Fill Out Your Nasd Rule 3050 Form

The NASD Rule 3050 form plays a critical role in the brokerage industry, particularly in maintaining transparency and compliance when an employee of a FINRA or Exchange member firm seeks to open a brokerage account. This form ensures that employee account holders formally acknowledge their affiliation with member firms while also notifying their employers of their intentions. The provisions of this form require employees to provide essential information, including the employer's name and address, as well as confirming whether the firm will require duplicate confirmations or statements. Additionally, the form mandates signatures from the employee and a compliance officer, underscoring the importance of oversight and adherence to industry standards. Overall, this form serves as a vital communication tool, fostering accountability and ethical practices in trading activities among affiliated persons.

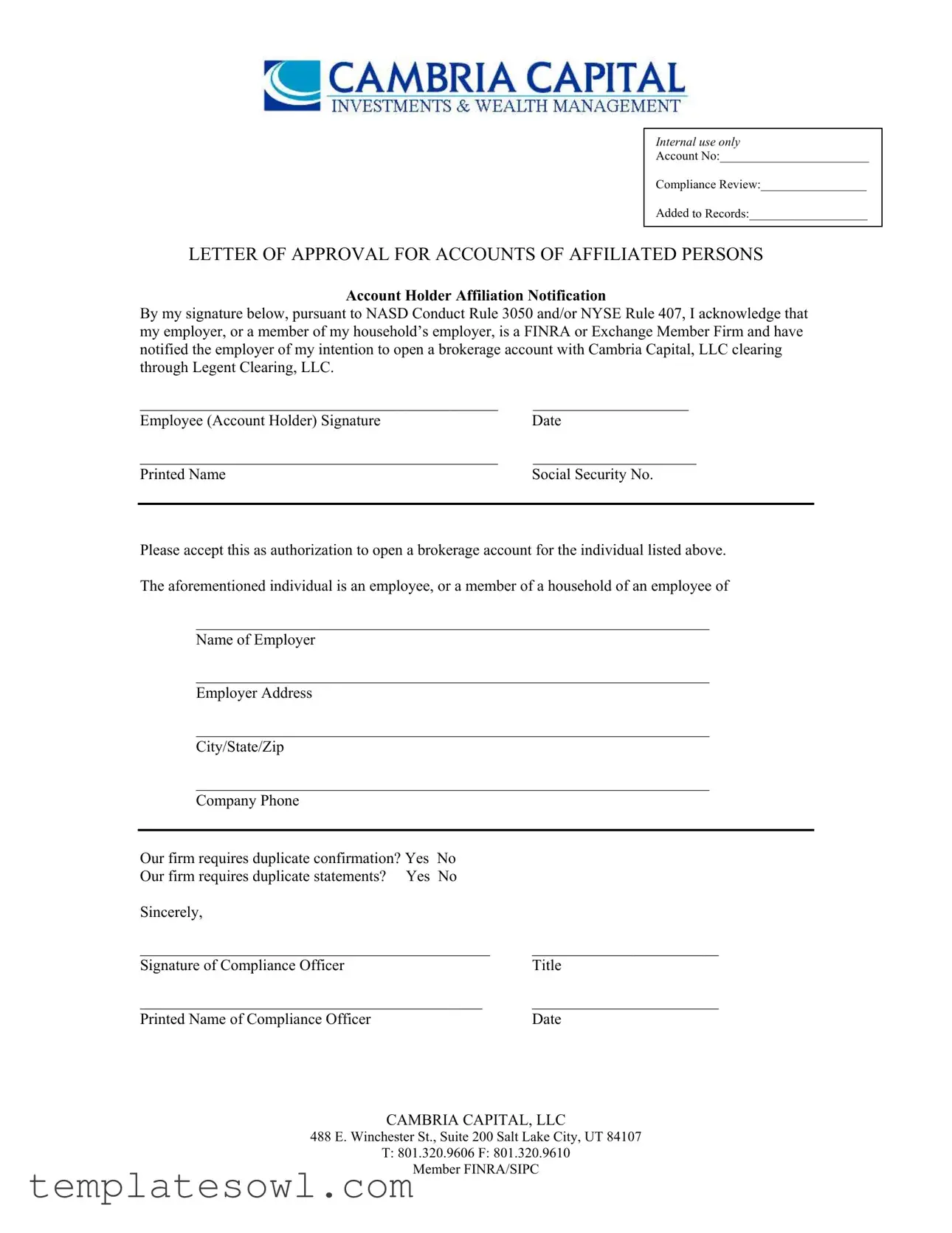

Nasd Rule 3050 Example

Internal use only

Account No:________________________

Compliance Review:_________________

Added to Records:___________________

LETTER OF APPROVAL FOR ACCOUNTS OF AFFILIATED PERSONS

ACCOUNT HOLDER AFFILIATION NOTIFICATION

By my signature below, pursuant to NASD Conduct Rule 3050 and/or NYSE Rule 407, I acknowledge that my employer, or a member of my household’s employer, is a FINRA or Exchange Member Firm and have notified the employer of my intention to open a brokerage account with Cambria Capital, LLC clearing through Legent Clearing, LLC.

______________________________________________ |

____________________ |

Employee (Account Holder) Signature |

Date |

______________________________________________ |

_____________________ |

Printed Name |

Social Security No. |

|

|

Please accept this as authorization to open a brokerage account for the individual listed above.

The aforementioned individual is an employee, or a member of a household of an employee of

__________________________________________________________________

Name of Employer

__________________________________________________________________

Employer Address

__________________________________________________________________

City/State/Zip

__________________________________________________________________

Company Phone

Our firm requires duplicate confirmation? Yes |

No |

|

Our firm requires duplicate statements? Yes |

No |

|

Sincerely, |

|

|

_____________________________________________ |

________________________ |

|

Signature of Compliance Officer |

|

Title |

____________________________________________ |

________________________ |

|

Printed Name of Compliance Officer |

|

Date |

CAMBRIA CAPITAL, LLC

488 E. Winchester St., Suite 200 Salt Lake City, UT 84107

T:801.320.9606 F: 801.320.9610 Member FINRA/SIPC

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The NASD Rule 3050 form is used to notify a broker-dealer about an employee's intention to open a brokerage account with them. |

| Affiliation Notification | The form requires the account holder to disclose their employment status or household member's employment status with a FINRA or Exchange Member Firm. |

| Compliance Review | Compliance officers review the form to ensure that account holders comply with related rules and regulations. |

| Signature Requirement | Both the employee (account holder) and a compliance officer must sign the form for it to be valid. |

| Duplicate Statements | The form includes options for whether the firm requires duplicate confirmations or statements to be sent out. |

| Governing Laws | The form is governed by NASD Conduct Rule 3050 and NYSE Rule 407. |

| Social Security Number | The account holder is required to provide their Social Security number for identification purposes. |

| Employer Information | Details about the employer, including the name and address, must be filled out on the form. |

| Firm Details | Cambria Capital, LLC’s address and contact information are included for record-keeping and communication purposes. |

Guidelines on Utilizing Nasd Rule 3050

Filling out the NASD Rule 3050 form is essential for employees looking to open a brokerage account while complying with regulatory standards. This process involves providing your personal information and notifying your employer, ensuring transparency and adherence to rules. Follow the steps carefully to complete the form accurately.

- Write your account number in the designated space.

- Indicate the compliance review by entering the appropriate information.

- Confirm whether you have been added to the records by noting the date.

- Sign your name as the account holder in the signature section.

- Fill in today's date next to your signature.

- Print your full name in the provided space below your signature.

- Enter your Social Security number in the corresponding field.

- Provide the name of your employer in the designated area.

- Fill out your employer's address, including city, state, and zip code.

- List the company phone number to keep contact clear.

- Indicate whether your firm requires duplicate confirmations by selecting "Yes" or "No."

- Indicate whether your firm requires duplicate statements by selecting "Yes" or "No."

- The compliance officer must sign the form in the signature section provided.

- The compliance officer should also input their title below their signature.

- The compliance officer’s printed name must be filled in next to their signature.

- Provide the date next to the compliance officer's printed name.

Once these steps are complete, ensure you have all required signatures and information before submitting the form to avoid any delays in processing your account request.

What You Should Know About This Form

What is the NASD Rule 3050 form?

The NASD Rule 3050 form is a document that employees or members of a household of employees must complete when they intend to open a brokerage account with a firm that is a member of FINRA or an Exchange Member. This form is designed to ensure that the employer is aware of the employee's intention to open the account, thereby maintaining compliance with industry regulations.

Who needs to fill out the NASD Rule 3050 form?

Any employee who works for a FINRA member firm or whose household member is employed by one must fill out this form. The form serves as a notification to the employer about the employee's intention to open a personal brokerage account.

What information do I need to provide on the form?

You will need to provide your account number, compliance review details, your affiliation to the employer, and the employer's information. Additionally, you must sign and date the form, confirming your acknowledgment of the requirements under NASD and/or NYSE rules.

What is the purpose of the compliance review section?

This section allows the compliance officer to review the account application to ensure that it adheres to internal policies and any regulatory requirements. It helps maintain transparency and integrity in trading activities.

Do I need my employer's approval to open a brokerage account?

While you do not need explicit approval from your employer, you must notify them of your intention to open the account by completing the NASD Rule 3050 form. This is a requirement to comply with the associated regulations.

What are duplicate confirmations and statements?

Duplicate confirmations and statements refer to the practice of sending an additional copy of trade confirmations or account statements to your employer. This is often required by firms to keep the employer informed about all trading activities conducted by their employees.

Where do I submit the NASD Rule 3050 form?

You should submit the completed form to your brokerage firm, in this case, Cambria Capital, LLC. They will process your request and inform you of any further steps needed to open your account.

Common mistakes

Filling out the NASD Rule 3050 form is important for compliance and for protecting your financial interests. Mistakes during this process can lead to delays or even denial of your brokerage account application. One common error is failing to provide the correct Account Number. This information is crucial for accurately processing your application and maintaining your records. Double-check to ensure that you have included this information in the specified blank.

Another frequent mistake occurs when individuals do not include their Social Security Number. This number is essential for identification purposes, and omitting it can cause complications. It is also important to make sure it's written clearly. Incomplete identification can result in unnecessary delays in your application.

People often neglect the Employer Name and Employer Address sections. The form explicitly requires these details to verify your employment status, which is essential for compliance with NASD rules. Any missing information in these sections can stall the application process.

Inaccurate or illegible signatures are another problem. The signature of the employee (Account Holder) must be clear and match the printed name provided. A signature that is difficult to read could lead to confusion and may require additional follow-up.

Another error is not checking the boxes regarding duplicate confirmations and duplicate statements. If your firm requires these, leaving these sections unchecked can create issues in managing your account documentation. It's important to carefully consider these options to ensure you receive all necessary information.

Failing to notify your employer or the compliance officer about the account can also lead to complications. It is essential to keep your employer informed of your activities and intentions regarding brokerage accounts, which is a requirement under the NASD Conduct Rule.

A common oversight involves the Compliance Officer's section. Ensure that the signature, printed name, and title of the Compliance Officer are filled in correctly and signed. An incomplete Compliance Officer section can result in the rejection of the application.

Finally, ensure all dates are entered correctly. Dates are often overlooked or misplaced, which can cause confusion in processing your application. An accurate date ensures the timeliness of your application and maintains a proper timeline for compliance checks.

Documents used along the form

When dealing with the NASD Rule 3050 form, several other important documents may come into play. These forms help ensure compliance and facilitate smooth operations within the brokerage and financial sectors. Understanding these auxiliary documents is key for efficient management of an account.

- Account Application Form: This document is the initial paperwork required for opening a new brokerage account. It gathers essential information about the individual, including personal details, financial status, and investment objectives.

- Customer Disclosure Agreement: This agreement outlines the firm's policies regarding the use of customer information and their rights. It provides transparency on how the firm handles customer data, affirming compliance with privacy regulations.

- Client Investment Policy Statement: This document establishes client investment goals, risk tolerance, and asset allocation preferences. It serves as a roadmap for investment decisions and adjustments over time.

- W-9 Form: A W-9 form is used to provide taxpayer identification information to the brokerage. This form is essential for tax purposes, especially when reporting investment earnings to the IRS.

- Compliance Certification: This certification confirms that the client has reviewed and understood compliance rules. Required by many firms, it assures that the client is aware of the potential risks associated with trading.

- Privacy Policy Acknowledgment: This document ensures clients understand the firm's privacy practices. Clients acknowledge their rights regarding the sharing and protection of their personal information.

Reviewing and completing these documents promptly can help streamline account opening and management processes. Ensuring compliance with regulations not only protects the business but also builds trust with clients.

Similar forms

The NASD Rule 3050 form is essential for individuals who work for or are associated with a FINRA or Exchange Member Firm. It helps regulate the opening of brokerage accounts for these individuals. Here are ten other documents that share similarities with the NASD Rule 3050 form:

- W-9 Form: This form is used to provide taxpayer identification information to a financial institution. Like the NASD Rule 3050 form, it requires acknowledgment that the individual is connected in a significant way to a financial entity.

- Brokerage Account Application: This document is necessary for opening a brokerage account. It, too, requires personal information and a declaration of any affiliations with financial institutions.

- Conflict of Interest Disclosure: Similar to the NASD Rule 3050, this form discloses any personal or professional conflicts an individual may have when engaging in financial transactions. Transparency is key in both cases.

- Insider Trading Policy Acknowledgment: Employees often need to acknowledge their understanding of insider trading policies. Just like the NASD Rule 3050, this document emphasizes the importance of understanding one's role and responsibilities within the financial ecosystem.

- Employment Verification Form: This document confirms an individual's employment status. It parallels the NASD Rule 3050 form in ensuring that employers are aware of their employees' activities.

- Consent for Electronic Delivery: Many firms require consent for sending account-related documents electronically. This is similar in nature to the NASD Rule 3050 form as both require a formal acknowledgment from the individual.

- Privacy Policy Acknowledgment: Clients usually need to understand how their information is used. This acknowledgment is like the NASD Rule 3050 form because it ensures that the individual is aware of information handling related to their accounts.

- Account Transfer Instruction Form: When transferring accounts, this form must be completed. It similarly requires consent and acknowledgment of the person's affiliations.

- New Account Confirmation: This document confirms the details after the account is set up. Much like the NASD Rule 3050 form, it serves to validate the relationship between the individual and the financial institution.

- Regulatory Reporting Forms: These forms are often used to report certain activities to regulatory bodies. They, too, necessitate clear disclosure of relationships similar to those outlined in the NASD Rule 3050.

Understanding these documents is crucial for maintaining compliance and ensuring transparency in the financial industry.

Dos and Don'ts

When filling out the NASD Rule 3050 form, attention to detail is crucial. Below are guidelines to help ensure compliance with the necessary requirements.

- Do: Clearly print your name and provide accurate personal information, including Social Security number.

- Do: Obtain your employer's acknowledgment of your intention to open a brokerage account.

- Do: Sign and date the form in the designated areas to validate your submission.

- Do: Ensure that all required fields are filled out completely before submission.

- Don't: Submit the form without confirming that your employer is a FINRA or Exchange member.

- Don't: Forget to check if your firm requires duplicate confirmations and statements, and indicate your preference.

Adhering to these guidelines will streamline the process and help avoid any complications with your application.

Misconceptions

Misconceptions about the NASD Rule 3050 form can lead to misunderstandings about its purpose and requirements. Here’s a list of common misconceptions:

- 1. It is only required for employees of financial firms. Many believe that only employees working directly for financial firms need to fill out the NASD Rule 3050 form. However, it also applies to members of households associated with such firms.

- 2. The form is optional. Some people might think the form is just a suggestion. In reality, it is a requirement for anyone opening a brokerage account with an affiliated person.

- 3. Only the account holder needs to sign. While the account holder’s signature is mandatory, the compliance officer’s signature and details are also required to ensure the proper approval process is followed.

- 4. It only needs to be submitted once. Many assume that submitting the form once is sufficient for future accounts. In truth, it must be submitted for each new account opened.

- 5. It doesn’t require disclosure of employer information. Some may not realize that individuals must disclose detailed information about their employer, including name and address. This is crucial for compliance.

- 6. There are no consequences for failing to file. Ignoring the requirement can lead to serious consequences, including fines or disciplinary actions against both the account holder and the employer.

- 7. The form is only about account holder identification. While personal identification is important, the form also focuses on potential conflicts of interest and ensuring compliance with regulatory obligations.

Understanding the correct requirements and implications of the NASD Rule 3050 form helps to ensure compliance and foster transparency in brokerage account openings. Individuals should take the time to familiarize themselves with these aspects to avoid costly mistakes.

Key takeaways

Here are key takeaways for filling out and using the NASD Rule 3050 form:

- The form is required for employees or household members of employees wishing to open a brokerage account with a firm that is a FINRA or Exchange Member Firm.

- The account holder must notify their employer about their intention to open the account, ensuring compliance with relevant rules.

- Both the employee and the compliance officer must sign the form, with the compliance officer confirming the relationship between the employer and the employee.

- It is essential to provide complete and accurate information, including the employer's name and contact details, to facilitate the processing of the application.

- Consider whether the firm requires duplicate confirmations and statements, and indicate your preference clearly on the form.

Browse Other Templates

Sample Loan Application Application Application Form Application Cars Finance - Indicate how long you’ve been employed to show job stability.

Boiler Engineer Affidavit,Minnesota Boiler License Declaration,License Experience Verification Form,Boiler Operation Certification,Engineer Operating Experience Affidavit,Steam Engineer Affidavit,Boiler Qualification Statement,Thermal Systems Experie - Any submission of false information may result in serious civil penalties.

Creative Ways to Pick a Winner - Prepare for exciting upcoming specials!