Fill Out Your Netspend Dispute Form

The Netspend Dispute Notification Form is a critical tool for cardholders seeking to resolve issues related to unauthorized transactions. This form is designed to initiate the dispute process for any credit or debit transactions that you believe were processed without your consent. Timing is crucial; you must complete and submit the form within 60 days of the transaction date to ensure your claim is considered. Upon receipt of your completed form, Netspend promises to make a decision about crediting the disputed funds within ten business days. To bolster your case, including supporting documentation is advisable. It's also important to understand your liability: if your card has been lost or stolen and you notify Netspend to block transactions, you will not be responsible for any further unauthorized charges. The form requires basic personal information, such as your name and contact details, as well as specifics about each transaction you're disputing. You can dispute up to five transactions on a single form. Additional questions prompt you about contacting the merchant, whether they’re issuing a refund, and provide space for a detailed explanation of your situation. Ensure to attach all necessary documentation, such as a police report or receipts, along with your signature and the date. By completing this form diligently, you can help expedite the resolution of your dispute.

Netspend Dispute Example

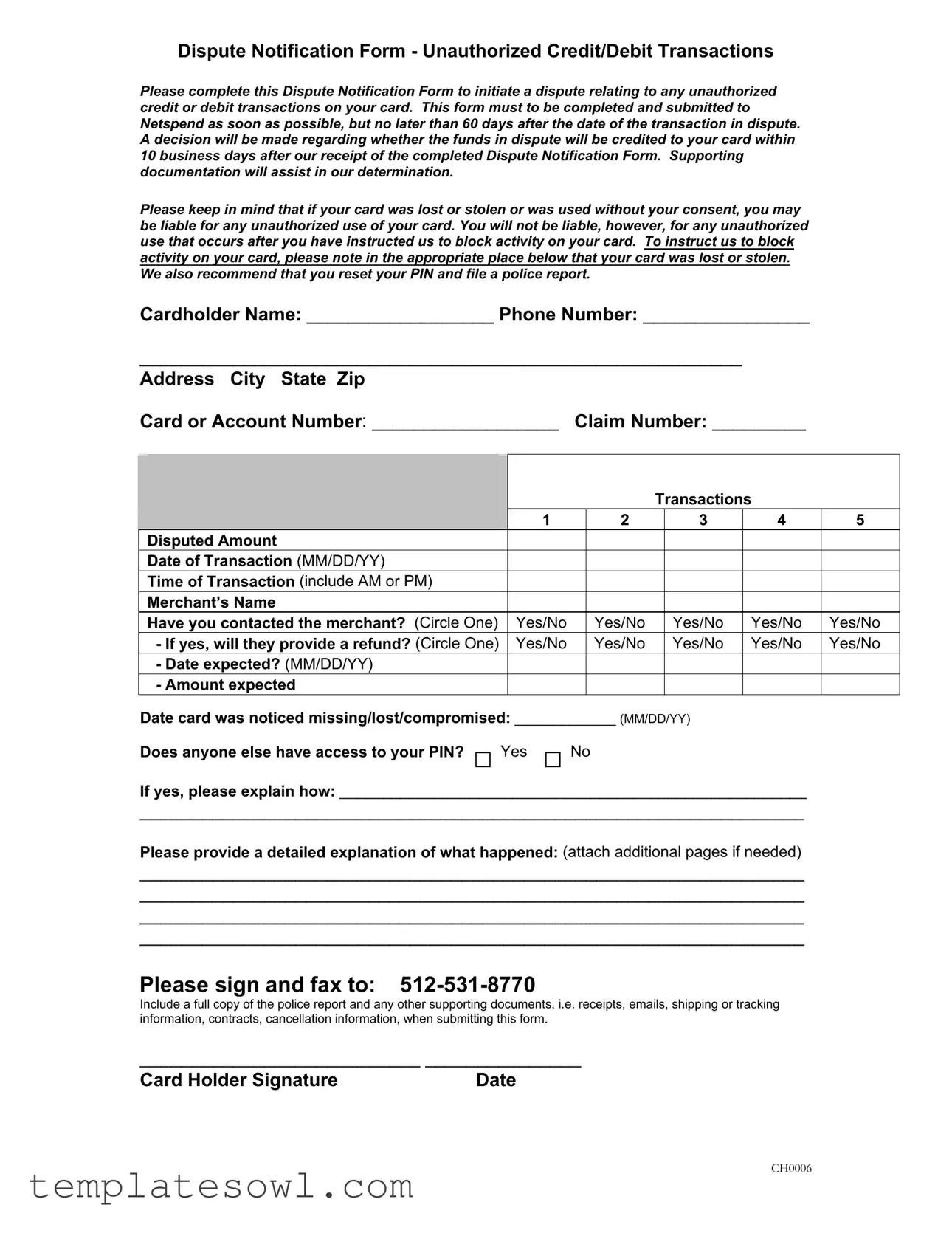

Dispute Notification Form - Unauthorized Credit/Debit Transactions

Please complete this Dispute Notification Form to initiate a dispute relating to any unauthorized credit or debit transactions on your card. This form must to be completed and submitted to Netspend as soon as possible, but no later than 60 days after the date of the transaction in dispute. A decision will be made regarding whether the funds in dispute will be credited to your card within 10 business days after our receipt of the completed Dispute Notification Form. Supporting documentation will assist in our determination.

Please keep in mind that if your card was lost or stolen or was used without your consent, you may be liable for any unauthorized use of your card. You will not be liable, however, for any unauthorized use that occurs after you have instructed us to block activity on your card. To instruct us to block activity on your card, please note in the appropriate place below that your card was lost or stolen. We also recommend that you reset your PIN and file a police report.

Cardholder Name: __________________ Phone Number: ________________ |

|

||||||||

__________________________________________________________ |

|

|

|||||||

Address City State Zip |

|

|

|

|

|

|

|

||

Card or Account Number: __________________ |

Claim Number: _________ |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

Please provide information for each |

|

|

|

|

|

|

|

|

|

transaction you are disputing (submit up to 5 |

|

|

|

|

|

|

|

|

|

on one form) |

|

|

|

|

Transactions |

|

||

|

|

|

1 |

|

2 |

|

3 |

4 |

5 |

Disputed Amount |

|

|

|

|

|

|

|

||

Date of Transaction (MM/DD/YY) |

|

|

|

|

|

|

|

||

Time of Transaction (include AM or PM) |

|

|

|

|

|

|

|

||

Merchant’s Name |

|

|

|

|

|

|

|

||

Have you contacted the merchant? (Circle One) |

Yes/No |

|

Yes/No |

|

Yes/No |

Yes/No |

Yes/No |

||

|

- If yes, will they provide a refund? (Circle One) |

Yes/No |

|

Yes/No |

|

Yes/No |

Yes/No |

Yes/No |

|

|

- Date expected? (MM/DD/YY) |

|

|

|

|

|

|

|

|

|

- Amount expected |

|

|

|

|

|

|

|

|

Date card was noticed missing/lost/compromised: _____________ (MM/DD/YY)

Does anyone else have access to your PIN?

Yes

No

If yes, please explain how: ______________________________________________________

________________________________________________________________

Please provide a detailed explanation of what happened: (attach additional pages if needed)

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

Please sign and fax to:

Include a full copy of the police report and any other supporting documents, i.e. receipts, emails, shipping or tracking information, contracts, cancellation information, when submitting this form.

___________________________ _______________

Card Holder Signature |

Date |

CH0006

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose of the Form | The Netspend Dispute Notification Form is used to report unauthorized credit or debit transactions on a card. Completing this form initiates the dispute process. |

| Submission Deadline | The form must be submitted to Netspend within 60 days of the date of the transaction in question. Timely submission is essential for processing the dispute. |

| Decision Timeline | Netspend will make a determination regarding the dispute within 10 business days after receiving the completed form. This decision will include whether the disputed funds will be credited back to the card. |

| Liability Information | If the card was lost or stolen, the cardholder may be held liable for unauthorized use. However, the cardholder is not responsible for unauthorized transactions occurring after they have reported the loss. |

| Supporting Documentation | Providing supporting documents can enhance the determination process. It is advisable to include items such as a police report and evidence of the transaction, like receipts or emails. |

Guidelines on Utilizing Netspend Dispute

Filling out the Netspend Dispute Notification Form is necessary to initiate a dispute for unauthorized transactions. After submission, the review process will commence, and a decision regarding the credits will typically be provided within 10 business days.

- Obtain a copy of the Netspend Dispute Notification Form.

- In the designated section, enter your Cardholder Name, Phone Number, and Address including city, state, and zip code.

- Fill in your Card or Account Number and Claim Number if applicable.

- For each disputed transaction (up to 5), provide the following information:

- Disputed Amount

- Date of Transaction (format MM/DD/YY)

- Time of Transaction (include AM or PM)

- Merchant’s Name

- Indicate if you have contacted the merchant by circling Yes or No.

- If yes, will they provide a refund? Circle Yes or No.

- If applicable, provide the Date expected for the refund (MM/DD/YY) and the Amount expected.

- Record the Date the card was noticed missing/lost/compromised in the specified area.

- Indicate if anyone else has access to your PIN by circling Yes or No. If Yes, provide an explanation.

- Write a detailed explanation of the incident in the space provided. If more space is needed, attach additional pages.

- Sign and date the form in the designated area at the bottom.

- Fax the completed form to 512-531-8770 along with any required supporting documents such as your police report, receipts, emails, or other related information.

What You Should Know About This Form

What is the purpose of the Netspend Dispute Notification Form?

The Netspend Dispute Notification Form allows cardholders to report unauthorized credit or debit transactions associated with their Netspend card. By filling out and submitting this form, individuals can initiate a formal dispute process that seeks the return of funds taken without their consent. It is crucial for cardholders to act promptly, as the form must be submitted within 60 days of the disputed transaction.

How long does it take to process a dispute once the form is submitted?

Once Netspend receives the completed Dispute Notification Form, a decision regarding the crediting of disputed funds will typically be made within 10 business days. Therefore, it is advantageous to provide as much supporting documentation as possible to assist in the decision-making process and potentially expedite the resolution.

What information is required on the form?

The form requires specific details, including the cardholder's name, contact information, account number, and the transaction information for each dispute. Cardholders also need to indicate whether they have contacted the merchant involved and provide a brief explanation of the situation. If necessary, additional pages can be attached for more detailed descriptions.

What should I do if my card was lost or stolen?

It is essential to report a lost or stolen card immediately. You should indicate on the form that your card was compromised, which instructs Netspend to block any activity on that card. Additionally, resetting your PIN and filing a police report are strongly recommended steps to take in such circumstances, as they can help protect your account from further unauthorized use.

What happens if there is unauthorized use of my card?

If unauthorized use occurs after you have reported your card as lost or stolen, you will not be held liable for those transactions. However, if someone uses your card without your consent before reporting the loss, you may be liable for those transactions. Submitting the Dispute Notification Form promptly is crucial in asserting your position regarding unauthorized charges.

Common mistakes

Filling out the Netspend Dispute form can be straightforward, but common mistakes can delay the process. One frequent error is not submitting the form within the required time frame. It's crucial to complete and submit the form within 60 days of the transaction in question. Missing this deadline could mean losing the chance to recover those funds.

Another mistake people often make is not providing sufficient details about the disputed transactions. Filling out the sections regarding the disputed amount, date, time, and merchant’s name accurately is essential. Incomplete or inaccurate information can hinder Netspend's ability to process your dispute effectively.

Some individuals forget to gather and include necessary supporting documentation. This documentation can be vital for a successful resolution. Attach any relevant receipts, emails, or police reports as specified in the form. Failing to provide these documents can lead to a longer investigation and, potentially, a denial of the claim.

Lastly, many people overlook the importance of signing the form. A missing signature will delay the processing of your dispute. Ensure that you sign and date the form before submission to prevent unnecessary delays. Each step of this process is vital for a prompt response.

Documents used along the form

The Netspend Dispute Notification Form is essential for initiating disputes related to unauthorized transactions. Along with this form, several other documents and forms can support the process and ensure that all necessary information is submitted for a clear and effective resolution. Here is a list of additional forms and documents that are often used in conjunction with the Netspend Dispute Form, each serving a unique purpose.

- Police Report: A formal report filed with law enforcement regarding the loss or theft of a card, documenting the incident. It provides proof that unauthorized access occurred and may enhance the legitimacy of your dispute.

- Merchant Communication Records: Any emails, messages, or notes detailing communications with the merchant regarding a disputed transaction. These records can demonstrate efforts to resolve the issue prior to filing the dispute.

- Transaction Receipts: Copies of receipts or confirmation messages related to the disputed transactions. These receipts offer evidence of the original purchase or service that is now being contested.

- Tracking Information: If the transaction involved shipping, providing tracking details can help confirm whether the purchased items were delivered or not. This documentation can clarify whether the charge is valid.

- Cancellation Confirmation: Proof showing that a service or order was canceled, which supports the case for a refund when a refund was promised but not provided.

- Affidavit of Identity Theft: A sworn statement outlining details of identity theft, which can provide additional context and strengthen the claim if applicable.

- Customer Support Transcripts: If available, transcripts of prior communications with customer service about the issue at hand can lend credibility to your case and demonstrate ongoing efforts to resolve the matter.

By organizing and presenting these documents along with the Netspend Dispute Notification Form, you can create a compelling case that aids in a prompt and thorough review of your dispute. Collecting and submitting the right supporting materials can significantly enhance the chances of a successful dispute resolution.

Similar forms

- Fraud Report Form: Similar to the Netspend Dispute Form, a Fraud Report Form is used to address unauthorized transactions. It typically requires details such as the nature of the fraud and specific transaction information. Both forms emphasize quick submission to ensure timely review and resolution.

- Chargeback Request Form: A Chargeback Request Form is submitted to challenge specific transactions with a bank or credit card issuer. Like the Netspend Dispute Form, it details disputed transactions and may require supporting documents for the bank's assessment.

- Identity Theft Affidavit: If a person’s identity has been stolen, this affidavit helps document incidents of identity theft. Both forms collect detailed accounts of unauthorized activity, focusing on protection against further misuse.

- Credit Card Dispute Form: Used to report errors or unauthorized transactions on a credit card, it shares the structure of the Netspend Dispute Form, requiring transaction details and user identification to process disputes efficiently.

- Preliminary Report of Unauthorized Use: This internal report enables users to formally notify their banks about suspicious activity on their accounts. Similarly organized, it gathers essential data to initiate an investigation into unauthorized use.

- Bank Error Resolution Form: For reporting discrepancies in bank statements, this form aids customers seeking corrections. It resembles the Netspend Dispute Form by requiring precise transaction details and supporting documentation relevant to the case.

- Merchant Dispute Form: Designed for disputes directly with merchants, this form outlines the transaction details and the customer’s grievance. Both forms involve documenting communication attempts with merchants to resolve discrepancies.

- Lost or Stolen Card Affidavit: This affidavit provides a formal declaration of a lost or stolen card and may include transaction disputes. Like the Netspend Dispute Form, it prioritizes account security and outlines steps to mitigate fraud.

- Error Resolution Request: This document allows consumers to request investigations into account errors or unauthorized transactions, involving similar processes and information gathering as seen in the Netspend Dispute Form.

- Credit Report Dispute Form: When inaccuracies appear on a credit report, individuals can use this form to challenge those errors. The focus on documentation and timely submission parallels the requirements of the Netspend Dispute Form.

Dos and Don'ts

When filling out the Netspend Dispute form, it’s essential to follow a few guidelines to ensure your submission is successful. Here are seven things to consider:

- Do submit the form as soon as possible, ideally within 60 days of the unauthorized transaction.

- Do provide detailed information about each disputed transaction, including dates and amounts.

- Do include supporting documentation, such as receipts and police reports, to strengthen your claim.

- Do check the box if your card was lost or stolen, to prevent further unauthorized use.

- Do reset your PIN to enhance security after the incident.

- Don't leave any required fields blank; incomplete forms may delay the process.

- Don't submit the form without signing it; an unsigned form is not valid.

Misconceptions

Misconceptions about the Netspend Dispute form can lead to confusion and delays in resolving unauthorized transactions. The following points address four common misunderstandings:

- The form must be submitted immediately or it cannot be filed later. Many people believe that any delay means forfeiting their right to dispute a transaction. In reality, the form should be submitted as soon as possible, but you have up to 60 days from the date of the transaction to file your dispute.

- Filing a dispute guarantees a refund. Some individuals assume that submitting the Dispute Notification Form will automatically result in a credited amount. However, a review process takes place, and a decision is made within 10 business days. Documentation is crucial to support your case.

- After reporting a lost or stolen card, all unauthorized transactions are covered. Although reporting your card as lost or stolen protects you from further unauthorized use, it is essential to know that you may still be liable for transactions made before the report. Mitigating your liability requires timely communication with Netspend.

- Providing details about transactions is unnecessary. Some may believe that a brief explanation will suffice when disputing transactions. However, offering a comprehensive and detailed account of what happened enhances the likelihood of a positive resolution. It is advisable to include as much relevant information as possible.

Key takeaways

Key Takeaways for Using the Netspend Dispute Form:

- Complete the Dispute Notification Form promptly. You must submit it within 60 days of the unauthorized transaction.

- Provide detailed information for each disputed transaction. Your submission can include up to 5 transactions on one form.

- Include supporting documentation. Attach copies of receipts, emails, police reports, or other relevant evidence to strengthen your claim.

- Indicate if your card was lost or stolen. This is crucial for protecting yourself against further unauthorized use.

- Expect a resolution within 10 business days. This is the timeframe for Netspend to review your submitted form and make a decision regarding your funds.

Browse Other Templates

Labor Code 351 - The application must be executed in California or before a notary if outside the state.

Dod Telework Policy - The DD Form 2946 encapsulates critical information about PDF handling.

Uncontested Divorce in Tn - Information is provided on court fees and potential waivers for filing costs.