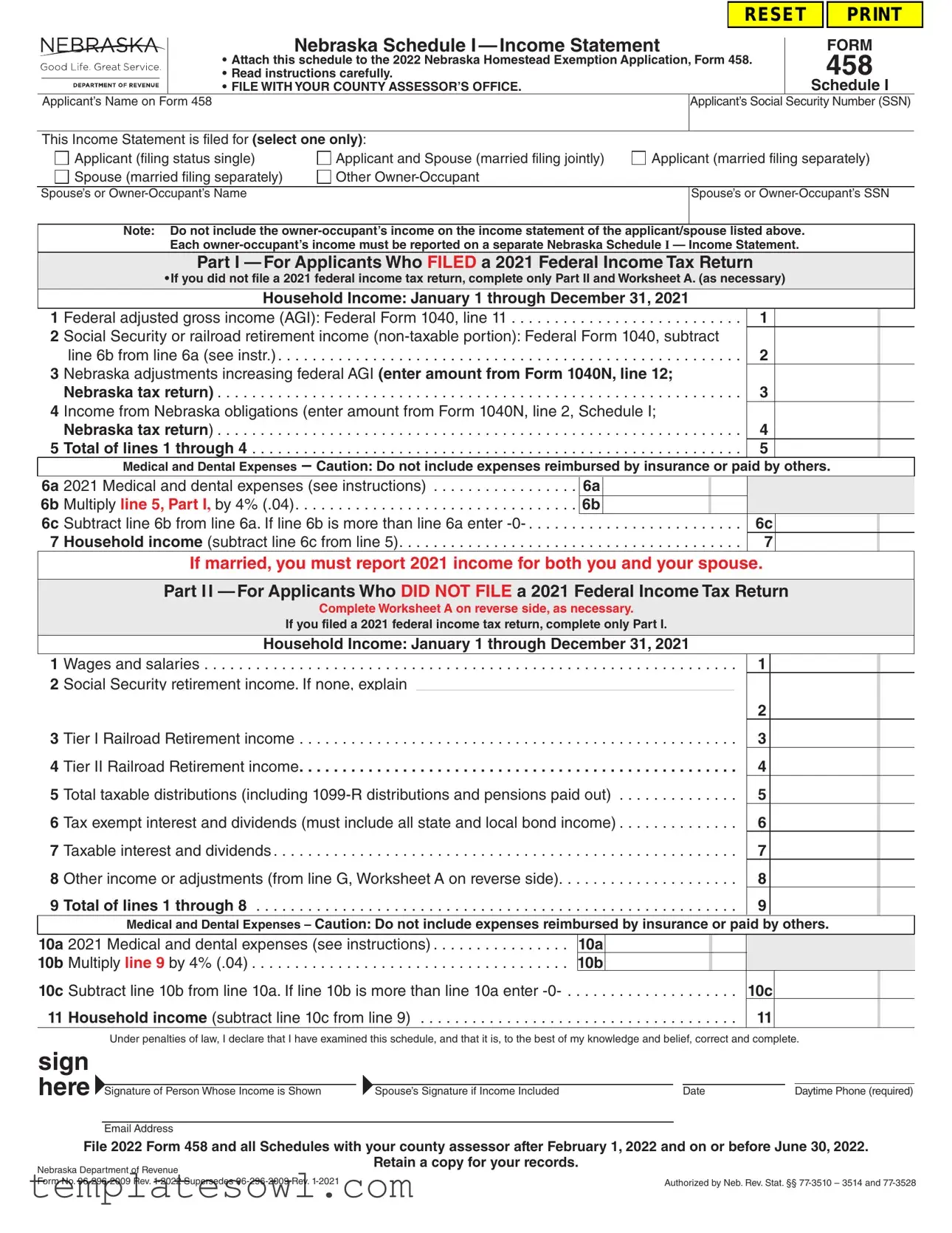

Fill Out Your Ne 458 Form

The Nebraska Department of Revenue Form NE 458, commonly known as the Homestead Exemption Application, plays a critical role in assisting eligible homeowners in Nebraska to claim a reduction in property taxes. This form, issued by the state department, ensures that consumers can effectively apply for tax relief designed for individuals who meet specific income and residency criteria. The completion of the NE 458 is not standalone; it requires the attachment of Schedule I, which is the Income Statement. This section demands detailed reporting of household income, including federal adjusted gross income, social security benefits, and applicable adjustments. Understanding the distinction between married and single filings is essential, as it dictates the required income disclosures. The form also includes provisions for individuals who did not file a federal tax return, requiring the completion of Worksheet A to assess total household income accurately. Furthermore, the guidelines explicitly state which types of income should not be included, such as certain disability benefits and various forms of governmental aid. Filing deadlines, specific instructions, and the reporting process through the county assessor's office are critical components of the NE 458 framework, designed to facilitate accurate processing and eligibility determination for homeowners seeking tax relief.

Ne 458 Example

|

|

|

|

|

|

|

RESET |

|

|

|

|||

|

|

|

|

Nebraska Schedule |

|

|

|

|

|

FORM |

|

||

|

|

|

|

|

|

|

|

||||||

|

|

|

• Attach this schedule to the 2022 Nebraska Homestead Exemption Application, Form 458. |

|

458 |

|

|

||||||

|

|

|

• Read instructions carefully. |

|

|

|

|

|

|

||||

|

|

|

• FILE WITH YOUR COUNTY ASSESSOR’S OFFICE. |

|

|

|

|

Schedule I |

|

||||

|

Applicant’s Name on Form 458 |

|

|

Applicant’s Social Security Number (SSN) |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

This Income Statement is filed for (select one only): |

|

|

|

|

|

|

|

|

|

|||

|

Applicant (filing status single) |

Applicant and Spouse (married filing jointly) |

Applicant (married filing separately) |

|

|||||||||

|

Spouse (married filing separately) |

Other |

|

|

|

|

|

|

|

|

|

||

Spouse’s or |

|

|

Spouse’s or |

|

|

||||||||

Note: Do not include the

Part I

• If you did not file a 2021 federal income tax return, complete only Part II and Worksheet A. (as necessary)

|

Household Income: January 1 through December 31, 2021 |

|

|

|

||||||

1 |

Federal adjusted gross income (AGI): Federal Form 1040, line 11 |

. . . . . . . . . |

1 |

|

|

|||||

2 |

Social Security or railroad retirement income |

|

|

|

||||||

|

line 6b from line 6a (see instr.) |

. |

. |

. . . . 對 |

. . . . . . . . . |

2 |

|

|

||

3 |

Nebraska adjustments increasing federal AGI (enter amount from Form 1040N, line 12; |

|

|

|

||||||

|

Nebraska tax return). . . . . . . . . . . . . . . . . . 對 . . . |

. . . . . . . . . . |

3 |

|

|

|||||

4 |

Income from Nebraska obligations (enter amount from Form 1040N, line 2, Schedule I; |

|

|

|

||||||

|

Nebraska tax return) |

. |

. |

. 對 . . . |

. . . . . . . . . . |

4 |

|

|

||

5 |

Total of lines 1 through 4 |

. |

. |

. . . 對 . |

. . . . . . . . . . |

5 |

|

|

||

|

Medical and Dental Expenses – Caution: Do not include expenses reimbursed by insurance or paid by others. |

|||||||||

6a |

2021 Medical and dental expenses (see instructions) |

6a |

|

|

|

|

|

|||

6b |

Multiply line 5, Part I, by 4% (.04) |

|

|

|

6b |

|

|

|

|

|

6c |

Subtract line 6b from line 6a. If line 6b is more than line 6a enter |

. . . . . . . . . |

6c |

|

|

|||||

7 |

Household income (subtract line 6c from line 5). . . . . . . . . . . . . . . . . 對 . . |

|

|

|

7 |

|

|

|||

If married, you must report 2021 income for both you and your spouse.

Part I I

Complete Worksheet A on reverse side, as necessary.

If you filed a 2021 federal income tax return, complete only Part I.

Household Income: January 1 through December 31, 2021

1 |

Wages and salaries |

. 對 |

||||

2 |

Social Security retirement income. If none, explain _______________________________________________ |

|||||

|

_ ________________________________________________________________________________________________ |

|||||

3 |

Tier I Railroad Retirement income |

. |

. |

. |

. |

. . 對 |

4 |

Tier II Railroad Retirement income |

. . . . . . . 對 |

||||

5 |

Total taxable distributions (including |

|||||

6 |

Tax exempt interest and dividends (must include all state and local bond income) |

|||||

7 |

Taxable interest and dividends |

. . . . . 對 |

||||

8 |

Other income or adjustments (from line G, Worksheet A on reverse side) |

|||||

9 |

Total of lines 1 through 8 |

. |

. |

. |

. |

對 |

1

2

3

4

5

6

7

8

9

Medical and Dental Expenses – Caution: Do not include expenses reimbursed by insurance or paid by others.

10a |

2021 Medical and dental expenses (see instructions) |

10a |

|

|

|

|

|

10b |

Multiply line 9 by 4% (.04). . . . . . . . . . . . . . . . . . 對 . |

10b |

|

|

|

|

|

10c |

Subtract line 10b from line 10a. If line 10b is more than line 10a enter |

. . . . . . . . . |

10c |

|

|

||

11 |

Household income (subtract line 10c from line 9) |

. . . . . . . . 對 . |

11 |

|

|

||

Under penalties of law, I declare that I have examined this schedule, and that it is, to the best of my knowledge and belief, correct and complete.

sign here

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

Signature of Person Whose Income is Shown |

|

Spouse’s Signature if Income Included |

|

Date |

Daytime Phone (required) |

|||

Email Address

File 2022 Form 458 and all Schedules with your county assessor after February 1, 2022 and on or before June 30, 2022.

Retain a copy for your records.

Authorized by Neb. Rev. Stat. §§

|

|

|

Worksheet |

|

|

|

FORM 458 |

||

|

|

|

|

|

|||||

|

|

|

Line 8, Other Income or Adjustments |

|

|

|

Schedule I |

||

|

|

|

|

|

|

Worksheet A |

|||

|

|

|

|

|

|

|

|

||

|

.........................................................A Net business income including rental, or farm income, or (loss) |

A |

|

|

|

||||

|

B Capital gain or (loss) |

B |

|

|

|

||||

|

C Other gain or (loss) |

C |

|

|

|

||||

|

D Unemployment compensation |

D |

|

|

|

||||

|

E Any other income or adjustments reducing income. Explain: |

|

|

E |

|

|

|

||

|

F Penalty on early withdrawal of savings |

F |

|

|

|

||||

|

G Total of lines A through E, minus line F (enter this amount here and on Part II, line 8) |

G |

|

|

|

||||

|

|

|

Retain a copy for your records. |

|

|

|

|

|

|

|

|

|

Instructions |

|

|

|

|

|

|

Who Must File. This Form 458 Schedule I must be filed by persons applying for a homestead exemption, who are not filing as a veteran drawing compensation from the Department of Veteran’s Affairs (DVA) or as a paraplegic veteran or multiple amputee whose home was substantially contributed to by the DVA. This form is to be attached to and filed with the Nebraska Homestead Exemption Application or Certification of Status, Form 458. (See Form 458 Instructions). If you filed, or would have filed as married for Nebraska individual income tax purposes for 2021, you must include income for both you and your spouse, even if you filed as “married, filing separately.” Each additional owner who occupied the homestead during any part of 2021 must also report their income on a separate schedule.

When and Where to File. Schedule I must be attached to the Form 458 and FILED WITH YOUR COUNTY ASSESSOR, after February 1, 2022 and on or before June 30, 2022.

Specific Instructions

Note – Do NOT include the following on the income statement:

•Department of Veterans Affairs disability compensation;

•Supplemental Security Disability Income (SSDI);

•Worker’s Compensation Act payments;

•Child support payments;

•Aid to Dependent Children (ADC); and

•Nebraska Department of Health and Human Services aid.

Exclude Social Security payments based on disability for applicants and spouses under their full retirement age (generally age 66) EXCEPT for any portion of the benefits included in federal adjusted gross income (AGI). Disability benefits automatically convert to retirement benefits at full retirement age and must be reported. See SSA Publication No.

Part I

Line 1, Federal AGI. Include income as reported for federal income tax purposes on line 11, Federal Form 1040 for tax year 2021.

Line 2, Social Security Retirement Income and/or Railroad Retirement Income. Enter retirement benefits minus any portion included as taxable in AGI (Line 6b, Federal Form 1040, minus any amount reported on line 6a, Federal Form 1040). Do NOT subtract Medicare premiums or any other adjustments from the amount in Box 6.

Line 3, Nebraska Adjustments Increasing federal AGI. Report the total amount of Nebraska adjustments increasing federal AGI as shown on line 12, Nebraska Form 1040N. Do not reduce this amount. Amounts on line 13 of the Form 1040N are not allowed.

Line 4, Income From Nebraska Obligations. Include the total amount of interest income from Nebraska obligations as shown on line 2, Schedule I, Nebraska Form 1040N.

Line 5, Total of Lines 1 Through 4. Add all amounts listed in lines 1 though 4. Put the total amount on line 5. Line

Line 7. Household Income. This amount represents your household income. Household income table can be located at

Part II

Line 1, Wages and Salaries. Include any wages, salaries, fees, commissions, tips, bonuses, etc. received in 2021, even if you do not have a Federal Form

Line 2, Social Security Retirement Income. Report net benefits received in 2021, as shown in Box 5, Federal Form SSA‑1099. Do NOT subtract Medicare premiums or any other adjustments from the amount in Box 5.

Line 3, Tier I Railroad Retirement Income. Include Tier I net Social Security equivalent benefit received in 2021, as shown in Box 5, Federal Form

Line 4, Tier II Railroad Retirement Income. Include Tier II Railroad retirement income received in 2021, as shown in Box 7, Federal Form

Line 5, Total Taxable Distributions. On line 5, report the taxable amount from Box 2(a), Form 1099‑R. Report any taxable portion of any pensions received. Do not report any amount from a qualified IRA rollover. See Federal Form

Line 6, Tax Exempt Interest and Dividends. Report the total interest received in 2021 on tax exempt obligations as shown in:

1.Box 8, Federal Form

2.Box 11, Federal Form

3.Box 11, Federal Form

State and local bond income from both Nebraska and

Line 7, Taxable Interest and Dividends. Include your total interest and dividends received in 2021, as shown in:

1.Box 1 and Box 3, Federal Form

2.Box 1 and Box 2, Federal Form

3.Box 1a and Box 2a, Federal Form

Interest and dividends from all U.S. government obligations must be included.

Line 8, Other Income or Adjustments. Complete Worksheet A and enter the amount from line G. Line 9, Total of Lines 1 Through 8. Add all amounts listed in lines 1 through 8. Put total amount on line 9. Line

Line 11. Household Income. This amount represents your household income. Household income table can be located at

Medical Expenses Instructions

Part I, Line 6a or Part II, Line 10a

“Medical expenses paid” includes all 2021 medical expenses incurred for and paid by the applicant, spouse, or

In general, medical expenses include any payments you made that would qualify for the income tax medical expenses deduction on Federal Form 1040, Schedule A, line 1; except payments for the treatment of a dependent who is not an

Reimbursements. Do not include any amounts you paid that have been or will be reimbursed by insurance. Doctors, Dentists, Hospitals. Include amounts paid for medical services such as:

1.Payments to doctors, dentists, osteopaths, nurses, chiropractors, and other licensed medical practitioners;

2.Payments to hospitals or licensed nursing care facilities; and

3.Payments for purchases of medical equipment, crutches, hearing aids, eyeglasses, contact lenses, dentures, etc.

Do not include funeral, burial, or cremation costs.

Prescription Medicines. Include payments for prescription medicines and insulin. Prescription medicines are only those drugs and medicines that cannot be purchased without a prescription.

Do not include any medicine that can be purchased

Health Insurance Premiums. Include insurance premiums paid for medical insurance for the applicant, spouse, or

Do not include: Medicare Part A deductions withheld from wages;

Worksheet

Note: Retain a copy for your records.

Line A, Net Business Income Including Rental, or Farm Income, or (Loss). Report your 2021 net

income. For information on computing the income, refer to the following federal schedules and instructions:

1.For business income, see Schedule C, Federal Form 1040, or Schedule

2.For income from rental real estate, royalties, partnerships, S corporations, trusts, REMICs, etc., see Schedule E, Federal Form 1040; and

3.For farm income, see Schedule F, Federal Form 1040.

Line B, Capital Gains or (Loss). Include all income or loss resulting from the sale of stock, bonds, or real estate from

Line C, Other Gains or (Loss). Report all other gains or losses on tangible or intangible property not included on line A or line B. See Federal Form 4797.

Line D, Unemployment Compensation. Include all unemployment compensation received for 2021 from Box 1, Federal Form

Line E, Any Other Income or (Adjustments Reducing Income). Report all other taxable income from Federal Form 1099‑MISC and taxable state income tax refunds reported on Federal Form

Subtract the calculated adjustments from the calculated “other income” and enter the net income or loss on line E.

Line F, Penalty on Early Withdrawal of Savings. Report your total amount of penalties for early withdrawal of savings from Box 2, Federal Form

Note: A homestead exemption percentage is subject to change based upon the review by the Tax Commissioner of any information necessary to determine whether an application is in compliance with Neb. Rev. Stat. §§ 77‑3501 to

For more information, contact your local county assessor’s office, or

visit

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The Nebraska Schedule I Income Statement (Form 458) is used for reporting income by individuals applying for the Homestead Exemption. |

| Filing Requirement | Applicants must file this form with their County Assessor’s Office along with the Homestead Exemption Application. |

| Submission Period | Forms must be submitted after February 1, 2022, and by June 30, 2022. |

| Applicable Law | This form is authorized under Nebraska Revised Statutes §§ 77-3510 – 3514 and 77-3528. |

| Exclusion of Certain Income | Certain types of income, such as VA disability compensation and SSDI, must not be included in the income statement. |

| Filing Status Options | Applicants can select their filing status as single, married filing jointly, married filing separately, or other owner-occupant. |

| Medical Expense Reporting | Applicants should report medical and dental expenses paid in 2021, excluding any reimbursed amounts. |

| Federal AGI Reporting | Federal Adjusted Gross Income (AGI) from the 2021 tax return is required to determine the household income. |

| Owner-Occupant Income Separation | Each owner-occupant’s income must be reported on separate schedules to ensure accurate accounting. |

| Documentation Retention | Applicants are advised to retain a copy of the completed form and schedules for their records. |

Guidelines on Utilizing Ne 458

Filling out the Nebraskan Form 458 can be a straightforward process if you follow each step carefully. This form plays a crucial role for individuals applying for a homestead exemption. Ensure that you have all necessary documents and information before you begin.

- Obtain Form 458 and Schedule I from the Nebraska Department of Revenue website or your local county assessor's office.

- Fill in the applicant’s name and Social Security Number (SSN) at the top of Schedule I.

- Select the appropriate filing status for the applicant and spouse. Choose from: single, married filing jointly, married filing separately, or other owner-occupant.

- If applicable, enter the spouse’s or other owner-occupant’s name and SSN.

- Proceed to Part I if you filed a 2021 federal tax return. If not, complete Part II instead.

- For Part I, report your federal adjusted gross income (AGI) as indicated on line 11 of your 2021 Federal Form 1040.

- Include any non-taxable Social Security or railroad retirement income on line 2, following the instructions provided.

- Complete line 3 by entering the Nebraska adjustments that increase your federal AGI from your Nebraska tax return.

- On line 4, enter income from Nebraska obligations as shown on your Nebraska tax return.

- Add lines 1 through 4 and enter the total on line 5.

- Report your medical and dental expenses on lines 6a through 6c, ensuring to follow the provided instructions.

- Calculate your household income by subtracting line 6c from line 5 and enter this amount on line 7.

- If you did not file a 2021 federal tax return, complete Part II and fill in the applicable income sources as instructed.

- Once all sections are complete, sign and date the form. Include your daytime phone number and email address.

- Make a copy of the completed form for your records.

- Submit Form 458 and all attached schedules to your county assessor's office by June 30, 2022.

Be sure to keep an eye on the deadlines and file your documents promptly. If you have questions about the information required or your eligibility, consider reaching out to your local county assessor's office or visiting the Nebraska Department of Revenue website for further assistance.

What You Should Know About This Form

What is the purpose of Nebraska Form NE 458?

The Nebraska Form NE 458 is used for applying for a homestead exemption. This exemption is designed to reduce the amount of property tax owed by eligible homeowners, particularly those who are seniors, disabled, or meet specific income criteria. By filling out this form, residents provide necessary information regarding their income and eligibility for the exemption, leading to substantial tax savings.

Who needs to file Form NE 458?

Any homeowner who wishes to apply for a homestead exemption in Nebraska must file Form NE 458. This includes single applicants, married couples filing jointly or separately, and other owner-occupants. However, veterans receiving compensation from the Department of Veterans Affairs typically do not need to file this form for the exemption. It's important to note that all income for both spouses must be reported if they filed taxes together, even if they file separately for the homestead exemption application.

When and where should I file Form NE 458?

Form NE 458 must be filed with your county assessor. The application period opens after February 1st and closes on June 30th each year. It’s crucial to remember not to wait too long, as late submissions can lead to disqualification from receiving the homestead exemption for that tax year. Ensure that you've attached any required schedules, including Schedule I, when filing.

What income should be reported on Form NE 458?

When completing Form NE 458, applicants must report their federal adjusted gross income (AGI) and other specific sources of income. Examples include wages, pensions, and Social Security retirement benefits. However, some income sources, such as Department of Veterans Affairs disability compensation and child support payments, should be excluded from your reported income. It’s essential to read the instructions carefully and complete Worksheet A if you did not file a federal tax return, to ensure accurate reporting.

What happens after I submit Form NE 458?

After submitting your completed Form NE 458 to your county assessor, the application will be reviewed for eligibility. You should keep a copy of your submission for your records. The Tax Commissioner will assess whether your application meets the necessary criteria, and they will take action within three years if adjustments to your exemption percentage are needed based on the provided information. If you have any questions or require assistance, contacting your local county assessor’s office is a wise choice.

Common mistakes

Filling out the Nebraska Schedule I — Income Statement, Form 458, can be a daunting process. Errors can lead to delays or even denials of the homestead exemption. One common mistake people make is failing to read the instructions carefully. Skipping this step can result in missing essential details about eligibility criteria or required documentation.

Another frequent error occurs when applicants do not report income accurately. Each owner-occupant must report their income on separate schedules. Failure to do this can lead to incomplete information, which may jeopardize the entire application. It is crucial to ensure that all required income amounts, especially in Lines 1 through 4, are correctly summed up on Line 5.

Not including necessary tax-exempt income can also be a significant mistake. Participants often overlook reporting income from Nebraska obligations, which should be included in Line 4. Missing this can make it appear as if the total household income is lower than it actually is, potentially affecting the exemption calculation.

In addition, many applicants neglect to sign the form appropriately. The signature of the person whose income is being reported is required. If the applicant is married, the spouse’s signature is also needed if their income is included. Forgetting to do so can lead to processing delays or outright rejection of the form.

Providing inaccurate medical and dental expense calculations represents another common pitfall. For medical expenses, only include the amount paid that is deductible. Reimbursement amounts or expenses paid by others should not be included. This can lead to a miscalculation in household income, further complicating your claim.

Lastly, missing the filing deadline can have serious consequences. Schedule I must be attached to your Homestead Exemption Application and filed with your county assessor's office after February 1 and on or before June 30. Inability to meet this deadline may result in the loss of your eligibility for the exemption for that tax year.

Documents used along the form

The Nebraska Homestead Exemption Application involves various forms and documents to accurately assess eligibility. Among these, Nebraska Form 458, also known as Schedule I, stands out as a central component. However, applicants may also need to familiarize themselves with additional documents that complement this form. Below is a concise overview of these essential forms and documents.

- Form 458: This is the primary application form for the Nebraska Homestead Exemption. It collects general information about the applicant and their qualifying homestead, establishing the foundation for the exemption process.

- Worksheet A: This worksheet is used in conjunction with Form 458 to provide detailed income information. Applicants must calculate their total income and any necessary adjustments, which aids in determining eligibility.

- Nebraska Form 1040: The standard state income tax form, which applicants may need to refer to in order to report their federal adjusted gross income. It is helpful for understanding overall financial obligations and income.

- Nebraska Form 1040N: This form is specific to Nebraska and captures state-level income along with any adjustments. Applicants will often reference this when completing the Schedule I Income Statement.

- Form SSA-1099: This is a Social Security benefit statement. If the applicant receives Social Security Income, this document outlines the total benefits distributed and impacts the income calculation on Schedule I.

- Form RRB-1099: For applicants receiving Railroad Retirement Benefits, this form details their benefit payments. It is crucial for accurately reporting Tier I and Tier II income.

- Federal Form 1099-R: This document reports distributions from pensions, annuities, retirement, or profit-sharing plans. It helps determine total taxable distributions that must be reported in the income statement.

- Form 1040X: The amended U.S. individual income tax return may be used if an applicant needs to correct information previously reported on their federal tax return. Corrections can impact eligibility for the homestead exemption.

- Form 1099-G: This form outlines any unemployment compensation received. Applicants must account for this income when calculating their total household income for the homestead exemption.

Understanding these accompanying forms and documents can significantly streamline the application process for Nebraska's Homestead Exemption. Proper and timely submission increases the likelihood of successfully receiving the exemption, ultimately providing critical financial relief for eligible homeowners.

Similar forms

- Form 1040 - The federal income tax return form where individuals report their annual income. Similar to the NE 458 form, it requires detailed income information from various sources to determine tax liability or eligibility for certain exemptions.

- Form 1040-NR - This is used by non-resident aliens to report income. It shares similarities with the NE 458 form in that both forms require income reporting, though each serves different taxpayer audiences.

- Form W-2 - Issued by employers, this form summarizes an employee's annual earnings and the taxes withheld. Like the NE 458 form, it is a critical document for determining total income for exemption applications.

- Schedule A - This schedule is used to report itemized deductions on the federal tax return. Both the Schedule A and NE 458 include deductions that can affect total income reported for tax and exemption purposes.

- Form 1099 - Issued for various types of non-employment income, such as freelance work or interest income. Similar to the NE 458, this form helps to detail income sources necessary for exemption calculations.

- Form 1040X - This is used for correcting errors on a previously filed 1040 form. It bears resemblance to the NE 458 in that both forms might be revised to reflect accurate income for exemption status.

- Form 1040-SR - Designed for seniors, this tax form allows older taxpayers to claim income and deductions. Just like the NE 458, this highlights the importance of income reporting for tax benefits.

- Nebraska Schedule II - This specific schedule assesses property valuation similarly to Schedule I on the NE 458. Both play a role in assisting the application for homestead exemptions based on income and property assessment.

Dos and Don'ts

When filling out the Nebraska Schedule I – Income Statement (Form 458), here are five things to keep in mind:

- Read the instructions carefully before starting the form.

- Ensure you file the completed form with your county assessor’s office.

- Include the correct income information for both you and your spouse, if applicable.

- Attach the Schedule I to your homestead exemption application.

- Retain a copy of the completed form for your records.

Additionally, here are five common mistakes to avoid:

- Do not include the income of the owner-occupant on the applicant's income statement.

- Avoid omitting any necessary income information; this includes Social Security income correctly reported.

- Never mix medical expenses that have been reimbursed or paid by others; only include your out-of-pocket expenses.

- Do not forget to sign and date the form before submission.

- Do not submit the form after the deadline of June 30, 2022.

Misconceptions

- Misconception 1: The NE 458 form is only for veterans.

- Misconception 2: You can file the NE 458 form any time of the year.

- Misconception 3: All income is included when filling out the Income Statement.

- Misconception 4: If I file “married filing separately,” I do not need to report my spouse’s income.

- Misconception 5: The NE 458 form requires a long and detailed process.

- Misconception 6: You do not need to attach anything to the NE 458 form.

- Misconception 7: Once I submit the NE 458 form, I won’t hear anything back.

- Misconception 8: Only low-income individuals can apply for exemptions with the NE 458 form.

- Misconception 9: If my income changes after submitting the form, it won’t matter.

This form is intended for individuals applying for a homestead exemption and is not limited to veterans. Certain exemptions do apply to veterans, but the form is available to all eligible applicants.

The form must be filed with your county assessor after February 1 and no later than June 30 of the year you are applying for a homestead exemption.

Not all income is included. For example, certain disability benefits and child support payments should not be reported on the NE 458 form.

This is incorrect. If you filed as married for tax purposes, you must still include both you and your spouse’s income on the NE 458 form.

While it does require some information, the form can be filled out by following the instructions provided and it does not have an overly complicated format.

You must attach Schedule I — Income Statement to the NE 458 application when submitting it to the county assessor's office.

You may receive confirmation or further communication regarding your application from the county assessor’s office, depending on their processes.

Eligibility for a homestead exemption can vary by specific criteria, and it is not solely based on income level.

Changes in income can affect your eligibility for the homestead exemption. It’s important to report any significant changes to the county assessor's office.

Key takeaways

Completing the Nebraska Schedule I — Income Statement (Form NE 458) is essential for individuals applying for a homestead exemption. Below are key takeaways regarding the process and requirements:

- This form must be attached to the 2022 Nebraska Homestead Exemption Application (Form 458).

- Applicants should carefully read the provided instructions before completing the form.

- It is crucial to file the completed form with your county assessor’s office between February 1, 2022, and June 30, 2022.

- Only the income of the listed applicant (and spouse if applicable) should be reported; each owner-occupant must file a separate income statement.

- If you filed a 2021 Federal Income Tax Return, complete Part I. If you did not file, focus on Part II and Worksheet A.

- Under penalties of law, you must sign the form, verifying your information is accurate and complete.

- Do not include certain types of income, such as Veteran’s Affairs disability compensation and Worker’s Compensation payments.

- The calculation of household income is vital. It considers wages, retirement income, and other specified income types.

- Medical and dental expenses must be reported accurately but exclude any amounts reimbursed by insurance.

- Retain a copy of the completed form for your records after filing.

Following these guidelines will facilitate a smoother application process for the homestead exemption. For further clarification, contacting your local county assessor’s office is advisable.

Browse Other Templates

Lgr2 - Document if your business is sold or discontinued.

Payroll Calendar Template - Pay dates are aligned with the completion of timesheets.

Boiler Operator Job Description - Sign the renewal form to validate your submission.