Fill Out Your Net 30 Terms Order Form

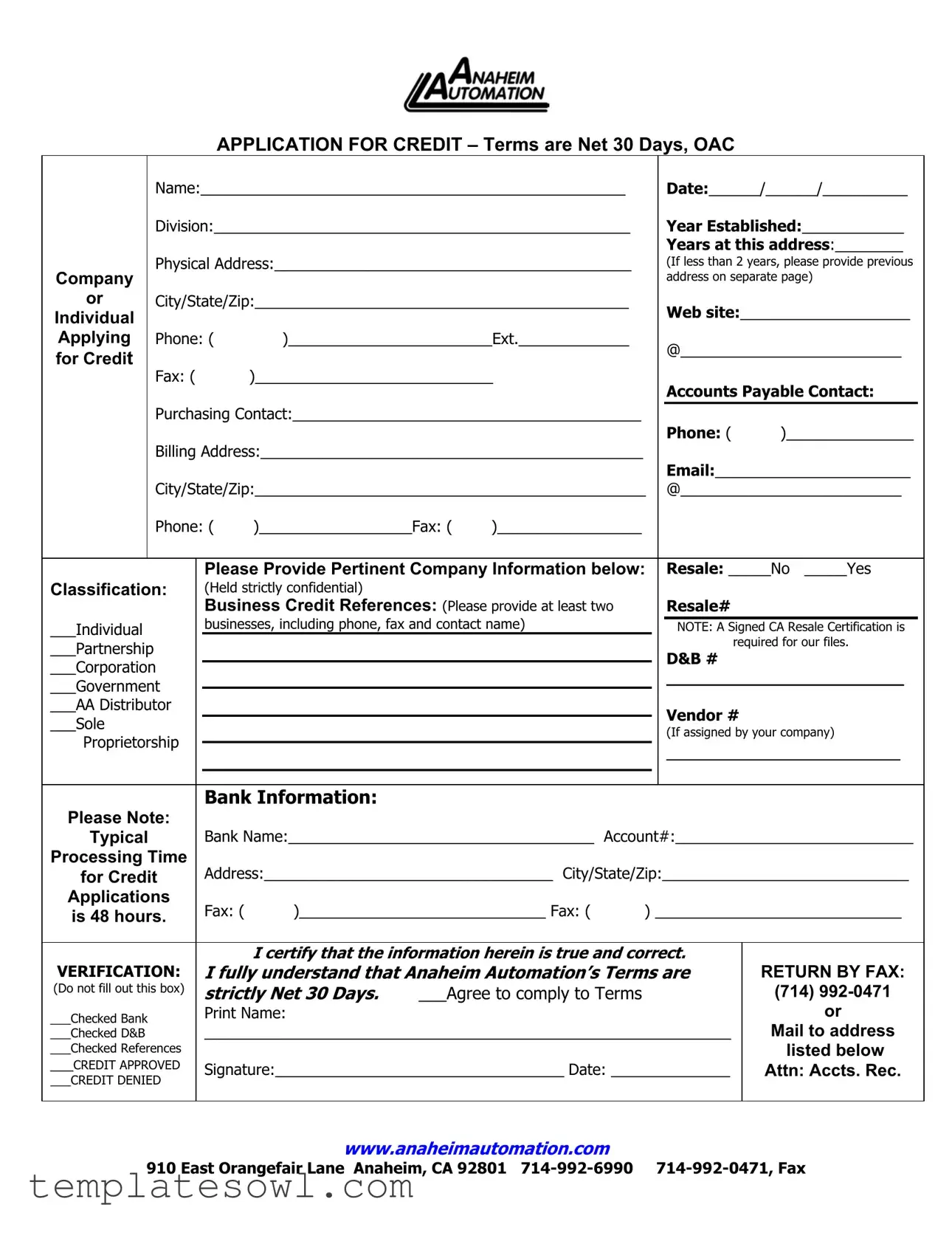

Understanding the Net 30 Terms Order form is crucial for businesses seeking to establish credit with suppliers. This form lays out essential details that facilitate the credit application process. It begins by capturing basic identifying information about the applicant, including name, division, and the date of the application. Additionally, it requests the physical address of the business, which is vital for verifying its legitimacy. Applicants must specify how long they have operated at that address and, if applicable, provide a previous address if they have been in operation for less than two years. The form also requires the name and contact details of the person applying for credit, as well as accounts payable and purchasing contacts. To further assess the applicant's creditworthiness, it asks for vital business information, such as resale status, classification, and relevant credit references. Additionally, it incorporates a section for bank details, making it easier for suppliers to perform due diligence. It emphasizes that the terms of the credit are Net 30 Days, indicating that payment is due within 30 days of the invoice date. This clarity helps both parties in managing expectations. The form also mandates a signature certifying that the information provided is accurate, underscoring the importance of transparency in business transactions. Overall, the Net 30 Terms Order form serves as a comprehensive tool for initiating credit relationships between businesses and suppliers.

Net 30 Terms Order Example

APPLICATION FOR CREDIT – Terms are Net 30 Days, OAC

|

|

Name:__________________________________________________ |

|

Date:______/______/__________ |

|

|||||||||

|

|

Division:_________________________________________________ |

|

Year Established:____________ |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

Years at this address:________ |

|

||

|

|

Physical Address:__________________________________________ |

|

(If less than 2 years, please provide previous |

|

|||||||||

Company |

|

|

|

|

|

|

|

|

|

|

address on separate page) |

|

||

or |

|

City/State/Zip:____________________________________________ |

|

Web site:____________________ |

|

|||||||||

Individual |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Applying |

|

Phone: ( |

)________________________Ext._____________ |

|

@__________________________ |

|

||||||||

for Credit |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fax: ( |

|

)____________________________ |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Accounts Payable Contact: |

|

||

|

|

Purchasing Contact:_________________________________________ |

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

Phone: ( |

)_______________ |

|

|

|

|

Billing Address:_____________________________________________ |

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

Email:_______________________ |

|

||

|

|

City/State/Zip:______________________________________________ |

|

@__________________________ |

|

|||||||||

|

|

Phone: ( |

)__________________Fax: ( |

)_________________ |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

Please Provide Pertinent Company Information below: |

|

Resale: _____No _____Yes |

|

|||||||

Classification: |

|

(Held strictly confidential) |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

Business Credit References: (Please provide at least two |

|

Resale# |

|

|

|

|||||

___Individual |

|

|

businesses, including phone, fax and contact name) |

|

|

|

NOTE: A Signed CA Resale Certification is |

|

||||||

|

|

|

|

|

|

|

|

|

|

required for our files. |

|

|||

___Partnership |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

D&B # |

|

|

|

||

___Corporation |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

________________________ |

|

|||||

___Government |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|||

___AA Distributor |

|

|

|

|

|

|

|

|

Vendor # |

|

||||

___Sole |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

(If assigned by your company) |

|

||||

Proprietorship |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

_______________________ |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank Information: |

|

|

|

|

|

|

|

|

|

|

Please Note: |

|

|

|

|

|

|

|

|

|

|

|

|

||

Typical |

|

|

Bank Name:____________________________________ |

Account#:____________________________ |

|

|||||||||

Processing Time |

|

|

|

|

|

|

|

|

|

|

|

|

||

for Credit |

|

Address:__________________________________ City/State/Zip:_____________________________ |

|

|||||||||||

Applications |

|

Fax: ( |

)_____________________________ Fax: ( |

) _____________________________ |

|

|||||||||

is 48 hours. |

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

I certify that the information herein is true and correct. |

|

|

|

||||||

VERIFICATION: |

|

I fully understand that Anaheim Automation’s Terms are |

|

RETURN BY FAX: |

|

|||||||||

(Do not fill out this box) |

|

strictly Net 30 Days. |

___Agree to comply to Terms |

|

|

(714) |

|

|||||||

___Checked Bank |

|

|

Print Name: |

|

|

|

|

|

|

|

or |

|

||

|

|

|

|

|

|

|

|

|

|

|

Mail to address |

|

||

___Checked D&B |

|

|

______________________________________________________________ |

|

|

|||||||||

___Checked References |

|

|

|

|

|

|

|

|

|

|

listed below |

|

||

___CREDIT APPROVED |

|

Signature:__________________________________ Date: ______________ |

|

Attn: Accts. Rec. |

|

|||||||||

___CREDIT DENIED |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

www.anaheimautomation.com

910 East Orangefair Lane Anaheim, CA 92801

Form Characteristics

| Fact Name | Description |

|---|---|

| Term Definition | Net 30 means payment is due within 30 days of the invoice date. |

| Application Requirement | Businesses must complete an Application for Credit to obtain Net 30 terms. |

| Location Information | The form requires the physical address and, if applicable, previous address. |

| Verification Process | Application verification typically takes 48 hours after submission. |

| Business Classification | Applicants must indicate their business classification; this information is confidential. |

| Credit References | At least two business credit references must be provided on the form. |

| Documentation Requirement | A signed CA resale certification is required for businesses claiming resale status. |

| Contact Details | Two contacts—Accounts Payable and Purchasing—must be listed with phone numbers. |

| Approval Notice | The status of the credit application will be indicated as either "CREDIT APPROVED" or "CREDIT DENIED". |

| Governing Law | This agreement is subject to California law, given the location of Anaheim Automation. |

Guidelines on Utilizing Net 30 Terms Order

Once you have the Net 30 Terms Order form ready, it's important to fill it out completely to ensure your application is processed smoothly. Double-check your entries for accuracy, as this will help avoid any delays. Now, let's guide you through the steps needed to fill out the form effectively.

- Start by entering the Name of your company in the designated space at the top of the form. This is essential for identifying your application.

- Next, fill in the Date of the application submission. Make sure to use the proper format (MM/DD/YYYY).

- In the Division field, specify the division of your business, if applicable.

- Indicate the Year Established to give context to your business history.

- Note how many Years you have been at your current address – this shows your stability as a business.

- Complete the Physical Address section. If your business has been at that address for less than two years, attach the previous address on a separate page.

- Fill in your City, State, and Zip Code.

- If you have a Web site, be sure to include the URL for easy reference.

- Enter the Individual Applying for Credit, along with their Phone Number and Extension.

- Provide an email address in the space for @.

- Fill in the Fax Number if available.

- Identify the Accounts Payable Contact by filling their name and phone number.

- Provide the Purchasing Contact’s Name and their phone number.

- Complete the Billing Address, making sure it’s accurate.

- Include the Email for billing information.

- Fill out the City, State, and Zip Code for the billing address as well.

- Enter the billing phone number, followed by the Fax Number.

- In the section for Pertinent Company Information, clarify if you have a Resale Number.

- Indicate your Classification, which will be kept confidential.

- List at least two Business Credit References, including their phone and fax numbers, as well as a contact name.

- Provide your Bank Information, including the Bank Name and Account Number.

- Fill in the Bank's Address and its City, State, and Zip Code.

- Note the Fax Number for the bank if available.

- Sign in the Signature field to certify the information is accurate.

- Finally, mark if you Agree to comply with Terms and date your application.

After completing these steps, make sure to review all the information inputted in the form for any mistakes or missing fields. You can then fax the completed application to the number provided or mail it as instructed. Your application will typically be processed within 48 hours.

What You Should Know About This Form

What are Net 30 terms?

Net 30 terms mean that payment is due within 30 days from the date of the invoice. This allows businesses to make their purchases and manage their cash flow while ensuring that the seller gets paid in a timely manner.

What information do I need to provide on the order form?

You need to fill out several fields, including your company name, address, years in operation, and information about your bank. Additionally, it’s essential to provide the details of business credit references and contact information for accounts payable and purchasing.

Is there any specific eligibility criteria for applying for Net 30 terms?

Yes. Your company should have a good credit history and stable financials. Typically, the application will require basic company details and references to demonstrate credibility. If your business is new (less than two years), you may need to provide previous addresses and additional documentation.

How long does it take to process my application for Net 30 terms?

The processing time for credit applications is typically 48 hours. During this time, the company will verify the information provided and your creditworthiness before approval.

What happens if my Net 30 application is denied?

If your application is denied, you will not be granted Net 30 terms, and you may need to consider alternative payment methods. You can inquire about the reason for denial to address any issues for future applications.

Do I need to submit a signed Resale Certification?

Yes, if your business intends to make tax-exempt purchases, a signed California Resale Certification is required for your files. This documentation helps clarify your business status and tax obligations.

Who should I contact if I have questions while filling out the application?

If you have any questions while filling out the application, you can reach out to the contact information provided on the order form. This typically includes a phone number and email for assistance, ensuring you have support during the application process.

Common mistakes

Filling out the Net 30 Terms Order form accurately is crucial for a smooth credit application process. Yet, many people sometimes overlook important details that can lead to delays or even denials. Here are five common mistakes to avoid.

One significant error is failing to provide the full legal name of the business. Incomplete names can create confusion and may lead to misunderstandings regarding the business's identity. It is essential to ensure that the name matches official documentation to avoid unnecessary complications.

Another frequent mistake involves omitting the physical address of the business. If the company has been at the same location for less than two years, it is especially important to include the previous address. This information aids in verifying the credibility of the business. Without it, the application may be viewed as incomplete.

Ensuring correct and complete contact information is vital. Many applicants fail to provide accurate phone numbers or email addresses. This missing information can hinder communication if further details are needed or if questions arise during the verification process. Double-checking these details can significantly expedite the application.

Additionally, applicants often neglect to list multiple business credit references. Providing at least two references with complete contact information is crucial for the approval process. Reference details are important indicators of the business's creditworthiness. Without them, the application may be turned away.

Lastly, individuals frequently forget to sign and date the application. A signature indicates that the provided information is accurate and that the applicant agrees to the terms. Omitting this step can lead to immediate denial of the application due to lack of consent.

By being mindful of these common mistakes, individuals can increase their chances of a smooth credit application process with the Net 30 Terms Order form. Paying close attention to detail can provide reassurance and facilitate a successful outcome.

Documents used along the form

When using a Net 30 Terms Order form, several other documents may be beneficial to ensure a smooth transaction and maintain clarity between all parties involved. Below is a list of these important forms and documents that can support your credit and purchasing process.

- Credit Application Form: This form gathers essential information about the applicant's business and credit history. It serves as a preliminary screening tool for vendors before extending credit terms.

- W-9 Form: Required for tax reporting purposes, this form provides the correct taxpayer identification number (TIN) of the vendor. Businesses use it to gather necessary information before issuing payments.

- Purchase Order (PO): This document acts as a formal request to a supplier to provide goods or services. It often includes pricing, item descriptions, and quantities, ensuring that both supplier and buyer are aligned on expectations.

- Invoice: After goods or services are delivered, an invoice is issued by the supplier. It outlines the details of the transaction, including the total amount due under the agreed-upon Net 30 terms.

- Resale Certificate: This document certifies that a business is purchasing goods with the intention of reselling them. It allows the buyer to avoid paying sales tax on purchases that will be resold.

- Business License: Some businesses may require a copy of the vendor's business license. This document verifies that they are operating legally within their jurisdiction, providing assurance before credit is extended.

- Bank Authorization Letter: If financing or credit checks are involved, a bank authorization letter allows the vendor to obtain necessary financial information from the applicant's bank.

- Terms and Conditions Agreement: This document outlines the specific terms, conditions, and responsibilities of both parties involved in a transaction. It helps to prevent misunderstandings about payment structure and deliverables.

- References List: A list of business references provides background on the creditworthiness of the applicant. It typically includes contact information for other suppliers that can attest to the applicant’s payment history.

Utilizing these documents in conjunction with the Net 30 Terms Order form can help clarify expectations and enhance communication between businesses and their vendors. Proper documentation streamlines the credit application process and builds long-lasting professional relationships.

Similar forms

- Invoice: Similar to the Net 30 Terms Order form, an invoice serves as a request for payment for goods or services provided. Both documents outline payment terms and details about the buyer and seller.

- Purchase Order: A purchase order is a document issued by a buyer to a seller, confirming the purchase of products or services. It often includes payment terms like Net 30, paralleling the payment structure in the order form.

- Credit Application: This document collects information from a potential buyer to evaluate creditworthiness. Both the credit application and the Net 30 Terms Order form require detailed company information for processing.

- Sales Agreement: A sales agreement outlines the terms of sale between a buyer and seller. Like the order form, it also specifies payment terms, ensuring clarity in the transaction.

- Credit Terms Agreement: This document states the credit terms under which a seller extends credit to a buyer. It typically includes payment periods like Net 30, which aligns with the payment terms in the order form.

- Account Statement: An account statement summarizes all transactions and outstanding payments between a buyer and seller. It reflects the payment history and terms like Net 30 similar to the order form.

- Letter of Credit: A letter of credit acts as a guarantee from a bank to pay a seller on behalf of a buyer. Similar to the order form, it involves credit terms and conditions necessary for completing a transaction.

- Billing Statement: A billing statement is sent to a buyer to request payment for outstanding invoices. It often includes terms like Net 30, similar to the payment requirements found in the order form.

- Contract for Services: A contract for services outlines the terms and conditions for services rendered. In conjunction with payment terms, it is comparable to the Net 30 Terms Order form in structure and intent.

- Reseller Agreement: A reseller agreement defines the relationship between a manufacturer and a reseller, including payment terms like Net 30, akin to what is specified in the order form.

Dos and Don'ts

When filling out the Net 30 Terms Order form, there are important steps to consider to ensure the application is processed smoothly. Below is a list of things you should and shouldn't do.

- Do provide accurate and complete information, including your name, business details, and contact information.

- Do be sure to list at least two business credit references with their contact details to facilitate your application.

- Do include your physical address and, if applicable, your previous address if your business is under two years old.

- Do check your numbers twice, ensuring phone and fax numbers are correct before submission.

- Don't leave any mandatory fields blank; incomplete forms may delay processing.

- Don't forget to sign and date the application to affirm the accuracy of the information provided.

- Don't ignore the processing time; plan to submit your application 48 hours before you need credit.

Misconceptions

Understanding the Net 30 Terms can be crucial for businesses and their financial planning. However, several misconceptions often lead to confusion. Here are four common misunderstandings about these terms:

- Net 30 Means You Have 30 Days After Invoicing to Pay. Many people believe that Net 30 indicates they have exactly 30 days from the date they receive the invoice to settle the bill. It is essential to clarify that it is 30 days from the date the invoice is issued, which may arrive before the product or service is delivered.

- Net 30 is the Standard Payment Terms for All Businesses. While Net 30 is a common practice, it is not the universal standard. Different industries and companies might have varying payment terms, such as Net 15 or 60 days. It’s vital to understand what is being offered in each particular contract.

- Paying On Time Guarantees Future Credit. Although timely payments help maintain a positive credit relationship, they do not guarantee future credit approvals. Each application for credit may involve additional factors and evaluations that determine eligibility.

- Net 30 Terms are Negotiable with All Suppliers. Some individuals assume that they can negotiate Net 30 terms with every supplier. However, acceptance of these terms can depend on the relationship between the businesses and the suppliers' policies. Often, common practices are adhered to, leaving little room for negotiation.

Understanding these misconceptions can help businesses manage their finances better and foster healthy supplier relationships. Always review your payment terms and conditions attentively to avoid surprises.

Key takeaways

When filling out the Net 30 Terms Order form, consider the following key points:

- Complete All Sections: Ensure that every part of the form is filled out accurately. Missing information could delay the approval process.

- Provide Contact Information: Include phone numbers and email addresses for key contacts like Accounts Payable and Purchasing to facilitate communication.

- Business References: List at least two business credit references. Make sure to include their contact details to aid in the verification process.

- Understand the Terms: Be aware that the payment terms are Net 30 Days. Read and agree to comply with these terms before submitting the form.

Browse Other Templates

998 Offer California - Choosing to settle can often be less stressful than waiting for a court decision.

Jean Keating Classes - Explore the depths of the prison system's commercial underpinnings with insights from Jean Keating.

Massage Therapy Invoice Template - Let us know if there are specific areas you want us to avoid.