Fill Out Your Ncis 757 Form

The NCIS 757 form is an essential document for farmers and agricultural producers who utilize crop insurance. This form facilitates the assignment of indemnity payments from an insurance policy to a designated creditor, providing a layer of financial security. It requires important details like the insured's name, policy number, and the crops involved, ensuring all parties have a clear understanding of the insured interests. Furthermore, it outlines conditions regarding how indemnity payments will be handled, including deductions for any existing debts owed to the insurance provider. The NCIS 757 form also stipulates that the assignment remains effective until the end of the crop year unless canceled in writing by the creditor before then. Moreover, it emphasizes that the insurance provider must approve the assignment for it to take effect, underscoring the importance of maintaining clear communication with all involved parties. Compliance with privacy and nondiscrimination regulations is fundamental, making this document not only a legal safeguard but also a commitment to fairness and transparency in the agricultural insurance process. Farmers must be diligent when completing the NCIS 757 to ensure that all required information is accurately reported to avoid potential complications with insurance claims. Understanding this form's critical role in crop insurance is vital for protecting agricultural investments and ensuring financial stability during challenging times.

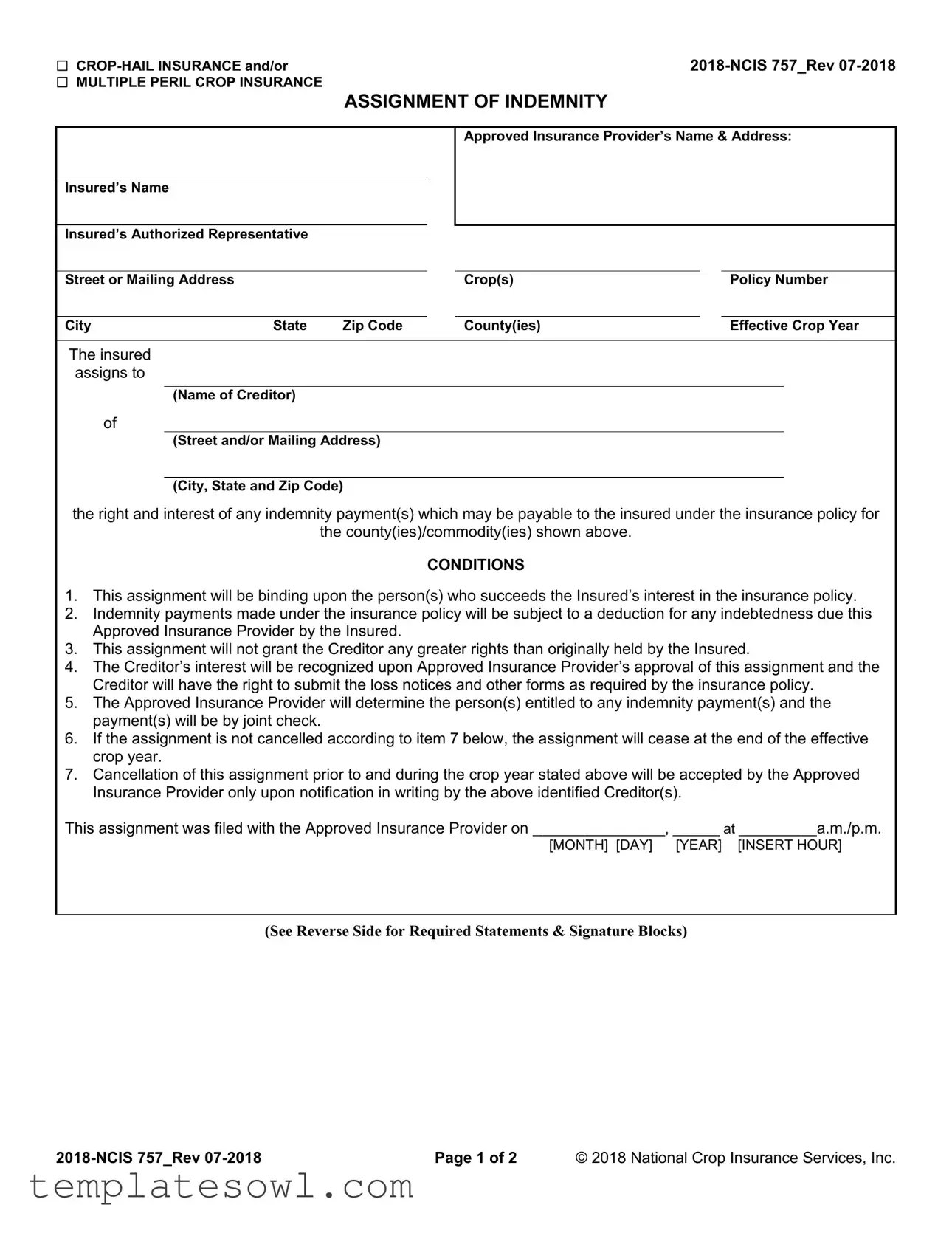

Ncis 757 Example

|

MULTIPLE PERIL CROP INSURANCE

ASSIGNMENT OF INDEMNITY

Approved Insurance Provider’s Name & Address:

Insured’s Name

Insured’s Authorized Representative

Street or Mailing Address |

|

|

Crop(s) |

Policy Number |

City |

State |

Zip Code |

County(ies) |

Effective Crop Year |

The insured

assigns to

(Name of Creditor)

of

(Street and/or Mailing Address)

(City, State and Zip Code)

the right and interest of any indemnity payment(s) which may be payable to the insured under the insurance policy for

the county(ies)/commodity(ies) shown above.

CONDITIONS

1.This assignment will be binding upon the person(s) who succeeds the Insured’s interest in the insurance policy.

2.Indemnity payments made under the insurance policy will be subject to a deduction for any indebtedness due this Approved Insurance Provider by the Insured.

3.This assignment will not grant the Creditor any greater rights than originally held by the Insured.

4.The Creditor’s interest will be recognized upon Approved Insurance Provider’s approval of this assignment and the Creditor will have the right to submit the loss notices and other forms as required by the insurance policy.

5.The Approved Insurance Provider will determine the person(s) entitled to any indemnity payment(s) and the payment(s) will be by joint check.

6.If the assignment is not cancelled according to item 7 below, the assignment will cease at the end of the effective crop year.

7.Cancellation of this assignment prior to and during the crop year stated above will be accepted by the Approved Insurance Provider only upon notification in writing by the above identified Creditor(s).

This assignment was filed with the Approved Insurance Provider on _________________, ______ at __________a.m./p.m.

[MONTH] [DAY] [YEAR] [INSERT HOUR]

(See Reverse Side for Required Statements & Signature Blocks)

Page 1 of 2 |

© 2018 National Crop Insurance Services, Inc. |

COLLECTION OF INFORMATION AND DATA (PRIVACY ACT) STATEMENT

Agents, Loss Adjusters and Policyholders

The following statements are made in accordance with the Privacy Act of 1974 (5 U.S.C. 552a): The Risk Management Agency (RMA) is authorized by the Federal Crop Insurance Act (7 U.S.C.

NONDISCRIMINATION STATEMENT

In accordance with Federal law and U.S. Department of Agriculture (USDA) civil rights regulations and policies, the USDA, its Agencies, offices, and employees, and institutions participating in or administering USDA programs are prohibited from discriminating on the basis of race, color, national origin, religion, sex, gender identity (including gender expression), sexual orientation, disability, age, marital status, family/parental status, income derived from a public assistance program, political beliefs, or reprisal or retaliation for prior civil rights activity, in any program or activity conducted or funded by USDA (not all bases apply to all programs).

To File a Program Complaint

If you wish to file a Civil Rights program complaint of discrimination, complete the USDA Program Discrimination Complaint Form, found online at

Persons with Disabilities

Persons with disabilities who require alternative means of communication for program information (e.g., Braille, large print, audiotape, American Sign Language, etc.) should contact the responsible State or local Agency that administers the program or USDA's TARGET Center at (202)

Persons with disabilities, who wish to file a program complaint, please see information above on how to contact the Department by mail directly or by email.

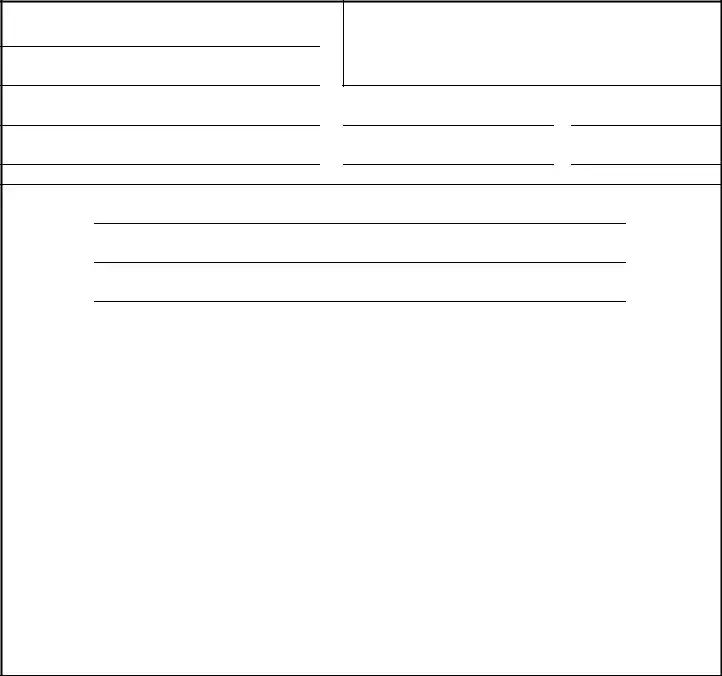

It is understood and agreed that this assignment will be subject to the terms and conditions of the insurance policy.

Insured’s Printed Name |

|

Insured’s Signature |

Date |

Witness’ Printed Name |

|

Witness’ Signature |

Date |

Creditor’s Authorized Representative Printed Name |

|

|

|

|

|

Creditor’s Authorized Representative Signature |

Date |

|

|

||

Creditor’s Authorized Representative’s Telephone Number |

||

|

|

|

Witness’ Printed Name |

|

|

|

|

|

Witness’ Signature |

Date |

|

AIP’s Authorized Representative’s Printed Name |

|

AIP’s Authorized Representative’s Signature |

Date |

Page 2 of 2 |

© 2018 National Crop Insurance Services, Inc. |

Form Characteristics

| Fact Name | Fact Details |

|---|---|

| Document Title | The NCIS 757 form is used for assigning indemnity payments related to Multiple Peril Crop Insurance and Crop-Hail Insurance. |

| Purpose | This form allows insured individuals to assign their right to indemnity payments from the insurance provider to a creditor. |

| Binding Nature | The assignment is binding on anyone who succeeds the insured’s interest in the insurance policy, ensuring continuity of the agreement. |

| Indemnity Payment Deduction | Indemnity payments will have deductions made for any debts that the insured owes to the Approved Insurance Provider. |

| Approval Requirement | The creditor’s assignment must be approved by the Approved Insurance Provider to be recognized legally. |

| Cancellation Policy | This assignment will automatically cease at the end of the effective crop year unless canceled in writing before that date. |

| Privacy Compliance | The form complies with the Privacy Act of 1974, ensuring that the information collected is used only for program eligibility and integrity. |

Guidelines on Utilizing Ncis 757

Filling out the NCIS 757 form is a straightforward process. This form allows an insured party to assign their claim payments to a creditor. Accurate completion is essential to ensure that the assignment is recognized by the insurance provider, so it’s important to take your time and check the information carefully.

- At the top of the form, indicate whether you are applying for CROP-HAIL INSURANCE or MULTIPLE PERIL CROP INSURANCE.

- Write the Approved Insurance Provider's name and address in the designated section.

- Fill in the Insured's name and, if applicable, the name of the Insured's Authorized Representative.

- Provide the complete street or mailing address for the Insured.

- List the specific crop(s) related to this insurance policy.

- Enter the policy number associated with the insurance.

- Fill in the city, state, and zip code where the insured is located.

- Specify the county(ies) relevant to the crops covered under the policy.

- Indicate the effective crop year for this assignment.

- In the section for assignment, write the name of the creditor to whom the indemnity payments will be assigned.

- Fill out the creditor's street and/or mailing address, including city, state, and zip code.

- Provide the date the assignment was filed with the Approved Insurance Provider. Write the month, day, and year, along with the time it was submitted.

- Complete the signature section, including the printed name, signature, and date for both the insured and the witnesses.

- Make sure the creditor’s authorized representative details are filled in, including their printed name, signature, telephone number, and the date of signing.

- Lastly, the Authorized Representative from the Approved Insurance Provider should also sign and print their names, ensuring all details are correct.

What You Should Know About This Form

What is the purpose of the NCIS 757 form?

The NCIS 757 form is used to assign the right and interest in indemnity payments from crop insurance to a specified creditor. When farmers or insured parties enter into this agreement, they allow the creditor to receive insurance payouts that may be due under the insurance policy. This is particularly important when the insured has outstanding debts and the creditor wants to ensure that payments are made toward those debts directly from any insurance claims.

What are the conditions that apply to the assignment of indemnity payments?

Several key conditions govern this assignment. First, once this assignment is in place, it will be binding on anyone succeeding the insured's interest in the policy. Secondly, indemnity payments will first need to account for any debts owed to the Approved Insurance Provider by the insured. Additionally, this assignment does not extend any rights to the creditor beyond what the insured originally held. The Approved Insurance Provider has the final say on who receives the indemnity payments, which will be disbursed through joint checks. Importantly, the assignment will automatically end at the conclusion of the effective crop year unless otherwise cancelled in writing by the creditor.

How does one cancel the assignment before the end of the crop year?

To cancel this assignment, the creditor must notify the Approved Insurance Provider in writing. This cancellation can occur at any time prior to or during the effective crop year stated on the form. It is essential that this notification is clear to ensure that all parties understand the termination of the assignment. If done properly, the assignment will no longer be effective, allowing the insured to receive any future indemnity payments directly.

What happens if the information provided in the NCIS 757 form is incorrect?

Providing inaccurate information on the NCIS 757 form can lead to complications. The Approved Insurance Provider or the Risk Management Agency may reject the document if it contains errors. This can result in the denial of program eligibility, which means that the insured might not receive the benefits they are entitled to. In some cases, failure to provide truthful information may lead to legal actions, including civil or criminal penalties. Therefore, it is crucial to ensure all details are accurate and complete before submission.

Common mistakes

When completing the NCIS 757 form, individuals often make several common mistakes that can lead to delays or complications with their insurance claims. One frequent error is the incomplete or incorrect entry of names. It is essential to write the insured’s name clearly and accurately, as any discrepancies can result in processing issues. An inaccuracy in the name can hinder the ability of the insured to receive indemnity payments.

Another mistake involves misreporting the policy number. The policy number is crucial for identifying the correct insurance coverage. A wrong entry may cause confusion and lead to a rejection of the claim. It is imperative to double-check this information before submission.

Individuals often fail to provide the correct mailing address for both the insured and the creditor. An incorrect address can result in critical documents being sent to the wrong location, potentially causing missed deadlines. When filling out the form, ensure that all addresses are verified and up-to-date.

Some people neglect to fill in the effective crop year. This information is vital for determining the validity of the assignment and ensuring that the insurance coverage is applicable for the correct time frame. Omitting this detail can delay the processing of the assignment.

Additionally, failing to sign the form is a significant oversight. Both the insured and the creditor must provide their signatures where required. Without signatures, the assignment is not legally binding, and the insurance provider cannot act upon it.

Attaching missing supporting documents is another common error. The insurance provider may require additional documentation to process the assignment properly. Not including these documents can lead to delays or rejections, causing unnecessary stress for all parties involved.

People sometimes overlook the importance of notifying the approved insurance provider about the assignment. It is essential that this assignment is communicated effectively to ensure that the creditor's interests are recognized. Failure to do so may result in complications during the claims process.

Moreover, some individuals forget to indicate the date on the form clearly. The date of filing is necessary for administrative purposes and legal obligations. An absent date can cause confusion regarding the timing of the assignment and related claims.

Another frequent mistake is assuming that verbal agreements are sufficient. A written assignment is necessary for clarity and legal standing. This misunderstanding can impact the insured's ability to secure their indemnity payments.

Lastly, individuals often overlook conditions stated on the form. Fully understanding and adhering to all conditions outlined ensures compliance and helps avoid potential future disputes. Reviewing these details thoroughly can protect both the insurer and the insured.

Documents used along the form

The NCIS 757 form is an important document in the realm of crop insurance, specifically relating to assignments of indemnity payments. When working with this form, several other documents may also be necessary to ensure compliance and facilitate communication between the insured and the insurance provider. Below is a list of forms that are often used in conjunction with the NCIS 757 form, along with brief descriptions of each.

- USDA Program Discrimination Complaint Form: This form allows individuals to file complaints regarding discrimination in USDA programs. It ensures that those who feel wronged can seek resolution through a formal complaint process.

- CROP-HAIL Insurance Application: This document is used to apply for crop-hail insurance, providing necessary details about the applicant, the crops, and coverage options. It is crucial for farmers looking to protect their fields from hail damage.

- Multiple Peril Crop Insurance Policy: This policy covers various risks that might affect crop yields, such as drought, flood, or disease. It outlines the terms and conditions of the coverage provided to the insured party.

- Loss Notice Form: After a loss occurs, this form must be submitted to notify the insurance provider of the incident. It includes critical details about the crops affected and the estimated losses.

- Indemnity Payment Request: This document is used to formally request payment from the insurance provider following a loss. It includes information about the specific loss and any supporting documents that may be required.

- Insurance Provider’s Approval Letter: After a claim is filed, this letter confirms that the insurance provider has approved or denied the claim. It serves as official notification of the status of the claim.

Understanding these associated documents can alleviate confusion and help in navigating the insurance process. Each form plays a significant role in ensuring that policies are executed correctly and that claims are handled efficiently. Familiarity with these documents can greatly benefit those involved in crop insurance matters.

Similar forms

The NCIS 757 form serves a specific purpose in the realm of crop insurance, primarily focusing on the assignment of indemnity. Several other documents share similar characteristics in that they outline rights, responsibilities, and procedures associated with insurance policies or financial agreements. Below is a list of five documents that are comparable to the NCIS 757 form:

- UCC Financing Statement (UCC-1) - This document is filed to provide public notice of a secured party's interest in the collateral offered by a borrower. Like the NCIS 757, it indicates an assignment of rights and is binding on future parties.

- Crop Insurance Policy - This policy details the coverage, conditions, and obligations between the insured and the insurer. It establishes the framework within which indemnities are managed, similar to how the NCIS 757 form assigns rights to indemnity payments.

- Assignment of Benefits Form - Common in insurance dealings, this form allows a policyholder to assign their insurance benefits directly to another party, much like how the NCIS 757 form assigns indemnity payments to a creditor. Both require agreement from the insurance provider.

- Collateral Assignment Agreement - This document is used when a borrower assigns their rights in a collateral to secure a debt. It parallels the NCIS 757 in that it defines the rights and protection of both parties involved in the agreement.

- Power of Attorney for Health Care - Although differing in context, this form empowers an agent to make medical decisions on behalf of a principal. Similar to the NCIS 757, it is a legally binding document that transfers certain rights and requires formal acceptance.

Dos and Don'ts

When filling out the NCIS 757 form, there are important dos and don’ts to keep in mind. Following this guidance can help ensure that your application is processed smoothly.

- Do fill in all required fields completely and accurately.

- Do double-check spellings of names and addresses.

- Do provide all necessary documentation as requested.

- Do sign and date the form where indicated to validate your submission.

- Don’t leave any fields blank unless they are specifically marked as optional.

- Don’t use white-out or any correction fluid on the form.

- Don’t submit the form without a thorough review.

- Don’t forget to send the form to the correct insurance provider.

Misconceptions

- Misconception 1: The NCIS 757 form is only for crop-hail insurance.

- Misconception 2: Once the form is signed, creditors immediately have full rights to indemnity payments.

- Misconception 3: All indemnity payments go directly to the creditor.

- Misconception 4: The assignment of indemnity payments lasts indefinitely.

- Misconception 5: The form guarantees indemnity payments to creditors.

- Misconception 6: Creditors can cancel the assignment without notifying the insured.

- Misconception 7: Information provided on the form is not subject to privacy regulations.

Many people believe that this form is exclusively designed for crop-hail insurance. In reality, the NCIS 757 can also pertain to multiple peril crop insurance, allowing for broader applications in crop-related claims.

It’s a common misunderstanding that creditors gain complete rights upon signing. The assignment is binding, but the indemnity payment rights will only be recognized once the approved insurance provider’s approval is obtained.

This is not correct. The approved insurance provider will issue payments by joint check, meaning the insured will still receive a portion of the payout, subject to the terms of the assignment.

Some individuals think that once the assignment is made, it lasts forever. In truth, the assignment will cease at the end of the effective crop year unless specifically canceled by the creditor in writing.

This form does not ensure that creditors will receive payment. The approved insurance provider will determine the eligibility for any indemnity payments based on the insurance policy’s terms.

This assumption is misleading. Creditors must notify the approved insurance provider in writing to cancel the assignment. The insured is not solely responsible for managing this communication.

Many believe that there are no privacy concerns related to the information on the NCIS 757 form. However, all submissions must comply with privacy standards outlined by the Privacy Act of 1974, ensuring that sensitive data is handled appropriately.

Key takeaways

- Filling out the NCIS 757 form is essential for assigning your insurance indemnity payments to a creditor.

- Accurate information is crucial. Ensure that the names, addresses, and policy details are correct.

- Indemnity payments can only be assigned to one creditor as stipulated in the form.

- The assignment remains active until the end of the effective crop year unless canceled beforehand.

- All indemnity payments are subject to deductions for debts owed to the approved insurance provider.

- Your creditor's rights are defined by the form and will be recognized only after the provider's approval.

- To cancel the assignment, a written notification from the creditor is required.

Browse Other Templates

Estimated Taxes 2023 - Be aware of changes in tax laws that may affect your estimated payments.

Register Car in Ma - The form also requires the new owner's information, including their name and address.

Ssa Forms - Income earned by the deceased in the year of death and the prior year must be reported.