Fill Out Your Nc Deed Trust Form

The North Carolina Deed of Trust form is a crucial legal document used in real estate transactions, particularly as part of the N.C. Home Advantage Mortgage Program administered by the North Carolina Housing Finance Agency. This form serves multiple purposes: it establishes a trust relationship among the parties involved, sets the terms for loan repayment, and provides a clear outline for the management of the property that secures the loan. The document begins with identifying the Grantor, Trustee, and Beneficiary, detailing their rights and responsibilities, and resulting obligations. Notably, it highlights the amount borrowed and stipulates a 15-year repayment plan, all of which are secured by the property detailed within the document. In the event of a default, the Deed of Trust provides guidelines for foreclosure, including the responsibilities of the Trustee to handle any necessary legal proceedings and manage the sale of the property. Furthermore, it contains protective measures for the Beneficiary, ensuring they have the right to inspect the property and obtain necessary insurance. The form also outlines the consequences of any failure to meet obligations, which could lead to significant financial repercussions. As such, understanding the North Carolina Deed of Trust form is essential for those involved in property transactions, ensuring all parties are aware of their rights and obligations and the impacts of noncompliance.

Nc Deed Trust Example

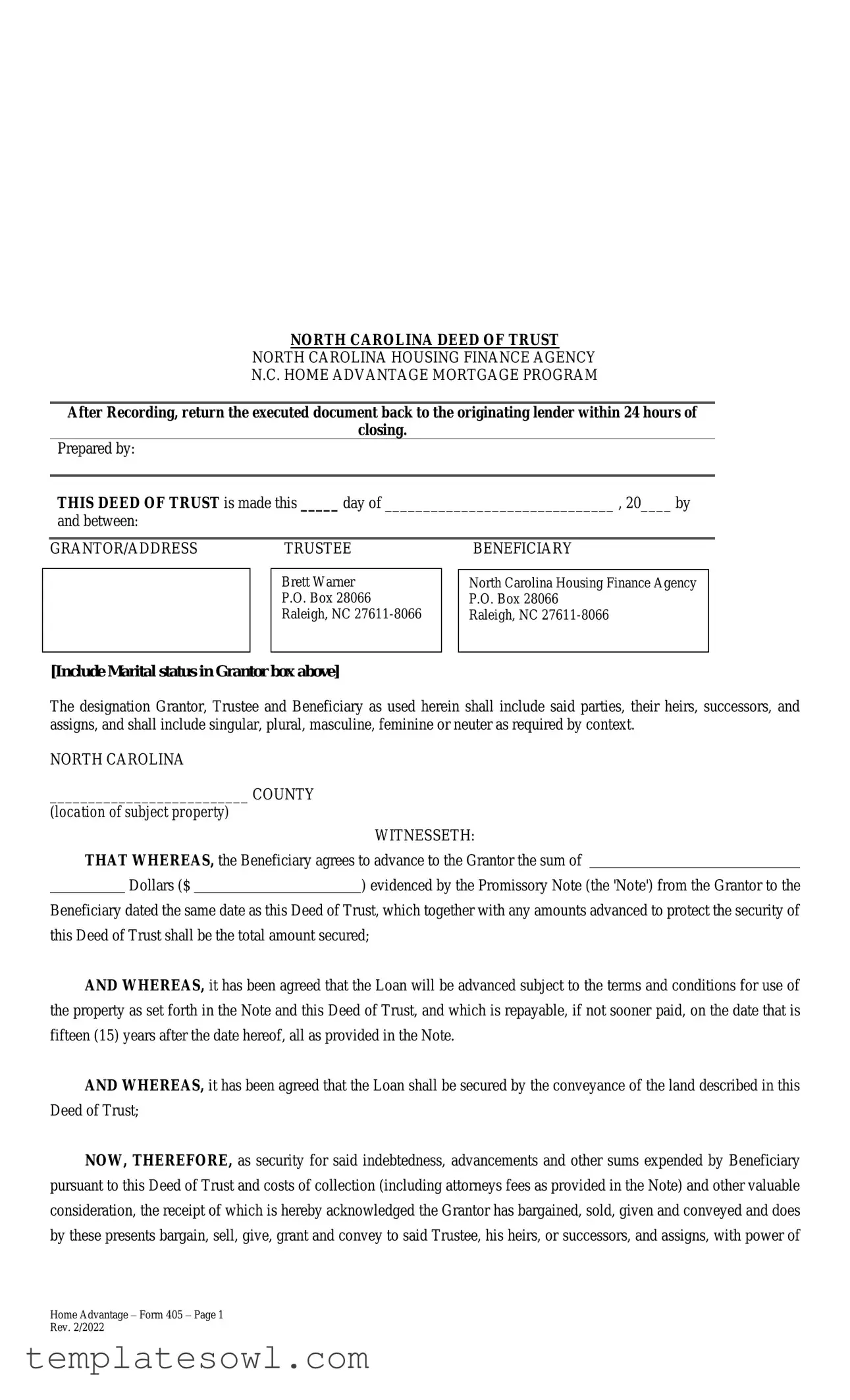

NORTH CAROLINA DEED OF TRUST

NORTH CAROLINA HOUSING FINANCE AGENCY

N.C. HOME ADVANTAGE MORTGAGE PROGRAM

After Recording, return the executed document back to the originating lender within 24 hours of

closing.

Prepared by:

THIS DEED OF TRUST is made this _____ day of ______________________________ , 20____ by

and between:

GRANTOR/ADDRESS |

TRUSTEE |

BENEFICIARY |

Brett Warner

P.O. Box 28066

Raleigh, NC

North Carolina Housing Finance Agency

P.O. Box 28066

Raleigh, NC

[Include Marital status in Grantor box above]

The designation Grantor, Trustee and Beneficiary as used herein shall include said parties, their heirs, successors, and assigns, and shall include singular, plural, masculine, feminine or neuter as required by context.

NORTH CAROLINA

__________________________ COUNTY

(location of subject property)

WITNESSETH:

THAT WHEREAS, the Beneficiary agrees to advance to the Grantor the sum of

Dollars ($) evidenced by the Promissory Note (the 'Note') from the Grantor to the Beneficiary dated the same date as this Deed of Trust, which together with any amounts advanced to protect the security of this Deed of Trust shall be the total amount secured;

AND WHEREAS, it has been agreed that the Loan will be advanced subject to the terms and conditions for use of the property as set forth in the Note and this Deed of Trust, and which is repayable, if not sooner paid, on the date that is fifteen (15) years after the date hereof, all as provided in the Note.

AND WHEREAS, it has been agreed that the Loan shall be secured by the conveyance of the land described in this Deed of Trust;

NOW, THEREFORE, as security for said indebtedness, advancements and other sums expended by Beneficiary pursuant to this Deed of Trust and costs of collection (including attorneys fees as provided in the Note) and other valuable consideration, the receipt of which is hereby acknowledged the Grantor has bargained, sold, given and conveyed and does by these presents bargain, sell, give, grant and convey to said Trustee, his heirs, or successors, and assigns, with power of

Home Advantage – Form 405 – Page 1

Rev. 2/2022

sale, the parcel(s) of land situated in the City of __________________, ___________________ County, North Carolina,

(the "Premises") and more particularly described as follows:

together with all heating, plumbing and lighting fixtures and equipment now or hereafter attached to or used in connection with the premises (the “Property”).

TO HAVE AND TO HOLD the Property, with all privileges and appurtenances thereunto belonging, to the Trustee, the Trustee's heirs, and assigns forever, upon the trust terms and conditions and for the uses set forth in this Deed of Trust.

If the Grantor shall pay the Note secured hereby in accordance with its terms, together with interest thereon, and any renewals or extensions thereof in whole or in part, all other sums secured hereby and shall comply with all of the covenants, terms and conditions of this Deed of Trust, then this conveyance shall be null and void and may be canceled of record at the request and the expense of the Grantor. If, however, there shall be any default (a) in the payment of any sums due under the Note, this Deed of Trust or any other instrument securing the Note and such default is not cured within thirty (30) days from the due date, or (b) if there shall be default in any of the other covenants, terms or conditions of the Note secured hereby, or any failure or neglect to comply with the covenants, terms or conditions contained in this Deed of Trust or any other instrument securing the Note and such default is not cured within thirty (30) days after written notice, then and in any of such events, without further notice, it shall be lawful for and the duty of the Trustee, upon request of the Beneficiary, to sell the land herein conveyed at public auction for cash, after having first giving such notice of hearing as to commencement of foreclosure proceedings and obtained such findings or leave of court as may then be required by law and giving such notice and advertising the time and place of such sale in such manner as may then be provided by law, and upon such and any resales and upon compliance with the law then relating to foreclosure proceedings under power of sale to convey title to the purchaser in as full and ample manner as the Trustee is empowered. The Trustee shall be authorized to retain an attorney to represent him in such proceedings. The proceeds of the Sale shall after the Trustee retains his commission, together with reasonable attorneys fees incurred by the Trustee in such proceedings, be applied to the costs of sale, including, but not limited to, costs of collection, taxes, assessments, costs of recording, service fees and incidental expenditures, the amount due on the Note hereby secured and advancements and other sums expended by the Beneficiary according to the provisions hereof and otherwise as required by the then existing law relating to foreclosures. The Trustee's commission shall be five percent (5%) of the gross proceeds of the sale for a completed foreclosure.

The said Grantor does hereby covenant and agree with the Trustee and Beneficiary as follows:

1.PAYMENT AND PERFORMANCE. Grantor shall pay the Note and perform all other requirements at the time and in the manner provided in the Note and herein.

2.INSURANCE. Grantor shall keep the property and all improvements, now or hereafter erected, constantly insured for the benefit of the Beneficiary against loss by fire, windstorm and such other casualties and contingencies, in the manner and with companies as may be satisfactory to the Beneficiary. The amount of the insurance required by this provision shall be the lesser of either the amount of the Note secured by this Deed of Trust or 100% of the insurable value of the improvements on the Property. Grantor shall purchase such insurance and pay all premiums in a timely manner. In the event that Grantor fails to pay any premium when it is due, then the Beneficiary, at its option, may purchase such insurance. Such amounts paid by the Beneficiary shall be added to the Note secured by this Deed of Trust and shall be due and payable by Grantor upon demand of the Beneficiary.

3.TAXES, ASSESSMENTS, CHARGES. Grantor shall pay all taxes, assessments and charges as may be lawfully levied against the Property before the same shall become past due. In the event that the Grantor fails to pay all taxes, assessments and charges as required, then the Beneficiary at its option may pay them and the amount paid shall be added to the Note secured by this Deed of Trust and shall be due and payable by Grantor upon demand of the Beneficiary.

Home Advantage – Form 405 – Page 2

Rev. 2/2022

Grantor shall promptly discharge any lien which has priority over this Deed of Trust unless Grantor: (a) agrees in writing to the payment of the obligation secured by the lien in a manner acceptable to Beneficiary, but only so long as Grantor is performing such agreement; (b) contests to the lien in good faith by, or defends against enforcement of the lien in, legal proceedings which in Beneficiary’s opinion operate to prevent the enforcement of the lien while those proceedings are pending, but only until such proceedings are concluded; or (c) secures from the holder of the lien an agreement satisfactory to Beneficiary subordinating the lien to this Deed of Trust. If Beneficiary determines that any part of the Property is subject to a lien which can attain priority over this Deed of Trust, Beneficiary may give Grantor a notice identifying the lien. Within 10 days of the date on which that notice is given, Grantor shall satisfy the lien or take one or more of the actions set forth above in this Deed of Trust.

4.WASTE. The Grantor covenants that the Grantor will keep the Property in good order, repair and condition, reasonable wear and tear excepted, and that Grantor will not commit or permit any waste on the Property.

5.WARRANTIES. Grantor covenants with Trustee and Beneficiary that Grantor is seized of the Property in fee simple, has the right to convey the same in fee simple, that the title is marketable and free and clear of all encumbrances, and that the Grantor will warrant and defend the title against the lawful claims of all persons whomsoever, except that the title to the Property is subject to the following exceptions:

(See Exhibit “B” attached hereto and incorporated herein by references, if applicable)

6.OCCUPANCY. Grantor shall occupy, establish, and use the Premises as Grantor’s principal residence.

7.SUBSTITUTION OF TRUSTEE. Grantor and Trustee covenant and agree that in case the Trustee, or any trustee, shall die, become incapable of acting, renounce this trust, or for other similar or dissimilar reason become unacceptable to the Beneficiary or if the Beneficiary desires to replace the Trustee, then the Beneficiary may appoint, in writing, a trustee to take the place of the Trustee; and upon the probate and registration of the writing, the trustee thus appointed shall succeed to all the rights, powers and duties of the Trustee.

8.CIVIL ACTIONS. In the event that the Trustee is named as a party in any civil action as trustee in this Deed of Trust, the Trustee shall be entitled to employ an attorney at law, including himself if he is a licensed attorney, to represent him in said action and the reasonable attorney's fees of the Trustee in such action may be Paid by the Beneficiary and added to the Note secured by this Deed of Trust, and shall be due and payable by Grantor upon demand of the Beneficiary.

9.PRIOR LIENS. Default under the terms of any instrument secured by a lien to which this Deed of Trust is subordinated shall constitute default under this Deed of Trust.

10.SUBORDINATION. Any subordination of this lien to additional liens or encumbrances shall be only upon the prior written consent of the Beneficiary.

11.LOAN APPLICATION. Grantor shall be in default if, during the Loan application process, Grantor or any persons or entities acting at the direction of Grantor or with Grantor’s knowledge or consent gave materially false, misleading, or inaccurate information or statements to (or failed to provide Lender with material information) in connection with the Loan. Material representations include, but are not limited to, representations concerning Grantor’s occupancy of the Property as Grantor’s principal residence and Grantor’s income level.

12.RIGHT TO INSPECT. To assure and protect its right in this Deed of Trust and the Property, the Beneficiary shall have right of access and inspection of the Property at reasonable times and with ample notice to the Grantor.

13.INDEMNITY. If any suit or proceeding be brought against the Trustee or Beneficiary or if any suit or proceeding be brought which may affect the value or title of the Property, Grantor shall defend, indemnify and hold harmless and on demand reimburse Trustee or Beneficiary from any loss, cost, damage or expense and any sums expended by Trustee or Beneficiary shall bear interest as provided in the Note secured hereby for sums due after default and shall be due and payable on demand.

14.SALE OF PROPERTY. Grantor agrees that if the Property or any part thereof or interest therein is sold, assigned, transferred, conveyed or otherwise alienated by Grantor, whether voluntarily or involuntarily or by operation of law other than: (i) the creation of a lien or other encumbrance subordinate to this Deed of Trust which does not relate to a transfer of rights of occupancy in the Property; (ii) a transfer by devise, descent, or operation of law on the death of a

Home Advantage – Form 405 – Page 3

Rev. 2/2022

joint tenant or tenant by the entirety; (iii) a transfer to a relative resulting from the death of a Grantor; (iv) a transfer resulting from a decree of a dissolution of marriage, legal separation agreement, or from an incidental property settlement agreement, by which the spouse of the Grantor becomes an owner of the Property; (v) any other transfer permitted under federal law, without the prior written consent of Beneficiary, Beneficiary, at its own option, may declare the Note secured hereby and all other obligations hereunder to be forthwith due and payable. Any change in the legal or equitable title of the Property or in the beneficial ownership of the Property shall be deemed to be the transfer of an interest in the Property.

15.TERMINATION OF RESTRICTIONS. Any restrictions contained in the Note or this Deed of Trust will automatically terminate if title to the Property is transferred by foreclosure or

16.PROTECTION OF BENEFICIARY’S INTEREST IN THE PROPERTY AND RIGHTS UNDER THIS DEED OF TRUST. If (a) Grantor fails to perform the covenants and agreements contained in this Deed of Trust, (b) there is a legal proceeding that might significantly affect Beneficiary’s interest in the Property and/or rights under this Deed of Trust (such as a proceeding in bankruptcy, probate, for condemnation or forfeiture, for enforcement of a lien which may attain priority over this Deed of Trust or to enforce laws or regulations), or (c) Grantor has abandoned the

Property, then Beneficiary may do and pay for whatever is reasonable or appropriate to protect Beneficiary’s interest in the Property and rights under this Deed of Trust, including protecting and/or assessing the value of the Property, and securing and/or repairing the Property. Beneficiary’s actions can include, but are not limited to: (a) paying any sums secured by a lien which has priority over this Deed of Trust; (b) appearing in court; and (c) paying reasonable attorneys’ fees to protect its interest in the Property and/or rights under this Deed of Trust, including its secured position in a bankruptcy proceeding. Securing the Property includes, but is not limited to, entering the Property to make repairs, change locks, replace or board up doors and windows, drain water from pipes, eliminate building or other code violations or dangerous conditions, and have utilities turned on or off. Although Beneficiary may take action under this Section 15, Beneficiary does not have to do so and is not under any duty or obligation to do so. It is agreed that Beneficiary incurs no liability for not taking any or all actions authorized under this Section 15.

Any amounts disbursed by Beneficiary under this Section 15 shall become additional debt of Grantor secured by this Deed of Trust. These amounts shall bear interest at the Note rate, if any, from the date of disbursement and shall be payable, with such interest, upon notice from Beneficiary to Grantor requesting payment.

17.CONDEMNATION. If the Property, or any part of the Property, is condemned under any power of eminent domain, or acquired for public use, the damages, proceeds, and the consideration for such acquisition, to the extent of the full amount of indebtedness upon this Deed of Trust and if the Note remains unpaid, are hereby assigned by the Grantor to the Beneficiary and shall be paid to the Beneficiary to be applied by the Beneficiary on account of the indebtedness.

18.WAIVER OF DEFAULT. No sale of the Property and no forbearance on the part of the Beneficiary and no extension of the time for the repayment of the debt secured hereby given by the Beneficiary shall operate to release, discharge, modify, change, or affect the original liability of the Grantor either in whole or in part. The Beneficiary can, in its complete discretion, waive any default, and can waive by written instrument, in advance, any individual actions which might constitute a default.

19.GOVERNING LAW. This Deed of Trust is to be governed and construed in accordance with the laws of the State of North Carolina.

20.SUCCESSORS AND ASSIGNS. The covenants herein contained shall bind, and the benefits and advantages shall inure to the legal representatives, successors and assigns of the parties hereto.

Home Advantage – Form 405 – Page 4

Rev. 2/2022

IN TESTIMONY WHEREOF, Grantor(s) has executed this instrument under seal on the date first above written. GRANTOR(S):

(SEAL) (Print Name)

(SEAL) (Print Name)

STATE OF |

|

COUNTY OF |

I, ___________________________, a Notary Public of ______________ County (enter county matching your notary

stamp), State of |

|

, certify that the following person(s): |

||

|

|

|

|

personally appeared before me this day |

and presented this Deed of Trust and he or she signed the Deed of Trust while in my physical presence and while being personally observed signing the Deed of Trust by me for the purposes stated therein.

|

Witness my hand and official stamp or seal, this the |

|

day of |

, 20 . |

||||||

(Apply Notary Seal) |

Signature of Notary Public |

|

|

|

|

|

|

|

||

|

My Commission expires |

|

|

|

|

|

|

|

|

|

Mortgage Loan Originator Name and NMLS #: |

|

, # |

|

|

(must match 1003) |

|||

Company Name and NMLS #: |

|

|

, # |

|

|

|

(must match 1003) |

|

Home Advantage – Form 405 – Page 5 |

|

|

|

|

|

|

|

|

Rev. 2/2022 |

|

|

|

|

|

|

|

|

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Purpose of the Deed of Trust | This document serves as a security instrument that allows a lender to secure a loan with real property as collateral. It outlines the rights and responsibilities of the parties involved. |

| Governing Law | The North Carolina Deed of Trust form is governed by North Carolina state laws, specifically related to real estate and lending practices. |

| Parties Involved | The Deed of Trust outlines the roles of the Grantor (borrower), Trustee (neutral third party), and Beneficiary (lender) in the transaction. |

| Foreclosure Process | Should a default occur, the Trustee is empowered to sell the property at public auction to settle the debt, following due process as mandated by law. |

| Duration of the Loan | The loan secured by the Deed of Trust is typically repayable over a period of fifteen years, as outlined in the associated Promissory Note. |

Guidelines on Utilizing Nc Deed Trust

Filling out the North Carolina Deed of Trust form is an important step in securing a loan. Proper completion of this document ensures that all parties are clearly identified and that the necessary legal protections are in place. Once this form is filled out and executed, it must be returned to the originating lender within 24 hours of closing.

- Enter the date at the top of the form where indicated, specifying the day, month, and year.

- In the Grantor section, list the full name of the borrower (Grantor) along with their address. Include their marital status as required.

- In the Trustee section, enter the name of the Trustee you are appointing.

- In the Beneficiary section, indicate the name of the beneficiary, which is the North Carolina Housing Finance Agency, followed by its address.

- Specify the county where the property is located next to "NORTH CAROLINA" in the designated area.

- Fill in the total loan amount in the blank space following "the sum of Dollars ($)".

- Identify the city and county of the property in the Premises section.

- Attach an Exhibit “B” if there are exceptions to the title that need to be described.

- Sign and print the names of the Grantor(s) at the bottom, ensuring that all required parties are present.

- Locate the Notary section and have it signed by a Notary Public. They will verify the identities of the individuals signing the deed.

After completing these steps, ensure that the document is executed properly and returned to the lender without delay. Following these instructions carefully helps in avoiding legal issues later on.

What You Should Know About This Form

What is a North Carolina Deed of Trust?

A North Carolina Deed of Trust is a legal document used in real estate transactions that secures a loan on a property. It involves three parties: the Grantor (borrower), Trustee (a neutral third party), and Beneficiary (lender). The Deed of Trust conveys title to the property to the Trustee, who holds it as collateral for the loan provided to the Grantor by the Beneficiary.

What is the purpose of a Deed of Trust in financing?

The primary purpose of a Deed of Trust is to protect the lender's interest in the property until the borrower fulfills their obligation to repay the loan. It establishes a legal claim to the property, allowing the Trustee to sell it if the Grantor defaults on the loan. This mechanism provides a level of security for the lender while enabling the borrower to acquire financing.

How is a Deed of Trust executed in North Carolina?

To execute a Deed of Trust, the Grantor must complete the necessary sections, including identifying the parties and detailing the property description and loan amount. The document must then be signed in the presence of a notary public. Once executed, it should be recorded at the local register of deeds to provide public notice of the lien on the property. Furthermore, the originating lender must receive the document within 24 hours of closing.

What happens if the Grantor defaults on the Deed of Trust?

If the Grantor defaults, meaning they fail to make timely payments or comply with other terms of the loan agreement, the Trustee has the authority to initiate foreclosure proceedings. This process involves selling the property at public auction. The law requires prior notice of these proceedings to be given to the Grantor, and the proceeds from the sale are used to pay off the outstanding debt and expenses incurred in the process.

Can the terms of a Deed of Trust be modified after execution?

Once a Deed of Trust is executed, its terms are generally binding. However, the Beneficiary may agree to modify certain provisions if both parties consent. Such modifications must be documented in writing and may require additional formalities such as notarization or recording, depending on the nature of the changes involved.

What obligations does the Grantor have under a Deed of Trust?

The Grantor has several vital obligations under a Deed of Trust, including timely payment of the loan, maintaining property insurance, and covering all property taxes. Additionally, the Grantor must occupy the property as their principal residence and not allow any waste or deterioration of the property, which could devalue its worth. Failure to meet these obligations can trigger a default.

What is the role of a Trustee in a Deed of Trust?

The Trustee serves as an impartial intermediary, holding the legal title to the property for the benefit of the Beneficiary until the loan is repaid. In the event of default, the Trustee is responsible for initiating foreclosure proceedings and ensuring the sale of the property is conducted in accordance with the law. The Trustee also has the authority to hire legal representation if necessary to protect the interests of the parties involved.

Common mistakes

Completing the North Carolina Deed of Trust form requires attention to detail, and common mistakes can lead to delays or complications. One significant error is failing to include the grantor's marital status in the designated box. Without this crucial information, the validity of the document may come into question, complicating the loan process.

Another frequent oversight occurs when individuals neglect to fill in the exact amount of the loan secured by the Deed of Trust. The absence of this critical figure may result in unclear terms regarding the borrower’s obligations, potentially leading to disputes later on. It is essential to clearly denote the amount in both numeric and written form.

Many applicants also overlook the importance of specifying the location of the property. Failing to provide the accurate city and county information can create confusion and may hinder the legal processing of the Deed of Trust. This detail is fundamental for establishing jurisdiction and property matters.

A common mistake involves skipping the section that requires the signature of the notary public. Notarization is a legally required component of the Deed of Trust. If not completed properly, this can invalidate the document and create administrative headaches that delay processing and potential funding.

Lastly, individuals often forget to include the Mortgage Loan Originator's name and NMLS number. This oversight affects the chain of accountability and may lead to regulatory scrutiny. Accurately capturing this information is vital and ensures that all parties involved can be held responsible throughout the transaction.

Documents used along the form

The North Carolina Deed of Trust form is a critical document used in securing loans against real property. Several other forms and documents are commonly associated with this process, which help clarify the obligations and rights of the parties involved. Understanding these documents can help simplify the transaction and ensure all parties are protected.

- Promissory Note: This is a written promise to repay a specified sum of money to the lender at a determined interest rate within a set timeframe. The Promissory Note outlines the borrower's commitment to repay the debt secured by the Deed of Trust.

- Loan Application: This form collects essential information from the borrower, including income, employment, and credit history. It aids the lender in assessing the borrower's qualifications for receiving the loan funds.

- Closing Disclosure: This document provides a detailed account of final loan terms, closing costs, and other specific expenses related to the loan transaction. It must be shared with the borrower at least three days before the closing date.

- Title Insurance Policy: This insurance protects against potential disputes over property ownership. It ensures that the lender is protected in case any issues arise with the property's title after the loan is secured.

- Deed of Conveyance: This legal document officially transfers ownership of the property from the seller to the buyer. It details the property being sold and is important during the closing of the property sale.

- Property Inspection Report: This report assesses the condition of the property and identifies potential issues that may require attention. It serves as an important part of the due diligence process for both the buyer and the lender.

These documents, when combined with the Deed of Trust, form a comprehensive framework that protects the interests of both lenders and borrowers. Understanding each document's role can lead to more informed decisions throughout the real estate transaction process.

Similar forms

- Mortgage - A mortgage is a legal agreement where the lender provides funds to the borrower to purchase a property. Similar to a deed of trust, it secures the loan against the property and specifies terms of repayment.

- Promissory Note - This document outlines the borrower's promise to repay the loan. While a deed of trust secures the loan, the promissory note specifically details the repayment terms and obligations of the borrower.

- Mortgage Deed - A mortgage deed, like a deed of trust, transfers an interest in the property as security for a loan. It establishes the lender’s rights in the property without requiring a third-party trustee.

- Home Equity Loan Agreement - This document allows a homeowner to borrow against the equity in their home. Similar to a deed of trust, it uses the home as collateral for the loan.

- Land Contract - A land contract is an agreement where the buyer pays the seller in installments while gaining equitable title to the property. Like a deed of trust, it facilitates the transfer of property ownership while securing the seller's interest.

- Security Agreement - This document establishes the lender's right to the collateral protecting the loan. It functions similarly to a deed of trust by securing obligations under a loan agreement.

- Deed Reservation - A deed reservation retains certain rights or interests while transferring property ownership. It is somewhat akin to a deed of trust, as both deal with property rights and obligations.

- Quitclaim Deed - A quitclaim deed transfers a party's interest in a property without guaranteeing that title is clear. Although it does not secure a loan, it is a conveyance form related to property rights.

- Loan Modification Agreement - This document alters the terms of an existing loan. It may reference the original deed of trust and represents a change in the conditions under which the property is secured.

- Title Insurance Policy - This policy protects against losses caused by defects in a property's title. It relates to the deed of trust by securing the lender's interests, ensuring that their claim on the property is protected.

Dos and Don'ts

When filling out the North Carolina Deed of Trust form, it’s important to be thorough and accurate. Here are some do’s and don’ts to consider:

- Do: Include your marital status in the Grantor box.

- Do: Enter the correct date and location of the property in the appropriate sections.

- Do: Ensure all names are printed clearly and correspond to legal documents.

- Do: Answer all questions completely to avoid processing delays.

- Don't: Leave any blanks unless specifically instructed.

- Don't: Alter the form or use different fonts or paper.

- Don't: Forget to include a notary signature and seal where required.

- Don't: Submit the form without confirming all information is accurate and complete.

Misconceptions

Misconceptions about the North Carolina Deed of Trust can lead to confusion for grantors and beneficiaries. Here are six common misunderstandings:

- The Deed of Trust is the same as a mortgage. While both documents secure a loan with real property, a Deed of Trust involves three parties: the grantor, beneficiary, and trustee, whereas a mortgage involves only two parties: the borrower and the lender.

- Signing a Deed of Trust means giving up ownership of the property. The grantor still maintains ownership of the property. The Deed of Trust simply creates a security interest for the lender, ensuring they can recover the loan through foreclosure if the borrower defaults.

- A Deed of Trust guarantees a loan will be approved. A Deed of Trust is executed only after the loan has been agreed upon. It does not guarantee loan approval; eligibility is determined during the application process based on various factors.

- Only lenders can initiate foreclosure. In a Deed of Trust, the trustee can initiate foreclosure on behalf of the lender if the grantor defaults. This means that there may be less control by the lender compared to a traditional mortgage scenario.

- The terms of the Deed of Trust cannot be changed. While the original terms are binding, modifications can be made if all parties agree. Written amendments are common, especially if circumstances change over the course of the loan.

- The Deed of Trust protects only the lender's interests. Along with securing the lender's investment, it also protects the grantor by outlining their rights and responsibilities. Understanding these provisions can help avoid defaults and legal conflicts.

Clarifying these misconceptions is essential for parties involved in a Deed of Trust. A better understanding can lead to smoother transactions and stronger agreements.

Key takeaways

Here are six key takeaways about filling out and using the North Carolina Deed of Trust form:

- Timely Recording: After closing, ensure to return the executed document to the originating lender within 24 hours.

- Identify Participants: Clearly list the Grantor, Trustee, and Beneficiary with their addresses. Include the marital status of the Grantor where indicated.

- Insurance Requirement: The Grantor must maintain insurance on the property and pay all related premiums promptly. This protects the Beneficiary's interests.

- Default Consequences: Understand that failure to meet payment terms can lead to foreclosure. The Trustee has the authority to sell the property if defaults are not cured within specified timeframes.

- Taxes and Liens: The Grantor is responsible for paying all property taxes and any charges. If unpaid, the Beneficiary can cover these costs, adding the amount to the Grantor's Note.

- Governing Law: This Deed of Trust is governed by North Carolina law, ensuring that all actions taken under it comply with local regulations.

Browse Other Templates

Med 9 Form Colorado - Section 2 is completed by medical personnel after evaluation of the individual’s disability.

Transit Check Login - Items ordered cannot be returned or refunded after purchase.

What Is a Schedule B Tax Form - For new entities needing to make tax deposits, the 8109 B form is essential if you haven’t received your preprinted coupons.