Fill Out Your New York Ls 665 Form

The New York LS 665 form is a crucial document required for the registration of Professional Employer Organizations (PEOs) in New York State. This form, managed by the Division of Labor Standards Permit and Certificate Unit, serves two primary purposes: it facilitates initial registration and renewals for individual PEOs and groups. When completing the form, applicants provide essential information such as the name of the PEO or parent organization, the type of business structure, and federal identification numbers. Additionally, it requires details regarding the physical and mailing addresses of the principal office, as well as any other locations operated by the organization in New York. The form also demands ownership information, necessitating a list of individuals or entities holding a significant stake in the PEO. For group applicants, a list of all member organizations along with their respective addresses and federal identification numbers must be submitted. Clear submission instructions guide applicants through the registration process, outlining the necessary documentation required. Compliance with fiscal responsibilities, declarations, and guarantees of obligations are part of ensuring a smooth approval process. Those interested in understanding the operational requirements for PEOs in New York will find that the LS 665 form is not just a regulatory hurdle but a foundation for establishing clear communication and compliance with state laws.

New York Ls 665 Example

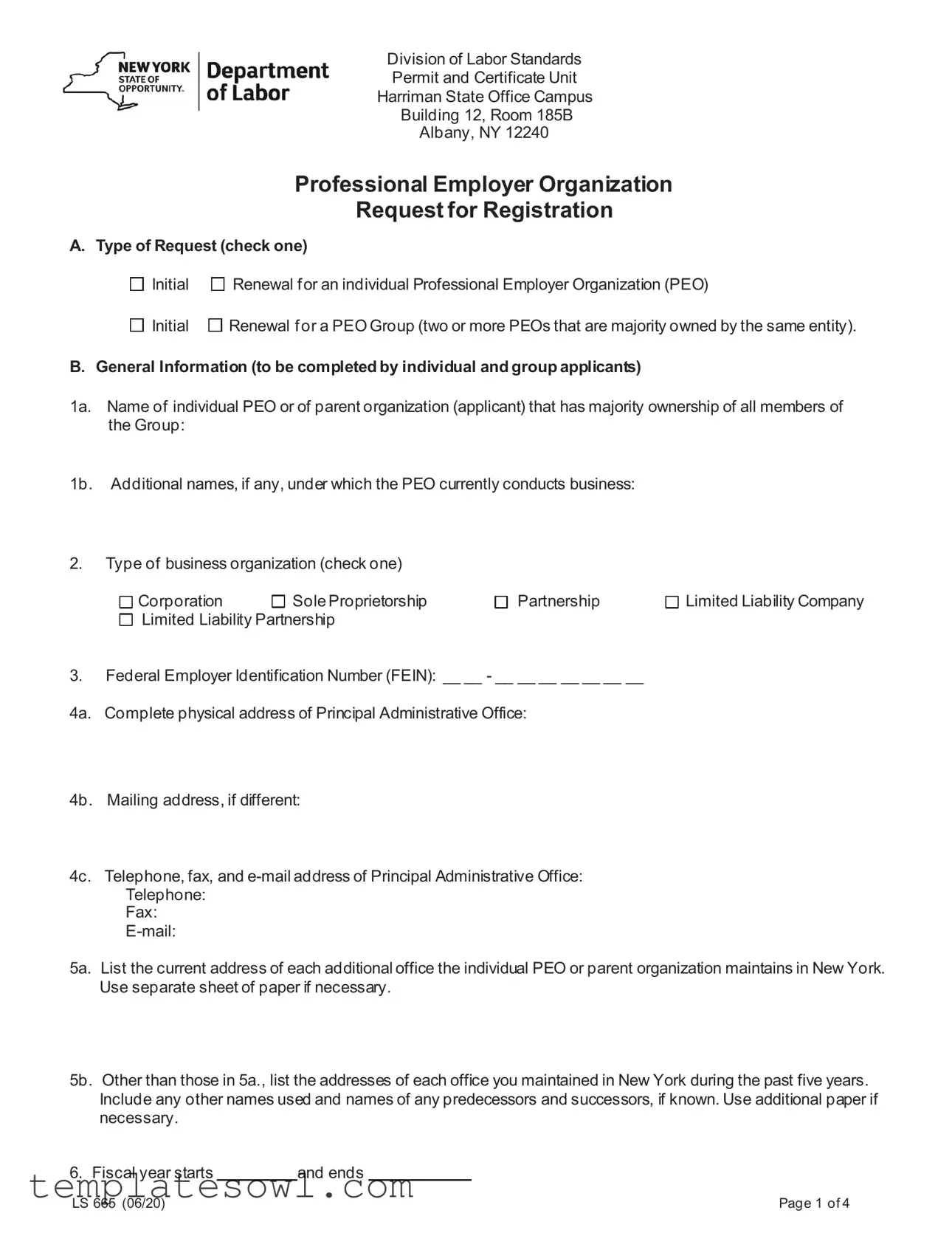

Division of Labor Standards

Permit and Certificate Unit

Harriman State Office Campus

Building 12, Room 185B

Albany, NY 12240

Professional Employer Organization

Request for Registration

A. Type of Request (check one)

Initial |

Renewal for an individual Professional Employer Organization (PEO) |

Initial |

Renewal for a PEO Group (two or more PEOs that are majority owned by the same entity). |

B. General Information (to be completed by individual and group applicants)

1a. Name of individual PEO or of parent organization (applicant) that has majority ownership of all members of the Group:

1b. Additional names, if any, under which the PEO currently conducts business:

2.Type of business organization (check one)

Corporation |

Sole Proprietorship |

Limited Liability Partnership

Partnership |

Limited Liability Company |

3.Federal Employer Identification Number (FEIN): __ __ - __ __ __ __ __ __ __

4a. Complete physical address of Principal Administrative Office:

4b. Mailing address, if different:

4c. Telephone, fax, and

Fax:

5a. List the current address of each additional office the individual PEO or parent organization maintains in New York. Use separate sheet of paper if necessary.

5b. Other than those in 5a., list the addresses of each office you maintained in New York during the past five years. Include any other names used and names of any predecessors and successors, if known. Use additional paper if necessary.

6. Fiscal year starts |

and ends |

|||

LS 665 (06/20) |

|

|

|

Page 1 of 4 |

C. Ownership Information (to be completed by individual and group applicants)

1a. If the applicant PEO is privately or closely held, list all persons or entities that own a five percent (5%) or greater interest in the individual PEO or the parent organization of the PEO group at the time of this application. Use additional paper if necessary.

Person or Entity |

% Ownership |

Address |

1b. List all persons not listed above that have owned a five percent (5%) or greater interest in the individual PEO or the parent organization of the PEO group in the five years preceding the date of this application. Use additional paper if necessary.

Person or Entity |

% Ownership |

Address |

2.If the applicant PEO or its parent company is a publicly traded company, list all persons or entities that own fifty percent (50%) or greater interest in the PEO or the parent company of the PEO.

Person or Entity |

% Ownership |

Address |

D. Group Information (to be completed only by group applicants)

1a. List all the Professional Employer Organizations in the group. Include the FEIN and address for each PEO. Use additional paper if necessary.

PEO |

FEIN |

Address |

1b. Additional names, if any, under which the PEOs conduct business.

2a. List the addresses of each additional office each member of the group maintains in New York. Use separate sheet of paper if necessary.

2b. Other than those in 2a., list the addresses of each office maintained by each member of the group in New York during the past five years. Include any other names used and names of predecessors and successors, if known. Use additional paper if necessary.

LS 665 (06/20) |

Page 2 of 4 |

E. Submission Instructions (applicable to individual and group applicants)

•For any questions, email PEOinfo.LS@labor.ny.gov or call (518)

•The initial PEO registration application must be submitted prior to operating in New York State. Renewal registration application(s) must be submitted no later than 180 days after the end of the PEO’s fiscal year.

•Make sure you have marked on the first page whether this is an initial or renewal request by an individual PEO or a PEO Group, and the Declaration and Group Guaranty, if applicable, on the next page are completed.

•With an initial request, submit a copy of the corporate filing receipt and/or authorization to do business in New York State from the New York State Secretary of State for each incorporated individual PEO, parent organization and PEO group member.

•Attach a blank client contract incorporating the requirements of Article 31 of the New York Labor Law and a sample written notice to worksite employees.

•Attach a list of all New York clients including the name, address, FEIN, type of business, name of the New York State Workers’ Compensation and Disability Insurance policyholders, and number of employees for each client. This list will be kept confidential. Attach a reviewed or audited financial statement of the PEO’s most recent fiscal year;

o The statement must have been prepared within 180 days prior to the submission by an independent certified public accountant (CPA) using generally accepted accounting principles (GAAP) and must show a minimum net worth of $75,000.

o The statement must be accompanied by a cover letter, signed by the independent CPA, certifying that (1) the statement fairly represents the financial position of the firm in accordance with GAAP and (2) there is reasonable assurance that the firm has timely paid all applicable federal and state payroll taxes on all New York employees (for example: office, worksite, etc.) for that fiscal year and explaining the basis for these certifications.

o A PEO Group may submit combined or consolidated audited or reviewed financial statements.

o Where the Group or the Group’s parent submit a combined or consolidated statement, supplemental consolidated or combined schedules covering each professional employer organization registered under the group must be included.

o If a bond or security is to be submitted in place of financial statements, email or call us for submission information.

•Attach proof of New York Workers’ Compensation and Disability Insurance:

oIf you have office and internal employees in New York, provide evidence of coverage for New York State Workers’ Compensation and

Disability Insurance by attaching copies of Form

oIf you have no office or internal employees in New York, attach Form

•If a corporation, the request must be signed by an officer of the corporation authorized to bind the entity.

•If a partnership, proprietorship or LLC, the request must be signed by a partner, owner or member authorized to bind the entity.

•Mail the completed request with all attachments to:

New York State Department of Labor

Division of Labor Standards

Permit and Certificate Unit

State Office Campus

Building 12, Room 185B

Albany, NY 12240

F. Responsibilities (applicable to individual and group applicants)

•Within 60 days of the end of each calendar quarter, the PEO must submit a statement, signed by an independent CPA, certifying that there

is reasonable assurance that the firm has timely paid all applicable federal and state payroll taxes on all New York employees (for example: office, worksite, etc.) for that quarter and explaining the basis for this certification.

•Within 60 days of the end of each calendar quarter, a client list must be submitted, showing all changes since the last list submitted. Include the name and address, FEIN, type of business, and name of New York State Workers’ Compensation and Disability Insurance policyholders for each new client. The list should be signed by an officer, partner, owner or member, certifying the list is complete, current and accurate.

•Upon ending a contract, the client must be advised to contact the Unemployment Insurance (UI) Division concerning its UI liability. Inquiries can be directed to Liability and Determination Section, Unemployment Insurance Division, Department of Labor, State Campus, Albany, NY 12240. The telephone number is (518)

LS 665 (06/20) |

Page 3 of 4 |

G. Declaration (to be completed by individual and group applicants)

By filing this request, the applicant authorizes the Unemployment Insurance Division to release the Unemployment Insurance records of the individual PEO, or PEO parent and each member of the group to the Division of Labor Standards.

I, the undersigned, affirm that I am an officer, partner, proprietor or member of the PEO, or the Applicant and Applicant Group, and am authorized to file this Request for Registration to operate as a PEO, or as a PEO Group, in the State of New York on its behalf or on behalf of the applicant PEO Group. I further affirm that the individual PEO, or PEO parent and each member of the group reviewed and will comply with all legal requirements of statues, in particular Article 31, the New York Professional Employer Act, and regulations of the Department of Labor. I affirm that the information in this request and all attachments is complete and accurate to the best of my knowledge.

Date |

|

|

Signature of Chief Executive Officer, Partner, |

|

|

|

|

|

Sole Proprietor or Member |

||

|

|

|

|

|

|

|

|

|

Print name of above signatory |

||

H. Group Guaranty (to be completed by each member of a PEO Group)

Each PEO that is a member of the PEO Group and is listed on this request must provide the following guaranty.

Guaranty

I, the undersigned, affirm that I am authorized to file this guaranty with the Department of Labor of the State of New York on

behalf of |

|

[insert PEO name] (hereinafter Member Company). |

Member Company is a PEO member of the |

[insert name of applicant] |

|

PEO Group and joins in the application for registration as a PEO group.

As part of this request, Member Company guarantees payment of all legal financial obligations of all other PEOs listed as members of the PEO Group in the request so long as they continue as members of the Group and under the common ownership and control of the applicant.

Date Signed |

|

Signature of Chief Executive Officer, Partner, |

|

|

Sole Proprietor or Member |

Print name of above signatory

LS 665 (06/20) |

Page 4 of 4 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The New York LS 665 form serves as a request for registration of Professional Employer Organizations (PEOs) in New York State, ensuring compliance with local laws and regulations. |

| Governing Law | This form is governed by Article 31 of the New York Labor Law, which regulates the operations of PEOs. |

| Submission Timeline | Initial requests must be submitted before operating in New York, while renewal applications are due within 180 days after the end of the PEO's fiscal year. |

| Required Attachments | Applicants must include various documents such as financial statements, client lists, and proof of workers' compensation insurance with the LS 665 form. |

| Contact Information | For inquiries regarding the form, applicants can reach out via email at PEOinfo.LS@labor.ny.gov or call (518) 457-1942. |

Guidelines on Utilizing New York Ls 665

Completing the New York LS 665 form is essential for establishing or renewing registration as a Professional Employer Organization (PEO). This registration process requires careful attention to detail to ensure compliance with state regulations. Follow these steps to fill out the form correctly.

- Check the Type of Request: On the first page, indicate whether this is an initial or renewal request for either an individual PEO or a PEO Group.

- Fill in General Information: Provide the name of the PEO or parent organization, any additional business names, and select the type of business organization. Include the Federal Employer Identification Number (FEIN) and complete the physical and mailing addresses, as well as contact information.

- List Office Addresses: Detail current addresses of any additional offices in New York and previous addresses for the past five years if applicable.

- Provide Ownership Information: If privately held, list all persons or entities with 5% or greater ownership. Include prior significant owners from the last five years. If publicly traded, list any entity with 50% or greater interest.

- For Group Applicants: List all PEOs within the group along with their FEIN and address. Provide any additional names used for business and the locations of additional offices.

- Gather Submission Documents: Ensure you have the necessary attachments: corporate filing receipts, client contracts, financial statements, proof of insurance coverage, and any other required documentation.

- Complete Signatures: Ensure the request is signed by an authorized individual: an officer for corporations or a partner/member for partnerships and LLCs.

- Mail the Application: Send the completed form and all attachments to the New York State Department of Labor at the address provided in the instructions.

With your LS 665 form filled out and submitted, the next step involves waiting for confirmation of your registration or renewal. Stay vigilant for any follow-up communication from state authorities.

What You Should Know About This Form

What is the New York LS 665 form used for?

The New York LS 665 form is a request for registration for Professional Employer Organizations (PEOs) in New York State. This form is necessary for both initial registrations and for renewals of PEOs and PEO groups. PEOs provide employee leasing services, which means they take on the responsibility for human resources tasks, payroll, and employee benefits for their clients.

Who needs to file the LS 665 form?

Any individual PEO or a group of PEOs wishing to operate in New York State must file the LS 665 form. This requirement applies whether they are seeking to register for the first time or to renew their existing registration. The form must be completed with accurate and comprehensive information about the PEO or its parent organization, including ownership details and operational addresses.

What information is required on the LS 665 form?

The form requires several types of information. Applicants must provide the name of the PEO or its parent organization, their federal employer identification number (FEIN), and details about their corporate structure. The section on ownership requires listing individuals or entities that hold significant ownership stakes. Additionally, contact information, addresses for each operational office, and fiscal year details must be included. The form also necessitates submission of supporting documents, such as financial statements and proof of Workers’ Compensation insurance.

What are the submission instructions for the LS 665 form?

Applicants must ensure they clearly mark whether the application is for an initial registration or a renewal. The completed LS 665 form, along with all required attachments, must be mailed to the Division of Labor Standards Permit and Certificate Unit located at the State Office Campus in Albany, NY. It’s also recommended to contact their office via email or phone for any clarifications needed regarding the submission process.

What are the ongoing responsibilities of a registered PEO in New York?

Once a PEO is registered in New York, it has several responsibilities to uphold. These include submitting a certified statement from a CPA within 60 days following the end of each calendar quarter, confirming timely payment of payroll taxes. Additionally, PEOs must maintain an updated client list that reflects any changes. Following the termination of a client contract, the PEO is responsible for advising clients about their unemployment insurance liabilities.

Common mistakes

Submitting the New York Ls 665 form involves several critical steps. However, many applicants overlook important details that could lead to delays or even rejection. Here are nine common mistakes to avoid when filling out this form.

One frequent error is failing to check the appropriate box for the type of request. Whether it’s an initial application or a renewal, making this distinction clear is essential. Incomplete checks can result in confusion and unnecessary processing time. Make a note to double-check this section before submitting the form.

Another common mistake involves inaccurate or missing information in the general information section. Applicants often forget to include the complete physical address of the principal administrative office or provide a separate mailing address if it's different. Double-check all contact details to ensure that everything is correct and up-to-date. An error here can lead to communication issues later.

Additionally, many applicants neglect to provide their Federal Employer Identification Number (FEIN) or fill it out incorrectly. This number is crucial for identifying your business and facilitating operations. It's worth taking the time to verify that this number is accurate and complete.

Ownership disclosures often present challenges. Some applicants forget to list all individuals or entities holding a five percent or greater interest in the company. Others fail to indicate former ownership interests. Ensure that ownership details are comprehensive and include past stakeholders to avoid complications.

Completing the submission instructions is another area where applicants often stumble. It is vital to attach the required documents, such as proof of insurance and financial statements. Omitting these can halt the processing of your application. Carefully review the submission checklist to guarantee that you have all necessary attachments.

Furthermore, not signing the request correctly can lead to outright rejection. If the applicant is a corporation, ensure the signature comes from an authorized officer. For partnerships, proprietorships, or LLCs, signatures must come from someone with binding authority. Confirm that the signature aligns with your entity's structure.

Another mistake is failing to submit the application within the required timeframe. For initial registrations, the form must be submitted before operating in New York. Renewal applications must be submitted within 180 days after the end of your fiscal year. Missing these deadlines can result in penalties or the need for reapplication.

Lastly, applicants often overlook the importance of the Declaration section. This statement affirms your authority and acknowledges compliance with legal requirements. Failing to sign or misrepresenting your authority can lead to serious legal implications and delays.

Being thorough and careful in your application process is critical. By avoiding these common pitfalls, you can facilitate a smoother review and approval process for your New York Ls 665 form.

Documents used along the form

When completing the New York LS 665 form for Professional Employer Organization registration, several other documents often accompany it. These documents are essential for ensuring compliance with relevant labor laws and for establishing the legitimacy of the application. Below is a list of common forms and documents used alongside the LS 665.

- Form C-105.2: This is a Certificate of Workers' Compensation Insurance provided by an authorized insurance carrier. It confirms that the PEO has the required coverage for its employees in New York.

- DB-120.1: Similar to Form C-105.2, this is a certificate that demonstrates compliance with Disability Insurance requirements in New York. It is important for employee protections.

- CE-200: This form is used by entities without any office or internal employees in New York to claim exemption from Workers’ Compensation and Disability Insurance coverage.

- Client Contract Template: A blank contract form that adheres to Article 31 of the New York Labor Law. This outlines the terms and responsibilities between the PEO and their clients.

- Sample Written Notice: This document serves as a template to inform worksite employees of their rights and responsibilities under the PEO agreement.

- Financial Statement: A reviewed or audited financial statement prepared by a certified public accountant. It must confirm that the PEO has a minimum net worth of $75,000 and validate tax compliance.

- Cover Letter from CPA: This accompanying letter from the CPA certifies the accuracy of the financial statement and confirms timely payment of payroll taxes.

- Client List: A detailed and up-to-date document that specifies all clients, including names, addresses, and Federal Employer Identification Numbers, essential for PEO compliance tracking.

By understanding and preparing these additional documents, applicants can ensure a smoother registration process. Proper preparation reinforces compliance with New York's labor laws and enhances the credibility of the Professional Employer Organization.

Similar forms

The New York LS 665 form, which requests registration for Professional Employer Organizations (PEOs), resembles several other documents in its function or purpose. Below is a list of eight similar forms, along with a brief explanation of how they are alike.

- Application for Employer Identification Number (EIN): Like the LS 665, this form requires information about the business's ownership, structure, and operations for tax purposes.

- New York State Business Certificate Filing: This document also demands details about the business entity, such as ownership structure and business name, similar to the requirements of the LS 665.

- Limited Liability Company (LLC) Formation Documents: Much like the LS 665, these documents gather ownership information and business structure details for registration and compliance.

- Application for a New York State Workers’ Compensation Insurance Policy: This form seeks detailed information on the business operations and ownership, paralleling the LS 665's inquiries.

- Annual Report for Corporations: Both documents require financial information and ownership details, ensuring compliance with state regulations.

- Sales Tax Registration Application: Similar to the LS 665, this application collects information on the business’s structure and ownership to ensure proper tax collection.

- New York City Business License Application: This application requires basic business information along with specific ownership details, similar to the data requested in the LS 665.

- Professional License Application: Like the LS 665, professional licensing applications require personal and business information to verify qualification and compliance with state regulations.

Dos and Don'ts

When completing the New York LS 665 form, it's essential to adhere to certain best practices to ensure a smooth application process. Here are some key dos and don’ts:

- Do read the instructions thoroughly before starting to fill out the form.

- Do ensure that all information provided is accurate and up to date.

- Do double-check your federal employer identification number (FEIN) for accuracy.

- Do sign the application with the appropriate authority for your entity type.

- Do attach all necessary documents, such as financial statements and proof of insurance.

- Don't leave any sections blank; if a question does not apply, indicate that clearly.

- Don't submit the application without reviewing all attachments to ensure completeness.

- Don't miss the submission deadlines; initial applications must be filed before operating, and renewals within 180 days after the fiscal year ends.

- Don't fail to include required certifications from an independent CPA for financial statements.

Following these guidelines closely will help prevent delays in the review process and ensure a successful registration as a Professional Employer Organization in New York.

Misconceptions

- Misconception 1: The LS 665 form is only for new businesses.

- Misconception 2: You can submit the form at any time.

- Misconception 3: Any officer can sign the LS 665 form.

- Misconception 4: Financial statements are optional.

- Misconception 5: You only submit one application for a group of PEOs.

- Misconception 6: You don’t need to provide client information.

- Misconception 7: Previous ownership details don’t matter.

- Misconception 8: Only the owner files the LS 665.

- Misconception 9: You can provide incorrect information and fix it later.

Many people think that the LS 665 form applies solely to new Professional Employer Organizations (PEOs). In reality, both initial applications and renewal requests are handled through this form, making it essential for ongoing operations as well.

It's a common misunderstanding that timing doesn’t matter when submitting the LS 665. Initial registrations must occur before operating in New York, and renewals need to be submitted within 180 days after a PEO’s fiscal year ends.

Not just anyone can sign off on this form. For corporations, the signing authority must come from an officer who is authorized to bind the entity. Similarly, for partnerships and LLCs, only designated members or partners can sign.

Some believe that submitting financial statements is optional, but that's not true. A reviewed or audited financial statement showing a minimum net worth of $75,000 is a crucial part of the application process.

This can be misleading. If you belong to a group of PEOs, each member must provide its own guaranty and details in the application. Each entity has specific reporting and compliance obligations.

Many people overlook the requirement to submit a comprehensive list of all clients, including their names, addresses, and FEINs. This list is not only necessary but is treated confidentially.

Some applicants ignore the requirement to disclose key ownership information about any individuals or entities that held a significant stake in the PEO within the last five years. This transparency is critical for assessments.

It's easy to think that just the owner submits the form, but members of a PEO group must also file pertinent documents and information to ensure compliance, reflecting shared responsibilities.

Providing false or incomplete information is a risky game. The application must be accurate and truthful upon submission. Misrepresentations can lead to denial of registration or further legal issues.

Key takeaways

Here are key takeaways about filling out and using the New York LS 665 form:

- Understand the Purpose: The LS 665 form is used for Professional Employer Organizations (PEOs) to register or renew their status in New York. It's essential for compliance with state requirements.

- Complete All Sections: Each part of the form must be thoroughly filled out. This includes general, ownership, and group information, depending on whether you are applying as an individual PEO or as part of a group.

- Attach Necessary Documentation: When submitting the application, include required documents such as proof of insurance, financial statements, a client list, and corporate filing receipts to ensure your request is processed without delays.

- Follow Submission Guidelines: The completed form and attachments should be mailed to the specified address within the required timeline. Ensure you indicate whether it's an initial or renewal application.

- Stay Compliant Post-Submission: After approval, PEOs must regularly submit tax compliance statements and updated client lists to maintain their registration status and fulfill ongoing obligations.

Browse Other Templates

Lpc Counselor - Appraisal and Evaluation knowledge is essential for effective practice.

How Much Does a Live Scan Cost - Processing fees for Live Scan services on the DMV 8016 are non-refundable.

Rpp Bond - The form serves as a safeguard for the government in case of non-compliance by the principal.