Fill Out Your New York Certificate Form

The New York Certificate of Incorporation is a crucial document for anyone looking to establish a business corporation within the state. This form, specifically designed under Section 402 of the Business Corporation Law, requires several key pieces of information to ensure that the corporation is legally recognized. It includes the corporation's name, its intended purpose, and the county where the office will be located. Additionally, the certificate outlines the authority to issue shares—typically 200 common shares without par value. An important aspect of the form is the designation of the Secretary of State as the agent for receiving legal documents on behalf of the corporation. This means that any legal processes directed toward the corporation can be formally served through the Secretary’s office. Completing this form also involves providing details about the incorporator, who must be a natural person, ensuring that the process is compliant with New York’s legal requirements. While the Department of State provides this template for convenience, it's advised to consult with an attorney to understand any optional provisions or additional requirements that may apply. Filing the certificate incurs a fee of $125, emphasizing the need for businesses to plan accordingly as they navigate the incorporation process.

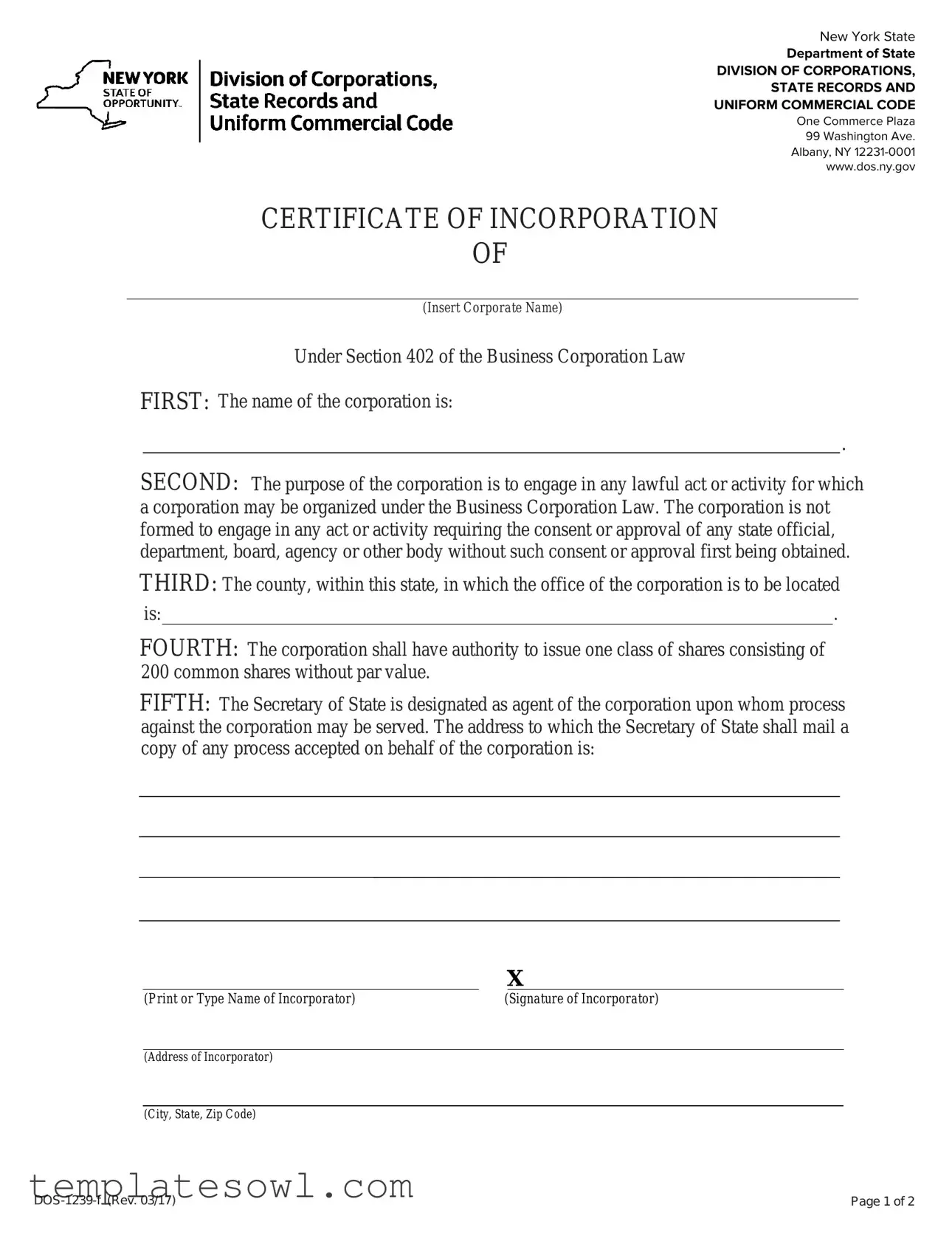

New York Certificate Example

New York State

Department of State

DIVISION OF CORPORATIONS,

STATE RECORDS AND

UNIFORM COMMERCIAL CODE

One Commerce Plaza

99 Washington Ave.

Albany, NY

www.dos.ny.gov

CERTIFICATE OF INCORPORATION

OF

(Insert Corporate Name)

Under Section 402 of the Business Corporation Law

FIRST: The name of the corporation is:

.

SECOND: The purpose of the corporation is to engage in any lawful act or activity for which a corporation may be organized under the Business Corporation Law. The corporation is not formed to engage in any act or activity requiring the consent or approval of any state official, department, board, agency or other body without such consent or approval first being obtained.

THIRD: The county, within this state, in which the office of the corporation is to be located

is: |

|

. |

FOURTH: The corporation shall have authority to issue one class of shares consisting of 200 common shares without par value.

FIFTH: The Secretary of State is designated as agent of the corporation upon whom process against the corporation may be served. The address to which the Secretary of State shall mail a copy of any process accepted on behalf of the corporation is:

|

X |

|

(Print or Type Name of Incorporator) |

|

(Signature of Incorporator) |

(Address of Incorporator)

(City, State, Zip Code)

Page 1 of 2 |

CERTIFICATE OF INCORPORATION

OF

(Insert Corporate Name)

Under Section 402 of the Business Corporation Law

Filer’s Name and Mailing Address:

Name:

Company, if Applicable:

Mailing Address:

City, State and Zip Code:

Notes:

1.This form was prepared by the New York State Department of State for filing a certificate of incorporation for a business corporation. It does not contain all optional provisions under the law. You are not required to use this form. You may draft your own form or use forms available at legal stationery stores.

2.The Department of State recommends that legal documents be prepared under the guidance of an attorney.

3.The fee for filing a certificate of incorporation is $125. Checks should be made payable to the Department of State.

4.The incorporator must be a natural person, not a corporation or other business entity.

5.The filer may not be the corporation being formed.

For DOS use only

Page 2 of 2 |

Form Characteristics

| Fact Name | Details |

|---|---|

| Governing Law | The Certificate of Incorporation is governed by Section 402 of the New York Business Corporation Law. |

| Department of State | The form is issued by the New York State Department of State, Division of Corporations. |

| First Requirement | The corporation's name must be inserted in the designated section of the form. |

| Purpose Statement | The form states that the corporation's purpose is to engage in any lawful act or activity. |

| Office Location | The form requires the inserter to specify the county in New York where the corporate office will be located. |

| Share Issuance | The corporation is authorized to issue 200 common shares without par value. |

| Agent for Service | The Secretary of State is designated as the agent for service of process against the corporation. |

| Filer's Requirements | The incorporator must be a natural person, not another corporation or business entity. |

| Filing Fee | The filing fee for submitting the certificate is $125, payable to the Department of State. |

Guidelines on Utilizing New York Certificate

When you set out to fill out the New York Certificate form for incorporation, it's essential to gather the relevant information ahead of time. Completing the form properly will get the process moving smoothly.

- Visit the New York State Department of State website to obtain the form or use your printed copy.

- In the first section, write the name of the corporation where it says "(Insert Corporate Name)".

- For the second section, state the purpose of the corporation as engaging in lawful activities according to the Business Corporation Law.

- Identify the county in New York where the corporation's main office will be located and write it in the space provided.

- In the fourth section, indicate that the corporation will issue 200 common shares without par value.

- Designate the Secretary of State as the agent for the corporation and provide the address where process can be served on behalf of the corporation.

- Under the signature block, print or type the name of the incorporator and provide their signature.

- Fill in the address, including city, state, and zip code, of the incorporator at the bottom of the form.

- Note the fee of $125 for filing, and prepare a check made out to the Department of State if filing by mail.

What You Should Know About This Form

What is the New York Certificate of Incorporation?

The New York Certificate of Incorporation is a legal document required to officially establish a corporation in New York State. It outlines essential details about the corporation, such as its name, purpose, and the number of shares it can issue. This form, developed by the New York State Department of State, helps ensure that the corporation operates within the guidelines set by the state's Business Corporation Law.

How do I fill out the New York Certificate of Incorporation?

Filling out the New York Certificate of Incorporation involves providing specific information about your corporation. You need to state the corporate name, define the purpose, indicate the county where the office will be located, and specify the number of shares. Additionally, the incorporator’s details, including name and address, must be included. It is advised that individuals seek assistance from an attorney to ensure the document is completed accurately.

What is the filing fee for the certificate?

The filing fee for the New York Certificate of Incorporation is $125. When submitting your application, make sure to include a check made payable to the Department of State. This fee covers the processing of your application and is required for the establishment of your corporation.

Who can serve as the incorporator?

The incorporator must be a natural person, which means it cannot be a corporation or any other type of business entity. The incorporator is responsible for executing the certificate and is typically the person initiating the incorporation process.

Can I draft my own certificate of incorporation?

Yes, you can draft your own certificate of incorporation if you prefer not to use the provided form. There are no legal stipulations requiring the use of the state form, but make sure your document includes all necessary information as outlined in the Business Corporation Law. Seeking legal guidance during this process is highly recommended.

Is it necessary to consult an attorney when filing?

While it is not a legal requirement, consulting an attorney is strongly recommended when preparing legal documents like the certificate of incorporation. An attorney can help ensure that your form is correctly filled out and that all legal conditions are met, which could save you time and prevent issues down the line.

What happens after I file the certificate of incorporation?

Once you file the certificate of incorporation and pay the fee, the New York State Department of State will process your application. If everything is in order, they will issue a Certificate of Incorporation, officially recognizing your corporation. This allows you to begin conducting business under your corporation’s name.

Can the corporation itself file the certificate?

No, the corporation being formed cannot file the certificate of incorporation. The incorporator, who must be a natural person, is responsible for submitting the form. This ensures that the formation process is handled correctly, establishing a clear separation between the individual and the entity.

Common mistakes

Filling out the New York Certificate of Incorporation can be straightforward, but many individuals stumble in the process. One common mistake is failing to provide the correct corporate name. It is crucial to ensure that the name chosen is unique and not already in use by another corporation. The state maintains a database of registered names, so a quick search can help avoid this issue.

Another frequent error involves misunderstanding the purpose of the corporation. While the form states that the purpose is to engage in any lawful act, some people narrow it down unnecessarily. A vague or overly specific purpose can lead to trouble down the road. Ensure the description captures the broad scope of activities your corporation intends to pursue.

Many filers also neglect to specify the correct county where the corporation's office will be located. Missing or incorrect information can delay processing. Make sure to review this section carefully. The county must align with the address provided, as discrepancies can lead to confusion.

Providing inaccurate information for the incorporator is another pitfall. The incorporator must be a natural person, not another corporation. This requirement is often overlooked. Having the correct name, signature, and address of the incorporator is essential for a smooth filing process.

Lastly, people often overlook the importance of including the correct mailing address for the Secretary of State. This address is where any legal process will be sent. If the address is incorrect, it can lead to missed communications, which could be detrimental to your corporation’s compliance and legal standing.

Documents used along the form

When incorporating a business in New York, several forms and documents are typically required alongside the New York Certificate of Incorporation. Each document serves a unique purpose in the process, helping to establish and formalize the new corporation.

- Bylaws: These are the internal rules and regulations governing the operations of the corporation. Bylaws outline the roles of officers, procedures for meetings, and rules for shareholder voting. They serve as an essential guide for corporate governance.

- Initial Board of Directors Resolution: This document is created to appoint the initial board members and address related operational matters. It's significant as it formally establishes the leadership structure and sets the groundwork for decision-making processes.

- Employer Identification Number (EIN) Application (Form SS-4): This form is used to obtain a unique identification number from the IRS. The EIN is vital for tax purposes and is required to open a business bank account and hire employees.

- Consent to Serve as Director: This document indicates that individuals agree to serve on the board of directors. It demonstrates compliance with legal requirements and confirms that the directors understand their responsibilities.

- Certificate of Publication: After incorporation, New York requires new corporations to publish a notice of incorporation in local newspapers. This document serves as proof that the corporation has met the public notice requirements.

- State and Local Business Licenses: Depending on the nature of the business, various licenses may be required at the state or local level. This includes permits related to zoning, health, safety, or specific industry regulations.

Completing and submitting these documents can help ensure a smooth incorporation process. It's advisable to consult with a legal professional to navigate these requirements effectively and to make sure everything is in compliance with state laws.

Similar forms

- Articles of Incorporation: Similar to the New York Certificate form, this document outlines the basic information about a corporation and is required for its formation in many states. It typically includes the name of the corporation, purpose, registered agent, and share structure.

- Certificate of Formation: Often used interchangeably with Articles of Incorporation, this document serves the same purpose in certain jurisdictions. It officially establishes a corporation and includes essential information about its existence.

- Operating Agreement: While typically associated with Limited Liability Companies (LLCs), this document outlines the organizational structure and operating procedures. Like the New York Certificate, it is a foundational document that governs the company's operations.

- Bylaws: This internal document details the management structure and organizational rules of a corporation. While not required to be filed with the state, it complements the Certificate of Incorporation by providing guidelines for the corporation's operation.

- Initial Resolution: This document captures the decisions made by the initial board of directors or incorporators regarding the establishment of the corporation. It serves a similar foundational role as the New York Certificate form.

- Certificate of Good Standing: This document verifies that a corporation is legally registered and compliant with state regulations. It can reflect similar corporate standing as that achieved by filing the Certificate of Incorporation.

- Employer Identification Number (EIN) Application: This form, filed with the IRS, is used to obtain a unique identifier for tax purposes. While it is not a state document, obtaining an EIN is a critical step following the incorporation process, similar to filing the New York Certificate.

- Foreign Qualification Application: If a corporation intends to operate in a state other than where it was formed, it must file this document. It is similar in purpose, as it ensures compliance with state laws regarding business operations.

- Annual Report: Though filed after initial incorporation, this document provides updates to the state about the company's activities and ensures that it remains compliant. It functions as an ongoing requirement following the establishment of the corporation, similar in importance to the New York Certificate.

Dos and Don'ts

When filling out the New York Certificate form, there are essential dos and don'ts to keep in mind. Here’s a helpful list:

- Do ensure that the corporate name is unique and compliant with New York regulations.

- Do clearly outline the purpose of the corporation in accordance with the Business Corporation Law.

- Do include the correct address where the corporation's office will be located.

- Do designate a natural person as the incorporator to sign and submit the form.

- Do pay the required filing fee of $125 to the Department of State upon submission.

- Don’t use this form if you plan to include optional provisions that are not listed.

- Don’t forget to print or type the incorporator's name clearly in the designated space.

- Don’t submit the form without checking it for any errors or omissions first.

- Don’t assume that the incorporator can be an entity—only a natural person can fulfill this role.

- Don’t mix personal and corporation information; keep them separate to avoid confusion.

Misconceptions

Understanding the New York Certificate of Incorporation is vital for anyone looking to establish a business. However, misconceptions abound, which can lead to confusion. Here’s a look at five common misunderstandings.

- It's just a formality. Many believe that filing this certificate is merely a bureaucratic step. In reality, this document lays the groundwork for your business's legal identity and protections.

- Anyone can file for incorporation. Some think they can file the certificate without restrictions. However, the incorporator must be a natural person, not a corporation or other entity.

- The Department of State provides everything needed. It’s misinterpreted that the form includes all necessary provisions for incorporation. This is not true—while the form is a good starting point, optional provisions may need to be addressed separately.

- Filing fees are negotiable. Many assume the filing fee, set at $125, can be altered. That fee is fixed and should be expected when budgeting for incorporation costs.

- Legal guidance isn't necessary. Some entrepreneurs think they can handle all paperwork independently. While it's possible, the New York State Department of State strongly recommends consulting an attorney to ensure proper compliance with legal requirements.

A solid understanding of these misconceptions can help pave the way for a smoother incorporation process. When forming your business, always seek clarity and reliable advice.

Key takeaways

Filing the New York Certificate of Incorporation is an important step for those looking to start a business. Here are some key takeaways to keep in mind:

- Correct Corporate Name: Ensure that the corporate name you choose is unique and complies with New York's naming requirements. You cannot use a name that is already in use or resembles another corporation's name too closely.

- Purpose of Incorporation: The purpose of your corporation must be clearly stated. According to New York law, the stated purpose should allow for any lawful business activities, which grants flexibility for future adjustments.

- Designating an Agent: It's crucial to designate the Secretary of State as the agent for service of process. This means that any legal paperwork can be directed to them, ensuring that you receive important notices.

- Filing Fee: Be prepared to pay a $125 filing fee when you submit your certificate. Ensure that payment is made out to the Department of State to avoid any delays in processing.

Remember, while you can fill out the New York Certificate of Incorporation form, consulting an attorney may be beneficial. Legal guidance can help ensure that you adhere to all regulations and make the most informed choices for your new venture.

Browse Other Templates

Michigan Underpayment Penalty - It is important to maintain accurate records of payments made.

Steer Clear Safe Driver Discount - Initial requirements must be met by all drivers under age 25.