing them to benefit from reduced tariffs when exported to or from Canada.

Who is responsible for completing the form?

The exporter is responsible for fully completing the NAFTA Certificate of Origin Canada form. This includes providing necessary information, such as the names and addresses of the exporter, producer, and importer, along with detailed descriptions of the goods and relevant tariff classification numbers. The exporter must ensure that all information is accurate and supportable with documentation, as they assume liability for any misrepresentation.

What information is required in the NAFTA Certificate of Origin Canada form?

The form requires several key pieces of information. You must provide the full legal names and addresses of the exporter, producer, and importer. Additionally, the description of the goods and their corresponding HS tariff classification is necessary. You must also indicate the preference criterion that applies to each good and certify the accuracy of the information provided. If the certificate covers multiple shipments, a blanket period must also be specified.

What should I do if I am not the producer of the goods?

If you are not the producer of the goods, you must clearly state this on the form. Indicate "No" in Field 8, followed by (1) or (2). Choose (1) if your knowledge supports that the good qualifies as an originating good. Select (2) if your assertion is based on the producer's written representation. It is vital to provide this information accurately to maintain the integrity of the certificate.

Common mistakes

Completing the NAFTA Certificate of Origin Canada form can be challenging, and numerous mistakes can compromise its accuracy and effectiveness. One common mistake occurs in Field 1, where people often fail to include the full legal name and address of the exporter. This information is crucial as it identifies the party responsible for the goods. Omitting or incorrectly entering this information can lead to delays or even rejection by customs.

Another frequent error can be found in Field 2, the blanket period. Many individuals either skip this field entirely or do not input the dates correctly. Misunderstanding the concept of the blanket period can create significant problems. The "from" date should accurately reflect when the certificate becomes applicable, which may be earlier than the signing date. Similarly, the "to" date needs to align with the end of the specified period for imports of the goods covered by the certificate.

Field 5, which requires a full description of the goods, often sees mistakes due to vague or incomplete descriptions. Some exporters may not provide enough detail to adequately relate the goods to their corresponding invoice or HS descriptions. This can lead to confusion, and customs officials may hesitate to accept a poorly described shipment. Providing clear and specific details is essential for smooth processing.

One critical aspect that exporters frequently overlook is in Field 7, where they must indicate the applicable preference criterion. Many fail to understand that each good must meet at least one of the outlined criteria to qualify for preferential tariff treatment. This misunderstanding can easily lead to disqualification of goods when they do not meet the necessary standards established by the free trade agreement.

Lastly, completing Field 10 is often rushed, which results in missing or inaccurate signatures and dates. This field is mandatory, and inadequate completion can render the entire certificate invalid. Taking extra care to ensure that this field is accurately filled out is crucial for maintaining the certificate’s integrity and ensuring compliance with trade regulations.

Documents used along the form

The NAFTA Certificate of Origin is an essential document for businesses engaged in trade within North America. However, several other forms and documents often accompany it to ensure compliance with trade agreements and customs regulations. Here’s a brief overview of these documents.

- Commercial Invoice: This document includes details about the sale of goods, such as the buyer's and seller's information, a description of the products, and their value. It is crucial for customs clearance and serves as proof of transaction.

- Packing List: This lists all the items included in a shipment, detailing quantities and weights. While it is not always mandatory, it facilitates customs inspections and helps in accurately calculating shipping costs.

- Bill of Lading: Serving as a contract between the shipper and the carrier, this document outlines the specifics of transportation. It provides evidence of shipment and details the terms under which goods are being transported.

- Import/Export License: Depending on the goods and the countries involved, these licenses may be necessary. They grant permission to import or export specific items and ensure compliance with national regulations.

- Customs Declaration Form: Required for all shipments entering or leaving a country, this form contains information about the goods being transported, including their value and classification. It helps customs officials determine applicable duties and taxes.

- Letter of Credit: This financial document is used in international trade to guarantee that payment will be made to the exporter. The bank commits to pay the exporter as long as they meet the specified conditions, providing security for both parties.

Understanding these accompanying documents is vital for smooth international trade operations. They not only help ensure compliance with various trade agreements but also pave the way for efficient customs processing, minimizing potential delays and complications along the way.

Similar forms

-

Certificate of Origin (CO): This document is often used in international shipping to certify the country of origin of goods. Similar to the NAFTA Certificate of Origin, it provides necessary details about the shipment, such as the exporter, importer, and product description, allowing preferential treatment under various trade agreements.

-

Commercial Invoice: A commercial invoice is a record of the sale between the buyer and seller. Like the NAFTA Certificate, it describes the goods, including their value and origin. It is essential for customs clearance and may also declare the terms of sale.

-

Bill of Lading (BOL): The bill of lading serves as a contract between the shipper and carrier. It details the transportation of goods and is similar to the NAFTA Certificate of Origin in that it outlines essential shipment information and facilitates the movement of products across borders.

-

Import/Export License: This document grants permission to import or export goods and is essential for compliance with international trade regulations. Similar to the NAFTA Certificate, it provides specific information about the goods and ensures that they meet the necessary legal requirements for trade.

Dos and Don'ts

When filling out the NAFTA Certificate of Origin Canada form, it is important to adhere to specific guidelines to ensure accuracy and compliance.

- Do: Always print or type clearly to ensure legibility. This helps prevent any misunderstandings or errors.

- Do: Provide the full legal names and addresses for the exporter, producer, and importer. This information must be complete for regulatory purposes.

- Do: Include a detailed description of goods along with the invoice number or another unique reference number. Clarity is crucial.

- Do: Specify the HS tariff classification number for each good, as this is necessary for proper categorization.

- Do: Sign and date the certificate in the designated area, ensuring it matches the date the form was completed.

- Do: Maintain supporting documentation that corroborates the information provided. This may be requested by authorities in the future.

- Don't: Do not leave any fields blank. Each section must be completed to avoid delays or invalidation of the certificate.

- Don't: Avoid using vague terms or descriptions. Each item should be clearly identified to prevent confusion during inspections.

- Don't: Do not misrepresent information. Providing false statements or incorrect details can lead to serious penalties.

- Don't: Forget to check the accuracy of the HS classification. Each number must align with the specific good being exported.

- Don't: Skip the certification section. Ensure that it is signed by the exporter and includes the appropriate date.

- Don't: Use outdated information. Ensure that all details reflect the current state of goods being exported.

Misconceptions

Many people misunderstand the Nafta Certificate of Origin for Canada. Here are seven common misconceptions and their clarifications:

- The Nafta Certificate is the same as the NAFTA Certificate. The form is actually for goods exported to or from Canada, but it is not for use under NAFTA.

- All exporters need to fill out the certificate. Only exporters who want preferential tariff treatment for their goods must complete this document.

- The certificate guarantees no tariffs. Completing the certificate does not automatically exempt goods from tariffs. Each good must meet specific criteria to qualify for preferential treatment.

- Blanket certificates are only for one shipment. Blanket certificates can cover multiple shipments of identical goods over a specified period, up to one year.

- Incorrect information has no consequences. The exporter is liable for any false statements or omissions. Responsibility lies in providing truthful and complete information.

- If the producer is unknown, it can be left blank. If the producer is not known, you must indicate "Unknown" in the appropriate field; it cannot be omitted.

- The certificate is valid forever. The certificate is only valid for the specified blanket period or until the information changes. It must be updated if needed.

Understanding these points can help ensure proper use of the Nafta Certificate of Origin in Canada.

Key takeaways

Key takeaways for filling out and using the NAFTA Certificate of Origin Canada form:

- The form must be completed fully and legibly, providing all requested information, including details about the exporter, producer, importer, and goods.

- To qualify for preferential tariff treatment under this agreement, each good must meet certain rules of origin criteria outlined in the form.

- If the goods are being shipped multiple times, a blanket period can be used, but specific date ranges must be defined for the certificate’s validity.

- Keep accurate documentation and records to support the information on the certificate. Changes affecting the accuracy must be communicated in writing to all parties involved.

Browse Other Templates

Background Check Pennsylvania - Requesting for international adoption requires notarization and a $15.00 fee.

Job Activity Safety Assessment,Workplace Risk Evaluation,Safety Task Analysis,Job Risk Assessment Form,Hazard Identification and Evaluation,Safety Measures Documentation,Worksite Safety Review,Activity Hazard Assessment,Risk Management Evaluation,Saf - Specific actions and recommendations are made to control identified risks within the JSA.

What Is It 201 Tax Form - It is essential to follow instructions carefully when completing this form.