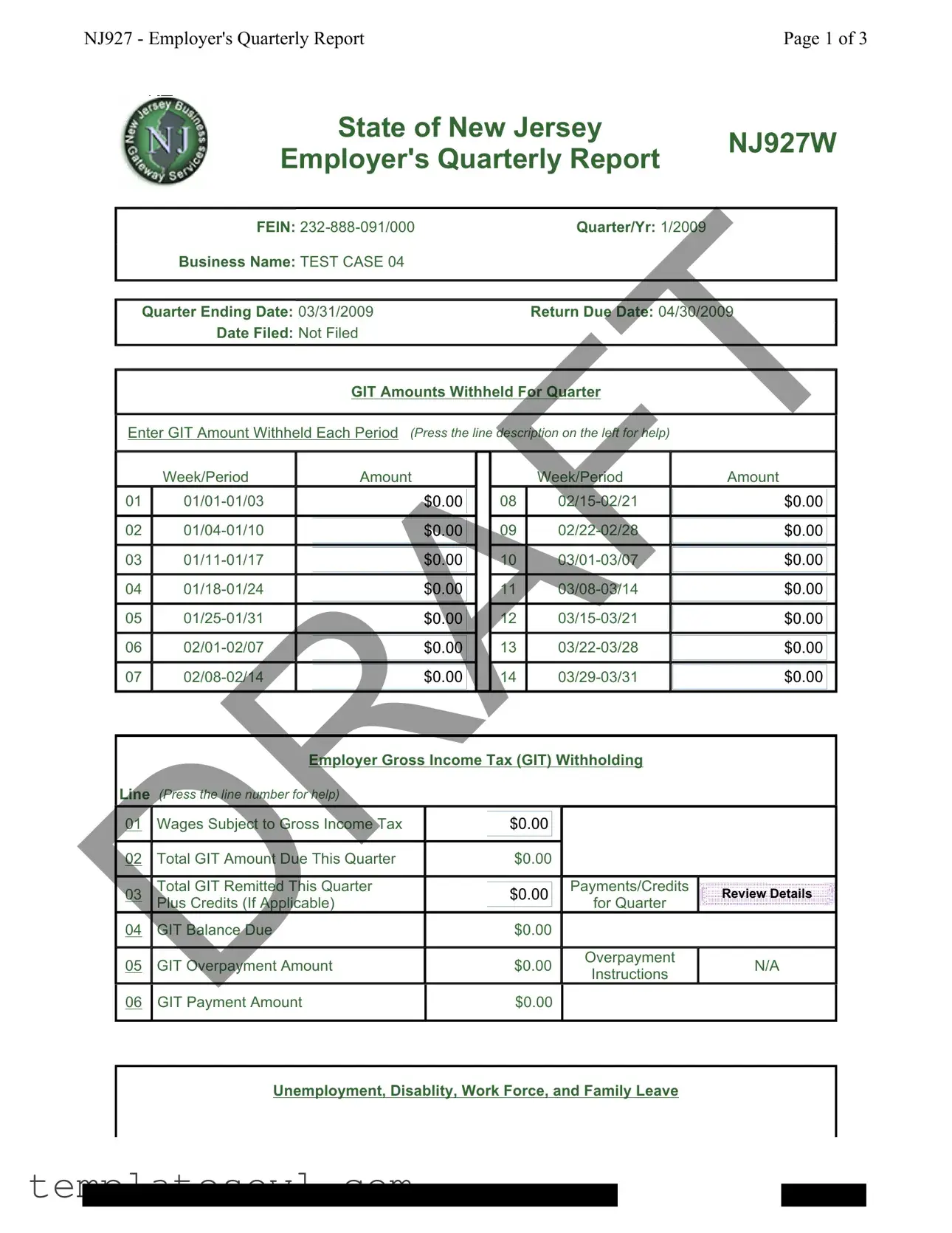

Fill Out Your Nj 927 W Form

The NJ 927 W form is a vital document for employers in New Jersey, serving as the Employer's Quarterly Report that tracks important financial and employment metrics. Each quarter, businesses are required to report specific details regarding their employees' wages and the taxes withheld from those earnings, particularly focusing on the Gross Income Tax (GIT). This form captures critical information such as the total wages subject to GIT, the amounts withheld, and any payments or overpayments made. Additionally, it provides insights into unemployment, disability, and family leave contributions, ensuring that employers comply with state regulations. Employers must complete this form accurately and submit it by the designated due date to avoid penalties and maintain good standing with the state. Understanding the various components of the NJ 927 W form is essential for responsible financial management and compliance with New Jersey tax obligations.

Nj 927 W Example

NJ927 - Employer's Quarterly Report |

Page 1 of 3 |

State of New Jersey

NJ927W

Employer's Quarterly Report

FEIN: |

Quarter/Yr: 1/2009 |

||

Business Name: TEST CASE 04 |

|

|

|

|

|

|

|

Quarter Ending Date: 03/31/2009 |

Return Due Date: 04/30/2009 |

||

Date Filed: Not Filed |

|

|

|

GIT Amounts Withheld For Quarter

Enter GIT Amount Withheld Each Period (Press the line description on the left for help)

|

Week/Period |

01 |

|

02 |

|

03 |

|

04 |

|

05 |

06

07

Amount

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

Week/Period

08

09

10

11

12

13

14

Amount

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

Employer Gross Income Tax (GIT) Withholding

Line (Press the line number for help)

01Wages Subject to Gross Income Tax

02 Total GIT Amount ue This Quarter

03Total GIT Remitted This Quarter Plus Credits (If Applicable)

04GIT Balance ue

05GIT Overpayment Amount

06

GIT Payment Amount

GIT Payment Amount

$0.00

$0.00

|

|

Payments/Credits |

|

$0.00 |

|

Review Details |

|

|

for Quarter |

||

|

|

|

|

|

|

|

$0.00

Overpayment

$0.00N/A

Instructions

$0.00

Unemployment, Disablity, Work Force, and Family Leave

NJ927 - Employer's Quarterly Report |

Page 2 of 3 |

|

|

|

View Rate Detail |

||||

Line (Press the line number for help) |

|

|

|

|

|

|

|

|

The count of all |

Month 1 |

|||||

07 |

covered workers who worked during, or |

|

|

|

|

|

|

|

received pay for the pay period that |

|

0 |

|

|||

|

included the 12th day of each month. |

|

|

||||

|

|

|

|

|

|

||

|

|

|

|

|

|

||

08 |

Total of All Wages Paid Subject to |

|

|

|

|

||

|

|

$0.00 |

|

|

|||

09 |

UI, DI, WF & FLI |

|

|

|

|

|

|

|

|

|

|

|

|

||

Wages in Excess of First $27,700 |

|

|

|

||||

|

|

$0.00 |

|

|

|||

|

|

|

|

|

|

|

|

10 |

Taxable Wages UI & WF |

|

$0.00 |

|

|

||

11 |

Taxable Wages Subject to DI |

P |

$0.00 |

|

|

||

12 |

Taxable Wages Subject to FLI |

P |

$0.00 |

|

|

||

13 |

Total UI & WF Contributions |

0.032250 |

$0.00 |

|

|

||

14 |

Total DI Contributions |

0.000000 |

$0.00 |

|

|

||

15 |

Total FLI Contributions |

0.000000 |

$0.00 |

|

|

||

16 |

Payments Received for this Quarter |

$100.00 |

|

|

|||

17 |

Balance Due - UI, WF, DI & FLI |

|

$0.00 |

|

|||

18 |

Payment Amount - UI, WF, DI & FLI |

$0.00 |

|

||||

Month 2

0

Payments/Credits

for Quarter

Month 3

0

Review Details

Private Plan

The count of all

19Plan" for TDI who worked during or received pay for the pay period that included the 12th day of each month.

The count of all

20Plan" for FLI who worked during or received pay for the pay period that included the 12th day of each month.

0

0

|

Summary Balance Due and Payment Information |

|

||

|

|

|

|

Grand Total |

|

|

|

|

Gross Income Tax and |

|

Gross Income Tax |

UI, WF, DI & FLI |

UI, WF, DI, & FLI |

|

|

Balance ue |

$0.00 |

$0.00 |

$0.00 |

The Amount You Indicate to Pay |

$0.00 |

$0.00 |

$0.00 |

|

|

|

|||

|

|

|

|

|

|

Calculate |

Next Page |

Reset |

|

Help |

Email the Division |

Return To Processing Center |

Logout |

|

NJ927 - Employer's Quarterly Report |

Page 3 of 3 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Title | The NJ 927 W form is officially known as the Employer's Quarterly Report. |

| Governing Law | This form is governed by the New Jersey Gross Income Tax Act (N.J.S.A. 54A). |

| Filing Frequency | Employers must file the NJ 927 W form quarterly, detailing income tax withheld from employees. |

| Due Date | The return is due on the last day of the month following the end of the quarter. |

| Tax Period Example | The example provided shows a quarter ending on March 31, 2009. |

| Information Required | Employers must report the total wages subject to gross income tax and the total tax withheld. |

| Payment Information | Information about any GIT payments, overpayments, or amounts due must be included in the submission. |

| Line Item Details | Specific line items allow for detailed tracking of wages and contributions related to various taxes. |

| Zero Payments | It is possible to submit the form with $0 reported amounts, as shown in the example provided. |

| Record Keeping | Employers are advised to keep a copy of the filed report for their records, along with any related documentation. |

Guidelines on Utilizing Nj 927 W

Completing the NJ 927 W form is an essential task for employers in New Jersey who are reporting their quarterly Gross Income Tax withholdings. Properly filling out this form ensures compliance with state regulations and avoids potential penalties. Follow these steps carefully to ensure accurate submission.

- Begin by providing your Federal Employer Identification Number (FEIN) at the top of the form.

- Indicate the quarter and year you are reporting for in the designated area.

- Fill in your business name and the quarter ending date.

- Note the return due date for this quarter next to where you entered the ending date.

- In the section labeled GIT Amounts Withheld For Quarter, enter the amounts withheld for each week based on the provided periods.

- Calculate and enter the total wages subject to Gross Income Tax for the quarter.

- Complete the total GIT amount due this quarter based on your calculations.

- If applicable, provide details for total GIT remitted this quarter plus credits and the GIT balance due.

- To calculate GIT overpayment (if any), fill out the GIT overpayment amount field.

- Specify your GIT payment amount if you're remitting any payments along with the form.

- Next, report the count of all covered workers who worked during the pay period that included the 12th day of each month.

- Include the total wages paid that are subject to unemployment insurance (UI), disability insurance (DI), workforce (WF), and family leave insurance (FLI).

- Add details about contributions for UI, WF, DI, and FLI, including the payment amounts received for the quarter.

- Finally, complete the summary balance, detailing any total amounts due across all sections.

Once you've filled out the form accurately, review all entries before submission. Ensuring precision is critical for compliance with the state and preventing undue complications. Prepare to submit the form by the due date indicated at the top, and keep a copy for your records.

What You Should Know About This Form

What is the NJ 927 W form?

The NJ 927 W form, also known as the Employer's Quarterly Report, is used by employers in New Jersey to report gross income tax withheld from employees. It includes details about wages paid and taxes owed for a specific quarter.

Who needs to file the NJ 927 W form?

All employers in New Jersey who withhold gross income tax from employees' wages are required to file the NJ 927 W form. This includes businesses of all sizes and organizations that pay wages to employees.

When is the NJ 927 W form due?

The NJ 927 W form is due by the last day of the month following the end of the quarter. For example, for the first quarter ending March 31, the form must be filed by April 30.

What information is needed to complete the form?

You will need the following details: your business name, Federal Employer Identification Number (FEIN), total wages subject to gross income tax, total GIT amount withheld, and any payments or credits for the quarter.

What happens if I miss the filing deadline?

Failure to file the NJ 927 W form by the due date can result in penalties and interest on unpaid amounts. It's crucial to submit the form on time to avoid these additional charges.

Can I amend a previously filed NJ 927 W form?

Yes, if you discover an error after filing, you can amend the NJ 927 W form. You must submit the corrected form with the necessary adjustments and indicate that it is an amendment.

Where can I find help with completing the NJ 927 W form?

The New Jersey Division of Taxation provides guidance and resources to assist you in completing the NJ 927 W form. You can visit their website or contact their office for support.

What should I do if I have no GIT to report?

If you have no Gross Income Tax to report for the quarter, you are still required to file the NJ 927 W form indicating zero amounts. This keeps your records up to date and maintains compliance.

What are the consequences of providing incorrect information on the NJ 927 W form?

Providing incorrect information can lead to mismatched records with the state. This may result in penalties, audits, or additional taxes owed. Always ensure that the data you provide is accurate and complete.

Common mistakes

Filling out the NJ 927 W form can seem daunting, and mistakes are not uncommon. One significant error is failing to provide accurate wage information. Businesses must ensure that the wages reported reflect what was actually paid to employees during the quarter. Discrepancies can lead to fines or additional assessments. Double-checking these numbers helps to avoid issues during the review process.

Another frequent mistake involves neglecting to include all periods of employment when reporting income. Each week or period requires careful accounting of wages subject to tax. It is crucial for employers to complete all sections related to wages accurately. Missing any week may result in incomplete submissions that trigger follow-up requests from state officials.

Using outdated information is also a serious concern. The NJ 927 W form should be filled using the latest guidelines provided by the state. Tax rates or reporting requirements may change from year to year. Employers need to consult the most recent resources to ensure compliance and avoid mistakes that could complicate their filings.

Lastly, many individuals overlook the importance of deadlines. Submitting the NJ 927 W form late can lead to penalties and interest on unpaid amounts. It is essential to mark dates on a calendar and set reminders well in advance. These simple steps can provide peace of mind and ensure timely submissions, keeping businesses in good standing with state authorities.

Documents used along the form

The NJ927 W form is essential for New Jersey employers as it details employer withholding for gross income tax. However, several other documents may accompany it to ensure compliance with state tax and labor regulations. Here’s a brief overview of four documents often used in conjunction with the NJ927 W form.

- NJ-1040ES: This is the New Jersey Estimated Income Tax Payment voucher. Self-employed individuals and those with income not subject to withholding may use this form to make quarterly estimated tax payments, ensuring they meet their tax obligations throughout the year.

- NJ-W-3: Known as the Annual Reconciliation of Payroll Records, this form summarizes the withholding for the year. Employers submit it at the end of the tax year, reconciling the amounts reported on the NJ927 W for the year.

- WR-30: The Worker’s Compensation Implementation Form outlines coverage and benefits for employees who may be injured on the job. This document is crucial for reporting worker's compensation insurance information to the state.

- NJ-927: The NJ-927 form itself is the Employer’s Quarterly Report that details the quarterly payroll information for unemployment insurance. This form tracks contributions toward the state’s unemployment fund, which is vital for maintaining workforce stability.

Understanding these documents can help employers maintain compliance and effectively manage their reporting obligations. Accurate documentation not only facilitates smoother processing but also fosters trust between employers and the state regulatory bodies.

Similar forms

W-2 Form: Like the NJ 927 W form, the W-2 reports wages paid to employees and the taxes withheld from their pay. Both documents are essential for employees when filing their personal income tax returns.

Quarterly Tax Return (e.g., Form 941): This document is similar because it reports payroll taxes withheld, including federal income tax and Social Security. Employers must file it quarterly, mirroring the reporting period of the NJ 927 W form.

Form 1099-MISC: While the 1099-MISC reports payments made to independent contractors, it also reflects total earnings, similar to how the NJ 927 W details taxes associated with wages paid.

State Unemployment Tax Return (SUTA): This form is also filed periodically and provides information on unemployment insurance contributions, akin to the unemployment portions in the NJ 927 W.

Payroll Records: Employers keep payroll records that document employee earnings and withholdings. This information closely relates to what’s reported on the NJ 927 W form.

Employer's Annual Report: Similar to the NJ 927 W, this report provides a summary of the employer's financial activities throughout the year, including employee wages and taxes withheld.

Form 1040 Schedule C: This form is for self-employed individuals and includes information about business income and expenses, paralleling how the NJ 927 W captures wages and taxes for businesses.

State Income Tax Withholding Form: This document specifies how much state income tax an employer needs to withhold from employee wages, just like the withholdings detailed in the NJ 927 W.

Form 941-PR: This form is used in Puerto Rico for reporting taxes and is similar in function to NJ 927 W. Both are focused on employer tax responsibilities for employee wages.

Form 720: This is a quarterly federal excise tax return which, like the NJ 927 W, facilitates reporting on various payroll taxes owed by the employer.

Dos and Don'ts

When filling out the NJ 927 W form, it is crucial to pay attention to details. Here’s a list of things you should and shouldn't do to ensure accuracy and compliance:

- Double-check your Employer Identification Number (FEIN) for accuracy.

- Ensure all gross income tax amounts are filled in completely.

- Be mindful of the quarterly due dates to avoid penalties.

- Keep records of all employees and their wages for reference.

- Verify that all calculations are correct before submission.

- Don’t forget to file by the due date listed on the form.

- Never leave any fields blank unless specified; use “0” if applicable.

- Avoid using outdated versions of the form.

- Do not underestimate the importance of correct mailing addresses and contact information.

- Never hesitate to seek assistance when unsure about any part of the form.

Following these guidelines can help streamline the process and avoid costly mistakes. It’s essential to stay organized and proactive to maintain your compliance obligations.

Misconceptions

There are several misconceptions regarding the NJ 927 W form. Understanding the realities can help in managing compliance more effectively. Here are some of the common misunderstandings:

- Only Large Businesses Need to File: Many believe that only large employers are required to file this form. In reality, all employers with employees subject to New Jersey Gross Income Tax need to submit it, regardless of size.

- Form Only Applies to Wages Paid: Some individuals think that the form only pertains to wages. It also includes other types of payments such as bonuses and commissions that may be subject to tax.

- You Can Only File Once a Year: A common myth is that this form can be filed annually. However, it must be filed quarterly to report the taxes withheld each period.

- You Don’t Need to Worry About Late Filing: Some employers may assume that late filing will not result in penalties. Unfortunately, late submissions can lead to fines and issues with tax compliance.

- The Form is Too Complicated to Understand: Many people feel overwhelmed by the form, but it is designed to be straightforward. Basic accounting knowledge can help in filling it out correctly.

- Filing Online is Not Necessary: There is a misconception that filing online is optional. While paper filing is allowed, online submission is often faster and more efficient.

- You Can Ignore the Payment Section: Some believe that if no taxes are due, they can skip the payment section. However, it is important to complete all sections as part of the filing process.

- One Mistake Means the Form is Invalid: Some individuals think that any error makes the entire form unusable. In fact, minor mistakes can often be corrected and resubmitted without starting over.

- Once Filed, You Can Forget About It: Finally, some employers think that once they file, they don’t need to follow up. It's crucial to keep records and monitor for any discrepancies or notices from the tax authority.

Recognizing these misconceptions can alleviate confusion and improve compliance. It is essential to treat the NJ 927 W form as an important part of business operations.

Key takeaways

The NJ 927 W form is essential for employers in New Jersey who need to report their gross income tax withholding. Below are some key takeaways to consider when filling out and using this form.

- Timeliness is Crucial: Ensure that the form is filed by the due date, which is typically the last day of the month following the end of each quarter. Missing this deadline may result in penalties.

- Understand Each Section: The form is divided into different sections. A careful reading of what each section requires can prevent errors. Each line item provides instructions if assistance is needed.

- Accurate Reporting: Report the amounts withheld for each pay period accurately. Double-check calculations to ensure that the total does not exceed the amounts you have withheld from employee wages.

- Keep Records: Maintain detailed records of all payments made and wages reported. This documentation is vital for verifying submitted information if a discrepancy arises.

- Contributions and Payments: Be aware of the different contributions for Unemployment Insurance (UI), Disability Insurance (DI), and Family Leave Insurance (FLI). Accurately calculate these amounts based on the wages paid to employees.

- Online Resources: Utilize online resources and guides provided by the state to assist with the completion of the form. These resources can offer further clarification on complex areas.

In conclusion, completing the NJ 927 W form with care and attention can help ensure compliance with state requirements, ultimately benefiting both the employer and their employees.

Browse Other Templates

Georgia Adoption Petition Form - The Fiorm 3927 is a Certificate of Adoption used in legal proceedings for adoption in Georgia.

Probate Petition California - It includes legal affirmations to protect against fraud.