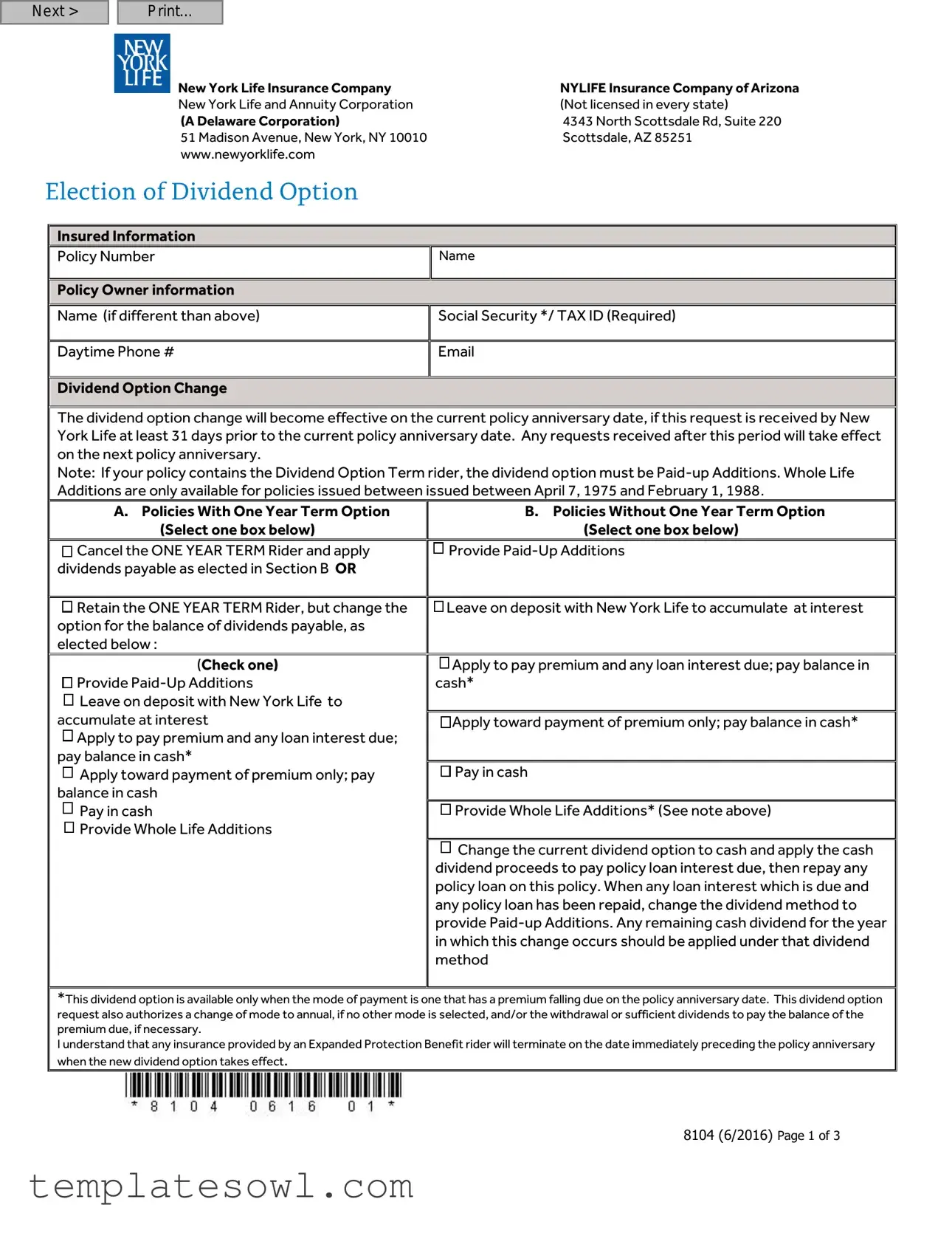

Fill Out Your New York 8104 Form

The New York 8104 form plays a significant role for policyholders of New York Life Insurance Company and its affiliates. It primarily focuses on facilitating changes to dividend options in life insurance policies. When a policyholder wishes to adjust how dividends are utilized—whether that means applying them to premium payments, converting them into paid-up additions, or receiving them in cash—they must complete this form. The effective date for any requested dividend option changes depends on the timing of the submission; requests received more than 31 days before a policy's anniversary will take effect on that date, while later requests will apply to the next anniversary. Additionally, the form requires the policyholder to make important decisions regarding income tax withholding, ensuring compliance with federal and state requirements. Completing the 8104 form correctly not only reveals choices about dividends but also includes necessary certifications regarding the policyholder's tax status. Proper navigation of this form can aid in optimizing the financial management of life insurance benefits, making it an essential document for many insured individuals.

New York 8104 Example

Next >

Print...

New York Life Insurance Company |

NYLIFE Insurance Company of Arizona |

New York Life and Annuity Corporation |

(Not licensed in every state) |

(A Delaware Corporation) |

4343 North Scottsdale Rd, Suite 220 |

51 Madison Avenue, New York, NY 10010 |

Scottsdale, AZ 85251 |

www.newyorklife.com |

|

Insured Information

Insured Information

Policy Number |

Name |

|

|

Policy Owner information |

|

|

|

Name (if different than above) |

Social Security */ TAX ID (Required) |

|

|

Daytime Phone # |

|

|

|

Dividend Option Change

Dividend Option Change

The dividend option change will become effective on the current policy anniversary date, if this request is received by New York Life at least 31 days prior to the current policy anniversary date. Any requests received after this period will take effect on the next policy anniversary.

Note: If your policy contains the Dividend Option Term rider, the dividend option must be

A.Policies With One Year Term Option (Select one box below)

Cancel the ONE YEAR TERM Rider and apply dividends payable as elected in Section B OR

Cancel the ONE YEAR TERM Rider and apply dividends payable as elected in Section B OR

Retain the ONE YEAR TERM Rider, but change the option for the balance of dividends payable, as elected below :

Retain the ONE YEAR TERM Rider, but change the option for the balance of dividends payable, as elected below :

(Check one)

Provide

Provide

Leave on deposit with New York Life to accumulate at interest

Leave on deposit with New York Life to accumulate at interest

Apply to pay premium and any loan interest due; pay balance in cash*

Apply to pay premium and any loan interest due; pay balance in cash*

Apply toward payment of premium only; pay balance in cash

Apply toward payment of premium only; pay balance in cash

Pay in cash

Pay in cash

Provide Whole Life Additions

Provide Whole Life Additions

B.Policies Without One Year Term Option (Select one box below)

Provide

Provide

Leave on deposit with New York Life to accumulate at interest

Leave on deposit with New York Life to accumulate at interest

Apply to pay premium and any loan interest due; pay balance in cash*

Apply to pay premium and any loan interest due; pay balance in cash*

Apply toward payment of premium only; pay balance in cash*

Apply toward payment of premium only; pay balance in cash*

Pay in cash

Pay in cash

Provide Whole Life Additions* (See note above)

Provide Whole Life Additions* (See note above)

Change the current dividend option to cash and apply the cash dividend proceeds to pay policy loan interest due, then repay any policy loan on this policy. When any loan interest which is due and any policy loan has been repaid, change the dividend method to provide

Change the current dividend option to cash and apply the cash dividend proceeds to pay policy loan interest due, then repay any policy loan on this policy. When any loan interest which is due and any policy loan has been repaid, change the dividend method to provide

*This dividend option is available only when the mode of payment is one that has a premium falling due on the policy anniversary date. This dividend option request also authorizes a change of mode to annual, if no other mode is selected, and/or the withdrawal or sufficient dividends to pay the balance of the premium due, if necessary.

I understand that any insurance provided by an Expanded Protection Benefit rider will terminate on the date immediately preceding the policy anniversary when the new dividend option takes effect.

8104 (6/2016) Page 1 of 3

< Back

Next >

Print...

I wish to elect Added Value Advantage

Income Tax Withholding Section

Income Tax Withholding Section

IMPORTANT: The Internal Revenue Service (IRS) requires that you complete this section. See important tax information below before you make your withholding election. If your social security number (SSN) or taxpayer identification number (TIN) is not furnished, we are required by Federal law to withhold 10% of the taxable gain. Withholding election is not required for withdrawal from Dividend Deposits.

Are you a citizen of the United States (including a resident alien)? Yes |

No |

I elect to have the following withholding option applied to this payment and any future payment(s) under this policy (check only one box):

NO Federal or State Income taxes will be withheld |

ONLY Federal Income taxes withheld |

|

(This option may not be available for residents |

|

of certain states. See the State Income Tax |

|

Withholding section of this form) |

BOTH Federal and State Income taxes will be withheld

BOTH Federal and State Income taxes will be withheld

ONLY State income taxes withheld

If you elected any of the option above in which taxes will be withheld, you can specify the tax withholding percentage(%) of each withdrawal you would like to have applied to Federal and/or State income tax withholding. If a specific tax withholding amount is not indicated below, we will withhold 10% for federal tax purposes and the state’s minimum withholding (if applicable). Please fill in items (1) and (2) below.

(1)I would like to apply _____% of the taxable portion to Federal Withholding.

(2)I would like to apply _____% of the taxable portion to State Withholding.

If you elect to have Federal Income tax withheld, we are required to withhold at least 10% of the taxable portion of the distribution. If your state requires withholding, we will withhold the state’s minimum amount if you select an amount that is less than the minimum. Please see Important State Income Tax Withholding Information section.

Policyowner’s Signature (REQUIRED)

Policyowner’s Signature (REQUIRED)

Under penalties of perjury, I (as owner named) certify: (1) my social security number or Tax ID number shown on this form is my correct taxpayer identification number, (2) I am not subject to back withholding because (a) I am exempt from backup withholding; or (b) I have not been notified by the IRS that I am subject to backup withholding as a result of a failure to report all interest or dividend income; or (c) the IRS has notified me that I am no longer subject to backup withholding, (3) I am a U.S. person (includes a U.S. resident alien), and (4) I am exempt from Foreign Account Compliance Act (FATCA) reporting.

Check this box if the IRS has notified you that you are subject to backup withholding.

If I am not a U.S. citizen, U.S. resident alien or other U.S. person, I am submitting the applicable Form W8 with this form to certify my foreign status and if applicable, claim treaty benefits.

The Internal Revenue Service does not require your consent to any provision of this document other than the certifications required to avoid backup withholding.

X

|

Policy Owner Signature |

Name (Printed) |

Date |

|

|

X |

|

|

|

|

|

|

|

|

|

Policy Owner Signature |

Name (Printed) |

Date |

|

|

RETURN FORM TO: |

|

|

|

|

New York Life |

|

|

|

|

P.O. Box 130539 |

|

|

|

|

Dallas, TX |

|

|

|

8104 (6/2016) Page 2 of 3

< Back |

|

Print... |

|

|

|

Important Tax Information

Important Tax Information

You should consider very carefully which box you check above. You should consult with your personal tax advisor, plan administrator, State income tax authority, or your local IRS office if you have any questions about income tax withholding. IRS publication 505 (Tax Withholding and Estimated Tax) and IRS forms

Federal Income Tax Withholding

Federal Income Tax Withholding

A dividend withdrawal from your policy may result in a taxable gain reportable to the IRS on Form 1099. Federal income taxes must be withheld at a flat 10% rate from the taxable portion of your payment (as determined from our records), unless you elect not to have withholding apply by checking the appropriate box in the Income Tax Withholding Election section on this form.

Even if you elect not to have Federal income tax withheld, you are liable for payment of such tax on the taxable portion of your payment. There are penalties under the estimated tax payment rules if enough tax has not been paid through either estimated tax payments or withholding. If the taxable portion of a payment when added to the taxable portion of all other payments during the year is less than $200, Federal income tax is not required to be withheld.

State Income Tax Withholding

State Income Tax Withholding

In addition to the Federal income tax withholding requirements, some states require withholding on policy gains when federal income tax is withheld. As of January 1, 2012, the following states require state income tax withholding when federal income tax withholding is in effect: Iowa, Kansas, Maryland, Massachusetts, Nebraska, Oklahoma, and Virginia. If you live in Arkansas, California, Delaware, Georgia, Maine, North Carolina, Oregon, or Vermont we are required to withhold state income tax if federal income tax withholding is in effect, unless you elect not to have state income tax withheld. If you live in Michigan, we are required to withhold state income tax from the taxable portion of your payments, unless you provide us with a properly completed Form MI

If you reside in any of the following states and request state tax withholding, you must also specify the percentage of state tax withholding that you choose to apply to the taxable portion of the withdrawal: Alabama, Colorado, Connecticut, District of Columbia, Idaho, Illinois, Indiana, Kentucky, Louisiana, Minnesota, Missouri, Montana, New Jersey, New Mexico, New York, North Dakota, Ohio, South Carolina, Utah, West Virginia, and Wisconsin. In these states, if a percentage is not specified, state tax will not be

withheld.

8104 (6/2016) Page 3 of 3

Form Characteristics

| Fact Title | Details |

|---|---|

| Governing Law | The New York 8104 form is governed by the New York State Insurance Law and regulations from the New York State Department of Financial Services. |

| Purpose | This form is used for managing dividend option changes related to life insurance policies issued by New York Life. |

| Effective Date | The dividend option change becomes effective on the current policy anniversary date if received at least 31 days prior. |

| Dividend Options | Policyowners can choose several dividend options, including Paid-Up Additions, cash payments, or accumulating interest. |

| Federal Tax Withholding | The IRS mandates a 10% withholding on taxable gains unless the policy owner opts out using the form. |

| State Tax Withholding | Some states require withholding in addition to federal taxes, especially if federal withholding is applied. |

| Eligibility for Tax Withholding | If the policy owner does not provide a Social Security number or Tax ID, federal law mandates 10% withholding on taxable gains. |

Guidelines on Utilizing New York 8104

Filling out the New York 8104 form requires attention to detail to ensure correct information is submitted. This form allows policyholders to make changes to their dividend options and address tax withholding preferences. Ensure all sections are completed accurately before submitting.

- Begin by entering the insured information in the designated area. Include the policy number and name of the insured.

- If the policy owner differs from the insured, provide the owner's name, Social Security number or TAX ID, daytime phone number, and email address.

- For the dividend option change, follow the instructions to select a box under section A if the policy has a ONE YEAR TERM option. Choose to either cancel the rider or retain it with a different dividend option.

- If the policy does not have a ONE YEAR TERM option, proceed to select a box under section B to indicate your desired dividend option.

- Complete the Income Tax Withholding Section by checking the applicable box regarding federal and state income tax withholding. Provide the withholding percentages if desired.

- Sign the form by providing the policy owner's signature and print your name along with the date of signing.

- Ensure the form is returned to New York Life at the address specified, either by mailing or other means specified for submission.

What You Should Know About This Form

1. What is the New York 8104 form used for?

The New York 8104 form is used to change the dividend options for life insurance policies issued by New York Life. It allows policyholders to indicate how they want their dividends to be handled. Options include applying dividends toward premiums, requesting paid-up additions, or receiving dividends in cash. The form is crucial for ensuring that the policyholder's preferences regarding their dividends are clearly stated and documented.

2. Who can fill out the 8104 form?

The 8104 form can be filled out by the policy owner, who is typically the person or entity that holds the life insurance policy. If the policy owner’s name is different from the insured, both names must be provided on the form. The policy owner must also furnish their Social Security number or Tax ID, as it is a requirement for tax purposes.

3. How do I submit the 8104 form?

After completing the form, you need to return it to New York Life Insurance Company. The submission address is P.O. Box 130539, Dallas, TX 75313-0539. Ensure you have signed the form in the required sections to avoid processing delays. It’s advisable to keep a copy for your records after submission.

4. When does the dividend option change take effect?

The changes to the dividend options will take effect on the current policy anniversary date, provided that the request is received by New York Life at least 31 days before that date. If your request is received after this period, the changes will take effect on the following policy anniversary. This timing factor is essential for ensuring that the dividend options align with the policy cycle.

5. What is the significance of the tax withholding section?

The tax withholding section of the 8104 form is vital for tax compliance. The IRS mandates that Federal income tax be withheld from taxable gains, typically at a rate of 10%, unless you opt-out of withholding. It also includes options for state income tax withholding. Completing this section can help manage your tax obligations related to any withdrawals you may request under the policy.

6. What happens if I do not provide my Social Security number?

If you fail to provide your Social Security number or Tax ID, the IRS requires New York Life to withhold 10% of the taxable gain. This means you would receive a smaller payment than expected, as preemptive withholding occurs for tax purposes. It is essential to fill out this information accurately to avoid unnecessary withholding.

7. Can I change my withholding election later?

Yes, you can change your withholding election at any time. If you decide to elect a different withholding option in the future, you will need to complete a new form to document this choice. Documenting your preferences ensures that your tax obligations align with your financial strategy.

8. Are there any penalties related to early withdrawals and tax withholding?

Yes, penalties may apply if you withdraw funds from your policy before reaching age 59½. The IRS typically imposes a 10% penalty on early distributions unless certain exceptions, such as disability, are met. Always consult a tax advisor if you have questions regarding your specific situation to ensure compliance and to avoid unexpected penalties.

Common mistakes

Filling out the New York 8104 form can sometimes be a straightforward process, but several common mistakes can complicate matters. One major mistake occurs when individuals fail to provide their Social Security Number or Tax ID. This information is mandatory, and its absence can lead to delays or automatic withholding of taxes, which may not be desired.

Another frequent error involves misinterpreting the dividend option selections. It is crucial to clearly understand the choices available. For instance, individuals often select an option without realizing the implications, such as the differences between Paid-Up Additions and leaving dividends to accumulate at interest. Each choice impacts future dividends and the overall value of the policy.

Inattention to detail can also lead to inaccurate calculations of the withholding percentages. Some people either neglect to fill in the percentage fields or mistakenly enter amounts that are not permissible. Since the IRS has specific minimums and requirements, this oversight can result in unintended withholding amounts.

Another common pitfall is not consulting with a tax advisor about the withholding election. This section can significantly impact tax liabilities, yet many individuals make choices based on assumptions rather than informed advice. Proper guidance can help avoid potential penalties and ensure compliance with federal and state regulations.

Signatures are also a point of confusion. Some policy owners forget to sign the form altogether, while others may sign in the wrong location. This simple oversight can render the entire form invalid, delaying the processing of their request.

A critical mistake involves misunderstanding the timeline for dividend option changes. Requests must be submitted at least 31 days before the current policy anniversary. Last-minute submissions can lead to unexpected outcomes, such as changes not taking effect until the following year.

Many individuals also overlook the note regarding the Expanded Protection Benefit rider. Ignoring this information can have serious repercussions if the insurance coverage associated with this rider is allowed to lapse due to an unchecked box.

Furthermore, failing to review the important tax information in the form can lead to misinformed choices. The IRS mandates informative guidelines, yet many skip this section and proceed without fully understanding the consequences of their decisions.

Lastly, some applicants do not verify their tax status before completing the form. For instance, failing to clarify residency status can lead to complications, especially for those who might be non-residents or dual-status individuals. This mistake could affect both federal and state tax obligations and should be avoided.

By being aware of these common mistakes and taking the time to carefully complete the New York 8104 form, individuals can ensure a smoother process. Attention to detail, consultation with professionals, and understanding the implications of their elections will facilitate successful management of their life insurance policy.

Documents used along the form

The New York 8104 form is typically used for making election changes regarding dividend options, tax withholding, and other important matters related to an insurance policy. While filing the 8104, individuals may encounter several other documents that complement its purpose. Below is a list of these commonly used forms and documents, each briefly described to enhance understanding.

- Form W-9: This document is used to provide your Taxpayer Identification Number (TIN) to the insurance company. It is essential for tax reporting purposes, ensuring that the correct information is submitted to the IRS.

- Form 1099: Issued by the insurance company, this form reports any taxable gains from dividend withdrawals. It is critical for individuals to include this information in their tax filings.

- Policy Loan Application: If a policyholder wishes to borrow against their insurance policy, this form is required. It outlines the terms and conditions of the loan, including interest rates and repayment obligations.

- Dividends Election Form: This document allows policyholders to select their preferred method for receiving dividends, whether through cash, account credit, or other options. It helps clarify dividend distribution choices.

- Withdrawal Request Form: Used when a policyholder wants to withdraw funds from their policy. This form specifies the amount to withdraw and may affect the policy's cash value and benefits.

- Beneficiary Designation Form: This form is used to designate or update the beneficiaries of the policy. It is essential for ensuring that the intended individuals receive the policy benefits upon the policyholder's passing.

- Income Tax Withholding Requirement Notice: A notice that informs policyholders about state-specific income tax withholding rules on gains from policy withdrawals. It ensures compliance with local regulations.

- Expansion Protection Benefit Rider: If a policy includes this rider, the associated documentation must be reviewed. This rider can offer additional coverage but may involve specific provisions related to dividend elections.

Understanding these additional forms and documents is crucial for effectively managing insurance policies and ensuring compliance with tax obligations. Proper attention to these details can help avoid unexpected issues down the line.

Similar forms

-

IRS Form W-4: This form allows employees to indicate their tax withholding preferences. Just like the New York 8104 form, it ensures that the correct amount of taxes are withheld from payments, either for employment or retirement. Both forms serve to communicate tax withholding choices effectively.

-

IRS Form W-9: Used to request a taxpayer identification number, the W-9 form collects essential personal information. Similarly, the New York 8104 requires the owner’s social security number or tax ID, establishing a connection to tax obligations for both forms.

-

IRS Form 1099: This form reports various forms of income, including dividends. Just as the New York 8104 mentions the tax implications of dividends, the 1099 form functions to provide a formal record of taxable amounts received.

-

State Tax Withholding Forms: Various states have their own tax withholding forms for income tax deductions. Similar to the New York 8104, these forms ensure that taxpayers are compliant with state tax requirements and have the option to specify withholding preferences.

-

IRS Form 1040: This annual tax return form summarizes an individual’s income and tax liabilities for the year. The New York 8104 complements this process by addressing the withholding and taxable amounts that impact the total reported income on Form 1040.

-

Life Insurance Beneficiary Designation Form: This document allows policyholders to name beneficiaries. Like the New York 8104, it ensures that important choices regarding benefits are clear and documented to facilitate future transactions.

-

Withdrawal Request Form: This form is often used to pull out funds from investment accounts. The New York 8104 addresses a similar need, allowing policyholders to choose options regarding their dividends and the withdrawal of funds.

-

Beneficiary Change Form: Individuals can use this form to alter their designated beneficiaries for various accounts. Like the New York 8104, it manages critical choices about who will benefit from the policy in the future.

-

Tax Exemption Certificate: This certificate may be used to declare exempt status for tax purposes. Both forms capture necessary information to ensure compliance with federal and state tax laws and obligations.

Dos and Don'ts

Things to Do:

- Ensure you provide your correct social security or Tax ID number.

- Check the appropriate boxes for dividend options carefully.

- Submit the form at least 31 days before your policy anniversary date for timely changes.

- Sign the form where required, making sure all names are printed clearly.

Things to Avoid:

- Do not leave any required fields blank.

- Avoid selecting multiple options for dividend distributions.

- Do not forget to check if you are subject to backup withholding.

- Refrain from submitting the form without double-checking your entries.

Misconceptions

Understanding the New York 8104 form can be challenging, and various misconceptions often arise. Below are some common misunderstandings addressed to clarify the vital information regarding this form.

- Myth 1: The New York 8104 form is only for people withdrawing cash from a life insurance policy.

- Myth 2: Submitting the form late will not affect my dividends.

- Myth 3: Completing the tax withholding section is optional.

- Myth 4: The form only applies to U.S. citizens.

- Myth 5: My policy will automatically switch to cash dividends if I do not make a selection.

- Myth 6: There are no penalties for early withdrawal from my policy.

This is not the case. While the 8104 form does relate to cash withdrawals, it also includes substantial information regarding dividend options and tax withholding for policy distributions. It encompasses various aspects of policy management.

In reality, if the form is submitted less than 31 days prior to the policy anniversary date, any requested changes will not take effect until the following anniversary. Therefore, timely submission is crucial.

While it may seem optional, it is essential to complete the tax withholding section. If not specified, federal law mandates a 10% withholding on taxable gains, which may cause unnecessary deductions from your distribution.

This misconception overlooks that the form is also applicable to resident aliens. However, the requirements may differ, and non-citizens need to submit additional documentation like Form W8.

This is inaccurate. If no option is selected, policyholders risk receiving a default option that might not align with their preferences. Making explicit choices will ensure the dividends are managed according to your wishes.

Unfortunately, early withdrawals can incur a penalty. If the withdrawal is made before the age of 59½, the IRS may impose a 10% penalty, unless specific exceptions apply. It is vital to consider the financial repercussions of an early withdrawal.

Addressing these misconceptions can assist policyholders in making informed decisions regarding their life insurance policies and understanding the core functions of the New York 8104 form.

Key takeaways

Filling out the New York 8104 form can seem daunting, but understanding the key components makes the process smoother. Here are some important takeaways to guide you:

- Know your information: Ensure that your policy number, name, and Social Security or Tax ID are accurate. Any errors can cause delays in processing your request.

- Timing is key: If you want your dividend option change to take effect on the current policy anniversary, submit your request at least 31 days in advance.

- Understand dividend options: There are several ways you can choose to apply your dividends. Familiarize yourself with options like Paid-Up Additions or leaving dividends to accumulate interest.

- Tax withholding matters: The IRS mandates that certain sections regarding income tax withholding must be completed accurately to avoid penalties.

- Consult a tax advisor: Before making any withholding elections, it's wise to discuss options with a personal tax advisor to determine which choices best fit your situation.

- Non-persons have restrictions: Only individuals can usually elect out of federal income tax withholding. Corporations and trusts don’t have that option.

- Penalties may apply: Be aware that withdrawing dividends before age 59½ usually incurs a 10% IRS penalty, unless certain exceptions apply.

- State-specific rules: Some states have their own withholding requirements. Be mindful of these when completing the form based on your state of residence.

Browse Other Templates

Ppd Hours - A duplicate copy of the form should be submitted alongside the filing fee.

What Is a Claim of Exemption for Wage Garnishment - The form must be returned to the levying officer and is not to be filed with the court.

Vehicle Inspection Pdf - Inspection forms must be retained for a minimum of fourteen months, promoting thorough record-keeping.