Fill Out Your Nc Mvr 615 Form

The NC MVR 615 form plays a crucial role in the automotive landscape of North Carolina, particularly concerning vehicle registration and insurance coverage eligibility. This form, designated for the Eligible Risk Statement, establishes a declaration that individuals or entities meet certain criteria defined by state law (G.S. 58-37-1(4a)). The qualifications for being considered an "eligible risk" include being a resident of North Carolina with a valid driver’s license, owning a vehicle primarily garaged in the state, or being an out-of-state student or military personnel with ties to North Carolina. Additionally, the form details the implications of providing false information, emphasizing the seriousness of compliance with these requirements. The MVR 615 form also clarifies what constitutes a “non-fleet private passenger vehicle,” outlining distinctions that affect insurance eligibility and coverage. This thorough framework aids in preventing potential legal issues related to automobile insurance and registration, ensuring that all applicants are aware of their obligations and the consequences of their declarations. The accuracy and honesty in filling out the form are paramount, as incorrect submissions can lead to criminal prosecution and denial of coverage.

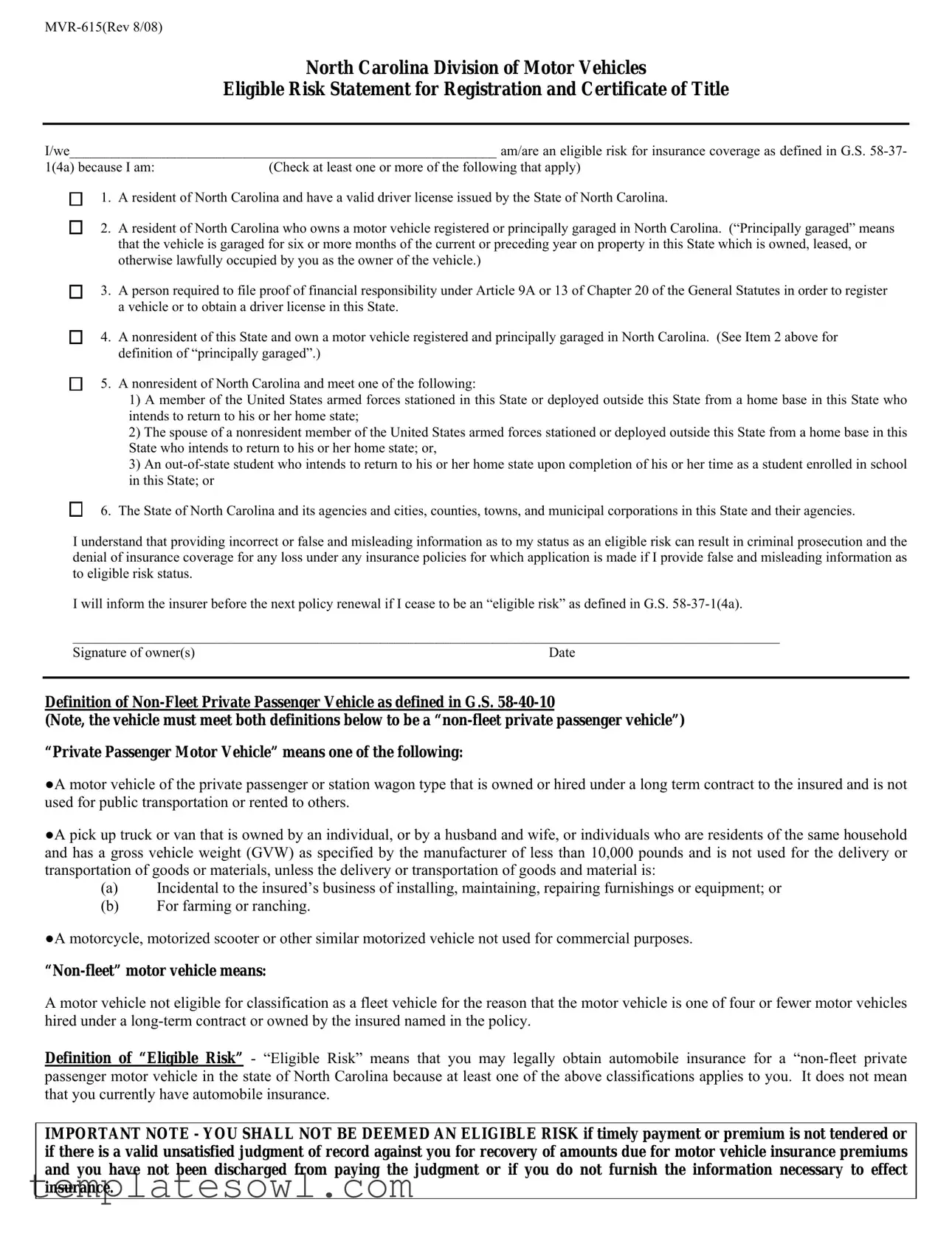

Nc Mvr 615 Example

North Carolina Division of Motor Vehicles

Eligible Risk Statement for Registration and Certificate of Title

I/we_____________________________________________________________ am/are an eligible risk for insurance coverage as defined in G.S.

1(4a) because I am: |

(Check at least one or more of the following that apply) |

□1. A resident of North Carolina and have a valid driver license issued by the State of North Carolina.

□2. A resident of North Carolina who owns a motor vehicle registered or principally garaged in North Carolina. (“Principally garaged” means that the vehicle is garaged for six or more months of the current or preceding year on property in this State which is owned, leased, or otherwise lawfully occupied by you as the owner of the vehicle.)

□3. A person required to file proof of financial responsibility under Article 9A or 13 of Chapter 20 of the General Statutes in order to register a vehicle or to obtain a driver license in this State.

□4. A nonresident of this State and own a motor vehicle registered and principally garaged in North Carolina. (See Item 2 above for definition of “principally garaged”.)

□5. A nonresident of North Carolina and meet one of the following:

1)A member of the United States armed forces stationed in this State or deployed outside this State from a home base in this State who intends to return to his or her home state;

2)The spouse of a nonresident member of the United States armed forces stationed or deployed outside this State from a home base in this State who intends to return to his or her home state; or,

3)An

□6. The State of North Carolina and its agencies and cities, counties, towns, and municipal corporations in this State and their agencies.

I understand that providing incorrect or false and misleading information as to my status as an eligible risk can result in criminal prosecution and the denial of insurance coverage for any loss under any insurance policies for which application is made if I provide false and misleading information as to eligible risk status.

I will inform the insurer before the next policy renewal if I cease to be an “eligible risk” as defined in G.S.

_____________________________________________________________________________________________________

Signature of owner(s) |

Date |

Definition of

(Note, the vehicle must meet both definitions below to be a

“Private Passenger Motor Vehicle” means one of the following:

●A motor vehicle of the private passenger or station wagon type that is owned or hired under a long term contract to the insured and is not used for public transportation or rented to others.

●A pick up truck or van that is owned by an individual, or by a husband and wife, or individuals who are residents of the same household and has a gross vehicle weight (GVW) as specified by the manufacturer of less than 10,000 pounds and is not used for the delivery or transportation of goods or materials, unless the delivery or transportation of goods and material is:

(a)Incidental to the insured’s business of installing, maintaining, repairing furnishings or equipment; or

(b)For farming or ranching.

●A motorcycle, motorized scooter or other similar motorized vehicle not used for commercial purposes.

A motor vehicle not eligible for classification as a fleet vehicle for the reason that the motor vehicle is one of four or fewer motor vehicles hired under a

Definition of “Eligible Risk” - “Eligible Risk” means that you may legally obtain automobile insurance for a

IMPORTANT NOTE - YOU SHALL NOT BE DEEMED AN ELIGIBLE RISK if timely payment or premium is not tendered or if there is a valid unsatisfied judgment of record against you for recovery of amounts due for motor vehicle insurance premiums and you have not been discharged from paying the judgment or if you do not furnish the information necessary to effect insurance.

Form Characteristics

| Fact Name | Details |

|---|---|

| Eligible Risks | The MVR-615 form is used to certify that an individual meets the criteria to be an eligible risk for insurance coverage in North Carolina. |

| Governing Law | The form is governed by North Carolina General Statutes, specifically G.S. 58-37-1(4a) and relevant sections of Chapter 20. |

| Residency Requirements | A person must be a resident or a non-resident with specific ties to North Carolina to qualify as an eligible risk. |

| False Information Consequences | Providing false or misleading information can lead to criminal prosecution and denial of insurance coverage. |

| Non-Fleet Vehicle Definition | The form defines a “non-fleet private passenger vehicle,” which includes specific criteria about vehicle types and usage. |

Guidelines on Utilizing Nc Mvr 615

Filling out the NC MVR-615 form is a straightforward process, but it requires attention to detail to ensure accuracy. By completing this form properly, you establish your status as an "eligible risk," which is essential for obtaining automobile insurance in North Carolina. Follow the steps below to fill out the form correctly.

- Begin by clearly printing your name in the space provided for "I/we" at the top of the form. Ensure that the spelling is correct, as this is your official identification.

- Carefully read through the eligibility criteria listed. Check at least one box that applies to your situation. Options include being a resident with a valid North Carolina driver license, owning a vehicle registered in the state, or meeting conditions for non-residents.

- Write your signature in the designated area to confirm that the information you've provided is true and accurate. This signature is important for establishing your commitment to notifying the insurer if your status changes.

- Next, add the date of signing next to your signature. This is essential for record-keeping purposes.

- After completing the form, review it to ensure that all entries are correct and legible. This step helps avoid potential issues that may arise due to misinformation.

- Finally, submit the completed form according to the instructions provided by your insurance company or the relevant department. Make sure to keep a copy for your records.

What You Should Know About This Form

What is the purpose of the NC MVR-615 form?

The NC MVR-615 form serves as a declaration of eligible risk for individuals seeking insurance coverage for their motor vehicles in North Carolina. It is required for registration and obtaining a certificate of title. By completing this form, applicants confirm their status as "eligible risks" under North Carolina law.

Who qualifies as an "eligible risk" under the NC MVR-615 form?

An "eligible risk" is defined as someone who can legally obtain insurance for a non-fleet private passenger vehicle in North Carolina. Qualifying categories include residents with valid driver licenses, vehicle owners whose vehicles are registered or primarily garaged in the state, and certain non-residents such as military personnel, their spouses, or out-of-state students.

What information do I need to provide on the NC MVR-615 form?

You will need to provide your name, signature, and the date, along with checkboxes for the categories that apply to your eligible risk status. Ensure that you provide accurate information, as any misrepresentation can lead to serious consequences.

What is meant by "principally garaged" regarding vehicle registration?

"Principally garaged" refers to the location where your vehicle is stored for six or more months in the current or preceding year. The vehicle must be kept on property that you own, lease, or legally occupy. This definition is important for determining where the vehicle is registered.

What should I do if my status as an "eligible risk" changes?

If your status changes such that you no longer meet the criteria for "eligible risk," you must inform your insurance provider before the next renewal of your policy. This ensures compliance with North Carolina law and may affect your ability to maintain insurance coverage.

What can happen if I provide false information on the NC MVR-615 form?

Providing incorrect, false, or misleading information can lead to serious ramifications, including criminal prosecution. Additionally, it can result in the denial of insurance coverage for any claims arising from your insurance policy, which could expose you to financial risks.

What types of vehicles qualify as "non-fleet private passenger vehicles"?

Qualifying vehicles include private passenger cars, station wagons, certain pickup trucks and vans that weigh less than 10,000 pounds, and motorcycles, as long as they are not used for commercial purposes. To be classified as non-fleet, the vehicle must not be categorized with a fleet of more than four vehicles.

Are there any payment obligations that affect my eligibility?

Your eligibility may be impacted if you have not paid premiums on time or if there is an unsatisfied judgment against you for motor vehicle insurance premiums. It is essential to ensure that any payments are made timely and all judgments are resolved to maintain your status as an eligible risk.

What should I do if I have additional questions about the NC MVR-615 form?

If you have further questions or need clarification, it is advisable to consult the North Carolina Division of Motor Vehicles or a qualified insurance professional. They can provide guidance specific to your situation and help you navigate the requirements of the form.

Common mistakes

Filling out the NC MVR-615 form correctly is crucial for obtaining automobile insurance in North Carolina. However, many people make common mistakes that can lead to complications. Here are six mistakes to watch out for.

One frequent mistake is not checking the appropriate boxes. It's essential to select at least one of the eligibility criteria outlined on the form. Failing to do this can result in delays or even denial of insurance coverage. Double-check your answers to ensure that you meet the necessary definitions of an eligible risk.

Another error occurs when individuals provide incorrect personal information. This includes your name, address, and signature. Ensure that all details are accurate and match any supporting documents. Errors in this section can hinder the processing of your application and cause issues down the road.

Some applicants forget to sign and date the form. This oversight may seem minor, but without a signature, the form is not valid. Always review the form before submission to confirm that you have included your signature and the correct date.

Another common mistake is misunderstanding the term "principally garaged." Some individuals may mistakenly believe that it applies to any location where the vehicle is parked. According to the form, the vehicle must be garaged for six months or more at a property that you own, lease, or occupy lawfully. Clarifying this definition helps ensure compliance.

Providing outdated information can also be a problem. Applicants often neglect to inform their insurers of changes that could affect their status as an eligible risk. If you have moved, sold a vehicle, or any other significant change occurs, make sure to keep your insurer updated to avoid complications later.

Lastly, failing to understand the consequences of providing false information is a serious mistake. The form clearly states that incorrect or misleading information can lead to criminal prosecution and denial of coverage. Being honest and conscientious while filling out the form is the best approach to ensure compliance with the law.

Documents used along the form

The MVR-615 form is an essential document in North Carolina that verifies the eligibility of individuals for insurance coverage. However, this form is often accompanied by various other documents that help facilitate the registration and title transfer processes for motor vehicles. Below is a list of related forms and documents commonly used alongside the MVR-615, providing a brief description of each.

- NCDMV Title Application (Form MVR-1): This form is used to apply for a certificate of title for a newly purchased vehicle or to transfer an existing title to a new owner.

- NCDMV Vehicle Registration Application (Form MVR-4): This document serves to register a vehicle in North Carolina, providing necessary information for the issuance of a license plate and vehicle registration card.

- Insurance Card: Proof of insurance is mandatory when registering a vehicle. This card displays evidence of valid auto insurance coverage and must be presented to the NCDMV.

- Vehicle Inspection Report: This report confirms that a vehicle has passed an emissions and safety inspection, as required by North Carolina law before registration can occur.

- Bill of Sale: A bill of sale outlines the transaction details between buyer and seller, serving as proof of purchase for the vehicle being registered.

- Power of Attorney (if applicable): This document may be necessary when a representative is signing on behalf of the vehicle owner for registration or title purposes.

- Affidavit of Vehicle Ownership: In cases where the title is lost, this affidavit can help establish ownership when applying for a new title.

- Verification of Vehicle Identification Number (VIN): This form is used to verify the VIN for the vehicle being registered, ensuring it matches the information on the title application.

- Financial Responsibility Certificate: This certificate proves compliance with North Carolina’s financial responsibility laws, ensuring that the owner can cover any damages resulting from vehicle incidents.

- Non-Resident Registration Application (if applicable): This is for individuals living outside North Carolina who wish to register their vehicle in the state, showcasing their eligibility under specific conditions.

Using the MVR-615 form in conjunction with these additional documents helps ensure that all necessary information is submitted accurately and efficiently, allowing for a smoother vehicle registration process in North Carolina. Proper preparation and understanding of these forms can greatly aid individuals in meeting state requirements and securing insurance coverage.

Similar forms

- Form SR-22: Similar to the MVR-615, the SR-22 form serves as proof of financial responsibility for those who have had their driver’s license suspended or revoked. It confirms that a driver carries the required liability insurance, ensuring compliance with state laws.

- Application for Certificate of Title (Form MVR-1): Like MVR-615, the MVR-1 is utilized in the vehicle registration process. It confirms ownership of a vehicle and establishes eligibility for titling and registration under North Carolina’s laws.

- Form DL-123 (Affidavit of Residency): This document verifies residency status, much like the eligibility requirements outlined in MVR-615. It ensures the applicant meets local residency laws to qualify for certain benefits in North Carolina.

- Financial Responsibility Insurance Policy Documents: These documents outline the insurance coverage details for vehicle owners. Similar to the MVR-615, they establish the owner's financial responsibility, primarily focusing on providing necessary proof of insurance.

- Form MVR-4 (Application for Duplicate Title): This form is used when a title is lost or damaged. While the context differs, both forms are integral to the ownership documentation of vehicles in North Carolina.

- Form TC-1 (Vehicle Registration Application): This application initiates the vehicle registration process, requiring confirmation of eligibility akin to the MVR-615, ensuring individuals qualify before registering their vehicles.

- Form MVR-10 (Affidavit of Negligence): Though it addresses a different issue, it similarly requires a sworn statement relating to a vehicle incident. This form also relies on the accuracy of the applicant’s claims, emphasizing truthful reporting similar to the MVR-615.

- Insurance Identification Card: This card serves as proof of insurance coverage and is a key document for ensuring compliance with financial responsibility laws. It complements the information provided on the MVR-615, establishing legal insurance documentation.

Dos and Don'ts

When filling out the NC MVR 615 form, adherence to guidelines can prevent errors and ensure compliance. Below are key things you should and shouldn't do:

- Do: Carefully read the instructions provided with the form.

- Do: Check all relevant eligibility criteria applicable to your situation.

- Do: Provide accurate and truthful information to avoid potential legal issues.

- Do: Sign and date the form where indicated.

- Do: Keep a copy of the completed form for your records.

- Don't: Leave any sections of the form blank if they are applicable to you.

- Don't: Use incorrect or misleading information when stating your eligibility.

- Don't: Submit the form without reviewing it for errors.

- Don't: Forget to inform your insurer of any changes in your eligibility status.

- Don't: Provide false information as it may lead to prosecution and denial of coverage.

Misconceptions

Misconceptions about the NC MVR-615 form can lead to confusion regarding eligibility and insurance responsibilities. Below is a list of eight common misconceptions:

- Only residents of North Carolina are eligible. Non-residents may also qualify if they own a vehicle registered and principally garaged in North Carolina.

- The form guarantees insurance coverage. Completing the MVR-615 indicates eligibility but does not automatically secure an insurance policy.

- All vehicles are classified as non-fleet vehicles. To be considered a non-fleet vehicle, it must meet specific criteria, including ownership limits.

- False information has no consequences. Providing incorrect information can lead to criminal prosecution and denial of insurance coverage.

- The definition of "principally garaged" is vague. "Principally garaged" means the vehicle is kept in North Carolina for six or more months in the current or previous year.

- You can just submit the form once. It is important to notify the insurer if you no longer meet the "eligible risk" criteria before the next policy renewal.

- The MVR-615 is only for new registrations. This form can also be relevant for current vehicle owners who need to prove their eligibility for insurance.

- Only the vehicle owner needs to sign the form. All owners listed on the vehicle title must sign the form to validate eligibility.

Key takeaways

Filling out and using the NC MVR 615 form is an important step for those looking to obtain automobile insurance in North Carolina. Here are some key takeaways to keep in mind:

- Eligibility Confirmation: The form serves to confirm your status as an eligible risk for insurance coverage.

- Residency Requirements: Check at least one eligibility criterion that confirms your residency in North Carolina.

- Valid License: You must have a valid North Carolina driver license to qualify as an eligible risk.

- Vehicle Registration: Owning a motor vehicle registered or principally garaged in North Carolina is essential for eligibility.

- Financial Responsibility: Some individuals must provide proof of financial responsibility as required by North Carolina law.

- Nonresidents: Nonresidents may also be eligible if they meet certain conditions, such as being military members or students.

- Honesty is Critical: Providing false information can lead to criminal charges and denial of insurance coverage.

- Policy Renewal Notification: You must notify your insurer if you cease to be an eligible risk before your policy is renewed.

- Understanding Definitions: Familiarize yourself with terms like "private passenger vehicle" and "non-fleet" to ensure compliance.

Completing the NC MVR 615 form correctly is vital for securing insurance coverage. Make sure to review all criteria thoroughly.

Browse Other Templates

Workers Comp Idaho - Late payments incur a 10% penalty for each ten-day period missed after the due date.

Ssa-3105 - If not completed correctly, the form could lead to delays or unfavorable decisions on your case.