Fill Out Your New York Ifb 1 Form

The New York IFB-1 form is a critical document in the fight against insurance fraud within the state. This form is utilized by individuals and organizations to report suspicious activities or transactions related to various types of insurance claims, including auto, medical, and workers' compensation claims. The form requires detailed information about the suspect transaction, such as the date of loss, the amount involved, and the county where the incident occurred. It also prompts the reporter to provide identifying details about the parties involved, including names, addresses, and relevant information about suspects, like vehicle identification numbers for automobile-related issues. Furthermore, the IFB-1 form asks for a policy or claim number to enable efficient tracking of reports within the insurance system. Essential contact information is also requested, allowing authorities to reach out for further clarity or investigation. Additionally, the form inquires whether the transaction has been reported to any other law enforcement agency, which helps to coordinate efforts in tackling fraud comprehensively. By compiling all this information, the IFB-1 form serves as a crucial tool for the New York State Department of Financial Services Insurance Frauds Bureau to monitor and address fraudulent activities effectively.

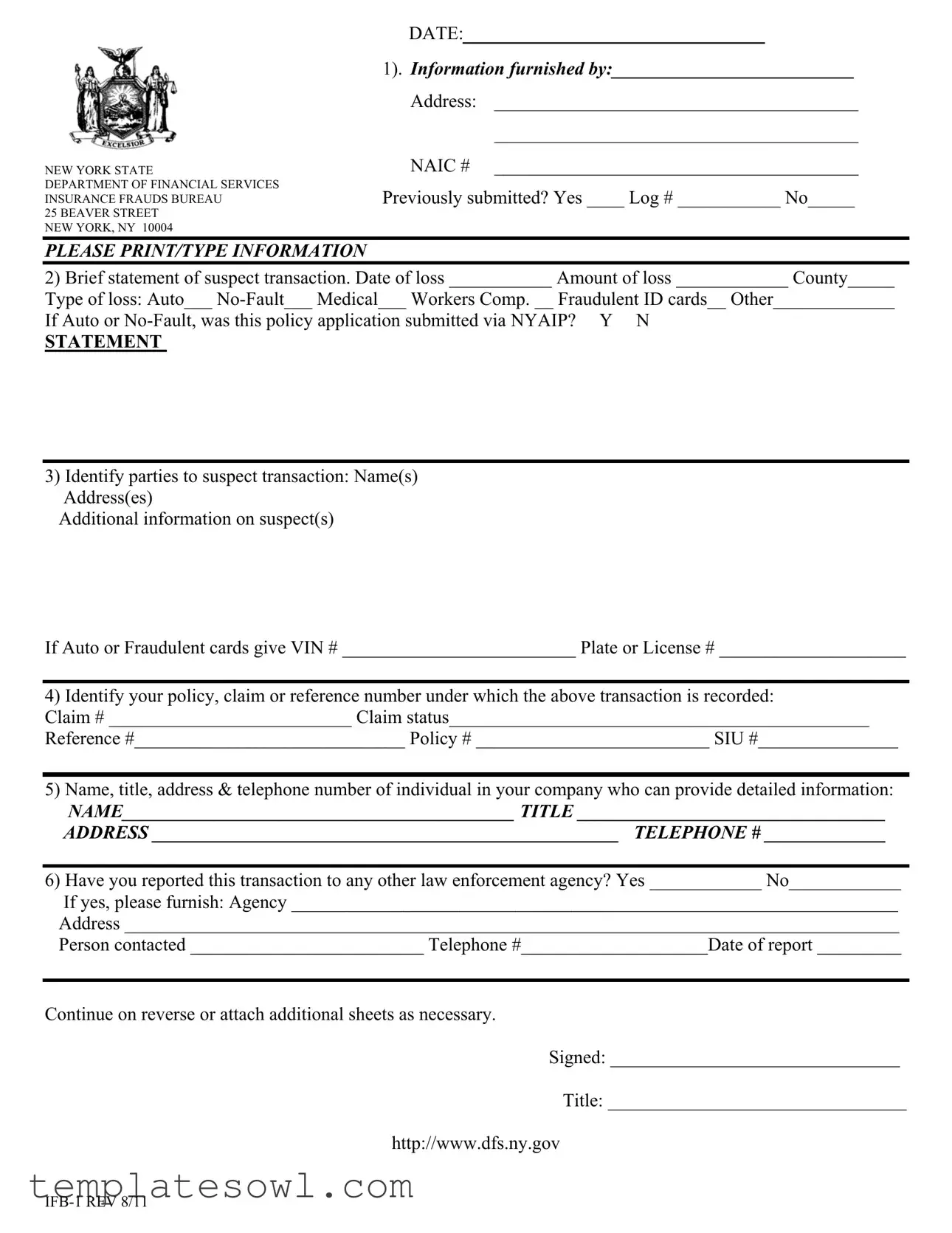

New York Ifb 1 Example

NEW YORK STATE

DEPARTMENT OF FINANCIAL SERVICES INSURANCE FRAUDS BUREAU

25 BEAVER STREET

NEW YORK, NY 10004

DATE:

1). Information furnished by:__________________________

Address: _______________________________________

_______________________________________

NAIC # _______________________________________

Previously submitted? Yes ____ Log # ___________ No_____

PLEASE PRINT/TYPE INFORMATION

2)Brief statement of suspect transaction. Date of loss ___________ Amount of loss ____________ County_____

Type of loss: Auto___

If Auto or

STATEMENT

3)Identify parties to suspect transaction: Name(s) Address(es)

Additional information on suspect(s)

If Auto or Fraudulent cards give VIN # _________________________ Plate or License # ____________________

4) Identify your policy, claim or reference number under which the above transaction is recorded:

Claim # __________________________ Claim status_____________________________________________

Reference #_____________________________ Policy # _________________________ SIU #_______________

5)Name, title, address & telephone number of individual in your company who can provide detailed information:

NAME__________________________________________ TITLE _________________________________

ADDRESS __________________________________________________ TELEPHONE # _____________

6)Have you reported this transaction to any other law enforcement agency? Yes ____________ No____________

If yes, please furnish: Agency _________________________________________________________________

Address ___________________________________________________________________________________

Person contacted _________________________ Telephone #____________________Date of report _________

Continue on reverse or attach additional sheets as necessary.

Signed: _______________________________

Title: ________________________________

http://www.dfs.ny.gov

Form Characteristics

| Fact Name | Description |

|---|---|

| Governing Law | The IFB-1 form is governed by the New York Insurance Law, specifically relevant sections regarding insurance fraud. |

| Purpose | This form is utilized to report suspected insurance fraud to the New York State Department of Financial Services (DFS). |

| Submitting Agency | The form is submitted to the Insurance Frauds Bureau, located at 25 Beaver Street, New York, NY 10004. |

| Date Requirement | Each form must include the date of the transaction in question, facilitating accurate record-keeping. |

| Transaction Details | The form requires a brief statement describing the suspicious transaction, including the type and amount of loss. |

| Identity of Suspects | It is essential to identify the parties involved in the suspect transaction, including their names and addresses. |

| Additional Information | If the fraud involves vehicles, the form requests the Vehicle Identification Number (VIN) and license plate numbers. |

| Claim Details | Applicants must provide claim numbers, policy numbers, and the status of the claims related to the fraudulent activities. |

| Contact Information | The individual in the company responsible for providing further details must be identified, including their contact information. |

| Reporting to Other Agencies | Forms must indicate whether the incident has been reported to other law enforcement agencies. |

Guidelines on Utilizing New York Ifb 1

Filling out the New York IFB 1 form requires careful attention to detail. It's important to provide accurate information to ensure effective communication with the relevant authorities. Here’s how to complete the form step by step.

- Begin by entering your information: Write your name in the space provided. Below that, include your address, ensuring that each line is filled out completely. Additionally, enter the NAIC number, if applicable. If you have submitted this information previously, indicate 'Yes' or 'No' and provide the log number if you answered 'Yes.'

- Include a brief statement of the suspect transaction: Fill in the date of the loss and the amount lost. Indicate the county where the incident occurred. Then, select the type of loss that applies: Auto, No-Fault, Medical, Workers Comp, Fraudulent ID cards, or Other. If applicable, clarify if the policy application was submitted via NYAIP by marking 'Y' or 'N.'

- Identify the parties involved: Provide the names and addresses of the individuals or entities involved in the transaction. If the transaction involves an auto or fraudulent cards, include the Vehicle Identification Number (VIN) and the plate or license number as well.

- Record your policy and claim information: Enter the claim number, followed by its status. Also, fill in the reference number, policy number, and SIU number if applicable.

- Designate an individual in your company: Write the name, title, address, and telephone number of the person who can provide additional details regarding the transaction.

- Report to law enforcement: Indicate whether this transaction has been reported to any law enforcement agency. If the answer is 'Yes', provide the agency's name, their address, and whom you contacted, along with their telephone number and the date of the report.

- Final steps: Review all the information for accuracy before signing the form. Fill in your title, sign in the space provided, and ensure that you have included any necessary additional sheets.

What You Should Know About This Form

What is the purpose of the New York IFB 1 form?

The New York IFB 1 form is a document used to report suspected insurance fraud to the Insurance Frauds Bureau of the New York State Department of Financial Services. It serves as a formal mechanism for individuals or entities to disclose information regarding fraudulent insurance activities. This can include fraudulent claims, misuse of insurance policies, or any other suspicious transactions that may involve illegal acts pertaining to insurance. By submitting this form, the reporter helps to ensure that fraudulent activities are documented and investigated, promoting integrity within the insurance system.

What information do I need to provide when filling out the IFB 1 form?

When completing the IFB 1 form, detailed information is required. This includes personal information about the individual submitting the report, a brief statement outlining the suspect transaction, and specific details regarding the type of loss. You will also need to include relevant identifiers such as claim numbers, policy numbers, and VINs if applicable. It’s important to provide as much information as possible to assist in the investigation process. If the transaction has been reported to other law enforcement agencies, that information should also be included.

Can I submit the form anonymously?

While the IFB 1 form allows for the reporting of insurance fraud, it typically requires the contact information of the individual or entity submitting the report. This is essential for follow-up and additional inquiries that may arise during the investigation. However, individuals concerned about retaliation or privacy may wish to speak with representatives from the Insurance Frauds Bureau to discuss the possibility of submitting information under protective measures.

What happens after I submit the IFB 1 form?

After the submission of the IFB 1 form, the Insurance Frauds Bureau will review the information provided. If sufficient evidence or reasonable cause is present, an investigation may be initiated. The bureau prioritizes cases based on the severity and potential impact of the alleged fraud. The individual who reported the fraud may be contacted for further information or clarification. All reported cases are handled with confidentiality, with the aim of reducing fraud and protecting consumers and insurers alike.

Common mistakes

Filling out the New York IFB 1 form can be a straightforward process, but many people make common mistakes that can hinder their reporting of insurance fraud. Here are six key pitfalls to avoid.

One frequent error is not providing complete information. Omitting details like the names and addresses of the parties involved in the suspected transaction can lead to delays or a rejection of the report. Take the time to fill out every section meticulously. Ensure that all relevant fields, especially those asking for specifics about the suspect transaction, are addressed in full.

Another mistake is using illegible handwriting or not typing the information clearly. If the form is difficult to read, it may be misinterpreted, which can result in complications for your report. Always print the information neatly or use a computer to fill out the form to avoid confusion.

Many individuals also forget to attach supporting documents. It’s crucial to include evidence, whether it be receipts, photos, or correspondence that corroborates your claims. Without these attachments, your report might lack the evidence needed for further investigation.

Some people incorrectly think that they can leave the form unsigned. Failing to sign the IFB 1 form can render it invalid. Always ensure that there’s a signature at the end to authenticate your report, confirming that the information provided is true to the best of your knowledge.

When it comes to the question of whether the transaction has been reported to other agencies, some forget to provide information about previous reports. If you answer yes, be specific and clear about which agency you contacted and the outcome. This information helps law enforcement understand the context of the report better.

Finally, be cautious with the claim or policy numbers. Failing to provide accurate or complete reference numbers can create confusion and lead to delays in processing your report. Double-check these numbers carefully before submitting the form.

By avoiding these common mistakes, you can improve the accuracy of your report and help ensure that your concerns about insurance fraud are addressed promptly. Thoroughness and clarity are essential when filling out the New York IFB 1 form.

Documents used along the form

The New York Ifb 1 form is an essential document used to report suspected insurance fraud. In many cases, individuals or organizations may also need to complete and submit additional forms to provide a comprehensive overview of the incident. Below is a list of forms and documents that are commonly used alongside the New York Ifb 1 form.

- Fraud Reporting Form: This form provides detailed information about the suspected fraudulent activity, specifying various aspects of the alleged fraud, including dates, amounts, and types of insurance involved.

- Incident Report: Often required by insurance companies, this document outlines the circumstances surrounding the incident. It includes details such as location, involved parties, and a narrative description of events leading to the fraud suspicion.

- Witness Statement: In cases where witnesses are available, this document captures their accounts of the incident. It includes personal information, their observations, and how they relate to the suspected fraud.

- Police Report: If a law enforcement agency has been involved, a copy of the police report may be necessary. This document typically includes information about the investigation and any findings related to the fraud claim.

- Claim Adjustment Request: If changes are needed to a previously submitted insurance claim, a claim adjustment request form is required. This document allows you to provide updated information or correct errors that may have been identified.

- Insurance Policy Documentation: Copies of insurance policies connected to the transaction may be needed. This documentation helps clarify the terms of coverage and any relevant exclusions or stipulations.

- Legal Affidavit: In some cases, a formal legal affidavit may be necessary to affirm the truthfulness of the information presented in the fraud report. This document often requires notarization and may escalate the seriousness of the fraud allegations.

Having these forms on hand enhances the clarity and thoroughness of the fraud report. They provide important context and supporting evidence that can help facilitate a successful investigation. Proper documentation is crucial for addressing insurance fraud effectively.

Similar forms

- New York Insurance Claim Form: Both forms require detailed information about the claim, including the parties involved, the nature of the loss, and relevant dates.

- Fraudulent Claims Report: They serve a similar purpose in investigating suspicious claims, requiring specifics about the transaction and parties to identify potential fraud.

- Incident Report Form: These documents ask for a brief description of the incident, including dates and amounts, allowing for a thorough investigation.

- Suspected Fraud Notification Form: Like the IFB 1 form, this notifies authorities of potential fraud, requiring the reporting party's contact information along with details of the fraudulent activity.

- Loss Verification Form: Both forms include reporting requirements for verifying losses, often tied to insurance claims or suspected fraudulent activities.

- Insurance Investigation Report: This document outlines ongoing investigations, similar to how the IFB 1 form collects and documents initial reports of suspicious claims.

Dos and Don'ts

When filling out the New York IFB-1 form, consider the following do’s and don’ts:

- Do: Write clearly and legibly to ensure that your information can be easily read.

- Do: Provide accurate and complete information about the suspect transaction, including all relevant details.

- Do: Include identification numbers, such as VIN or policy numbers, when applicable.

- Do: Sign and date the form before submitting it to the Insurance Frauds Bureau.

- Do: Keep a copy of the completed form for your records.

- Don't: Leave any required fields blank; incomplete forms may delay your submission.

- Don't: Use abbreviations or shorthand that may confuse the information you provide.

- Don't: Forget to check if the transaction has already been reported to another agency; provide details if it has.

- Don't: Misrepresent any information; this can lead to legal issues.

- Don't: Wait until the last minute to submit the form; allow time for any necessary revisions.

Misconceptions

Misconceptions about the New York IFB-1 form can lead to confusion and errors in reporting. Here are nine common misconceptions, explained.

- It's only for major fraud cases. The IFB-1 form can be used for any suspicion of fraud, regardless of the scale. Small instances of fraudulent activities should also be reported.

- Only insurers can submit the form. Any individual or organization that suspects fraud can fill out and submit the IFB-1 form. This includes policyholders, medical providers, and law enforcement officials.

- Providing detailed information is optional. Accurate and complete information is crucial for the investigation process. Omitting details can hinder the ability to address the suspected fraud effectively.

- Submission guarantees an investigation. Filing the form does not guarantee that an investigation will take place. The IFB-Bureau will review submissions and determine if further action is warranted.

- Reports can remain anonymous. While some information may be kept confidential, submitting the form typically requires providing personal and contact information for follow-up.

- The form only pertains to insurance fraud. Although primarily focused on insurance fraud, the IFB-1 can also capture fraudulent activities related to other services covered by insurance, such as medical billing fraud.

- Once submitted, there's no need to follow up. It is advisable to keep a copy of your submission and follow up if you do not receive any communication from the Bureau.

- You can't report fraud if it's already under investigation. It is permissible to report suspected fraud even if it is already being investigated by another party. The information may still be valuable.

- Only specific types of fraud can be reported. The form allows for a variety of fraud types to be reported, including auto, medical, and workers' comp fraud, among others.

Key takeaways

Understanding the New York Ifb 1 form is crucial for effectively reporting suspected insurance fraud. Here are key takeaways to help you navigate this process:

- The form is intended for submissions to the New York State Department of Financial Services Insurance Frauds Bureau.

- Ensure that all information is printed or typed to maintain legibility.

- Provide your contact information, including your name, address, and NAIC number, if applicable.

- Include a brief statement detailing the suspect transaction, clearly specifying the date and amount of loss.

- Identify the type of loss related to the suspected fraud, such as auto, medical, or workers' compensation.

- If applicable, mention whether the policy application was submitted via the New York Automobile Insurance Plan (NYAIP).

- Name the parties involved in the transaction, providing any additional information that could assist in the investigation.

- Detail your policy, claim, or reference number to ensure the Bureau has the necessary context for your report.

- It's essential to check whether the transaction has been reported to other law enforcement agencies; include those details if relevant.

Filling out the form accurately and completely will help expedite the investigation process. Remember to sign the document before submission.

Browse Other Templates

Louisiana Standardized Credentialing Application - List all the languages spoken at your practice to accommodate diverse patients.

University of Richmond Transfer - The decision to request a transfer should align with the student's educational needs and circumstances.