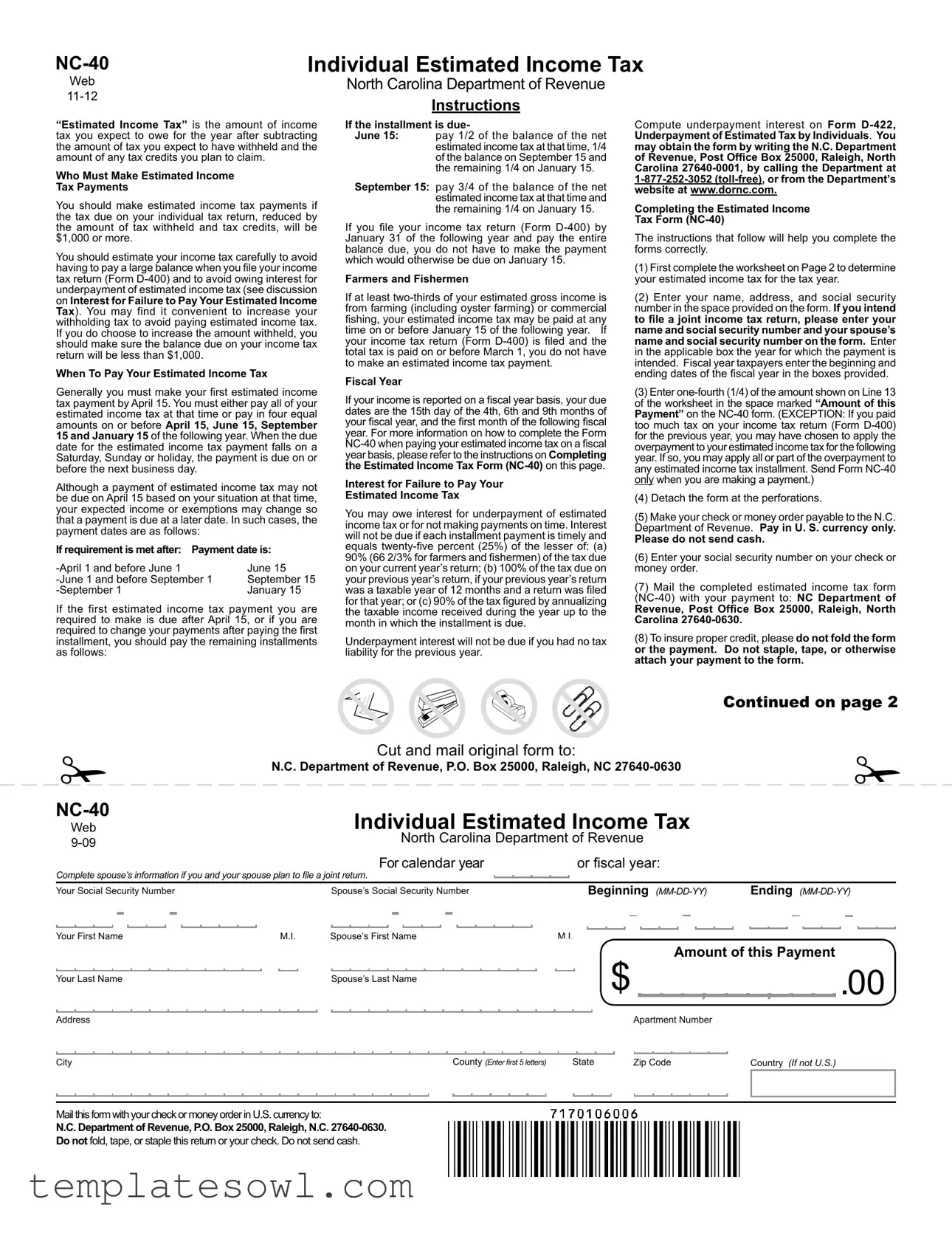

Fill Out Your Nc Estimated Tax Payment Form

The North Carolina Estimated Tax Payment form, known as NC-40, serves as an essential tool for individuals who may owe income tax at the end of the year. When filing, taxpayers are required to project the amount of income tax they will owe after accounting for any tax withheld and credits they intend to claim. If your tax obligation, after these considerations, is expected to exceed $1,000, timely estimated payments become necessary to avoid a hefty balance due and potential interest charges for underpayment. It is recommended that taxpayers estimate their income tax with care, as inaccurate estimations can lead to unwanted financial strain. Important deadlines for making these payments are set throughout the year, with initial payments typically due by April 15, followed by three additional payments on June 15, September 15, and January 15 of the following year. Occasionally, circumstances may necessitate adjustments to payment dates, especially for those whose income fluctuates. The NC-40 form must be completed accurately, ensuring that all required information such as names, Social Security numbers, and payment amounts are included. For those with agricultural or fishing incomes, distinct rules apply, allowing more flexible payment timelines. Overall, understanding and adhering to the guidelines for the NC Estimated Tax Payment can significantly alleviate end-of-year financial stress and ensure compliance with state tax obligations.

Nc Estimated Tax Payment Example

Individual Estimated Income Tax |

|

Web |

North Carolina Department of Revenue |

Instructions |

|

|

“Estimated Income Tax” is the amount of income tax you expect to owe for the year after subtracting the amount of tax you expect to have withheld and the amount of any tax credits you plan to claim.

Who Must Make Estimated Income

Tax Payments

You should make estimated income tax payments if the tax due on your individual tax return, reduced by the amount of tax withheld and tax credits, will be $1,000 or more.

You should estimate your income tax carefully to avoid having to pay a large balance when you ile your income tax return (Form

underpayment of estimated income tax (see discussion on Interest for Failure to Pay Your Estimated Income Tax). You may find it convenient to increase your withholding tax to avoid paying estimated income tax. If you do choose to increase the amount withheld, you should make sure the balance due on your income tax return will be less than $1,000.

When To Pay Your Estimated Income Tax

Generally you must make your irst estimated income tax payment by April 15. You must either pay all of your estimated income tax at that time or pay in four equal amounts on or before April 15, June 15, September 15 and January 15 of the following year. When the due date for the estimated income tax payment falls on a Saturday, Sunday or holiday, the payment is due on or before the next business day.

Although a payment of estimated income tax may not be due on April 15 based on your situation at that time, your expected income or exemptions may change so that a payment is due at a later date. In such cases, the payment dates are as follows:

If requirement is met after: Payment date is:

June 15 |

|

September 15 |

|

January 15 |

If the first estimated income tax payment you are

required to make is due after April 15, or if you are required to change your payments after paying the irst installment, you should pay the remaining installments

as follows:

If the installment is due-

June 15: pay 1/2 of the balance of the net estimated income tax at that time, 1/4 of the balance on September 15 and the remaining 1/4 on January 15.

September 15: pay 3/4 of the balance of the net estimated income tax at that time and the remaining 1/4 on January 15.

If you ile your income tax return (Form

Farmers and Fishermen

If at least

from farming (including oyster farming) or commercial ishing, your estimated income tax may be paid at any time on or before January 15 of the following year. If your income tax return (Form

to make an estimated income tax payment.

Fiscal Year

If your income is reported on a iscal year basis, your due dates are the 15th day of the 4th, 6th and 9th months of your iscal year, and the irst month of the following iscal year. For more information on how to complete the Form

Interest for Failure to Pay Your

Estimated Income Tax

You may owe interest for underpayment of estimated income tax or for not making payments on time. Interest

will not be due if each installment payment is timely and equals

month in which the installment is due.

Underpayment interest will not be due if you had no tax liability for the previous year.

Compute underpayment interest on Form

may obtain the form by writing the N.C. Department of Revenue, Post Ofice Box 25000, Raleigh, North Carolina

Completing the Estimated Income

Tax Form

The instructions that follow will help you complete the forms correctly.

(1)First complete the worksheet on Page 2 to determine your estimated income tax for the tax year.

(2)Enter your name, address, and social security

number in the space provided on the form. If you intend to ile a joint income tax return, please enter your name and social security number and your spouse’s

name and social security number on the form. Enter in the applicable box the year for which the payment is

intended. Fiscal year taxpayers enter the beginning and ending dates of the iscal year in the boxes provided.

(3)Enter

(4)Detach the form at the perforations.

(5)Make your check or money order payable to the N.C. Department of Revenue. Pay in U. S. currency only.

Please do not send cash.

(6)Enter your social security number on your check or money order.

(7)Mail the completed estimated income tax form

Revenue, Post Ofice Box 25000, Raleigh, North

Carolina

(8)To insure proper credit, please do not fold the form or the payment. Do not staple, tape, or otherwise attach your payment to the form.

|

|

|

Continued on page 2 |

|

|

Cut and mail original form to: |

|

|

|

N.C. Department of Revenue, P.O. Box 25000, Raleigh, NC |

||||

|

|

|||

Individual Estimated Income Tax |

|

|||

Web |

|

|||

North Carolina Department of Revenue |

|

|||

|

|

|

||

|

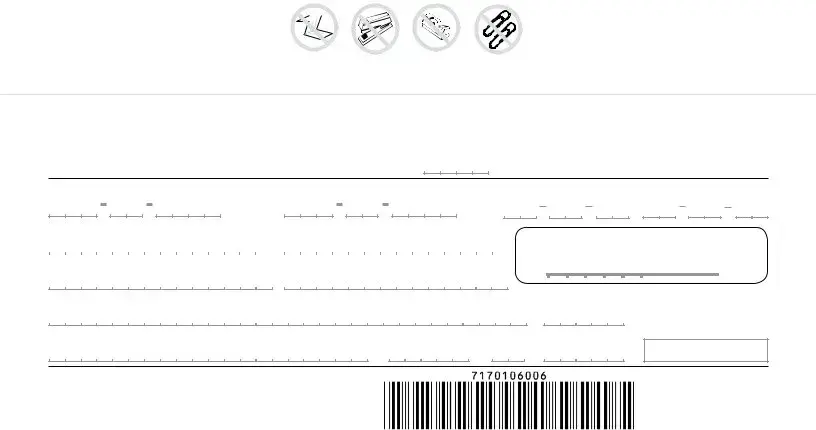

For calendar year |

or iscal year: |

|

|

Complete spouse’s information if you and your spouse plan to ile a joint return. |

|

|

||

Your Social Security Number |

Spouse’s Social Security Number |

Beginning |

Ending |

|

|

Your First Name |

|

M.I. |

Spouse’s First Name |

|

M.I. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your Last Name |

|

|

|

Spouse’s Last Name |

|

|

|

$

Amount of this Payment

, ,

.00

.00

Address |

Apartment Number |

City |

County (Enter irst 5 letters) |

State |

Zip Code |

Country (If not U.S.)

Mail this form with your check or money order in U.S. currency to:

N.C. Department of Revenue, P.O. Box 25000, Raleigh, N.C.

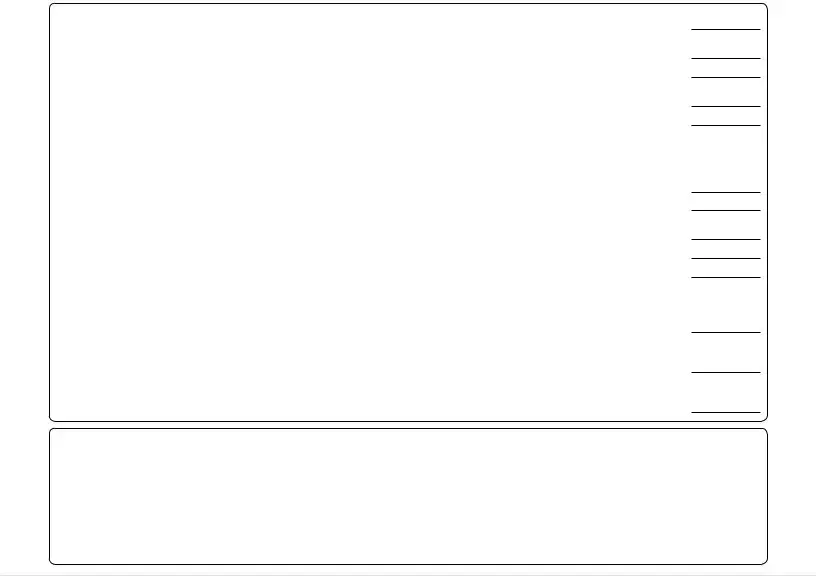

Page 2

Web

Worksheet for Computation of Estimated N.C. Income Tax

1. Estimated Federal Adjusted Gross Income |

1. |

2.Estimated Additions to Federal Adjusted Gross Income

(See Individual Income Tax Instructions for Form |

2. |

3. Add Lines 1 and 2 and enter the total |

3. |

4.Estimated Deductions from Federal Adjusted Gross Income

(See Individual Income Tax Instructions for Form |

4. |

5. Subtract Line 4 from Line 3 and enter the total |

5. |

6.• If you plan to itemize deductions, enter the estimated total of your itemized deductions.

• If you do not plan to itemize, enter your standard deduction.

|

IMPORTANT: Do not enter the amount from your federal return. |

|

|

|

|

(You must refer to the Individual Income Tax Instructions for Form |

|

6. |

|

7. |

Subtract Line 6 from Line 5 and enter the total |

|

7. |

|

8. |

N.C. personal exemption (Multiply $2,500 or $2,000 by the number of exemptions) |

|

|

|

|

(You must refer to the Individual Income Tax Instructions for Form |

8. |

||

9. |

Estimated North Carolina Taxable Income (Subtract Line 8 from Line 7) |

|

9. |

|

10. |

Amount of Tax - Use the Tax Rates shown below |

|

10. |

|

11. |

A. Estimated N. C. Tax to be withheld |

A. |

|

|

|

B. Estimated Tax Credits |

B. |

|

|

12. |

Add Lines 11A and 11B |

|

12. |

|

13.Estimated Income Tax (Subtract Line 12 from Line 10) If $1,000 or more, ill out and mail the estimated income tax form along with your payment; if less than $1,000, no payment is

required at this time |

.......................................................................................................................................................................13. |

14.If the irst payment you are required to make is due April 15, enter 1/4 of Line 13 here and in the space marked “Amount of this Payment” on Form

whole dollar |

...................................................................................................................................................................................14. |

Tax Rates

Single |

|

|

|

Head of Household |

|

|

|||

$ |

0 |

$ 12,750 |

6% |

$ |

0 |

$ 17,000 |

6% |

|

|

|

12,750 |

60,000 |

$ |

765 + 7% of the amount over $12,750 |

|

17,000 |

80,000 |

$ 1,020 |

+ 7% of the amount over $17,000 |

|

60,000 |

$ |

4,072.50 + 7.75% of the amount over $60,000 |

|

80,000 |

$ 5,430 |

+ 7.75% of the amount over $80,000 |

||

Married Filing Jointly / Qualifying Widow(er) |

Married Filing Separately |

||||||

$ |

0 |

$ 21,250 |

6% |

$ |

0 |

$ 10,625 |

6% |

|

21,250 |

100,000 |

$ 1,275 + 7% of the amount over $21,250 |

|

10,625 |

50,000 |

$ 637.50 + 7% of the amount over $10,625 |

100,000 |

$ 6,787.50 + 7.75% of the amount over $100,000 |

|

50,000 |

$ 3,393.75 + 7.75% of the amount over $50,000 |

|||

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Title | The form is titled NC-40 Individual Estimated Income Tax. |

| Agency | It is issued by the North Carolina Department of Revenue. |

| Purpose | It is used to estimate the income tax owed for the year. |

| Minimum Payment Requirement | You need to make payments if you expect to owe $1,000 or more. |

| Payment Timelines | The first payment is generally due by April 15 each year. |

| Installment Payments | Payments can be divided into four equal installments due on April 15, June 15, September 15, and January 15. |

| Farmers and Fishermen | These individuals may pay their estimated tax by January 15 of the following year. |

| Interest for Underpayment | Interest may apply if estimated tax payments are not made on time. |

| Fiscal Year Payments | If you report income on a fiscal year, your payment due dates differ. |

| Filing Requirements | The form should be filed with a payment to the NC Department of Revenue. |

Guidelines on Utilizing Nc Estimated Tax Payment

Filling out the NC Estimated Tax Payment form can seem daunting, but breaking it down into clear steps makes the process manageable. Follow these instructions closely to ensure that your form is properly completed and submitted in a timely manner.

- Gather your financial information, including your estimated income and any credits.

- Complete the worksheet on Page 2 to calculate your estimated income tax for the year.

- On the form, write your name, address, and social security number in the designated spaces.

- If filing jointly, include your spouse's name and social security number as well.

- Indicate the tax year you are making the payment for, or provide the fiscal year dates if applicable.

- Enter one-fourth (1/4) of the amount from Line 13 of the worksheet in the "Amount of this Payment" section.

- If you have an overpayment from last year that you want to apply to this year's installment, adjust your payment accordingly.

- Detach the form at the perforation to prepare it for mailing.

- Make your check or money order payable to the N.C. Department of Revenue.

- Write your social security number on your check or money order for identification.

- Mail the completed form along with your payment to the NC Department of Revenue at P.O. Box 25000, Raleigh, NC 27640-0630.

- To avoid issues, do not fold or staple the form or payment, and do not send cash.

What You Should Know About This Form

What is the NC Estimated Tax Payment form and why do I need it?

The NC Estimated Tax Payment form, known as NC-40, is used by individuals to report and pay their estimated income tax for the year. You need this form if you expect to owe $1,000 or more in tax after subtracting any tax withheld and any credits you may have. It's important to estimate your taxes accurately to avoid a large payment when you file your return and to prevent interest charges for underpayment.

Who is required to make estimated tax payments?

You must make estimated tax payments if the total tax you owe, minus your withholding and tax credits, is $1,000 or more. If this is the case, it may be wise to pay estimated taxes regularly to avoid a large balance due when you file your income tax return. Alternatively, you might consider increasing your tax withholding to limit or avoid having to pay estimated taxes altogether.

When are the estimated tax payments due?

Your first estimated income tax payment is generally due by April 15. You can choose to either pay all at once or in four equal installments. The due dates for the payments are April 15, June 15, September 15, and January 15 of the following year. If a due date falls on a weekend or holiday, your payment is due on the next business day.

What if my financial situation changes after I’ve made my payments?

If your income or exemptions change, you might find that you need to make a payment after the April 15 deadline. In that case, your payments are adjusted. If your requirement arises after April 1 but before June 1, you would then make your payment by June 15, and similar rules apply for later dates. Be sure to keep track of your changing situation to ensure compliance.

Are there any special rules for farmers and fishermen?

If you earn at least two-thirds of your income from farming or commercial fishing, you have more flexibility. You can pay your estimated income tax anytime before January 15 of the following year, and if you file your return and pay all taxes due by March 1, you won't have to make any estimated payments.

What happens if I underpay my estimated taxes?

You may incur interest charges if you underpay or fail to make timely payments. To avoid these charges, ensure that each installment is 25% of either 90% of your current year’s tax liability, 100% of your previous year’s tax, or 90% of your current year’s liability based on your income received to date. If you had no tax liability for the previous year, you will not owe underpayment interest.

How do I complete the NC Estimated Tax Payment form?

To fill out the NC-40, you'll need to start with a worksheet to determine your estimated tax. Enter your personal information, including your spouse's details if filing jointly. Follow the prompts to fill in your estimates, including expected deductions and credits. After calculating the payment amount, detach the form, and mail it with your payment to the address specified, ensuring that you do not staple or fold the form.

Common mistakes

When completing the North Carolina Estimated Tax Payment form, many individuals encounter common pitfalls that can lead to unnecessary complications or errors in their filings. One significant mistake is failing to accurately estimate their income. It is crucial to assess all sources of income throughout the year. Many overlook income from side jobs, freelance work, or investments, leading to underestimations that can result in a tax bill later on or possible interest and penalties.

Another frequent error is neglecting to factor in tax credits. Taxpayers often assume that tax credits will automatically be applied without careful consideration. Inaccurately calculating eligible credits can dramatically skew the estimated tax owed. Ensuring that you are aware of credits applicable to your situation is key to a realistic tax payment estimate.

Providing incomplete personal information is a mistake that can delay processing. Some individuals mistakenly skip filling in crucial details like their or their spouse's Social Security numbers or mailing addresses. Missing this information can lead to confusion and may result in the return getting rejected or not processed properly, which could impact future filings and payments.

In addition, many overlook the importance of rounding numbers correctly. The form requires amounts to be rounded to the nearest whole dollar, and failure to do this can lead to inconsistencies. A simple rounding mistake might seem trivial, but it can affect the total estimated tax due.

Timeliness is another crucial aspect often mismanaged. Some individuals forget the due dates for estimates, assuming that late payments, especially those that fall on weekends or holidays, can be submitted without consequence. It is essential to know that if a due date falls on a weekend or holiday, the payment is due the next business day. Ignoring this can incur avoidable penalties.

Individuals also frequently miscalculate the payment itself. When required to pay a fraction of the yearly estimate, some mistakenly fill in the incorrect amount on the NC-40 form. Correctly determining the one-fourth payment based on line calculations from the worksheet is vital to avoid overpaying or underpaying your estimated tax.

Lastly, sending cash as a form of payment is a mistake that many make. The instructions clearly advise against sending cash, which can lead to loss or theft. Instead, using a check or money order ensures a secure method of payment and helps maintain a clear record of transactions.

Familiarizing yourself with these common errors can save time, stress, and potentially significant amounts in additional tax liabilities or penalties. A careful and thorough approach to filling out the NC Estimated Tax Payment form will help ensure compliance and alleviate unnecessary financial burdens.

Documents used along the form

When it comes to managing your taxes in North Carolina, understanding the forms and documents associated with your estimated income tax payments is essential. The NC-40 form, which documents your estimated income tax, often accompanies other important forms. Familiarizing yourself with these documents helps ensure that you fulfill your obligations and avoid any surprises at tax time.

- Form D-400: This is the main individual income tax return for North Carolina. You file it to report your total income, deductions, and credits for the year. If your estimated tax payments show that you have overpaid, you may apply this credit to your future estimated tax payments.

- Form D-422: Use this form to calculate any interest owed for underpayment of your estimated tax. If you fail to make your estimated tax payments on time, this form assists in determining the interest you may need to pay. It’s vital for keeping track of any potential penalties.

- Schedule A: This is a supplemental form used for itemizing deductions. If you decide to take itemized deductions instead of the standard deduction, this form will help you detail those expenses. Itemizing can sometimes lower your tax liability significantly.

- Form NC-40A: This document is used for making annualized estimated tax payments based on income that fluctuates throughout the year. If you earn income unevenly, this form helps you compute the appropriate tax payments due during the year.

Understanding these forms is crucial for efficient tax planning. Each document plays a specific role in ensuring accurate reporting and compliance with the North Carolina tax laws. By staying informed and organized, you can simplify your tax preparation and minimize potential liabilities.

Similar forms

- IRS Form 1040-ES: This form is used to calculate and pay estimated taxes to the Internal Revenue Service. Like the NC Estimated Tax Payment form, it aims to help taxpayers make regular payments throughout the year to avoid a large tax balance when filing their annual return.

- IRS Form 2210: This form is necessary for those who may owe a penalty for underpayment of estimated tax. It helps determine if you need to pay a penalty, similar to how the NC form addresses underpayment interest issues.

- State Estimated Tax Payment Forms: Other states have similar forms, such as the California Form 3519. These are designed to pay state income taxes based on expected income, much like the NC-40 assists with North Carolina taxes.

- Form D-400: This is the North Carolina individual income tax return. While the NC-40 allows for estimated payments, the D-400 is for actual tax filing. Both forms play crucial roles in the annual tax process.

- Form NC-421: This form allows for claims on various North Carolina tax credits. While NC-40 is for estimated payments, it is closely related as both deal with tax calculation and payment processes.

- Form D-422: This is used for calculating underpayment interest for those who fail to make timely estimated payments. As such, it complements the information provided by the NC Estimated Tax Payment form.

- Form W-4: Although primarily for withholding allowances, the W-4 helps taxpayers manage withholding and estimate tax obligations, just as the NC-40 helps estimate payments due throughout the year.

Dos and Don'ts

When filling out the NC Estimated Tax Payment form, follow these guidelines:

- Do complete the worksheet on Page 2 to accurately determine your estimated income tax for the tax year.

- Do enter your name, address, and social security number in the provided spaces correctly.

- Do ensure that you pay at least one-fourth of the estimated income tax amount indicated on the worksheet.

- Do mail your completed form with a check or money order made out to the N.C. Department of Revenue.

- Don't send cash, as it will not be accepted for payments.

- Don't fold, staple, or tape the form or payment; it can cause processing issues.

- Don't forget to check that your payment is in U.S. currency only before mailing it.

Misconceptions

Many individuals feel uncertain about their responsibilities when it comes to estimated tax payments in North Carolina. Let's address six common misconceptions that can lead to confusion or missteps in compliance.

- Misconception 1: You only need to make estimated tax payments if you own a business.

This is not true. Any taxpayer who expects to owe $1,000 or more after withholding and credits needs to make estimated tax payments. This includes individuals with income from side jobs, freelance work, or investment income.

- Misconception 2: Estimated tax payments must be paid in one lump sum by April 15.

While it's true that the first payment is due by April 15, taxpayers have the option to pay their estimated taxes in four equal installments. Payments are due on April 15, June 15, September 15, and January 15 of the following year.

- Misconception 3: If I don’t make estimated tax payments, I won’t face any penalties.

This isn't accurate. Failing to make required payments can result in penalties and interest charges. The North Carolina Department of Revenue takes underpayment seriously, so it is wise to stay informed about your obligations.

- Misconception 4: I can figure out my payments easily without any calculations or worksheets.

Estimating tax payments involves more than just a guess. The state requires you to carefully calculate your expected income, deductions, and credits. Using the provided worksheet is essential to determine your estimated income tax accurately.

- Misconception 5: Any tax overpayment can automatically be applied to the following year's estimated tax payments.

This is somewhat misleading. You can apply overpayments to your estimated tax payments, but only if you specifically choose to do so on your tax return. It’s vital to indicate your preference clearly.

- Misconception 6: Estimated taxes are solely for individuals who file a standard tax return.

This is incorrect. Taxpayers who file under various circumstances, including those with fiscal year reporting, must also manage estimated tax payments appropriately. Each individual's situation may have unique requirements.

Key takeaways

Understanding the NC Estimated Tax Payment Form is crucial for managing your tax liabilities effectively. Here are some key takeaways:

- Estimated Tax Payments: You need to make estimated tax payments if the amount due on your tax return, after accounting for withholdings and credits, is $1,000 or more. Estimating accurately can help avoid a large balance remaining when filing your tax return.

- Payment Schedule: The first payment is generally due by April 15. Additional payments follow on June 15, September 15, and January 15 of the next year. If a due date falls on a weekend or holiday, payments are due the next business day.

- Completing the Form: Make sure to fill out the NC-40 form correctly. Start by determining your estimated income tax. Include basic information, the amount of payment, and avoid sending cash—only checks or money orders are accepted.

- Interest on Underpayments: If you miss payments or underpay, you may incur interest. Ensure each installment is submitted on time to avoid penalties. However, no interest is charged if your payments are consistent with previous tax obligations.

Browse Other Templates

Good Faith Estimate for Insured Patients - Understanding the tradeoff between interest rates and settlement charges through this form can greatly affect your loan selection.

Power of Attorney for Buying Property in India - By signing this document, the account holder acknowledges the scope of powers granted to the attorney.