Fill Out Your Hmrc Starter Checklist Form

The HMRC Starter Checklist form is an essential tool designed for both new employees and employers, streamlining the process of tax code allocation and payroll management. This form gathers critical personal information about the employee, including their name, date of birth, and National Insurance number, to ensure accurate tax reporting. It is vital for new employees to complete the checklist before their first payday, as the employer will use this information to submit the first Full Payment Submission (FPS) to HM Revenue and Customs (HMRC). One of the key elements of the form is choosing the correct employment statement—either A, B, or C—each of which corresponds to specific circumstances regarding previous job status and tax payments. Failure to select the right statement may result in overpayment or underpayment of taxes, which can have lasting implications. Additionally, it addresses any student loans the employee might have, providing clarity on repayment obligations. While this form must be maintained by the employer for record-keeping over multiple tax years, it is crucial to note that neither party should send the checklist to HMRC directly. Instead, it serves as an internal document to streamline payroll processes and keep tax-related information accurate and up-to-date.

Hmrc Starter Checklist Example

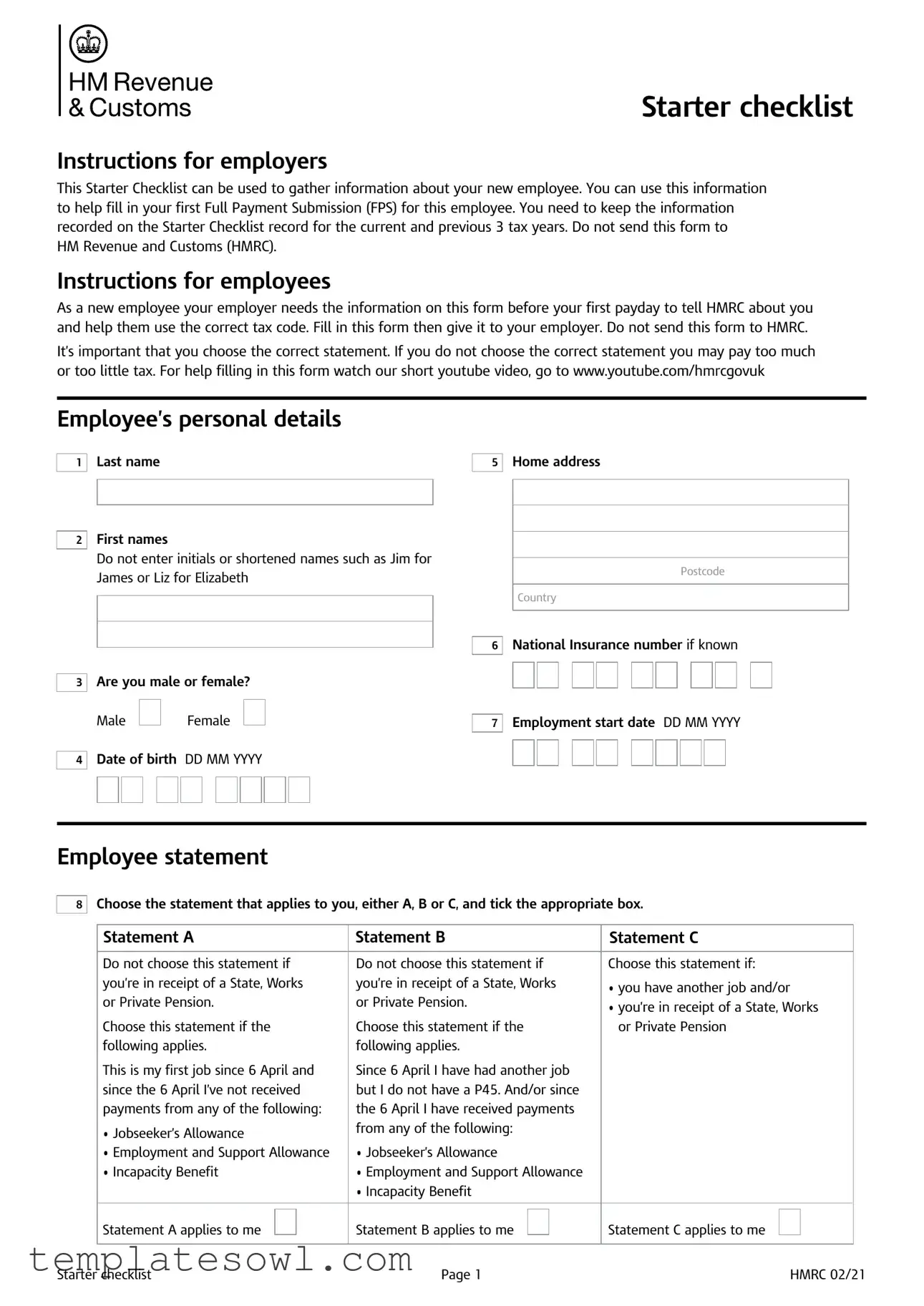

Starter checklist

Instructions for employers

This Starter Checklist can be used to gather information about your new employee. You can use this information to help fill in your first Full Payment Submission (FPS) for this employee. You need to keep the information recorded on the Starter Checklist record for the current and previous 3 tax years. Do not send this form to

HM Revenue and Customs (HMRC).

Instructions for employees

As a new employee your employer needs the information on this form before your first payday to tell HMRC about you and help them use the correct tax code. Fill in this form then give it to your employer. Do not send this form to HMRC.

It’s important that you choose the correct statement. If you do not choose the correct statement you may pay too much or too little tax. For help filling in this form watch our short youtube video, go to www.youtube.com/hmrcgovuk

Employee’s personal details

1

Last name

5

Home address

2First names

Do not enter initials or shortened names such as Jim for James or Liz for Elizabeth

3Are you male or female?

Male Female

4 Date of birth DD MM YYYY

Postcode

Country

6National Insurance number if known

7Employment start date DD MM YYYY

Employee statement

8

Choose the statement that applies to you, either A, B or C, and tick the appropriate box.

Statement A |

Statement B |

Statement C |

|||||||

|

|

|

|

|

|

|

|

|

|

Do not choose this statement if |

Do not choose this statement if |

Choose this statement if: |

|||||||

you’re in receipt of a State, Works |

you’re in receipt of a State, Works |

• you have another job and/or |

|||||||

or Private Pension. |

or Private Pension. |

||||||||

• you’re in receipt of a State, Works |

|||||||||

|

|

|

|

|

|

||||

Choose this statement if the |

Choose this statement if the |

or Private Pension |

|||||||

following applies. |

following applies. |

|

|

|

|||||

This is my first job since 6 April and |

Since 6 April I have had another job |

|

|

|

|||||

since the 6 April I’ve not received |

but I do not have a P45. And/or since |

|

|

|

|||||

payments from any of the following: |

the 6 April I have received payments |

|

|

|

|||||

• Jobseeker’s Allowance |

from any of the following: |

|

|

|

|||||

|

|

|

|

|

|

||||

• Employment and Support Allowance |

• Jobseeker’s Allowance |

|

|

|

|||||

• Incapacity Benefit |

• Employment and Support Allowance |

|

|

|

|||||

|

|

|

• Incapacity Benefit |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

Statement A applies to me |

|

|

Statement B applies to me |

|

|

Statement C applies to me |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

Starter checklist |

Page 1 |

HMRC 02/21 |

Student loans

9Tell us if any of the following statements apply to you:

•you do not have any Student or Postgraduate Loans

•you’re still studying

•you completed or left your

•you’re already making regular direct debit repayments from your bank, as agreed with the Student Loans Company

If No, tick this box and go to question 10

If Yes, tick this box and go straight to the Declaration

10To avoid repaying more than you need to, tick the correct Student Loans that you have - use the guidance on the right to help you.

Please tick all that apply

Plan 1

Plan 2

Plan 4

Postgraduate Loan (England and Wales only)

Types of Student Loan

You have Plan 1 if any of the following apply:

•you lived in Northern Ireland when you started your course

•you lived in England or Wales and started your course before 1 September 2012

You have a Plan 2 if:

You lived in England or Wales and started your course on or after 1 September 2012.

You have a Plan 4 if:

You lived in Scotland and applied through the

Students Award Agency Scotland (SAAS) when you started your course.

You have a Postgraduate Loan if any of the following apply:

•you lived in England and started your Postgraduate

Master’s course on or after 1 August 2016

•you lived in Wales and started your Postgraduate Master’s course on or after 1 August 2017

•you lived in England or Wales and started your

Postgraduate Doctoral course on or after 1 August 2018

Employees, for more information about the type of loan you have, go to

Declaration

I confirm that the information I’ve given on this form is correct.

Signature |

Full name |

|

|

|

|

Date DD MM YYYY

Page 2

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Starter Checklist gathers information about new employees to help employers submit their first Full Payment Submission (FPS) to HM Revenue and Customs (HMRC). |

| Retention Period | Employers must keep the information for the current and previous three tax years. |

| Submission Requirement | This form should not be sent to HMRC. It’s for internal use only. |

| Importance of Accuracy | Choosing the correct statement is vital to avoid overpaying or underpaying tax. |

| Employee Responsibility | Employees must complete this form and give it to their employer before their first payday. |

| Statutory Guidance | For student loan status, guidance is available at www.gov.uk/repaying-your-student-loan. |

| Completion Guidance | Employers and employees can find further assistance on completing the form at www.gov.uk/guidance/special-rules-for-student-loans. |

Guidelines on Utilizing Hmrc Starter Checklist

Completing the HMRC Starter Checklist form is essential for ensuring that your employer has the correct information to report your earnings and tax information to HMRC. Once you fill out the form, submit it to your employer before your first payday. This will help you be taxed correctly from the start of your employment.

- Fill in your personal details:

- Last name

- First names (no initials or shortened names)

- Gender (tick either Male or Female)

- Date of birth (format: DD MM YYYY)

- Home address (include postcode and country)

- National Insurance number (if known)

- Employment start date (format: DD MM YYYY)

- Select the appropriate employee statement:

- Statement A: This is my first job since 6 April and I have not received payments from any applicable benefits.

- Statement B: I have another job since the 6 April and do not have a P45.

- Statement C: I have been receiving payments from State, Works, or Private Pension.

Choose one statement by ticking the corresponding box.

- Answer the Student Loan questions:

- Indicate if you have an unrepaid Student Loan (Yes or No).

- If Yes, specify whether you completed or left your studies before 6th April.

- State if you are repaying your Student Loan directly via direct debit (Yes or No).

- Choose the type of Student Loan from Plan 1, Plan 2, or both.

- Respond to the Postgraduate Loan questions:

- Indicate if you have an unrepaid Postgraduate Loan (Yes or No).

- If Yes, specify whether you completed or left your postgraduate studies before 6th April.

- Confirm if you are repaying your Postgraduate Loan directly via direct debit (Yes or No).

- Fill in the declaration:

- Sign the document.

- Print your full name.

- Enter the date (format: DD MM YYYY).

What You Should Know About This Form

What is the purpose of the HMRC Starter Checklist form?

The HMRC Starter Checklist is utilized by employers to collect important information about new employees. This information assists in accurately completing the first Full Payment Submission (FPS) for the employee. Employers must keep the details recorded on this checklist for the current tax year and the previous three tax years. It is crucial to note that this form must not be sent to HM Revenue and Customs (HMRC).

What should new employees do with the Starter Checklist?

New employees should fill out the Starter Checklist before their first payday. It is essential that they provide accurate information so that their employer can notify HMRC about them and apply the correct tax code. After completing the form, employees must return it directly to their employer and avoid sending it to HMRC themselves.

What are the possible statements an employee must choose from on the form?

Employees need to select one of three statements, labeled A, B, or C. Each statement applies to different situations regarding their employment status and previous income. Choosing the correct statement is critical, as selecting the wrong option could result in paying either too much or too little tax. Clear guidance is provided in the form to help employees identify which statement accurately reflects their circumstances.

How should employees handle their National Insurance number on the checklist?

Employees should provide their National Insurance number if they know it. This number helps the employer ensure accurate reporting to HMRC. If an employee does not have a National Insurance number, they can leave that section blank. It is essential to note that having a National Insurance number supports the correct tax handling but is not strictly mandatory for filling out the checklist.

What information must be retained by employers after completing the form?

Employers are required to keep the information gathered through the Starter Checklist for a minimum of four years, which encompasses the current tax year plus the previous three years. This retention policy ensures that they have necessary documentation available for reference if required by HMRC or for their own record-keeping purposes.

What should employees do if they need assistance while filling out the form?

If employees require assistance while completing the Starter Checklist, they can refer to a short instructional video provided online at the HMRC’s official YouTube channel. This resource can clarify how to fill out the checklist accurately and is designed to help employees avoid common mistakes.

Common mistakes

Filling out the HMRC Starter Checklist form can seem straightforward, but many people run into common pitfalls that could lead to tax issues down the line. Understanding these mistakes is crucial for ensuring accuracy. Here are eight common mistakes to watch out for.

One of the most frequent errors is incomplete personal information. People sometimes forget to include their full names in the correct format. It’s essential to provide your entire first name rather than an initial or shortened form, like "Jim" for "James." This ensures that your records match and prevents unnecessary confusion.

Another common oversight occurs with the date of birth section. Many individuals mistakenly write down the wrong date or use an incorrect format. Always double-check that the day, month, and year are correct—any discrepancy here can affect your tax code and retirement plans.

Some individuals neglect to indicate their gender, leaving that section blank. While it may seem minor, this information helps define your tax obligations and may influence your benefits. It's a small detail that can save you from future headaches.

A big mistake happens when choosing the appropriate statement. Many people either misunderstand the criteria for each statement or fail to read them closely. It's vital to select the correct statement applicable to your situation. Choosing wrongly can lead to overpayment or underpayment of taxes.

Don't forget to fill in the employment start date. A significant number of new employees skip this section, thinking it's not necessary. The start date is crucial information that helps determine how your income will be taxed from day one, so ensure it's accurate!

Confusion often occurs with Student Loan questions, especially regarding the type of loan. Individuals sometimes fail to check the right plan, which can be critical for deductions from your wages. Review the guidelines provided in the form and make sure your answers are squarely aligned with your circumstances.

Inadequate signing of the declaration section is another common mistake. Many individuals forget to sign or date the form, rendering it incomplete. A signed declaration confirms that all provided information is accurate, which is crucial for compliance.

Lastly, some people mistakenly think they need to send the form directly to HMRC. Instead, keep it with your employer who will use it for their payroll records. This simple mistake can lead to administrative complications and potential penalties.

These common mistakes might seem small, but they can significantly impact tax calculations and compliance. Taking time to review and accurately complete your HMRC Starter Checklist can save you from future frustrations.

Documents used along the form

When hiring a new employee, various forms and documents work together to ensure that the necessary information is collected and processed accurately. This approach facilitates smoother payroll procedures and adherence to tax regulations. Below is a list of other important documents that are often used alongside the HMRC Starter Checklist form.

- P45 Form: The P45 form is provided by former employers when an employee leaves their job. It details the employee's tax code and earnings to date in the current tax year, which is essential information for the new employer to calculate the correct tax withheld from the employee's payslip.

- P60 Form: The P60 form summarizes an employee's total pay and deductions for the tax year. Employees receive this document from their employer after the end of the tax year, and it serves as important proof of income and tax contributions for personal records or future job applications.

- National Insurance Number (NIN): This reference number is unique to each individual and is essential for tracking National Insurance contributions and eligibility for various benefits. If known, the new employee should provide their NIN to help the employer register them correctly with HMRC.

- Employment Contract: An employment contract outlines the terms and conditions of employment. It typically includes information about job responsibilities, salary, work hours, and benefits. This document protects both the employee and the employer by clearly defining expectations and obligations.

- Tax Code Confirmation: This document confirms the employee's tax code, which is essential to accurately determine how much tax should be deducted from their income. It helps both the employee and employer understand their tax obligations in relation to other income sources.

- Student Loan Notification: If the employee has a student loan, they should inform the employer, as this affects the repayment process. Documentation regarding the type of student loan will help the employer make accurate deductions from the employee's pay as required by HMRC.

Ensuring that these additional documents accompany the HMRC Starter Checklist creates a comprehensive payroll process, promoting transparency and accuracy. Each of these files plays a critical role in ensuring that both employee and employer meet their tax obligations while safeguarding the worker’s rights.

Similar forms

The HMRC Starter Checklist form is similar to various other documents that gather employee information for tax and payroll purposes. Here are nine such documents:

- W-4 Form: This form is used by employees in the U.S. to indicate their tax situation to their employer. It helps determine the amount of federal income tax to withhold from their paycheck.

- I-9 Form: This document verifies an employee's identity and eligibility to work in the United States. Employers must have this completed for their records.

- Direct Deposit Form: Employees complete this form to authorize their employer to directly deposit their wages into their bank account. It requires personal banking information.

- State Tax Form: Similar to the federal W-4, this form allows employees to indicate their state tax situation, affecting state income tax withholding.

- Health Insurance Enrollment Form: This document gathers personal information to enroll employees in health insurance plans offered by the employer. It captures essential details regarding dependents too.

- Retirement Plan Enrollment Form: Employees use this form to register for employer-sponsored retirement plans, like a 401(k), and to select their contribution amount.

- Employee Handbook Acknowledgment: This acknowledgment confirms that employees have received and understood the company policies as outlined in the employee handbook, which may include conduct, benefits, and other relevant information.

- Emergency Contact Form: This is filled out by employees to provide their employer with contact information for someone to reach in case of an emergency.

- Performance Review Forms: While not filled out by the employee, these documents require the employee's self-assessment and feedback on their performance, impacting future employment and evaluations.

Dos and Don'ts

When completing the HMRC Starter Checklist form, consider these helpful dos and don'ts to ensure accuracy and compliance.

- Do provide your full legal name—avoid using shortened forms like Jim for James.

- Don't forget to include your home address, including the postcode.

- Do choose the correct statement that corresponds to your employment situation.

- Don't choose a statement that does not apply to you, as this could affect your tax code.

- Do enter your employment start date in the correct format: DD MM YYYY.

- Don't skip any of the required fields; every piece of information is important.

- Do confirm your National Insurance number if you know it, as it helps HMRC identify you.

- Don't send the completed form to HMRC; it should be given directly to your employer.

- Do keep a copy of the completed form for your own records.

By following these tips, you can help ensure that your information is accurate and submitted correctly!

Misconceptions

There are several misconceptions surrounding the HMRC Starter Checklist form that could lead to confusion for both employers and employees. Understanding these misconceptions is vital for compliance and accurate tax reporting.

- Misconception 1: The Starter Checklist needs to be submitted to HMRC.

- Misconception 2: The Starter Checklist is optional for new employees.

- Misconception 3: Any statement can be selected on the form without ramifications.

- Misconception 4: The Starter Checklist is only for employees without prior work experience.

- Misconception 5: Information on the form does not need to be kept past the current tax year.

This is incorrect. The form is not required to be sent to HM Revenue and Customs. Employers should retain the information for their records, but it does not need to be submitted.

This form is crucial. It helps employers gather necessary details about new employees for accurate tax code usage. Without it, complications may arise in tax reporting.

This is a dangerous assumption. Selecting the wrong statement can lead to incorrect tax deductions, resulting in overpayment or underpayment of taxes.

In fact, the form is relevant for all new employees, including those who may have held jobs previously but did not receive a P45. The specific circumstances must be accurately indicated.

This is misleading. Employers must retain the information for the current tax year and the previous three years to comply with record-keeping requirements.

Key takeaways

The HMRC Starter Checklist form is an essential document for new employees and their employers. Here are seven key takeaways about filling it out and using it effectively:

- This checklist gathers vital information about new employees to ensure accurate and timely reporting to HMRC.

- Employers must retain the information recorded on this form for the current and three prior tax years.

- Employees should not send this form to HMRC; instead, they should provide it directly to their employer.

- Choosing the correct statement (A, B, or C) is crucial. This choice affects the tax code and, consequently, the amount of tax deducted from pay.

- Specific personal details, such as name, address, date of birth, and National Insurance number, must be accurately filled in by the employee.

- Employees with student loans must disclose information about their repayment status, as this impacts tax calculations.

- A declaration at the end of the form confirms that the information provided is accurate, which is a crucial step in the process.

Browse Other Templates

Capf 163 - Correct completion ensures smooth functioning of emergency contacts during CAP activities.

8668425178 - Utilize FAQs to guide your appeal process.