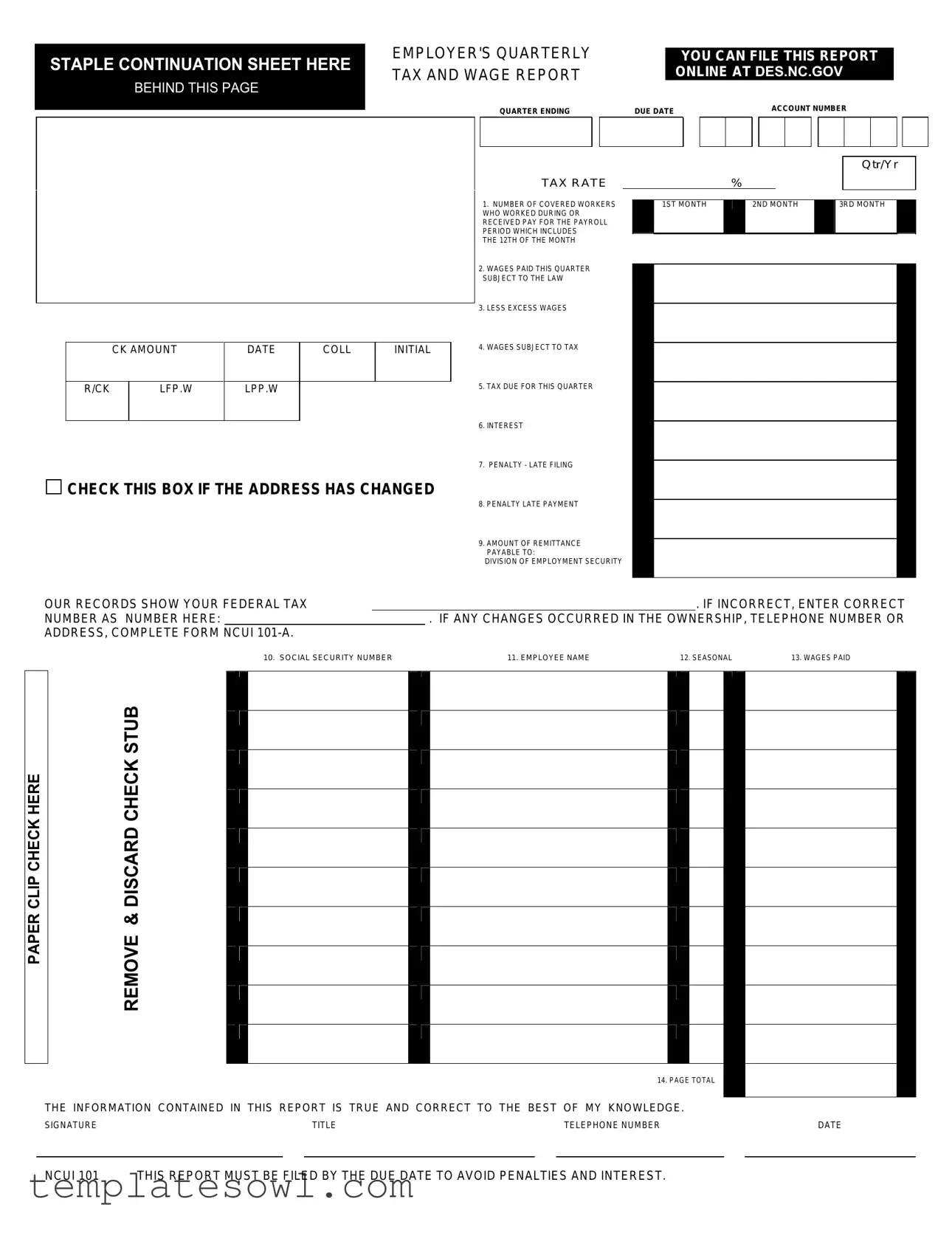

Fill Out Your Ncui 101 Form

The Ncui 101 form serves as an essential tool for employers in North Carolina to report their quarterly tax and wage information accurately. This particular form requires employers to detail the number of workers who were compensated during the quarter, breaking it down month by month. Employers must report all wages paid to employees during this time, encompassing full-time, part-time, and seasonal workers. Important calculations follow the wage reports, including the application of the applicable tax rate and deductions for any excess wages. The form also addresses penalties, should the report not be filed by the designated due date. Employers are instructed to provide relevant identification numbers, worker names, and wages, ensuring all necessary details are captured thoroughly. It's vital for employers to understand the instructions associated with each item, as any inaccuracies or omissions can lead to penalties or complications with their payroll responsibilities. Proper completion and timely submission of the Ncui 101 form not only help maintain compliance with North Carolina's employment laws but also foster transparency and accountability in employer-employee relationships.

Ncui 101 Example

STAPLE CONTINUATION SHEET HERE

BEHIND THIS PAGE

EMPLOYER'S QUARTERLY TAX AND WAGE REPORT

QUARTER ENDING

TAX RATE

YOU CAN FILE THIS REPORT ONLINE AT DES.NC.GOV

DUE DATE |

|

|

|

ACCOUNT NUMBER |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Qtr/Yr

%

1. NUMBER OF COVERED WORKERS |

1ST MONTH |

2ND MONTH |

3RD MONTH |

WHO WORKED DURING OR |

|

|

|

RECEIVED PAY FOR THE PAYROLL |

|

|

|

PERIOD WHICH INCLUDES |

|

|

|

THE 12TH OF THE MONTH |

|

|

|

|

CK AMOUNT |

DATE |

COLL |

INITIAL |

R/CK |

LFP.W |

LPP.W |

|

|

CHECK THIS BOX IF THE ADDRESS HAS CHANGED

CHECK THIS BOX IF THE ADDRESS HAS CHANGED

2.WAGES PAID THIS QUARTER SUBJECT TO THE LAW

3.LESS EXCESS WAGES

4.WAGES SUBJECT TO TAX

5.TAX DUE FOR THIS QUARTER

6.INTEREST

7.PENALTY - LATE FILING

8.PENALTY LATE PAYMENT

9.AMOUNT OF REMITTANCE PAYABLE TO:

DIVISION OF EMPLOYMENT SECURITY

OUR RECORDS SHOW YOUR FEDERAL TAX |

|

|

. IF INCORRECT, ENTER CORRECT |

|

NUMBER AS NUMBER HERE: |

|

. IF ANY CHANGES OCCURRED IN THE OWNERSHIP, TELEPHONE NUMBER OR |

||

ADDRESS, COMPLETE FORM |

NCUI |

|

|

|

CLIP CHECK HERE |

DISCARD CHECK STUB |

PAPER |

REMOVE & |

|

|

10. SOCIAL SECURITY NUMBER |

11. EMPLOYEE NAME |

12. SEASONAL |

13. WAGES PAID |

|

|

14. PAGE TOTAL |

|

THE INFORMATION CONTAINED IN THIS REPORT IS TRUE AND CORRECT TO THE BEST OF MY KNOWLEDGE.

SIGNATURE |

TITLE |

TELEPHONE NUMBER |

DATE |

NCUI 101 THIS REPORT MUST BE FILED BY THE DUE DATE TO AVOID PENALTIES AND INTEREST.

INSTRUCTIONS FOR COMPLETING FORM NCUI 101, EMPLOYER'S QUARTERLY TAX AND WAGE REPORT

ITEM 1: For each month in the calendar quarter, enter the number of all

ITEM 2: Enter all wages paid to all employees, including

(A)CORPORATION, the wages paid to all employees who performed services in North Carolina should be reported. Corporate officers are employees and their wages and/or draws are reportable.

(B)A PARTNERSHIP, the draws or payments made to general partners should not be reported.

(C)A PROPRIETORSHIP, the draws or payments made to the legal owner of the business (the proprietor) should not be reported. Wage paid to the children of the proprietor under the age of 21 years, as well as wages paid to the spouse or parents of the proprietor, should not be reported.

Special payments given in return for services performed, I.E., commissions, bonuses, fees, prizes, are wages and reportable under the Employment Security Law of North Carolina. These payments (or dollar value of the gifts/prizes) are to be included in the payroll of each employee by the employer for the calendar quarter(s) in which they are given.

If no wages were paid, enter NONE.

ITEM 3: Enter the amount of wages paid during this quarter that is in excess of the applicable North Carolina taxable wage base. This entry cannot be more than item 2.

Example: An employer using the 2012 taxable wage base of $20,400 and reporting one employee, John Doe, earning $6,000 per quarter.

1ST QTR 2ND QTR 3RD QTR 4TH QTR

ITEM 2: |

$6,000.00 |

$6,000.00 |

$6,000.00 |

$6,000.00 |

ITEM 3: |

$3,600.00 |

|||

ITEM 4: |

$6,000.00 |

$6,000.00 |

$6,000.00 |

$2,400.00 |

ITEM 4: Subtract Item 3 from Item 2. THE RESULTS CANNOT BE A NEGATIVE AMOUNT.

ITEM 5: Multiply Item 4 by the tax rate shown on the face of this report. (Example: .012% = .00012) If the tax due is less than $5.00, you do not have to

pay it, but you must file a report.

NOTE: ITEMS 6,7, AND 8 MUST BE COMPUTED ONLY IF THE REPORT IS NOT FILED (POSTMARKED) BY THE DUE DATE.

ITEM 6: Multiply the tax due (Item 5) by the current interest rate for each month, or fraction thereof, past the due date. The applicable interest rate may be obtained at des.nc.gov or by contacting the nearest Division of Employment Security Office.

ITEM 7: Multiply the tax due (Item 5) by 5% (.05) for each month, or fraction thereof, past the due date. The maximum late filing penalty is 25% (.25).

ITEM 8: Multiply the tax due (Item 5) by 10% (.1). The minimum late payment penalty is $5.00.

ITEM 9: Enter the sum of Items 5, 6, 7 and 8. Remittance should be made payable to the Division of Employment Security.

IF YOUR FEDERAL IDENTIFICATION NUMBER AS PRINTED ON THE REPORT IS INCORRECT, ENTER THE CORRECT NUMBER IN THE SPACE PROVIDED. STATE TAX CREDITS WILL BE REPORTED TO THE INTERNAL REVENUE SERVICE USING THIS NUMBER. IF YOUR FEDERAL IDENTIFICATION NUMBER IS NOT PREPRINTED; ENTER IT IN THIS SPACE.

ITEM 10: Enter the federal Social Security number of every worker whose wages are reported on this form.

ITEM 11: Enter the name of every worker whose wages are reported on his form. If the last name is listed first, it must be followed by a comma.

ITEM 12: Enter an 'S' in this space if the wages reported are seasonal, otherwise leave this space blank. To report seasonal wages you must have

been determined a seasonal pursuit by this agency.

ITEM 13: Wages are reportable in the quarter paid to the employee, regardless of when the wages were earned. Enter each worker's total quarterly

wages paid, whether or not the worker has exceeded the taxable wage base for this year. Do not show credit or minus amounts to adjust for

ITEM 14: Enter the sum of wages shown in Item 13 for this page only. The sum of the page totals of all pages must equal the amount shown in Item 2.

Additional information is available at: des.nc.gov

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The NCUI 101 form is used to report an employer's quarterly tax and wage information to the North Carolina Division of Employment Security. |

| Filing Requirement | This report must be filed by the specified due date to avoid penalties and interest charges. |

| Governing Law | The submission of the NCUI 101 form is governed by North Carolina's Employment Security Law. |

| Covered Workers | Employers must report the number of all full-time and part-time workers who received pay during the payroll period that includes the 12th of the month. |

| Wages Reporting | Wages paid to employees, including part-time and temporary workers, must be reported for the quarter. |

| Excess Wages | Employers should report the amount of wages that exceed the applicable taxable wage base; this is denoted in Item 3. |

| Tax Calculation | The tax due is calculated by multiplying the taxable wages (after excess wages are deducted) by the applicable tax rate. |

| Penalties | Late filing and late payment penalties apply if the form is not submitted by the due date, with maximum penalties defined. |

| Federal Identification Number | Employers must enter their federal identification number, ensuring accuracy for state tax credits reported to the IRS. |

| Seasonal Wages | Employers can indicate if reported wages are seasonal by marking an 'S' on the form; they must have been deemed a seasonal pursuit. |

Guidelines on Utilizing Ncui 101

Filling out the Ncui 101 form is essential for employers to report their quarterly wages and taxes accurately. Completing this form can be straightforward if you follow the steps carefully. Make sure you have all necessary information on hand before you begin.

- Gather all relevant financial records, including payroll details for the quarter.

- Look for the "Employer's Quarterly Tax and Wage Report" header at the top of the form.

- Fill in the due date and account number for your business.

- For Item 1, count the number of covered workers you employed during the quarter. Record this for each of the three months.

- In Item 2, write down the total wages paid to all employees during the quarter, including part-time and temporary workers.

- If applicable, complete Item 3 by entering any wages that exceed the taxable wage base. If none, put zero.

- Calculate Item 4 by subtracting Item 3 from Item 2. Ensure this number is not negative.

- For Item 5, multiply the amount in Item 4 by your tax rate, which you can find on the form.

- If you filed late, calculate interest for Item 6 based on the current interest rate.

- Complete Item 7 by calculating the late filing penalty, which is 5% of the tax due for each month it is late, up to a maximum of 25%.

- In Item 8, calculate the late payment penalty at 10% of the tax due, with a minimum of $5.

- For Item 9, sum Items 5, 6, 7, and 8. This will be the total remittance amount.

- In Item 10, enter the Social Security number for each employee reported.

- List the names of all workers in Item 11, ensuring the correct format is used.

- If applicable, note if your wages are seasonal in Item 12.

- Enter each worker's total wages for the quarter in Item 13, without including over-reported amounts from other quarters.

- Finally, add up all wages reported on the page for Item 14 to ensure it matches Item 2.

- Sign and date the form to certify the information is accurate.

Once you have completed the Ncui 101 form, check for any missing information or errors before submitting it. Timely and accurate filing helps avoid potential penalties and ensures compliance with North Carolina tax requirements.

What You Should Know About This Form

What is the NCUI 101 form and who needs to file it?

The NCUI 101 form is an Employer's Quarterly Tax and Wage Report, used in North Carolina. Employers must file this report each quarter to report wages paid to workers and the corresponding payroll taxes. This includes all full-time and part-time workers who received pay during the payroll period that includes the 12th of the month. It applies to various business structures, including corporations and sole proprietorships, though the reporting requirements may differ slightly among them.

What information is required to complete the NCUI 101 form?

To complete the NCUI 101, the following information is required: the number of covered workers for each month of the quarter, total wages paid, any excess wages, the taxable wage amount, tax due, and possibly interest and penalties if filed late. Additionally, employers must provide the Social Security numbers and names of all workers, including seasonal designation if applicable. Accurate reporting of all wage-related information is essential to ensure compliance with state laws.

What penalties may apply if the NCUI 101 form is not filed on time?

Penalties for late filing of the NCUI 101 include interest on the tax due, a late filing penalty of 5% per month, and a late payment penalty of 10%. The maximum late filing penalty is capped at 25%. It is important for employers to meet the filing deadline to avoid these additional charges.

How is the tax due calculated on the NCUI 101 form?

The tax due is calculated by subtracting any excess wages from the total wages reported for the quarter. The remaining amount is then multiplied by the tax rate indicated on the form. If the calculated tax due is less than $5.00, the employer is not required to make a payment but still must file the report.

Where can I find additional resources or help regarding the NCUI 101 form?

Additional information about the NCUI 101 form, including filing instructions and deadlines, can be found on the North Carolina Division of Employment Security website at des.nc.gov. Employers may also contact their nearest Division of Employment Security Office for assistance with any specific questions or concerns regarding the reporting process.

Common mistakes

Filling out the NCUI 101 form can seem straightforward, but many individuals encounter pitfalls that can lead to errors. One common mistake is failing to accurately report the number of covered workers. Employers must record the total number of full-time and part-time workers who received payment during the payroll period that includes the 12th of the month. If this information is incorrect, it can affect tax calculations and indicate discrepancies in the report.

Another frequent error involves the wages paid during the quarter. Some employers may overlook part-time or temporary employees in their calculations. All wages need to be reported, including those for special payments like commissions or bonuses. If an employer mistakenly concludes that certain payments do not need to be included, they may face penalties for failing to accurately reflect total payouts.

A third mistake arises when reporting excess wages in Item 3. Employers often miscalculate these figures, leading to entries that do not align with the total wages paid in Item 2. The amount reported in Item 3 cannot exceed the wages in Item 2. Misunderstanding this can result in negative entries that are not permitted, causing further complications down the line.

Many individuals also misunderstand the instructions for calculating tax due, as described in Item 5. It's crucial to multiply the wages subject to tax (Item 4) by the tax rate accurately. When tax liabilities are miscalculated, employers may fail to remit the correct amount or end up overpaying, both of which can create compliance issues.

Failure to account for interest and penalties due to late filing is another common oversight. Items 6, 7, and 8 require careful consideration, especially if the report is submitted after the due date. Employers should be aware of how to calculate these penalties and the specific interest rates to apply in order to avoid unexpected financial repercussions.

Furthermore, some employers forget to provide their federal identification number correctly. This number is essential for reporting state tax credits to the Internal Revenue Service. If the federal identification number is incorrect or omitted, it may create administrative burdens and delays in processing.

Additionally, the Social Security numbers of employees must be reported accurately. Mistypes or omissions in this section can lead to significant problems, including confusion with the IRS or issues with employees' tax records. Employers must verify these numbers before submitting the form to ensure compliance.

Finally, a frequent mistake relates to the total wages in Item 14. Some employers do not check that the sum of wages reported on the page matches the total wages recorded in Item 2. Discrepancies can raise flags during audits, resulting in increased scrutiny or penalties. Ensuring the totals align is a critical last step in completing the NCUI 101 form.

Documents used along the form

In conjunction with the NCUI 101 form, there are several additional documents that employers may need to complete or submit to meet their reporting obligations. Each of these documents serves a specific purpose related to employee wages and taxation. Below are some common forms and documents that may be required.

- Form NCUI 101-A: This form is used to report changes in ownership, telephone number, or address. Employers must complete this form and submit it if there have been any relevant changes since the last submission.

- Form NCUI 686: Employers use this form to report any corrections to wages or taxes reported in previous quarters. This helps maintain accurate records with the North Carolina Division of Employment Security (DES).

- Form NCUI 500: This document is used for annual reporting of contributions due for unemployment insurance. It reflects the cumulative wages and taxes owed over the entire year.

- Form 941: This is a federal form used to report income taxes, social security tax, and Medicare tax withheld from employee's paychecks. Employers submit this form quarterly to the Internal Revenue Service (IRS).

- W-2 Forms: Employers issue W-2 forms to their employees at the end of each year. These forms summarize an employee’s annual wages and the taxes withheld throughout the year.

- Form 1099-MISC: This form is required for reporting income paid to independent contractors and freelancers. Unlike W-2s, which are for employees, 1099-MISC is used for reporting non-employee compensation.

It is essential for employers to keep accurate records and submit the appropriate forms in a timely manner. Doing so helps ensure compliance with both state and federal regulations regarding employment and taxation.

Similar forms

-

Form 941 - Employer's Quarterly Federal Tax Return: Similar to the NCUI 101, Form 941 is used to report income taxes, Social Security tax, and Medicare tax withheld from employees' paychecks. Both forms are filed quarterly and detail the wages paid to employees, ensuring compliance with tax laws at both the federal and state levels.

-

Form W-2 - Wage and Tax Statement: While the NCUI 101 is used for quarterly reporting, Form W-2 is issued annually to report wages paid and taxes withheld to the IRS and the employee. Both forms track employees' earnings and are essential for accurate tax reporting.

-

Form NC-4 - Employee's Withholding Certificate: This form is completed by employees to determine the amount of state tax to withhold from their wages. Like the NCUI 101, it involves the collection of wage information necessary for the state to assess tax withholdings accurately.

-

Form NCUI 101-A - Employer's Supplemental Report: This form serves to report changes in ownership, address, or other relevant information related to the employer. It complements the NCUI 101 by ensuring that additional pertinent information is accurately recorded and reported to the Division of Employment Security.

Dos and Don'ts

Things You Should Do:

- Provide accurate information about the number of covered workers for each month.

- Include all wages paid to employees, ensuring you account for part-time and temporary workers.

- Report special payments such as bonuses and commissions as part of wages.

- Enter the correct federal identification number if it is not preprinted.

- File the report by the due date to avoid penalties and interest.

Things You Shouldn't Do:

- Do not omit wages paid to corporate officers or other employees who performed services in North Carolina.

- Do not include draws or payments made to general partners of a partnership.

- Do not report payments to the proprietor’s family members, unless they are employees.

- Do not report negative amounts or adjust for over-reported wages in prior quarters.

- Do not forget to include wages reported on a prior page in the page total for Item 14.

Misconceptions

Misconceptions about the NTUI 101 form can lead to confusion for employers. Here are six common misunderstandings:

- Only full-time employees need to be reported. Employers must report both full-time and part-time employees who worked during the applicable payroll period.

- Wages of all partners or proprietors are reportable. In fact, draws paid to general partners or sole proprietors do not need to be reported. However, wages for other employees must be included.

- Seasonal wages can be reported arbitrarily. Employers should only report seasonal wages if they have been authorized as a seasonal pursuit by the agency.

- Filing online eliminates the penalty risks. While you can file the NCUI 101 form online, it must still be filed by the due date to avoid penalties and interest.

- Only wages over the taxable wage base count. All wages paid to employees must be reported, regardless of whether they exceed the taxable wage base.

- Corrections can be made on the same form. Corrections for past quarters should not be made on the current NCUI 101. Instead, employers should request a separate correction form.

Understanding these misconceptions can help employers avoid mistakes and ensure compliance.

Key takeaways

When filling out the NCUI 101 form, understanding several key points can help ensure compliance and accuracy. Here are four essential takeaways:

- Timely Filing is Crucial: Submit the NCUI 101 by the due date to avoid penalties and interest charges. Failure to file on time can lead to additional costs that may burden your business.

- Accurate Wage Reporting: Ensure that all wages paid to employees during the quarter are reported correctly. This includes part-time and temporary workers. Be aware of what to include and exclude based on your business type.

- Changes Must Be Reported: If there have been any changes in the ownership, address, or phone number, it's mandatory to complete the NCUI 101-A form. Keeping your records updated helps avoid potential issues.

- Double-Check Federal Identification Numbers: Verify that the federal tax ID number on the form is correct. If it is incorrect, enter the correct number in the designated space to ensure proper reporting to the IRS.

By following these guidelines when filling out the NCUI 101, you can alleviate stress and position your business for ongoing compliance with North Carolina employment regulations.

Browse Other Templates

Massage Therapy Invoice Template - Please provide your first and last name for identification.

Walmar - Provide your supervisor's contact number for efficient communication regarding your reference.