Fill Out Your Ndpc 13 Form

The Ndpc 13 form serves a crucial role in the estate administration process in North Dakota, particularly for personal representatives tasked with managing the affairs of a deceased individual. This form is known as the Personal Representative's Assignment and is used to legally transfer certain personal property from the estate of the deceased to a designated individual or entity. Typically, the form includes spaces for the names, addresses, and contact information of the personal representative and the assignee, ensuring that all parties involved are clearly identified. Additionally, it contains a statement affirming the personal representative’s authority to act, alongside the acknowledgment that the assignee is entitled to receive specified items from the estate. The document requires notarization, reinforcing its legitimacy. Overall, the effective use of the Ndpc 13 form helps facilitate a smooth transition of property, aligning with the legal requirements set forth under North Dakota law.

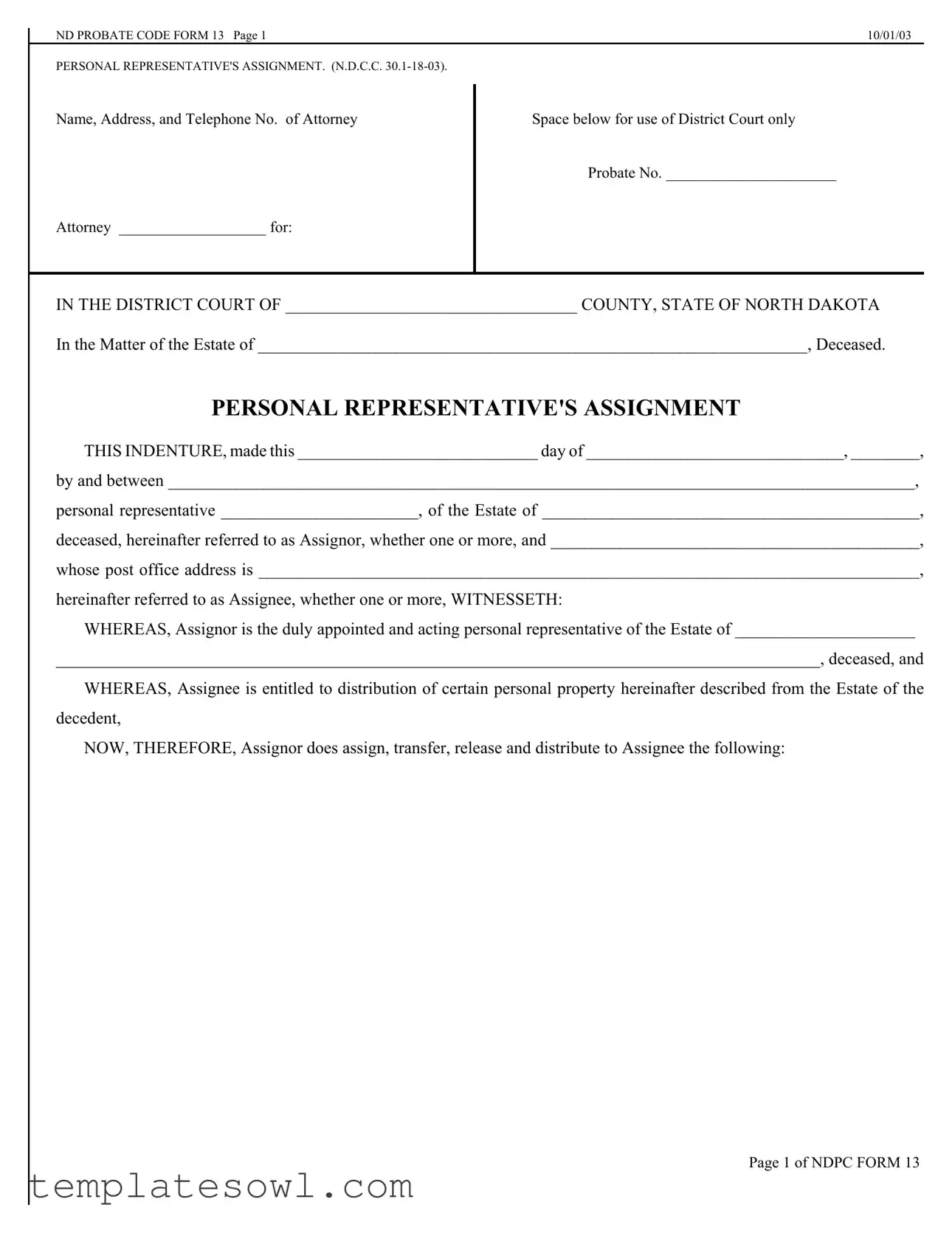

Ndpc 13 Example

ND PROBATE CODE FORM 13 Page 1 |

10/01/03 |

PERSONAL REPRESENTATIVE'S ASSIGNMENT. (N.D.C.C.

Name, Address, and Telephone No. of Attorney

Space below for use of District Court only

Probate No. ______________________

Attorney ___________________ for:

IN THE DISTRICT COURT OF __________________________________ COUNTY, STATE OF NORTH DAKOTA

In the Matter of the Estate of ________________________________________________________________, Deceased.

PERSONAL REPRESENTATIVE'S ASSIGNMENT

THIS INDENTURE, made this ____________________________ day of ______________________________, ________,

by and between _______________________________________________________________________________________,

personal representative _______________________, of the Estate of ____________________________________________,

deceased, hereinafter referred to as Assignor, whether one or more, and ___________________________________________,

whose post office address is _____________________________________________________________________________,

hereinafter referred to as Assignee, whether one or more, WITNESSETH:

WHEREAS, Assignor is the duly appointed and acting personal representative of the Estate of _____________________

_________________________________________________________________________________________, deceased, and

WHEREAS, Assignee is entitled to distribution of certain personal property hereinafter described from the Estate of the decedent,

NOW, THEREFORE, Assignor does assign, transfer, release and distribute to Assignee the following:

Page 1 of NDPC FORM 13

ND PROBATE CODE FORM 13 Page 2 |

|

10/01/03 |

PERSONAL REPRESENTATIVE'S ASSIGNMENT. (N.D.C.C. |

|

|

WITNESS, the hand of the Assignor: |

_____________________________________________ |

|

|

|

_____________________________________________ |

|

|

Personal Representative ____________________ of the |

|

|

Estate of _____________________________________, |

|

|

Deceased |

STATE OF NORTH DAKOTA |

} |

|

}ss.

County of ____________________ }

The foregoing instrument was acknowledged before me this __________________________________________, day of

____________________________________, ________, by ___________________________________________________,

personal representative______ of the estate of ______________________________________________________, deceased.

|

____________________________________________ |

|

Notary Public |

|

_________________________, County, North Dakota |

(Seal) |

My commission expires:_________________________ |

Page 2of NDPC FORM 13

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The NDPC 13 form is used for the assignment of property to beneficiaries from a deceased individual's estate in the state of North Dakota. |

| Governing Law | This form is governed by North Dakota Century Code (N.D.C.C.) Section 30.1-18-03, which outlines the responsibilities and powers of personal representatives in estate matters. |

| Affidavit Requirement | A notary public must acknowledge the signatures on the form, ensuring that the document is legally valid and that the individuals signing it are properly identified. |

| Personal Representative | The form designates the personal representative, who is responsible for managing the estate and distributing its assets according to the decedent's wishes and the law. |

Guidelines on Utilizing Ndpc 13

Filling out the NDPC 13 form requires attention to detail. This document needs to be completed accurately to ensure the proper assignment of estate assets. After completing the form, it needs to be signed and notarized before submission.

- Obtain the NDPC 13 form from a reliable source or legal authority.

- Fill in the Probate Number in the designated space.

- Enter the name, address, and telephone number of your attorney in the appropriate fields.

- In the section mentioning the District Court, fill in the county and state of North Dakota.

- Provide the name of the deceased individual in the area labeled “In the Matter of the Estate of.”

- In the “Assignor” section, write the name of the personal representative, who will also sign the document.

- Note the name of the Assignee, the person entitled to the distribution of personal property, including their post office address.

- In the section that follows, describe the personal property being assigned from the estate.

- Have the Assignor sign the form in the designated area.

- Complete the acknowledgment section by filling in the county, the date of acknowledgment, and the personal representative's name.

- Ensure there is space for the Notary Public's signature and seal, and indicate the expiration date of the notary's commission.

What You Should Know About This Form

What is the NDPC 13 form used for?

The NDPC 13 form, also known as the Personal Representative's Assignment, is utilized in North Dakota probate proceedings. It is specifically used by the personal representative of an estate to assign certain rights or distributions of personal property to another party, known as the Assignee. This formalizes the transfer of property after a decedent's death, clarifying who is entitled to what from the estate.

Who should complete the NDPC 13 form?

The personal representative of the estate is responsible for completing the NDPC 13 form. This individual has been appointed by the court to manage the estate's affairs. It is important that this person accurately represents the interests of the estate and acts in accordance with the decedent's wishes as outlined in their will, if one exists.

What information is required on the NDPC 13 form?

The form requires specific information, including the names and addresses of both the Assignor (the personal representative) and the Assignee. Additionally, it must include details about the deceased, including their name and the probate number. It is also necessary to specify the personal property being assigned from the estate.

Is it necessary to have the NDPC 13 form notarized?

Yes, the NDPC 13 form must be notarized. This means that the personal representative must sign the document in the presence of a notary public. The notary will then acknowledge this signature, adding an extra layer of legitimacy to the assignment. This helps to ensure that the transfer is recognized legally and can prevent disputes over the assignment later on.

Can anyone challenge an assignment made with the NDPC 13 form?

Yes, an assignment made via the NDPC 13 form can be challenged. Interested parties, such as heirs or beneficiaries, can dispute the validity of the assignment on various grounds. These might include claims that the personal representative acted improperly or that the assignment does not align with the decedent’s wishes or estate plan.

What happens after the NDPC 13 form is completed?

Once the NDPC 13 form is completed and notarized, it should be filed with the probate court as part of the estate administration process. This ensures that the assignment is officially recorded and recognized by the court. It also helps establish clear records of what property has been assigned and to whom, which is essential for the estate's proper management and distribution.

Where can I obtain the NDPC 13 form?

The NDPC 13 form can be obtained from multiple sources. Typically, it is available at local county probate court offices in North Dakota. Additionally, it can often be found on official state government websites or legal resource websites that provide probate forms. It is advisable to ensure that you are using the most recent version of the form to prevent any issues during the probate process.

Common mistakes

Filling out the NDPC Form 13 can be a straightforward process, but several common mistakes can lead to complications down the line. One prevalent error is the improper completion of the personal representative's information. The Assignor's name, address, and contact details must be clearly filled out. If any section is left blank or filled out incorrectly, this can result in delays or questions about the validity of the assignment.

Another frequent mistake occurs when individuals fail to provide complete information about the estate. The name of the deceased and all relevant details should be filled in with precision. Missing or incorrect information could cause issues when the court reviews the form. Remember, accuracy is crucial; omissions or errors here can hinder the distribution process of the estate.

A third common oversight involves the failure to have the document notarized. After the Assignor signs the assignment, it is essential to have it acknowledged by a notary public. If this step is neglected, the document may not hold up in court, which could potentially invalidate the assignment. Make sure all signatures are properly witnessed, as this adds a layer of authenticity to the document.

Lastly, people often overlook the completion of the probate number section. This number is assigned when the case is filed in court and should be included on the form. Leaving it blank can confuse the process, leading to further delays. It is critical to double-check that this number is accurate before submissions.

Documents used along the form

The NDPC 13 form, also known as the Personal Representative's Assignment, is utilized in the administration of an estate in North Dakota. This form is crucial for addressing the distribution of personal property by the personal representative to the interested parties. Alongside this form, several other documents may be required throughout the probate process. Each of these documents serves a specific purpose to facilitate the orderly and lawful transfer of assets.

- Affidavit of Heirship: This document establishes the rightful heirs of a deceased person's estate. It provides relevant details regarding the deceased, the heirs, and the relationship between them. It helps to confirm who is entitled to inherit under state law.

- Inventory of Assets: This form lists all the assets within an estate, including real property, bank accounts, and personal belongings. The inventory is essential for outlining what is available for distribution and is often filed with the court.

- Notice to Creditors: This document is filed to formally notify any creditors of the decedent’s estate regarding the probate proceedings. It specifies a deadline for creditors to submit any claims against the estate for consideration during the distribution process.

- Final Accounting: This report details all transactions made during the probate process, including income, expenses, and distributions to beneficiaries. The final accounting must be submitted to the court for approval before the estate can be closed.

These documents play a significant role in ensuring that the estate is managed and settled according to the law. Understanding each form's purpose can help individuals navigate the complexities of estate administration more effectively.

Similar forms

The NDPC 13 form is crucial in the probate process as it assigns personal property from a decedent's estate. Similar documents also serve important roles in estate management and distribution. Here are four documents that share key similarities with the NDPC 13 form:

- Last Will and Testament: Both documents outline how property should be distributed after death. The NDPC 13 facilitates the transfer of specific assets while the will outlines a broader strategy for all estate assets.

- Power of Attorney: This document grants an individual authority to make decisions on behalf of another. Like the NDPC 13, which allows a personal representative to act on behalf of an estate, the power of attorney enables someone to manage financial or health-related decisions.

- Small Estate Affidavit: In situations where an estate qualifies as small, this affidavit can expedite distribution without formal probate. Similar to the NDPC 13, it allows heirs to claim property efficiently, bypassing extensive legal proceedings.

- Declaration of Trust: A trust declaration appoints a trustee to manage assets for beneficiaries. Both the trust document and NDPC 13 involve the transfer of property, ensuring that it reaches the intended individuals in accordance with legal protocols.

Dos and Don'ts

When filling out the NDPC 13 form, it's crucial to ensure accuracy and clarity. Here are some important dos and don’ts to keep in mind:

- Do ensure all names are spelled correctly, including the names of the deceased and the personal representative.

- Do double-check that all relevant information is complete, including addresses and contact details.

- Do use clear and legible handwriting if filling out the form by hand.

- Do make sure to sign the document and have it notarized as required.

- Don't leave any sections blank; if a section does not apply, indicate that clearly.

- Don't use abbreviations or jargon that might confuse the reader.

- Don't submit the form without reviewing it for errors or omissions.

- Don't forget to keep a copy of the completed form for your own records.

Misconceptions

There are several misconceptions about the NDPC 13 form that can lead to confusion. Here are eight of the most common misunderstandings:

- The NDPC 13 form is only for lawyers. Many people believe that only attorneys can utilize this form. However, personal representatives can also complete the NDPC 13, as it pertains to their role in the probate process.

- This form is required for all estates. Not every estate requires the NDPC 13 form. It is specifically used for assigning personal property and may not be necessary if the estate comprises only real property.

- Once the form is submitted, it cannot be changed. In fact, modifications can be made to the NDPC 13 form before it is finalized. The personal representative should review the information carefully to ensure its accuracy.

- The NDPC 13 is the same as other probate forms. The NDPC 13 has a specific purpose for personal property assignment, distinguishing it from other forms used in probate proceedings.

- A notary public is optional for the NDPC 13. Acknowledgment by a notary public is required to validate the form. This step is crucial to ensure that the assignment is legally binding.

- Filling out the form guarantees a successful distribution of assets. While the NDPC 13 facilitates the assignment, successful distribution still depends on proper administration of the estate and addressing any outstanding debts or claims.

- There are no deadlines for submitting the NDPC 13. Timeliness matters in probate. Submit the NDPC 13 form promptly to adhere to the timelines established by state law.

- This form can be filed at any time during probate. The NDPC 13 must be filed once the personal property is ready for distribution but cannot be submitted until the personal representative is appointed.

Being aware of these misconceptions can help clarify the process for personal representatives as they navigate the responsibilities associated with managing an estate.

Key takeaways

Filling out the NDPC 13 form is a critical step for personal representatives managing an estate in North Dakota. Understanding the essentials can help ensure the process goes smoothly. Here are some key takeaways:

- Personal Representative's Role: The personal representative, often referred to as the executor, holds a vital responsibility in administering the estate. This individual must ensure that all assets are properly assigned and distributed according to the decedent's wishes and state laws.

- Accurate Information is Essential: When completing the form, accuracy in detailing the names, addresses, and relationships is crucial. Errors can lead to delays and complications in the probate process.

- Witness and Notary Requirements: Acknowledgment by a notary public is necessary for the form to be legally binding. This step affirms that the personal representative is acting in good faith and agrees to the terms of the assignment.

- Distribution of Assets: The NDPC 13 form facilitates the transfer of specific assets from the estate to the rightful beneficiaries. Clearly list these assets to prevent any misunderstandings among heirs or beneficiaries.

Browse Other Templates

Cbp Form 3078 - Applicants must list any other names they have been known by, such as nicknames or aliases.

Boeing Advantage+ Health Plan - The privacy of your information will be maintained according to Boeing's security policies.