Fill Out Your Nfp 102 10 Form

The NFP 102.10 form is a crucial document for those looking to establish a Not For Profit Corporation in Illinois. This form serves as the Articles of Incorporation, outlining essential details required by the Secretary of State's Department of Business Services. It encompasses various sections, beginning with the corporate name and the associated registered agent's name and address, ensuring proper representation. In addition, the form requires the listing of the initial Board of Directors and their respective addresses, promoting transparency and accountability right from the outset. Furthermore, it asks for a statement of the corporation’s purpose, which defines the objectives for which the organization is formed. This form also includes sections that inquire whether the corporation aligns with specific classifications, such as a condominium association, cooperative housing corporation, or homeowner's association, which can impact its regulatory obligations. Lastly, incorporators must substantiate the validity of the information by signing and dating the document, affirming its accuracy under penalty of perjury. Overall, the NFP 102.10 form encapsulates the foundational elements necessary for launching a nonprofit enterprise in accordance with Illinois law.

Nfp 102 10 Example

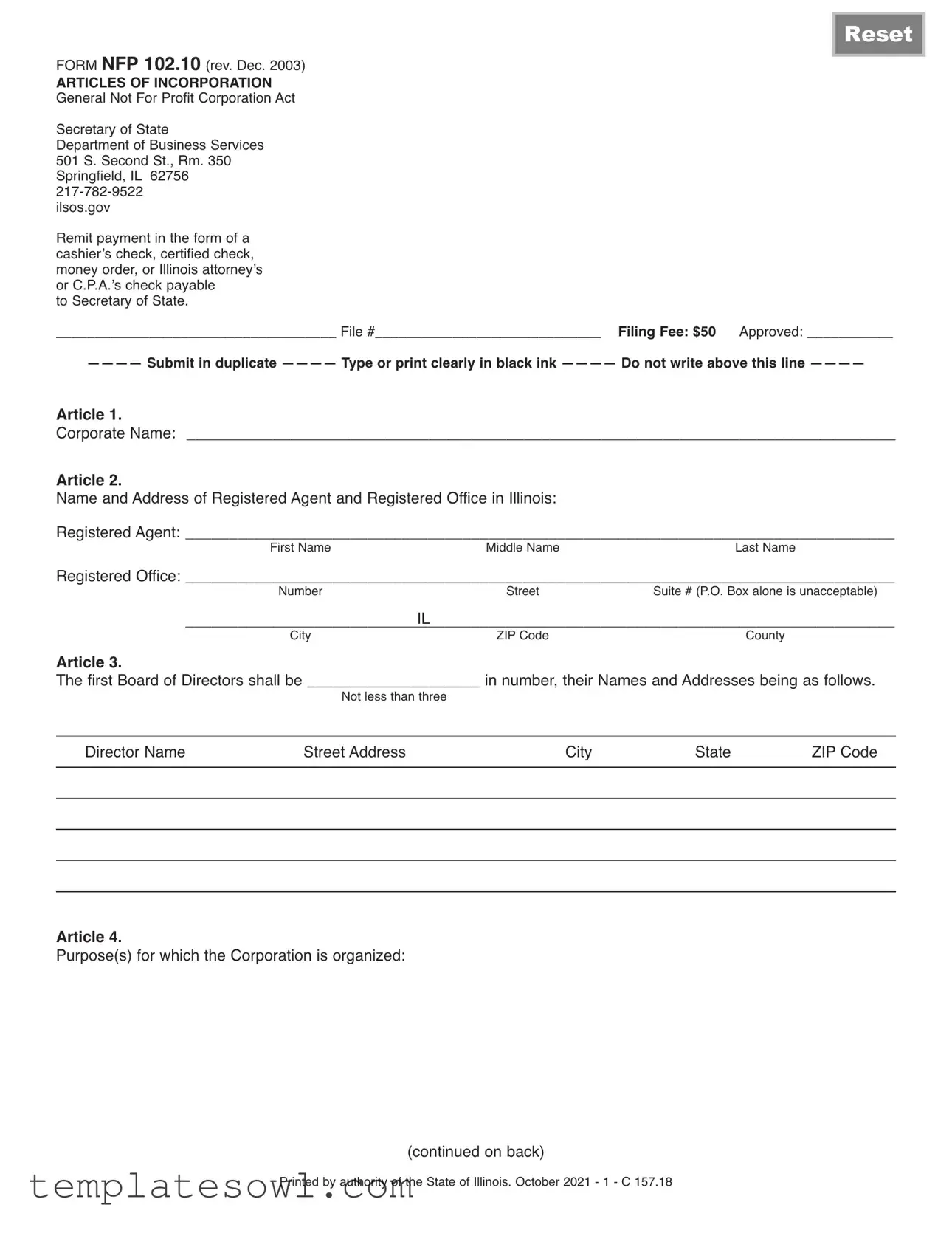

Reset

FORM NFP 102.10 (rev. Dec. 2003)

ARTICLES OF INCORPORATION

General Not For Profit Corporation Act

Secretary of State

Department of Business Services 501 S. Second St., Rm. 350 Springfield, IL 62756

ilsos.gov

Remit payment in the form of a cashier’s check, certified check, money order, or Illinois attorney’s or C.P.A.’s check payable

to Secretary of State.

____________________________________ File #_____________________________ Filing Fee: $50 Approved: ___________

Article 1.

Corporate Name: __________________________________________________________________________________

Article 2.

Name and Address of Registered Agent and Registered Office in Illinois:

Registered Agent: __________________________________________________________________________________

First NameMiddle NameLast Name

Registered Office: __________________________________________________________________________________

Number |

Street |

Suite # (P.O. Box alone is unacceptable) |

Registered Off |

IL |

County |

City |

ZIP Code |

Article 3.

The first Board of Directors shall be ____________________ in number, their Names and Addresses being as follows.

Not less than three

Director Name |

Street Address |

City |

State |

ZIP Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Article 4.

Purpose(s) for which the Corporation is organized:

(continued on back)

Printed by authority of the State of Illinois. October 2021 - 1 - C 157.18

Article 5.

Other provisions (For more space, attach additional sheets of this size.):

Article 6.

Is this Corporation a Condominium Association as established under the Condominium Property Act? (check one) n Yes n No

Is this Corporation a Cooperative Housing Corporation as defined in Section 216 of the Internal Revenue Code of 1954? (check one)

n Yes n No

Is this Corporation a Homeowner's Association, which administers a

(c) of Section

Article 7.

Names & Addresses of Incorporators

The undersigned incorporator(s) hereby declare(s), under penalties of perjury, that the statements made in the foregoing Articles of Incorporation are true.

Dated _______________________________ , |

_____ |

|

Month Day |

Year |

|

Signatures and Names |

Post Office Address |

|

1. ________________________________________ |

1. ________________________________________ |

|

Signature |

|

Street |

________________________________________ |

________________________________________ |

|

Name (print) |

|

City, State, ZIP |

2. ________________________________________ |

2. ________________________________________ |

|

Signature |

|

Street |

________________________________________ |

________________________________________ |

|

Name (print) |

|

City, State, ZIP |

3. ________________________________________ |

3. ________________________________________ |

|

Signature |

|

Street |

________________________________________ |

________________________________________ |

|

Name (print) |

|

City, State, ZIP |

Signatures must be in BLACK INK on the original document.

Carbon copies, photocopies or rubber stamped signatures may only be used on the duplicate copy.

•If a corporation acts as incorporator, the name of the corporation and the state of incorporation shall be shown and the execution shall be by a duly authorized corporate officer. Please print name and title beneath the officer's signature.

•The registered agent cannot be the corporation itself.

•The registered agent may be an individual, resident in Illinois, or a domestic or foreign corporation, authorized to act as a registered agent.

•The registered office may be, but need not be, the same as its principal office.

•A corporation that is to function as a club, as defined in Section

Return to:

________________________________________ |

__________________________________________ |

Firm Name |

Attention |

________________________________________ |

__________________________________________ |

Mailing address |

City, State, ZIP |

Form Characteristics

| Fact Name | Fact Details |

|---|---|

| Governing Law | The NFP 102.10 form is governed by the General Not For Profit Corporation Act of Illinois. |

| Filing Fee | A filing fee of $50 is required when submitting the NFP 102.10 form. |

| Submission Requirements | Submit the form in duplicate, ensuring clarity by typing or printing in black ink. |

| Registered Agent | The registered agent must be an individual or corporation authorized to act in Illinois, but cannot be the corporation itself. |

| Composition of Board | The first Board of Directors must consist of at least three individuals, and their names and addresses must be included in the form. |

| Purpose Statement | Clearly outline the purpose(s) for which the corporation is organized, with options related to condominiums and cooperatives. |

| Signature Requirements | All signatures on the original form must be in black ink; carbon copies or photocopies are only permitted on the duplicate copy. |

| Return Information | Return the completed form in the designated mailing address section to the Secretary of State, Department of Business Services. |

Guidelines on Utilizing Nfp 102 10

Once the Nfp 102 10 form is completed, it will need to be submitted along with the required payment to the Illinois Secretary of State. The following steps will guide you through filling out the form properly. Ensure you have the necessary details at hand before you begin.

- Obtain the form: Download or request the Nfp 102 10 form from the Illinois Secretary of State's website or office.

- Corporate Name: Fill in the desired corporate name in the designated space. Ensure that it complies with state naming requirements.

- Registered Agent Information: Provide the full name and address of the registered agent, ensuring to include the first, middle, and last name, as well as the complete street address along with the county and ZIP code.

- Board of Directors: State the number of directors, ensuring there are at least three. List each director’s name and address clearly.

- Corporate Purpose: Detail the primary purpose for which the corporation is being established, using the space provided. Additional sheets may be attached if necessary.

- Other Provisions: If there are any extra provisions to be included, write them in the space provided or on an attached sheet.

- Special Classification: Check 'Yes' or 'No' for the questions regarding if the corporation is a Condominium Association, Cooperative Housing Corporation, or Homeowner's Association.

- Names & Addresses of Incorporators: Each incorporator must sign and print their name and provide their associated address. Signatures must be in black ink on the original document.

- Payment: Prepare payment in the form of a cashier’s check, certified check, money order, or attorney's or C.P.A.’s check, made out to the Secretary of State. The filing fee is $50.

- Submission: Send the completed form in duplicate to the Secretary of State's office along with your payment.

What You Should Know About This Form

What is the Nfp 102 10 form?

The Nfp 102 10 form is utilized for filing Articles of Incorporation for a Not For Profit Corporation in Illinois. This document is essential for legally establishing a nonprofit organization in the state, setting the foundation for its operations and governance.

What is the purpose of the Nfp 102 10 form?

This form serves to officially register a nonprofit corporation. It outlines crucial information about the organization's name, purpose, and structure. By completing and submitting this form, you are taking the first step to gain legal recognition for your nonprofit initiative.

What are the filing fees associated with the Nfp 102 10 form?

The filing fee for the Nfp 102 10 form is $50. This fee must accompany your application and can be paid using a cashier’s check, certified check, money order, or a check from an Illinois attorney or CPA.

Who must be included as a registered agent?

A registered agent is a person or entity designated to receive legal documents on behalf of the nonprofit corporation. The registered agent should be a resident of Illinois or a corporation authorized to act in that capacity. Importantly, the nonprofit itself cannot serve as its own registered agent.

What if my nonprofit has more than three directors?

You can list more than three directors in the designated section of the form. Ensure that you provide their names and addresses accurately. There is space to include additional directors if necessary—simply attach another sheet with the required information.

Can the registered office be different from the principal office?

Yes, the registered office does not have to be the same as the principal office. However, it must be a physical location in Illinois, and a P.O. Box alone is not acceptable.

What should I do if my organization does not fit any specified categories?

If your nonprofit does not fall into the categories mentioned—such as a condominium association, cooperative housing corporation, or homeowner's association—you can simply mark “No” to those questions on the form. Proceed to explain your organization's purpose clearly.

Is there a specific format for signatures on the Nfp 102 10 form?

Yes, all signatures on the original document must be in black ink. Photocopies, carbon copies, or rubber-stamped signatures cannot be used on the original but are acceptable on any duplicate copies submitted.

Where do I submit the Nfp 102 10 form?

Submit the completed Nfp 102 10 form to the Illinois Secretary of State’s Department of Business Services. The address for submission is 501 S. Second St., Rm. 350, Springfield, IL 62756. Make sure your submission includes the requisite fee.

What if I have more questions about the Nfp 102 10 form?

If you have further questions or need assistance, please feel free to contact the Secretary of State's office at 217-782-9522 or visit their website at ilsos.gov. They are there to help you through this process.

Common mistakes

Completing the NFP 102.10 form can be a straightforward task, but many individuals encounter common pitfalls that complicate the process. One major mistake is neglecting to type or print clearly in black ink. This requirement is critical because any illegible information may lead to delays in processing the form, or, worse, the form might be rejected entirely.

Another frequent error arises in the section regarding the corporate name. Some individuals attempt to use names that are either too similar to existing businesses or violate naming conventions. It’s essential to conduct a thorough search to ensure the chosen name is unique and compliant with state regulations to avoid operational setbacks.

Filling out the registered agent information often poses challenges as well. Some individuals mistakenly list the corporation itself as the registered agent, which is not permitted. The registered agent must be an individual or an authorized entity that meets state requirements. Failing to comply with this requirement can lead to legal complications.

Errors in the board of directors section can also be problematic. Applicants sometimes record fewer than the required three individuals, leading to non-compliance. This mistake may seem minor, but it effectively nullifies the filing, forcing the applicant to start over. Therefore, always ensure that at least three directors are listed.

Another area that frequently causes confusion is the purpose statement. It’s not uncommon for individuals to leave this section blank or to provide an overly vague description of the corporation’s purpose. A well-defined purpose is necessary for legal clarity and to align with the corporation’s activities. Failure to articulate this properly means facing scrutiny from governing authorities.

Additionally, many applicants overlook the importance of including their date of incorporation. Although it may appear insignificant, omitting this detail can lead to a miscalculation of the corporation's establishment date and could affect various legal timelines and obligations.

Furthermore, signing the document with anything other than black ink can lead to challenges in processing. While many may mistakenly think blue or other colors are acceptable for the signature, this is not the case for the original document and signatures must adhere strictly to the guidelines specified on the form.

Lastly, individuals sometimes fail to submit the required number of copies. The instructions clearly state to submit in duplicate, but in the rush of completing paperwork, some neglect this step entirely. Submitting only one copy can delay the processing of the form significantly.

By keeping these common mistakes in mind when filling out the NFP 102.10 form, applicants can improve their chances of successfully establishing their not-for-profit corporation without unnecessary delays or complications.

Documents used along the form

The NFP 102.10 form is a key document for incorporating a Not-For-Profit organization in Illinois. It outlines essential information about the organization, including its name, purpose, and the registered agent. Alongside this form, several other documents are often required for a complete filing package. Below is a list of these important forms and their descriptions.

- Registered Agent Consent Form: This document confirms that the registered agent agrees to serve in this capacity. It ensures that there is an official point of contact for legal communications on behalf of the corporation.

- Bylaws: These internal rules govern the organization’s operations. They address matters such as the roles of directors, member voting procedures, and how meetings will be conducted. Bylaws are crucial for transparency and legal compliance.

- Initial Board of Directors Meeting Minutes: Following incorporation, the first meeting minutes must be documented. This record outlines decisions made regarding the structure and operation of the organization, including the election of officers.

- Application for Federal Employer Identification Number (EIN): This form is necessary for tax identification purposes. Obtaining an EIN allows the organization to hire employees, open bank accounts, and file tax returns appropriately.

- Form for State Tax Exemption: A separate submission to the state requesting tax-exempt status may be needed. This form supports the organization’s claim for exemption from state taxes, aligning with its not-for-profit mission.

- Conflict of Interest Policy: This document is designed to prevent potential conflicts between the personal interests of board members and the organization's interests. It outlines the procedures for disclosing and addressing any conflicts that may arise.

These supporting documents work in conjunction with the NFP 102.10 form to ensure that a Not-For-Profit organization is set up in compliance with state laws and regulations. Properly completing and filing all necessary documents leads to a stronger foundation for fulfilling the organization’s mission.

Similar forms

The Nfp 102 10 form is a crucial document used for registering not-for-profit corporations in Illinois. Several other documents share similarities with this form in terms of purpose, structure, and information required. Below is a list that highlights six such documents and their connections to the Nfp 102 10 form.

- Articles of Organization: This document is used to establish a limited liability company (LLC) and contains similar foundational information such as company name, registered agent details, and the purpose of the entity.

- Certificate of Incorporation: Required for the formation of a corporation, this certificate serves a parallel purpose by documenting similar details, including the corporate name, registered agent, and purpose of the organization.

- Charter Application: This form is utilized by certain nonprofit organizations to apply for tax-exempt status. Like the Nfp 102 10, it asks for the purpose of the organization and information about its leadership.

- Bylaws: Though they differ in that they provide internal governance rules, bylaws often reference similar elements such as the purpose of the organization and the roles of the board of directors, akin to the Nfp 102 10.

- Registration Statement: Some states require nonprofits to file a registration statement to solicit contributions. This document often includes the organization’s name, address, and purpose, mirroring the Nfp 102 10 form's requirements.

- 501(c)(3) Application: This application is used to apply for federal tax exemption. It requests detailed organizational information, similar to the Nfp 102 10, including the mission and structure of the nonprofit entity.

Dos and Don'ts

When filling out the NFP 102.10 form, it is essential to follow specific guidelines to ensure accuracy and compliance. Here are some dos and don'ts to consider:

- Do type or print clearly in black ink.

- Do submit the form in duplicate.

- Do ensure the names and addresses of the Board of Directors are complete and accurate.

- Do provide a physical address for the registered office; P.O. Boxes are not acceptable.

- Do check the appropriate boxes regarding the type of corporation when applicable.

- Don't write above the designated lines on the form.

- Don't use carbon copies or photocopies for the original signatures.

- Don't list the corporation itself as its registered agent.

- Don't forget to include a statement regarding compliance with liquor laws if applicable.

Misconceptions

Misconceptions about the NFP 102.10 form can lead to unnecessary complications during the incorporation process. Here is a list of common misunderstandings:

- It is only for nonprofit organizations. While the form is typically used for nonprofits, it can also be utilized by organizations that may have associations or membership objectives.

- A registered office can be a P.O. Box. This is incorrect. The registered office must be a physical address in Illinois; P.O. Boxes do not fulfill this requirement.

- Only individuals can serve as registered agents. In reality, a registered agent can be an individual or a corporation authorized to conduct business in Illinois.

- You need an attorney to file this form. Although legal guidance can be beneficial, it is not mandatory. Individuals can complete and file the form themselves.

- Submitting one copy of the form is sufficient. The form must be submitted in duplicate. Both copies are required for processing.

- Any signature is acceptable. The original document must feature signatures in black ink. Photocopies or rubber stamps are only allowed on the duplicate copy.

- There's no fee to file this form. A filing fee of $50 must be submitted, either by a cashier’s check, certified check, money order, or checks from an IL attorney or CPA.

- Changing the purpose of the corporation is easy after filing. Altering the purpose can be complicated and often requires additional paperwork and fees.

- Using the wrong date or information is not a big deal. Incorrect information can delay processing and may lead to rejection of the filing.

- All incorporators need to be residents of Illinois. This is not true. Incorporators can be from outside Illinois, but at least one registered agent must be a resident.

Key takeaways

Here are some key takeaways for filling out and using the Nfp 102 10 form for your non-profit corporation:

- Complete in Black Ink: Always use black ink when filling out the original document to ensure readability and compliance.

- Registered Agent: Your registered agent must be an individual or corporation authorized to operate in Illinois; the corporation itself cannot serve in this role.

- Filing Fee: A fee of $50 is required for processing. Pay using a cashier's check, certified check, or money order made out to the Secretary of State.

- Submit in Duplicate: Make sure to submit two copies of the completed form—one for the state and one for your records.

- Corporate Name: Clearly state the name of your corporation. Ensure it complies with naming guidelines and isn’t already in use.

- Board of Directors: You must list at least three directors, including their names and addresses. This is crucial for establishing your governance structure.

- Purpose Clause: Clearly articulate the purpose of your corporation, which should align with non-profit activities. This is vital for legal recognition and operation.

By following these guidelines, you can effectively navigate the process of establishing your non-profit corporation in Illinois.

Browse Other Templates

Dhs Income Guidelines - Make sure to provide accurate details about your household members when filling out the application.

Form 779 Oklahoma - Spouses can also submit this affidavit under specific conditions outlined in the form.

Michigan Lottery Claim Form - It is the retailer’s responsibility to ensure the physical security of lottery equipment.