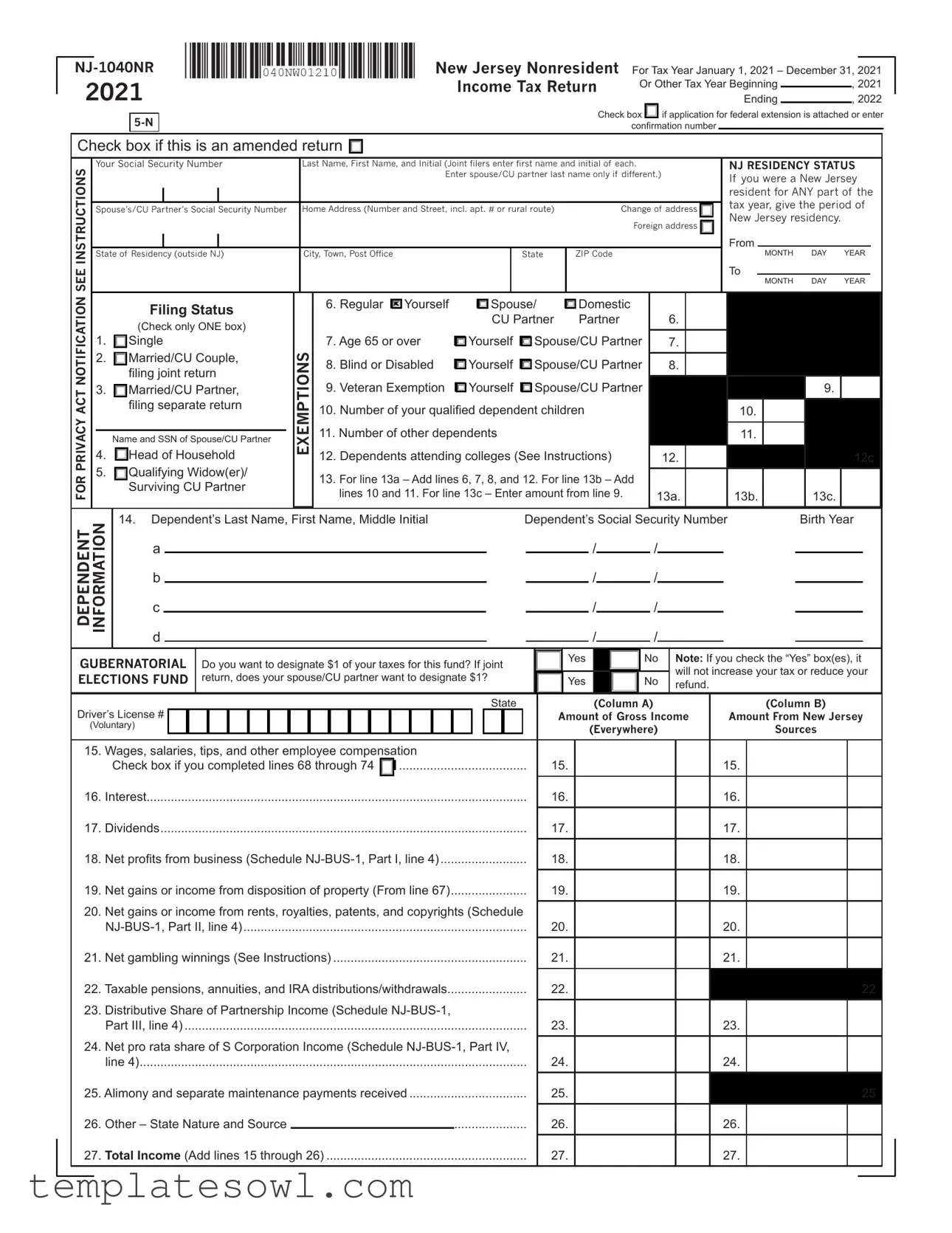

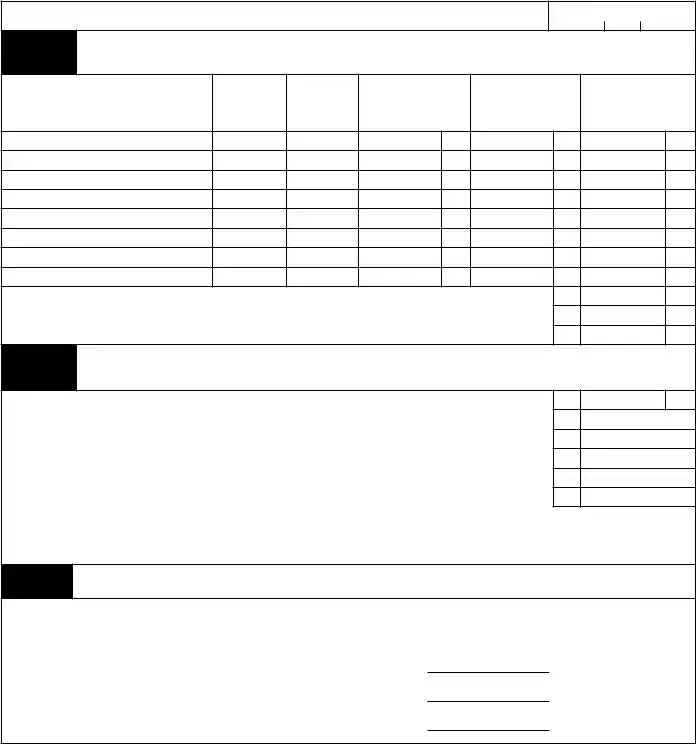

Fill Out Your Nj 1040Nr Form

The NJ-1040NR form serves as a crucial document for individuals who earned income in New Jersey while residing outside the state during the tax year. This form is tailored for nonresidents who must report their income derived from New Jersey sources between January 1 and December 31 of the tax year. Key sections of the form include details on personal identification, such as Social Security numbers and addresses, alongside essential filing statuses like single or married. Beyond just personal information, the form requires a comprehensive breakdown of income derived from various sources, including wages, interest, and dividends. Another significant aspect is the listing of exemptions and deductions that may apply to the filer, impacting overall tax liability. Taxpayers must also account for any tax withheld and additional payments made throughout the year. Finally, the form requires a declaration affirming the information provided is accurate and complete. Understanding and accurately completing the NJ-1040NR is essential for compliance and ensures nonresidents fulfill their tax obligations efficiently.

Nj 1040Nr Example

2021

New Jersey Nonresident For Tax Year January 1, 2021 – December 31, 2021

Income Tax Return |

Or Other Tax Year Beginning |

|

, 2021 |

|

|||

|

Ending |

|

, 2022 |

Check box |

|

if application for federal extension is attached or enter |

confirmation number

Check box if this is an amended return

INSTRUCTIONSSEE |

Your Social Security Number |

|

Last Name, First Name, and Initial (Joint filers enter first name and initial of each. |

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

Enter spouse/CU partner last name only if different.) |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s/CU Partner’s Social Security Number |

|

Home Address (Number and Street, incl. apt. # or rural route) |

Change of address |

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign address |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State of Residency (outside NJ) |

|

City, Town, Post Office |

|

|

|

State |

ZIP Code |

|

|

|

||||||

NOTIFICATIONACTPRIVACY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Filing Status |

EXEMPTIONS |

6. Regular |

Yourself |

Spouse/ |

Domestic |

|

|

|

|||||||

|

|

|

|

CU Partner |

Partner |

6. |

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

(Check only ONE box) |

|

|

|

|

|

|

||||||||

|

1. |

Single |

|

|

7. Age 65 or over |

Yourself |

Spouse/CU Partner |

7. |

|

|

|||||||

|

2. |

Married/CU Couple, |

|

|

8. Blind or Disabled |

Yourself |

Spouse/CU Partner |

8. |

|

|

|||||||

|

|

|

filing joint return |

|

|

|

|

||||||||||

|

3. |

|

|

9. Veteran Exemption |

Yourself |

Spouse/CU Partner |

|

|

|

||||||||

|

Married/CU Partner, |

|

|

|

|

|

|||||||||||

|

|

|

filing separate return |

|

|

10. Number of your qualified dependent children |

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

11. Number of other dependents |

|

|

|

|

|

|||

|

|

|

Name and SSN of Spouse/CU Partner |

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

4. |

Head of Household |

|

|

12. Dependents attending colleges (See Instructions) |

12. |

|

|

|||||||||

FOR |

5. |

Qualifying Widow(er)/ |

|

|

13. For line 13a – Add lines 6, 7, 8, and 12. For line 13b – Add |

|

|

|

|||||||||

|

|

Surviving CU Partner |

|

|

|

|

|

||||||||||

|

|

|

|

lines 10 and 11. For line 13c – Enter amount from line 9. |

13a. |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||

NJ RESIDENCY STATUS If you were a New Jersey resident for ANY part of the tax year, give the period of New Jersey residency.

From

MONTH DAY YEAR

To

MONTH DAY YEAR

9.

10.

11.

12c

13b. |

13c. |

|

|

DEPENDENT INFORMATION

14.Dependent’s Last Name, First Name, Middle Initial a

b c d

Dependent’s Social Security Number |

Birth Year |

/ /

/ /

/ /

/ /

|

GUBERNATORIAL |

Do you want to designate $1 of your taxes for this fund? If joint |

|

Yes |

|

|

|

No |

|

Note: If you check the “Yes” box(es), it |

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

will not increase your tax or reduce your |

|

|||||||||||||||||||||||||||

|

ELECTIONS FUND |

return, does your spouse/CU partner want to designate $1? |

|

Yes |

|

|

|

No |

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

refund. |

|

|

|

|

|

||||||||||||||||||||||||||

|

Driver’s License # |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

|

|

|

|

(Column A) |

|

|

|

(Column B) |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amount of Gross Income |

Amount From New Jersey |

|

||||||||||||||

|

(Voluntary) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Everywhere) |

|

|

|

Sources |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15. |

Wages, salaries, tips, and other employee compensation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

Check box if you completed lines 68 through 74 |

15. |

|

|

|

|

|

|

|

15. |

|

|

|

|

|||||||||||||||||||||

|

16. |

Interest |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16. |

|

|

|

|

|

|

|

16. |

|

|

|

|

||||

|

17. |

Dividends |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17. |

|

|

|

|

|

|

|

17. |

|

|

|

|

||||

|

18. |

Net profits from business (Schedule |

18. |

|

|

|

|

|

|

|

18. |

|

|

|

|

||||||||||||||||||||||

|

19. |

Net gains or income from disposition of property (From line 67) |

19. |

|

|

|

|

|

|

|

19. |

|

|

|

|

||||||||||||||||||||||

|

20. |

Net gains or income from rents, royalties, patents, and copyrights (Schedule |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

20. |

|

|

|

|

|

|

|

20. |

|

|

|

|

||||||||||||||||||||||

|

21. |

Net gambling winnings (See Instructions) |

21. |

|

|

|

|

|

|

|

21. |

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

22. Taxable pensions, annuities, and IRA distributions/withdrawals |

22. |

|

|

|

|

|

|

|

22 |

|

||||||||||||||||||||||||||

|

23. |

Distributive Share of Partnership Income (Schedule |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

Part III, line 4) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

23. |

|

|

|

|

|

|

|

23. |

|

|

|

|

|||

|

24. |

Net pro rata share of S Corporation Income (Schedule |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

line 4) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

24. |

|

|

|

|

|

|

|

24. |

|

|

|

|

|||

|

25. Alimony and separate maintenance payments received |

25. |

|

|

|

|

|

|

|

25 |

|

||||||||||||||||||||||||||

|

26. |

Other – State Nature and Source |

..................... |

26. |

|

|

|

|

|

|

|

26. |

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

Total Income (Add lines 15 through 26) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

27. |

27. |

|

|

|

|

|

|

|

27. |

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name(s) as shown on Form |

Your Social Security Number |

|

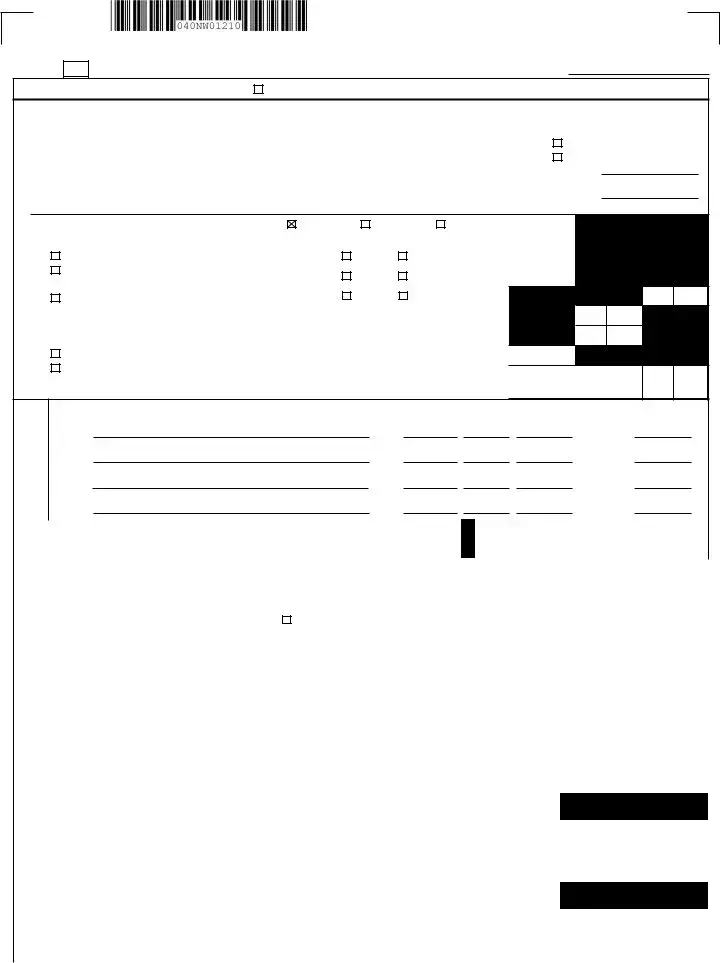

28a. |

.............................................Pension/Retirement Exclusion (See Instructions) |

|

|

|

|

28a. |

|

|

|

|

|

|

|

|

||||||

|

28b. |

Other Retirement Income Exclusion (See Worksheet and |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

Instructions) |

|

|

|

|

|

|

|

|

28b. |

|

|

|

28b. |

|

|

|

|

|

|

28c. Total Exclusion Amount (Add line 28a and line 28b) |

|

|

|

|

28c. |

|

|

|

28c. |

|

|

|

|

|||||||

|

29. |

Gross Income (Subtract line 28c from line 27) |

|

|

|

|

|

|

|

29. |

|

|

|

29. |

|

|

|

|

|||

|

30. |

Total Exemption Amount (See Instructions) |

|

|

|

|

|

|

|

30. |

|

|

|

|

|

|

|

|

|||

|

31. |

Medical Expenses (See Worksheet and Instructions) |

|

|

|

|

31. |

|

|

|

|

|

|

|

|

||||||

|

32. Alimony and separate maintenance payments |

................................................. |

|

|

|

|

|

|

32. |

|

|

|

|

|

|

|

|

||||

|

33. |

Qualified Conservation Contribution |

|

|

|

|

|

|

|

33. |

|

|

|

|

|

|

|

|

|||

|

34. |

Health Enterprise Zone Deduction |

|

|

|

|

|

|

|

34. |

|

|

|

|

|

|

|

|

|||

|

35. Alternative Business Calculation Adjustment (Schedule |

35. |

|

|

|

|

|

|

|

|

|||||||||||

|

36. |

Organ/Bone Marrow Donation Deduction (See instructions) |

36. |

|

|

|

|

|

|

|

|

||||||||||

|

37. |

Total Exemptions and Deductions (Add lines 30 through 36) |

37. |

|

|

|

|

|

|

|

|

||||||||||

|

38. |

..............................Taxable Income (Subtract line 37 from line 29, column A) |

|

|

|

|

38. |

|

|

|

|

|

|

|

|

||||||

|

39. |

Tax on amount on line 38 (From Tax Table) |

|

|

|

|

|

|

|

39. |

|

|

|

|

|

|

|

|

|||

|

40. |

Income Percentage |

B. (line 29) |

= |

|

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

A. (line 29) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

41. |

New Jersey Tax (Multiply amount from line 39 |

|

|

x |

|

% from line 40) |

41. |

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

||||||||||||||

|

42. |

Sheltered Workshop Tax Credit (Enclose |

|

|

|

|

42. |

|

|

|

|

||||||||||

|

43. |

Gold Star Family Counseling Credit (See Instructions) |

|

|

|

|

|

|

|

|

43. |

|

|

|

|

||||||

|

44. |

Credit for Employer of Organ/Bone Marrow Donor (See instructions) |

|

|

|

|

44. |

|

|

|

|

||||||||||

|

45. |

Total Credits (Add lines 42, 43, and 44) |

|

|

|

|

|

|

|

|

|

|

|

45. |

|

|

|

|

|||

|

46. |

Balance of Tax After Credits (Subtract line 45 from line 41) |

|

|

|

|

|

|

|

|

46. |

|

|

|

|

||||||

|

47. |

Penalty for Underpayment of Estimated Tax. Check box |

if Form |

47. |

|

|

|

|

|||||||||||||

|

48. |

Total Tax and Penalty (Add line 46 and line 47) |

|

|

|

|

|

|

|

|

48. |

|

|

|

|

||||||

|

49. Total New Jersey Income Tax Withheld (From enclosed Forms |

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

1099) |

|

|

|

|

|

|

|

49. |

|

|

|

Also enter on line 50: |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

50. |

New Jersey Estimated Tax Payments/Credit from 2020 return |

|

50. |

|

|

|

• Payments made in con- |

|

||||||||||||

|

|

|

|

nection with sale of NJ real |

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

property |

|

|||

|

51. |

Tax paid on your behalf by Partnership(s) |

|

|

|

|

|

|

|

51. |

|

|

|

• Payments by S corporation |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

for nonresident shareholder |

|

|||

|

52. |

Excess NJ UI/WF/SWF Withheld (Enclose Form |

|

|

|

|

|

52. |

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

53. |

Excess NJ Disability Insurance Withheld (Enclose Form |

53. |

|

|

|

|

|

|

|

|

||||||||||

|

54. |

Excess NJ Family Leave Insurance Withheld (Enclose Form |

54. |

|

|

|

|

|

|

|

|

||||||||||

|

55. |

55. |

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name(s) as shown on Form |

Your Social Security Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

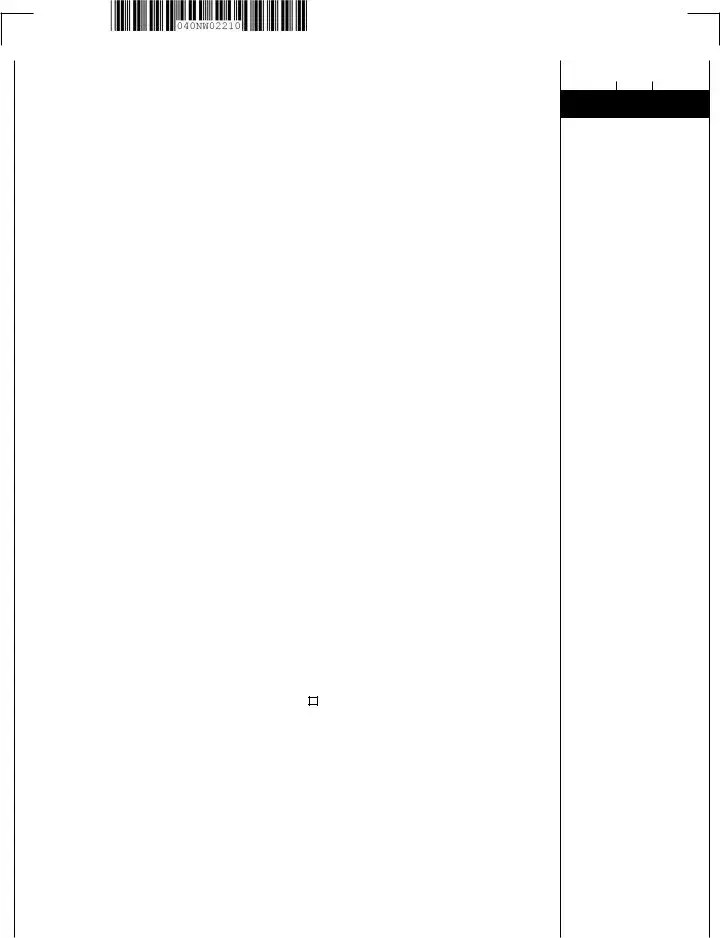

..............................................................................................56. Total Payments/Credits (Add lines 49 through 55) |

|

|

|

|

|

|

56. |

|

|

|

|

|||||||||

57. If line 56 is less than line 48, you have tax due. |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

Subtract line 56 from line 48 and enter the amount you owe |

|

|

|

|

|

57. |

|

|

|

|

|||||||||

|

If you owe tax, you can still make a donation on lines 60A through 60F. |

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||

58. If line 56 is more than line 48, you have an overpayment. |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

Subtract line 48 from line 56 and enter the overpayment |

|

|

|

|

|

|

58. |

|

|

|

|

||||||||

59. Amount from line 58 you want to credit to your 2022 tax |

|

|

|

|

|

|

59. |

|

|

|

|

|||||||||

60. Amount you want to credit to: |

|

|

|

|

|

|

|

|

|

NOTE: |

||||||||||

|

|

|

|

|

|

|

|

|

An entry on lines 59 through |

|||||||||||

|

(A) N.J. Endangered Wildlife Fund |

$10, |

$20, |

Other |

|

60A. |

|

|

|

60F will reduce your tax refund |

||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||

|

(B) N.J. Children’s Trust Fund |

$10, |

$20, |

Other |

|

60B. |

|

|

|

|

|

|

|

|

||||||

|

(C) N.J. Vietnam Veterans’ Memorial Fund |

$10, |

$20, |

Other |

|

60C. |

|

|

|

|

|

|

|

|

||||||

|

(D) N.J. Breast Cancer Research Fund |

$10, |

$20, |

Other |

|

60D. |

|

|

|

|

|

|

|

|

||||||

|

(E) U.S.S. N.J. Educational Museum Fund |

$10, |

$20, |

Other |

|

60E. |

|

|

|

|

|

|

|

|

||||||

|

(F) Designated Contribution |

|

|

|

$10, |

$20, |

Other |

|

60F. |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

61. Total Adjustments to Tax Due/Overpayment (Add lines 59 through 60F) |

|

|

|

|

61. |

|

|

|

|

|||||||||||

62. Balance due (If line 57 is more than zero, add line 57 and line 61) |

|

|

|

|

|

62. |

|

|

|

|

||||||||||

63. Refund amount (If line 58 is more than zero, subtract line 61 from line 58) |

|

|

|

|

63. |

|

|

|

|

|||||||||||

|

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my |

Pay amount on line 62 in |

||||||||||||||||||

|

knowledge and belief, it is true, correct, and complete. If prepared by a person other than taxpayer, this declaration is based on all information of |

full. Write Social Security |

||||||||||||||||||

|

which the preparer has any knowledge. |

|

|

|

|

|

|

|

|

|

number(s) on check or money |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

order and make payable to: |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State of New Jersey – TGI |

||||

HERE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Division of Taxation |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue Processing Center |

|||||

|

|

Your Signature |

Date |

Spouse’s/CU Partner’s Signature (if filing jointly, BOTH must sign) |

||||||||||||||||

|

|

PO Box 244 |

||||||||||||||||||

|

|

|

||||||||||||||||||

|

If enclosing copy of death certificate for deceased taxpayer, check box (See instructions) |

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

Trenton, NJ |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

SIGN |

I authorize the Division of Taxation to discuss my return and enclosures with my preparer (below) |

You can also make a |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

payment on our website: |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

nj.gov/taxation. |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Paid Preparer’s Signature |

|

|

|

|

Federal Identification Number |

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Firm’s name |

|

|

|

Firm’s Federal Employer Identification Number |

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Division 1 |

|

2 |

|

3 |

|

4 |

|

5 |

|

6 |

|

7 |

|

8 |

Use |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

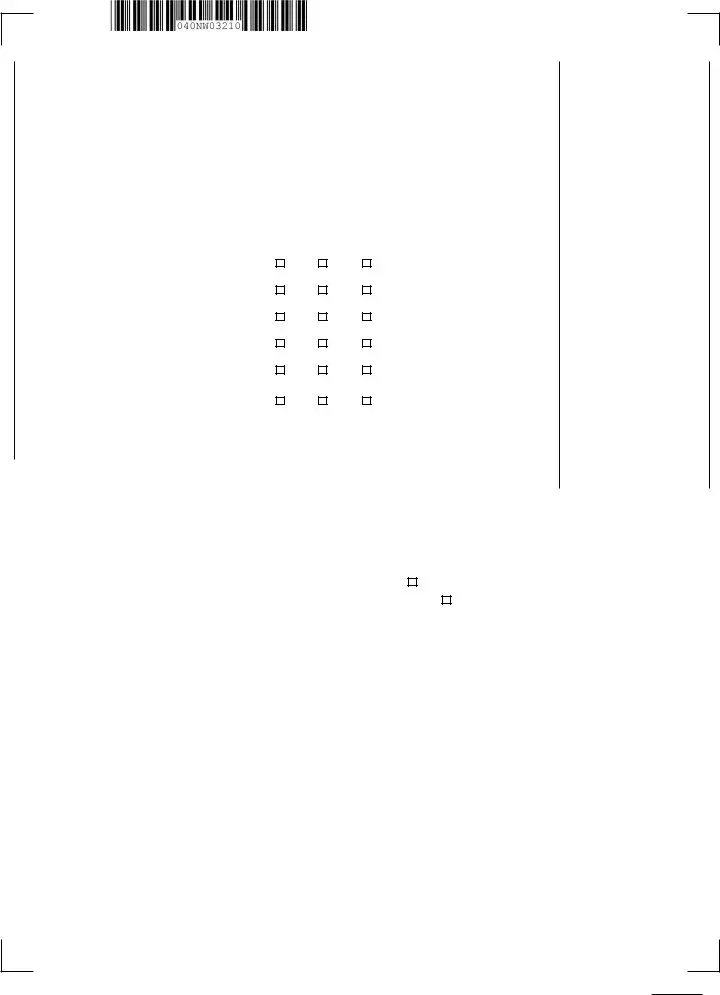

Name(s) as shown on Form

Your Social Security Number

Part I

Net Gains or Income From Disposition of Property

List the net gains or income, less net loss, derived from the sale, exchange, or other disposition of property including real or personal whether tangible or intangible as reported on federal Schedule D.

|

(b) Date |

|

|

(e) Cost or other |

|

|

(a) Kind of property and description |

(c) Date sold |

(d) Gross sales price |

basis as adjusted |

(f) Gain or (loss) |

||

aquired |

||||||

(Mo., day, yr.) |

(see instructions) |

(d less e) |

||||

|

(Mo., day, yr.) |

|

||||

|

|

|

and expense of sale |

|

||

|

|

|

|

|

64.

65.Capital Gains Distribution.......................................................................................................................................

66.Other Net Gains.....................................................................................................................................................

67.Net Gains (Add lines 64, 65, and 66) (Enter here and on line 19) (If loss, enter zero)..........................................

65.

66.

67.

Part II

Allocation of Wage and Salary |

(See instructions if compensation depends entirely on volume of business |

|

Income Earned Partly Inside and |

||

transacted or if other basis of allocation is used.) |

||

Outside New Jersey |

||

|

68.Amount reported on line 15 in column A required to be allocated...........................................................................

69.Total days in taxable year........................................................................................................................................

70.Deduct nonworking days (Sundays, Saturdays, holidays, sick leave, vacation, etc.).............................................

71.Total days worked in taxable year (subtract line 70 from line 69) ..........................................................................

72.Deduct days worked outside New Jersey...............................................................................................................

73.Days worked in New Jersey (subtract line 72 from line 71)....................................................................................

68.

69.

70.

71.

72.

73.

74. Allocation Formula |

(Line 73) |

x |

|

= |

|

(Include this amount on |

|

(Line 71) |

|

(Enter amount from line 68) |

(Salary earned inside N.J.) line 15, col. B) |

||

Part III

Allocation of Business |

(See instructions if other than Formula Basis of allocation is used.) |

|

Income to New Jersey |

||

|

Business Allocation Percentage (From Schedule

Enter below the line number and amount of each item of business income reported in column A that is required to be allocated and multiply by allocation percentage to determine amount of income from New Jersey sources.

From Line No. |

|

|

$ |

|

|

x |

|

% = $ |

|||

|

|

|

|

||||||||

From Line No. |

|

|

$ |

|

|

x |

|

% |

= |

$ |

|

From Line No. |

|

|

$ |

|

|

x |

|

% |

= |

$ |

|

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The NJ-1040NR form is specifically for nonresidents to report income earned in New Jersey. |

| Tax Year | This form is used for the tax year that runs from January 1, 2021, through December 31, 2021. |

| Filing Status | It allows various filing statuses including Single, Married, Head of Household, and others. |

| Exemptions | Taxpayers can claim exemptions for dependents, age, veteran status, and other factors. |

| Residency Status | Form requires the period of New Jersey residency if applicable. Nonresidents report only NJ-source income. |

| New Jersey Tax | The calculated tax is based on taxable income determined after exemptions and deductions. |

| Governing Law | The form is governed by New Jersey Division of Taxation laws under N.J.S.A. 54A. |

| Credits | Taxpayers may claim available credits which can reduce the total tax liability. |

| Payment Options | Individuals can pay taxes owed online or by check, ensuring proper tracking of their payments. |

Guidelines on Utilizing Nj 1040Nr

Filling out the NJ-1040NR form can seem daunting at first, but with a clear step-by-step approach, it becomes manageable. This form is important for non-residents who earned income in New Jersey and need to report it for that tax year.

- Begin by entering your Social Security Number at the top of the form.

- Fill in your Last Name, First Name, and Initial. If filing jointly, include your spouse or civil union partner's name and initial only if different.

- Provide your spouse's or civil union partner’s Social Security Number, if applicable.

- Complete your Home Address, including street number, apartment number (if any), city, state, and ZIP code.

- Indicate your State of Residency outside of New Jersey.

- Choose your Filing Status by checking the appropriate box: Single, Married/CU Couple filing joint return, Married/CU Partner filing separate return, Head of Household, or Qualifying Widow(er)/Surviving CU Partner.

- Fill out the Exemptions section, indicating if you or your spouse/CU partner are age 65 or older, blind or disabled, or a veteran, and list dependents.

- Provide the Period of New Jersey Residency if applicable.

- In the Income section, report your gross income from various sources such as wages, interest, dividends, and other specified categories.

- Calculate your Total Income by adding the various sources together.

- Deduct any Exclusions applicable to your income, focusing on retirement exclusions if relevant.

- Once you have your Gross Income, proceed to calculate your Total Exemptions and Deductions.

- Subtract the total exemptions and deductions from your gross income to find your Taxable Income.

- From the provided tax table, determine the Tax on your Taxable Income.

- Account for any available Credits, reducing your tax burden.

- Add any penalties for late payment if necessary to find your Total Tax and Penalty.

- Review and enter the total tax withholdings from your W-2 or 1099 forms.

- If you owe taxes, calculate the amount due. Alternatively, if you've overpaid, determine your overpayment amount.

- Make any designations for charitable contributions if you wish.

- Finally, sign and date the form, ensuring both spouses sign if filing jointly.

After completing these steps, you'll have a comprehensive tax return ready for submission. Double-check for any calculations or missing information before filing, as accuracy is essential for a smooth process. Remember, if you have any questions about specific entries or need assistance, consider reaching out to a professional or checking the New Jersey Division of Taxation website for guidance.

What You Should Know About This Form

What is the NJ 1040NR form?

The NJ 1040NR form is a state income tax return specifically designed for nonresidents of New Jersey who earned income sourced from the state during a tax year. It must be completed and filed to report income, calculate taxes owed, and determine any refund eligibility for nonresidents. The form is relevant for individuals who resided outside of New Jersey for the entire year but had income from New Jersey sources, such as wages, rental income, or business profits.

Who needs to file the NJ 1040NR?

What types of income should be reported on the NJ 1040NR?

What deductions and credits are available on the NJ 1040NR?

How is tax assessed on the NJ 1040NR?

Common mistakes

Filling out the NJ-1040NR form can be a daunting task for many, particularly for those unfamiliar with the nuances of tax documents. One common mistake occurs when individuals fail to provide accurate personal information. For instance, neglecting to include a complete and correct Social Security number or not accurately listing last names can cause significant delays or even rejections of the return. Ensuring that these details are correct is essential for smooth processing and compliance with state requirements.

Another frequent error is related to residency status. Taxpayers sometimes misclassify their residency, either mistakenly marking themselves as nonresidents or failing to indicate periods of residency accurately. This misstep can lead to incorrect tax calculations and required payments. Understanding your residency status directly influences your obligations and potential benefits under tax law, so it’s vital to carefully consider the dates and details you provide.

Furthermore, mishandling exemptions can have a significant impact on a taxpayer's overall tax liability. Individuals often overlook their eligibility for exemptions based on age or disability, which can lead to overpayment of taxes. Completing this section accurately ensures that taxpayers are not paying more than necessary and allows them to take full advantage of available deductions and credits.

Another potential pitfall lies in the misreporting of income from various sources. The NJ-1040NR requires a diligent and thorough approach to report all relevant income, including wages, dividends, and business earnings. A common mistake is under-reporting income earned outside of New Jersey, which can subsequently trigger penalties or additional audits. Careful attention to financial records and accurate reporting is paramount in this section.

Lastly, many taxpayers forget to double-check their calculations or neglect the importance of supporting documentation. Errors in arithmetic or failing to include required forms can lead to complications. It is advisable to take the time to review each section of the form for accuracy and to ensure that all necessary documents are attached. Simple mistakes can compound and result in significant inconveniences, making diligence in reviewing the form crucial for compliance and peace of mind.

Documents used along the form

The NJ-1040NR form is utilized by nonresidents who earned income in New Jersey during the tax year. To complete this form accurately, several other forms and documents may be required. Below is a list of common forms and documents often used in conjunction with the NJ-1040NR.

- W-2 Form: This form reports an employee’s annual wages and the taxes withheld by their employer. It is essential for determining total income and tax deductions.

- 1099 Forms: Various types of 1099 forms are used to report different types of income, such as freelance work or interest and dividends. They provide a record of income outside of traditional employment.

- Schedule NJ-BUS-1: Used to report business income, expenses, and loss from New Jersey sources. It provides details needed to calculate income accurately.

- Schedule NJ-NR-A: This schedule allocates income derived from New Jersey sources. It is crucial for identifying which portion of income is taxable by New Jersey for nonresidents.

- Form NJ-2210NR: This form calculates any penalty for underpayment of estimated tax. It helps nonresidents understand if they owe any penalties based on their estimated tax payments.

- Form NJ-2450: Required for claiming a refund of excess New Jersey withholdings for unemployment, disability, or family leave insurance. This form ensures accurate tax credit calculations.

- Form NJ-1040: Residents filing their tax returns may also complete this form for context. It provides comparisons and guidelines for nonresident tax calculations.

- Tax Extension Form: If an extension has been filed for federal taxes, attaching a copy may be necessary. This helps provide proof of the extension when submitting the NJ-1040NR.

- Proof of Identity: Documents such as a driver's license or state ID may be necessary to verify the identity of the taxpayer, especially when filing jointly.

- Payment Receipts: If taxes were paid or overpayments were made in the previous year, holding on to receipts is essential for proper reporting and reconciliation.

Gathering these forms and documents can help ensure a smooth and accurate filing process for the NJ-1040NR form. Each document plays a critical role in accurately reporting income and ensuring compliance with state tax regulations. Be mindful of the deadlines and the specific information required by each form to avoid any complications.

Similar forms

The NJ-1040NR form is similar to several other tax forms. Each of these forms shares key similarities, mainly in terms of structure and purpose. Here is a detailed comparison:

- Form 1040: This is the standard individual income tax return form used by residents of the U.S. It serves a similar purpose of reporting income and calculating tax liability, much like the NJ-1040NR for nonresidents.

- Form 1040-SR: Specifically for seniors, this form follows the same format as the 1040. The intended audience and simplicity make it similar to the NJ-1040NR in addressing specific demographics.

- Form 1040-NR: This form is for nonresident aliens. Like the NJ-1040NR, it is focused on individuals who do not qualify as residents for tax purposes but still need to report certain income sources.

- Form 1040-X: The amendment form for individual tax returns. Just as the NJ-1040NR can be amended, this form allows taxpayers to correct any errors on their initial filings.

- Form Schedule C: This is used for reporting profit and loss from a business. It is similar to the business income sections of the NJ-1040NR which address income earned from various sources.

- Schedule A: Used for itemizing deductions on the federal tax return. The NJ-1040NR has a similar section for deductions, reflecting the parallel in complexity between the two forms.

- Form W-2: This form reports wages and taxes withheld from the employee's paycheck. It serves as a supporting document for the NJ-1040NR in ensuring reported income matches with federal standards.

- Form 8862: This form is used to claim the Earned Income Credit after prior disallowance. NJ-1040NR incorporates various tax credits, reflecting a resemblance in seeking tax benefits.

- Form 8606: Used to report non-deductible contributions to IRAs. Similar to how NJ-1040NR accounts for retirement income, this offers insights into retirement planning on the tax return.

Each of these forms plays an essential role in managing tax obligations, yet they cater to different taxpayer situations. Understanding these similarities might be beneficial for anyone engaging with the NJ-1040NR.

Dos and Don'ts

Guidelines for Completing the NJ-1040NR Form

The following list outlines essential actions to take and avoid while filling out the NJ-1040NR form. Proper attention to detail will aid in ensuring an accurate submission.

- Do provide your Social Security Number accurately.

- Do include all relevant income sources received during the tax year.

- Do check all boxes that apply to your filing status, such as "Single" or "Married/CU Couple."

- Do read the instructions thoroughly to ensure compliance with regulations.

- Don't leave any required fields blank; enter '0' where applicable.

- Don't submit your form without reviewing it for errors or omissions.

- Don't forget to sign and date the form if filing jointly.

- Don't underestimate the importance of attaching necessary documentation, such as W-2s or 1099s.

Misconceptions

When it comes to the NJ-1040NR form, several misconceptions tend to circulate. Clarifying these misunderstandings can help residents and non-residents alike fulfill their tax obligations accurately. Here are seven common misconceptions:

- The NJ-1040NR is only for residents of New Jersey. In reality, the NJ-1040NR form is specifically designed for non-residents who earned income in New Jersey. Residents file a different form, the NJ-1040.

- You can file the NJ-1040NR without any supporting documents. This is not correct. Taxpayers must provide W-2 forms, 1099 forms, and any other relevant documents to substantiate their income and deductions.

- If you lived in New Jersey for part of the year, you do not need the NJ-1040NR. This is misleading. Anyone who earned income in New Jersey while being a non-resident must file the NJ-1040NR, regardless of how long they lived in the state.

- You cannot claim any deductions on the NJ-1040NR. This misconception is inaccurate. Non-residents can claim certain deductions and credits, including personal exemptions and various tax credits.

- The NJ-1040NR form is only for specific types of income. Many believe that this form only applies to wages. However, it covers a wide range of income types, including rental income, dividends, and capital gains.

- You must pay New Jersey tax on all your income. This is not true. Non-residents only pay taxes on income sourced from New Jersey, not on income earned from outside the state.

- Filing the NJ-1040NR guarantees a refund. While it's possible to receive a refund, it is not a given. The final determination depends on the taxpayer's total income, deductions, and credits applied throughout the tax year.

Being aware of these misconceptions can help taxpayers navigate their New Jersey tax obligations more effectively. Understanding the nuances of the NJ-1040NR ensures compliance and maximizes eligible benefits.

Key takeaways

Understanding and properly using the NJ-1040NR form is crucial for non-residents filing their New Jersey tax returns. Here are some key takeaways:

- Ensure accurate personal information is entered, including your Social Security number and home address.

- Filing status is an important choice; only one box should be checked in that section.

- Identify dependents correctly, including their Social Security numbers and date of birth when applicable.

- The amount of gross income must be reported accurately, breaking it down by various sources such as wages, dividends, and rental income.

- Contributions to specific funds may be designated, but they do not alter the tax amount due or refund.

- Gather supporting documents required, including Forms W-2 and 1099, to substantiate income and taxes withheld.

- It is possible to have both a tax due and a credit. Be diligent about calculating potential overpayments.

- Review deductions and exemptions carefully to maximize potential tax benefits.

- Sign and date the form to validate the return; if filing jointly, both signatures are essential.

Browse Other Templates

Cosmetology License Renewal California - Familiarize yourself with the regulations to ensure compliance during renewal.

Irs Publication 503 - The form is crucial for establishing a brand distinct from the legal entity name.

Download D1 Form - Replacing a licence requires enclosing your current driving licence with the form.