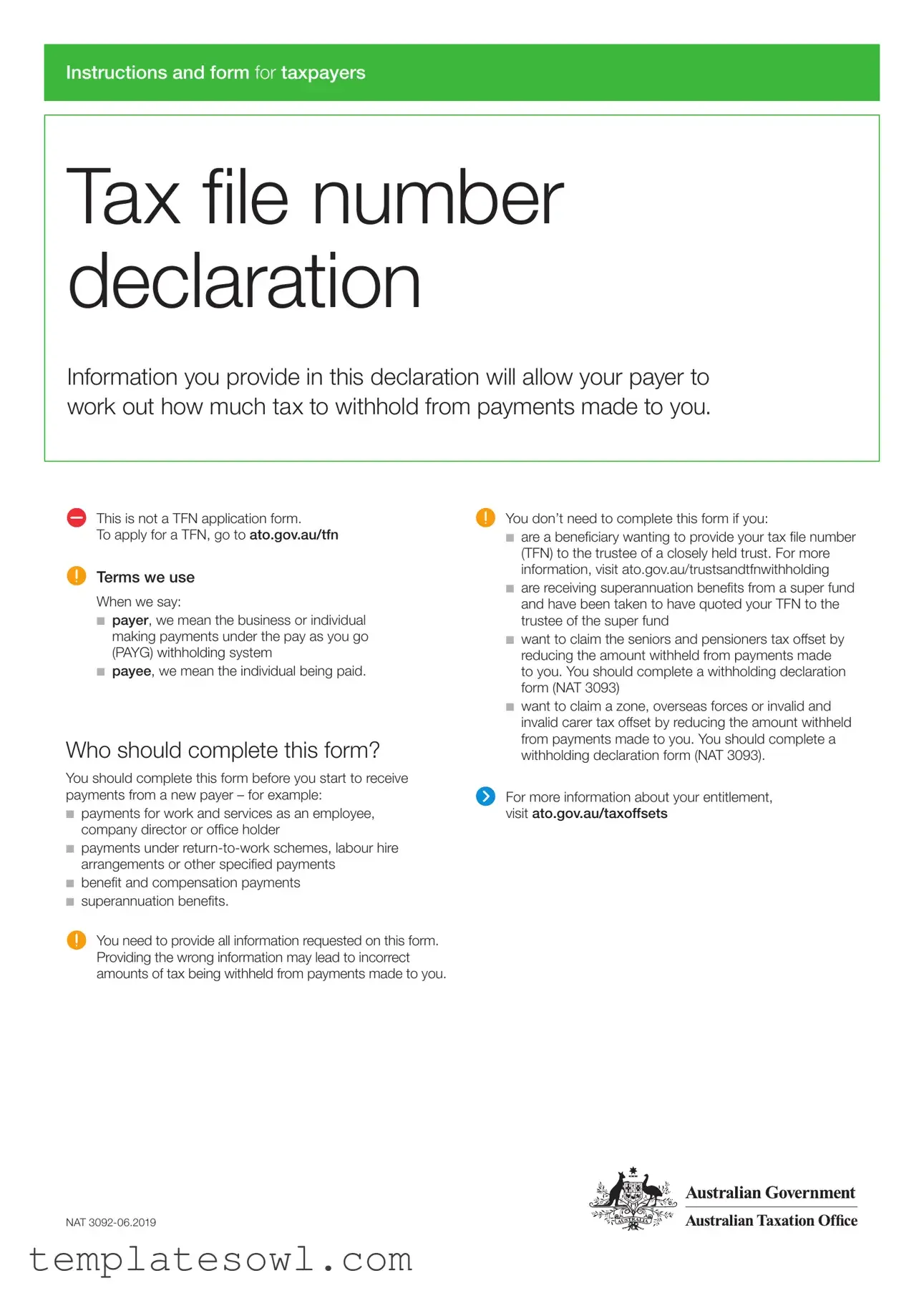

Fill Out Your Tax Declaration Nat 3092 Form

The Tax Declaration Nat 3092 form serves a crucial purpose for individuals who are entering into payment arrangements with new payers. Its primary function is to enable accurate tax withholding by allowing payers to determine the correct tax amounts to be deducted from payments made to payees. Completing this form is essential before accepting payments for various services, including employment, director fees, labor hire, and benefit or compensation payments. Taxpayers must provide their Tax File Number (TFN), which is vital for minimizing withholding tax rates. This form also requires individuals to declare their residency status for tax purposes, their eligibility for tax offsets, and any obligations concerning Higher Education Loan Program debts. Clarity in the provided information is paramount; errors can lead to incorrect tax withholding or administrative challenges. It is worth noting that there are specific scenarios where the form is unnecessary, such as when claiming certain tax offsets or when providing TFNs for closely held trusts. Understanding the implications and requirements of the Nat 3092 form is essential for individuals to effectively manage their tax obligations.

Tax Declaration Nat 3092 Example

Instructions and form for taxpayers

Tax file number declaration

Information you provide in this declaration will allow your payer to work out how much tax to withhold from payments made to you.

This is not a TFN application form.

To apply for a TFN, go to ato.gov.au/tfn

Terms we use

When we say:

■■payer, we mean the business or individual making payments under the pay as you go (PAYG) withholding system

■■payee, we mean the individual being paid.

Who should complete this form?

You should complete this form before you start to receive payments from a new payer – for example:

■■payments for work and services as an employee, company director or office holder

■■payments under

■■benefit and compensation payments

■■superannuation benefits.

You need to provide all information requested on this form. Providing the wrong information may lead to incorrect amounts of tax being withheld from payments made to you.

You don’t need to complete this form if you:

■■are a beneficiary wanting to provide your tax file number (TFN) to the trustee of a closely held trust. For more information, visit ato.gov.au/trustsandtfnwithholding

■■are receiving superannuation benefits from a super fund and have been taken to have quoted your TFN to the trustee of the super fund

■■want to claim the seniors and pensioners tax offset by reducing the amount withheld from payments made to you. You should complete a withholding declaration form (NAT 3093)

■■want to claim a zone, overseas forces or invalid and invalid carer tax offset by reducing the amount withheld from payments made to you. You should complete a withholding declaration form (NAT 3093).

For more information about your entitlement, visit ato.gov.au/taxoffsets

NAT

Section A: To be completed by the payee

Question 1

What is your tax file number (TFN)?

You should give your TFN to your employer only after you start work for them. Never give your TFN in a job application or over the internet.

We and your payer are authorised by the Taxation Administration Act 1953 to request your TFN. It’s not an offence not to quote your TFN. However, quoting your TFN reduces the risk of administrative errors and having extra tax withheld. Your payer is required to withhold the top rate of tax from all payments made to you if you do not provide your TFN or claim an exemption from quoting your TFN.

How do you find your TFN?

You can find your TFN on any of the following:

■■your income tax notice of assessment

■■correspondence we send you

■■a payment summary your payer issues to you.

If you have a tax agent, they may also be able to tell you. If you still can’t find your TFN, you can:

■■phone us on 13 28 61 between 8.00am and 6.00pm, Monday to Friday.

If you phone or visit us, we need to know we are talking to the correct person before discussing your tax affairs. We will ask you for details only you, or your authorised representative, would know.

You don’t have a TFN

If you don’t have a TFN and want to provide a TFN to your payer, you will need to apply for one.

For more information about applying for a TFN, visit ato.gov.au/tfn

You may be able to claim an exemption from quoting your TFN.

Print X in the appropriate box if you:

■■have lodged a TFN application form or made an enquiry to obtain your TFN. You now have 28 days to provide your TFN to your payer, who must withhold at the standard rate during this time. After 28 days, if you haven’t given your TFN to your payer, they will withhold the top rate of tax from future payments

■■are claiming an exemption from quoting a TFN because you are under 18 years of age and do not earn enough to pay tax, or you are an applicant or recipient of certain pensions, benefits or allowances from the:

––Department of Human Services – however, you will need to quote your TFN if you receive a Newstart, Youth or sickness allowance, or an Austudy or parenting payment

––Department of Veterans’ Affairs – a service pension under the Veterans’ Entitlement Act 1986

––Military Rehabilitation and Compensation Commission.

Providing your TFN to your super fund

Your payer must give your TFN to the super fund they pay your contributions to. If your super fund doesn’t have your TFN, you can provide it to them separately. This ensures:

■■your super fund can accept all types of contributions to your accounts

■■additional tax will not be imposed on contributions as a result of failing to provide your TFN

■■you can trace different super accounts in your name.

For more information about providing your TFN to your super fund, visit ato.gov.au/supereligibility

Question

Complete with your personal information.

Question 7

On what basis are you paid?

Check with your payer if you’re not sure.

Question 8

Are you an Australian resident for tax purposes or a working holiday maker?

Generally, we consider you to be an Australian resident for tax purposes if you:

■■have always lived in Australia or you have come to Australia and now live here permanently

■■are an overseas student doing a course that takes more than six months to complete

■■migrate to Australia and intend to reside here permanently.

If you go overseas temporarily and don’t set up a permanent home in another country, you may continue to be treated as an Australian resident for tax purposes.

If you are in Australia on a working holiday visa (subclass 417) or a work and holiday visa (subclass 462) you must place an X in the working holiday maker box. Special rates of tax apply for working holiday makers.

For more information about working holiday makers, visit ato.gov.au/whm

If you’re not an Australian resident for tax purposes or a working holiday maker, place an X in the foreign resident box, unless you are in receipt of an Australian Government pension or allowance.

Temporary residents can claim super when leaving Australia, if all requirements are met. For more information, visit ato.gov.au/departaustralia

Foreign resident tax rates are different

A higher rate of tax applies to a foreign resident’s taxable income and foreign residents are not entitled to a tax‑free threshold nor can they claim tax offsets to reduce withholding, unless you are in receipt of an Australian Government pension or allowance.

To check your Australian residency status for tax purposes or for more information, visit ato.gov.au/residency

2 |

Tax file number declaration |

Question 9

Do you want to claim the tax‑free threshold from this payer?

The

Answer yes if you want to claim the tax‑free threshold, you are an Australian resident for tax purposes, and one of the following applies:

■■you are not currently claiming the tax‑free threshold from another payer

■■you are currently claiming the tax‑free threshold from another payer and your total income from all sources will be less than the tax‑free threshold.

Answer yes if you are a foreign resident in receipt of an Australian Government pension or allowance.

Answer no if none of the above applies or you are a working holiday maker.

If you receive any taxable government payments or allowances, such as Newstart, Youth Allowance or Austudy payment, you are likely to be already claiming the tax‑free threshold from that payment.

For more information about the current tax‑free threshold, which payer you should claim it from, or how to vary your withholding rate, visit ato.gov.au/taxfreethreshold

Question 10

Do you have a Higher Education Loan Program (HELP), VET Student Loan (VSL), Financial Supplement (FS), Student Start‑up Loan (SSL) or Trade Support Loan (TSL) debt?

Answer yes if you have a HELP, VSL, FS, SSL or TSL debt.

Answer no if you do not have a HELP, VSL, FS, SSL or TSL debt, or you have repaid your debt in full.

You have a HELP debt if either:

■■the Australian Government lent you money under HECS‑HELP, FEE‑HELP, OS‑HELP, VET FEE‑HELP, VET Student loans prior to 1 July 2019 or SA‑HELP.

■■you have a debt from the previous Higher Education Contribution Scheme (HECS).

You have a SSL debt if you have an ABSTUDY SSL debt.

You have a separate VSL debt that is not part of your HELP debt if you incurred it from 1 July 2019.

For information about repaying your HELP, VSL, FS, SSL or TSL debt, visit ato.gov.au/getloaninfo

Have you repaid your HELP, VSL, FS, SSL or TSL debt?

When you have repaid your HELP, VSL, FS, SSL or TSL debt, you need to complete a Withholding declaration (NAT 3093) notifying your payer of the change in your circumstances.

Sign and date the declaration

Make sure you have answered all the questions in section A, then sign and date the declaration. Give your completed declaration to your payer to complete section B.

Section B: To be completed by the payer

Important information for payers – see the reverse side of the form.

Lodge online

Payers can lodge TFN declaration reports online if you have software that complies with our specifications.

For more information about lodging the TFN declaration report online, visit ato.gov.au/lodgetfndeclaration

Tax file number declaration |

3 |

More information

Internet

■■For general information about TFNs, tax and super in Australia, including how to deal with us online, visit our website at ato.gov.au

■■For information about applying for a TFN on the web, visit our website at ato.gov.au/tfn

■■For information about your super, visit our website at ato.gov.au/checkyoursuper

Useful products

In addition to this TFN declaration, you may also need to complete and give your payer the following forms which you can download from our website at ato.gov.au:

■■Medicare levy variation declaration (NAT 0929), if you qualify for a reduced rate of Medicare levy or are liable for the Medicare levy surcharge. You can vary the amount your payer withholds from your payments.

■■Standard choice form (NAT 13080) to choose a super fund for your employer to pay super contributions to. You can find information about your current super accounts and transfer any unnecessary super accounts through myGov after you have linked to the ATO. Temporary residents should visit ato.gov.au/departaustralia for more information about super.

Other forms and publications are also available from our website at ato.gov.au/onlineordering or by phoning 1300 720 092.

Phone

■■Payee – for more information, phone 13 28 61 between 8.00am and 6.00pm, Monday to Friday. If you want to vary your rate of withholding, phone 1300 360 221 between 8.00am and 6.00pm, Monday to Friday.

■■Payer – for more information, phone 13 28 66 between 8.00am and 6.00pm, Monday to Friday.

If you phone, we need to know we’re talking to the right person before we can discuss your tax affairs. We’ll ask for details only you, or someone you’ve authorised, would know. An authorised contact is someone you’ve previously told us can act on

your behalf.

If you do not speak English well and need help from the ATO, phone the Translating and Interpreting Service on 13 14 50.

If you are deaf, or have a hearing or speech impairment, phone the ATO through the National Relay Service (NRS) on the numbers listed below:

■■TTY users – phone 13 36 77 and ask for the ATO number you need (if you are calling from overseas, phone +61 7 3815 7799)

■■Speak and Listen (speech‑to‑speech relay) users – phone 1300 555 727 and ask for the ATO number you need (if you are calling from overseas, phone +61 7 3815 8000)

■■Internet relay users – connect to the NRS on relayservice.gov.au and ask for the ATO number you need.

If you would like further information about the National Relay Service, phone 1800 555 660 or email helpdesk@relayservice.com.au

Privacy of information

Taxation law authorises the ATO to collect information and to disclose it to other government agencies. For information about your privacy, go to ato.gov.au/privacy

Our commitment to you

We are committed to providing you with accurate, consistent and clear information to help you understand your rights and entitlements and meet your obligations.

If you follow our information in this publication and it turns out to be incorrect,

or it is misleading and you make a mistake as a result, we must still apply the law correctly. If that means you owe us money, we must ask you to pay it but we will not charge you a penalty. Also, if you acted reasonably and in good faith we will not charge you interest.

If you make an honest mistake in trying to follow our information in this publication and you owe us money as a result, we will not charge you a penalty. However, we will ask you to pay the money, and we may also charge you interest. If correcting the mistake means we owe you money, we will pay it to you. We will also pay you any interest you are entitled to.

If you feel that this publication does not fully cover your circumstances, or you are unsure how it applies to you, you can seek further assistance from us.

We regularly revise our publications to take account of any changes to the law, so make sure that you have the latest information. If you are unsure, you can check for more recent information on our website at ato.gov.au or contact us.

This publication was current at June 2019.

© Australian Taxation Office for the Commonwealth of Australia, 2019

You are free to copy, adapt, modify, transmit and distribute this material as you wish (but not in any way that suggests the ATO or the Commonwealth endorses you or any of your services or products).

Published by

Australian Taxation Office

Canberra

June 2019

4 |

Tax file number declaration |

|

|

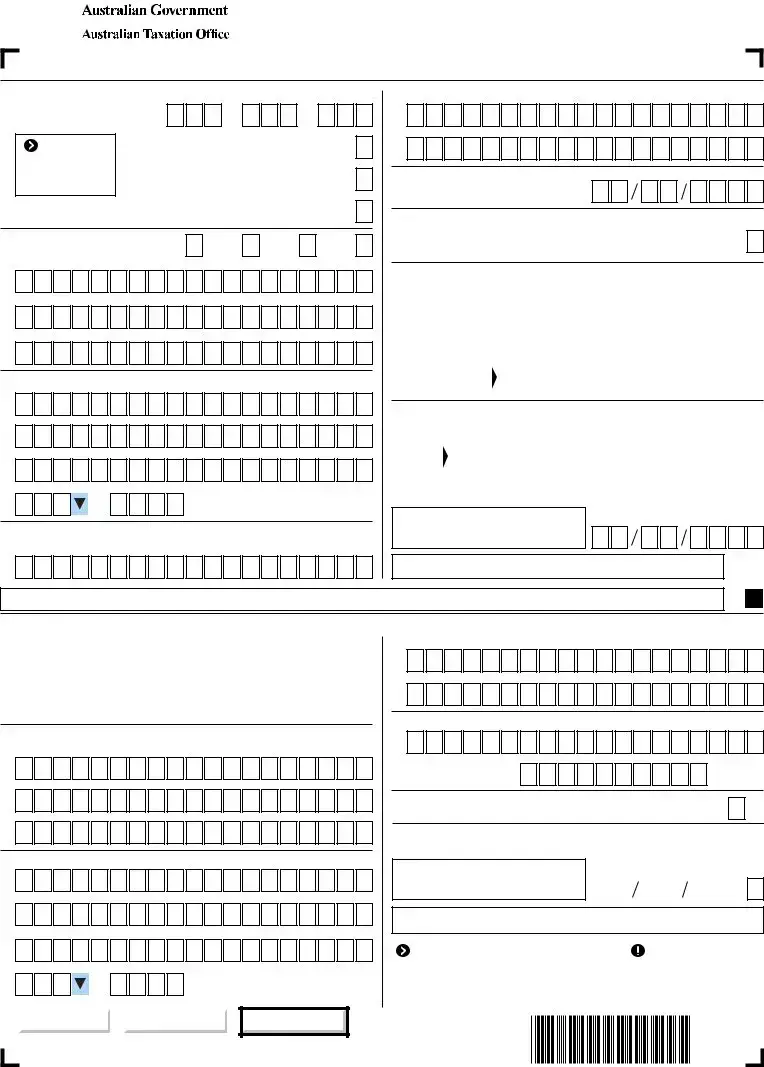

Tax file number declaration |

|

|

This declaration is NOT an application for a tax file number. |

|

|

■ Use a black or blue pen and print clearly in BLOCK LETTERS. |

|

|

■ Print X in the appropriate boxes. |

ato.gov.au |

■ Read all the instructions including the privacy statement before you complete this declaration. |

|

Section A: To be completed by the PAYEE

5 What is your primary

1What is your tax file number (TFN)?

For more information, see question 1 on page 2 of the instructions.

OR I have made a separate application/enquiry to the ATO for a new or existing TFN.

OR I am claiming an exemption because I am under 18 years of age and do not earn enough to pay tax.

OR I am claiming an exemption because I am in receipt of a pension, benefit or allowance.

Day |

Month |

Year |

6 What is your date of birth?

7 On what basis are you paid? (select only one)

2 What is your name? |

Title: Mr |

Mrs |

Miss |

Ms |

Surname or family name |

|

|

|

|

First given name |

|

|

|

|

Other given names |

|

|

|

|

3 What is your home address in Australia?

Suburb/town/locality

State/territory Postcode

4If you have changed your name since you last dealt with the ATO, provide your previous family name.

Full‑time |

|

Part‑time |

|

Labour |

|

Superannuation |

|

Casual |

|

|

|

|

|||||

employment |

|

employment |

|

hire |

|

or annuity |

|

employment |

|

|

|

income stream |

|

||||

|

|

|

|

|

|

|

|

8Are you: (select only one)

An Australian resident |

|

A foreign resident |

|

OR |

A working |

|

|

|

|

||||

for tax purposes |

|

for tax purposes |

|

holiday maker |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

9 Do you want to claim the tax‑free threshold from this payer?

Only claim the tax‑free threshold from one payer at a time, unless your total income from all sources for the financial year will be less than the tax‑free threshold.

|

|

|

|

Answer no here if you are a foreign resident or working holiday |

Yes |

|

No |

|

maker, except if you are a foreign resident in receipt of an |

|

|

|

|

Australian Government pension or allowance. |

|

|

|

|

10Do you have a Higher Education Loan Program (HELP), VET Student Loan (VSL), Financial Supplement (FS), Student Start‑up Loan (SSL) or

Trade Support Loan (TSL) debt?

Yes |

|

Your payer will withhold additional amounts to cover any compulsory |

No |

|

|

|

|||

|

repayment that may be raised on your notice of assessment. |

|

||

|

|

|

|

|

|

|

|

|

|

DECLARATION by payee: I declare that the information I have given is true and correct.

Signature

Date

Day |

Month |

Year |

You MUST SIGN here

There are penalties for deliberately making a false or misleading statement.

There are penalties for deliberately making a false or misleading statement.

Once section A is completed and signed, give it to your payer to complete section B.

Once section A is completed and signed, give it to your payer to complete section B.

Section B: To be completed by the PAYER (if you are not lodging online)

1 |

|

What is your Australian business number (ABN) or |

|

|

|

Branch number |

|||||||||||||||||

|

withholding payer number? |

|

|

|

(if applicable) |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

If you don’t have an ABN or withholding |

|

Yes |

|

|

|

No |

|

|

|||||||||||||

|

|

|

|

|

|

||||||||||||||||||

|

|

payer number, have you applied for one? |

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

3What is your legal name or registered business name (or your individual name if not in business)?

4What is your business address?

Suburb/town/locality

State/territory Postcode

5What is your primary

6Who is your contact person?

Business phone number

7 If you no longer make payments to this payee, print X in this box. DECLARATION by payer: I declare that the information I have given is true and correct.

Signature of payer

Date

Day |

|

Month |

|

|

Year |

|||

|

|

|

|

|

|

|

|

|

There are penalties for deliberately making a false or misleading statement.

There are penalties for deliberately making a false or misleading statement.

Return the completed original ATO copy to: |

|

IMPORTANT |

Australian Taxation Office |

|

See next page for: |

PO Box 9004 |

|

■ payer obligations |

PENRITH NSW 2740 |

|

■ lodging online. |

|

|

|

|

|

|

Print form |

|

Save form |

|

|

|

NAT

Reset form

Sensitive (when completed)

30920619

Payer information

The following information will help you comply with your pay as you go (PAYG) withholding obligations.

Is your employee entitled to work in Australia?

It is a criminal offence to knowingly or recklessly allow someone to work, or to refer someone for work, where that person is from overseas and is either in Australia illegally or is working in breach of their visa conditions.

People or companies convicted of these offences may face fines and/or imprisonment. To avoid penalties, ensure your prospective employee has a valid visa

to work in Australia before you employ them. For more information and to check a visa holder’s status online, visit the Department of Home Affairs website at homeaffairs.gov.au

Lodging the form

You need to lodge TFN declarations with us within 14 days after the form is either signed by the payee or completed by you (if not provided by the payee). You need to retain a copy of the form for your records. For information about storage and disposal, see below.

You may lodge the information:

■■online – lodge your TFN declaration reports using software that complies with our specifications. There is no need to complete section B of each form as the payer information is supplied by your software.

■■by paper – complete section B and send the original to us within 14 days.

For more information about lodging your

TFN declaration report online, visit our website at ato.gov.au/lodgetfndeclaration

Is your payee working under a working holiday visa (subclass 417) or a work and holiday visa (subclass 462)?

Employers of workers under these two types of visa need to register with the ATO, see ato.gov.au/whmreg

For the tax table “working holiday maker” visit our website at ato.gov.au/taxtables

Payer obligations

If you withhold amounts from payments, or are likely to withhold amounts, the payee may give you this form with section A completed. A TFN declaration applies to payments made after the declaration is provided to you. The information provided on this form is used to determine the amount of tax to be withheld from payments based on the PAYG withholding tax tables we publish. If the payee gives you another declaration, it overrides any previous declarations.

Has your payee advised you that they have applied for a TFN, or enquired about their existing TFN?

Where the payee indicates at question 1 on this form that they have applied for an individual TFN, or enquired about their existing TFN, they have 28 days to give you their TFN. You must withhold tax for 28 days at the standard rate according to the PAYG withholding tax tables. After 28 days, if the payee has not given you their TFN, you must then withhold the top rate of tax from future payments, unless we tell you not to.

If your payee has not given you a completed form you must:

■■notify us within 14 days of the start of the withholding obligation by completing as much of the payee section of the form as you can. Print ‘PAYER’ in the payee declaration and lodge the form – see ‘Lodging the form’.

■■withhold the top rate of tax from any payment to that payee.

For a full list of tax tables, visit our website at ato.gov.au/taxtables

Provision of payee’s TFN to the payee’s super fund

If you make a super contribution for your payee, you need to give your payee’s TFN to their super fund on the day of contribution, or if the payee has not yet quoted their TFN, within 14 days of receiving this form from your payee.

Storing and disposing of TFN declarations

The TFN Rule issued under the Privacy Act 1988 requires a TFN recipient to use secure methods when storing and disposing of TFN information. You may store a paper copy of the signed form or electronic files of scanned forms. Scanned forms must be clear and not altered in any way.

If a payee:

■■submits a new TFN declaration (NAT 3092), you must retain a copy of the earlier form for the current and following financial year.

■■has not received payments from you for 12 months, you must retain a copy of the last completed form for the current and following financial year.

Penalties

You may incur a penalty if you do not:

■■lodge TFN declarations with us

■■keep a copy of completed TFN declarations for your records

■■provide the payee’s TFN to their super fund where the payee quoted their TFN to you.

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose of Form | The NAT 3092 form is designed to declare your Tax File Number (TFN) to ensure the correct amount of tax is withheld from your payments. |

| Who Should Complete It? | This form should be filled out by anyone who is going to receive payments from a new payer, including employees, company directors, and beneficiaries. |

| When Not to Use It | You do not need to complete this form if you are a beneficiary providing your TFN to a trustee of a closely held trust. |

| TFN Requirement | Providing your TFN reduces the risk of administrative errors and extra tax being withheld. If not provided, the highest tax rate will be applied. |

| Special Considerations | Foreign residents face different tax rules, including higher rates and no tax-free thresholds unless receiving certain Australian Government pensions. |

| Submission of the Form | The completed NAT 3092 form must be given to your payer. Payers can lodge it online if they have the appropriate software. |

Guidelines on Utilizing Tax Declaration Nat 3092

Completing the Tax Declaration NAT 3092 form is essential for ensuring that the correct amount of tax is withheld from payments made to you. This guide provides clear steps to accurately fill out the form. Follow these instructions carefully to avoid any errors that could affect your tax withholding.

- Obtain the form. You can download the Tax Declaration NAT 3092 from the Australian Taxation Office (ATO) website.

- Use a black or blue pen. Ensure that you print clearly in BLOCK LETTERS throughout the form.

- In Section A, provide your tax file number (TFN) in Question 1. Check your income tax notice of assessment or payment summaries for this number.

- If you do not have a TFN, indicate that in Question 1 and state if you are claiming an exemption.

- Provide your personal information in Questions 2 to 6. Include your full name, home address, and date of birth.

- In Question 7, specify the basis on which you are being paid (e.g., full-time, part-time, casual, etc.).

- Answer Question 8 by deciding if you are an Australian resident, foreign resident, or a working holiday maker for tax purposes.

- In Question 9, indicate whether you want to claim the tax-free threshold. This applies to Australian residents only.

- Answer Question 10 by stating if you have any HELP, VET Student Loan, or related debts.

- Sign and date the form at the end of Section A to confirm that your information is accurate.

- Submit the completed form to your payer so they can fill out Section B.

Once you have completed these steps, your payer will process the information. Ensure that you keep a copy of the form for your records. If you have any questions about the form or need assistance, consult the ATO website or contact their customer service for support.

What You Should Know About This Form

1. What is the purpose of the Tax Declaration Nat 3092 form?

The Tax Declaration Nat 3092 form is used by taxpayers to provide their Tax File Number (TFN) to a new payer. By supplying this information, the payer can accurately determine how much tax to withhold from payments made to the payee. This form plays a crucial role in preventing administrative errors and ensuring that the correct amount of tax is withheld from wages or benefits. It is important to note that this form is not an application for a TFN.

2. Who is required to complete this form?

Individuals are required to complete the Nat 3092 form when they begin receiving payments from a new payer. This includes payments for work as an employee, company director, or office holder, as well as payments under various schemes such as return-to-work programs and benefit payments. It’s essential that the form is filled out fully and accurately to ensure correct withholding. However, certain individuals may not need to fill out this form, such as beneficiaries providing their TFN to a closely held trust.

3. What happens if I do not provide my TFN?

If you do not provide your TFN to your payer, they are obligated to withhold tax at the highest marginal rate. This is often higher than what would otherwise be withheld if your TFN were provided. While it is not an offense to not quote your TFN, failing to do so means you may face a larger tax burden than necessary. To minimize tax withholding, it is advisable to provide your TFN or apply for one promptly.

4. How can I find my tax file number (TFN)?

Your TFN can typically be located on various personal tax documents such as your income tax notice of assessment or payment summaries issued by your payer. If these documents cannot be found, you can contact the ATO by phone for assistance. They will verify your identity before providing your TFN over the phone. It is crucial to handle your TFN securely to avoid identity theft.

5. Am I eligible to claim the tax-free threshold?

6. What if I have a HELP or similar loan debt?

If you have a Higher Education Loan Program (HELP), VET Student Loan (VSL), or any other similar debt, it is important to notify your payer by answering "yes" in the relevant section of the form. Doing so will ensure that additional amounts are withheld to cover mandatory repayments when you receive your tax notice. If you have paid off your debt, you must complete a different declaration to inform your payer accordingly.

7. Where can I get more information about the NAT 3092 form?

For additional details regarding the Tax Declaration Nat 3092 form, including instructions, related forms, and tax information, visit the ATO's official website at ato.gov.au. There, you will find a wealth of resources including how to apply for a TFN, superannuation information, and guidance on specific tax situations. If you have further questions, you can reach out to the ATO by phone during business hours.

Common mistakes

Filling out the Tax Declaration NAT 3092 form can be a straightforward process, but many people encounter common pitfalls that can lead to complications. One significant mistake is providing incorrect or incomplete information regarding their Tax File Number (TFN). Entering an incorrect TFN or failing to provide it altogether results in the payer withholding the highest tax rate. It's critical to double-check this number to ensure it's accurate before submission.

Another frequent error involves misunderstanding the residency status for tax purposes. Individuals often miscategorize themselves as either residents or foreign residents. This mistake can drastically affect the tax rate applied to their income. Those on working holiday visas may confuse their status, leading to inappropriate claims regarding the tax-free threshold. It’s essential to review the descriptions carefully to select the correct box.

Many payees neglect essential questions about prior debts related to the Higher Education Loan Program (HELP) or other loans, such as the VET Student Loan (VSL). Failing to disclose these debts can lead to additional levies that can be avoided with accurate reporting. Individuals must also understand the implications of their responses, as outstanding debts can result in higher withholding amounts.

Additionally, some individuals do not fully grasp their eligibility to claim the tax-free threshold. While it may seem enticing, it's crucial to ensure that one is not simultaneously claiming the threshold from another payer. If multiple claims are made, one could face tax liabilities that were not anticipated. Understanding the conditions surrounding this benefit can help prevent financial surprises down the road.

Timing can also play a critical role in completing the NAT 3092 form. Some individuals delay submitting the form until after they receive their first payment. This could result in higher tax rates being withheld during that initial pay period, which may not be adjusted until the following year’s tax return. Submitting the form promptly ensures that the correct tax rate applies from the start.

People often forget to sign and date the declaration, which is a mandatory requirement for the form. A missing signature can delay processing and may complicate tax withholding provisions. It’s a small but vital step that many tend to overlook, leading to unnecessary complications.

Lastly, many taxpayers fail to read all instructions thoroughly. Ignoring key notes about the form's requirements or additional forms that might be needed can lead to errors. Understanding the entirety of the form, including where to seek further information, is essential for ensuring that all applicable rules are followed. Taking the time to familiarize oneself with the instructions could save a significant amount of time and stress later in the tax season.

Documents used along the form

The Tax Declaration Nat 3092 form is a crucial document for individuals beginning new employment or receiving payments under various arrangements. However, several other forms and documents often accompany this declaration to ensure proper tax administration. Below is a list of these forms, each with a brief description.

- Withholding Declaration (NAT 3093): This form allows payees to inform their payer of their tax withholding preferences and any exemptions they may be claiming. It helps to adjust the amount of tax withheld from payments based on personal circumstances.

- Medicare Levy Variation Declaration (NAT 0929): Individuals can use this form to declare if they qualify for a reduced Medicare Levy or are liable for the Medicare Levy Surcharge. Completing it may lower the amount withheld for Medicare costs.

- Standard Choice Form (NAT 13080): This form is utilized by employees to select a superannuation fund for their employer to make contributions. It's important to ensure superannuation payments go to the proper fund.

- Taxpayer’s Notice of Assessment: This document outlines the taxpayer's income tax obligations for the financial year. It serves as a summary of how much tax a payer has already withheld or how much is owed.

- Tax File Number (TFN) Application: If an individual does not have a TFN, they must submit this application to secure one, which is essential for proper taxation and other government entitlements.

- Business Activity Statement (BAS): Businesses use this form to report their tax obligations, including goods and services tax (GST), pay as you go (PAYG) withholding, and other relevant information to the Australian Tax Office (ATO).

- Income Statement: This document details an employee’s total income and taxes withheld for the year, aiding individuals in their tax return assessments.

- Superannuation Guarantee Contributions Statement: Employers use this statement to report compulsory super contributions made on behalf of their employees to ensure compliance with superannuation laws.

- Payment Summary: This summary is provided to employees by their payers at year-end and details the total earnings and tax withheld, serving as a vital record for annual tax returns.

Understanding these forms and how they interrelate with the Tax Declaration Nat 3092 is important for smooth tax compliance. Navigating these documents correctly can help ensure accurate reporting and reduce the risk of paying excess tax or underreporting income.

Similar forms

-

Withholding Declaration Form (NAT 3093): Similar to the Tax Declaration Nat 3092, this form is used by taxpayers to indicate their tax file number (TFN) and the withholding tax arrangements that apply to them. It is particularly used when individuals wish to claim tax offsets that affect the amount of tax withheld from their payments.

-

Tax File Number Application (NAT 1432): This document is also related to the TFN process, specifically for individuals who do not yet have a TFN. It allows individuals to formally apply for a TFN, thereby enabling correct tax withholding once their employment or payment arrangements commence.

-

Medicare Levy Variation Declaration (NAT 0929): Just like the Nat 3092 form, this document is designed to help individuals communicate relevant tax information to their payers. It allows taxpayers to request a variation in their Medicare levy based on their circumstances, impacting how much tax is withheld from their payments.

-

Standard Choice Form (NAT 13080): This form allows employees to choose their superannuation fund. Similar to the Tax Declaration Nat 3092, it requires essential personal information that significantly influences how super contributions are managed by the employer.

-

Higher Education Loan Program (HELP) Debt Notification: This form allows individuals with HELP debt to notify their payer of their circumstances, similar to how the Nat 3092 manages taxpayer information. The communication ensures correct tax arrangements are in place for individuals repaying their educational loans.

Dos and Don'ts

- Do: Use a black or blue pen to fill out the form.

- Do: Print your details clearly in BLOCK LETTERS.

- Do: Provide your Tax File Number (TFN) accurately to avoid excess tax withholding.

- Do: Complete all sections of the form before submitting.

- Do: Sign and date the declaration after ensuring all information is correct.

- Don't: Give your TFN in job applications or over the internet.

- Don't: Forget to talk to your payer if you are unsure about your residency status.

- Don't: Claim the tax-free threshold from more than one payer unless your total income is below the threshold.

- Don't: Ignore the need to inform your payer of any changes in your financial circumstances.

Misconceptions

Misconceptions about tax forms can lead to misunderstandings regarding tax obligations and benefits. The Tax Declaration NAT 3092 form is no exception. Here are five common misconceptions:

- This form is an application for a Tax File Number (TFN). Many believe that the NAT 3092 form serves as a means to apply for a TFN. In reality, it only allows individuals to declare their existing TFN to their employer or payer. If you need to apply for a TFN, you must follow a separate process available at the Australian Taxation Office's website.

- You should submit this form at any time. Some think it’s acceptable to submit the NAT 3092 whenever they feel like it. However, this form should be completed before you start receiving payments from a new employer or payer. Timely submission is essential to ensure correct withholding amounts from your pay.

- Providing incorrect information has no consequences. A mistaken belief is that it does not matter if the information provided on the form is wrong. Actually, giving incorrect details can lead to improper tax withholding. That means you might end up paying more tax than necessary, affecting your financial situation.

- Only Australians should complete this form. It's a common misconception that the NAT 3092 is only for Australian residents. In fact, foreign residents can also complete the form, but must pay attention to different tax rates and obligations that apply to them.

- This form guarantees I won’t pay tax. Some individuals assume that filling out the NAT 3092 will eliminate their tax obligations entirely. This is incorrect. While the form might help in reducing the amount withheld by the payer if specific conditions are met, individuals are still responsible for all tax dues according to their income level and applicable laws.

Understanding these misconceptions can help ensure compliance and optimize tax management. Take the time to learn about the requirements and ramifications associated with your tax obligations.

Key takeaways

Quickly filling out the Tax Declaration NAT 3092 form can help ensure the correct amount of tax is withheld from your payments. Here are some key points to keep in mind:

- Accuracy is essential. Ensure that all information you provide is complete and correct. Providing inaccurate information may result in incorrect withholding rates.

- TFN importance. If you provide your Tax File Number (TFN), it reduces the risk of extra tax being withheld. Not providing it may lead to your payer withholding tax at the highest rate.

- Adequate time to apply for a TFN. If you do not have a TFN and have applied for one, make sure to inform your payer using the proper option on the form. You can have 28 days to submit your TFN after your application.

- Claiming tax offsets. If you qualify for various tax offsets, such as the tax-free threshold or a HELP debt, ensure you indicate this correctly to have the proper withholding amounts applied.

Completing this form accurately helps you manage your tax obligations smoothly, ensuring that you receive your payments in the correct amounts.

Browse Other Templates

Gnc Jobs Near Me - Utilize trusted translation services for documents not in English.

Verbal Voe Form - Verification efforts are intended to promote accurate lending practices.

Household Employee Tax Form - This form applies to individuals who employ household workers.