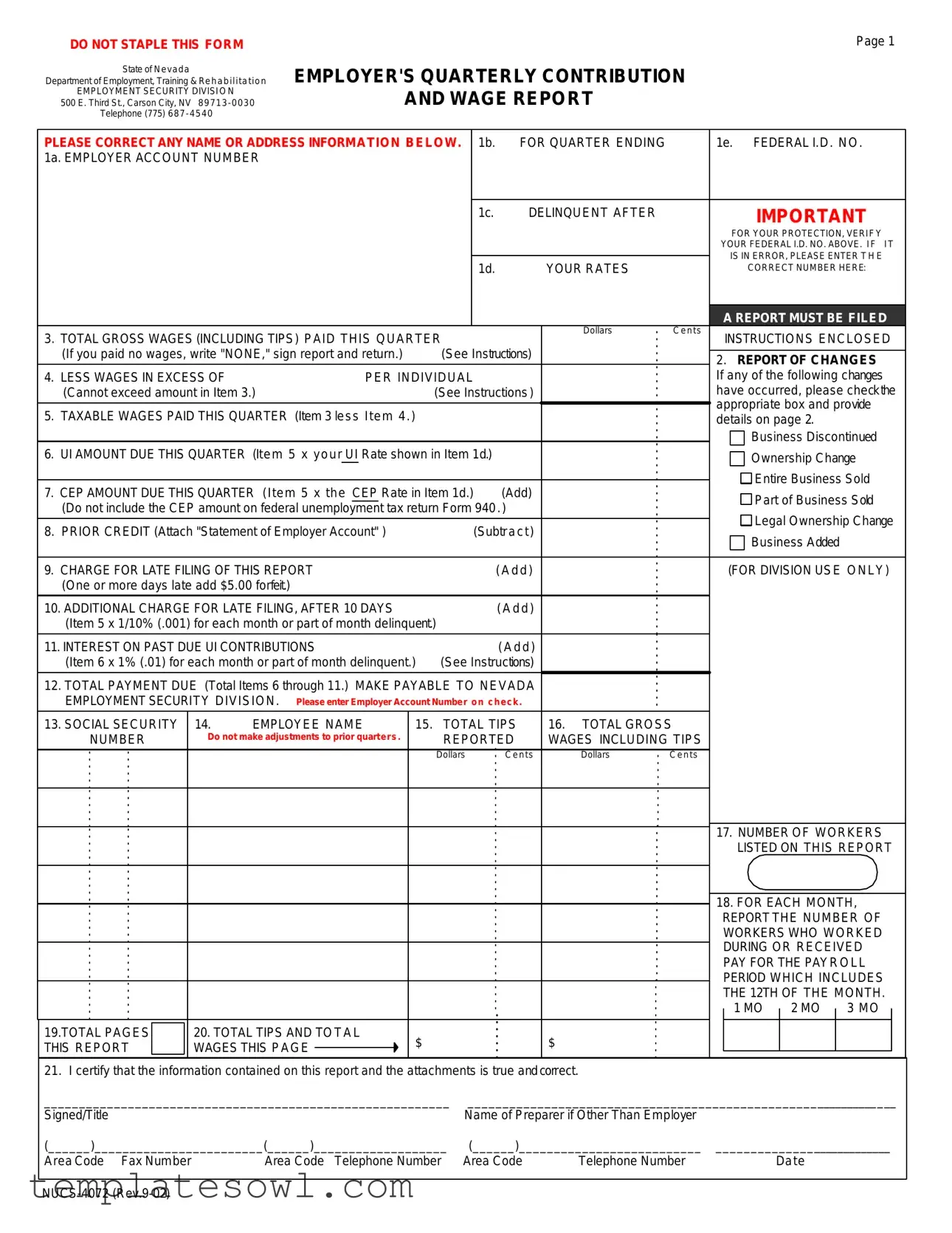

Fill Out Your Nevada Nucs 4072 Form

The Nevada Nucs 4072 form plays a crucial role in the state's employment reporting system. This quarterly report must be filed by employers to detail their contribution and wage information, ensuring that proper records are maintained for unemployment insurance calculations. Each submission includes vital information such as the employer's account number and federal identification number, which helps verify identity and compliance. The form requires employers to report total gross wages, wages exceeding individual thresholds, and taxable wages for the quarter. It also captures any changes in business ownership or structure, essential for accurate payroll reporting. Additionally, employers are responsible for noting any corrections needed in their company details and providing employee wages, ensuring that an accurate reflection of all wages paid is submitted. Timeliness is paramount when submitting this form, as late filings incur penalties and interest fees, thus emphasizing the importance of meeting the required deadlines. Ultimately, this form serves as a comprehensive tool for maintaining transparent and organized employment records, facilitating a smoother relationship between employers and the Nevada Employment Security Division.

Nevada Nucs 4072 Example

DO NOT STAPLE THIS FORM

State of Nevada

Department of Employment, Training & Rehabilitation

EMPLOYMENT SECURITY DIVISION

500 E. Third St., Carson City, NV

Telephone (775)

Page 1

EMPLOYER'S QUARTERLY CONTRIBUTION

AND WAGE REPORT

PLEASE CORRECT ANY NAME OR ADDRESS INFORMATION BELOW. |

1b. |

FOR QUARTER ENDING |

|

|

1e. |

|

FEDERAL I.D. NO. |

||||||||||

1a. EMPLOYER ACCOUNT NUMBER |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1c. |

DELINQUENT AFTER |

|

|

|

|

|

IMPORTANT |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FOR YOUR PROTECTION, VERIFY |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YOUR FEDERAL I.D. NO. ABOVE. IF IT |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IS IN ERROR, PLEASE ENTER T H E |

||

|

|

|

|

|

|

|

|

1d. |

|

|

YOUR RATES |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CORRECT NUMBER HERE: |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A REPORT MUST BE FILED |

|||

3. TOTAL GROSS WAGES (INCLUDING TIPS) PAID THIS QUARTER |

|

|

Dollars |

Cents |

INSTRUCTIONS ENCLOSED |

||||||||||||

|

|

|

|

|

|||||||||||||

(If you paid no wages, write "NONE," sign report and return.) |

(See Instructions) |

|

|

|

|

|

|

|

|||||||||

|

|

|

2. |

|

REPORT OF CHANGES |

||||||||||||

4. LESS WAGES IN EXCESS OF |

|

|

|

PER INDIVIDUAL |

|

|

|

|

|

If any of the following changes |

|||||||

(Cannot exceed amount in Item 3.) |

|

|

(See Instructions ) |

|

|

|

have occurred, please checkthe |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

appropriate box and provide |

|||

5. TAXABLE WAGES PAID THIS QUARTER (Item 3 less Item 4.) |

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

details on page 2. |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business Discontinued |

6. UI AMOUNT DUE THIS QUARTER (Item 5 x your |

UI |

Rate shown in Item 1d.) |

|

|

|

|

|

|

|

|

Ownership Change |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Entire Business Sold |

7. CEP AMOUNT DUE THIS QUARTER (Item 5 x the CEP Rate in Item 1d.) |

(Add) |

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

Part of Business Sold |

|||||||||||

(Do not include the CEP amount on federal unemployment tax return Form 940.) |

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

Legal Ownership Change |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8. PRIOR CREDIT (Attach "Statement of Employer Account" ) |

|

(Subtract) |

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

Business Added |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. CHARGE FOR LATE FILING OF THIS REPORT |

|

|

|

|

(Add) |

|

|

|

(FOR DIVISION USE ONLY) |

||||||||

(One or more days late add $5.00 forfeit.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

10. ADDITIONAL CHARGE FOR LATE FILING, AFTER 10 DAYS |

|

|

(Add) |

|

|

|

|

|

|

|

|||||||

(Item 5 x 1/10% (.001) for each month or part of month delinquent.) |

|

|

|

|

|

|

|

|

|

||||||||

11. INTEREST ON PAST DUE UI CONTRIBUTIONS |

|

|

|

|

(Add) |

|

|

|

|

|

|

|

|||||

(Item 6 x 1% (.01) for each month or part of month delinquent.) |

(See Instructions) |

|

|

|

|

|

|

|

|||||||||

12. TOTAL PAYMENT DUE (Total Items 6 through 11.) MAKE PAYABLE TO NEVADA |

|

|

|

|

|

|

|

||||||||||

EMPLOYMENT SECURITY DIVISION. Please enter Employer Account Number on check . |

|

|

|

|

|

|

|

||||||||||

13. SOCIAL SECURITY |

14. |

EMPLOYEE NAME |

|

15. |

TOTAL TIPS |

16. TOTAL GROSS |

|

|

|

|

|||||||

NUMBER |

Do not make adjustments to prior quarters . |

|

REPORTED |

WAGES INCLUDING TIPS |

|

|

|

||||||||||

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

Dollars |

Cents |

Dollars |

Cents |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17. NUMBER OF WORKERS |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

LISTED ON THIS REPORT |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18. FOR EACH MONTH, |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

REPORT THE NUMBER OF |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

WORKERS WHO WORKED |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

DURING OR RECEIVED |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

PAY FOR THE PAYROLL |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

PERIOD WHICH INCLUDES |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

THE 12TH OF THE MONTH. |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

1 MO |

|

|

2 MO |

|

3 MO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19.TOTAL PAGES |

|

|

20. TOTAL TIPS AND TOTAL |

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

THIS REPORT |

|

|

WAGES THIS PAGE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

21. I certify that the information contained on this report and the attachments is true and correct. |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

__________________________________________________________ |

_______________________________________________________________ |

|

|||||||||||||||||||

Signed/Title |

|

|

|

|

Name of Preparer if Other Than Employer |

|

|

|

|

|

|

|

|

||||||||

(______)________________________(______)___________________ |

(______)__________________________ ___________________________ |

|

|

||||||||||||||||||

Area Code Fax Number |

Area Code Telephone Number |

Area Code |

Telephone Number |

Date |

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

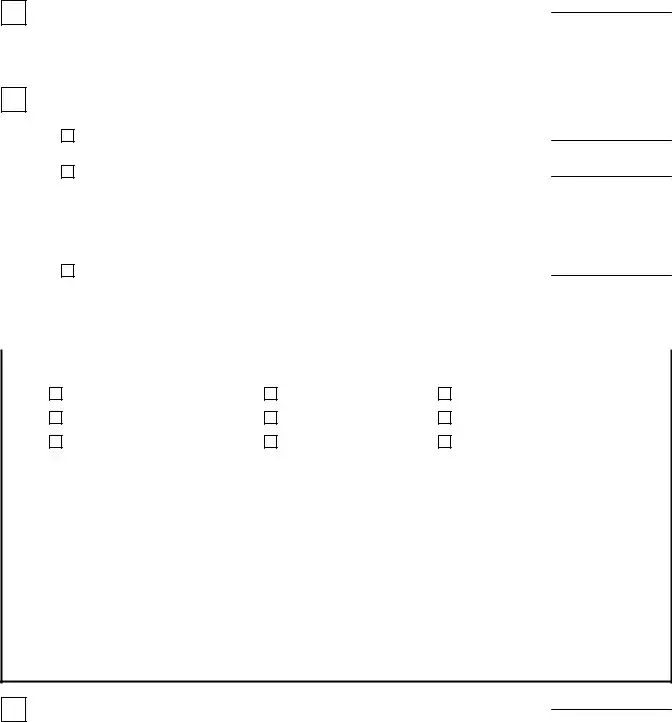

E M P L O Y E R ' S R E P O R T O F C H A N G E S

P a g e 2

E m p l o y e r A c c o u n t N u m b e r : _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ T e l e p h o n e N u m b e r : _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Business Discontinued (no new ownership) ..........................................................

M o n t h / D a y / Y e a r

( P l e a s e n o t i f y t h e D i v i s i o n i f , o r w h e n , b u s i n e s s r e s u m e s . )

E x a c t D a t e o f L a s t P a y r o l l _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

M o n t h / D a y / Y e a r

C h a n g e i n B u s i n e s s O w n e r s h i p - C o m p l e t e N E W O W N E R ( S ) s e c t i o n b e l o w .

Sale of Entire Business .............................................................................

M o n t h / D a y / Y e a r

Partial Sale (not out of business) ..............................................................

M o n t h / D a y / Y e a r

D e s c r i b e P a r t S o l d _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Change in Legal Ownership .....................................................................

( s u c h a s a d d i n g o r d r o p p i n g a p a r t n e r , i n c o r p o r a t i n g , e t c . )

M o n t h / D a y / Y e a r

N E W O W N E R ( S ) |

N e w F e d e r a l I d e n t i f i c a t i o n N u m b e r ( i f a p p l i c a b l e ) : |

|

|

|

|

|

|

C h e c k T y p e o f O r g a n i z a t i o n: |

|

|

|

S C o r p o r a t i o n |

S o l e P r o p r i e t o r |

L i m i t e d L i a b i l i t y P a r t n e r s h i p |

|

P u b l i c l y T r a d e d C o r p o r a t i o n |

A s s o c i a t i o n |

L i m i t e d L i a b i l i t y C o m p a n y |

|

P r i v a t e l y H e l d C o r p o r a t i o n |

P a r t n e r s h i p |

O t h e r |

|

N a m e a n d a d d r e s s o f n e w o w n e r ( s ) , p a r t n e r ( s ) , c o r p o r a t e o f f i c e r ( s ) , m e m b e r ( s ) , e t c . _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

R e m a r k s _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

New Business Units Added to Present Ownership .................................................

M o n t h / D a y / Y e a r

T r a d e N a m e _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

L o c a t i o n _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

N a t u r e o f O p e r a t i o n _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

P r e v i o u s O w n e r ( s ) _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

N U C S - 4 0 7 2 ( R e v . 9 - 0 2 )

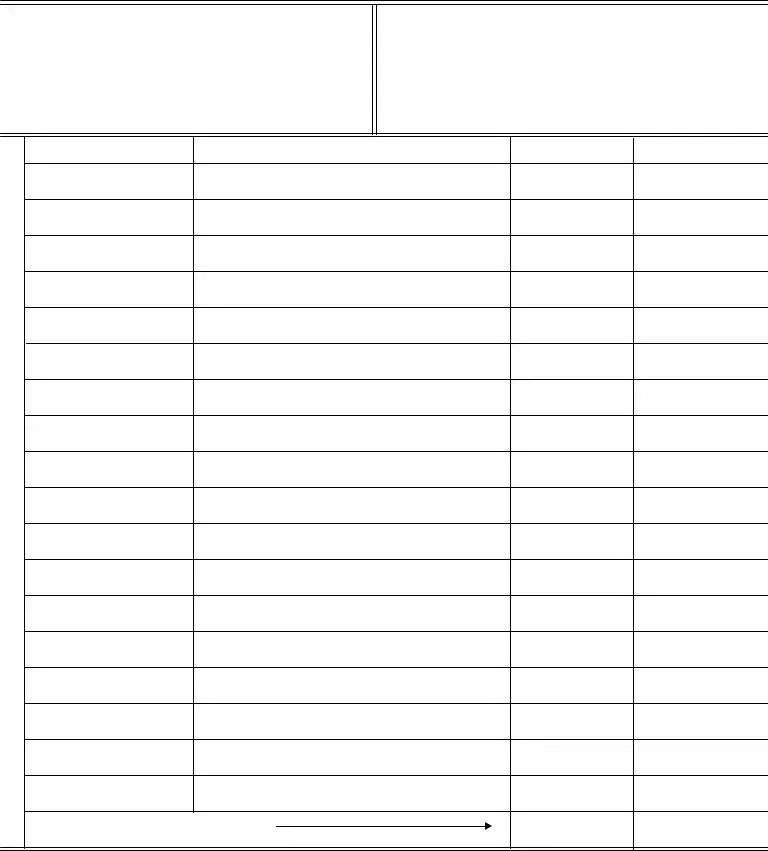

STATE OF NEVADA

DEPARTMENT OF EMPLOYMENT, TRAINING AND REHABILITATION

EMPLOYMENT SECURITY DIVISION

500 E. Third Street

Carson City, Nevada

CONTINUATION SHEET

EMPLOYER'S QUARTERLY LIST OF WAGES PAID

EMPLOYER ACCOUNT NUMBER

NAME

ADDRESS

FOR QUARTER ENDING |

PAGE NUMBER |

|

|

|

|

ENCLOSE THIS FORM WITH THE "EMPLOYER'S QUARTERLY CONTRIBUTION AND WAGE REPORT" (FORM

Report Not Complete if Social Security Numbers Are Missing

SOCIAL SECURITY NUMBER

EMPLOYEE'S NAM E

TOTAL TIPS REPORTED

THIS QUARTER

TOTAL WAGES (INCLUDING REPORTED TIPS) THIS QUARTER

TOTAL TIPS AND TOTAL WAGES THIS PAGE

$

$

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The NUCS 4072 form is used by employers in Nevada to report their quarterly wages and contributions to the State's Employment Security Division. |

| Submission Deadline | This report must be filed after each quarter ends. Late filing incurs penalties. |

| Governing Law | The form is governed by Nevada Revised Statutes (NRS) Sections 612.215 and 612.230, which dictate employer reporting requirements for unemployment insurance. |

| Information Required | Employers must provide their federal ID number, employer account number, and total gross wages paid during the quarter. |

| Corrections | If there are any errors in the employer's name or address, those must be corrected directly on the form to ensure accurate record-keeping. |

| Payment Details | Employers need to calculate their total payment due and make checks payable to the Nevada Employment Security Division, including their account number. |

Guidelines on Utilizing Nevada Nucs 4072

Filling out the Nevada Nucs 4072 form is a crucial task for employers to ensure accurate reporting of their quarterly contributions and wages paid to employees. Completing this form requires attention to detail to avoid any errors that may lead to penalties. Follow the steps below to accurately fill out the form and meet your submission requirements.

- Obtain the Nevada Nucs 4072 form. Make sure that it is the most recent version, which can be downloaded from the Nevada Department of Employment, Training & Rehabilitation website.

- At the top of the form, provide the Employer Account Number in the appropriate box.

- Fill in the Federal I.D. Number. Double-check this number to avoid errors.

- Indicate the quarter ending date in the assigned space.

- Input the total gross wages paid this quarter, including tips, in the designated section.

- If applicable, check any boxes indicating changes such as business discontinuation or ownership change. Provide additional details on the second page of the form.

- Calculate the taxable wages by subtracting any excess wages from your total gross wages paid this quarter.

- Determine the amount due for unemployment insurance (UI) for the quarter based on your UI rate.

- If there are prior credits, attach the required documents and enter the information as instructed.

- Calculate any late fees, if applicable, due to late filing and interest on past due UI contributions as directed.

- Calculate the total payment due by summing all applicable charges.

- In the signature section, provide the name and title of the person signing the report and include contact information.

- Make sure to double-check all entries for accuracy before submitting the form.

- Do not staple the form. Instead, return it along with supporting documents to the address provided on the form.

Ensuring the accuracy of each step will help in avoiding delays or penalties related to your employer's quarterly contribution and wage report. After completing the form, consider setting reminders for the future reporting periods to maintain compliance with Nevada's regulations.

What You Should Know About This Form

What is the purpose of the Nevada Nucs 4072 form?

The Nevada Nucs 4072 form is primarily designed for employers to report their contributions and the wages paid to employees for specific quarterly periods. It plays a crucial role in determining unemployment insurance tax obligations. By submitting this form, employers provide essential information about the total gross wages paid, the taxable wages, and the contributions due for unemployment insurance, helping to ensure compliance with state regulations.

How do I correct errors on the Nevada Nucs 4072 form?

If you notice any errors on the Nevada Nucs 4072 form, such as incorrect employer information or wage amounts, it’s important to correct them promptly. First, write the correct information directly on the form where the mistakes are located. Ensure to clearly indicate the accurate details. After making the necessary corrections, sign and return the revised form to the Employment Security Division. Always keep a copy for your records to prevent potential disputes.

What happens if I fail to submit the Nucs 4072 form on time?

Submitting the Nucs 4072 form after the deadline can lead to late filing penalties. For every day it is late, a forfeit of $5.00 may be added. If the form is significantly overdue, there could also be additional charges based on a percentage of past due contributions. Moreover, interest may accrue on any overdue unemployment insurance contributions at a rate of 1% for each month or part of a month delinquent. It’s critical to file on time to avoid unnecessary penalties.

What information must I include when filling out the Nucs 4072 form?

The Nucs 4072 form requires various key pieces of information. This includes your Employer Account Number, Federal Identification Number, total gross wages paid during the quarter, and wages reported in excess of the specific limits. You must also disclose any changes in ownership or business status. Additionally, detailed information about employees, including their Social Security Numbers, and total tips reported must be provided for accuracy in reporting. Completing all sections diligently helps prevent issues with state authorities.

Is it necessary to attach any additional documentation when submitting the Nucs 4072 form?

Yes, accompanying documents may be required. For instance, if you’re reporting a prior credit, you must attach a "Statement of Employer Account." Furthermore, if there are changes in ownership or business structure, additional documentation may be needed to substantiate these changes. Ensure that all necessary attachments are included before submitting the form to avoid delays or rejections in processing by the Employment Security Division.

Common mistakes

Filling out the Nevada Nucs 4072 form can be a daunting task, especially if you're not familiar with the required information. One common mistake people make is not verifying their Federal I.D. Number. This number is crucial for proper identification and must be accurate. If you've entered it incorrectly, it can lead to processing delays or even penalties. Always double-check the number before submitting your form.

Another frequent error involves leaving out gross wage information. Individuals may mistakenly write "NONE" when they did, in fact, pay wages during the quarter. Even if wage payments seem minimal, they still need to be reported. Ensure that you completely fill out the section concerning total gross wages, including tips. Accurate records will save you from additional hassles later.

Making changes without proper documentation can also trip up many employers. If there have been changes in business ownership or changes in operations, these must be noted adequately. Failing to check the appropriate boxes and provide required details on page two can lead to complications. Ensure all changes are clearly communicated on the form to avoid confusion.

Another area where mistakes often occur is the calculation of taxable wages. Many people confuse amounts in different fields, particularly when subtracting wages in excess of an individual. Take your time to ensure that you're correctly calculating taxable wages to avoid underreporting or overreporting your total. Errors here can affect your tax liabilities.

Lastly, individuals sometimes overlook the importance of signatures and dates. An unsigned form or missing date can lead to the entire form being rejected. Always make sure the certification section is completed with the signature, title, and date filled in correctly. Small details matter, so take a moment to review before submitting.

Documents used along the form

In federally regulated employment contexts, appropriate documentation is crucial for compliance and effective communication between employers and the relevant state authorities. The Nevada Nucs 4072 form serves as a vital tool for employers submitting their quarterly contribution and wage reports. However, several other forms and documents often accompany it to ensure a smooth reporting process. Below is a brief overview of these related documents.

- NUCS 4073 - Employer's Quarterly List of Wages Paid: This document provides a detailed record of the wages paid to employees during the reporting quarter. It includes vital information such as employee names, Social Security numbers, and total wages, ensuring a complete wage report when filed together with the Nucs 4072 form.

- Form 940 - Employer's Annual Federal Unemployment Tax Return: This annual form is used to report and pay the federal unemployment tax. It helps employers summarize their annual contributions, which are significant for their overall tax obligations and employment records.

- IRS Form W-2 - Wage and Tax Statement: Issued to employees, this form summarizes their earnings and tax withholdings for the year. It is essential for employees when filing their personal income tax returns, providing necessary details about their wages and withheld taxes.

- State Business License Application: This document is crucial for any employer starting a business in Nevada. It ensures that the business is legally recognized by the state and adheres to required operational standards, impacting employment practices and tax responsibilities.

- Quarterly Unemployment Insurance (UI) Tax Report: In addition to the Nucs 4072, this report provides state authorities with information on employment levels and wages subject to unemployment tax. It plays a critical role in determining an employer's UI tax rate for subsequent reporting periods.

- Statement of Employer Account: This document provides a detailed summary of an employer's account status with the Nevada Employment Security Division. It includes information about contributions, credits, and any outstanding payments, helping employers maintain accurate records and financial obligations.

By understanding the complementary roles of these forms and documents, employers can effectively navigate the complexities of payroll reporting and contribute to a more organized compliance process. Staying informed ensures that all obligations are met, reducing the risk of errors or potential penalties down the line.

Similar forms

- IRS Form 941: Similar to the NUCS 4072, Form 941 is used by employers to report payroll taxes. It includes details of wages paid, taxes withheld, and the employer's tax obligations for a quarter.

- UC-1 Form: This form is critical for unemployment insurance reporting. Like the NUCS 4072, it collects information on wages paid, employee details, and contributions owed to the state.

- W-2 Form: Employers use the W-2 to report annual wages and tax withholdings for each employee. Both forms track wages paid but serve different purposes, with W-2 being annual compared to the quarterly nature of NUCS 4072.

- Form 940: This is an annual report of federal unemployment taxes. While NUCS 4072 focuses on state unemployment contributions, both documents ensure compliance with unemployment tax obligations.

- Florida Form RT-6: This quarterly report is required for Florida employers to report unemployment compensation tax. Similar to NUCS 4072 in function, it outlines total wages and taxes owed for the quarter.

- California DE 9 Form: The DE 9 is a quarterly contribution return that provides a summary of California employer tax contributions. It parallels NUCS 4072 in its reporting of wages and tax responsibilities to the state.

Dos and Don'ts

When filling out the Nevada Nucs 4072 form, consider these important do's and don'ts:

- DO ensure that all your information is accurate, especially your federal ID number.

- DO follow the instructions carefully; they provide necessary guidance for completing the form.

- DO report total gross wages for the quarter, including tips.

- DO double-check calculations, especially for deductions and total payment due.

- DO sign and date the report before submission.

- DON'T staple the form, as it is clearly advised against.

- DON'T submit it without ensuring no sections are left blank.

- DON'T make adjustments to prior quarters on this form.

- DON'T forget to include your Employer Account Number on your payment.

- DON'T miss the filing deadline to avoid late fees.

Misconceptions

Misunderstandings often arise around the Nevada Nucs 4072 form. Below are common misconceptions along with clear explanations.

- Only large employers need to file this form. Every employer, regardless of size, must complete the Nucs 4072 form if they pay wages to employees.

- The form can be submitted anytime during the quarter. The Nucs 4072 must be filed by the deadlines set by the Nevada Employment Security Division to avoid penalties.

- No wages mean no reporting requirement. Even if no wages are paid, a report must indicate this by writing "NONE" and returning the form.

- The information on the form can be estimated. All information must be accurate and based on actual payroll records. Estimates can lead to penalties.

- Once filed, the form cannot be amended. Corrections can be made, but these should be filed as soon as possible; this does not guarantee that penalties will be avoided.

- The same form is used for all employee types. Specific details may differ depending on whether employees are full-time, part-time, or seasonal, and the employer should report these accurately.

- Filing electronically is the only method available. While electronic filing is encouraged, employers can still submit a paper form if preferred.

- There are no penalties for late submissions if it's a minor delay. Any late filing incurs charges, starting with a $5.00 penalty for late reports.

- Adjustment entries can be made directly on the Nucs 4072 form. Adjustments for previous reports must be made on a separate form as instructed by the guidelines.

- All payments can be submitted without reference to the employer account number. It is crucial to include the employer account number on the payment to ensure proper credit.

Key takeaways

Filling out the Nevada Nucs 4072 form requires careful attention to detail. Here are some important takeaways to keep in mind.

- Accuracy is Critical: Always verify the information entered on the form. This includes your Employer Account Number and Federal I.D. number. Any errors could lead to complications down the line.

- Timeliness Matters: Submit the report on time to avoid late fees. If filed late, expect additional charges, which can accumulate quickly. Mark your calendar for due dates to ensure compliance.

- Report Changes Promptly: If there have been changes in business ownership or changes to your wages, it is vital to indicate those on the form. Use the provided sections to specify any updates accurately.

- No Wages? No Problem: If your business did not pay any wages during the quarter, you still need to submit the form. Simply write "NONE" where applicable, sign it, and return it as required.

- Keep Records: Maintain copies of the submitted forms and any supporting documents. This helps in case of audits or discrepancies. Good record-keeping can save you from future headaches.

By paying attention to these details, you can navigate the completion and submission of the Nevada Nucs 4072 form with confidence.

Browse Other Templates

Irs Form 8949 Instructions - The Qualified Dividends Tax Worksheet helps determine the tax on qualified dividends received during the tax year.

Minimum Insurance Coverage in Michigan - Keeping this certificate in your vehicle is a legal requirement in Michigan.

Dd2642 - The DD 2642 is integral for those needing reimbursement for healthcare costs.