Fill Out Your Nc 3 Form

The NC-3 form is a critical document for businesses operating in North Carolina. It serves as the Annual Withholding Reconciliation form, which summarizes the taxes withheld from employee wages over the course of the calendar year. This form ensures accurate reporting and compliance with state tax laws. When filling out the NC-3, businesses need to provide detailed information about the total tax withheld each month, along with comparisons between totals reported on W-2 and 1099 statements. Businesses must use blue or black ink and avoid any punctuation marks, which keeps the form clear and consistent. It's important to include your legal name, address, account ID, and specific tax figures. Additionally, if a business has closed or stopped paying wages during the year, that information must also be reported. The form includes sections for overpayments, additional taxes due, and penalties for late filing, which highlights the importance of submitting it correctly and on time. Ultimately, completing the NC-3 helps businesses reconcile their withholding accounts with the North Carolina Department of Revenue and avoid penalties. Electronic filing is encouraged, though paper submission is an option if electronic filing is not possible.

Nc 3 Example

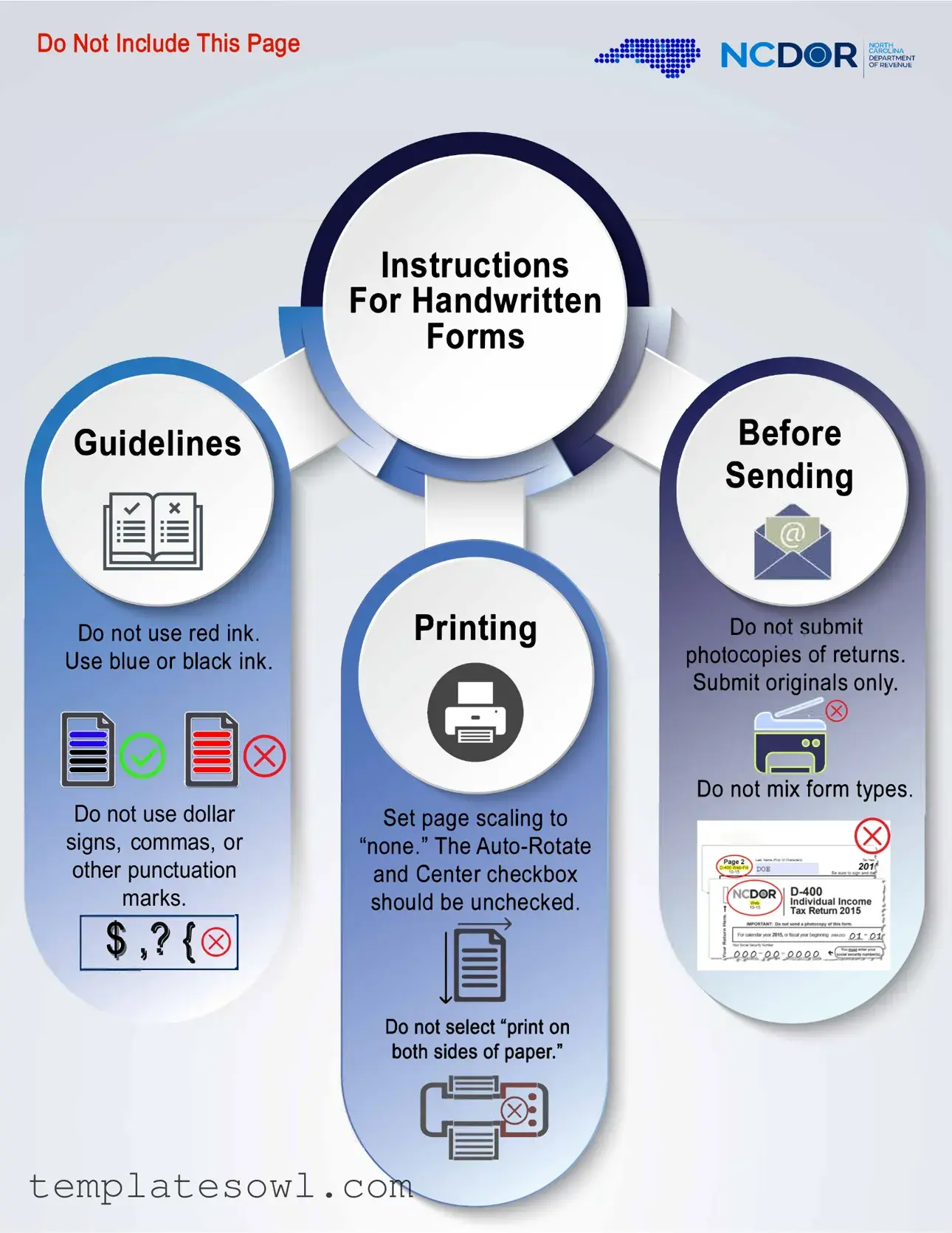

Do Not Include This Page

Guidelines

::::==·

. •• ··=!!!:::!:•

Instructions

For Handwritten

Forms

NCD(i)• R

Before Sending

I NORTH CAROLINA DEPARTMENT OF REVENUE

Do not use red ink. Use blue or black ink.

®

®

Do not use dollar signs, commas, or other punctuation

marks.

, 1 t®I

, 1 t®I

Printing

Set page scaling to

"none." The

1�

ocopies of returns. Submit originals only.

,,___(8)

Do not mix form types.

Do not select "print on bothc;sides of paper."

;�1

WEB

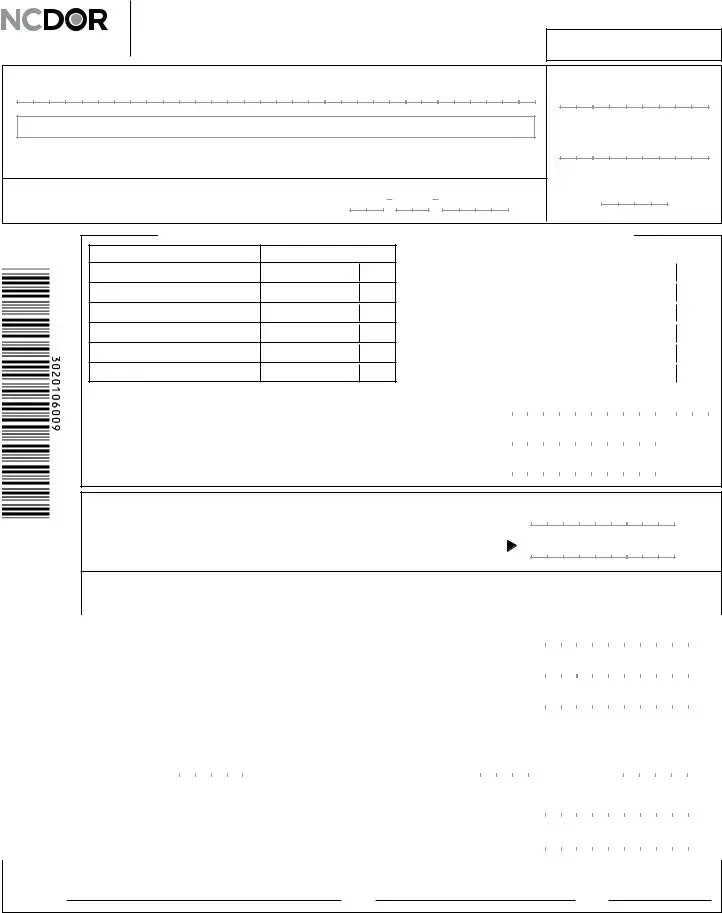

Annual Withholding Reconciliation

DOR

Use

Only

Legal Name (First 32 Characters) (USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS)

Street Address

City |

State |

|

Zip Code |

|

|

|

|

|

|

If your business closed or if you stopped paying wages during the calendar year, enter the final date you paid wages:

Account ID

FEIN or SSN

For Calendar Year

(YYYY)

Enter total tax withheld as reported to the Department for each period

Month |

Amount |

1. January

2. February

3. March - End of 1st Quarter

4. April

5. May

6. June - End of 2nd Quarter

13.Total Tax Withheld as Reported to the Department

Add Lines 1 through 12. Enter total here and on Line 16.

14.Tax Withheld as Reported on

15.Tax Withheld as Reported on 1099 Statements

|

Month |

|

Amount |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

7. |

July |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8. |

August |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. |

September - End of 3rd Quarter |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10. |

October |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

11. November |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

12. |

December - End of 4th Quarter |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

, |

|

. |

|

|

|

|

|

|

|

|

, |

, |

|

. |

|

|

|

|

|

|

|

|

, |

, |

|

. |

|

|

|

|

|

|

16.Total Tax Withheld as Reported to the Department

From Line 13; round to the nearest whole dollar

17.Total Tax Withheld as Reported on

Add Lines 14 and 15; ROUND TO THE NEAREST WHOLE DOLLAR

, |

, |

.00 |

, |

, |

.00 |

Compare Line 16 and Line 17. If Line 16 and Line 17 are the same, skip to Line 21. If Line 16 is more than Line 17, the account IS overpaid. Subtract Line 17 from Line 16 and enter the amount of overpayment on Line 18. If Line 16 is less than Line 17, the account is underpaid. Subtract Line 16 from Line 17 and enter the amount of tax due on Line 19.

|

|

|

|

|

|

|

.00 |

18. |

Overpayment |

|

, |

, |

|

||

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

19. |

Additional Tax Due |

|

, |

, |

|

||

|

|

|

|

|

|

|

.00 |

20. |

Interest (See the Department’s website, www.ncdor.gov, for current interest rate.) |

|

, |

, |

|

||

|

Multiply Line 19 by applicable rate |

|

|

||||

|

|

|

|||||

21.Informational Return Penalties (See instructions)

Add Lines 21a and 21b and enter the total on Line 21c

|

a. Failure to File by Due Date |

, |

.00 |

b. FAILURE TO FILE IN FORMAT |

.00 |

c. |

, |

|

.00 |

|||

|

|

Prescribed by the Secretary |

|

|

|

|||||||

|

|

|

|

|

|

|||||||

22. |

Amount of Refund Requested - If Line 18 is blank or zero, skip to Line 23. Otherwise, compare Line 18 with |

|

|

, |

, |

|

|

.00 |

||||

|

Line 21c. If Line 18 is more than Line 21c, subtract Line 21c from Line 18 and enter the amount of refund |

|

|

|

|

|||||||

|

here. If Line 18 is less than Line 21c, subtract Line 18 from Line 21c and enter the amount due on Line 23. |

|

|

|

|

|||||||

23. |

Total Amount Due |

|

|

Pay in U.S. Currency From a Domestic Bank |

|

|

, |

, |

|

|

.00 |

|

|

Add Lines 19, 20, and 21c |

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature: |

|

|

Title: |

|

|

Date: |

|

|

|

|

||

I certify that, to the best of my knowledge, this claim is accurate and complete.

North Carolina law requires Form

Form Characteristics

| Fact Title | Details |

|---|---|

| Governing Law | The NC-3 form is governed by North Carolina tax law, specifically under the authority of the North Carolina Department of Revenue. |

| Purpose | The form NC-3 serves as the Annual Withholding Reconciliation, summarizing all employer withholding tax for the calendar year. |

| Filing Requirement | Employers must file Form NC-3 electronically, as required by North Carolina law. |

| Information Required | The form requires detailed reporting on total tax withheld monthly and must include totals from W-2 and 1099 statements. |

| Deadline | Form NC-3 should be filed by January 31 of the following year after all wages have been reported. |

| Payment Submission | If taxes are owed, payments must be made in U.S. currency from a domestic bank. |

| Penalties | Failure to file electronically can result in penalties as outlined by the North Carolina Department of Revenue. |

Guidelines on Utilizing Nc 3

When preparing to submit Form NC-3, it’s important to follow a clear set of steps to ensure that everything is done correctly. Completing the form accurately helps prevent any delays in processing and can avoid penalties. Take your time to gather all necessary information before filling it out.

- Obtain a copy of Form NC-3 and read through it carefully.

- Use blue or black ink only; avoid red ink.

- Make sure not to use dollar signs, commas, or any other punctuation marks.

- For your name and address, use capital letters and ensure it fits within the first 32 characters.

- Fill in your business's legal name at the top of the form.

- Provide your street address, city, state, and zip code in the designated fields.

- If applicable, enter the final date you paid wages during the year (format: MM-DD-YYYY).

- Include your Account ID, FEIN, or SSN.

- Specify the calendar year for which you are reporting (YYYY).

- In the month-by-month sections, fill in the total tax withheld for each corresponding month from January to December.

- Add the totals from all months for Line 13 and enter that amount on Line 16.

- Fill in the amount of tax withheld as reported on W-2 and 1099 statements on Lines 14 and 15.

- Calculate the total from Lines 14 and 15, round it to the nearest whole dollar, and enter it on Line 17.

- Compare Line 16 and Line 17- if they match, move to Line 21. If Line 16 is greater, fill in the overpayment on Line 18. If Line 17 is greater, enter the tax due on Line 19.

- For any applicable interest, refer to the Department’s website for the current interest rate and calculate that for Line 20.

- If needed, compute penalties for failure to file by the due date and enter them on Line 21a and 21b, then add those to Line 21c.

- If you have an overpayment, figure the refund amount on Line 22. If Form Line 18 is zero, skip this step.

- Finally, if any amounts are due, calculate the total for Line 23, which includes any additional tax, interest, and penalties.

- Sign and date the form, affirming its accuracy and completeness.

Once the form is filled out, ensure to keep a copy for your records. This form must be filed electronically, but if you cannot do that, you can mail it along with any required statements and payment to the North Carolina Department of Revenue. Be mindful of deadlines and guidelines to avoid potential penalties.

What You Should Know About This Form

What is the NC-3 form?

The NC-3 form is the Annual Withholding Reconciliation form used by employers in North Carolina. It summarizes the total amount of taxes withheld from employees' wages throughout the year and reconciles it with the amounts reported on W-2 and 1099 statements. This form must be submitted to the North Carolina Department of Revenue to ensure compliance with state tax laws.

Who needs to file the NC-3 form?

Any business or organization that has withheld state income tax from employees’ wages during the calendar year is required to file the NC-3 form. This includes both for-profit businesses and non-profit organizations. Even if a business closes or stops paying wages within the year, the NC-3 form must still be submitted for the closing period.

When is the NC-3 form due?

The NC-3 form is due by January 31 of the year following the tax year for which you are filing. Timely submission is crucial to avoid penalties. If January 31 falls on a weekend or holiday, the due date shifts to the next business day.

How do I correctly fill out the NC-3 form?

To fill out the NC-3 form accurately, use blue or black ink and avoid using red ink or any punctuation marks. Clearly print your legal name and address in capital letters. Enter the total tax amounts withheld for each month, and ensure that the totals reported on the form match those on the W-2 and 1099 statements. Follow the provided guidelines closely for formatting.

What happens if I do not file the NC-3 form?

Failure to file the NC-3 form by the due date may result in penalties imposed by the North Carolina Department of Revenue. Penalties can include fines and interest on any unpaid tax amounts. It is important to file on time or request an extension, if possible.

Can I file the NC-3 form electronically?

Yes, the NC-3 form can be filed electronically through the North Carolina Department of Revenue's website. Electronic filing is required, and a penalty applies for those who do not comply. If you cannot file electronically, you may submit a paper form along with required statements by mail.

What should I do if there is an overpayment reported on the form?

If Line 16 of the NC-3 form indicates an overpayment, subtract Line 17 from Line 16. This overpayment amount should be entered in Line 18. If applicable, you can request a refund for this amount when you complete the form.

What if there is an underpayment reported on the NC-3 form?

In cases where the total tax withheld as reported on Line 16 is less than the total reported on Lines 14 and 15, an underpayment is indicated. The difference should be recorded on Line 19, where you can also include any applicable interest due.

Where do I send the NC-3 form if filing by mail?

If you are mailing the NC-3 form, send it along with any required documents to the North Carolina Department of Revenue, PO Box 25000, Raleigh, North Carolina 27640-0001. Ensure that it is postmarked by the due date to avoid penalties.

Is there assistance available for filling out the NC-3 form?

Yes, the North Carolina Department of Revenue provides resources and guidance for individuals needing help with the NC-3 form. Access their website or contact their office for assistance with any questions or concerns regarding the filing process.

Common mistakes

When filling out the NC-3 form, several common mistakes can lead to complications or penalties. Understanding these pitfalls can save time and help ensure that your submission is accurate.

One frequent issue arises when individuals use the wrong ink color. The instructions specifically state not to use red ink; it is essential to stick to blue or black ink. This detail can seem minor, but using the inappropriate color can result in your form being rejected or delayed.

Another mistake is including dollar signs or commas when filling out the financial sections. These small punctuations are not allowed, and their inclusion may confuse the processing system, leading to potential errors in your reported tax amounts. Thus, it is crucial to write numbers clearly and without additional symbols.

Some people mix different form types on the NC-3, which can cause significant issues. Each form serves a specific purpose. If you blend forms, it might cause discrepancies that can raise red flags during reviews or audits. Ensure your form relates directly to only the content required by the NC-3.

When it comes to submitting copies of returns, make sure to send originals only. Providing copies instead of the original documents can lead to problems. The North Carolina Department of Revenue seeks original forms to maintain accuracy and integrity in their records, and failing to comply can complicate your filing.

Additionally, some filers forget to double-check their calculations on tax withheld. Errors in the computation can lead to an incorrect understanding of whether you owe money or are eligible for a refund. It’s always a good idea to go over your figures to confirm that everything adds up as it should.

Lastly, failing to sign and date the form can also be a significant oversight. Signatures validate the accuracy of the information provided, and without one, the Department may consider the form incomplete. Always remember to provide your signature and the date to ensure your form is processed smoothly.

By being aware of these common errors and taking the time to fill out the NC-3 form carefully, individuals can avoid many of the headaches that arise from improper submissions. Attention to detail is not just important; it's essential in keeping your filings accurate and timely.

Documents used along the form

The NC-3 form is essential for businesses in North Carolina to report annual withholding taxes. When completing this form, it is often necessary to accompany it with several other documents that help ensure compliance with tax regulations. Here’s a list of additional forms and documents that are frequently used alongside the NC-3.

- W-2 Forms: These forms report the annual wages and withholding information for employees. Each employee receives a copy summarizing their earnings and taxes withheld for the year.

- 1099 Forms: Used primarily for reporting income paid to independent contractors and freelancers, these forms detail the amounts paid to non-employees throughout the year.

- IRS Form 941: This quarterly federal tax return summarizes the total taxes withheld from employee wages for Social Security and Medicare. It must be filed regularly and complements state withholding reports.

- NC-4 Forms: Employers use this form to document employee withholding allowances. It helps determine how much tax to withhold from each paycheck based on personal exemptions.

- Schedule B: Included with the NC-3 form in certain circumstances, this schedule provides details regarding withholding amounts for various types of payments, ensuring transparency and accuracy.

- Power of Attorney (Form DOR-2848): This is necessary if a tax professional is filing on behalf of a business, granting them permission to discuss the company’s tax matters with the Department of Revenue.

- Declaration of Estimated Tax (Form NC-40): Businesses that expect to owe more than a certain amount in taxes may need to file this form to report estimated income tax payments throughout the year.

- Annual Report (for LLCs and Corporations): This document is often required to confirm the status of a business entity and to provide updates on its structure, directors, or members.

Having these forms ready can streamline the tax filing process and minimize potential complications. When working with the NC-3 form, it helps to ensure that all necessary documents are submitted together to meet the state's requirements effectively.

Similar forms

The NC-3 form serves an essential purpose in reconciling annual withholding taxes for employers in North Carolina. Several other documents share similarities with the NC-3 in terms of purpose, structure, or the information required. Below is a list of eight documents that are comparable to the NC-3 form:

- Form W-2: Employers use W-2 forms to report annual wages and tax withholding for each employee. Like the NC-3, it provides totals that affect tax reconciliation and must be submitted to the Department of Revenue.

- Form 1099: This form is often issued to independent contractors and freelancers to report income earned. It parallels the NC-3 in that it also summarizes total withholding that must be compared against reported forms.

- Form 941: Employers file Form 941 quarterly to report income taxes, Social Security, and Medicare taxes withheld from employee pay. This document complements the NC-3 by detailing the amounts withheld over the year.

- Form 940: The Annual Federal Unemployment Tax Return (FUTA) provides an overview of unemployment taxes. It is similar to the NC-3 as both forms require year-end calculations and filings with respective tax authorities.

- Form CT-1: This form is used to report and pay the railroad retirement taxes. Like the NC-3, CT-1 includes totals for tax withholding and requires careful record-keeping and filing.

- Form 1065: This partnership tax return requires partners to report their shares of income, deductions, and credits. Though focused on partnerships, it shares the NC-3's aim of providing an accurate year-end summary of tax obligations.

- Schedule C: Sole proprietors use this form to report income and expenses. It parallels the NC-3 in summarizing a business's financial activities over a year, affecting overall tax responsibilities.

- Form 1040: Individuals file this form to report their annual income, including any withholding from W-2 and 1099 forms. Like the NC-3, the Form 1040 finalizes the annual tax picture for individuals and assesses any owed amounts.

Dos and Don'ts

- Do use blue or black ink when completing the form. This ensures clarity and prevents issues with legibility.

- Do write your name and address in capital letters. This makes the information easy to read and helps avoid confusion.

- Do submit only the original forms. Copies of your returns should not be included.

- Do enter the total tax withheld accurately from your records. Double-check your calculations to avoid mistakes.

- Do carefully fill out the account ID and FEIN or SSN. Accurate identification numbers are essential for processing.

- Don't use red ink or any other color; stick to blue or black ink only.

- Don't mix form types when filling out the NC-3. Each form should be distinct and separate.

- Don't include dollar signs, commas, or leading zeros while entering amounts. This simplifies the information for processing.

- Don't select the “print on both sides of paper” option. Always keep each page separate.

Misconceptions

Understanding the NC-3 form is crucial for managing annual withholding reconciliations in North Carolina. However, several misconceptions often lead to confusion. Here is a list of eight common misconceptions regarding the NC-3 form, along with clarifications for each.

- Only large businesses need to file the NC-3 form. This is not true. Any business that pays wages to employees in North Carolina must file the NC-3 form, regardless of size.

- The NC-3 form is optional. Contrary to this belief, the NC-3 form is mandatory for reporting and reconciling tax withheld from employee wages. Failure to file can result in penalties.

- I can use red ink to fill out the form. Using red ink is a common mistake. The instructions clearly state that only blue or black ink should be used to ensure the form is processed correctly.

- It is okay to mix different form types. This is incorrect. Different form types should not be mixed. The NC-3 must be submitted as a standalone form.

- I can submit a photocopy instead of the original form. This is another misconception. Only the original NC-3 form should be submitted; photocopies are not accepted.

- The NC-3 form can be filled out on both sides of the paper. It’s essential to follow the guidelines, which state that the NC-3 must be printed on one side of the paper only.

- I can use dollar signs and commas on the form. This is a common pitfall. The instructions specify that no dollar signs, commas, or punctuation marks should be used in the numerical entries.

- All tax amounts reported are automatically correct. It is vital to double-check the calculations. Compare totals on the form closely to ensure they are accurate, as discrepancies may lead to overpayment or underpayment issues.

By clarifying these misconceptions, individuals and businesses can navigate the NC-3 form requirements more effectively. Proper understanding fosters a smoother filing process and helps avoid unnecessary complications or penalties.

Key takeaways

Filling out and using the NC 3 form requires attention to detail to ensure compliance with North Carolina regulations. Here are some key takeaways:

- Use Appropriate Ink: When filling out the form, only use blue or black ink. Avoid using red ink, as it may not be readable by the processing equipment.

- Submit Originals: Always submit original documents. Do not send copies, and ensure forms are not mixed with other types.

- Accurate Reporting: Ensure that the total tax withheld is reported accurately. This includes totals for each month as well as totals reported on W-2 and 1099 statements.

- Electronics Matters: North Carolina law mandates electronic submission of the NC-3 and its related statements unless you are unable to do so. Filing electronically can help avoid penalties.

Understanding these points can significantly simplify the process and help maintain compliance with state requirements.

Browse Other Templates

Irp Plate - Document any prior title information to establish the vehicle's registration history.

Transcript Delivery Request,Academic Record Release Form,Student Academic Transcript Application,GTCC Official Transcript Form,Transcript Release Authorization,Educational Record Request,GTCC Transcript Submission Form,Student Transcript Order Form,T - Students are advised to keep a copy of the completed request for reference.

Wells Fargo Letterhead - Employees can find information about employment practices and rights here.