Fill Out Your Nj Cbt 2553 R Form

The NJ CBT-2553 R form is a crucial document for corporations seeking retroactive S Corporation status in New Jersey. It allows a corporation that has previously filed for S Corporation status but may have missed the timely submission of their application to request that status effective from a prior tax period. This form must be filed alongside the original New Jersey S Corporation Election form, known as CBT-2553, when the initial status has not been approved. For those corporations that already have S Corporation status, this form serves as an application for retroactive relief and must be submitted with a copy of the original form filed with the Division of Revenue. The application requires several pieces of information, including the corporation’s name, Federal Employer Identification Number, and NJ Corporation Serial Number. Importantly, a non-refundable payment of $100 must accompany the application for each tax year affected, thus ensuring that the application is processed appropriately. Furthermore, both corporate officers and shareholders must provide their consent, verifying their agreement to the retroactive tax implications. After submission, the Division of Taxation will review the application, ensuring that all relevant criteria are met, before granting or denying the retroactive election. Navigating these requirements can feel daunting, but understanding the purpose and process of the NJ CBT-2553 R form is a vital step for corporations aiming to achieve compliance and potentially save on tax liabilities.

Nj Cbt 2553 R Example

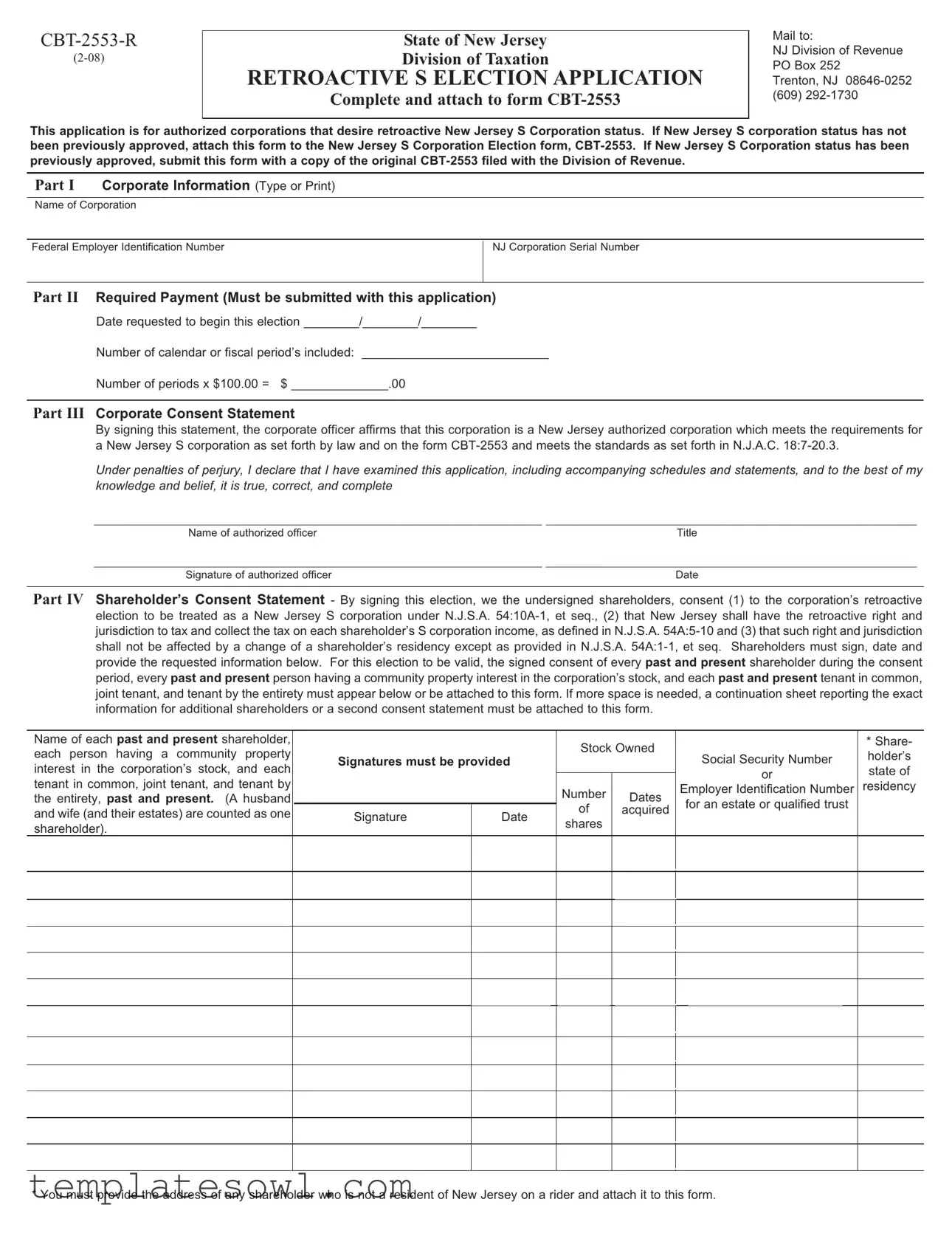

State of New Jersey

Division of Taxation

RETROACTIVE S ELECTION APPLICATION

Complete and attach to form

Mail to:

NJ Division of Revenue PO Box 252

Trenton, NJ

This application is for authorized corporations that desire retroactive New Jersey S Corporation status. If New Jersey S corporation status has not been previously approved, attach this form to the New Jersey S Corporation Election form,

Part I Corporate Information (Type or Print)

Name of Corporation

Federal Employer Identification Number

NJ Corporation Serial Number

Part II Required Payment (Must be submitted with this application)

Date requested to begin this election ________/________/________

Number of calendar or fiscal period’s included: ___________________________

Number of periods x $100.00 = $ ______________.00

Part III Corporate Consent Statement

By signing this statement, the corporate officer affirms that this corporation is a New Jersey authorized corporation which meets the requirements for a New Jersey S corporation as set forth by law and on the form

Under penalties of perjury, I declare that I have examined this application, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete

________________________________________________________________ _____________________________________________________

Name of authorized officerTitle

________________________________________________________________ _____________________________________________________

Signature of authorized officer |

Date |

|

|

Part IV Shareholder’s Consent Statement - By signing this election, we the undersigned shareholders, consent (1) to the corporation’s retroactive election to be treated as a New Jersey S corporation under N.J.S.A.

Name of each past and present shareholder, each person having a community property interest in the corporation’s stock, and each tenant in common, joint tenant, and tenant by the entirety, past and present. (A husband and wife (and their estates) are counted as one shareholder).

Signatures must be provided

Signature |

Date |

|

|

Stock Owned

Number |

Dates |

|

of |

||

acquired |

||

shares |

|

|

|

|

Social Security Number

or

Employer Identification Number

for an estate or qualified trust

*Share- holder’s state of

residency

* You must provide the address of any shareholder who is not a resident of New Jersey on a rider and attach it to this form.

INSTRUCTIONS FOR FORM

1.This form is to be used by a currently authorized corporation electing New Jersey S corporation status effective retroactively to a prior return period. Submit a copy of the original

2.Part I Name of Corporation: Type or print the name exactly as it appears on form

3.Part I Federal Employer Identification Number (FEIN): As assigned by the Internal Revenue Service.

4.Part II Payment of $100.00 (non refundable) must be included for each and every year or privilege period for which this retroactive request applies.

5.Part III Please read the Corporate Attestation and the cited New Jersey rule.

6.Part III Print the name and title of the current corporate officer signing this document and the

7.Part IV All shareholders including original and subsequent shareholders for the retroactive period in question must sign and consent to New Jersey taxation in Part IV.

8.Mail the completed forms and appropriate payment to: New Jersey Division of Revenue, PO Box 252, Trenton, NJ

9.After the application is reviewed, the taxpayer will be notified if the retroactive election is granted.

N.J.A.C.

(a)A taxpayer that is authorized to do business in New Jersey and that is registered with the Division of Taxation and that has filed

(b)An administrative user fee of $ 100.00 shall be included with a taxpayer's filing of its retroactive New Jersey S corporation election Form

(c)A retroactive New Jersey S corporation or Qualified Subchapter S Subsidiary election will not be granted if:

1.All appropriate corporation business tax returns have not been timely filed and taxes timely paid as if the New Jersey S corporation election request had been previously approved;

2.A New Jersey S corporation request is not received before an assessment becomes final;

3.The Division has issued a notice denying a previous late filed New Jersey S election request, and the taxpayer has not protested the denial within 90 days; or

4.All shareholders have not filed appropriate tax returns and paid tax in full when due as if the New Jersey S corporation election request had been previously approved, and the taxpayers have not reported the appropriate S corporation income on those returns.

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Purpose | The CBT-2553-R form is used by New Jersey corporations to apply for retroactive S Corporation status. |

| Submission Requirements | This application must be submitted along with the original CBT-2553 if S Corporation status was previously approved. |

| Filing Fee | A non-refundable payment of $100 is required for each year included in the retroactive request. |

| Corporate Information | Part I requires the corporation's name, federal employer identification number, and state serial number. |

| Corporate Consent | Authorizing signatures from corporate officers confirm that the corporation meets the requirements for S Corporation status as per N.J.A.C. 18:7-20.3. |

| Shareholder Consent | All shareholders, both past and present, must consent for the election to be valid; signatures are mandatory. |

| Additional Documentation | Ending necessity, a rider with addresses of non-resident shareholders must be attached if applicable. |

| Mailing Address | The completed form and payment must be mailed to the New Jersey Division of Revenue at PO Box 252, Trenton, NJ 08646-0252. |

| Governing Law | The form is governed by New Jersey statutes, specifically N.J.S.A. 54:10A-1 and related regulations. |

| Denial of Application | Retroactive elections may be denied if tax returns were not timely filed or if there are outstanding tax obligations. |

Guidelines on Utilizing Nj Cbt 2553 R

Filling out the NJ CBT 2553 R form requires careful attention to detail. This application is meant for corporations that want to request retroactive S corporation status in New Jersey. To ensure the form is filled out correctly, it’s important to follow each step methodically. Below are the specific steps to complete the form.

- Obtain the Form: Download or print the NJ CBT 2553 R form from the New Jersey Division of Taxation's website.

- Complete Part I: Corporate Information

- Type or print the Name of Corporation exactly as it appears on form NJ-REG and the CBT-2553.

- Fill in the Federal Employer Identification Number (FEIN) assigned by the IRS.

- Include the NJ Corporation Serial Number.

- Complete Part II: Required Payment

- Indicate the Date requested to begin this election.

- Specify the Number of calendar or fiscal periods included.

- Calculate the total payment by multiplying the number of periods by $100. Ensure this amount is clearly stated.

- Complete Part III: Corporate Consent Statement

- Read the Corporate Attestation for understanding.

- Print the Name and Title of the authorized officer who will sign the document.

- Have the authorized officer sign the form and date it.

- Complete Part IV: Shareholder's Consent Statement

- List all past and present shareholders, including their names and signatures.

- Each individual must provide their Date, Stock Owned, Dates of acquired shares, and Social Security Number or Employer Identification Number.

- If necessary, attach a continuation sheet for additional shareholders.

- Prepare for Submission: Ensure all signatures are present and that the application is complete.

- Mail the Form: Send the completed form and payment to:

- New Jersey Division of Revenue

- PO Box 252

- Trenton, NJ 08646-0252

- Await Response: After the application is reviewed, you will receive notification regarding the status of your retroactive election.

What You Should Know About This Form

What is the purpose of the NJ CBT-2553 R form?

The NJ CBT-2553 R form is designed for corporations in New Jersey that wish to re-establish their status as an S Corporation retroactively. This means that if a corporation failed to file for New Jersey S Corporation status in a timely manner, it can apply for retroactive recognition under specific conditions. The form should be submitted alongside appropriate documentation, which could include previous election forms, if applicable.

Who is eligible to file the CBT-2553 R form?

Only authorized corporations registered to do business in New Jersey can file the CBT-2553 R form. Corporations must have filed tax returns as an S Corporation with New Jersey and must meet specific requirements set forth by the Division of Taxation. If a corporation has never had New Jersey S Corporation status, it should file the original CBT-2553 alongside this form.

What is required for the completion of the form?

The form requires basic corporate information, including the name of the corporation, federal employer identification number, and New Jersey Corporation serial number. Additionally, it mandates payment of a non-refundable fee of $100 for each year the retroactive status is desired. Shareholder consent is also necessary, demonstrating that all significant stakeholders are aware of and agree to this election.

What happens if the application is denied?

If the application for retroactive New Jersey S Corporation status is denied, the corporation will be notified in writing. Reasons for denial may include late tax filings or failure to meet specific criteria for S Corporation status. It is important for all shareholders to comply with tax obligations to avoid complications during the application process.

How does the retroactive election affect shareholders?

When a corporation successfully files the CBT-2553 R form, it allows for the retroactive treatment of shareholders' income according to New Jersey S Corporation rules. Shareholders will be subject to New Jersey taxes based on S corporation income, regardless of their residency status. It is necessary for every past and present shareholder to sign the consent statement for the application to be valid.

Is there a deadline for submitting the CBT-2553 R form?

There is no specific deadline mentioned in the instructions, but it is advisable to submit the form as soon as a corporation identifies the need for retroactive S Corporation status. Timeliness may affect the ability to qualify for retroactive treatment, particularly if related to pending assessments or notices from the Division of Taxation.

Can multiple periods be included in a single application?

Yes, the form allows for multiple calendar or fiscal periods to be included in a single application. For each period, the corporation will need to pay the required $100 fee, thus ensuring that all affected years are properly accounted for in the retroactive election.

Where should the completed form be sent?

The completed NJ CBT-2553 R form, along with any attachments and the required payment, should be mailed to the New Jersey Division of Revenue at the following address: PO Box 252, Trenton, NJ 08646-0252. It is advisable to retain copies of all documents for the corporation’s records.

Common mistakes

When filling out the NJ CBT 2553 R form, individuals often make critical mistakes that can jeopardize their application for retroactive New Jersey S Corporation status. Understanding these common errors is essential to ensuring accurate and timely submissions.

One significant mistake involves inaccuracies in corporate information. It is imperative to provide the correct name of the corporation, as it appears on the NJ-REG and the CBT-2553 forms. Any discrepancies, such as misspellings or variations in naming conventions, can lead to delays in processing or even denial of the application. Additionally, the Federal Employer Identification Number (FEIN) must be entered accurately. An oversight in this area can create complications and necessitate further correspondence with the Division of Taxation.

Another frequent error relates to the payment section of the form. The required payment of $100 must be included for each tax year affected by the retroactive election. Failing to include this payment or miscalculating the total can result in the application being rejected outright. It is crucial to carefully calculate the number of periods involved and ensure that the payment matches the application requirements.

A vital component that is commonly overlooked is the Corporate Consent Statement. This section demands the signature of a corporate officer who must confirm that the corporation meets the necessary conditions for S Corporation status. Often, individuals forget to have this statement signed by the same officer who signed the original CBT-2553, leading to inconsistencies in the submission. It is essential to double-check that the details are complete and accurately signed to prevent processing delays.

Lastly, the Shareholder's Consent Statement is another area prone to mistakes. All past and present shareholders—including those with community property interests—must sign and consent to the application. Frequently, people neglect to secure signatures from all requisite parties, or they may fail to include critical information such as Social Security Numbers or dates of stock acquisition. This oversight can result in invalidating the application, making thorough verification of shareholder consent crucial.

Documents used along the form

The NJ CBT-2553-R form is essential for corporations seeking retroactive S corporation status in New Jersey. When filing this application, it's important to consider additional documents that may be required to ensure completeness and compliance with state tax laws. Below are commonly associated forms and documents that often accompany the CBT-2553-R.

- NJ CBT-2553: This is the primary form used to make an election for S Corporation status in New Jersey. If the corporation has not previously been granted S Corporation status, this form must be completed and submitted alongside the CBT-2553-R.

- Payment Voucher (NJ-1089): This voucher is used to submit the non-refundable payment associated with filing the CBT-2553-R. It ensures that the required fee, typically $100 per tax year, is processed with the application.

- New Jersey Corporation Business Tax Return (NJ CBT-100S): Corporations must file this return if they are recognized as an S Corporation in New Jersey. It reports the corporation's income and serves as an essential record of tax obligations.

- Consent Statements from Shareholders: Along with the CBT-2553-R, a document indicating consent from all shareholders must be attached. It confirms that all stakeholders are aware of and agree to the retroactive election.

- Continuation Sheet for Shareholder Information: If the space on the CBT-2553-R is insufficient to list all shareholders, a continuation sheet can be included. This document should capture the same information as required for each shareholder and ensure that the application is complete.

- Proof of Prior Tax Filings: In some cases, corporations may need to provide evidence of prior tax filings to demonstrate compliance with state tax laws. This could include copies of past NJ CBT-100S returns or other relevant tax documents.

Each of these documents supports the corporation's application for retroactive S corporation status and helps streamline the approval process. Ensuring that all necessary forms and payments are correctly submitted can significantly enhance the likelihood of receiving the desired election from the New Jersey Division of Taxation.

Similar forms

- Form C CBT-2553: This is the primary election form for New Jersey S Corporation status. It must be filed before submitting the CBT-2553-R, as it sets the groundwork for S Corporation eligibility.

- Form CBT-100S: This form is used annually by New Jersey S Corporations to report income, deductions, and credits. It also reflects the corporation's election status.

- Form CBT-100: This is the New Jersey Corporation Business Tax return for C Corporations. Unlike CBT-2553-R, it does not pertain to S Corporations.

- Form NJ-REG: This is used to register a corporation in New Jersey. It contains information about the corporation and is necessary for establishing its legitimacy.

- Form Form 2553: The federal election form filed with the IRS. Like CBT-2553-R, it seeks to establish S Corporation status but at the federal level.

- Form WS-1: The New Jersey Worksheet for allocation of company income that can coincide with S Corporation status. It assists in determining necessary tax calculations.

- Form CBT-103: This form is required for New Jersey corporations subject to the Corporation Business Tax, albeit typically used by C Corporations.

- Form NJ-1040: This is the personal income tax return form for residents, which reports individual shareholder income from S Corporations and can influence their tax obligations.

- Form Form K-1: Issued by S Corporations, this form details each shareholder’s share of the corporation’s income, deductions, and credits, similar in function to the shareholder's consent on CBT-2553-R.

- Form Form E: This document is used for election purposes related to shareholder consent for partnerships and closely held corporations, paralleling the consent requirement seen in CBT-2553-R.

Dos and Don'ts

Things to Do When Filling Out the NJ CBT 2553 R Form:

- Ensure you have the correct Name of Corporation as it appears on official documents.

- Include your Federal Employer Identification Number (FEIN) assigned by the IRS.

- Submit a payment of $100.00 for each year the retroactive election applies.

- Print clearly and sign the Corporate Consent Statement with the current officer's name and title.

- Gather signatures from all past and present shareholders for the Shareholder’s Consent Statement.

- Mail the completed form, payment, and any required attachments to the designated address.

Things to Avoid When Filling Out the NJ CBT 2553 R Form:

- Do not forget to submit a copy of the original CBT-2553 if this is a previously approved election.

- Avoid incomplete information; ensure all required fields are filled out.

- Do not misplace your payment; it must accompany the application.

- Do not use different officers’ names when signing the CBT-2553 and this form.

- Avoid sending your application to the wrong address; ensure it’s mailed to the NJ Division of Revenue.

- Do not skip obtaining consent from all shareholders, as each signature is necessary for validation.

Misconceptions

Understanding the NJ CBT 2553 R form can be complex, and there are several misconceptions surrounding its purpose and requirements. This confusion can lead to challenges for corporations seeking retroactive New Jersey S Corporation status. Below are six common misconceptions, along with clarifications to help individuals and businesses navigate this important form.

- Misconception 1: The NJ CBT 2553 R form can be used by any corporation in New Jersey.

- Misconception 2: Filing the CBT 2553 R guarantees approval of retroactive status.

- Misconception 3: There is no fee associated with filing the NJ CBT 2553 R form.

- Misconception 4: Only current shareholders need to provide signatures on the form.

- Misconception 5: The form can be mailed without additional documentation.

- Misconception 6: The retroactive election can be requested at any time without consequences.

This form is specifically for authorized corporations that have previously applied for or held New Jersey S Corporation status. Only those eligible corporations can file this form to request retroactive recognition.

Submitting this form does not automatically ensure that a corporation will be granted retroactive S Corporation status. The New Jersey Division of Taxation will review all applications and may deny requests based on certain conditions, such as failure to meet specific filing requirements.

In fact, an administrative user fee of $100 is required for each tax year affected by the retroactive election. This fee is non-refundable and must accompany the application for it to be processed.

All past and present shareholders during the consent period must sign the form for it to be valid. This includes individuals with community property interests and various classifications of ownership.

Additionally, if New Jersey S Corporation status has been previously approved, a copy of the original CBT-2553 must be submitted along with the NJ CBT 2553 R form. Adequate documentation is crucial for processing.

A request for retroactive election must be made before any final assessments on corporation tax status are completed. Missing this window can lead to complications and potential denials.

By dispelling these misconceptions, corporations can better prepare to navigate the application process and ensure compliance with New Jersey tax regulations.

Key takeaways

When completing and utilizing the NJ CBT-2553 R form, several important considerations must be kept in mind. The following key takeaways can help ensure clarity and compliance:

- This form is specifically designed for corporations seeking retroactive New Jersey S Corporation status.

- Filing occurs only if New Jersey S Corporation status has not been previously approved, requiring attachment to Form CBT-2553.

- Corporations must include a non-refundable payment of $100 for each year or privilege period related to the retroactive request.

- Accurate corporate and payment information must be provided, including the name of the corporation and the Federal Employer Identification Number (FEIN).

- Both the Corporate Consent Statement and Shareholder’s Consent Statement require signatures from authorized officers and all shareholders.

- A continuation sheet is necessary for additional shareholders if space on the form is insufficient to list all required signatures.

- Mail completed forms and payments to the New Jersey Division of Revenue at the specified address in Trenton.

- After submission, the corporation will be notified regarding the status of the retroactive election following a review by the Division.

Browse Other Templates

Supplemental Secure and Verifiable Identification Colorado - The form captures essential identification details from users for verification.

Ca W/h - Stay informed about the requirements related to withholding and Form 592-B to avoid complications.