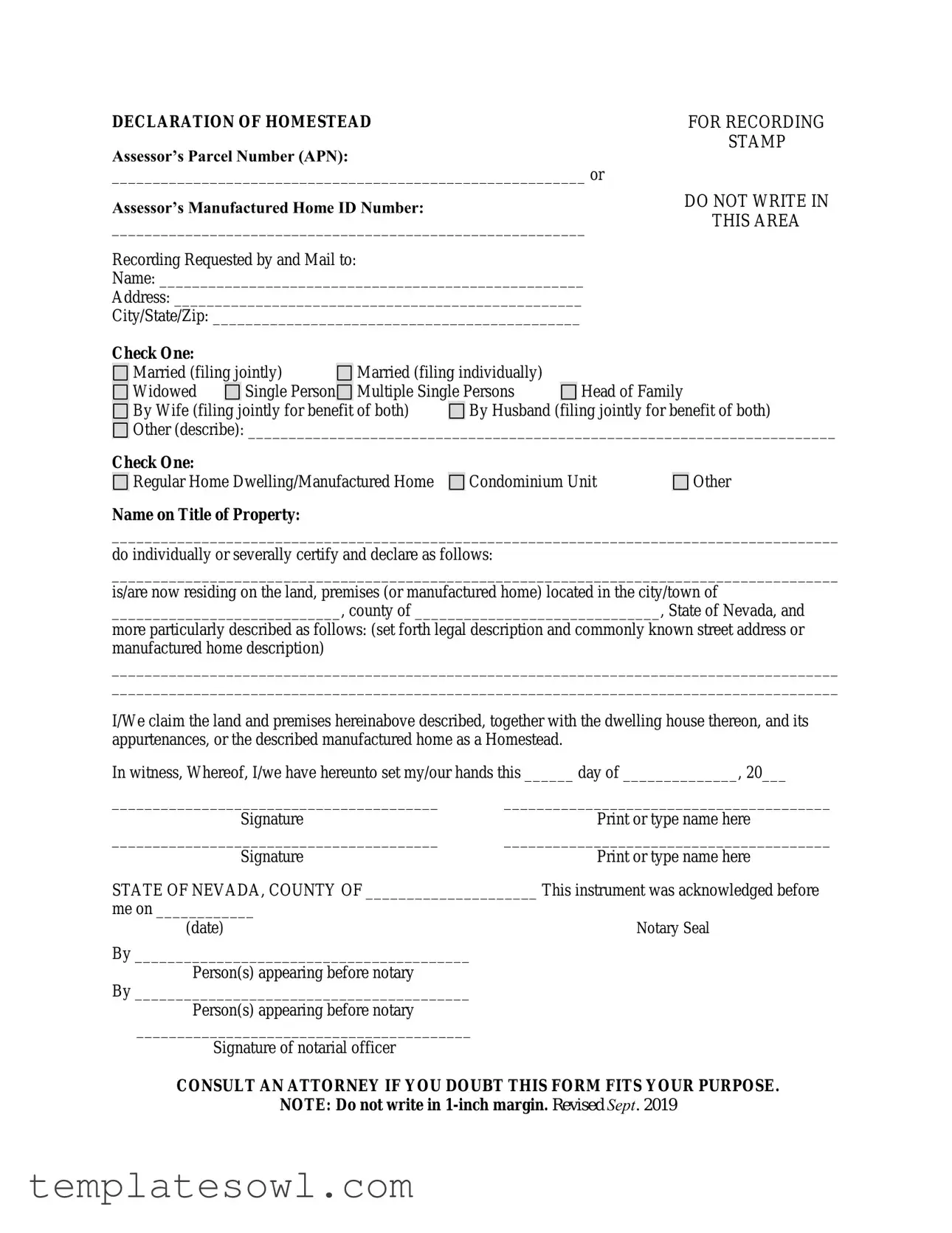

Fill Out Your Nevada Homestead Form

The Nevada Homestead form serves as an essential legal document that enables homeowners to protect their primary residence from certain creditors. This form is crucial for determining eligibility based on the homeowner's marital status, whether filing jointly or individually, and establishing the type of property being declared as a homestead. Homeowners can select from various options, including a regular home dwelling, a manufactured home, or a condominium unit. Additionally, the form requires the assessor’s parcel number or manufactured home ID number, which uniquely identifies the property. Legal descriptions and addresses must be provided, ensuring clarity in the property being claimed. The declaration affirms the homeowner's intent to claim homestead status, offering protections and benefits under Nevada law. Lastly, the signatures of the homeowners are required, and the document must be notarized to verify its authenticity, emphasizing the importance of legal acknowledgment in this process.

Nevada Homestead Example

DECLARATION OF HOMESTEAD

Assessor’s Parcel Number (APN):

__________________________________________________________ or

Assessor’s Manufactured Home ID Number:

__________________________________________________________

Recording Requested by and Mail to:

Name: ____________________________________________________

Address: __________________________________________________

City/State/Zip: _____________________________________________

FOR RECORDING

STAMP

DO NOT WRITE IN

THIS AREA

Check One: |

|

|

|

|

|

|

|

|

|

|

Married (filing jointly) |

|

Married (filing individually) |

|

|

||||

|

Widowed |

|

Single Person |

|

Multiple Single Persons |

|

Head of Family |

||

|

By Wife (filing jointly for benefit of both) |

|

By Husband (filing jointly for benefit of both) |

||||||

Other (describe): ________________________________________________________________________

Other (describe): ________________________________________________________________________

Check One: |

|

|

Regular Home Dwelling/Manufactured Home |

Condominium Unit |

Other |

Name on Title of Property:

_________________________________________________________________________________________

do individually or severally certify and declare as follows:

_________________________________________________________________________________________

is/are now residing on the land, premises (or manufactured home) located in the city/town of

____________________________, county of ______________________________, State of Nevada, and

more particularly described as follows: (set forth legal description and commonly known street address or manufactured home description)

_________________________________________________________________________________________

_________________________________________________________________________________________

I/We claim the land and premises hereinabove described, together with the dwelling house thereon, and its appurtenances, or the described manufactured home as a Homestead.

In witness, Whereof, I/we have hereunto set my/our hands this ______ day of ______________, 20___

________________________________________ |

________________________________________ |

Signature |

Print or type name here |

________________________________________ |

________________________________________ |

Signature |

Print or type name here |

STATE OF NEVADA, COUNTY OF _____________________ This instrument was acknowledged before

me on ____________

(date)

By _________________________________________

Person(s) appearing before notary

By _________________________________________

Person(s) appearing before notary

_________________________________________

Signature of notarial officer

CONSULT AN ATTORNEY IF YOU DOUBT THIS FORM FITS YOUR PURPOSE.

NOTE: Do not write in

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose of Homestead | The Nevada Homestead form protects a homeowner's equity in their primary residence from creditors, ensuring a degree of financial security. |

| Eligibility Criteria | Any individual or family residing in Nevada may file for a homestead declaration, including married couples, single persons, and heads of family. |

| Governing Laws | The Nevada Homestead Law is outlined in NRS 115.010 to 115.110, which governs the filing and protection provisions of homesteads. |

| Required Signatures | All owners listed on the title must sign the homestead declaration in front of a notary public to validate the form. |

Guidelines on Utilizing Nevada Homestead

After gathering all the necessary information, you will begin filling out the Nevada Homestead form. This form must be completed carefully and should be signed in the presence of a notary public. Below are the detailed steps to guide you through the process.

- Identify the Assessor’s Parcel Number or Manufactured Home ID Number. This information is critical and can usually be found on your property tax statement.

- Enter the name and address of the person recording the form. Fill in the Name, Address, City, State, and Zip code in the designated fields.

- For recording stamp space, leave it blank as instructed in the form.

- Select the appropriate personal status. Check the box that applies to your situation: Married (filing jointly or individually), Widowed, Single Person, Multiple Single Persons, Head of Family, or Other.

- Select the type of dwelling. Check the box that describes your home: Regular Home Dwelling/Manufactured Home, Condominium Unit, or Other.

- State the name on the property title. Clearly print the name(s) of the individual(s) on the title of the property.

- Complete the residence information. Describe the land, premises, or manufactured home. Include the city/town, county, and legal description along with the commonly known street address.

- Make the homestead claim. Clearly state that you claim the property as your Homestead.

- Sign and print your name. Both spouses should sign where indicated, if applicable. Ensure to print or type your names beneath your signatures.

- Acknowledge the notary section. This part will be completed by a notarial officer, so make sure to present the document to one for verification.

After completing the form, it’s essential to have it notarized. This ensures your homestead declaration is valid and can be recorded in the county where the property is located. Keep copies for your records once it’s been filed.

What You Should Know About This Form

What is the purpose of the Nevada Homestead form?

The Nevada Homestead form protects a homeowner's primary residence from certain creditors. By filing this form, individuals can claim a homestead exemption, which can provide significant legal protections for their property.

Who can file a Nevada Homestead form?

Any homeowner who occupies their property as their primary residence can file the Nevada Homestead form. This includes married couples, single individuals, widowed persons, and heads of families. The form accommodates different filing statuses to reflect individual circumstances.

What types of properties qualify for homesteading in Nevada?

Eligible properties include single-family homes, manufactured homes, and condominiums. The property must serve as the homeowner's primary residence. Other types of properties may also qualify, but it is essential to specify the property type on the form.

How do I complete the Nevada Homestead form?

To complete the form, individuals need to fill out the required information, including names, addresses, and legal descriptions of the property. The form must indicate the filing status and type of dwelling. Once completed, signatures from the homeowners and a notary public are necessary for the form to be valid.

Is notarization required for the Nevada Homestead form?

Yes, notarization is an essential step in the process. The form must be acknowledged by a notary public to confirm the identities of the individuals signing. This adds an extra layer of validation to the filing.

Where should I file the Nevada Homestead form?

After completing and notarizing the form, it should be filed with the county recorder's office in the county where the property is located. This step is crucial for the protections of the homestead to become effective.

What should I do if I am unsure whether the Nevada Homestead form applies to my situation?

If there are uncertainties regarding the applicability of the form, it is advisable to consult an attorney. A legal professional can provide guidance tailored to individual circumstances and ensure that the filing meets the necessary requirements.

Can I remove the homestead designation once it is filed?

Yes, a homeowner may choose to remove or abandon the homestead designation at any time. This usually involves filing a separate document to officially notify the county recorder's office of the change. Understanding the implications of such a decision is essential, so consultation with a legal professional is recommended.

Common mistakes

Filling out the Nevada Homestead form is a crucial step in protecting your home. However, many individuals stumble on key details that may complicate the process. One common mistake is failing to include the Assessor’s Parcel Number (APN) or the Manufactured Home ID Number. This information is essential for identifying your property and ensuring that the homestead declaration is properly recorded.

Another frequent error involves misidentifying the applicant's status. Applicants often check the wrong box when selecting their marital status. This selection not only affects how the homestead is classified but may also impact the benefits available under Nevada law. It's important to carefully consider your specific situation when making this choice.

Completing the section about where you reside can also lead to mistakes. People sometimes neglect to provide a complete legal description of the property or omit the commonly known street address. A vague description can invite confusion and delay in processing. It's crucial to be as detailed as possible.

Signatures pose another common challenge. Some individuals forget to have all necessary parties sign the form. If you are filing jointly or if multiple owners are involved, ensure that everyone who has an interest in the property provides their signature. Missing signatures can render the form invalid.

Also, the notary acknowledgment is critical. Individuals often overlook the requirement for a notary seal or signature. This oversight can prevent the form from being recorded. Ensure that a notary public confirms your identity and the authenticity of your signatures before submission.

When filling out the form, pay attention to the 1-inch margin note. Some people mistakenly write in this area, which can lead to the document being rejected. Follow the instructions carefully to avoid unnecessary complications.

Making sure that information is printed clearly is vital as well. Illegible handwriting can lead to misunderstandings. Take the time to fill out the form neatly to facilitate processing.

It's also essential to consult with a qualified attorney if you're uncertain about any aspect of the form. Skipping this step may save time now but can lead to complications later. Legal advice can provide clarity and ensure that your declarations are suitable for your needs.

Last but not least, double-check all information before submitting the form. Rushing through the process often results in simple mistakes that can cause delays or require re-filing. Taking a moment to review your entries can make a significant difference in the outcome.

Documents used along the form

The Nevada Homestead form serves an essential purpose in protecting homeowners' properties. When filing this document, you may also consider other forms and documents to ensure comprehensive protection and compliance with local regulations. Below is a list of commonly used documents that complement the Nevada Homestead form.

- Warranty Deed: This legal document transfers ownership of real property from one person to another. It provides guarantees regarding the title, ensuring that the seller holds clear and marketable title to the property.

- Affidavit of Title: This sworn statement asserts the seller's ownership of the property and outlines any encumbrances or claims against it. It is often used to clarify any potential issues regarding the title.

- Notice of Default: This document is filed when a borrower falls behind on mortgage payments. It notifies interested parties that foreclosure proceedings may begin if the issue is not resolved.

- Power of Attorney: This document allows one person to act on behalf of another concerning legal and financial matters. It is useful when homeowners cannot be present for the signing of essential documents.

- Property Tax Exemption Application: In Nevada, homeowners may need to file this application to qualify for certain property tax relief programs based on their homestead status.

- Occupancy Affidavit: Often required by lenders, this document certifies that the homeowner occupies the property as their primary residence, which is often a requirement to receive specific loan benefits.

- Title Insurance Policy: This policy protects against financial loss due to defects in the title to real property, including issues that may arise after the purchase.

- Certificate of Trust: If the property is held in a trust, this document proves the authority of the trustee managing the property, ensuring proper distribution according to the trust’s terms.

These documents can enhance your property protection strategy and reinforce your legal standing. It's wise to consider each of them in conjunction with the Nevada Homestead form to ensure your interests are fully safeguarded.

Similar forms

The Nevada Homestead form serves a specific legal purpose, primarily aimed at protecting a homeowner’s equity in their primary residence. While it has unique characteristics, it shares similarities with several other legal documents in property and family law. Here are ten documents that resemble the Nevada Homestead form, each with an explanation of their relationship.

- Declaration of Trust: Like the Homestead form, a Declaration of Trust outlines ownership and provides legal protections for real estate, ensuring that the property is managed according to the trust's terms.

- Living Will: This document, while focused on medical decisions, parallels the Homestead form in that both establish specific directives to protect individual interests—be they property rights or personal health wishes.

- Quitclaim Deed: A Quitclaim Deed transfers ownership interests without guaranteeing the title. Similar to the Homestead form, it is a critical document affecting property rights and requires careful consideration.

- Durable Power of Attorney: This document allows an individual to appoint someone to manage their financial affairs. It is similar in its protective intent, ensuring that the appointed person can handle property matters even if the original owner cannot.

- Mortgage Agreement: Like the Homestead form, a Mortgage Agreement outlines terms related to property ownership, establishing rights and obligations for both the borrower and the lender regarding the property’s equity.

- Title Insurance Policy: Both the Title Insurance Policy and the Homestead form aim to safeguard ownership rights. The insurance protects against claims that could undermine a homeowner's equity, paralleling the Homestead's protective function.

- Property Declarations for Tax Purposes: These documents declare property details for taxation; they resemble the Homestead form as they both require official claims regarding property ownership and use.

- Community Property Agreement: In states that recognize community property, such an agreement delineates ownership between spouses. Similar to the Homestead form, it affects how property is held and protected under state law.

- Family Limited Partnership Agreement: This document is often used to protect family assets, akin to the Homestead form's intent to shield a primary residence from creditors.

- Land Use License: This agreement grants the right to use land for specific purposes. Both documents share the theme of establishing and legally protecting a party's interests in real property.

Understanding these documents can help homeowners navigate their legal options and protections regarding property ownership. Each serves a unique purpose but connects through their fundamental goal of ensuring rights and protections are clearly established.

Dos and Don'ts

If you are preparing to fill out the Nevada Homestead form, it is essential to follow certain guidelines to ensure your submission is accurate and effective. Here are some important dos and don’ts:

- Do carefully read the entire form before filling it out.

- Do ensure that all required sections are completed in full.

- Do provide the correct Assessor’s Parcel Number or Manufactured Home ID Number.

- Do include your current mailing address prominently.

- Don’t forget to sign and date the form where indicated.

- Don’t write in the 1-inch margin area of the document.

Your attention to these details can make the process smoother. By following these guidelines, you help protect your property rights effectively.

Misconceptions

Misconceptions about the Nevada Homestead form can lead to confusion and misinformed decisions. Below are five common misconceptions and their explanations.

- Misconception 1: Filing a Homestead Declaration prevents the sale of the property.

- Misconception 2: Homestead protection applies to all types of property equally.

- Misconception 3: Only married couples can file a Homestead Declaration.

- Misconception 4: The Homestead Declaration provides unlimited protection against creditors.

- Misconception 5: Once filed, the Homestead Declaration never needs to be updated.

This is not true. A Homestead Declaration does not impede the owner's ability to sell their property. The owner retains the right to sell, transfer, or encumber the property as they see fit.

In Nevada, Homestead protection is primarily for primary residences. It does not automatically extend to rental properties, vacation homes, or investment properties.

This assertion is incorrect. Individuals, including single persons and widows or widowers, can file for Homestead protection. The form accommodates various filing statuses.

The Homestead Declaration offers limited protection, typically shielding a certain amount of equity in a home from creditors. However, it does not protect against all types of debt, such as mortgage obligations or tax liens.

This is misleading. Changes in ownership, property type, or a shift in primary residence necessitate a new Homestead Declaration to ensure ongoing protection and accuracy.

Key takeaways

Utilizing the Nevada Homestead form is a critical step for homeowners looking to protect their property. Here are some key takeaways to guide you through the process:

- Understand the Purpose: The Homestead form is designed to protect a portion of your home’s equity from creditors, offering a safeguard for your primary residence.

- Eligibility: Both married couples and single individuals can file for a homestead. Be clear on your status as this will determine how you complete the form.

- Property Types: The form can be used for a variety of properties including regular homes, manufactured homes, and condominiums. Choose the appropriate category that fits your situation.

- Legal Description: Ensure that you include an accurate legal description of your property. This might involve details like the street address and the Assessor’s Parcel Number (APN).

- Signatures Required: The form needs to be signed by all owners of the property. Make sure to print or type your names clearly under each signature.

- Notarization: After signing, a notary public must acknowledge the signatures. This step verifies the authenticity of the document.

- Filing Procedures: After completion, it is important to file the homestead declaration with the appropriate county recorder's office. This formally registers your claim.

- Consultation is Key: If you have any doubt about whether this form meets your needs, do not hesitate to consult with a legal professional experienced in property law.

- Margin Guidelines: Follow the guideline not to write in the 1-inch margin at the top of the form. This requirement ensures proper formatting for recording.

- Review and Keep Records: After submission, retain a copy of the filed form for your records. It serves as proof of your homestead claim.

By following these takeaways, you can navigate the homestead recording process with confidence, understanding its implications for your property protection in Nevada.

Browse Other Templates

Partcity - Omissions or misstatements can lead to disqualification or termination.

Does a Trust Override a Beneficiary on a Bank Account - Accurate completion of this form facilitates a smoother estate settlement process after an account holder's passing.

Da Form 67-10-1a Fillable Pdf - Maintaining accuracy in this documentation is essential for administrative and legal purposes.