Fill Out Your Nc Certificate Resale Form

The North Carolina Certificate of Resale is an essential document for registered merchants engaged in retail and wholesale transactions. This form allows businesses to purchase tangible personal property intended for resale without paying sales tax at the time of purchase. Key provisions within the certificate outline the responsibilities of the purchaser, who must confirm that the items acquired are indeed for resale and not personal use. Specific instructions accompany the certificate, guiding merchants on its proper use, including the requirement to keep copies on record. The certificate necessitates an affirmation of the buyer’s liability for sales and use taxes when the items eventually sold or consumed. This reinforces the importance of accurate tax compliance. Furthermore, an explicit list of conditions details when a seller can accept the certificate without incurring liability. It is vital to recognize that misuse of this certificate can lead to serious penalties. Understanding the implications of this form is crucial for maintaining compliance with the North Carolina Department of Revenue regulations and ensuring smooth business operations.

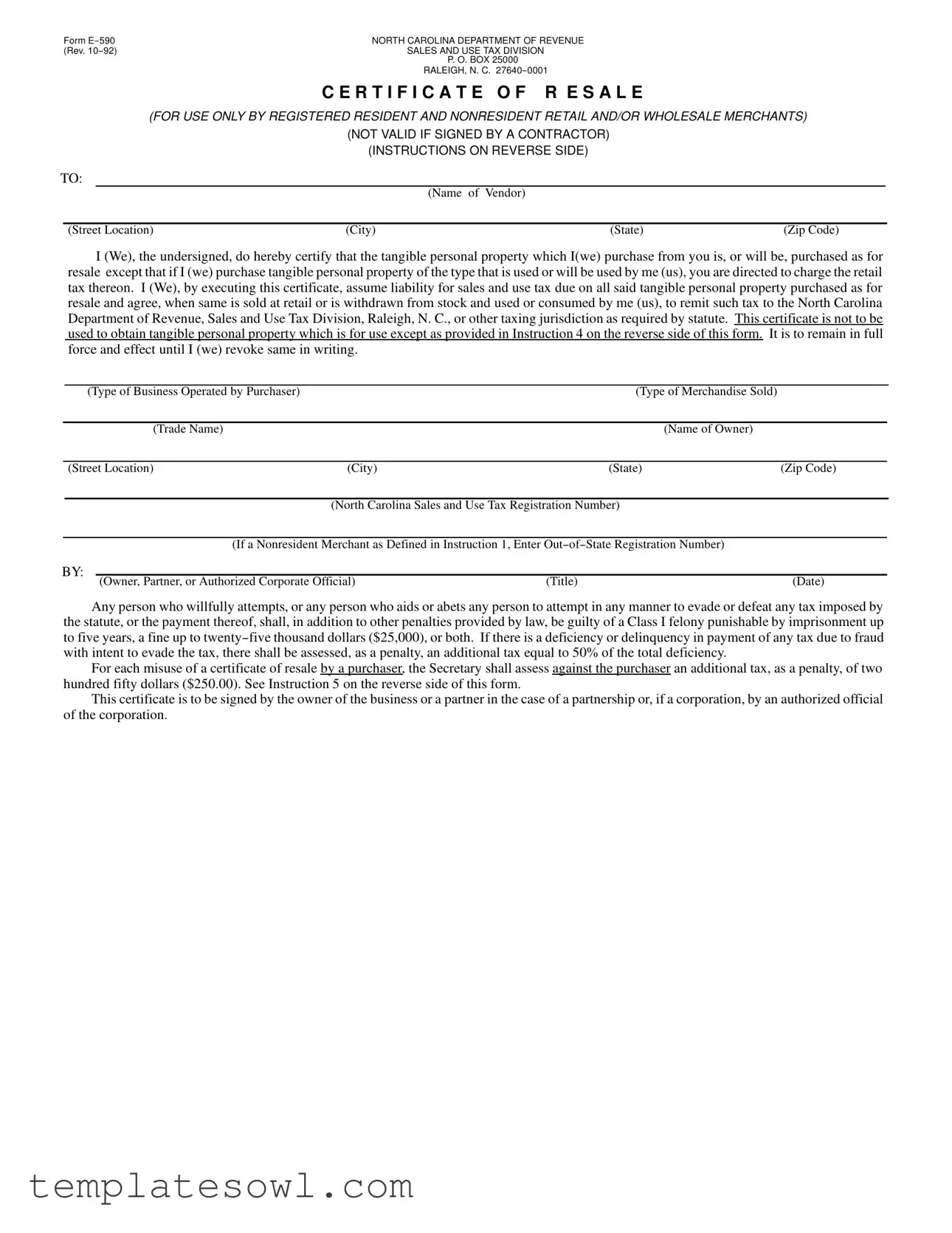

Nc Certificate Resale Example

|

FORM |

NORTH CAROLINA DEPARTMENT OF REVENUE |

|

|

|

|

(REV. |

SALES AND USE TAX DIVISION |

|

|

|

|

|

|

P. O. BOX 25000 |

|

|

|

|

|

RALEIGH, N. C. |

|

|

|

|

|

C E R T I F I C A T E O F R E S A L E |

|

|

|

|

(FOR USE ONLY BY REGISTERED RESIDENT AND NONRESIDENT RETAIL AND/OR WHOLESALE MERCHANTS) |

|||

|

|

|

(NOT VALID IF SIGNED BY A CONTRACTOR) |

|

|

|

|

|

(INSTRUCTIONS ON REVERSE SIDE) |

|

|

TO: |

|

|

|

||

|

|

|

(Name of Vendor) |

|

|

|

|

|

|

|

|

|

(Street Location) |

(City) |

(State) |

(Zip Code) |

|

I (We), the undersigned, do hereby certify that the tangible personal property which I(we) purchase from you is, or will be, purchased as for resale except that if I (we) purchase tangible personal property of the type that is used or will be used by me (us), you are directed to charge the retail tax thereon. I (We), by executing this certificate, assume liability for sales and use tax due on all said tangible personal property purchased as for resale and agree, when same is sold at retail or is withdrawn from stock and used or consumed by me (us), to remit such tax to the North Carolina Department of Revenue, Sales and Use Tax Division, Raleigh, N. C., or other taxing jurisdiction as required by statute. This certificate is not to be used to obtain tangible personal property which is for use except as provided in Instruction 4 on the reverse side of this form. It is to remain in full force and effect until I (we) revoke same in writing.

|

(Type of Business Operated by Purchaser) |

(Type of Merchandise Sold) |

|

|||

|

|

|

|

|

|

|

|

|

(Trade Name) |

|

(Name of Owner) |

|

|

|

|

|

|

|

|

|

|

(Street Location) |

(City) |

(State) |

(Zip Code) |

||

|

|

|

|

|

||

|

|

|

(North Carolina Sales and Use Tax Registration Number) |

|

||

|

|

|

|

|

||

|

|

|

(If a Nonresident Merchant as Defined in Instruction 1, Enter |

|

||

BY: |

|

|

|

|

||

(Owner, Partner, or Authorized Corporate Official) |

(Title) |

(Date) |

||||

|

|

|||||

Any person who willfully attempts, or any person who aids or abets any person to attempt in any manner to evade or defeat any tax imposed by the statute, or the payment thereof, shall, in addition to other penalties provided by law, be guilty of a Class I felony punishable by imprisonment up to five years, a fine up to

For each misuse of a certificate of resale by a purchaser, the Secretary shall assess against the purchaser an additional tax, as a penalty, of two hundred fifty dollars ($250.00). See Instruction 5 on the reverse side of this form.

This certificate is to be signed by the owner of the business or a partner in the case of a partnership or, if a corporation, by an authorized official of the corporation.

FORM

(REV.

INSTRUCTIONS

1.This certificate is for use only by registered resident and nonresident retail and/or wholesale merchants. ‘‘Nonresident retail or wholesale merchant” means a person who does not have a place of business in this State, is engaged in the business of acquiring, by purchase, consignment, or otherwise, tangible personal property and selling the property outside this State, and is registered for sales and use tax purposes in a taxing jurisdiction outside this State. Merchants issuing this certificate must keep a copy of the executed certificate in their records.

2.This certificate is not to be used to obtain tangible personal property for use except as provided in Instruction 4 below. See Sales and Use Tax Administrative Rules 7B .0106 and 7B .2301 for additional information in regard to the proper use of this certificate.

3.Retailers and wholesalers making occasional or infrequent purchases of tangible personal property for resale should furnish their suppliers with

a copy of this certificate with each purchase order for such tangible personal property. Only one certificate is necessary where frequent purchases are made.

4.Any registered merchant selling tangible personal property at retail and, in addition to such sales, makes purchases of such tangible personal

property |

for use in the general conduct of business and who cannot determine at the time of purchase whether the property will be resold or used may |

purchase |

the property from his suppliers without payment of tax by issuing a certificate to such suppliers as their authority for not charging the tax. |

Such merchant assumes responsibility for payment of the applicable sales and/or use taxes either (1) directly to the North Carolina Department of Revenue, if the transaction is taxable in this State or (2) to the appropriate taxing jurisdiction in another state, if the transaction is taxable in that state. An example of such a merchant is a

ing buildings or other structures and for installing equipment and fixtures to buildings and, in the performance of such contracts, consumes |

|

or uses |

such materials and merchandise. |

5.A seller who accepts a certificate of resale from a purchaser of tangible personal property has the burden of proving that the sale was not a retail sale unless all of the following conditions are met:

(a)The seller acted in good faith in accepting the certificate of resale.

(b)The certificate is in the form required by the Secretary.

(c)The certificate is signed by the purchaser, states the purchaser’s name, address, and registration number, and describes the type of tangible personal property generally sold by the purchaser in the regular course of business.

(d)The purchaser is licensed under the North Carolina Sales and Use Tax Law or under the law of another taxing jurisdiction.

(e)The purchaser is engaged in the business of selling tangible personal property of the type sold.

A purchaser who does not resell property purchased under a certificate of resale is liable for any tax subsequently determined to be due on the sale. A seller of property sold under a certificate of resale is jointly liable with the purchaser of the property for any tax subsequently determined to be due on the sale only if the Secretary proves that the sale was a retail sale.

6.This certificate is not valid if signed by a contractor. A contractor is the user or consumer of tangible personal property and sales to contractors

are taxable at the retail rate of tax.

7.The vendor must obtain a corrected certificate in the event of change of ownership of a business for which a certificate of resale is on file. Such changes in ownership of North Carolina businesses may be verified with the Sales and Use Tax Taxpayer Assistance Section, North Carolina Department of Revenue, Post Office Box 25000, Raleigh, N. C.

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The North Carolina Certificate of Resale allows registered merchants to purchase tangible personal property without paying sales tax, provided the items are intended for resale. |

| Eligibility | This form is exclusively for use by registered resident and nonresident retail and wholesale merchants. It is not valid if signed by a contractor. |

| Liability | By signing the certificate, the purchaser assumes responsibility for any sales or use tax due on property purchased for resale. Failure to comply may result in penalties. |

| Governing Laws | The use of this certificate is governed by the North Carolina Sales and Use Tax Law, specifically under Sections 7B .0106 and 7B .2301 of the Sales and Use Tax Administrative Rules. |

Guidelines on Utilizing Nc Certificate Resale

Completing the North Carolina Certificate of Resale (Form E--590) ensures that you're set to purchase tangible personal property for resale. It is essential to fill out the certificate accurately to avoid any potential issues with tax obligations. After submitting the form, it will allow vendors to verify your status as a resale purchaser, thus facilitating your future transactions.

- Begin by entering the name of the vendor from whom you are purchasing the tangible personal property.

- Provide the vendor's street location, city, state, and zip code.

- Next, complete the certification statement by confirming that the property is being purchased for resale.

- Indicate the type of business you operate and specify the merchandise you sell.

- Include your business's trade name and owner’s name.

- Fill in the street location, city, state, and zip code for your business address.

- Enter your North Carolina Sales and Use Tax Registration Number. If you are a nonresident merchant, provide your out-of-state registration number instead.

- Have the certificate signed by the owner, partner, or an authorized corporate official. Make sure they include their title and the date of signing.

What You Should Know About This Form

1. What is the purpose of the North Carolina Certificate of Resale?

The North Carolina Certificate of Resale is used by registered retail and wholesale merchants to purchase tangible personal property without paying sales tax. This means that merchants can acquire items which they intend to sell to consumers, thereby avoiding upfront taxation on inventory.

2. Who can use this certificate?

Only registered resident and nonresident retail and/or wholesale merchants can use the Certificate of Resale. Nonresident merchants are those without a physical presence in North Carolina but who are legally registered for sales tax purposes elsewhere.

3. Are there any restrictions on using the Certificate of Resale?

Yes, the certificate cannot be used for purchases intended for personal use. It’s specifically for items being acquired for resale. If a merchant intends to use or consume a product themselves, they must pay the appropriate sales tax.

4. How often should merchants provide this certificate to vendors?

Merchants making infrequent purchases should provide a copy of the certificate with each order. However, for those making frequent purchases, only one certificate is usually needed to cover multiple transactions. Always ensure to keep a copy for your records.

5. What happens if a merchant uses the certificate improperly?

If a merchant misuses the Certificate of Resale, they could face penalties. Misuse is defined as purchasing property under this certificate without the intention to resell it. Consequences include possible tax liabilities and penalties, such as a $250 fine for each misuse.

6. Can a contractor use the Certificate of Resale?

No, the certificate is not valid when signed by a contractor. Since contractors are considered users or consumers of the materials they purchase, sales to them are subject to standard retail tax rates.

7. What information must be included when filling out the Certificate of Resale?

The certificate must include the merchant's name, address, sales tax registration number, and a description of the type of merchandise sold. It should also contain the signature of an owner, partner, or authorized official, along with their title and the date of signing.

8. What are the responsibilities of a merchant once they submit this certificate?

Merchants assume responsibility for any sales or use taxes owed for the tangible personal property purchased under the certificate. This means that if the merchandise is ultimately used rather than sold, the merchant must remit the applicable tax to the North Carolina Department of Revenue or the appropriate tax authority of another state.

9. How long is the Certificate of Resale valid?

The certificate remains in effect until it is revoked in writing by the merchant. Therefore, it is essential to manage updates or changes as they may affect the use of the certificate.

10. What should a vendor do if there is a change in ownership of the business?

If there is a change in ownership, the vendor must obtain a corrected Certificate of Resale from the new business owner. This ensures that all records remain accurate and up-to-date with the North Carolina Department of Revenue.

Common mistakes

Filling out the North Carolina Certificate of Resale form correctly is crucial for avoiding potential issues with the tax authorities. However, many individuals make common mistakes that can lead to complications. Here are seven common errors to watch out for when completing this form.

1. Incorrect Business Type Indication: It's important for the purchaser to accurately state the type of business they operate. Some individuals choose the wrong category or leave this field blank. This can lead to confusion and may result in the vendor incorrectly processing the certificate.

2. Missing Registration Numbers: Failure to provide the North Carolina Sales and Use Tax Registration Number or the Out-of-State Registration Number can invalidate the certificate. Without these numbers, the vendor has insufficient information to correctly process the resale certificate and may charge sales tax unnecessarily.

3. Signature Issues: The certificate must be signed by the owner, partner, or an authorized corporate official. Often, people forget to sign or use a digital signature without actually writing their name on the form. This oversight can make the certificate invalid, leading to tax liabilities for the purchaser.

4. Incomplete Contact Information: It's essential to provide complete contact information, including the business's street address, city, state, and zip code. Leaving any of these fields empty can create delays or misunderstandings between the vendor and the purchaser.

5. Misunderstanding the Use of the Certificate: Some merchants mistakenly believe they can use the resale certificate to purchase items for personal use. This is not allowed. The certificate is only valid when the items are for resale in the regular course of business. Misusing the certificate can lead to penalties.

6. Not Keeping a Copy of the Certificate: Each merchant should keep a copy of the executed certificate for their records. Failing to do so means they may not have the documentation needed to defend against tax inquiries or audits in the future.

7. Ignoring Changes in Ownership: If there is a change in business ownership, the vendor must obtain a corrected resale certificate. Ignoring this requirement can lead to confusion and tax complications that could have been avoided with prompt action.

By being aware of these common mistakes and carefully filling out the North Carolina Certificate of Resale form, individuals can ensure a smoother transaction process and reduce the likelihood of facing tax-related penalties.

Documents used along the form

The North Carolina Certificate of Resale form is essential for registered retailers and wholesalers. This document enables businesses to purchase tangible goods without paying sales tax at the time of purchase, provided they plan to resell these items. There are several other forms and documents that often accompany the Certificate of Resale. Each of these plays a vital role in ensuring legal compliance and proper tax reporting.

- Form E-595E: This is the Sales Tax Exemption Certificate for use by certain nonprofit organizations. Nonprofits can use this form to buy goods without paying sales tax for their exempt purposes.

- Form E-595P: This document is used by farmers. It allows them to purchase certain tangible personal property without paying sales tax if the items are used in their farming operations.

- Form E-500: This is the general Sales and Use Tax return. Businesses must file this form periodically to report their tax liabilities and remit any sales tax collected during their operations.

- Form E-585: This is the application for a sales tax refund. If a vendor or purchaser overpays sales tax, they can use this form to request a refund from the North Carolina Department of Revenue.

- Form E-590D: This is the Certificate of Exemption from Sales Tax for qualifying exempt organizations. It allows qualifying entities to purchase goods and services without paying sales tax.

- Vendor Certificate: This document is filled out by the vendor. It details the purchaser's information and confirms that they are a registered seller who is allowed to make tax-exempt purchases.

- Form NC-3: This is the Employer's Annual Reconciliation of Income Tax Withheld. Employers use it to reconcile the amount of state income tax withheld from employee wages during the year.

- Form NC-BR: This is the Business Registration Application. New businesses must submit it to register for various tax accounts, including sales tax.

- Sales Tax Permit: This is a vital document for businesses. It shows that a seller is registered to collect sales tax in North Carolina and is a legal requirement for conducting retail activities.

- Form NC-20: This is the report for taxpayers who make sales in both North Carolina and other states. It helps businesses report their sales tax obligations accurately across jurisdictions.

Having the correct forms and documents on hand facilitates compliance with tax laws and can help avoid potential penalties. Each of these documents serves a specific purpose in the sales tax process, ensuring that both buyers and sellers meet their legal obligations effectively.

Similar forms

The North Carolina Certificate of Resale form serves a specific purpose, similar to several other important documents in the realm of retail and tax compliance. Here are ten documents that share common features with the Certificate of Resale form:

- Vendor Registration Form: Much like the Certificate of Resale, this form confirms that a business is officially registered to collect sales tax. It includes details about the business owner and the type of goods sold.

- Sales Tax Exemption Certificate: Required for certain purchases where sales tax does not apply, this certificate serves as proof that the buyer is exempt from sales tax, similar to the resale intent stated in the Certificate of Resale.

- IRS Form W-9: This form requests taxpayer identification information. It shares the need for genuine interaction between buyer and seller to ensure compliance and proper reporting, similar to the responsibilities outlined in the Certificate of Resale.

- Wholesale Purchase Order: Like the Certificate of Resale, this document confirms a buyer's intent to purchase goods for resale rather than for personal use. It includes information about the buyer and the products being ordered.

- Sales Invoice: This document details the sale of goods and typically includes tax charges. While it is used post-transaction, it relates to the Certificate of Resale because it reflects whether tax was collected based on the resale status claimed.

- Business License Application: This document registers a business to operate legally. It often requires disclosure of the nature of the business, echoing the requirement of specifying the type of merchandise sold on the Certificate of Resale.

- State-Specific Sales Tax Return: This return is required to report and remit sales tax collected. It correlates with the Certificate of Resale as both documents ensure that the proper taxes are reported and paid to the state.

- Retail Sales Tax Permit: This permit is necessary for businesses to operate legally and collect sales tax. It confirms the business’s authority to purchase items for resale without paying taxes upfront, similar to the functions of the Certificate of Resale.

- Purchase Affidavit from Exempt Organizations: Just as the Certificate of Resale is used by merchants, this affidavit certifies that certain nonprofit organizations are exempt from sales tax, serving a similar protective purpose.

- Supplier Agreement: This outlines the terms of sale between a supplier and a buyer. The buyer’s assertion of purchasing goods for resale mirrors the Certificate of Resale's intent, ensuring compliance with tax regulations.

Each document plays an essential role in the broader context of tax compliance and sales operations, offering a framework for merchants to operate effectively within legal guidelines.

Dos and Don'ts

Do's when filling out the North Carolina Certificate of Resale form:

- Ensure you are a registered resident or nonresident retail or wholesale merchant.

- Complete all required fields, including your name, business type, and address.

- Sign the certificate either as the owner, partner, or authorized corporate official.

- Provide your North Carolina Sales and Use Tax Registration Number.

Don'ts when filling out the North Carolina Certificate of Resale form:

- Do not use the certificate to obtain tangible personal property for your own use.

- Avoid leaving any fields blank; every section must be completed.

- Never sign the certificate if you are acting as a contractor.

- Do not forget to keep a copy of the certificate for your records.

Misconceptions

Misconceptions can lead to confusion about the North Carolina Certificate of Resale form. Here are five common misunderstandings:

- Only North Carolina Residents Can Use It: Many believe this certificate is restricted to North Carolina residents. In reality, it can also be used by registered nonresident merchants who sell products outside the state.

- It's Valid for All Purchases: Some think that the certificate can be used for any purchase. However, it is only valid for tangible personal property that is meant for resale. If the property is intended for personal use or consumption, tax must be paid.

- Any Signature is Acceptable: There's a notion that any signature on the certificate will suffice. This is not true. The certificate must be signed by the owner, a partner, or an authorized corporate official to be valid.

- One Certificate Covers All Transactions: Many people believe that one certificate can be used for multiple purchases. While one certificate is sufficient for frequent purchases, retailers making occasional purchases must provide a copy with each order.

- Contractors Can Utilize It: Some mistakenly believe that contractors can also use the certificate for their purchases. In fact, the certificate is not valid when signed by a contractor as they are considered end users of the materials.

Understanding these points can help ensure proper use of the North Carolina Certificate of Resale. It’s essential to follow the guidelines to avoid potential penalties.

Key takeaways

- Eligibility: Only registered retail and wholesale merchants can use the North Carolina Certificate of Resale. Nonresident merchants must also be registered in their own jurisdiction for sales tax purposes.

- Purpose: The form certifies that the property being purchased is intended for resale, allowing the merchant to avoid paying sales tax at the time of purchase. However, if the item is later used or consumed, the tax must be remitted to the state.

- Documentation: Merchants must retain a copy of the signed certificate in their records, especially for infrequent purchases. Frequent buyers can provide the certificate once for multiple purchases.

- Responsibilities: Merchants need to remit any applicable sales taxes if the purchased items are not resold. If the seller accepts the certificate in good faith but the purchase wasn’t for resale, both parties may be held liable for any unpaid taxes.

- Nonuse by Contractors: Contractors are not allowed to use this certificate, as they are considered end users of the materials they purchase, thus subject to retail sales tax.

Browse Other Templates

Lien Waiver Form Wisconsin - Each of the parties involved must ensure that the waivers are properly filed and recorded.

Rpp Bond - The form outlines the responsibilities and liabilities of both the principal and the surety.