Fill Out Your Ncci Erm 6 Form

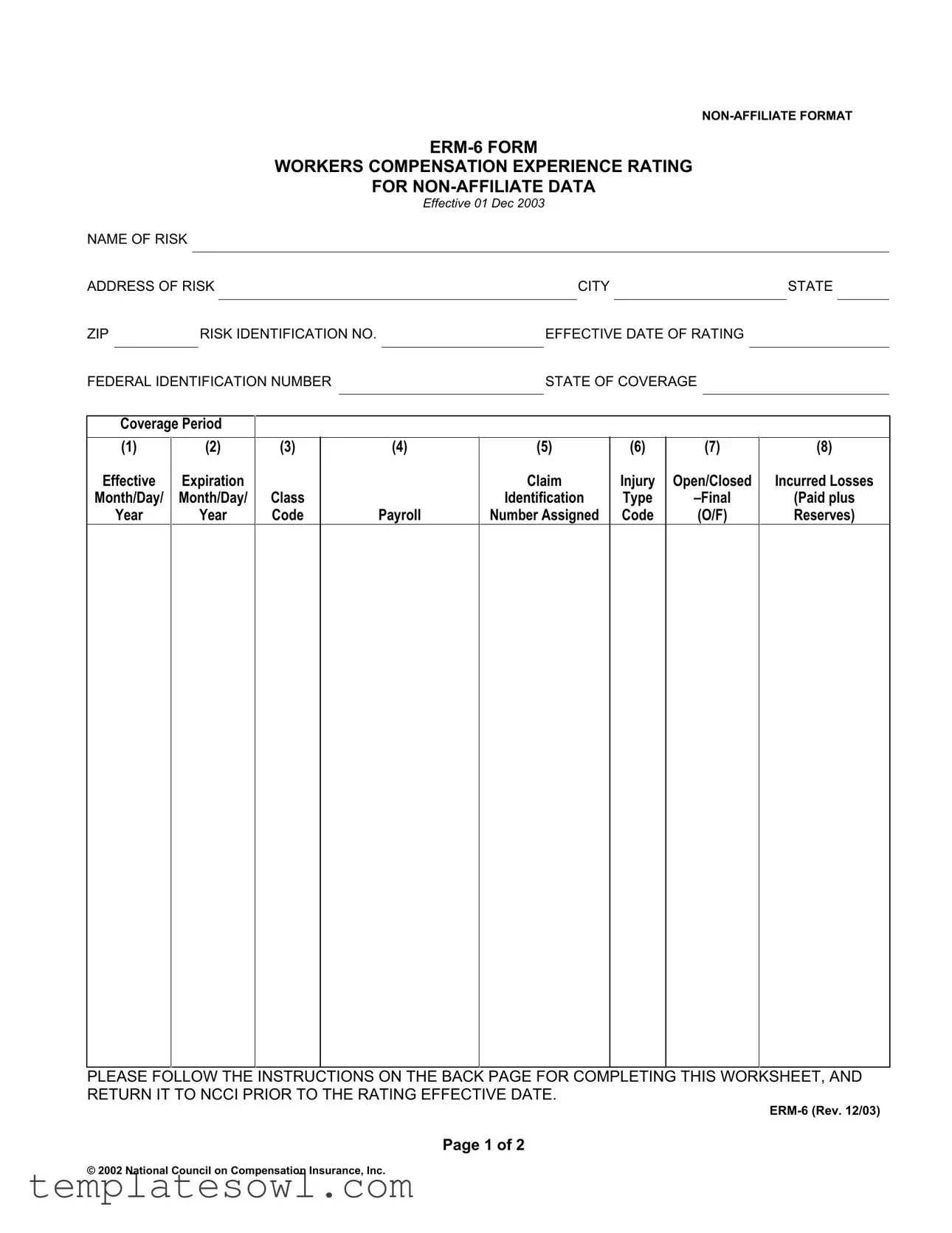

The NCCI ERM-6 form serves a crucial role in the realm of workers' compensation, particularly for self-insured businesses. It enables these entities to submit essential experience rating data to the National Council on Compensation Insurance (NCCI) for accurate assessment and modification of their workers' compensation insurance premiums. This form requires comprehensive details about the business, including the risk identification number, the state of coverage, and payroll amounts associated with different classification codes. In addition, critical information about any claims made during the coverage period must be included. A total of three years of experience is reported, excluding the year immediately before the effective rating date. The form’s instructions emphasize the need for accuracy and clarity when documenting claims, payroll, and losses to ensure that the resulting experience modification factor is as precise as possible. Designed to be user-friendly, the ERM-6 helps facilitate a streamlined rating process, ultimately impacting the cost of insurance premiums. Organizations looking to properly manage their workers' compensation responsibilities should pay close attention to the details required on this form to avoid potential discrepancies during the rating assessment process.

Ncci Erm 6 Example

WORKERS COMPENSATION EXPERIENCE RATING

FOR

|

|

|

|

|

|

|

|

|

|

|

EFFECTIVE 01 DEC 2003 |

|

|

|

|

|

|

|

||||

NAME OF RISK |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADDRESS OF RISK |

|

|

|

|

|

|

|

|

CITY |

|

|

|

|

|

STATE |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ZIP |

|

|

RISK IDENTIFICATION NO. |

|

|

|

|

EFFECTIVE DATE OF RATING |

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

FEDERAL IDENTIFICATION NUMBER |

|

|

|

|

STATE OF COVERAGE |

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Coverage Period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

(1) |

(2) |

(3) |

|

|

(4) |

|

(5) |

|

|

(6) |

(7) |

|

(8) |

|

||||||||

Effective |

Expiration |

|

|

|

|

|

|

Claim |

|

Injury |

Open/Closed |

Incurred Losses |

||||||||||

Month/Day/ |

Month/Day/ |

Class |

|

|

|

|

Identification |

|

Type |

|

(Paid plus |

|||||||||||

|

Year |

|

|

Year |

Code |

|

Payroll |

|

Number Assigned |

|

Code |

(O/F) |

|

Reserves) |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PLEASE FOLLOW THE INSTRUCTIONS ON THE BACK PAGE FOR COMPLETING THIS WORKSHEET, AND RETURN IT TO NCCI PRIOR TO THE RATING EFFECTIVE DATE.

Page 1 of 2

© 2002 National Council on Compensation Insurance, Inc.

INSTRUCTIONS FOR SUBMITTING EXPERIENCE RATING DATA

PAYROLL AND LOSSES MUST BE ROUNDED TO THE NEAREST WHOLE DOLLAR.

COLUMN 1 |

Fill in the effective month, day and year of the period for which information will be provided. A total of three |

|

|

years of experience can be included in the rating, not including the year immediately prior to the effective |

|

|

date of this rating. Each year’s payroll and losses should be listed separately. |

|

COLUMN 2 |

Fill in the expiration month, day and year of the period for which information will be provided. |

|

COLUMN 3 |

Fill in the NCCI classification codes(s) that best describes your type of business. If you have any questions |

|

|

regarding these classifications, please contact Customer Service at |

|

COLUMN 4 |

Fill in the payroll amounts associated with the classification code(s) for each year being reported. |

|

COLUMN 5 |

Provide the claim number used for internal record keeping should you desire this information on the |

|

|

modification worksheet. If claim numbers are not used for internal record keeping, leave column blank. |

|

COLUMN 6 |

Fill in the appropriate injury type code (see following list). Only one injury type code is applicable per claim. |

|

|

Medical only claims should be listed as a “6,” but claims that include both medical and disability or death |

|

|

benefits should be listed under the applicable disability or death code, such as “5” (Temporary Total or |

|

|

Temporary Partial Disability). Injury types must be noted for each entry. |

|

|

1 = Death |

6 = Medical Only |

|

2 = Permanent Total Disability |

7 = Contract Medical or Hospital Allowance |

|

5 = Temporary Total or Temporary Partial Disability |

9 = Permanent Partial Disability |

COLUMN 7 |

Indicate whether the claim is open or closed/final by placing an O or F in the column. |

|

COLUMN 8 |

In Column 8, fill in the sum of incurred (paid plus reserved) losses per row. If no claims occurred, place a 0 |

|

|

in that space. Claims must be reported individually regardless of claim amount. |

|

The experience rating will be completed in accordance with the NCCI Experience Rating Plan Manual for Workers Compensation and Employers Liability Insurance. However, because we do not verify the accuracy of the data submitted by

Name of the

Name of the entity submitting the data (if different) _________________________________________________________________________________

Address _______________________________________________________________________________________ City _____________________

State ___________ Zip _________________ Phone ________________________ Fax __________________________

AGREEMENT

We hereby certify that the information given in this report is correct to the best of our knowledge and belief. BY SUBMISSION OF THIS INFORMATION, WE REQUEST THAT NCCI PRODUCE EXPERIENCE MODIFICATION FACTORS ON EACH OF THE RISKS LISTED AND AGREE TO PAY THE FEES FOR THIS SERVICE. In consideration of NCCI’s agreement to produce the requested experience modifications, we release and discharge NCCI, its officers, directors, employees and agents from all liability (except for gross negligence) in connection with the production or application of the same.

The person signing this agreement certifies that he/she has the authority to execute this agreement on behalf of the

ONLY.

Signed __________________________________________ |

Date _________________________________ |

Printed Name of Signer _____________________________ |

Title __________________________________ |

|

|

Page 2 of 2 |

|

Guide to the

Workers Compensation Experience Rating for

Risk Identification

State of

Effective Date of

What Fits on a

For example, payroll and losses that would be included on a 4/4/04 rating would be:

The

Please Keep the Following in Mind When Preparing an

It is extremely important that everything be filled out completely and accurately. If handwritten, please print clearly.

Each payroll amount must have the appropriate class code assigned to it.

When consolidating small claims ($2,000 or less), remember to specify whether they are Injury Code 5 or 6, and put an asterisk (*) in the open/closed column.

Each claim amount must be submitted in whole dollars only.

1

When submitting multiple pages of

·Risk Name

·Risk ID No.

·Effective Date of Rating

·Policy Effective/Expiration Date

·State of Coverage

Loss runs, worksheets, or any other forms are not accepted in lieu of the approved NCCI

All information must be submitted on the approved NCCI

Information to Accompany Request:

If the insured has current coverage on file with NCCI, please provide a letter of authority on the current carrier’s letterhead.

If no current coverage is on file with NCCI, please include a $75 payment via credit card, check, or account and site number.

You can also fax the

2

The

This is a filed and approved form. NCCI has protected the content in order to avoid any changes to the document. The form can only be printed; it cannot be saved to your system. Please print a

copy for your records.

Helpful Hints for Completing the

·In order to easily navigate through the form, use your Mouse or Tab key. (Please note: The Enter key will bring you to the end of the form.)

·You will be able to enter information in the allotted space provided on the form. Please be aware that if the information you have typed exceeds the space provided, not all the information will be viewed on the form.

·You will need to print out the form in order to obtain the authorized signature of the person who has the authority to execute this agreement on behalf of the

·If you do not already have Adobe® Acrobat® installed, you can download the latest version of Acrobat® Reader® for free from the Adobe Web site at adobe.com.

3

|

EXPERIENCE RATING PLAN MANUAL |

|

|

|

|

|

|

|

|

|

|

Page |

||||||||||||

|

APPENDIX |

|

|

|

|

|

|

|

|

Issued January 14, 2002 |

|

|

|

|

|

|

Original Printing |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

WORKERS COMPENSATION EXPERIENCE RATING |

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

FOR |

|

|

|

|

|

|

|

|

|

|

|||

|

NAME OF RISK ABC Inc |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EXAMPLE |

|

|

|

|

|

STATE FL |

||||||||||

|

ADDRESS OF RISK 88 Mount Vernon Avenue |

|

|

CITY |

Wellington |

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

ZIP 33414 |

|

|

RISK IDENTIFICATION NO. 091 197 188 |

|

EFFECTIVE DATE OF RATING 4/14/2004 |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

FEDERAL IDENTIFICATION NUMBER 123123123 |

|

STATE OF COVERAGE |

|

Florida |

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

Coverage Period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

(1) |

(2) |

(3) |

|

(4) |

(5) |

|

(6) |

|

(7) |

|

(8) |

|

|||||||||||

|

Effective |

Expiration |

|

|

|

|

|

Claim |

Injury |

|

Open/Closed |

|

|

|||||||||||

|

Month/Day/ |

Month/Day/ |

Class |

|

|

|

|

Identification |

Type |

|

|

|

|

Incurred Losses |

|

|||||||||

|

|

Year |

|

|

Year |

Code |

|

|

Payroll |

Number Assigned |

Code |

|

|

|

(O/F) |

|

(Paid plus Reserves) |

|

||||||

|

4/14/2000 |

4/14/2001 |

8810 |

|

1,000,000 |

No.1 |

6 |

|

* |

|

5 |

|

|

|

||||||||||

|

|

|

|

|

|

|

4902 |

|

88,000,000 |

1969 |

|

|

5 |

|

|

|

F |

|

20,000 |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

1986 |

|

|

5 |

|

|

|

O |

|

32,000 |

|

|

|

|

4/14/2001 |

4/14/2002 |

8810 |

|

1,500,000 |

No. 2 |

6 |

|

* |

|

97 |

|

|

|||||||||||

|

|

|

|

|

O |

|

50,000 |

|

|

|||||||||||||||

|

|

1954 |

|

|

5 |

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

4902 |

|

100,000,000 |

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

8810 |

|

2,000,000 |

1994 |

|

|

5 |

|

|

|

F |

|

20,500 |

|

|

|||

|

4/14/2002 |

4/14/2003 |

|

|

|

|

* |

|

141 |

|

|

|||||||||||||

|

|

|

|

6 |

|

|

|

|

||||||||||||||||

|

|

No. 3 |

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

4902 |

|

200,000,000 |

5 |

|

|

|

F |

|

1,000 |

|

|

||||||

|

|

|

|

|

|

|

|

1971 |

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

|

|

|

O |

|

5,000 |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

1972 |

|

|

|

|

|

F |

|

10,000 |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

1978 |

|

|

|

|

|

O |

|

15,000 |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

1979 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PLEASE FOLLOW THE INSTRUCTIONS ON THE BACK PAGE FOR COMPLETING THIS WORKSHEET, AND RETURN IT TO NCCI PRIOR TO THE RATING EFFECTIVE DATE.

NC1816(0628d)

© 1995, 1999, 2002 National Council on Compensation Insurance, Inc. |

1/02 |

Page |

|

EXPERIENCE RATING PLAN MANUAL |

||

1st Reprint |

Issued February 18, 2000 |

|

|

APPENDIX |

|

|

|

|

|

|

|

|

NON |

|

|

EXAMPLE |

|||

PAYROLL AND LOSSES MUST BE ROUNDED TO THE NEAREST WHOLE DOLLAR. |

||||

COLUMN 1 |

Fill in the effective month, day and year of the period for which information will be provided. A total of three |

|||

|

years of experience can be included in the rating, not including the year immediately prior to the effective date |

|||

|

of this rating. Each year’s payroll and losses should be listed separately. |

|||

COLUMN 2 |

Fill in the expiration month, day and year of the period for which information will be provided. |

|||

COLUMN 3 |

Fill in the NCCI classification codes(s) that best describes your type of business. If you have any questions |

|||

|

regarding these classifications, please contact Customer Service at |

|||

COLUMN 4 |

Fill in the payroll amounts associated with the classification code(s) for each year being reported. |

|||

COLUMN 5 |

Provide the claim number used for internal record keeping should you desire this information on the |

|||

|

modification worksheet. If claim numbers are not used for internal record keeping, leave column blank. |

|||

COLUMN 6 |

Fill in the appropriate injury type code (see following list). Only one injury type code is applicable per claim. |

|||

|

Medical only claims should be listed as a “6,” but claims that include both medical and disability or death |

|||

|

benefits should be listed under the applicable disabililty or death code, such as “5” (Temporary Total or |

|||

|

Temporary Partial Disability). Injury types must be noted for each entry. |

|||

|

1 = Death |

6 = Medical Only |

||

|

2 = Permanent Total Disability |

7 = Contract Medical or Hospital Allowance |

||

|

5 = Temporary Total or Temporary Partial Disability |

9 = Permanent Partial Disability |

||

COLUMN 7 |

Indicate whether the claim is open or closed/final by placing an O or F in the column. |

|||

COLUMN 8 |

In Column 8, fill in the sum of incurred (paid plus reserved) losses per row. If no claims occurred, place a 0 in |

|||

|

that space. Claims must be reported individually regardless of claim amount. |

|||

The experience rating will be completed in accordance with the NCCI Experience Rating Plan Manual for Workers Compensation and Employers Liability Insurance. However, because we do not verify the accuracy of the data submitted by

Name of the

Name of the entity submitting the data (if different) ___________________________________________________________________________________

Address 88 Mount Vernon Avenue __________________________________________________________________ City Wellington_______________

State Florida_______ Zip |

Phone |

agibson@abcinc.com

AGREEMENT

We hereby certify that the information given in this report is correct to the best of our knowledge and belief. BY SUBMISSION OF THIS INFORMATION, WE REQUEST THAT NCCI PRODUCE EXPERIENCE MODIFICATION FACTORS ON EACH OF THE RISKS LISTED AND AGREE TO PAY THE FEES FOR THIS SERVICE. In consideration of NCCI’s agreement to produce the requested experience modifications, we release and discharge NCCI, its officers, directors, employees and agents from all liability (except for gross negligence) in connection with the production or application of the same.

The person signing this agreement certifies that he/she has the authority to execute this agreement on behalf of the

Signed “Please print form to include signature”_______________ |

Date May 24,2004________________________________ |

Printed Name of Signer Alfred Gibson IV ____________________ |

Title President & CEO ____________________________ |

© 1988, 1999 National Council on Compensation Insurance, Inc. |

2/00 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The ERM-6 form is used to provide workers' compensation experience rating information for self-insured entities that are not affiliated with other businesses. |

| Effective Date | The current version of the ERM-6 form is effective from December 1, 2003. |

| Data Submission | Information on the ERM-6 form must be submitted accurately and completely to NCCI prior to the rating effective date. |

| Claim Reporting | Each claim must be reported individually on the form, and losses must be rounded to the nearest whole dollar. |

| Injury Type Codes | The form includes specific codes for various injury types, which must be applied correctly to each claim entry. |

| State Governance | The ERM-6 form is governed under the NCCI Experience Rating Plan Manual for Workers' Compensation and Employers Liability Insurance. |

| Qualified Signers | Only authorized individuals, including representatives from the risk, the group self-insured, or the TPA, may sign the form. |

| Experience Reporting Limit | A maximum of three years of experience can be included in the rating, excluding the year immediately preceding the effective date. |

Guidelines on Utilizing Ncci Erm 6

Completing the NCCI ERM-6 form requires careful attention to detail and accuracy. This form plays a crucial role in determining workers' compensation experience ratings for self-insured entities. The next steps involve systematically filling out each section of the form according to the provided instructions to ensure compliance and correctness.

- Enter Risk Information: Provide the name, address, city, state, zip code, and risk identification number of the risk being reported.

- Effective Date: Fill in the effective date of the rating.

- Federal Identification Number: Include the federal identification number of the organization.

- State of Coverage: Indicate the state for which the insurance policy was written.

- Coverage Period: In Column 1, enter the effective month, day, and year of the coverage period. Remember to include three years of experience not including the most recent year.

- Expiration Date: In Column 2, specify the expiration date using month, day, and year.

- Classification Codes: In Column 3, list the NCCI classification codes that accurately describe the business type.

- Payroll Amounts: Fill in Column 4 with the payroll amounts corresponding to each classification code for the reported years.

- Claim Numbers: In Column 5, input the claim number for internal tracking, if applicable. Leave the column blank if not used.

- Injury Type Codes: Enter the injury type code in Column 6, noting that only one code applies per claim. Use the appropriate code for medical-only claims.

- Claim Status: In Column 7, indicate if each claim is open or closed by placing an "O" or "F" respectively.

- Incurred Losses: Fill in Column 8 with the total incurred losses for each claim, indicating "0" if no claims occurred.

- Submitter Information: Include the name, address, and contact details of both the self-insured entity and the data submitter, if different.

- Agreement Signature: Obtain the authorized signature confirming the accuracy of the information. Include the date and print the name and title of the signer.

After completing these steps, review the form for any errors before submission. Make sure to submit it to NCCI prior to the rating effective date to avoid any delays in processing.

What You Should Know About This Form

What is the purpose of the NCCI ERM-6 form?

The NCCI ERM-6 form is designed to report workers' compensation experience data for non-affiliated self-insured entities. By accurately completing the form, organizations can request an experience modification factor that helps adjust their workers' compensation insurance premiums based on their claims history. This form evaluates the risks associated with an organization by reviewing payroll amounts and claim details over a specific rating period.

What information is required to complete the ERM-6 form?

To complete the ERM-6 form, various details must be provided. This includes the name and address of the risk, risk identification number, effective date of the rating, federal identification number, state of coverage, and payroll amounts. Furthermore, information related to claim numbers, injury type codes, the status of claims (open or closed), and the sum of incurred losses for each entry is necessary. Each column must be filled with precise data to ensure accurate rating calculations.

How many years of data can be included on the ERM-6 form?

The form allows for the inclusion of three years of experience. However, it is important to note that the most recent year, which immediately precedes the effective date of the rating, cannot be included. For example, if the effective date is April 4, 2024, you may submit data from April 4, 2021, to April 4, 2023. This structure provides a clearer picture of historical claims and payroll data relevant to the rating process.

What steps should I take if I find errors after submitting the ERM-6 form?

If you discover any errors after submitting the ERM-6 form, it is recommended to contact the NCCI Customer Service Center promptly. Corrections may be necessary to ensure that your experience modification factor accurately reflects your data. Depending on the nature of the error, further documentation or a re-submission might be required to address any discrepancies effectively.

Can the ERM-6 form be submitted electronically?

Yes, the ERM-6 form is now available in a PDF format that allows users to enter information electronically. However, once the form is completed, it must be printed to obtain the authorized signature necessary for submission. This process ensures that the form maintains its integrity while allowing for a user-friendly experience in data entry.

Common mistakes

Filling out the NCCI ERM-6 form accurately is crucial for determining a company’s experience modification factor. However, many people make common mistakes that can lead to incorrect ratings. Here are ten frequent errors to avoid.

One major mistake is failing to include the correct effective date of rating. This date affects the entire rating period. If this date is entered incorrectly, it may lead to miscalculations in payroll and losses, potentially increasing insurance costs. Always double-check the effective date against your policy.

Another common issue arises in reporting payroll amounts. Many individuals forget to round payroll and loss amounts to the nearest whole dollar. This might seem minor, but entering $1,000.25 instead of $1,000 can cause problems in the assessment process, so rounding is essential.

Some people also fail to report losses for all claims. If a claim has incurred losses but is not reported, it could negatively impact your rating. It's important to provide complete information about each claim, even if it appears minor.

Additionally, misclassifying the NCCI classification codes is a frequent pitfall. Each business has specific codes that relate to its activities. Choosing an incorrect code can distort the overall payroll and losses, ultimately skewing the experience modification factor.

Many fill out the injury type code section incorrectly as well. It's vital to select the appropriate code for every claim. For instance, mixing up a medical-only claim with one involving disability can lead to inaccuracies. Remember, each claim can only have one injury code.

Another mistake happens with the open/closed indication. Some individuals do not mark whether their claims are open or closed accurately. This oversight is significant, as it affects how claims are processed and rated. Without clarity, assumptions may be made, leading to an incorrect rating.

Moreover, not including the appropriate claim numbers can create issues. Claim numbers are key for internal recordkeeping and can help NCCI track claims accurately. If these numbers are left out, it may slow down the processing of ratings.

A further common error includes submitting incomplete forms. Failing to fill out all columns can result in returned forms or incorrect ratings. Each section should be completed fully to avoid potential delays.

Another important consideration is that some mistakenly assume that additional documentation will be accepted instead of completing the ERM-6 form. NCCI does not accept loss runs or other attachments. Only the completed form will suffice.

Lastly, individuals often neglect to secure the authorized signature needed for submission. Without the proper signature, NCCI will not consider the submission valid. It's essential to ensure that the person signing has the authority to do so on behalf of the self-insured entity.

Avoiding these common mistakes will help in accurately completing the NCCI ERM-6 form. Careful attention to detail can save time, money, and ensure your organization's experience modification factor reflects the true nature of your claims and payroll history.

Documents used along the form

The NCCI ERM-6 form, used for reporting experience rating data for workers' compensation, typically accompanies several other documents to ensure complete and accurate submissions. Here is a brief overview of forms and documents often utilized in conjunction with the ERM-6 form.

- Loss Run Reports: These reports document all claim history over a specified period, typically the past three to five years. They summarize the claims made, amounts paid, and reserves for pending claims, which are crucial for calculating experience modifications.

- Claims Detail Report: This report provides an in-depth view of each claim, including dates, types of injuries, and associated costs. It assists in detailed analysis when completing the ERM-6 form.

- Payroll Reports: Accurate payroll records for each classification code are necessary to support the reported payroll amounts on the ERM-6 form. These documents should align with the reporting periods specified in the ERM-6 form.

- Classification Code List: This list outlines various classification codes, which are essential in accurately describing the types of businesses and industries associated with the risk being reported.

- Authorization Letter: A letter on the current carrier's letterhead, authorizing the submission of the experience rating data, may be required if there is an existing coverage contract.

- Payment Confirmation: If there is no current coverage, including payment confirmation for the submission fee is necessary. This can be via credit card or check.

- Insurance Policy Documents: Copies of present policy declarations or coverage documents are often necessary for verifying the risk identification number and state of coverage.

- Compliance Certificates: These documents verify that the entity is adhering to state regulations and requirements regarding workers’ compensation coverage.

- Additional Forms or Supporting Documents: Any supplemental documentation that may support the claims information or payroll data can be beneficial to include with the ERM-6 form submission.

Ensuring that these forms and documents accompany the NCCI ERM-6 form can significantly enhance the accuracy of the submitted data, thereby aiding in the effective calculation of the experience modification factor.

Similar forms

The ERM-6 form is an essential document within the realm of workers' compensation, particularly for self-insured entities seeking to report their experience rating. It shares similarities with other significant documents in the field. Below is a list of four documents similar to the ERM-6 form, highlighting how they relate:

- Workers' Compensation Claim Form (WC-1): This form is used to report individual claims for workers' compensation. Like the ERM-6, it requires detailed information regarding claims, including dates, injury types, and amounts incurred. Both documents aim to ensure an accurate assessment of a business's claim history.

- Experience Modification Rate Worksheet (EMR): The EMR is a detailed summary of a company's workers' compensation insurance claims and payroll history. Similar to the ERM-6, the EMR calculates a modifier that affects insurance premiums based on the company's claim history over a set period. Both documents require documentation of past claims and payroll for evaluation.

- Loss Run Reports: These reports provide a detailed history of a company's workers' compensation claims, summarizing costs associated with each claim. The ERM-6 form also relies on accurate loss data to determine a business's experience rating, thus facilitating analysis and understanding of risks and trends.

- Workers' Compensation Insurance Application: This application gathers various data about a business, including its industry classification and history of claims. Similar to the ERM-6, it is critical in determining the appropriate insurance rate a business will pay based on its past experiences and payroll data.

Dos and Don'ts

When filling out the NCCI ERM-6 form, attention to detail is crucial. Here are eight important dos and don'ts to guide you through the process.

- Do fill in all required fields completely and accurately to avoid any delays in processing.

- Do ensure payroll and losses are rounded to the nearest whole dollar.

- Do list claims individually, regardless of their amount, to meet submission requirements.

- Do specify the injury type code accurately for every claim to provide necessary classification information.

- Don't include the year immediately prior to the effective date of the rating when calculating your three years of experience.

- Don't submit handwritten forms if they are not clearly printed; illegible handwriting may lead to errors.

- Don't send any attachments or additional documents; only the approved NCCI ERM-6 form is acceptable.

- Don't forget to include a letter of authority on the current carrier's letterhead if applicable.

By following these guidelines, you can help ensure that your submission is processed efficiently and accurately. The accuracy of the provided information significantly impacts the experience rating modification process. Act promptly to meet your deadlines and fulfill all requirements for a successful application.

Misconceptions

- Misconception 1: The ERM-6 form is only for companies with a large number of claims.

- Misconception 2: All claims need to be large to be included on the ERM-6 form.

- Misconception 3: The ERM-6 form data is verified by NCCI before issuing the modifier.

- Misconception 4: You must include the most recent year of payroll and claims in the submission.

- Misconception 5: It doesn't matter how the form is filled out as long as it's submitted on time.

- Misconception 6: The ERM-6 form is not necessary if data is provided in another format.

- Misconception 7: Electronic submission of the ERM-6 form is not available.

- Misconception 8: Filling out the injury type code is optional.

- Misconception 9: The signatures on the ERM-6 form only need to be from the owner of the business.

This form is used by any self-insured entity looking to obtain an experience modification factor, regardless of the number of claims filed.

Even small claims can be reported on the ERM-6 form. All claims, regardless of amount, should be documented properly.

NCCI does not verify the accuracy of the information provided by non-affiliates. Data integrity is the responsibility of the submitter.

The year immediately prior to the rating date is excluded. Only three years of experience before that year can be included.

Completeness and accuracy are crucial. Handwritten entries must be clear, and rounding to whole dollars is required for payroll and claims.

NCCI will only accept information submitted on the approved ERM-6 form. Other formats or additional attachments are not permitted.

The ERM-6 form can now be filled out electronically in PDF format, allowing for easier entry of information.

Each claim must have a specified injury type code. Without this, claims will not be correctly processed.

The agreement must be signed by an authorized person who represents the self-insured entity, not necessarily the owner.

Key takeaways

- Understand the Objective: The NCCI ERM-6 form is used to report workers' compensation experience ratings for non-affiliate data.

- Effective Dates Matter: Ensure the effective date of rating is accurate, as it determines which experience period is evaluated.

- Three-Year Limit: Only include losses and payroll from the three years leading up to the effective date of the rating, excluding the year immediately prior.

- Complete Information: Accurately fill all columns, including payroll amounts, classification codes, and claims information. Skipped information can lead to inaccuracies.

- Unique Claim Numbers: Assign a claim number for your records if used; otherwise, leave the corresponding column blank.

- Injury Codes are Critical: Use the appropriate injury code for each claim, as this significantly impacts the rating process.

- Open or Closed Claims: Clearly indicate whether a claim is open (O) or closed/final (F) to avoid confusion in your records.

- Whole Dollar Reporting: Round payroll and incurred losses to the nearest whole dollar. Using fractions will result in errors.

- Submit on the Correct Form: Only the approved NCCI ERM-6 form is accepted. Attachments or alternative formats, such as Excel, are not allowed.

Browse Other Templates

Ny State Sales Tax - Understanding the implications of exemption claims is essential for all purchasers.

Rate of Respiration Virtual Lab Answer Key - This lab explores how carbon dioxide and oxygen cycles between snails and Elodea.