Fill Out Your Nc 5P Form

In the realm of North Carolina taxation, the NC 5P form plays a pivotal role for employers who withhold significant amounts of income tax. Specifically, any employer withholding an average of $2,000 or more each month is mandated to file withholding tax returns and remit the tax withheld by the same timelines required for federal income tax returns. This alignment ensures smooth compliance across both state and federal obligations. Employers are required to deduct North Carolina income tax from all resident salaries, regardless of where they are earned. Furthermore, it is essential to consider that wages paid to employees performing services in another state may not necessitate withholding if that state imposes its own withholding requirement. To maintain compliance, payments of withheld taxes must coincide with the due dates for federal employment taxes. For example, if the federal withholding exceeds $100,000, the payment must be submitted by the next banking day; however, North Carolina maintains its own deadlines that may differ. When making payments, employers utilize the withholding payment voucher, Form NC-5P, where they must provide specific details such as the compensation date, payment amount, and business information. Clear instructions guide employers to avoid common mistakes, emphasizing neatness and accuracy in completing the form. The NC 5P form, therefore, serves as a crucial tool for employers, ensuring they uphold their responsibilities while navigating state-specific tax regulations.

Nc 5P Example

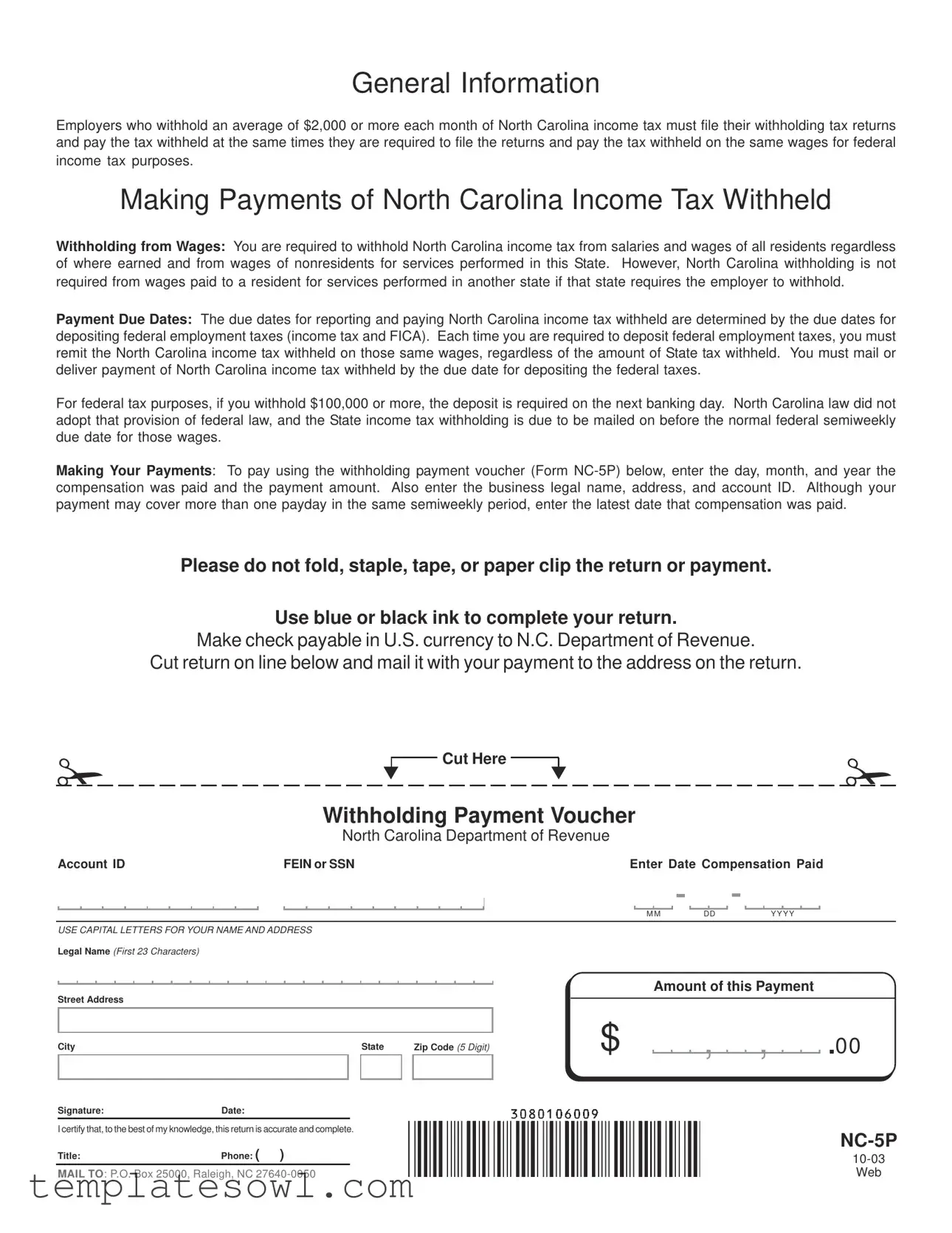

General Information

Employers who withhold an average of $2,000 or more each month of North Carolina income tax must file their withholding tax returns and pay the tax withheld at the same times they are required to file the returns and pay the tax withheld on the same wages for federal income tax purposes.

Making Payments of North Carolina Income Tax Withheld

Withholding from Wages: You are required to withhold North Carolina income tax from salaries and wages of all residents regardless of where earned and from wages of nonresidents for services performed in this State. However, North Carolina withholding is not required from wages paid to a resident for services performed in another state if that state requires the employer to withhold.

Payment Due Dates: The due dates for reporting and paying North Carolina income tax withheld are determined by the due dates for depositing federal employment taxes (income tax and FICA). Each time you are required to deposit federal employment taxes, you must remit the North Carolina income tax withheld on those same wages, regardless of the amount of State tax withheld. You must mail or deliver payment of North Carolina income tax withheld by the due date for depositing the federal taxes.

For federal tax purposes, if you withhold $100,000 or more, the deposit is required on the next banking day. North Carolina law did not adopt that provision of federal law, and the State income tax withholding is due to be mailed on before the normal federal semiweekly due date for those wages.

Making Your Payments: To pay using the withholding payment voucher (Form

Please do not fold, staple, tape, or paper clip the return or payment.

Use blue or black ink to complete your return.

Make check payable in U.S. currency to N.C. Department of Revenue.

Cut return on line below and mail it with your payment to the address on the return.

! |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cut Here |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

! |

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Withholding Payment Voucher |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

North Carolina Department of Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||

|

Account ID |

|

|

|

|

|

|

|

|

|

FEIN or SSN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Enter Date Compensation Paid |

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

M M |

|

|

|

|

|

DD |

|

|

|

|

|

|

|

Y Y Y Y |

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||

|

Legal Name (First 23 Characters) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amount of this Payment |

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

Street Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

, |

|

, |

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

|

|

|

Zip Code (5 Digit) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Signature: |

|

Date: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

|

I certify that, to the best of my knowledge, this return is accurate and complete. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Phone: ( ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

Title: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||

|

MAIL TO: P.O. Box 25000, Raleigh, NC |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Web |

||||||||||||||||||||||||||||||||||||||||||||

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | The NC 5P form is used by employers to report and pay North Carolina income tax withheld from employee wages. |

| Filing Requirement | Employers who withhold an average of $2,000 or more each month must file the NC 5P form. |

| Withholding Tax | North Carolina requires withholding from all salaries and wages of residents and from nonresidents working in the state. |

| Exemption Clause | No withholding is required for residents working out of state if that state mandates withholding. |

| Payment Schedule | Payments are due based on the federal employment tax deposit schedule, aligning with federal requirements. |

| Mailing Instructions | Employers should mail the completed NC 5P form along with payment to the address specified on the form. |

| Form Completion | Use blue or black ink when filling out the form, and avoid folding or stapling it. |

| Governing Law | The NC 5P form is governed by the North Carolina General Statutes, specifically G.S. 105-163.2 and G.S. 105-163.3. |

Guidelines on Utilizing Nc 5P

After completing the NC-5P form, the next step is to ensure that the payment is mailed to the correct address along with the form. Be mindful of deadlines to avoid any penalties. Follow these steps carefully to fill out the form accurately.

- Gather Required Information: Collect your business legal name, address, account ID, and payment amount.

- Fill in the Date: Enter the date compensation was paid using the format MM/DD/YYYY.

- Enter the Payment Amount: Indicate the amount of North Carolina income tax withheld.

- Provide Business Information: Write the legal name, street address, city, state, and zip code. Ensure to use capital letters.

- Input Account ID: Enter your Account ID and/or FEIN or SSN where required.

- Sign and Date the Form: Provide your signature and the date of signing. This certifies the accuracy of the information.

- Check Payment Instructions: Make the check payable in U.S. currency to the N.C. Department of Revenue.

- Prepare for Mailing: Cut the form along the designated line and do not fold, staple, or tape it. Use blue or black ink.

- Mail the Payment: Send the cut return and payment to P.O. Box 25000, Raleigh, NC 27640-0050.

What You Should Know About This Form

What is the NC 5P form and who needs to file it?

The NC 5P form, officially known as the Withholding Payment Voucher, is a document that employers in North Carolina use to report and remit income tax withheld from employees’ wages. This form is essential for any employer who withholds an average of $2,000 or more each month in North Carolina income tax. It's important to stay compliant with state tax regulations, as failure to do so can result in penalties.

When are the payment due dates for the NC 5P form?

Payment due dates for the NC 5P form coincide with the dates set for federal employment tax deposits. Specifically, every time an employer is required to deposit federal employment taxes, they must also remit the North Carolina income tax withheld on the same wages. Employers should be mindful that these payments are due to be mailed or delivered by the due date for the corresponding federal taxes, ensuring that they adhere to state law requirements.

How do I properly fill out the NC 5P form?

Filling out the NC 5P form requires some attention to detail. Start by entering the date when the compensation was paid, followed by the payment amount. You'll also need to provide your business's legal name, address, and account ID. Make sure to enter only the latest date of payment if your submission covers multiple payday periods during the same semiweekly timeframe. Importantly, avoid folding, stapling, or taping the return; use blue or black ink. Once completed, mail it to the address indicated on the form.

What if I am unsure about withholdings for non-resident employees?

If you employ non-residents who perform services in North Carolina, you are required to withhold income tax. However, be aware that if a resident employee is working in another state that mandates withholding, you do not need to withhold North Carolina income tax from their wages. It’s wise to consult payroll experts if uncertainties arise regarding specific employee classifications and their respective withholding obligations.

Can payments cover multiple paydays?

Yes, payments can indeed cover more than one payday within the same semiweekly period. However, if you choose to submit a combined payment, make sure to indicate only the latest payday on the NC 5P form. This ensures clarity and accuracy in your tax remittance.

Where should I send the completed NC 5P form and payment?

Once you have filled out the NC 5P form and prepared your payment, simply cut along the indicated line on the form to separate the return from the payment slip. Mail both to the North Carolina Department of Revenue at the designated address, which is P.O. Box 25000, Raleigh, NC 27640-0050. Ensuring that this is done correctly will help avoid payment delays or processing issues.

Common mistakes

Filling out the NC 5P form is crucial for ensuring proper payment of the North Carolina income tax withheld. However, many individuals make mistakes that can lead to complications and delays in processing. One common error is incomplete information. Failing to fill out all required fields, such as the legal name, address, or account ID, can result in your form being returned or not processed. Always double-check that every section is completely filled out before submitting your form.

Another frequent mistake is using incorrect payment amounts. It’s essential to verify the amount of tax you are remitting. A miscalculation can lead to penalties or additional interest charges. Keep track of your withholdings throughout the payment period to ensure accuracy. It’s advisable to maintain thorough records so that any discrepancies can be easily traced.

People also often overlook the importance of timely submissions. Payments that are mailed or delivered late can incur fees and penalties, which can add unnecessary expenses. Be aware of the due dates that align with federal tax deposits and ensure your payment is mailed in advance of those deadlines to avoid any last-minute issues.

It is also important to note that some individuals make the mistake of using inappropriate writing instruments. To fill out the NC 5P form properly, you must use blue or black ink. Using other colors can cause the form to be unreadable during processing, which may lead to further delays. Stick to the guidelines laid out in the form to ensure it's processed correctly.

Lastly, a major error involves not following submission guidelines. The NC 5P form explicitly states not to fold, staple, tape, or paper clip the return or payment. Not adhering to these instructions can also result in your form being rejected. Carefully read and follow all instructions to make sure your payment reaches the appropriate department without complications.

Documents used along the form

When dealing with North Carolina income tax withholding, it's essential to be aware of several important forms and documents that accompany the NC 5P form. These documents help ensure compliance with state regulations and facilitate proper payment processing. Here’s a brief overview of four key forms often used in this process.

- NC-5: This is the general withholding return form used by employers to report the amount of income tax withheld from employees’ salaries and wages throughout the tax period. It provides a summary of total withholding and is essential for reconciling withheld amounts with payments made.

- NC-3: This is a reconciliation form that businesses file at the end of the year. Employers summarize all the income tax withheld during the year and reconcile it with their NC-5 submissions. It ensures that what was reported aligns with what was actually withheld and paid to the state.

- Form W-2: While primarily a federal form, it is crucial for state reporting as well. Employers must issue W-2 forms to employees at the end of the year, detailing the total wages earned and the amount of state and federal taxes withheld. This form is necessary for employees when filing their state income tax returns.

- Withholding Payment Voucher: This document is often used alongside the NC 5P form to facilitate the actual payment process. Employers complete this voucher to provide details about the payment being made, ensuring that the North Carolina Department of Revenue can correctly apply the payment to the employer’s account.

Being familiar with these forms can help streamline the withholding process and reduce the likelihood of errors. Proper documentation is essential for compliance and will benefit both employers and employees in managing their tax responsibilities in North Carolina.

Similar forms

The NC 5P form plays an essential role in managing state income tax withholding for employers. It shares similarities with several other forms used for reporting and remitting tax information. Below is a list detailing eight documents that are similar to the NC 5P form:

- Form W-2: Employers use this form to report wages paid to employees and the taxes withheld. Like the NC 5P, it is essential for ensuring tax obligations are met accurately.

- Form 941: This is the Employer's Quarterly Federal Tax Return, used to report income taxes, social security tax, and Medicare tax withheld from employee paychecks. Both forms require timely submission to avoid penalties.

- Form 940: This form is the Employer's Annual Federal Unemployment (FUTA) Tax Return. It ensures that unemployment taxes are reported, similar to how the NC 5P assures state tax compliance.

- Form 1099: Issued to independent contractors, this form reports non-employee compensation, similar to how the NC 5P reports withholding for employees.

- Form 1065: Used by partnerships to report income, deductions, gains, and losses, highlighting how certain entities are obligated to report tax information to the state.

- State Quarterly Tax Returns: Various states have their own forms which resemble the NC 5P, focusing on state income tax withholding similar to what NC 5P does for North Carolina.

- Estimated Tax Payment Vouchers: These forms are used by individuals to make quarterly estimated tax payments, paralleling NC 5P’s purpose of ensuring tax is paid accurately and on time.

- Form 990: Non-profits use this form to report income and expenditures, mirroring the reporting requirement found in the NC 5P for withholding tax on paid wages.

Understanding these similarities is crucial for employers to maintain compliance with both state and federal tax regulations. Properly managing these forms will help avoid potential legal and financial issues down the line.

Dos and Don'ts

When filling out the NC 5P form, following certain practices can help ensure accuracy and compliance. Here are seven guidelines to follow:

- Use blue or black ink. Always complete the form using the appropriate ink to ensure legibility.

- Provide complete and accurate information. Enter your legal name, address, and Account ID without omissions.

- Enter the date compensation was paid correctly, including day, month, and year.

- Mail the form by the due date for federal employment taxes to avoid penalties.

- Ensure payment is made in U.S. currency to the N.C. Department of Revenue.

- Cut the return on the indicated line and send it with your payment.

- Keep a copy of the completed form for your records.

It's just as important to be aware of what to avoid while filling out the NC 5P form. Here are seven things you should not do:

- Do not fold, staple, tape, or paper clip the return or payment.

- Avoid using ordinary pen colors. The form must be completed in blue or black ink.

- Do not enter information in lower case; all details must be in capital letters.

- Do not send the form after the payment due date.

- Do not omit any required information including the signature and title.

- Avoid using a generic name or address; use the business legal name instead.

- Do not forget to verify the accuracy of the return before mailing it.

Misconceptions

Here are some common misconceptions about the Nc 5P form:

- Misconception 1: The Nc 5P form is only for large businesses.

- Misconception 2: Payments can be made at any time without regard to the federal schedule.

- Misconception 3: It is acceptable to fold or staple the Nc 5P form when sending it in.

- Misconception 4: You do not need to provide the date on which compensation was paid.

This is not true. Any employer who withholds an average of $2,000 or more each month must use the Nc 5P form, regardless of the size of the business.

In reality, North Carolina law aligns the due dates for withholding tax payments with federal employment tax deposit schedules. Payments are due based on when federal taxes are deposited.

This is incorrect. The instructions clearly state that the form should not be folded, stapled, taped, or clipped in any way. Doing so could cause issues in processing.

Actually, entering the date the compensation was paid is a required part of completing the Nc 5P form to ensure accurate processing of payments.

Key takeaways

Understanding the NC 5P Form is essential for employers who need to manage North Carolina income tax withholding accurately. Here are some key takeaways about filling out and using this form:

- Who Must File: Employers withholding an average of $2,000 or more in North Carolina tax each month must file their returns and pay taxes on time.

- Withholding Requirements: North Carolina tax must be withheld from resident wages, regardless of where earned, while nonresidents are taxed for services performed within the state.

- Payment Timing: Payments of withheld North Carolina income tax should match the federal employment tax deposit schedule. Late payments can lead to complications.

- Form Details: When filling out the NC 5P form, ensure to use blue or black ink and include your legal business name, address, and account ID. Do not fold or staple the form.

- Mailing Instructions: Cut the return form as instructed and send it with your payment to the NC Department of Revenue at the designated address.

By keeping these points in mind, employers can ensure a smoother process when managing their withholding responsibilities in North Carolina.

Browse Other Templates

Usa Draft - It states the reason for not registering was unawareness of the requirement.

Eeo Reporting 2023 - Technicians cover individuals who apply scientific or practical knowledge in specific fields.

Driver Verification Form,National Driver Registration Form,Driver Information Sheet,Motor Vehicle Record Request Form,Applicant Driving Profile,Driver's Background Inquiry,License Compliance Form,Driving Qualifications Questionnaire,Personal Driving - Specify your height in feet and inches along with your weight in pounds.