Fill Out Your Nj Estate Form

When dealing with estate matters in New Jersey, managing timelines is crucial, particularly concerning tax filings. The NJ Estate form, particularly the IT-EXT designed by the NJ Division of Taxation, serves as a vital tool for those navigating the complex landscape of inheritance and estate taxes. This form allows executors, administrators, or heirs-at-law to request an extension of time to file the necessary returns after the death of a decedent. Among its components, users must provide the decedent's personal details, such as their name and Social Security number, along with important dates like the date of death and county of residence. Depending on the nature of the estate, individuals can request extensions for both inheritance tax and estate tax returns. For inheritance taxes, returns are typically due within eight months post-death, while estates are given nine months for estate tax returns. Each can be extended, though only under exceptional circumstances, which emphasizes the need for timely submissions. It's essential to note that while filing extensions may alleviate some time pressures, they do not postpone the obligation to pay any taxes owed, as interest begins accruing shortly after the respective due dates. Understanding this form in detail helps ensure compliance and promotes smoother transitions during difficult times.

Nj Estate Example

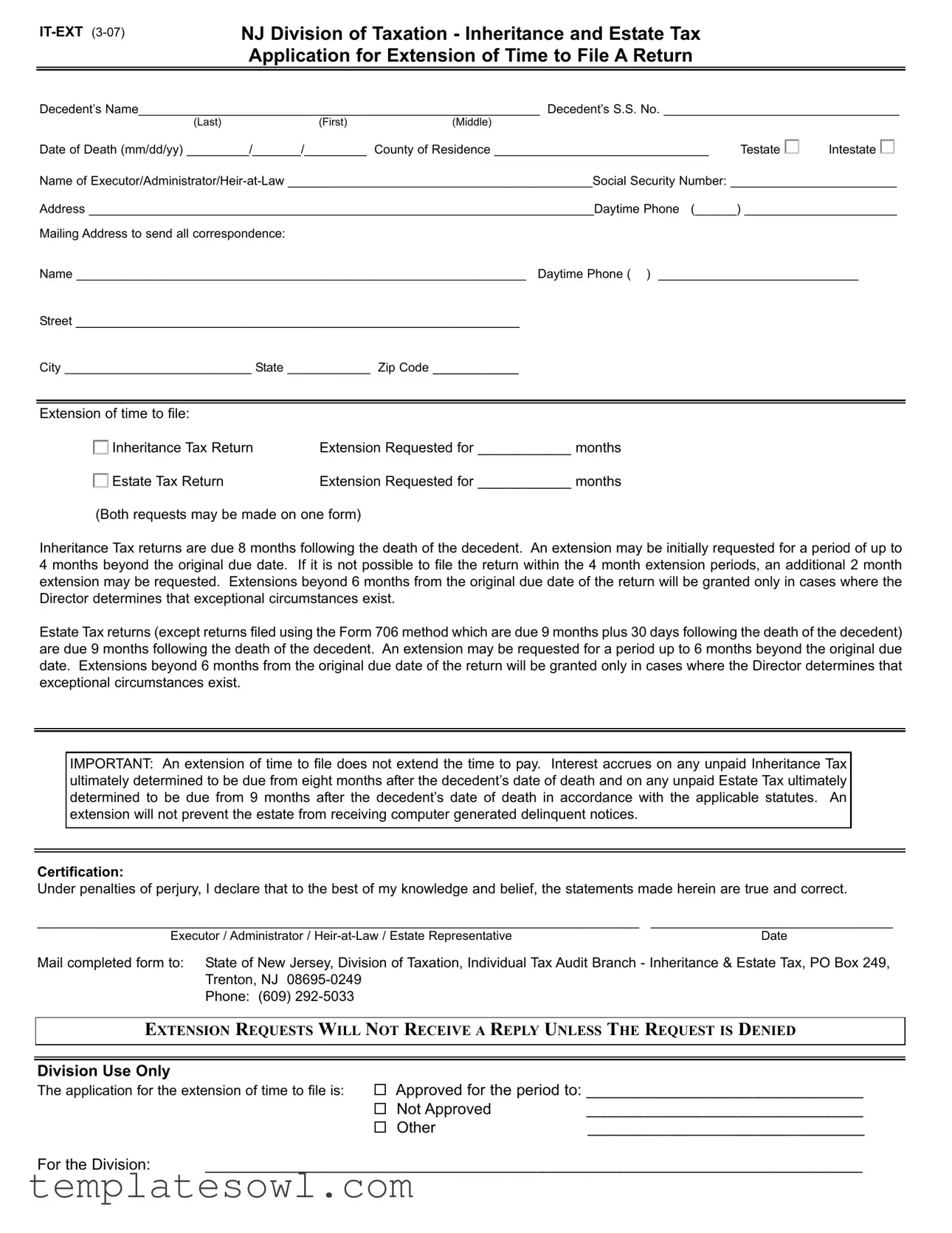

NJ Division of Taxation - Inheritance and Estate Tax Application for Extension of Time to File A Return

Decedent’s Name__________________________________________________________ Decedent’s S.S. No. __________________________________

(Last) |

(First) |

(Middle) |

|

|

Date of Death (mm/dd/yy) _________/_______/_________ |

County of Residence _______________________________ |

Testate |

Intestate |

|

Name of

Address _________________________________________________________________________Daytime Phone (______) ______________________

Mailing Address to send all correspondence:

Name _________________________________________________________________ Daytime Phone ( ) _____________________________

Street _________________________________________________________

City ___________________________ State ____________ Zip Code ___________

Extension of time to file: |

|

Inheritance Tax Return |

Extension Requested for ____________ months |

Estate Tax Return |

Extension Requested for ____________ months |

(Both requests may be made on one form)

Inheritance Tax returns are due 8 months following the death of the decedent. An extension may be initially requested for a period of up to 4 months beyond the original due date. If it is not possible to file the return within the 4 month extension periods, an additional 2 month extension may be requested. Extensions beyond 6 months from the original due date of the return will be granted only in cases where the Director determines that exceptional circumstances exist.

Estate Tax returns (except returns filed using the Form 706 method which are due 9 months plus 30 days following the death of the decedent) are due 9 months following the death of the decedent. An extension may be requested for a period up to 6 months beyond the original due date. Extensions beyond 6 months from the original due date of the return will be granted only in cases where the Director determines that exceptional circumstances exist.

IMPORTANT: An extension of time to file does not extend the time to pay. Interest accrues on any unpaid Inheritance Tax ultimately determined to be due from eight months after the decedent’s date of death and on any unpaid Estate Tax ultimately determined to be due from 9 months after the decedent’s date of death in accordance with the applicable statutes. An extension will not prevent the estate from receiving computer generated delinquent notices.

Certification:

Under penalties of perjury, I declare that to the best of my knowledge and belief, the statements made herein are true and correct.

_______________________________________________________________________________________ ___________________________________

Executor / Administrator / |

Date |

||

Mail completed form to: |

State of New Jersey, Division of Taxation, Individual Tax Audit Branch - Inheritance & Estate Tax, PO Box 249, |

||

|

Trenton, NJ |

|

|

|

Phone: (609) |

|

|

|

|||

EXTENSION REQUESTS WILL NOT RECEIVE A REPLY UNLESS THE REQUEST IS DENIED |

|||

|

|

|

|

|

|

|

|

Division Use Only |

|

Approved for the period to: ________________________________ |

|

The application for the extension of time to file is: |

|||

|

|

Not Approved |

________________________________ |

|

|

Other |

________________________________ |

For the Division: |

____________________________________________________________________________ |

||

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Form Identifier | The NJ Estate form is officially known as IT-EXT (3-07), which stands for Inheritance and Estate Tax Application for Extension of Time to File a Return. |

| Governing Body | This form is governed by the New Jersey Division of Taxation, which oversees inheritance and estate tax processes. |

| Filing Deadline | Inheritance Tax returns are due 8 months after the date of the decedent's death, while Estate Tax returns generally have a 9-month deadline. |

| Initial Extension | An initial extension for filing can be requested: up to 4 months for Inheritance Tax and up to 6 months for Estate Tax. |

| Exceptional Circumstances | Extensions beyond the standard time limits will only be granted when the Director has determined that exceptional circumstances exist. |

| Interest Accrual | Interest begins to accrue on any unpaid taxes: 8 months after death for Inheritance Tax and 9 months for Estate Tax. |

| Mailing Information | Completed forms must be mailed to the New Jersey Division of Taxation at the designated address in Trenton, NJ. |

Guidelines on Utilizing Nj Estate

After preparing the necessary information, proceed to fill out the NJ Estate form IT-EXT. This form is essential for requesting an extension of time to file either an Inheritance Tax Return or an Estate Tax Return in New Jersey. It is crucial to provide accurate details to avoid any delays in processing your request.

- Obtain the form: Download or print the NJ Estate form IT-EXT from the New Jersey Division of Taxation website.

- Complete the decedent's information: Fill in the decedent's name, Social Security number, and date of death.

- Specify the county of residence: Indicate the county where the decedent resided at the time of death.

- Indicate the type of estate: Mark whether the estate is testate (with a will) or intestate (without a will).

- Provide the executor/administrator/her-at-law information: Enter the name, Social Security number, and contact information for the executor or administrator of the estate.

- Fill in the mailing address: Write the name and daytime phone number of the person to whom correspondence should be sent. Include complete mailing address details.

- Request an extension: Choose whether to request an extension for the Inheritance Tax Return and/or the Estate Tax Return. Specify the number of months for each request.

- Read the important notes: Review the information regarding the due dates for filing and paying the taxes to understand the implications of your request.

- Certification: Sign and date the form, certifying that the information provided is true and correct.

- Mail the completed form: Send the form to the address specified at the bottom of the document using the appropriate mailing method.

What You Should Know About This Form

What is the NJ Estate form IT-EXT used for?

The NJ Estate form IT-EXT is an application for an extension of time to file either an Inheritance Tax Return or an Estate Tax Return in New Jersey. This form allows individuals handling a decedent's estate to request additional time beyond the initial due date for filing their tax returns. It is essential to understand that while this form grants an extension, it does not extend the deadline for payment of any taxes owed.

When are the Inheritance and Estate Tax Returns due?

Inheritance Tax returns are typically due eight months after the decedent's death. Estate Tax returns are due nine months after the death of the decedent, unless they are filed using the Form 706 method, which has a different deadline. It is critical to familiarize yourself with these deadlines to avoid penalties.

How long can I extend the filing deadline using this form?

You can request an initial extension of up to four months for the Inheritance Tax Return and up to six months for the Estate Tax Return. If you cannot file even after this extension, you may request an additional two-month extension for the Inheritance Tax Return. However, additional extensions beyond these periods are only granted under exceptional circumstances as determined by the Director of the NJ Division of Taxation.

What happens if I miss the filing deadline?

If you miss the filing deadline and do not submit the extension form on time, you may face penalties and interest on any unpaid taxes. Interest on the Inheritance Tax begins accruing eight months after the decedent's death, while interest on the Estate Tax begins accruing after nine months.

Where should I send the completed IT-EXT form?

After completing the form, it should be mailed to the State of New Jersey, Division of Taxation, Individual Tax Audit Branch - Inheritance & Estate Tax, PO Box 249, Trenton, NJ 08695-0249. Ensure that you send it promptly to avoid any penalties.

Will I receive a response after submitting the extension request?

No, typically, you will not receive a reply after submitting the request unless it is denied. If you do not receive a notice confirming the denial, you should consider the request as under review without further communication from the Division.

Common mistakes

When filling out the NJ Estate form, it's important to pay attention to details. Many individuals make mistakes that can hinder the process. Here are some common errors to watch out for.

One mistake is leaving out essential information. For instance, the decedent’s name and social security number must be filled out correctly. If these details are missing or inaccurate, it could lead to delays in processing the request. Always double-check this critical information before submitting.

Another frequent error involves the dates. Specifically, people often mishandle the date of death. If the format isn’t correct or if the date is entered as a future date, it raises red flags. Ensure the date is formatted as “mm/dd/yy” and reflects the true date of the decedent’s passing. This small detail can significantly impact your submission.

Incomplete contact information is a common oversight as well. Forgetting to provide a mailing address or daytime phone number can create complications. If the tax office cannot reach you for any reason, it could impede the progression of your tax matters. Take the time to fill it out fully so you can be notified of any updates without hassle.

Many individuals also confuse the extension requests for inheritance and estate tax returns. The form allows for extensions in both categories, but miscalculating the length of requested extensions can be problematic. Be sure to specify the correct number of months for each request to ensure clarity.

Another issue arises when people assume that requesting an extension also extends the payment deadline. This misconception can lead to accumulating interest on unpaid taxes. Remember, while you may have more time to file, the time to pay does not change. Be prepared to meet your financial obligations on time.

Some filers fail to sign the application or overlook the certification statement. This is a crucial step in validating the correctness of the information provided. Without a signature, the entire application may be deemed invalid, resulting in processing delays.

People may also neglect to send the form to the correct address. The NJ Division of Taxation has a specific mailing address for these applications. Make sure to verify this before hitting "send." Not sending it to the right place can cause your request to be lost in the shuffle.

Lastly, individuals often overlook that they will not receive a response unless the request for an extension is denied. It’s important to understand that "no news" doesn’t necessarily mean that your request is in limbo; it simply means it was approved since there is no other communication. This can lead to unnecessary follow-ups that waste time.

By keeping these common mistakes in mind and ensuring everything is filled out correctly, you can enhance the efficiency of the process while avoiding potential pitfalls along the way.

Documents used along the form

When navigating the estate planning and tax process in New Jersey, it's important to understand that the NJ Estate form is often accompanied by several other key documents. Each of these plays a crucial role in ensuring compliance with state laws regarding inheritance and estate taxes. Below is a brief overview of five such forms frequently used in conjunction with the NJ Estate form.

- NJ Inheritance Tax Return (Form IT-R): This form is required to report the inheritance tax due on property received by heirs from the decedent. It's typically due 8 months after the date of death and includes details about the decedent's assets and liabilities.

- NJ Estate Tax Return (Form ET): This return needs to be filed if the estate exceeds a certain value threshold set by the state. The estate tax return is generally due 9 months after death, and it calculates the tax owed based on the total value of the estate.

- Form 706 (United States Estate (and Generation-Skipping Transfer) Tax Return): This federal form is relevant for estates that exceed the federal exclusion amount. It is used to report and pay any federal estate taxes and is due within 9 months of the decedent’s death.

- Certificate of Death: This vital document establishes the date and cause of death, serving as evidence for the probate process. It is necessary for various filings, including the inheritance tax return and estate tax return.

- Will and Testament: If available, the will provides crucial information regarding the decedent's wishes for asset distribution and names the executor. This document must be submitted to probate court and is fundamental in guiding the administration of the estate.

Understanding these additional forms and documents is vital to ensuring a smooth estate settlement process in New Jersey. Properly completing and submitting all required paperwork can help avoid penalties and ensure compliance with both state and federal regulations. Whether you are an executor, administrator, or heir, being informed is key to managing the complexities of estate taxation.

Similar forms

- Form 706 (United States Estate (and Generation-Skipping Transfer) Tax Return): This federal form is used to report the estate taxes due for a decedent's estate. Similar to the NJ Estate form, it allows for extensions on filing deadlines. Both forms require the decedent's information and details about the executor or administrator.

- Form 1041 (U.S. Income Tax Return for Estates and Trusts): This form is necessary for estates to report income generated after the decedent's death. Like the NJ Estate form, it has strict deadlines for submission and can also request extensions to file.

- Application for the Certificate of Authority (State Tax): This document allows personal representatives to handle tax matters on behalf of a deceased person. It is akin to the NJ Estate form, as both require similar personal information and details about the decedent.

- Form 480.6 (New Jersey Inheritance Tax Return): This state-specific form details the taxes owed on the estate. Much like the NJ Estate form, it can request extensions and includes fundamental information about the decedent.

- Form 1040 (U.S. Individual Income Tax Return): While primarily for individual income tax reporting, if due after a decedent's passing, this form has filing timelines similar to the NJ Estate form, ensuring taxes are reported correctly.

- State Death Certificate: This official document verifies the death of an individual. It is comparable to the NJ Estate form since both documents establish a legal basis for handling the deceased’s estate.

- Form 8971 (Information Regarding Beneficiaries Acquired from the Estate of a Decedent): This IRS form provides information about beneficiaries inheriting property. Like the NJ Estate form, it relates to the distribution and tax implications of the estate.

- Trust Tax Returns (Form 1041 for Trusts): For any trust established post-death, this return reports income generated by the trust. It shares similarities with the NJ form in extension requests and executor details.

- Form 706-NA (U.S. Estate Tax Return for Non-Resident Aliens): This form caters to estates of non-resident aliens. Much like the NJ Estate form, it also provides procedures for filing deadlines and extensions.

- Form 8821 (Tax Information Authorization): While focused on tax information sharing, it can be necessary for executors or administrators. Similar to the NJ Estate form, it ensures authorized individuals can manage estate matters.

Dos and Don'ts

When filling out the NJ Estate form, it is crucial to be thorough and detailed. To ensure you navigate the process correctly, consider the following tips for what to do and what to avoid.

- Do provide complete and accurate information, including the decedent's name and Social Security number.

- Do clearly indicate the desired extension period for the tax return.

- Do sign and date the form before submission to validate your request.

- Do mail the completed form to the correct address listed on the form.

- Don't forget to check the deadlines to avoid late penalties.

- Don't ignore any instructions or guidelines included with the form.

Adhering to these guidelines can ease the process, and attention to detail will help avoid unnecessary complications. Completing the NJ Estate form correctly is essential to ensure compliance with the state’s requirements.

Misconceptions

Here are 10 common misconceptions about the NJ Estate form:

- Extensions automatically allow more time to pay taxes. An extension to file does not give you more time to pay. Taxes must still be paid on time to avoid interest.

- There is no limit on how many extensions can be requested. You can only request specific extensions as outlined. Beyond certain periods, additional extensions are only granted under exceptional circumstances.

- The form must be submitted immediately after the decedent's death. While the form should be filed promptly, it is due anywhere from 8 to 9 months after death, depending on the type of tax return.

- Providing incorrect information on the form is not a big deal. Accurate details are crucial. Incorrect information may lead to penalties and delays.

- Both inheritance and estate tax can be filed together without issues. While both requests can be made on one form, they each have their own requirements and timelines.

- Filing for an extension means a delay in estate processing. An extension is just that—a request for more time to file. The review process continues as normal.

- The NJ Division of Taxation will always respond to extension requests. They only reply if a request is denied. If you do not hear back, that often means it has been approved.

- Interest does not begin to accrue until the tax return is filed. Interest starts accruing from the due date of the return if any tax is unpaid, not from the filing date.

- Informal correspondence is enough for extension requests. You must submit the official form to request an extension formally. Informal notes or emails do not suffice.

- Executor responsibility ends after filing the extension. The executor must track deadlines, payments, and ensure proper processing after filing for any extension.

Key takeaways

Understanding the NJ Estate form, specifically IT-EXT, is crucial for navigating the inheritance and estate tax process. Here are some key takeaways:

- Timely Submission: It’s essential to submit the form within the required time frame. For inheritance tax returns, the original due date is eight months after the decedent's death, while estate tax returns are due nine months later.

- Extension Periods: You can request extensions for both inheritance and estate tax returns. Inheritance tax returns can be extended by up to four months, with an additional two months possible under specific circumstances. Estate tax returns may be extended for up to six months.

- Payment Obligations: Remember, an extension to file does not mean an extension to pay. Interest will begin to accrue on unpaid taxes after the respective deadlines.

- Communication with the Division: Be aware that extension requests will not receive a reply unless denied. Always ensure that the form is completed accurately to avoid complications.

Browse Other Templates

Georgia Adoption Petition Form - The completed form facilitates the creation of a new legal identity for the adopted child.

Acd-31075 - Filing status, such as monthly or quarterly, is also indicated on this form.

Pizza Hut Application Online - Legibility in filling out the application is crucial for processing applicants effectively.