Fill Out Your New York Hotel Tax Exempt Form

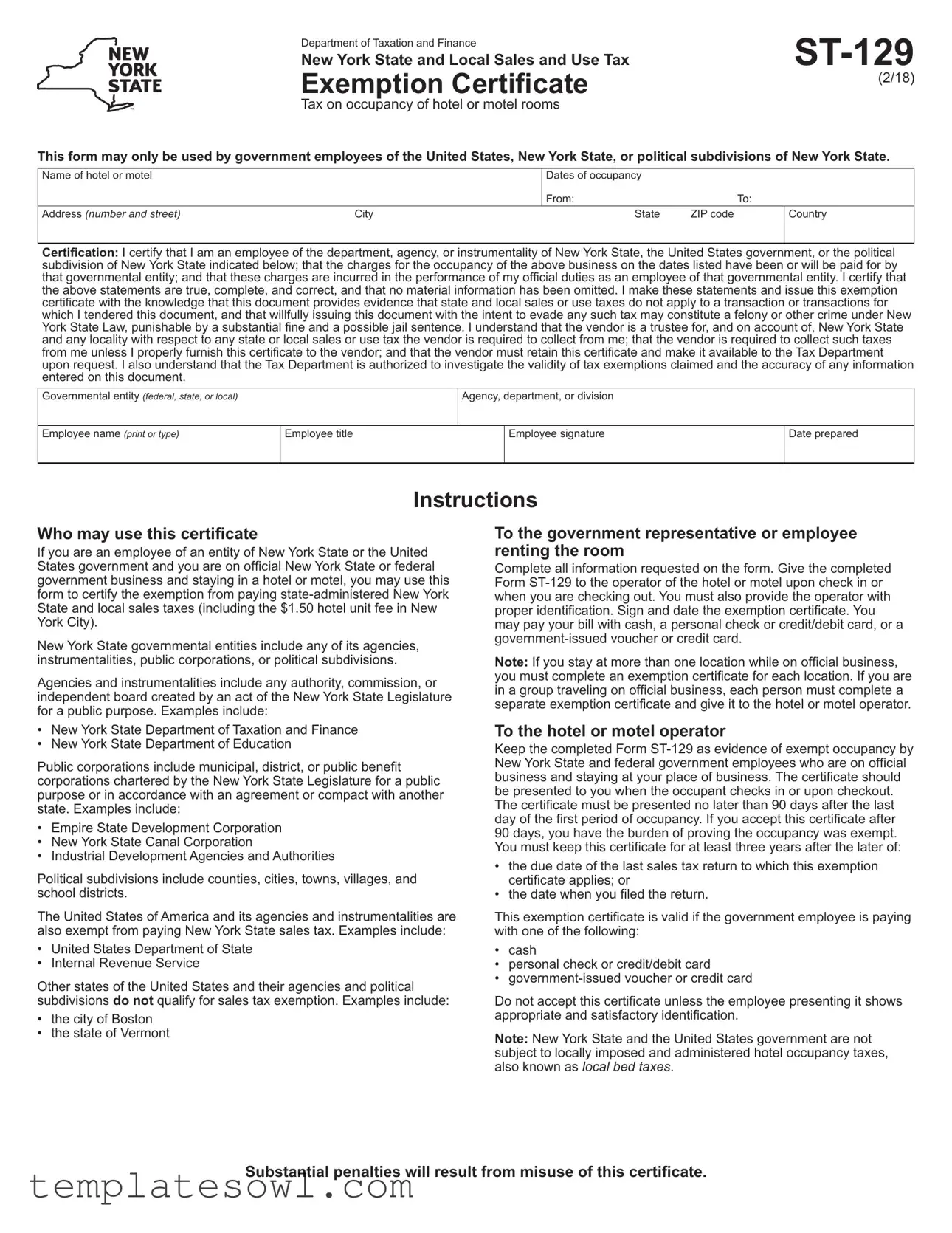

The New York Hotel Tax Exempt form, officially known as ST-129, is an essential document for government employees traveling for official business. This form allows eligible individuals—who represent the United States government, New York State, or its political subdivisions—to exempt themselves from paying state and local sales tax on hotel or motel occupancy. When completing the form, employees must provide vital details, including the hotel name, dates of stay, and the governmental entity they represent. Importantly, the employee certifies that their stay falls within the bounds of their official duties, ensuring the charges will be covered by the relevant government body. It is crucial to understand that proper identification must accompany this exemption certificate when presented to hotel operators. Additionally, the complete and accurate retention of the form is vital for the hotel, as it serves as proof of the exempt status, and they are required to keep these records for a minimum of three years. Given the possible penalties for misuse, adherence to these guidelines is essential for both employees and hotel operators to maintain compliance with New York State tax laws.

New York Hotel Tax Exempt Example

Department of Taxation and Finance |

|

New York State and Local Sales and Use Tax |

|

Exemption Certificate |

(2/18) |

|

Tax on occupancy of hotel or motel rooms

This form may only be used by government employees of the United States, New York State, or political subdivisions of New York State.

Name of hotel or motel |

|

Dates of occupancy |

|

|

|

|

|

|

|

|

From: |

|

|

|

To: |

|

|

Address (number and street) |

City |

|

State |

ZIP code |

|

|

Country |

|

|

|

|

|

|

|

|

|

|

Certification: I certify that I am an employee of the department, agency, or instrumentality of New York State, the United States government, or the political subdivision of New York State indicated below; that the charges for the occupancy of the above business on the dates listed have been or will be paid for by that governmental entity; and that these charges are incurred in the performance of my official duties as an employee of that governmental entity. I certify that the above statements are true, complete, and correct, and that no material information has been omitted. I make these statements and issue this exemption certificate with the knowledge that this document provides evidence that state and local sales or use taxes do not apply to a transaction or transactions for which I tendered this document, and that willfully issuing this document with the intent to evade any such tax may constitute a felony or other crime under New York State Law, punishable by a substantial fine and a possible jail sentence. I understand that the vendor is a trustee for, and on account of, New York State and any locality with respect to any state or local sales or use tax the vendor is required to collect from me; that the vendor is required to collect such taxes from me unless I properly furnish this certificate to the vendor; and that the vendor must retain this certificate and make it available to the Tax Department upon request. I also understand that the Tax Department is authorized to investigate the validity of tax exemptions claimed and the accuracy of any information entered on this document.

Governmental entity (federal, state, or local)

Agency, department, or division

Employee name (print or type)

Employee title

Employee signature

Date prepared

Instructions

Who may use this certificate

If you are an employee of an entity of New York State or the United States government and you are on official New York State or federal government business and staying in a hotel or motel, you may use this form to certify the exemption from paying

New York State governmental entities include any of its agencies, instrumentalities, public corporations, or political subdivisions.

Agencies and instrumentalities include any authority, commission, or independent board created by an act of the New York State Legislature for a public purpose. Examples include:

•New York State Department of Taxation and Finance

•New York State Department of Education

Public corporations include municipal, district, or public benefit corporations chartered by the New York State Legislature for a public purpose or in accordance with an agreement or compact with another state. Examples include:

•Empire State Development Corporation

•New York State Canal Corporation

•Industrial Development Agencies and Authorities

Political subdivisions include counties, cities, towns, villages, and school districts.

The United States of America and its agencies and instrumentalities are also exempt from paying New York State sales tax. Examples include:

•United States Department of State

•Internal Revenue Service

Other states of the United States and their agencies and political subdivisions do not qualify for sales tax exemption. Examples include:

•the city of Boston

•the state of Vermont

To the government representative or employee renting the room

Complete all information requested on the form. Give the completed Form

Note: If you stay at more than one location while on official business, you must complete an exemption certificate for each location. If you are in a group traveling on official business, each person must complete a separate exemption certificate and give it to the hotel or motel operator.

To the hotel or motel operator

Keep the completed Form

90 days, you have the burden of proving the occupancy was exempt. You must keep this certificate for at least three years after the later of:

•the due date of the last sales tax return to which this exemption certificate applies; or

•the date when you filed the return.

This exemption certificate is valid if the government employee is paying with one of the following:

•cash

•personal check or credit/debit card

•

Do not accept this certificate unless the employee presenting it shows appropriate and satisfactory identification.

Note: New York State and the United States government are not subject to locally imposed and administered hotel occupancy taxes, also known as local bed taxes.

Substantial penalties will result from misuse of this certificate.

Form Characteristics

| Fact Name | Description |

|---|---|

| Eligibility Criteria | This form is specifically for employees of the United States government, New York State, and political subdivisions of New York State who are on official business. |

| Exemption Coverage | The ST-129 form exempts users from paying state and local sales taxes on hotel room occupancy, including the $1.50 hotel unit fee in NYC. |

| Retention Requirement | Hotels must keep the completed ST-129 for at least three years after the due date of the last sales tax return to which the certificate applies. |

| Identification Requirement | The employee must present proper identification along with the ST-129 certificate when checking in or out of the hotel. |

| Governing Laws | This exemption certificate is governed by New York State law, specifically under the New York State Tax Law related to sales and use taxes. |

Guidelines on Utilizing New York Hotel Tax Exempt

Completing the New York Hotel Tax Exempt form is a straightforward process. It's crucial to ensure that all information is accurate and that the form is presented properly to the hotel or motel operator. Follow the instructions below to fill out the form correctly.

- Start by entering the name of the hotel or motel where you will be staying.

- Fill in the dates of occupancy. Include the start date in the 'From' field and the end date in the 'To' field.

- Provide the address of the hotel or motel, including the number and street.

- Input the city, state, ZIP code, and the country of the hotel or motel.

- In the Certification section, confirm that you are an employee of the governmental entity mentioned. Fill in the governmental entity (federal, state, or local) and the specific agency, department, or division you work for.

- Print or type your name as the employee.

- Fill in your employee title.

- Sign and date the form in the designated Employee signature and Date prepared fields.

Once completed, deliver the form to the hotel or motel operator. Remember to carry proper identification for verification. If you're traveling with a group or visiting multiple locations, each employee must fill out a separate form for their stay. Following these steps ensures that the exemption is processed smoothly.

What You Should Know About This Form

What is the purpose of the New York Hotel Tax Exempt form?

The New York Hotel Tax Exempt form, officially known as Form ST-129, is utilized by government employees of the United States, New York State, or its political subdivisions to avoid state-administered sales taxes, including local fees for hotel stays. When staying in a hotel as part of official duties, employees of qualifying governmental entities may present this form upon check-in or checkout. By doing so, they certify that their accommodation expenses are covered by their respective governmental entity, allowing tax exemptions that facilitate smoother travel for official business.

Who is eligible to use the tax exemption certificate?

This certificate is specifically intended for employees of governmental entities, which include U.S. federal agencies, New York State agencies, and political subdivisions. Eligible users consist of employees like those from the New York State Department of Education or the Internal Revenue Service. However, it is important to note that employees from other states or their agencies, such as the city of Boston or the state of Vermont, do not qualify for this exemption. To qualify, the employee must be on official state or federal business and must complete the form correctly before presenting it to the hotel operator.

What information needs to be provided on the form?

When filling out the ST-129 form, the employee must provide several key details. This includes the name and address of the hotel or motel, the specific dates of occupancy, and the employee's full name, title, and the governmental entity they represent. Additionally, the form must be signed and dated by the employee to certify the authenticity of the use of the certificate. Proper identification must also be shown to the hotel operator to verify the employee's identity as they present the exemption form.

What should hotel operators do with the completed form?

Hotel and motel operators must retain the completed ST-129 form as proof of the tax-exempt occupancy for their records. It is crucial to collect this form at the time of check-in or checkout and to keep it on file for at least three years. The operator is responsible for ensuring the form is presented no later than 90 days after the last occupancy to maintain the validity of the certificate. Failing to comply with these retention requirements could expose the operator to penalties, so proper diligence is necessary to uphold tax regulations.

Common mistakes

Filling out the New York Hotel Tax Exempt form can seem straightforward, but there are several common mistakes people often make that can lead to complications. One major error is failing to provide the proper identification. When presenting the Form ST-129, it’s essential for government employees to also show appropriate identification. Without it, the hotel operator may refuse to accept the exemption.

Another mistake involves incomplete information. Each section of the form must be filled out meticulously, including the name of the hotel, the dates of occupancy, and the governmental entity, among other details. Leaving any field blank or failing to provide accurate information can render the certificate invalid, making the employee liable for taxes.

Some individuals forget to date the exemption certificate. Signatures alone are not sufficient; the date is crucial. This date helps establish the timeline for the exemption and is vital for both the hotel and the employee’s records. Missing this simple step can create confusion during audits or future reference.

A frequent oversight is misunderstanding entity eligibility. The form is exclusively for employees of the United States, New York State, or its political subdivisions. Employees from other states or cities do not qualify, and mistakenly attempting to claim an exemption can lead to hefty penalties.

People sometimes misuse government-issued payment methods. While cash, personal checks, or credit/debit cards can be used, it’s crucial that the payment reflects the government entity, such as a government-issued voucher or credit card. If a personal card is used without proper adherence to this guideline, the exemption may be denied.

For those traveling as part of a group, another common mistake is the assumption that one exemption certificate is sufficient for everyone. Each traveler must independently complete and present their own certificate. Failing to do so can result in unexpected tax liabilities for individuals in the group.

Additionally, there is often confusion regarding submission timelines. The exemption certificate must be presented to hotel operators no later than 90 days after the first occupancy period. Ignoring this deadline can lead to the inability to claim the tax-exempt status, thus incurring unnecessary charges.

Lastly, retaining the form is just as important as filling it out correctly. Both hotel operators and government employees should keep copies of the exemption certificate for their records. This documentation is necessary for audits and verifying the exemption's legitimacy. Neglecting to hold on to these records can lead to complications if questioned later by tax authorities.

Documents used along the form

When completing the New York Hotel Tax Exempt form, some additional documents may be required to support your tax-exempt status. These documents help ensure that all the necessary information is provided and can facilitate a smoother experience during your stay. Below is a list of commonly used forms and documents that work hand-in-hand with the New York Hotel Tax Exempt form.

- Government Employee ID: This identification verifies your status as a government employee. It should be presented along with the exemption form to the hotel operator.

- Travel Authorization Letter: This document outlines the purpose of your travel on official business. It may be required by some hotels to confirm your exemption status.

- Payment Method Documentation: If you are using a government-issued credit card or voucher, you might need to provide proof of payment for the stay, showing that it will be covered by your agency.

- Confirmation of Reservations: A copy of your booking confirmation may be needed. This document helps justify that the accommodations are for official duties.

- Department Travel Policy: Some hotels may request a copy of your agency's travel policy that details the state’s tax-exempt policies. This confirms that your travel meets the requirements for exemption.

- Previous Tax Exemption Certificates: If you have stayed at various locations on official business, keeping copies of past exemption forms can validate your claims in subsequent stays.

Having these documents ready can help ensure you receive the tax-exempt benefits you are entitled to while traveling on official business. Always confirm with the hotel in advance about their specific requirements, as they can vary by location. Being prepared promotes a seamless experience during your stay.

Similar forms

The New York Hotel Tax Exempt form has similarities with several other tax exemption documents commonly used by government employees or entities. Below are nine documents that share characteristics with the New York Hotel Tax Exempt form:

- Federal Government Tax Exemption Certificate (IRS Form 8109): Similar in that it is used to exempt certain federal government transactions from taxation, specifically for purchases made in the course of official duty.

- State Sales Tax Exemption Certificate: Many states issue their own exemption certificates for sales taxes. These certificates allow government employees to avoid paying sales tax on purchases made for state-related activities.

- Local Government Tax Exemption Certificate: Municipalities often have their own exemption forms for local taxes that work similarly to the New York form, facilitating tax exemption for local government employees.

- Direct Pay Permit: Certain states issue these permits to governmental entities, allowing them to make purchases without paying sales tax, which they will later remit based on their usage.

- Government Contract Exemption Certificate: This document is used when a government entity contracts out services or goods, certifying that sales taxes do not apply due to their government status.

- Travel Expense Reimbursement Form: Though primarily for reimbursement, these forms often include federal or state exemptions for tax management, similar to the hotel tax exemption process.

- Emergency Service Tax Exemption Form: Used by entities that provide emergency services, this form grants similar tax exemptions as the hotel tax exemption for services rendered during official business.

- Educational Institution Tax Exemption Certificate: Many educational institutions possess forms that allow government employees to purchase goods or services without sales tax, much like the hotel exemption.

- Non-profit Organization Tax Exemption Certificate: Non-profits often use specific exemption certificates for transactions related to their exempt purposes, akin to government-related transactions.

Dos and Don'ts

When filling out the New York Hotel Tax Exempt form, follow these guidelines to ensure accuracy and compliance.

- Complete all sections of the form accurately, including the name of the hotel, dates of occupancy, and government entity information.

- Provide proper identification along with the exemption certificate at check-in or checkout.

- Sign and date the exemption certificate to validate your claim.

- Use the form only for official government business; personal trips do not qualify for tax exemption.

- Submit a separate exemption certificate for each location if staying at multiple hotels.

- Keep a copy of the completed form for your records.

In addition to the guidelines above, be mindful of these common pitfalls.

- Do not submit the form without proper identification from the governmental entity.

- Do not attempt to use this form for stays that are not related to official duties.

- Do not accept the exemption certificate after the 90-day limit following the last occupancy period.

- Do not forget to notify your hotel or motel if you are part of a group, as each member must have a separate certificate.

- Do not misuse the exemption certificate, as this may lead to substantial penalties.

- Do not neglect to retain the certificate for at least three years for audit purposes.

Misconceptions

When it comes to the New York Hotel Tax Exempt form, also known as Form ST-129, many people hold misconceptions that can lead to confusion. Understanding the facts can help ensure proper usage and compliance. Here are six common misconceptions:

- The form can be used by anyone. Only government employees from the United States, New York State, or its political subdivisions can use this form. It does not apply to employees of other states or local governments unless they are working specifically under federal or New York State mandates.

- It is acceptable to submit the form after checking out. To maintain its validity, the form must be presented at the time of check-in or checkout, no later than 90 days after the last occupancy day. Waiting too long could invalidate the exemption.

- Only specific payment methods qualify for tax exemption. In reality, government employees can pay using various methods, including cash, personal checks, credit/debit cards, or government-issued vouchers. The choice of payment does not hinder the exemption as long as the proper form is furnished.

- All hotel chains automatically recognize this form. While this form grants tax exemption, it is crucial for employees to communicate with the hotel in advance to ensure that they understand this certification and are prepared to accept it properly.

- One exemption certificate is enough for multiple stays. This is incorrect. Each hotel stay requires its own completed Form ST-129. Employees must prepare a new form for each location, even if the stays occur during the same business trip.

- Misuse of the form involves minor penalties. Misuse of the exemption certificate can lead to serious legal consequences, including substantial fines or even imprisonment. It is important for employees to understand the legal implications of issuing this document inaccurately.

By dispelling these misconceptions, government employees can better navigate the process of using the New York Hotel Tax Exempt form, ensuring compliance and avoiding potential pitfalls.

Key takeaways

Here are key takeaways regarding the New York Hotel Tax Exempt form ST-129:

- Eligibility: Only employees of the U.S., New York State, or its political subdivisions can use this form.

- Required Information: Complete all sections of the form, including hotel name, dates of stay, and personal details.

- Identification: Present proper identification along with the completed exemption certificate upon check-in or check-out.

- Multiple Stays: Each hotel stay requires a separate form, even for group travel.

- Payment Methods: Payments can be made by cash, personal check, credit/debit card, or government-issued payments.

- Submission Timing: The exemption certificate must be submitted within 90 days after the last day of stay.

- Record Keeping: Hotels must retain the completed certificate for at least three years.

- Local Taxes: New York State and federal government employees are exempt from local occupancy taxes.

- Compliance: Misuse of the form may lead to severe penalties, including fines and possible jail time.

- Trustee Responsibility: Vendors must collect taxes unless a valid certificate is provided and retained.

Browse Other Templates

Wisconsin Estimated Tax Form - Crossing out the year on the voucher can lead to misdirected payments.

How to Write a Eulogy Step by Step - The one I remember most is the time when (tell a story that illustrates your personality).