Fill Out Your Ncdor D 400 Form

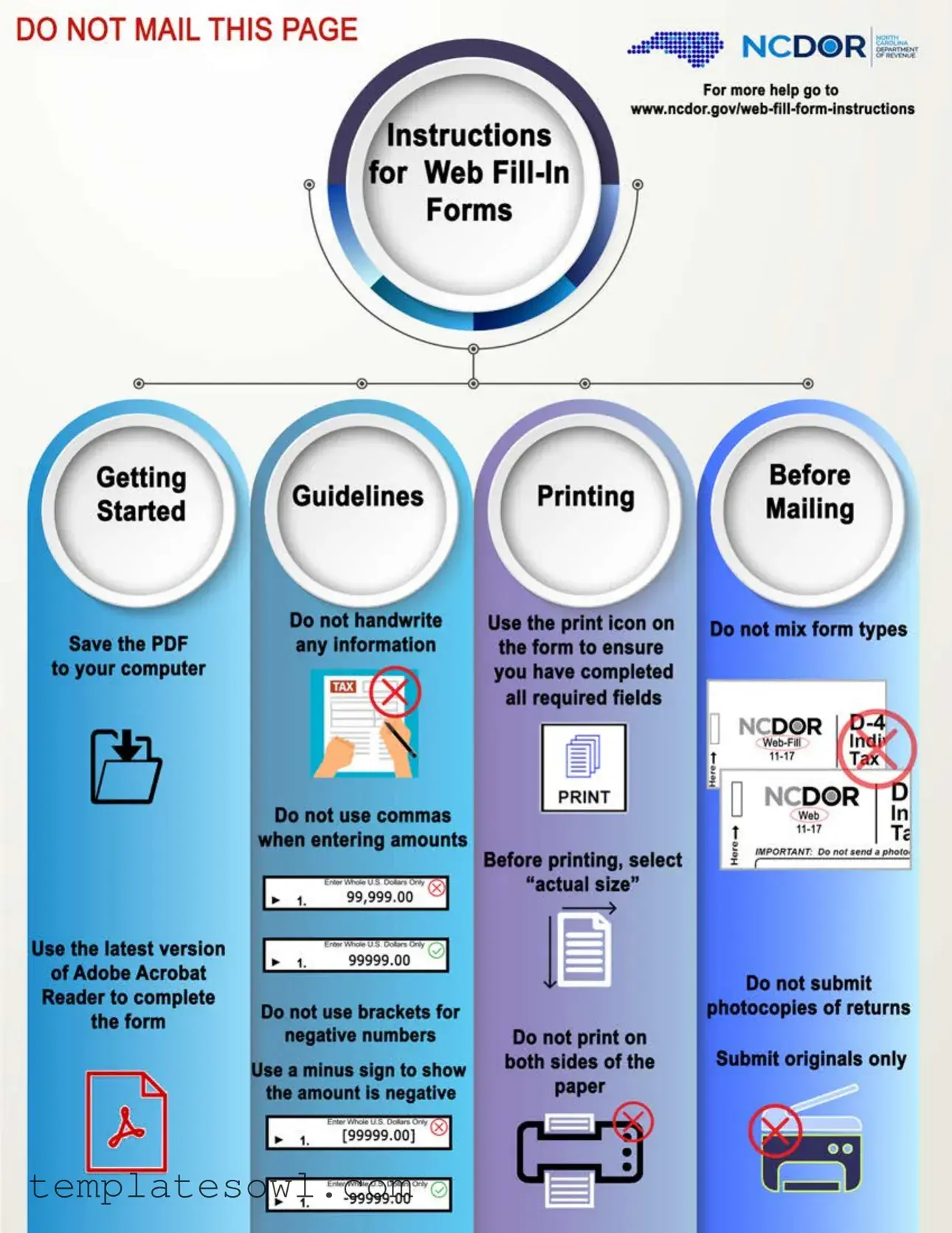

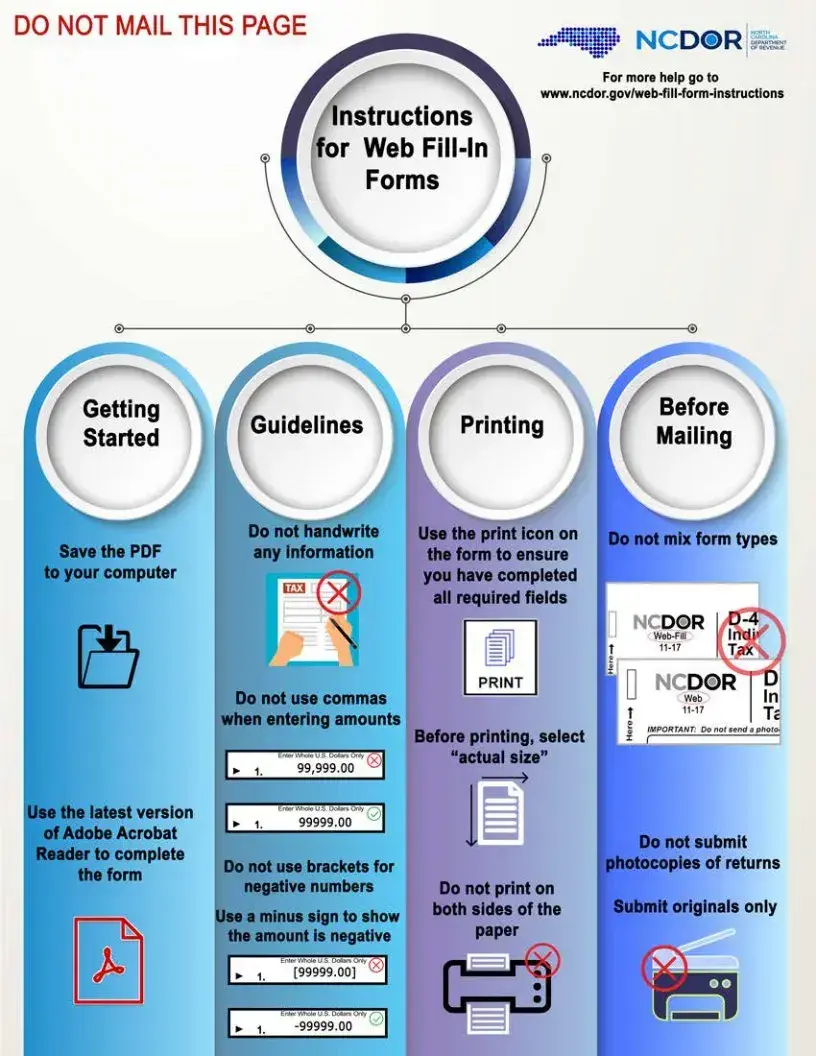

The NC D-400 form is an essential document for individual income tax returns in North Carolina, guiding residents through the process of reporting their taxable income for the year. This form accommodates different filing statuses, including single, married filing jointly, and head of household, allowing taxpayers to accurately depict their financial situations. Full-year residents will find that the taxable income is directly reported on Line 14, while part-year residents and nonresidents must calculate their taxable income based on specific percentages found on other parts of the form. Important details such as residency status, deductions, tax withheld, and contributions to various funds, like the N.C. Education Endowment Fund, are also addressed within its pages. Clear instructions are provided to help individuals avoid common pitfalls, such as handwriting errors and the submission of photocopies. Additionally, the form allows for the possibility of filing an amended return, reflecting changes in financial circumstances or corrections from previous filings. Understanding the intricacies of the D-400 is vital to ensuring compliance and making the most of available deductions and credits.

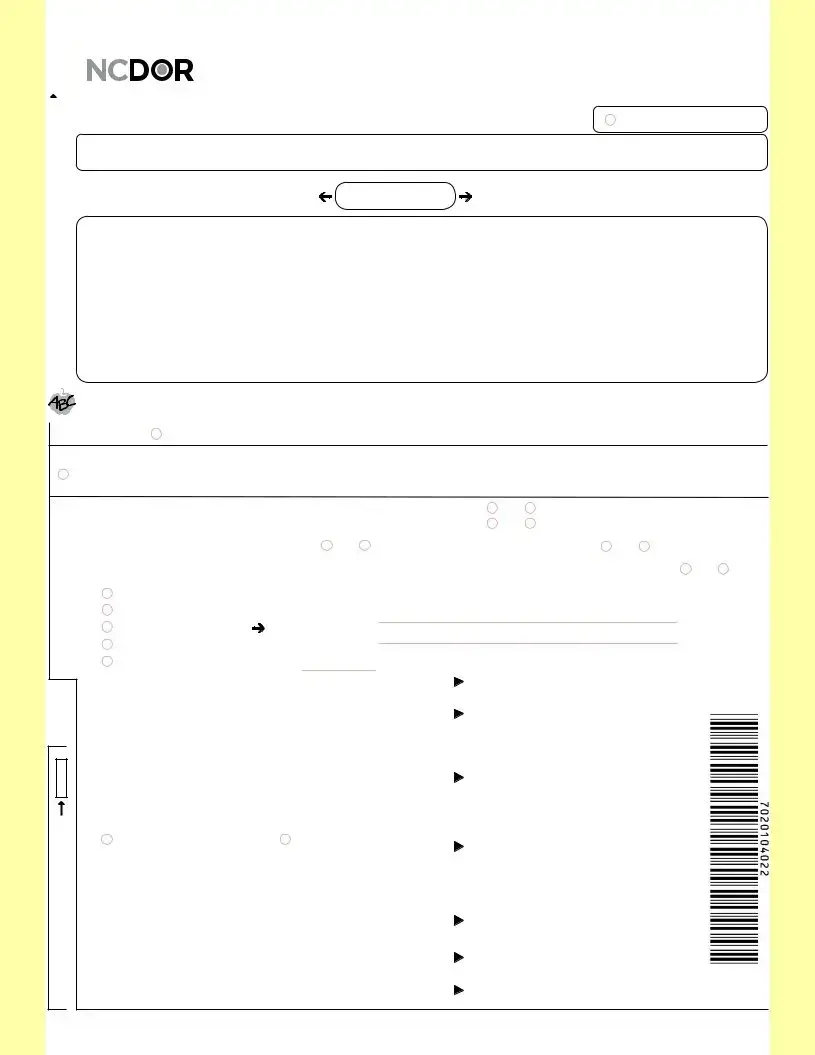

Ncdor D 400 Example

DO NOT HANDWRITE ON THIS FORM

|

|

|

|

|

|

|

|

|

|

|

|

CLEAR |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

✖ |

|

|

|

DOR Use Only |

|

|||

|

|

|

|

|

2020 Individual |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

Income Tax Return |

|

|

|

|

|

AMENDED RETURN |

||||||||||||

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Here |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IMPORTANT: Do not send a photocopy of this form. |

|

|

|

|

|

|

|

|

|

|

|

|

Fill in circle |

(See instructions) |

|||||||

Return |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

For calendar year |

2020, or fiscal year beginning |

|

|

|

|

|

2 0 |

and ending |

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

Your Social Security Number |

You must enter your |

Spouse’s Social Security Number |

|

|

|

||||||||||||||

Your |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

social security number(s) |

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

of |

|

Your First Name (USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS) |

M.I. |

|

Your Last Name |

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

PagesAll |

|

If a Joint Return, Spouse’s First Name |

|

M.I. |

|

Spouse’s Last Name |

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Staple |

|

Mailing Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Apartment Number |

|||

|

City |

|

|

|

|

State |

|

|

|

Zip Code |

Country (If not U.S.) |

County (Enter first five letters) |

||||||||||

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

N.C. Education Endowment Fund: You may contribute to the N.C. Education Endowment Fund by making a contribution or designating some or |

|||||||||||||||||||

|

|

|

all of your overpayment to the Fund. To make a contribution, enclose Form |

|||||||||||||||||||

|

|

|

To designate your overpayment to the Fund, enter the amount of your designation on Page 2, Line 31. (See instructions for information about the Fund.) |

|||||||||||||||||||

|

|

Out of Country |

Fill in circle if you, or if married filing jointly, your spouse were out of the country on April 15, 2021, and a U.S. citizen or resident. |

|||||||||||||||||||

|

|

Deceased Taxpayer Information |

|

|

Enter date of death of deceased taxpayer or deceased spouse. |

|

||||||||||||||||

|

|

|

Fill in circle if return is filed and signed by Executor, |

|

Taxpayer |

|

|

|

|

|

|

|

|

|

Spouse |

|

|

|

||||

|

|

|

Administrator, or |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

Residency Status |

|

Were you a resident of N.C. for the entire year? |

|

|

|

|

|

Yes |

No |

|

If No, complete and attach |

|

||||||||

|

|

|

Was your spouse a resident for the entire year? |

|

|

|

|

|

Yes |

No |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

Form |

|

||||||||||

|

|

Veteran Information |

Are you a veteran? |

Yes |

No |

|

Is your spouse a veteran? |

|

Yes |

No |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

Federal Extension |

|

Were you granted an automatic extension to file your 2020 federal income tax return (Form 1040)? |

Yes |

No |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DO NOT HANDWRITE ON THIS FORM

THAN YOUR SIGNATURE,

Filing Status (Fill in one circle only)

2s Here

1. |

Single |

|

|

|

2. |

Married Filing Jointly |

(Enter your spouse’s |

Name |

|

3. |

Married Filing Separately |

|||

|

||||

full name and Social |

SSN |

|||

4. |

Head of Household |

Security Number) |

||

|

|

|||

5. |

Qualifying Widow(er) (Year spouse died: |

) |

||

6.Federal Adjusted Gross Income

7.Additions to Federal Adjusted Gross Income (From Form

8.Add Lines 6 and 7

9.Deductions From Federal Adjusted Gross Income (From Form

10. Child Deduction (On Line 10a, enter the number of qualifying children for whom you were allowed a federal child tax credit. On Line 10b, enter the amount of the child deduction. See instructions.)

11. |

N.C. Standard Deduction OR |

N.C. Itemized Deductions |

(Fill in one circle only. See Form

6.

7.

8.

9.

10a.

10a.

11.

Enter Whole U.S. Dollars Only

10b.

10b.

THAN YOUR SIGNATURE,

OTHER

Staple W-

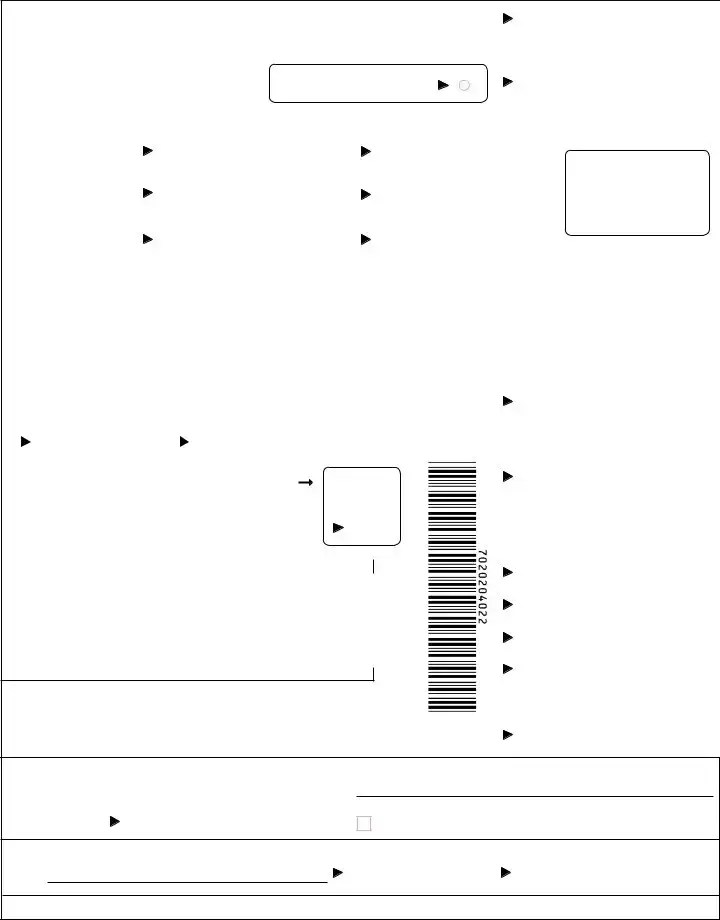

12.a. Add Lines 9, 10b, and 11.

15.North Carolina Income Tax

Multiply Line 14 by 5.25% (0.0525).

12b.

If zero or less, enter a zero.

Subtract the amount on Line 12a from Line 8.

13.

14.

15.

OTHER

Page 2 |

Last Name (First 10 Characters) |

Tax Year |

Your Social Security Number |

|

2020 |

|

|

|

|

|

16.Tax Credits (From Form

17.Subtract Line 16 from Line 15

18.Consumer Use Tax (See instructions)

19.Add Lines 17 and 18

20. |

North Carolina |

a. |

Your tax withheld |

|

|

||

|

Income Tax Withheld |

|

|

21. |

Other Tax Payments a. |

2020 estimated tax |

|

|

|

c. |

Partnership |

If you certify that no Consumer

Use Tax is due, fill in circle.

b.Spouse’s tax withheld

b.Paid with extension

d.S Corporation

16.

17.

18.

19.

If you claim a

partnership payment

on Line 21c or S

corporation payment on Line 21d, you must attach a copy of the NC

22. Amended Returns Only - Previous payments (See “Amended Returns” in instructions) |

22. |

||||

23. |

Total Payments - Add Lines 20a through 22 |

|

23. |

||

|

|

|

|

24. |

|

24. |

Amended Returns Only - Previous refunds (See “Amended Returns” in instructions) |

||||

|

|||||

25. |

Subtract Line 24 from Line 23. |

(If less than zero, see instructions.) |

25. |

||

26. a. Tax Due - If Line 19 is more than Line 25, subtract Line 25 from Line 19. |

26a. |

||||

|

Otherwise, go to Line 28. |

|

|

||

|

b. Penalties |

c. Interest |

(Add Lines 26b |

|

|

|

|

|

and 26c and |

26d. |

|

|

|

|

enter the total |

||

|

|

|

on Line 26d.) |

|

|

e. Interest on the Underpayment of Estimated Income Tax

(See instructions and enter letter in box, if applicable.)

27. Total Due - Add Lines 26a, 26d, and 26e

Pay in U.S. Currency from a Domestic Bank - You can pay online at www.ncdor.gov.

28. Overpayment - If Line 19 is less than Line 25, subtract Line 19 from Line 25.

When filing an amended return, see instructions.

When filing an amended return, see instructions.

29.Amount of Line 28 to be applied to 2021 Estimated Income Tax

30.Contribution to the N.C. Nongame and Endangered Wildlife Fund

31.Contribution to the N.C. Education Endowment Fund

32.Contribution to the N.C. Breast and Cervical Cancer Control Program

33.Add Lines 29 through 32

34.Subtract Line 33 from Line 28. This is the Amount To Be Refunded

For direct deposit, file electronically

26e.

27.$

28.

29.

30.

31.

32.

33.

34.

I declare and certify that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete.

|

Your Signature |

Date |

|

|

Contact Phone Number |

|

|

|

(Include area code) |

|

|

PAID PREPARER USEONLY |

If prepared by a person other than taxpayer, this certification is based on all |

||

Paid Preparer’s Signature |

Date |

||

|

|

information of which the preparer has any knowledge. |

|

Spouse’s Signature (If filing joint return, both must sign.) |

Date |

Check here if you authorize the North Carolina Department of Revenue to discuss this return and attachments with the paid preparer below.

Preparer’s FEIN, SSN, or PTIN |

Preparer’s Contact Phone Number (Include area code) |

If REFUND, mail return to: N.C. DEPT. OF REVENUE, P.O. BOX R, RALEIGH, NC

If you ARE NOT due a refund, mail return, any payment, and

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The D-400 form is used to file individual income tax returns for North Carolina residents, including full-year, part-year, and non-residents. |

| Eligibility | Full-year residents report their taxable income directly, while part-year residents and non-residents must calculate their taxable amount based on a percentage. |

| Filing Guidelines | Do not write by hand on this form. Use printed characters for all entries. |

| Education Fund Contribution | Taxpayers can contribute a portion of their overpayment to the N.C. Education Endowment Fund using Form NC-EDU. |

| Filing Deadline | The form is due on April 15 of the following year for those who do not have an automatic extension. |

| Governing Law | This form is governed by the North Carolina General Statutes, Title 105, which outlines the revenue laws of the state. |

Guidelines on Utilizing Ncdor D 400

Filling out the NCDOR D-400 form can seem daunting at first, but once you break it down into manageable steps, it becomes much easier. This form is crucial for reporting your income and taxes owed in North Carolina. Let's go through the steps to ensure you complete it accurately.

- Gather your necessary documents like your Social Security number, income statements, and any supporting schedules.

- Begin by clearly printing your first name, middle initial, and last name in capital letters at the top of the form.

- If you’re filing jointly, repeat the process for your spouse, including their Social Security number.

- Indicate your mailing address, including the apartment number, city, state, zip code, and country if outside the U.S.

- Complete the residency status questions by circling "Yes" or "No" for both you and your spouse.

- Check the appropriate circle for your filing status, selecting only one option (Single, Married Filing Jointly, etc.).

- Fill in your federal adjusted gross income on Line 6. Be sure this matches your federal form.

- Report any additions to your federal adjusted gross income on Line 7, referencing Form D-400 Schedule S.

- Add Lines 6 and 7 together and enter the total on Line 8.

- Claim any deductions from your federal adjusted gross income on Line 9.

- Complete Line 10 by entering the number of qualifying children on Line 10a and the total child deduction on Line 10b.

- Select either the N.C. Standard Deduction or N.C. Itemized Deductions on Line 11.

- Calculate Line 12 by adding Lines 9, 10b, and 11, and place the sum on Line 12a.

- Enter the amount from Line 12a on Line 12b. If this number is zero or less, simply enter zero.

- For Line 14, determine your North Carolina taxable income. Full-year residents will transfer the amount from Line 12b. Part-year residents and nonresidents will multiply the amount from Line 12b by the decimal from Line 13.

- Calculate your North Carolina income tax on Line 15 by multiplying the amount on Line 14 by 5.25% (0.0525).

- Complete the remaining sections, including tax credits and payments, following the prompts on the form.

- Sign and date the form, ensuring that all entries are accurate. If filing jointly, both spouses must sign.

Once you've filled out the form, it’s important to send it to the correct address based on whether you're expecting a refund or not. Take your time to double-check your entries, as accuracy here can save you time and potential headaches later. Happy filing!

What You Should Know About This Form

What is the NCDOR D-400 form?

The NCDOR D-400 form is the North Carolina Individual Income Tax Return. It is used by residents, part-year residents, and nonresidents of North Carolina to report income, calculate tax due, or claim a refund. This form is important for ensuring that individuals fulfill their state tax obligations accurately and on time.

Who needs to file the NCDOR D-400 form?

All individuals who earn income in North Carolina and meet specific income thresholds must file the D-400 form. This includes full-year residents, part-year residents, and nonresidents. Those who had federal taxable income during the tax year or received certain benefits may also be required to file.

What information do I need to provide on the D-400 form?

You will need to provide personal information, including your Social Security number, your residency status throughout the year, and your filing status (such as single, married, or head of household). You must also report your total federal adjusted gross income, any deductions, and information about child deductions if applicable.

How do I determine my taxable income on the D-400 form?

Full-year residents should enter the amount from Line 12b as their North Carolina taxable income. If you are a part-year resident or nonresident, you will multiply the amount from Line 12b by the percentage on Line 13, which you will derive from Form D-400 Schedule PN.

Can I electronically file the D-400 form?

Yes, the D-400 form can be filed electronically. This method is convenient and often faster, allowing for direct deposit of refunds. Ensure you follow the specific electronic filing guidelines provided by the North Carolina Department of Revenue.

What if I need to amend my D-400 form?

If you need to amend your D-400 form, complete a new D-400 form indicating that it is an amended return and include the necessary changes. Be sure to review the instructions carefully, as there may be additional requirements or information needed for amended returns.

Are there penalties for late filing or underpayment of taxes on the D-400 form?

Yes, penalties may apply for filing the D-400 form late or underpaying your taxes. The state will typically assess penalties based on the amount owed and how late the payment is. To avoid these penalties, it is advisable to file timely and accurately.

What contributions can I make when filing the D-400 form?

When filing the D-400 form, you can contribute to several funds, such as the North Carolina Education Endowment Fund, the Nongame and Endangered Wildlife Fund, and the Breast and Cervical Cancer Control Program. You can specify the amount you wish to contribute on the respective lines provided in the form.

Where do I send my completed D-400 form?

If you are expecting a refund, mail your completed form to the N.C. Department of Revenue, P.O. Box R, Raleigh, NC 27634-0001. For those who do not expect a refund, send your return and any payments to the N.C. Department of Revenue, P.O. Box 25000, Raleigh, NC 27640-0640.

Common mistakes

Filling out the NC D-400 form can be a daunting task, and many people make mistakes that can lead to delays or issues with their tax return. One common error occurs with the residency status section. Individuals often misidentify whether they are full-year residents, part-year residents, or non-residents. This mistake can affect the entire calculation of taxable income and lead to inaccuracies in tax obligations.

Another frequent issue lies in the Social Security Number section. Taxpayers sometimes forget to include their spouse’s Social Security Number when filing jointly. This oversight can cause processing delays or result in the return being flagged for further review, complicating an otherwise straightforward filing process.

Some people incorrectly fill in their income figures. The D-400 requires entries such as federal adjusted gross income and various deductions, but errors can occur if taxpayers rush or misread the instructions. Entering incorrect dollar amounts, or failing to carry over figures from related forms, can contribute to significant discrepancies in what is owed or the refund expected.

Handwriting on the D-400 form is strictly prohibited. Many taxpayers, in a rush, may scrawl notes or make corrections directly on the form instead of using the designated areas. This can lead to confusion and misinterpretation of the provided information, ultimately causing issues with tax calculations or processing.

In addition, failing to check the appropriate boxes for contributions and deductions can lead to missed opportunities for tax benefits. For example, not designating an amount for the N.C. Education Endowment Fund or failing to apply the child deduction means you could end up paying more taxes than necessary. Awareness of these options is key to maximizing your tax return.

Finally, submitting the original form instead of an amended return, when applicable, can create complications. If any changes are needed after the first submission, filling out the amended return correctly is crucial. This includes rechecking forms like the D-400 Schedule PN or D-400TC, which support the calculations on the main D-400 form. Ignoring this step can not only invalidate the changes but could also result in penalties.

Documents used along the form

The NCDOR D-400 form is central for filing individual income tax returns in North Carolina. Yet, it is often accompanied by several other forms and documents that provide necessary information for accurate tax assessment. Understanding these supplementary materials can lead to a smoother filing experience and ensure compliance with state tax regulations.

- Form D-400TC: This form is used to calculate various tax credits available to individual taxpayers. It helps in reducing the overall amount of tax owed, ensuring that taxpayers can take advantage of available credits to lessen their financial burden.

- Form D-400 Schedule A: Taxpayers who opt to itemize their deductions instead of taking the standard deduction need to complete this schedule. It lists eligible expenses that can reduce taxable income, helping individuals maximize tax savings.

- Form D-400 Schedule PN: Part-year residents and nonresidents use this schedule to determine the percentage of their income that is taxable in North Carolina. It calculates how much of their income is subject to local taxes based on their residency duration throughout the year.

- Form D-400 Schedule S: This schedule is utilized to report adjustments to federal adjusted gross income, which may include additions or deductions specific to North Carolina tax regulations. It ensures that taxpayers accurately reflect their income when calculating state taxes.

- Form NC-EDU: Taxpayers wishing to contribute to the North Carolina Education Endowment Fund can use this form. It allows individuals to allocate a portion of their tax payment towards educational initiatives in the state, demonstrating civic engagement while filing taxes.

Knowing about these additional forms can enhance your understanding of the North Carolina tax filing process. Each document plays a crucial role in ensuring accurate reporting, maximizing potential savings, and enhancing the taxpayer's experience. Properly completing and submitting these alongside the D-400 form ensures compliance and helps avoid any potential issues with the North Carolina Department of Revenue.

Similar forms

-

Form 1040: This is the standard federal income tax return form used by individual taxpayers to report their income and calculate their federal tax liability. Similar to the D-400, it requires income, deductions, and credits to be reported for accurate tax computation.

-

Form 1040-SR: Designed for seniors, this form also reports income, deductions, and tax calculations. Like the D-400, it includes options for taking standard or itemized deductions, catering to the unique needs of older adults.

-

Form 1065: This is the tax return for partnerships. While it deals with partnership income, it shares the need for accurate reporting of income and expenses similar to the D-400.

-

Form 1120: Used by corporations to report income, gains, losses, and deductions, this form parallels the D-400 in its purpose to document financial activity for tax obligations.

-

Form 8862: This form is used to claim the Earned Income Credit after having it disallowed in a prior year. It resembles the D-400 in its focus on tax credits and the need for qualifying conditions to be met.

-

Form D-400 Schedule S: This companion schedule allows taxpayers to report adjustments from federal income to state income. It is closely linked to the D-400 as it addresses additions and subtractions that affect North Carolina taxable income.

-

Form D-400 Schedule A: This form allows taxpayers to calculate their itemized deductions for state tax purposes, just like the standard deduction section in the D-400. Both forms ultimately influence the taxpayer’s total deductions.

-

Form D-400 TC: This form is utilized for tax credits in North Carolina. It is similar to D-400 as it also aims to reduce the tax owed through various credits offered by the state.

-

Form D-400 PN: This schedule is used for part-year residents and nonresidents in North Carolina to calculate their taxable percentage. Like the D-400, it seeks to clarify residency-related tax calculations.

-

Form NC-EDU: This form allows taxpayers to contribute to the North Carolina Education Endowment Fund. Similar to the contributions section of the D-400, it highlights options for charitable giving through tax forms.

Dos and Don'ts

When completing the NCDOR D-400 form, attention to detail can significantly impact the filing process. Here are some important do's and don’ts to consider:

- DO print clearly. Use capital letters for your name and address to ensure legibility.

- DO double-check your social security numbers. Ensure both your and your spouse’s numbers are correct to avoid processing delays.

- DO follow all instructions provided. Forms often contain specific guidelines that must be adhered to for successful submission.

- DO ensure you make contributions accurately. If choosing to contribute to funds, fill in the correct amounts carefully.

- DO file the form timely. Submit your return by the deadline to avoid penalties.

- DON'T handwrite on the form except for your signature. It is important for all entries to be completed electronically or printed clearly.

- DON'T submit photocopies. Always use the original form to prevent any issues with your submission.

- DON'T leave any fields blank. If a question does not apply, provide a clear response instead of skipping it.

- DON'T forget to sign your return. Ensure all necessary signatures are present, especially in joint filings.

- DON'T send payments with the return if you are due a refund. Follow the instructions for where to send payments properly.

Misconceptions

Understanding the NCDOR D-400 form can be challenging, and misconceptions often complicate the filing process. Here are some common misunderstandings, along with clarifications to help you navigate your tax preparation.

- The D-400 form is only for full-year residents. This is not true. While full-year residents file with less complexity, part-year residents and nonresidents also need to utilize the D-400 form, with specific calculations based on their status. This form accommodates all residency scenarios.

- You can write on the D-400 form. Many individuals think they can manually enter information by hand. However, the instructions clearly state that handwriting is not allowed. You must print the information on the form using an appropriate method.

- Amended returns do not need to follow the regular filing rules. Some believe that amended returns can bypass specific guidelines. However, it is crucial to adhere to the steps outlined for amended filings, as they retain the same structure and critical elements as regular returns.

- All tax payments must be submitted by mail. Another common myth is that payments can only be made via traditional mail. In fact, North Carolina allows taxpayers to make payments online, making it quicker and more efficient to fulfill your tax obligations.

- Contributions to charitable funds are optional and do not affect my taxes. While its true that contributing to the N.C. Education Endowment Fund and other similar initiatives is voluntary, these donations can significantly influence your tax return and potential refunds. Consider these contributions carefully, as they may enhance your financial outcome.

Key takeaways

1. Define Your Residency Status: Determine if you are a full-year resident, part-year resident, or nonresident of North Carolina. This affects how you report income on the D-400 form.

2. Enter Accurate Social Security Numbers: It's essential to include both your and your spouse’s Social Security Numbers (SSNs) accurately. This information is required for proper identification.

3. Use Capital Letters: When filling out the form, use capital letters for your name and address. This ensures clarity and reduces errors in processing.

4. Do Not Handwrite: Avoid handwritten entries on the D-400 form except for your signature. All data must be printed clearly, maintaining an organized and professional appearance.

5. Contribution Opportunities: You can contribute to the N.C. Education Endowment Fund while completing your return. Consider designating a portion of your overpayment or submitting a separate contribution form.

6. Taxable Income Calculations: Full-year residents should enter amounts directly, while part-year residents and nonresidents must adjust their entries based on the taxable percentage calculated on Schedule PN.

7. Pay Attention to Deadlines: Ensure that you adhere to filing deadlines to avoid penalties and interest on late payments. An extension does not excuse late payment of taxes owed.

8. Review for Amended Returns: If you are filing an amended return, follow specific instructions on the form carefully to accurately report any previous payments and refunds.

9. Keep Copies for Your Records: After submitting the D-400, maintain copies of the completed form and any supporting documents for your records. This may be necessary for future reference or audits.

Browse Other Templates

How to Fill Out E-500 Form Nc - Understanding how tax rates apply is crucial when completing the E-500.

Ait Sars - The declaration section obligates applicants to provide truthful information.